Home>Finance>Stock Market Crash Of 1929: Definition, Causes, Effects

Finance

Stock Market Crash Of 1929: Definition, Causes, Effects

Published: February 2, 2024

Learn about the Finance-related topic of the Stock Market Crash of 1929, including its definition, causes, and effects.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Stock Market Crash of 1929: Definition, Causes, Effects

Welcome to the “Finance” section of our blog, where we delve into the fascinating world of money, investing, and economics. In this article, we will be exploring a crucial event in financial history that left a lasting impact on global economies – the Stock Market Crash of 1929. What exactly was this crash, what caused it, and what were its effects? Let’s find out!

Key Takeaways:

- The Stock Market Crash of 1929 was a significant financial event that marked the beginning of the Great Depression in the United States.

- The crash was primarily caused by speculative trading, an overvaluation of stocks, and excessive borrowing by investors.

1. Definition:

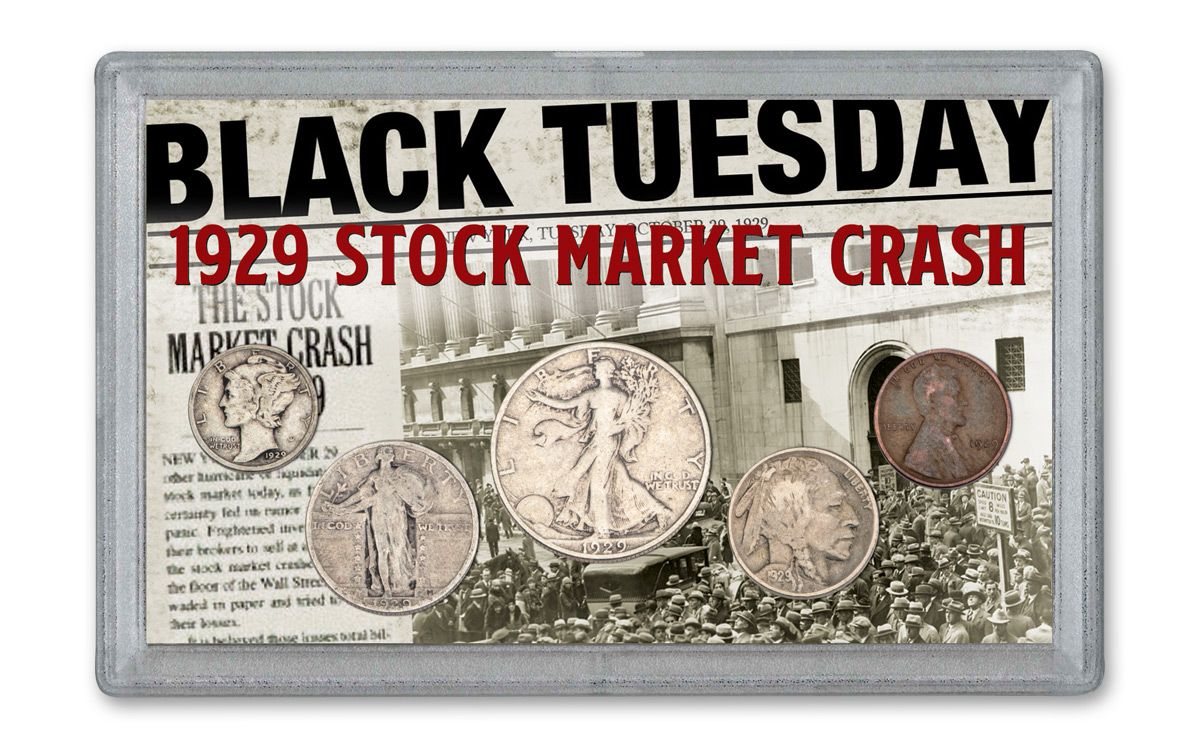

The Stock Market Crash of 1929, also known as Black Tuesday, refers to the rapid and severe decline in stock prices that occurred in the United States between October 24 and October 29, 1929. It is considered to be one of the most devastating financial downturns in history.

2. Causes:

The crash was the result of a combination of factors and events that created a perfect storm in the financial markets. Here are some of the primary causes:

- Speculative Trading: During the 1920s, there was a significant increase in speculative trading, where investors bought stocks with the anticipation of selling them quickly for a profit. This created an unsustainable bubble in the stock market.

- Overvaluation of Stocks: Stock prices had reached unprecedented heights, far surpassing the actual value of the underlying companies. This overvaluation made the market vulnerable to a significant correction.

- Excessive Borrowing and Margin Buying: Many investors had been borrowing heavily to purchase stocks on margin, which means they were using borrowed money to pay for a portion of their stock purchases. When prices started declining, they were forced to sell to meet margin calls, exacerbating the downward spiral.

- Tight Monetary Policies: The Federal Reserve had implemented tight monetary policies, increasing interest rates and reducing the money supply. These policies restricted credit and contributed to the collapse of financial institutions.

- Market Manipulation: Some insiders and speculators actively manipulated stock prices to drive up demand. When these manipulations were exposed, it eroded investor confidence and sparked panic selling.

Effects:

The Stock Market Crash of 1929 had far-reaching consequences that extended well beyond the financial sector. Here are some of the key effects:

- Great Depression: The crash marked the beginning of the Great Depression, a severe worldwide economic depression that lasted through the 1930s. High unemployment rates, widespread poverty, and a sharp decline in industrial production characterized this period.

- Bank Failures: As stock prices plummeted, many banks that had invested heavily in the market suffered massive losses. This led to a wave of bank failures and a loss of public trust in the banking system.

- Global Economic Impact: The crash had an international ripple effect, as economies around the world experienced a decline in trade, investment, and industrial production.

- Regulatory Reforms: In response to the crash, the U.S. government implemented various regulatory reforms, including the Securities Act of 1933 and the Securities Exchange Act of 1934, to restore confidence in the financial markets and prevent similar crises in the future.

In conclusion, the Stock Market Crash of 1929 was a pivotal event in financial history that had profound and lasting effects on the global economy. It serves as a reminder of the importance of prudent investing, regulations, and fiscal policies to maintain a stable and sustainable financial system.