Finance

What Is Old Age Pension

Published: November 27, 2023

Discover the importance of old age pension in finance and learn how it can provide financial security during retirement. Empower your financial future with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of old age pensions, a financial support system designed to provide income security for individuals during their senior years. As people age and retire, it becomes increasingly important to have a reliable source of income to cover living expenses and maintain a decent standard of living. Old age pensions, also known as retirement pensions or senior pensions, play a crucial role in ensuring financial stability and well-being for elderly individuals.

In this comprehensive guide, we will delve into the intricacies of old age pensions. We will explore the definition of old age pensions, discuss their purpose and benefits, outline the eligibility criteria, and provide insights into the application process and payment schedule. Additionally, we will address some of the challenges and issues associated with old age pensions, allowing you to gain a holistic understanding of the topic.

Whether you are approaching retirement age yourself or simply seeking information for a loved one, this article aims to equip you with the knowledge needed to navigate the world of old age pensions effectively.

Definition of Old Age Pension

An old age pension, also known as a retirement pension or senior pension, is a financial program implemented by governments to provide income support to individuals during their retirement years. It is a form of social insurance that aims to ensure a basic level of economic security for senior citizens who have reached a certain age and are no longer able to work or earn a sufficient income.

The concept of old age pensions originated as a response to the challenges faced by the elderly population, particularly in societies where traditional family support systems diminished. Through these pension programs, governments seek to provide a safety net that assists retirees in meeting their basic needs and maintaining their quality of life.

Old age pensions typically come in the form of regular payments made to eligible individuals who meet specific criteria. The amount of pension and the age of eligibility may vary depending on the country and the specific pension scheme in place. In some cases, the pensions are funded through contributions made by individuals and their employers throughout their working lives.

The primary goal of an old age pension is to alleviate poverty and promote social equity among retired individuals. By providing a steady source of income, old age pensions help seniors fulfill their daily living expenses, including housing, healthcare, and other essential needs. The pension serves as a financial cushion to maintain a reasonable standard of living and enjoy a comfortable retirement.

It’s important to note that an old age pension is distinct from other forms of retirement savings or private pension plans. While private pensions are typically managed by employers or individuals themselves, old age pensions are government-administered programs that aim to provide universal coverage and support for all eligible individuals.

Now that we’ve established a basic understanding of what an old age pension is, let’s explore the purpose and benefits of this important social security program.

Purpose and Benefits of Old Age Pension

The purpose of an old age pension is to provide financial stability and security to individuals during their retirement years. It aims to ensure that seniors have a reliable source of income to cover their basic needs and maintain a decent standard of living.

One of the primary benefits of an old age pension is the reduction of poverty among the elderly population. Many seniors face significant financial challenges after retirement due to a decrease in income and increased healthcare expenses. Without an old age pension, these individuals may struggle to make ends meet and may be forced to rely on inadequate savings or family support.

By providing a regular pension payment, governments help seniors avoid poverty and maintain their independence. This financial support allows them to cover essential expenses such as housing, food, healthcare, and transportation. It also provides peace of mind, knowing that there is a steady income stream to rely on during retirement.

Furthermore, old age pensions contribute to social welfare and maintain economic stability within a society. By ensuring that older citizens are financially secure, pensions reduce the burden on the younger generation for supporting their elderly family members. This can promote intergenerational equity and create a balanced distribution of resources.

Old age pensions also play a crucial role in promoting healthy aging. With a stable income, seniors can access better healthcare services, maintain a nutritious diet, and engage in social and recreational activities. Financial stability contributes to overall well-being and improves the quality of life for older individuals.

Another benefit of old age pensions is the reduction of social inequality. By providing a universal pension to eligible seniors, governments strive to create a more equitable society. This ensures that individuals who have contributed to the workforce throughout their lives, regardless of their socioeconomic background, receive financial support in their retirement years.

Finally, old age pensions provide a sense of dignity and respect for seniors. After a lifetime of hard work and contribution to society, retirees deserve to live their later years with financial security and independence. The provision of an old age pension acknowledges the value and importance of older individuals within the community.

Now that we understand the purpose and benefits of an old age pension, let’s explore the eligibility criteria required to access this form of financial support.

Eligibility Criteria for Old Age Pension

The eligibility criteria for old age pension programs may vary from country to country and even within different regions or jurisdictions. However, there are some common requirements that individuals must meet in order to qualify for this form of financial support.

One of the primary eligibility criteria is reaching the designated age for receiving the pension. In most countries, this age is typically referred to as the retirement age or the age of eligibility for social security benefits. The retirement age is often determined based on factors such as the average life expectancy, demographic trends, and the financial feasibility of the pension program. It’s important to note that the retirement age can differ for men and women or may vary based on work history or other specific circumstances.

In addition to the age requirement, old age pensions may have residency criteria. Individuals usually need to be permanent residents or citizens of the country where the pension program is implemented. This is to ensure that the benefits are going to those who have contributed to the society and economy of the country throughout their working years.

Income and asset thresholds are also considered for determining eligibility in some cases. Governments may set certain limits on the income and assets that applicants can have in order to qualify for an old age pension. This is to target the benefits to those who have limited financial resources and genuinely need the assistance. These thresholds can vary depending on factors such as the cost of living in a particular region or the overall economic conditions of the country.

Furthermore, some pension programs may have additional requirements related to the number of years of contributions or employment. For example, there may be a minimum number of years an individual must have paid into the social security system or worked in order to qualify for a full pension. This is to ensure that individuals have made sufficient contributions to the pension fund and have actively participated in the workforce before retirement.

It’s important to note that eligibility criteria may also differ for different types of old age pensions. Some countries offer universal pensions, where all eligible individuals receive the same amount, regardless of their income or work history. Others may have means-tested pensions, which are based on the individual’s income and assets. Additionally, there may be specific pension schemes designed for certain groups, such as veterans or individuals with disabilities.

Overall, the specific eligibility criteria for old age pensions vary across jurisdictions. It’s essential to consult the relevant government agencies or pension authorities to understand the specific requirements and documentation needed to apply for an old age pension in a particular country or region.

Now that we’ve discussed the eligibility criteria, let’s explore the application process for old age pensions.

Application Process for Old Age Pension

The application process for old age pension varies depending on the country and the specific pension program in place. While the exact steps may differ, there are some common elements to consider when applying for an old age pension.

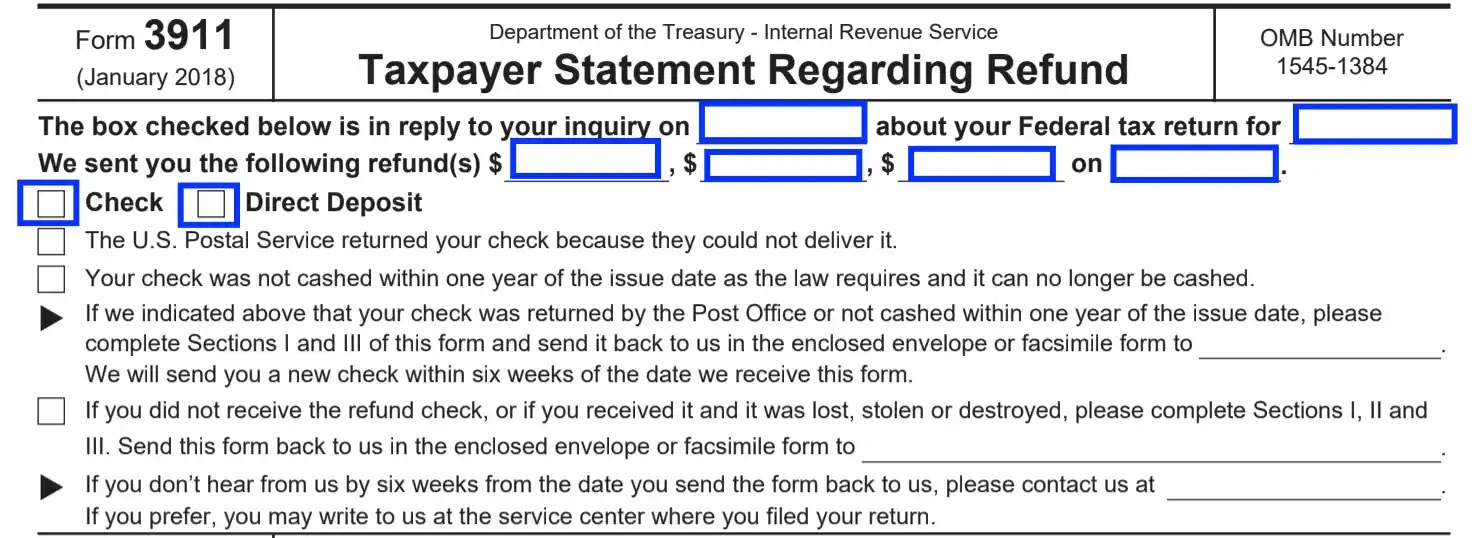

Firstly, it’s important to gather all the necessary documentation before starting the application process. This may include proof of identification, such as a valid passport or national identity card, as well as proof of residency or citizenship. Additionally, you may need to provide documents that verify your age, such as a birth certificate or passport.

Once you have gathered the required documents, you can proceed with the application process. In most cases, applications for old age pensions can be submitted online, through a government website or portal. Alternatively, there may be physical application forms that can be obtained from relevant government offices or social security departments.

When completing the application form, it’s important to provide accurate and detailed information. This may include your personal details, contact information, marital status, and details of any dependents. Some applications may also require information about your work history, income, and assets.

Along with the application form, you may be required to submit supporting documents as proof of your eligibility. This may include proof of income, such as tax returns or pay slips, as well as bank statements or other financial records. It’s important to provide the requested documentation in the specified format and within the given deadlines.

Once your application and supporting documents are submitted, they will be reviewed by the relevant authorities. This process may take some time, as the authorities need to verify the information provided and assess your eligibility for the pension program. It’s important to be patient during this waiting period and follow up with the pension office if necessary.

After the application has been reviewed and approved, you will receive notification regarding the outcome of your application. If approved, you will be informed about the amount of pension you will receive and the payment schedule. This information may be provided through the mail or electronically, depending on the communication preferences and methods used by the pension office.

In some cases, you may be required to provide periodic updates or reports to the pension office, such as changes in income or marital status. It’s important to comply with any reporting requirements to ensure that your pension continues to be paid without interruption.

If your application is denied, you may have the right to appeal the decision. The appeals process will vary depending on the country, and it’s important to follow the specified procedures and deadlines outlined by the pension authority.

Overall, the application process for old age pensions requires gathering necessary documents, completing an application form, and submitting it along with supporting documents. It’s essential to follow the guidelines provided by the pension office and to be patient throughout the review process. Now, let’s explore the amount and payment schedule of old age pensions.

Old Age Pension Amount and Payment Schedule

The amount of an old age pension and the payment schedule can vary depending on the country, the pension program, and individual circumstances. The following provides a general overview of how the pension amount is determined and how it is typically paid to eligible individuals.

The calculation of the old age pension amount is often based on various factors, including the individual’s earnings history, the number of years of contributions, and the pension formula used by the country’s pension system. Some countries may use a flat-rate system, where all eligible individuals receive the same amount regardless of their income or work history. Others may employ a contributory system, where the pension amount is based on the individual’s average earnings throughout their working years.

In many cases, the pension amount may be adjusted annually to account for changes in the cost of living or inflation. These adjustments, known as pension indexation, ensure that the purchasing power of the pension remains relatively stable over time.

The payment schedule for old age pensions can vary as well. Some countries may provide monthly payments, while others may offer bi-monthly or quarterly payments. The specific schedule is determined by the pension program and the administrative procedures in place.

In addition to the payment schedule, eligible individuals can expect to receive their pension through various methods. Traditional pension systems often make payments through checks that are mailed to the individual’s registered address. However, with increasing digitization and advancements in technology, many countries offer electronic payments, such as direct deposits into a bank account or prepaid pension cards. These electronic payment methods provide convenience and security for pension recipients.

It’s important to note that the old age pension amount and payment schedule may be subject to certain conditions and limitations. For example, in some cases, if a retiree has additional sources of income, such as earnings from part-time work or other pensions, the old age pension amount may be reduced or offset. Similarly, if there are changes in the retiree’s marital status or living arrangements, this may impact the pension amount.

Retirees should also be aware of any reporting requirements or obligations related to the pension. These may include providing updates on changes in income, marital status, or other relevant information. Failure to comply with reporting requirements may result in a suspension or reduction of the pension payments.

It’s important for individuals nearing retirement age or those already receiving an old age pension to familiarize themselves with the specific payment amounts and schedule established by their country’s pension system. This information is typically provided once the application has been accepted, and it’s crucial to keep the pension authority updated with any changes to personal circumstances that may affect the pension amount or payment schedule.

Now that we have explored the old age pension amount and payment schedule, let’s discuss some of the challenges and issues associated with old age pensions.

Challenges and Issues with Old Age Pension

While old age pensions are crucial for ensuring financial security and well-being for elderly individuals, there are several challenges and issues that can arise with these programs. Understanding these challenges is important for policymakers and individuals alike in order to address and mitigate any potential problems. Let’s explore some of the common challenges associated with old age pensions:

1. Adequacy of pension benefits: One of the primary challenges is ensuring that the pension benefits provided are sufficient to cover the basic needs of retirees. In some cases, the pension amount may not be enough to meet the rising costs of living, especially in areas with high expenses such as healthcare and housing. This can lead to financial hardship for seniors and a diminished quality of life.

2. Sustainability of pension systems: The sustainability of old age pension systems is a growing concern, particularly in the face of demographic changes such as an aging population and declining birth rates. As the number of retirees increases and the number of contributors decreases, there can be strains on the pension system’s financial resources. Governments need to carefully balance pension expenditures and contributions to ensure the long-term viability of these programs.

3. Inequality and disparities: Old age pensions can exacerbate existing social and economic inequalities. For individuals who have had limited access to employment opportunities or who have faced wage disparities throughout their working lives, their pension benefits may not adequately reflect their needs. Addressing these disparities is crucial to ensure a fair and equitable retirement system.

4. Administration and bureaucracy: Complex administrative processes and bureaucratic red tape can pose challenges for individuals trying to access their pension benefits. Lengthy application procedures, delays in processing, and difficulty navigating the system can create frustrations and barriers for retirees in receiving their entitled pensions. Simplifying administrative procedures can help improve the efficiency and accessibility of these programs.

5. Changing retirement age and pension eligibility: The increasing trend of raising the retirement age and adjusting eligibility criteria can impact individuals’ retirement plans. These changes can lead to uncertainty and disrupt financial planning for future retirees. It is essential to communicate these adjustments clearly and provide individuals with sufficient time to prepare for the changes.

6. Economic volatility and pension fund sustainability: Economic crises and market fluctuations can have a significant impact on pension fund sustainability. If pension funds are heavily invested in volatile markets, their value may decrease, causing concerns about the adequacy of future pension payments. Diversifying investment strategies and adopting sound financial management practices can mitigate the risks associated with economic volatility.

7. Demographic challenges: Aging populations pose additional challenges for old age pension systems. As life expectancies increase, pension payments must be sustained for longer periods, putting additional strain on pension funds. Addressing the demographic challenges requires a comprehensive approach that considers factors such as retirement age, contribution rates, and targeted policies to support the aging population.

Addressing these challenges and issues requires a collaborative effort among policymakers, social security experts, and the broader society. Continual evaluation and adjustments to pension programs are necessary to ensure that they remain effective in providing adequate financial security for seniors.

Now that we have explored the challenges and issues with old age pensions, let’s conclude our discussion.

Conclusion

Old age pensions play a vital role in safeguarding the financial well-being and dignity of senior citizens during their retirement years. These programs provide income support, alleviate poverty, and promote social equity among the elderly population. By ensuring a basic level of economic security, old age pensions contribute to healthy aging, reduce social inequalities, and maintain economic stability within societies.

Throughout this guide, we have explored the definition of old age pensions, the purpose and benefits they offer, the eligibility criteria, the application process, and the amount and payment schedule of pension benefits. We have also identified some of the challenges and issues associated with old age pensions, such as ensuring the adequacy of benefits, addressing sustainability concerns, tackling inequality, simplifying administrative procedures, and adapting to demographic changes.

It is evident that old age pensions have a profound impact on the lives of retirees, providing them with financial stability, independence, and a sense of dignity. However, it is essential to continually evaluate and improve these programs to address the evolving needs and challenges of an aging population.

Governments, policymakers, and social security experts must work towards ensuring that old age pensions are sustainable, adequately funded, and adapted to changing demographics. Simultaneously, efforts should be made to reduce disparities, simplify administrative processes, and enhance the accessibility of pension systems for retirees.

For individuals approaching retirement or those already receiving old age pensions, it is crucial to familiarize themselves with the eligibility criteria and application process specific to their country or region. This will help ensure a smooth transition into retirement and enable them to access the benefits they are entitled to.

Ultimately, old age pensions are a vital component of a comprehensive social security system. By providing financial support, these programs contribute to the well-being and quality of life of senior citizens, enabling them to enjoy a comfortable retirement after years of hard work and contribution to society. It is our collective responsibility to advocate for and enhance old age pension programs, ensuring that they continue to provide much-needed security and support for our aging population.