Home>Finance>Stock Markets Before And After Trump’s Inauguration

Finance

Stock Markets Before And After Trump’s Inauguration

Published: October 20, 2023

Discover how Trump's inauguration affected the finance world and stock markets with our comprehensive analysis of before and after trends.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Background of Trump’s Inauguration

- Pre-Inauguration Stock Market Performance

- Factors Impacting Stock Markets Before Trump’s Inauguration

- Trump’s Inauguration and Its Immediate Impact

- Post-Inauguration Stock Market Performance

- Factors Impacting Stock Markets After Trump’s Inauguration

- Comparison of Stock Markets Before and After Trump’s Inauguration

- Conclusion

Introduction

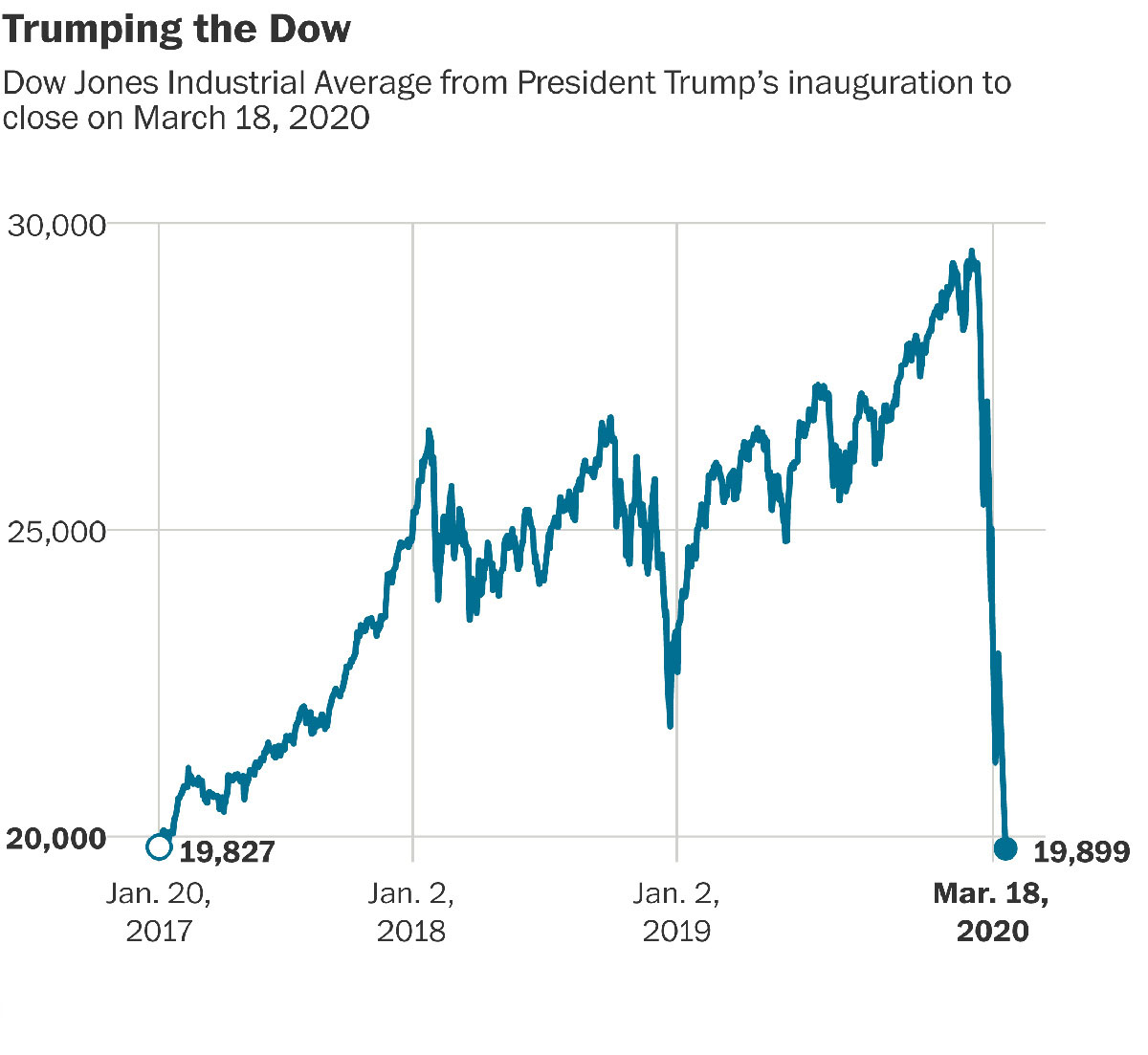

Donald Trump’s inauguration as the 45th President of the United States on January 20, 2017, marked a significant moment in history. It was a pivotal event that had a profound impact on various sectors, including the stock market. Trump’s campaign promises and his unconventional approach to governance created a sense of anticipation and uncertainty among investors.

Before delving into the effects of Trump’s inauguration on the stock market, it is important to understand the backdrop against which it occurred. The U.S. economy had been steadily recovering from the Great Recession of 2008, and stock markets had experienced a prolonged period of growth under the Obama administration.

The stock market is a complex and volatile system, influenced by a multitude of factors such as economic indicators, corporate earnings, geopolitical events, and government policies. In this article, we will examine how the stock market performed both before and after Trump’s inauguration, and explore the factors that contributed to these fluctuations.

By analyzing the market dynamics during this period, we can gain insights into how presidential transitions can impact investor sentiment and market trends. It is important to note that this article aims to provide a comprehensive overview of the topic, but it should not be used as financial advice. Individual investors should consult with financial professionals before making any investment decisions.

Background of Trump’s Inauguration

Donald J. Trump, a successful businessman and reality TV star, won the U.S. presidential election on November 8, 2016. His unexpected victory over the Democratic candidate, Hillary Clinton, sent shockwaves through the country and the world. Trump’s campaign was based on promises of economic growth, tax cuts, deregulation, and renegotiating trade deals to protect American jobs.

Trump’s inauguration on January 20, 2017, was met with a mix of anticipation and uncertainty. His unconventional style, controversial statements, and policy proposals created a sense of volatility and polarization. Investors and businesses were keenly interested in how Trump’s presidency would impact the economy and financial markets.

Leading up to his inauguration, Trump had already started making waves. Through his tweets and public statements, he targeted specific companies, praising those creating American jobs while criticizing others for offshoring or outsourcing. His direct approach in dealing with businesses drew both praise and criticism, with some seeing it as a sign of his commitment to revitalizing the American economy and others expressing concerns about potential disruptions to corporate strategies and international relations.

Trump’s policies and proposed changes during his campaign included tax reforms, reducing regulations, infrastructure spending, and a more restrictive trade policy. These proposals fueled speculation among investors about the potential impact on various sectors and industries. The anticipation of change, both positive and negative, affected market sentiment and contributed to market volatility.

Given his background in real estate and finance, market participants were particularly interested in how Trump’s policies could affect the financial sector. Speculation was rife about potential deregulation in the banking industry and changes to the Dodd-Frank Act, which was implemented in response to the 2008 financial crisis. The expectation of loosening regulations had a significant influence on the banking sector’s stock prices.

The international trade landscape was another area of focus. Trump’s strong stance on renegotiating trade deals and his skepticism of free trade agreements, such as the North American Free Trade Agreement (NAFTA), raised concerns among businesses that heavily relied on international markets. This uncertainty led to fluctuations in global stock markets, especially for companies with significant international exposure.

Pre-Inauguration Stock Market Performance

Prior to Donald Trump’s inauguration, the stock market experienced a period of anticipation and volatility. The markets were closely watching the transition of power and the potential impact of Trump’s proposed policies on various sectors.

Shortly after Trump’s election win, the stock market initially reacted positively. Investors saw Trump’s promises of tax cuts, deregulation, and infrastructure spending as potential catalysts for economic growth. This sentiment, coupled with the expectation of increased government spending, led to a surge in stock prices across several sectors, including financials, industrials, and defense.

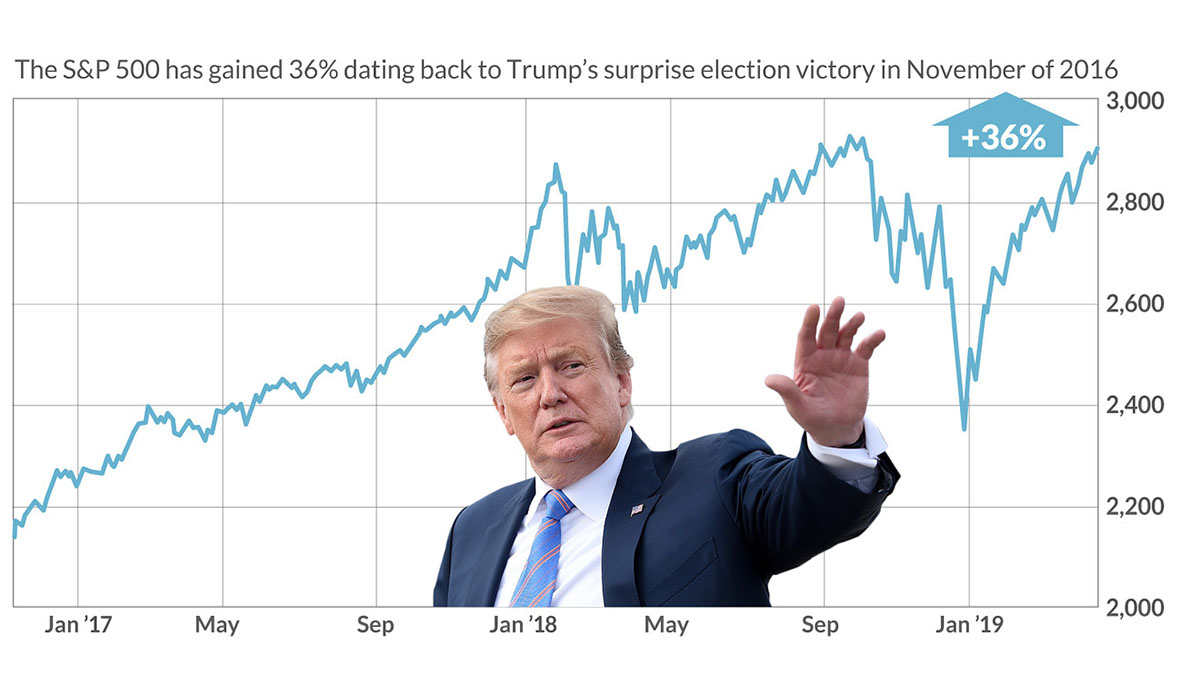

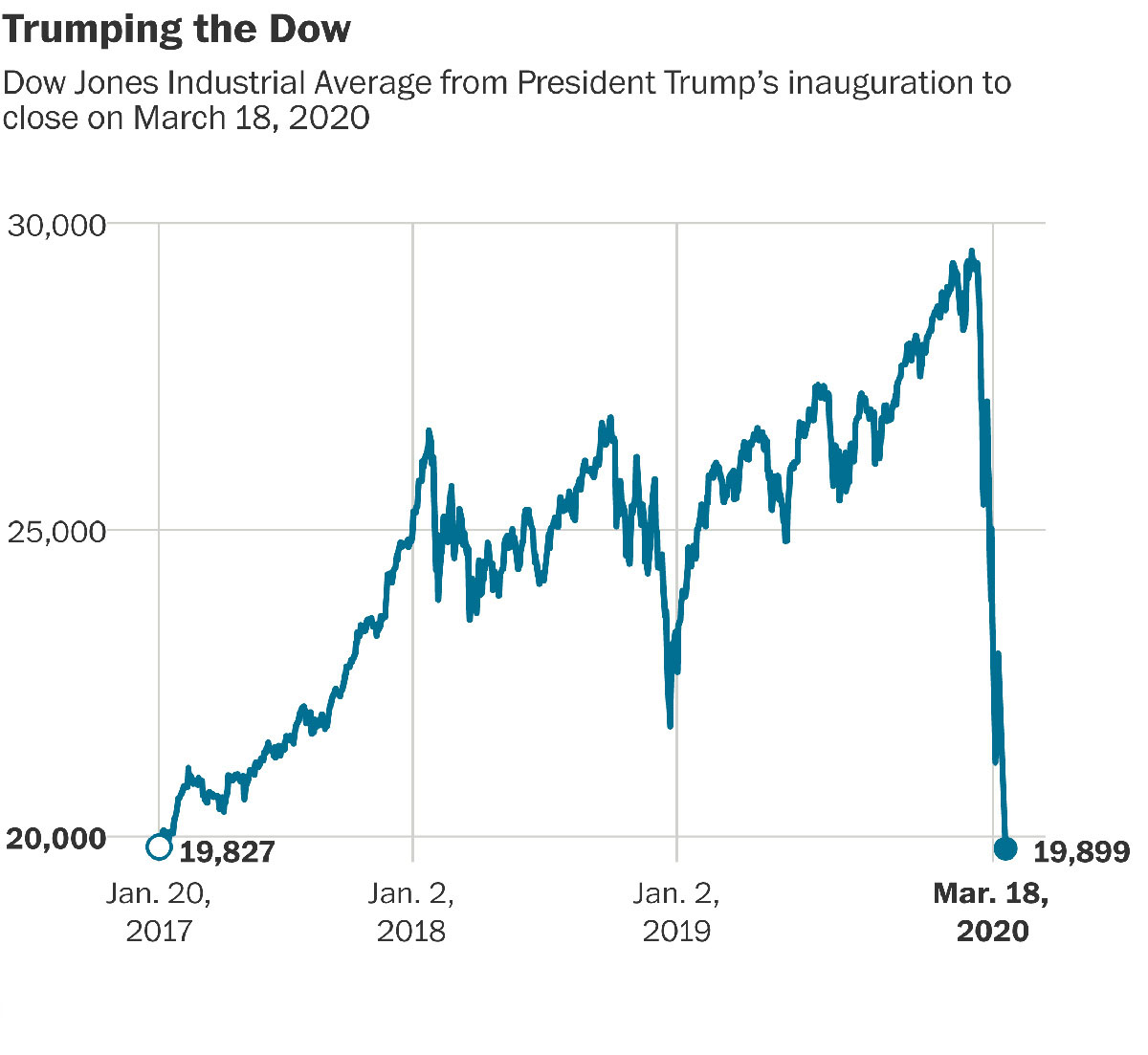

The Dow Jones Industrial Average (DJIA), a key measure of the U.S. stock market, reached a record high of 19,999.63 on January 6, 2017, just a stone’s throw away from the significant milestone of 20,000, which had never been achieved before. This rally was often referred to as the “Trump rally,” as it was fueled by the optimism surrounding his pro-growth agenda.

However, market volatility persisted as investors sought more clarity on Trump’s proposed policies and their potential implications. The market sentiment fluctuated based on Trump’s announcements and tweets, causing stocks to react with both gains and losses. For example, when Trump criticized specific companies or industries on social media, their stock prices would often experience sharp declines.

During this period, sectors such as healthcare and technology faced uncertainties due to prospective regulatory changes and concerns over international trade policies. Trump’s pledge to repeal and replace the Affordable Care Act (ACA), also known as Obamacare, generated uncertainty within the healthcare sector. Similarly, his tough stance on immigration and potential restrictions on H-1B visas created apprehension in the technology sector, which relied heavily on skilled foreign workers.

The attention on Trump’s proposed policies and his interactions with businesses created an environment of both optimism and caution in the stock market. Investors closely monitored events leading up to the inauguration for signals of potential market shifts or new investment opportunities.

Overall, the pre-inauguration stock market performance reflected a blend of optimism, volatility, and a wait-and-see approach as investors assessed the potential impact of Trump’s policies on various sectors and industries. This period set the stage for the market’s reaction to Trump’s inauguration and the subsequent market trends during his presidency.

Factors Impacting Stock Markets Before Trump’s Inauguration

Several factors influenced the stock markets in the buildup to Donald Trump’s inauguration as the 45th President of the United States. These factors played a significant role in shaping market sentiment and determining the performance of different sectors.

1. Trump’s Proposed Policies: Investors closely monitored Trump’s proposed policies and anticipated their potential impact on various industries. His promises of tax cuts, deregulation, and infrastructure spending were viewed positively, as they were expected to stimulate economic growth. Conversely, concerns were raised about potential trade restrictions and the impact on industries with international exposure.

2. Economic Indicators: Key economic indicators, such as GDP growth, employment rates, and consumer confidence, influenced market sentiment. Positive economic indicators leading up to the inauguration contributed to the initial market rally, as investors saw a strong foundation for potential growth under the new administration.

3. Corporate Earnings: The performance of individual companies and their quarterly earnings reports had a direct impact on their stock prices. Market participants closely monitored earnings releases for indications of companies’ financial health and growth prospects. Positive earnings reports often resulted in stock price increases, while disappointing earnings could lead to declines.

4. Federal Reserve Activities: The actions and statements of the Federal Reserve, which sets monetary policy in the United States, had an impact on the stock market. Investors analyzed the Fed’s decisions on interest rates and its outlook on the economy, as these factors influenced borrowing costs and investor sentiment.

5. Geopolitical Events: Geopolitical events, such as elections in other countries and ongoing geopolitical tensions, had the potential to influence global markets. Any events that created uncertainty or instability in the international arena could lead to fluctuations in stock prices, as investors sought safe havens or reevaluated their risk appetite.

6. Market Sentiment and Investor Psychology: Market sentiment was heavily influenced by investors’ views and expectations. Sentiment could shift based on media coverage, economic indicators, and political developments. Investor psychology, including fear and greed, played a role in driving market cycles and determining stock prices.

7. Global Economic Factors: The state of the global economy and international market trends also impacted the U.S. stock markets. Global economic indicators, trade policies, and international events had ripple effects on markets, especially for companies with significant international exposure.

It is important to note that these factors do not operate in isolation but rather interact with and influence one another. The collective impact of these factors shaped the stock market performance in the period leading up to Trump’s inauguration, setting the stage for the market dynamics that would unfold during his presidency.

Trump’s Inauguration and Its Immediate Impact

The inauguration of Donald Trump as the 45th President of the United States on January 20, 2017, had an immediate impact on the stock market. The markets closely watched Trump’s inaugural address and the actions he took in the early days of his presidency, as they sought indications of how his policies would unfold.

1. Inaugural Address: Trump’s inaugural address set the tone for his presidency and conveyed his vision for the country. The market paid close attention to his remarks on key issues such as economic growth, job creation, and trade. Any references to specific policies or industries could have an immediate impact on stock prices related to those sectors.

2. Infrastructure Spending: One of Trump’s key promises was to invest in rebuilding the country’s infrastructure. Investors were eager to see if he would provide further details or announce specific plans during his inaugural speech. Any indications of increased infrastructure spending could lead to gains in sectors such as construction, engineering, and raw materials.

3. Executive Orders: Following his inauguration, Trump signed several executive orders addressing various policy issues. Some of these orders had implications for specific industries. For example, his repeal of the Trans-Pacific Partnership (TPP) trade agreement directly affected the outlook for companies engaged in global trade. The signing of executive orders also created headlines that could impact market sentiment and investor confidence.

4. Market Volatility: The stock market can be particularly sensitive to changes in political leadership. Trump’s unconventional approach and unpredictability added an extra element of uncertainty. In the immediate aftermath of the inauguration, the market experienced fluctuations in response to any statements or actions from the new administration, reflecting the market’s attempt to digest and interpret the implications of Trump’s presidency.

5. Financial and Regulatory Policies: Investors awaited signals about Trump’s plans for financial regulation and the banking sector. Any indications of potential changes to banking regulations, including the possibility of repealing or modifying aspects of the Dodd-Frank Act, could impact the stock prices of financial institutions. Similarly, Trump’s stance on deregulation in various industries, such as energy and healthcare, also had the potential to influence market sentiment.

6. Foreign Policy and Trade: Trump’s inauguration marked a shift in U.S. foreign policy. His protectionist rhetoric and promises to renegotiate trade agreements created uncertainty among investors, particularly those heavily reliant on global markets. Any remarks or actions related to international trade during the early stages of his presidency could have an immediate impact on stock prices of companies with significant international exposure.

It is important to note that the immediate impact of Trump’s inauguration on the stock market was largely driven by market sentiment and speculation about future policy actions. The true effects of his policies on specific industries and the overall economy would unfold over time, and market participants continued to monitor developments closely to assess the long-term implications of the new administration’s actions.

Post-Inauguration Stock Market Performance

The stock market’s performance following Donald Trump’s inauguration as the 45th President of the United States was marked by continued volatility and shifting market dynamics. Investors closely monitored Trump’s policy decisions and their potential impact on various sectors, which led to both positive and negative market reactions.

1. Early Rally and Dow 20,000: In the days immediately following Trump’s inauguration, the stock market experienced a continuation of the “Trump rally” that began after his election victory. The Dow Jones Industrial Average (DJIA) surpassed the historic milestone of 20,000 on January 25, 2017, reflecting the optimism among investors fueled by expectations of pro-business policies and economic stimulus.

2. Sector Performance: Different sectors responded differently to Trump’s policies and announcements. Sectors such as financials, defense, and infrastructure-related industries initially benefited from favorable market sentiment. Expectations of tax cuts and deregulation boosted financial stocks, while defense stocks reacted positively to increased defense spending proposals. Infrastructure-related industries, such as construction and materials, experienced gains on expectations of increased government spending.

3. Geopolitical Events: Throughout Trump’s presidency, global geopolitical events had an impact on the stock market. Trump’s handling of international relations, particularly trade disputes with China and tensions in the Middle East, created market volatility. Any developments related to these events influenced investor sentiment and had ripple effects on various sectors and markets.

4. Economic Indicators: The stock market’s performance was also influenced by key economic indicators during Trump’s presidency. Positive indicators like GDP growth, job reports, and consumer confidence boosted market sentiment and led to stock market gains. Conversely, negative economic indicators or economic uncertainties had the potential to trigger market declines.

5. Regulatory Changes: Trump’s administration pursued a deregulatory agenda across various industries, including finance, energy, and healthcare. The anticipation and implementation of regulatory changes impacted the stock market, as investors analyzed the potential impact on specific companies and industries. Positive regulatory changes often resulted in stock price increases, while concerns over increased regulation or policy reversals led to declines.

6. Trade Policy Uncertainty: Trump’s strong stance on trade, particularly his focus on renegotiating international trade agreements, created uncertainty that influenced the stock market. Trade tensions, trade deals, and retaliatory measures taken by other countries had a direct impact on industries with significant international exposure, such as manufacturing and agriculture.

7. Earnings Reports and Corporate Performance: Throughout Trump’s presidency, quarterly earnings reports and corporate performance continued to impact stock prices. Strong earnings reports often resulted in market gains, while disappointing reports or downward revisions in corporate guidance could lead to declines.

It is important to note that the stock market’s performance during Trump’s presidency was not solely influenced by his policies and actions. Other factors, such as global economic trends, natural disasters, and unforeseen events, played a role in shaping market dynamics. Market participants closely monitored these various factors to assess market conditions and make informed investment decisions.

Factors Impacting Stock Markets After Trump’s Inauguration

After Donald Trump’s inauguration as the 45th President of the United States, several factors continued to impact the stock markets. The market dynamics were shaped by various factors, including policy decisions, economic indicators, geopolitical events, and investor sentiment.

1. Policy Implementation: The market closely analyzed the implementation of Trump’s proposed policies, such as tax cuts, deregulation, and infrastructure spending. The degree to which these policies were enacted, their impact on specific industries, and the pace of implementation all influenced market sentiment and stock prices. Any delays or difficulties encountered in policy implementation could lead to market volatility.

2. Federal Reserve Actions: The actions and statements of the Federal Reserve continued to impact the stock market after Trump’s inauguration. Changes in interest rates and shifts in the Fed’s monetary policy had implications for borrowing costs, economic growth, and investor sentiment. The market closely watched for signals from the Fed on its outlook and any potential changes in policy direction.

3. Earnings Reports and Corporate Performance: Quarterly earnings reports and corporate performance remained crucial in determining stock prices. The market responded to companies’ financial results, including their revenue growth, profitability, and outlook for future earnings. Positive earnings surprises often led to stock price increases, while disappointing results or lowered guidance could trigger declines.

4. Geopolitical Developments: Global geopolitical events continued to impact the stock markets during Trump’s presidency. Tensions with North Korea, trade disputes with China, and political developments in other countries all had the potential to influence investor sentiment and market performance. Any uncertainties or escalations in these events could lead to increased market volatility.

5. Economic Indicators: Economic indicators, such as GDP growth, employment data, consumer sentiment, and inflation, continued to play a role in shaping market sentiment. Positive economic indicators were typically associated with market optimism and could contribute to stock market gains. Conversely, negative economic data or concerns about economic stability could result in market declines.

6. Trade Policy and Tariffs: Trump’s trade policies and the imposition of tariffs on certain imported goods had a significant impact on specific industries and sectors. Any developments related to trade negotiations, retaliatory actions from other countries, or changes in tariff rates influenced market sentiment. Companies with substantial exposure to international markets and global supply chains were particularly susceptible to market fluctuations related to trade policy decisions.

7. Investor Sentiment and Market Psychology: Investor sentiment and market psychology continued to play a significant role in determining stock market performance. Market participants’ views on the overall economic climate, their risk appetite, and their expectations of future market movements influenced buying and selling decisions. Any shifts in sentiment, driven by economic news, policy announcements, or geopolitical events, could lead to market volatility.

It is important to recognize that these factors do not operate in isolation but interact with one another. The stock market performance after Trump’s inauguration was shaped by the cumulative impact of these factors, as well as other unforeseen events. Investors closely examined these influences to navigate market conditions and make well-informed investment decisions.

Comparison of Stock Markets Before and After Trump’s Inauguration

Comparing the stock markets before and after Donald Trump’s inauguration as the 45th President of the United States reveals a dynamic and evolving landscape shaped by various factors and market trends.

1. Market Sentiment: Before Trump’s inauguration, there was a sense of optimism and anticipation among investors. The market experienced a “Trump rally,” with stock prices surging on the expectations of pro-business policies, deregulation, and tax cuts. However, after the inauguration, market sentiment became more nuanced, with investors seeking clarity on policy implementation and reacting to the realities of governing.

2. Sector Performance: Sector performance differed before and after Trump’s inauguration. Leading up to the inauguration, sectors such as financials, defense, and infrastructure-related industries saw gains due to the expectations of policy support. Post-inauguration, sectors such as technology, renewable energy, and healthcare emerged as areas of focus, with investor attention shifting to factors such as innovation, sustainability, and potential regulatory changes.

3. Policy Impact: Trump’s policy decisions and implementation efforts influenced market dynamics. While there were delays and challenges in implementing certain policies, such as healthcare reform and infrastructure spending, other policies such as tax cuts and deregulation had a significant impact on the markets. These policies contributed to favorable market conditions, including increased corporate profits and share buybacks.

4. International Trade: Trade policies and negotiations under the Trump administration had implications for international markets. Before the inauguration, there were concerns about potential trade restrictions and their impact on industries with international exposure. Post-inauguration, the focus shifted to specific trade deals, such as the renegotiation of NAFTA and the trade tensions between the United States and China, which affected various sectors, including manufacturing and agriculture.

5. Market Volatility: While market volatility was present both before and after the inauguration, the reasons behind the volatility differed. Before the inauguration, market volatility was largely driven by anticipation and speculation. By contrast, post-inauguration volatility was influenced by policy developments, geopolitical events, and economic indicators. The market’s reaction to Trump’s tweets and statements also contributed to occasional bouts of volatility.

6. Regulatory Environment: Trump’s deregulatory agenda and changes to regulatory policies had a notable impact on specific industries. The financial sector experienced eased regulations under the Trump administration, leading to increased market valuation and higher profits for banks and financial institutions. Conversely, other sectors, such as environmental and energy, faced uncertainties due to changes in regulations and perceived shifts in government priorities.

7. Economic Indicators: Economic indicators play a significant role in assessing market performance. Before Trump’s inauguration, the economy experienced a period of steady recovery from the Great Recession, reflected in positive economic indicators. Following the inauguration, economic indicators such as GDP growth, job reports, and consumer confidence continued to influence market sentiment and the overall performance of the stock market.

It is important to note that while Trump’s presidency coincided with significant market movements, many external factors, such as global economic trends and geopolitical events, also played a role in shaping market performance. Examining the pre- and post-inauguration periods allows for a more nuanced understanding of the factors impacting the stock market under the Trump administration.

Conclusion

The period surrounding Donald Trump’s inauguration as the 45th President of the United States was marked by anticipation, volatility, and evolving market dynamics. The stock market’s performance both before and after the inauguration reflected the influence of factors such as policy decisions, economic indicators, geopolitical events, and investor sentiment.

Before Trump’s inauguration, the market experienced a “Trump rally” driven by optimism and expectations of pro-growth policies. Sectors such as financials, defense, and infrastructure-related industries saw gains as investors anticipated policy support. However, uncertainties surrounding policy implementation, trade relations, and regulatory changes led to fluctuations in market sentiment.

After the inauguration, the market continued to react to policy developments, executive actions, and macroeconomic factors. The implementation of tax cuts and deregulation positively impacted market conditions, leading to increased corporate profits and share buybacks. International trade policies and geopolitical tensions also influenced market sentiment, particularly in sectors with international exposure.

Throughout Trump’s presidency, economic indicators, quarterly earnings reports, and global events shaped market performance. The stock market’s response to Trump’s policies and statements showcased the interplay between news events, investor sentiment, and market psychology.

In conclusion, the stock market’s performance before and after Trump’s inauguration exemplified the complexities and uncertainties inherent in the financial markets. The impact of presidential transitions extended beyond political rhetoric, with market participants closely monitoring policy decisions, economic indicators, and geopolitical events. Understanding these dynamics provides valuable insights into the role of political leadership and broader market forces in shaping stock market performance.

It is important to remember that the stock market is influenced by a multitude of factors and is subject to inherent volatility. Individual investors should exercise caution and seek professional advice when making investment decisions. The analysis presented in this article serves as a comprehensive overview but should not be regarded as financial advice.