Home>Finance>What Effect Will Trump Have On The Stock Market

Finance

What Effect Will Trump Have On The Stock Market

Published: October 20, 2023

Explore the potential impact of Donald Trump on the stock market. Gain insights into the finance industry and discover how Trump's policies may shape the future of investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Historical Analysis of Presidents and Stock Market Performance

- Trump’s Impact on the Stock Market During His Presidency

- Economic Policies and their Effect on the Stock Market

- Trade Wars and Market Volatility

- Tax Reforms and Corporate Profits

- Deregulation and Financial Sector

- Infrastructure Spending and Industries

- Healthcare and Biotech Sectors

- Energy and Environmental Policies

- Impact of Global Events on Stock Market

- Market Expectations and Investor Sentiment

- Conclusion

Introduction

The stock market is often seen as a reflection of the overall health and stability of the economy. As a result, any shifts in political leadership can have a significant impact on investor sentiment and market performance. In recent years, the election of Donald Trump as the 45th President of the United States sparked intense debates and speculation about its potential implications for the stock market.

During his campaign, Trump promised to implement various economic policies aimed at stimulating growth, creating jobs, and boosting corporate profits. From tax reforms to deregulation, his proposals set the stage for significant changes that had the potential to affect the stock market in both positive and negative ways. Now, with Trump’s presidency behind us, it is an opportune time to evaluate the impact he had on the stock market and explore the reasons behind these effects.

In this article, we will delve into the historical analysis of presidents’ impact on the stock market, as well as examine Trump’s specific policies and their influence on different sectors. We will also discuss how external factors, such as trade wars and global events, interacted with Trump’s policies to shape market performance. By gaining a deeper understanding of these dynamics, investors can make more informed decisions and anticipate potential market movements.

While it is important to remember that past performance does not guarantee future results, studying the relationship between presidents and the stock market can provide valuable insights into the connections between politics and finance. So, let us dive into this analysis and explore the effect that President Trump had on the stock market during his tenure.

Historical Analysis of Presidents and Stock Market Performance

Throughout history, the performance of the stock market has shown a correlation with the actions and policies of presidents. While there are numerous factors that influence the stock market, including global events and economic indicators, the actions of the president can play a pivotal role in shaping investor sentiment and market performance.

Several studies have examined the relationship between presidents and the stock market, revealing interesting trends and patterns. For example, a study conducted by the National Bureau of Economic Research found that stock market returns tend to be higher during periods of Democratic administrations compared to Republican administrations.

In addition, researchers have observed that markets typically react positively to certain policies, such as tax cuts and infrastructure spending, while reacting negatively to policies like trade wars and increased regulation. Understanding these historical trends can provide valuable insights into how the stock market may respond to different presidential policies.

It is important to note that stock market performance is influenced by a wide range of factors, including interest rates, corporate earnings, and global economic conditions. Therefore, attributing all market movements solely to the actions of the president would be an oversimplification. However, presidents do have the power to shape policies and implement reforms that can directly impact specific industries and sectors.

By examining the historical performance of the stock market during different presidencies, we can gain a better understanding of how presidential actions and policies may impact market performance. This analysis serves as a valuable tool for investors, allowing them to anticipate potential opportunities and risks that may arise during different political regimes.

In the following sections, we will explore the impact that Donald Trump had on the stock market during his presidency, examining his economic policies and their effect on various sectors. We will also consider how external factors, such as trade wars and global events, influenced market performance during his tenure.

Trump’s Impact on the Stock Market During His Presidency

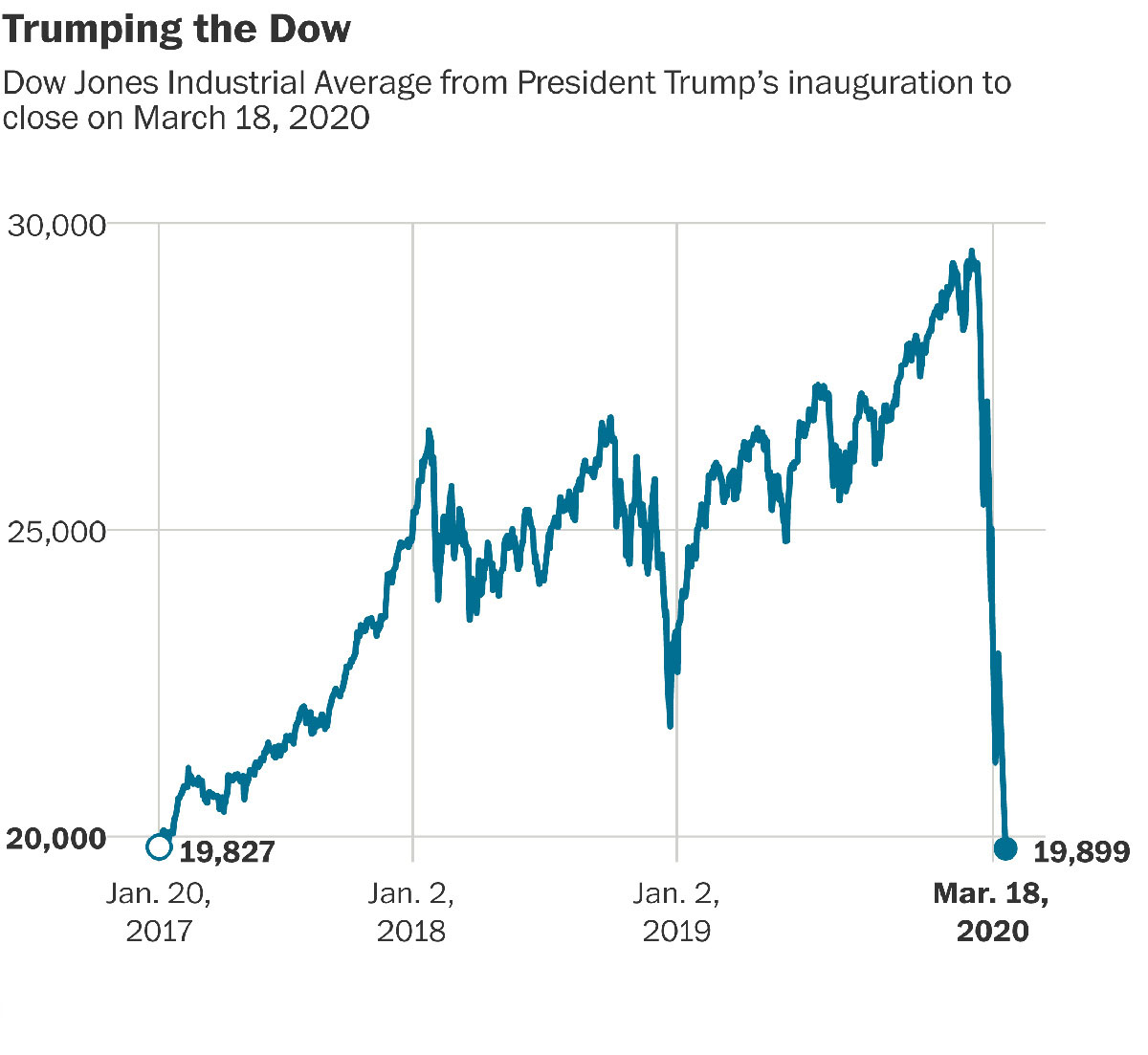

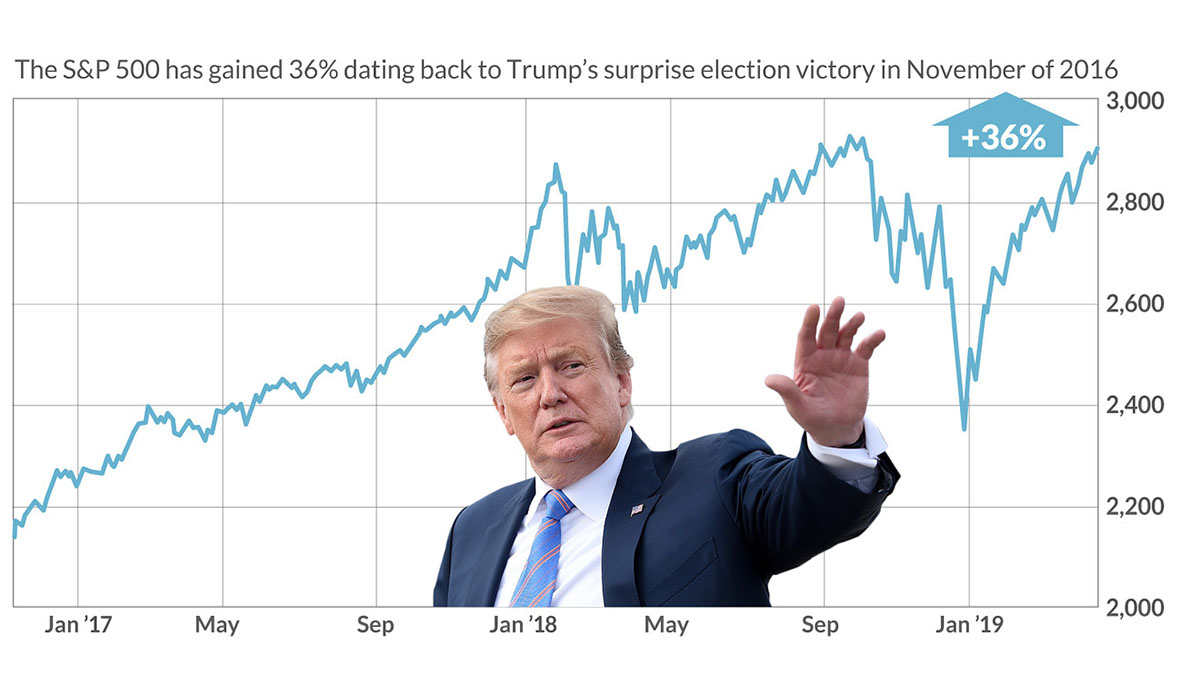

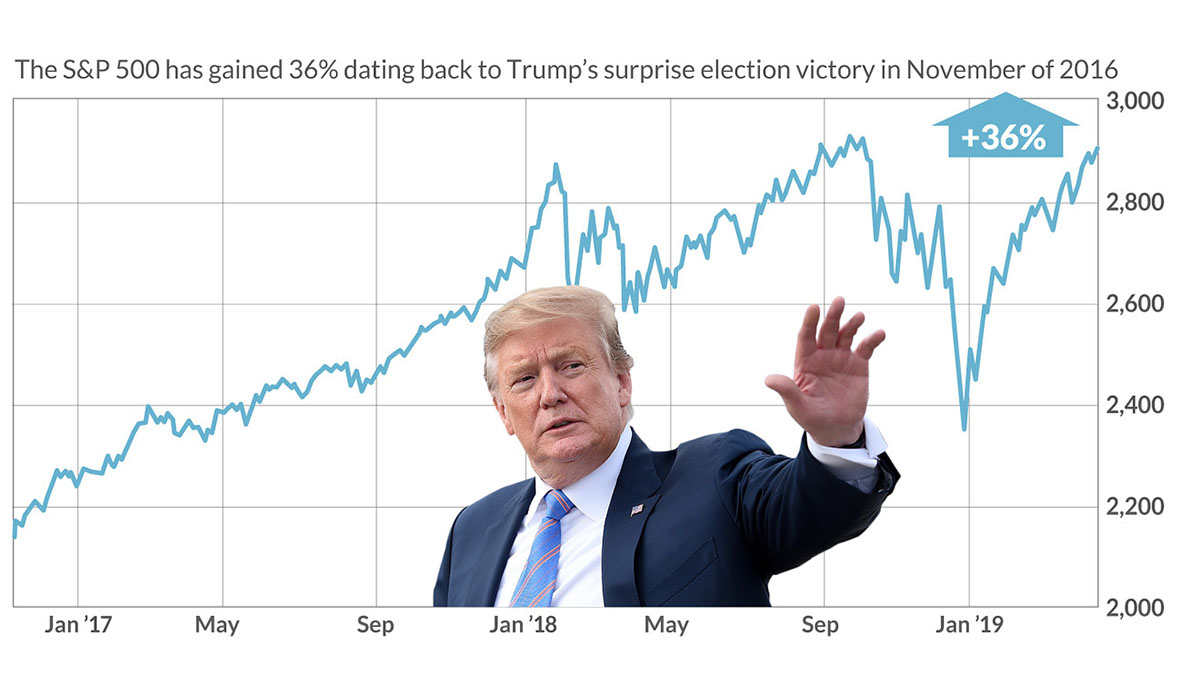

Donald Trump’s presidency was marked by significant volatility and fluctuations in the stock market. From the moment he took office in January 2017, his policies and rhetoric ignited both optimism and concern among investors, leading to a rollercoaster ride for the stock market.

At the outset of his presidency, Trump’s promises of tax cuts, deregulation, and infrastructure spending fueled a surge in market confidence. The anticipation of pro-business policies and reduced government interference led to a rally in stocks, with major indices reaching record highs. The stock market experienced what became known as the “Trump rally,” as investors eagerly awaited the implementation of his economic agenda.

However, the effects of Trump’s policies were not uniform across all sectors. One of the most significant impacts was felt in the financial sector. Trump’s agenda included rolling back regulations imposed after the 2008 financial crisis, with the aim of stimulating lending and investment. This led to a boost in financial stocks, as banks and other financial institutions anticipated increased profits and reduced regulatory burdens.

Another sector that experienced a mixed impact was healthcare. Trump’s efforts to repeal and replace the Affordable Care Act, also known as Obamacare, created uncertainty within the industry. Pharmaceutical and biotech companies faced uncertainty regarding drug pricing regulations, leading to fluctuations in stock prices. However, the potential for reduced regulations and tax reforms provided some support to healthcare stocks.

Trade policies also played a significant role in shaping market performance during Trump’s presidency. His commitment to renegotiating trade deals and imposing tariffs led to concerns of a global trade war. As tariffs and retaliatory measures were implemented, certain industries, such as manufacturing and agriculture, faced disruptions and financial strain. The uncertainty surrounding these trade policies created volatility in the stock market, as investors grappled with the potential consequences.

In addition to his economic policies, Trump’s rhetoric and social media presence also had an impact on market sentiment. His public statements, especially regarding trade negotiations and geopolitical tensions, had the potential to create volatility in the markets. Investors closely monitored his Twitter account for any indication of policy or geopolitical shifts that could affect their investment strategies.

Overall, Trump’s presidency was marked by periods of both significant gains and losses in the stock market. The market’s reaction to his policies and rhetoric demonstrated the interconnectedness of politics and finance. The stock market is highly sensitive to policy decisions and the perceptions of stability and confidence that a president can bring.

As we move forward, it is important to recognize that the relationship between presidents and the stock market is complex, with a multitude of factors influencing performance. While Trump’s policies and actions had a tangible impact on certain sectors, it is essential for investors to consider the broader economic landscape and global events when making investment decisions.

Economic Policies and their Effect on the Stock Market

During his presidency, Donald Trump implemented several notable economic policies with the goal of stimulating growth and boosting the stock market. These policies had varying impacts on different sectors and influenced market performance in different ways.

One of the signature policies of the Trump administration was the Tax Cuts and Jobs Act of 2017. This legislation aimed to reduce corporate tax rates and provide tax relief for individuals. The anticipation and subsequent implementation of these tax cuts led to a surge in corporate profits, benefiting many businesses and their shareholders. As a result, the stock market experienced a notable rally and reached new all-time highs.

In particular, sectors such as technology, finance, and industrials were among the primary beneficiaries of the tax reforms. Tech companies, with their high-profit margins, saw significant gains as corporate tax cuts translated into higher earnings. Financial institutions, with reduced regulations and a favorable tax environment, also experienced increased profitability. Additionally, the prospect of increased infrastructure spending as part of Trump’s economic agenda boosted the industrials sector.

Alongside tax cuts, deregulation was a key pillar of Trump’s economic policies. He sought to reduce government regulations across various industries, including finance, energy, and telecommunications. The removal of burdensome regulations was expected to unleash economic growth and stimulate investment. This deregulatory approach had a positive impact on the stock market, particularly for sectors with heavy regulatory burdens, such as financials and energy.

Another significant policy implemented by the Trump administration was a focus on trade and protectionism. Trump emphasized the need for fairer trade deals and employed tariffs as a negotiating tool. These trade policies created uncertainty and volatility in the stock market, as fears of a global trade war and disruptions to supply chains emerged. Industries dependent on international trade, such as manufacturing and agriculture, faced heightened risks and experienced volatility in their stock prices.

Furthermore, Trump’s policies regarding infrastructure spending had the potential to impact certain sectors. The promise of increased infrastructure investment created opportunities for construction and engineering companies, as well as material suppliers. Investors anticipated increased demand and potential profits, leading to positive market sentiment in these sectors.

It is important to note that the effects of these economic policies were not uniform across all sectors. While certain industries benefited from tax cuts and deregulation, others faced challenges due to trade uncertainties and disruption. Investors were keenly attuned to these policies and their implications, and market reactions were often swift and impactful.

Overall, the economic policies implemented by the Trump administration had a significant effect on the stock market. Tax cuts, deregulation, trade policies, and infrastructure spending all played a role in shaping market performance and investor sentiment. By understanding these policies and their potential consequences for different sectors, investors can make more informed decisions and navigate the ever-changing landscape of the stock market.

Trade Wars and Market Volatility

One of the defining features of Donald Trump’s presidency was his approach to trade, which led to escalating tensions and the initiation of trade wars with various countries. The imposition of tariffs and retaliatory measures had a significant impact on the stock market, causing increased volatility and uncertainty among investors.

Trump’s trade policies were centered around protecting American industries and reducing trade deficits. He believed that imposing tariffs on imported goods would bring back manufacturing jobs to the United States and protect domestic industries from what he saw as unfair trade practices.

However, the aggressive stance on trade had unintended consequences and created uncertainty in the stock market. The fear of a full-blown trade war and escalating tariffs led to increased volatility, as investors grappled with the potential impact on supply chains, consumer behavior, and global economic growth.

Industries that heavily rely on international trade, such as manufacturing, agriculture, and technology, were particularly vulnerable to the impacts of trade wars. Companies faced higher costs for imported raw materials and components, which squeezed profit margins. As a result, stock prices in these sectors experienced heightened volatility, reacting to each twist and turn in the trade negotiations.

Moreover, trade tensions between the United States and China drew significant attention from investors. As the world’s two largest economies engaged in a tit-for-tat exchange of tariffs, the stock market experienced pronounced swings. Companies with exposure to China, either through their supply chain or consumer base, faced additional uncertainties and potential disruptions.

While trade wars and protectionist measures had negative effects on certain sectors, there were also winners in this volatile landscape. Some domestic industries, such as steel and aluminum, benefited from protectionist policies and saw improved financial performance. Additionally, stocks of companies producing goods and services domestically were seen as more resilient to trade disruptions.

It is important to note that trade tensions were not limited to China, as Trump’s administration also renegotiated trade agreements, such as the North American Free Trade Agreement (NAFTA), which led to the creation of the United States-Mexico-Canada Agreement (USMCA). These negotiations created uncertainty and occasional market jitters, as investors assessed the implications for various industries and economies.

Overall, trade wars initiated during Trump’s presidency had a substantial impact on market volatility. The uncertainty created by tariff escalations and retaliatory measures introduced a new layer of risk for investors. Monitoring trade developments and understanding their potential effects on specific industries became crucial for investors navigating the stock market during this period.

Tax Reforms and Corporate Profits

One of the key pillars of Donald Trump’s economic agenda was tax reform. The Tax Cuts and Jobs Act of 2017 aimed to provide tax relief for both individuals and corporations, with the goal of stimulating economic growth and job creation. The implementation of these tax reforms had a significant impact on corporate profits and stock market performance.

The reduction in corporate tax rates was one of the most notable aspects of the tax reforms. The corporate tax rate was lowered from 35% to 21%, providing a substantial tax break for businesses. This reduction in tax liability meant increased profits for corporations, which was reflected in their financial reports and contributed to market optimism.

The impact of these tax cuts on corporate profits was particularly pronounced in certain sectors. Companies in industries with high-profit margins, such as technology and finance, were among the biggest beneficiaries. The reduction in tax rates directly translated into higher after-tax earnings, leading to positive investor sentiment and stock price increases.

Moreover, the repatriation of overseas profits at a lower tax rate incentivized companies to bring back money held abroad. This contribution to domestic investment and capital expenditure further boosted corporate profits and fueled market growth.

The immediate effects of the tax reforms on corporate profits and stock prices were evident. Many companies announced higher earnings, raised dividends, and initiated share buyback programs, which increased shareholder value. These positive financial outcomes, in turn, contributed to the upward trajectory of the stock market during Trump’s presidency.

However, it is worth noting that the impact of tax reforms on corporate profits is not uniform across all sectors. Some industries, such as utilities and real estate investment trusts (REITs), enjoy certain tax advantages and may have experienced less of a direct impact from the reduced corporate tax rates. Additionally, companies with significant operations abroad may have faced complications due to the complexities of international tax regulations.

It is important to consider the long-term implications of the tax reforms on corporate profits. While the immediate effects were positive, the sustainability of increased profits relies not only on tax savings but also on broader economic factors and business fundamentals. Factors such as consumer spending, global economic conditions, and technological advancements also play a crucial role in determining corporate profitability and, consequently, stock market performance.

Ultimately, the tax reforms implemented during Trump’s presidency had a notable impact on corporate profits, providing a boost to many companies and contributing to stock market gains. Understanding the direct and indirect effects of tax policy changes on specific industries and sectors can help investors make informed decisions and assess potential opportunities within the stock market.

Deregulation and Financial Sector

One of the key economic policies of the Trump administration was focused on deregulating various industries, with a particular emphasis on the financial sector. The aim was to reduce government oversight and burdensome regulations, which were seen as hindrances to economic growth and innovation. This deregulatory approach had a significant impact on the financial sector and influenced market dynamics during Trump’s presidency.

The financial sector, which encompasses banks, investment firms, and insurance companies, underwent substantial changes as a result of deregulation. The rollback of certain regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, released some of the constraints placed on financial institutions following the 2008 financial crisis.

The loosening of regulations had a positive effect on the financial sector, allowing banks and other financial institutions to engage in a wider range of activities and potentially increase profitability. Reducing regulatory burdens was perceived as a catalyst for increased lending, investment, and innovation within the industry.

Financial institutions, particularly large banks, benefited from the relaxed regulations, as they were able to allocate capital more freely and potentially take on more risk. This resulted in improved financial performance, as evidenced by higher profits and stock price appreciation. Additionally, the reduction in regulatory compliance costs provided a boost to the bottom line for many financial companies.

However, the deregulation of the financial sector also raised concerns among critics who argued that it could lead to a resurgence of risky practices and potentially create conditions for another financial crisis. The fear of a repeat of the 2008 crisis prompted skepticism and debates regarding the appropriate level of regulation needed to ensure financial stability.

It is important to note that deregulation had varying impacts on different segments of the financial sector. For instance, community banks and smaller financial institutions were expected to benefit from reduced compliance costs and greater flexibility. These institutions, which often faced more significant regulatory burdens compared to their larger counterparts, were able to allocate resources more efficiently and potentially expand their operations.

Overall, the deregulation of the financial sector during Trump’s presidency had a significant impact on market dynamics and investor sentiment. The loosening of regulations benefited financial institutions, particularly larger banks, leading to increased profitability and stock market gains. However, ongoing debates persist regarding the potential risks associated with reduced oversight, and the long-term implications of deregulation in the financial sector.

Investors in the financial sector should stay informed about evolving regulatory landscape and assess the potential risks and opportunities presented by deregulation. Careful evaluation of an individual company’s risk management practices, governance, and financial stability indicators is necessary to make sound investment decisions within this sector.

Infrastructure Spending and Industries

Infrastructure spending was a key component of Donald Trump’s economic agenda during his presidency. The promise of increased investment in infrastructure projects aimed to stimulate economic growth, create jobs, and drive industry expansion. The potential impact of infrastructure spending on various industries and sectors was closely watched by investors.

The anticipation of substantial infrastructure investment led to positive market sentiment in industries related to construction, engineering, and materials. Companies involved in building and maintaining infrastructure, such as construction firms, steel manufacturers, and engineering consultants, were expected to benefit from the increased demand for their services and products.

Infrastructure spending covers a wide range of sectors, including transportation, energy, water systems, and telecommunications. The potential for investment in roads, bridges, airports, rail systems, and broadband infrastructure excited market participants who anticipated increased business opportunities and potential growth for companies operating within these sectors.

Moreover, the increased demand for construction materials, such as steel, concrete, and asphalt, had the potential to boost the profitability of materials producers and suppliers. Construction-related companies could also benefit from higher demand for machinery, equipment, and technology used in infrastructure projects.

However, it is important to note that the impact of infrastructure spending is not immediate and can take time to materialize. The planning, approval, and implementation of large-scale infrastructure projects often involve complex processes and can face challenges related to funding, regulatory hurdles, and political considerations.

During Trump’s presidency, while the commitment to infrastructure spending remained a talking point, progress on passing comprehensive infrastructure legislation proved challenging. As a result, the expected boost to certain industries did not materialize to the extent initially anticipated. Investors who positioned themselves in infrastructure-related sectors had to carefully evaluate the evolving policy landscape and adjust their investment strategies accordingly.

It is also worth noting that the impact of infrastructure spending extends beyond the companies directly involved in construction and materials. The positive effects can ripple through the economy, benefiting industries such as transportation, manufacturing, and professional services. Companies in these sectors could experience increased demand for their products or services as a result of enhanced infrastructure networks and improved logistical capabilities.

Infrastructure spending can have broader effects on economic productivity, competitiveness, and job creation. By investing in critical infrastructure, countries can improve efficiency, reduce bottlenecks, and enhance overall economic growth potential. These effects can cascade across various sectors, creating a more favorable business environment that supports market expansion and investor confidence.

While the implementation of comprehensive infrastructure spending during Trump’s presidency faced challenges, ongoing discussions and potential bipartisan support for infrastructure investment remain topics of interest. Investors should continue to monitor developments in infrastructure policy and assess potential opportunities within industries directly and indirectly impacted by infrastructure spending.

Healthcare and Biotech Sectors

The healthcare and biotech sectors experienced significant fluctuations and uncertainty during Donald Trump’s presidency. The administration’s efforts to repeal and replace the Affordable Care Act, regulatory changes, and discussions regarding drug pricing created a dynamic environment for these sectors, impacting investor sentiment and market performance.

Trump’s pledge to repeal and replace the Affordable Care Act, also known as Obamacare, created uncertainty within the healthcare industry. This uncertainty stemmed from concerns over potential changes to the healthcare system, reimbursement rates, and the fate of insurance coverage for millions of Americans. Healthcare providers, insurers, and pharmaceutical companies closely monitored policy developments and prepared for potential shifts in their business models.

The biotech sector, which focuses on the development and commercialization of innovative drugs and therapies, was also subject to uncertainties during Trump’s presidency. The administration expressed a desire to lower drug prices and reduce regulatory barriers to promote competition and innovation. While the goal of lowering drug prices was generally supported, the uncertainty surrounding potential policy changes created volatility in the biotech sector.

Trump’s rhetoric around drug pricing and threats of government intervention put pressure on pharmaceutical companies to justify their pricing models. This led to increased scrutiny and the possibility of stricter regulations in the future. These factors, combined with public and political pressure to control healthcare costs, contributed to stock price volatility within the biotech sector.

Additionally, potential changes to intellectual property laws and patent regulations posed potential challenges for biotech companies, as their business models rely heavily on intellectual property protections. Policies that could curtail exclusivity rights and extend market competition could impact the financial prospects of these companies and their ability to recoup research and development costs.

However, it is important to acknowledge that the healthcare and biotech sectors are influenced by various factors beyond government policies. Scientific advancements, clinical trial results, and market demand for new therapies also play a significant role in the performance of these sectors.

Despite uncertainties, technological advances and breakthroughs in areas such as gene therapy, immunotherapy, and precision medicine continued to drive innovation and present opportunities for growth within the biotech sector. Companies involved in developing novel treatments and therapies for diseases like cancer and rare genetic disorders drew attention from investors seeking disruptive medical advancements.

Overall, the healthcare and biotech sectors experienced volatility and uncertainty during Trump’s presidency, as policy discussions and potential regulatory changes influenced investor sentiment. Investors in these sectors had to closely monitor policy developments and adapt their strategies accordingly, knowing that healthcare dynamics are influenced not only by government policies but also by scientific breakthroughs, clinical trials, and evolving patient needs.

Energy and Environmental Policies

Energy and environmental policies underwent significant changes during Donald Trump’s presidency, which in turn had an impact on the energy sector and related industries. The administration pursued a series of deregulatory actions and rolled back certain environmental protections, signaling a shift in approach compared to previous administrations.

One notable policy change was the United States’ withdrawal from the Paris Agreement, an international accord aimed at combatting climate change. The decision drew mixed reactions, with critics arguing that it could hinder global efforts to reduce greenhouse gas emissions and transition to cleaner energy sources. The withdrawal from the agreement created uncertainties regarding the long-term direction of U.S. environmental policies.

The Trump administration also focused on supporting traditional energy sectors like coal, oil, and natural gas. Efforts were made to roll back regulations that were seen as burdensome to these industries, allowing for increased domestic production and potentially lower energy costs. The “America First Energy Plan” aimed to promote energy independence and create jobs within the fossil fuel sector.

These policy shifts led to market dynamics within the energy sector. The deregulatory approach and support for traditional energy sources were generally welcomed by investors in coal, oil, and gas companies, as they anticipated favorable business conditions and potential profitability. Companies involved in exploration, production, refining, and distribution within these sectors experienced market reactions corresponding to policy developments and shifts in energy regulations.

On the other hand, renewable energy sources faced challenges due to policy shifts and reduced federal support. The withdrawal from international clean energy initiatives and the removal of certain environmental regulations impacted investor sentiment in the renewable energy sector. Companies involved in solar, wind, and other forms of renewable energy faced increased uncertainty and potential headwinds as government support and incentives were scaled back.

Despite changes in federal policies, interest in sustainable energy solutions and renewable technologies continued to grow at a global level. State-level initiatives, advancements in technology, and market demand for clean and sustainable energy solutions remained influential factors for investors in the energy sector. Companies that focused on energy efficiency, battery storage, and other environmentally friendly solutions attracted investor attention.

It is important to note that environmental policies and market dynamics within the energy sector are influenced by factors beyond government actions. Technological advancements, energy prices, global energy demand, and consumer preferences all play a role in shaping the industry’s trajectory.

Overall, changes in energy and environmental policies during Trump’s presidency introduced shifts in market dynamics within the energy sector. The deregulatory approach and support for traditional energy sources created opportunities and challenges for various industry players. Investors in the energy sector had to navigate the changing policy landscape and adapt their strategies based on market conditions, technological developments, and long-term sustainability trends.

Impact of Global Events on Stock Market

The stock market is intricately linked to global events, as economic, political, and social factors across the world can have a substantial impact on investor sentiment and market performance. Global events can create both opportunities and risks, influencing the direction of stock markets on a local and international scale.

One of the primary ways global events affect the stock market is through their impact on investor confidence. Events such as geopolitical tensions, economic crises, pandemics, and natural disasters can shake investor sentiment and create uncertainty. As a result, stock prices can experience significant volatility, reflecting investor reactions to evolving global conditions.

For example, geopolitical events like trade disputes, conflicts, or changes in government leadership can create instability and introduce market risk. The uncertainty surrounding these events can lead to sell-offs, flight to safe-haven assets, or cautious investment strategies. Conversely, resolutions or positive developments in these events can boost investor confidence, leading to market rallies.

Economic events also play a crucial role in shaping stock market performance. Factors such as global economic growth, interest rate changes, inflation, and monetary policy decisions by central banks can have far-reaching effects on stocks. Economic recessions or downturns can trigger widespread market declines, while robust economic growth can fuel optimism and drive stock prices higher.

Global events can have sector-specific impacts as well. For instance, fluctuations in commodity prices can directly affect industries such as energy, mining, and agriculture. Changes in government regulations, trade policies, or consumption patterns in certain countries can have profound implications for industries such as technology, automotive, and consumer goods.

Moreover, global events can create opportunities for investors to identify undervalued assets or potential growth areas. For example, events that trigger market downturns can provide buying opportunities for investors with a long-term perspective. Likewise, breakthroughs in technology, scientific discoveries, or political changes can create new investment prospects in specific sectors or regions.

In today’s interconnected world, global events can quickly drive market sentiment beyond national borders. With the advent of technology and the ease of information flow, investors can react swiftly to news and events happening around the world, amplifying the impact on the stock market.

It is crucial for investors to stay informed about global events and their potential implications on the stock market. Monitoring economic indicators, geopolitical developments, and the evolving global landscape enables investors to assess risks, identify opportunities, and make informed investment decisions.

However, it is important to note that while global events can significantly influence the stock market, they do not solely determine its direction. Other factors such as company fundamentals, market trends, and investor sentiment at a local level also contribute to market performance. Therefore, a comprehensive approach combining global event analysis with other fundamental and technical analysis is necessary for a well-informed investment strategy.

Market Expectations and Investor Sentiment

Market expectations and investor sentiment play a vital role in shaping stock market performance. The collective sentiment and outlook of investors can heavily influence buying and selling decisions, leading to shifts in stock prices and overall market trends. Understanding market expectations and investor sentiment is crucial for investors seeking to navigate the stock market.

Market expectations are formed based on a wide range of factors, including economic data, corporate earnings reports, policy decisions, and global events. Analyst forecasts, economic indicators, and industry trends contribute to the overall perception of market conditions and future prospects. Expectations about economic growth, interest rates, inflation, and industry-specific factors all play a role in shaping market sentiment.

Investor sentiment, on the other hand, reflects the emotions and attitudes of market participants. It can range from extreme optimism to extreme pessimism, influencing the level of risk-taking behavior and the demand for certain stocks or assets. Investor sentiment is driven by a combination of rational analysis, psychological biases, and market perception of future outcomes.

Optimistic investor sentiment often leads to increased buying activity and can drive stock prices higher. Positive sentiment is typically fueled by positive economic indicators, strong corporate earnings, favorable policy decisions, or market expectations of future growth. It creates a sense of confidence and encourages investors to deploy capital in the market.

Conversely, when sentiment turns negative, investors become more risk-averse and tend to sell-off stocks. Negative sentiment can be triggered by weak economic data, geopolitical tensions, adverse policy decisions, or uncertainty surrounding global events. Fear and uncertainty lead to market sell-offs, increasing volatility and driving stock prices lower.

It is worth noting that market expectations and investor sentiment are not always rational or entirely based on fundamental factors. Psychological biases, herding behavior, and market psychology can magnify both positive and negative sentiment, leading to market overreactions or bubbles.

Monitoring market expectations and investor sentiment can provide valuable insights for investors. By understanding prevailing sentiment and expectations, investors can make more informed decisions about asset allocation, risk management, and timing of investment decisions. It allows them to align their strategies with broader market dynamics and anticipate potential turning points or trends.

However, it is important for investors not to solely rely on market sentiment when making investment decisions. Fundamentals, valuation analysis, and individual company performance should also be considered. Combining qualitative and quantitative analysis helps investors make more comprehensive and well-informed decisions.

Additionally, market expectations and investor sentiment can change rapidly, influenced by new information and evolving market conditions. Being aware of ongoing market sentiment and staying informed about key developments and indicators is crucial for investors to adjust their strategies appropriately.

Ultimately, market expectations and investor sentiment act as powerful forces in shaping stock market performance. By monitoring and understanding these factors, investors can better position themselves to take advantage of opportunities, manage risks, and navigate the ever-changing landscape of the stock market.

Conclusion

The stock market is a dynamic and complex environment influenced by a wide range of factors, including political events, economic indicators, global trends, and investor sentiment. During Donald Trump’s presidency, the stock market experienced significant fluctuations and volatility, driven by his economic policies, trade wars, and global events.

Trump’s economic policies, including tax reforms and deregulation, had a notable impact on corporate profits and sectors such as finance and energy. Tax cuts stimulated corporate earnings, leading to stock market rallies, while deregulation created opportunities for industries burdened by regulations.

However, trade wars and uncertain trade policies introduced volatility into the stock market. Fluctuating trade tensions with China and other countries created uncertainty for industries dependent on international trade, impacting sectors like manufacturing and agriculture.

Furthermore, healthcare and biotech sectors faced uncertainty regarding changes to healthcare policies and drug pricing regulations. The potential repeal of the Affordable Care Act and discussions around drug pricing created market volatility and challenges for companies operating in those sectors.

Energy and environmental policies, including deregulation and a focus on traditional energy sources, influenced the energy sector. The shift in policies affected market dynamics for sectors involved in fossil fuels and renewable energy, creating opportunities for some and challenges for others.

Global events, such as geopolitical tensions and economic crises, had profound impacts on investor sentiment and market performance. Market expectations and investor sentiment played a crucial role in driving stock prices and shaping market trends, reflecting reactions to economic data, policy decisions, and global events.

In conclusion, understanding the interplay between politics, economic policies, global events, and investor sentiment is essential for investors in navigating the stock market. By staying informed about these factors and their potential implications, investors can make more informed decisions, manage risks, and identify opportunities within an ever-changing market landscape.

It is important to remember that while historical analysis can provide valuable insights, future stock market performance depends on a multitude of factors and is inherently uncertain. Therefore, investors should exercise caution, conduct thorough research, and diversify their portfolios to mitigate risks and achieve their long-term investment goals.