Finance

What Will Happen To Stocks If Trump Is Elected

Published: January 19, 2024

Discover the potential impact of a Trump presidency on the stock market and finance. Explore what to expect for stocks if he is re-elected.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Background on Donald Trump’s presidency

- Stock market performance under Trump’s presidency

- Potential impacts on stocks if Trump is re-elected

- Policies and initiatives that could affect the stock market

- Trade and tariff policies under Trump’s second term

- Potential reactions from major industries and sectors

- Investor sentiment and market volatility under a Trump presidency

- Conclusion

Introduction

As the upcoming US presidential election draws near, investors and market participants are closely monitoring the potential impact of the election outcome on various sectors, including the stock market. With President Donald Trump seeking re-election, many wonder what will happen to stocks if he secures another term in office.

Donald Trump’s presidency has been marked by a mix of economic policies and market fluctuations. His administration’s emphasis on deregulation, tax cuts, and trade tariffs has had significant implications for the stock market. The market has experienced periods of volatility and uncertainty, punctuated by both record highs and dramatic drops.

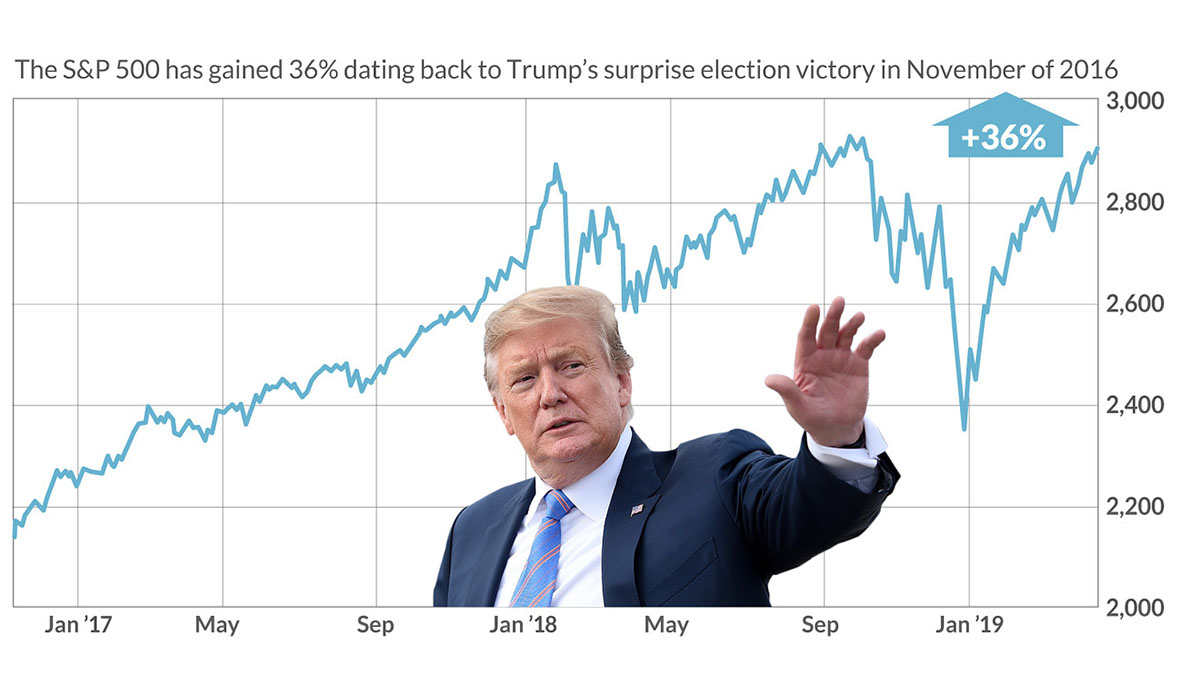

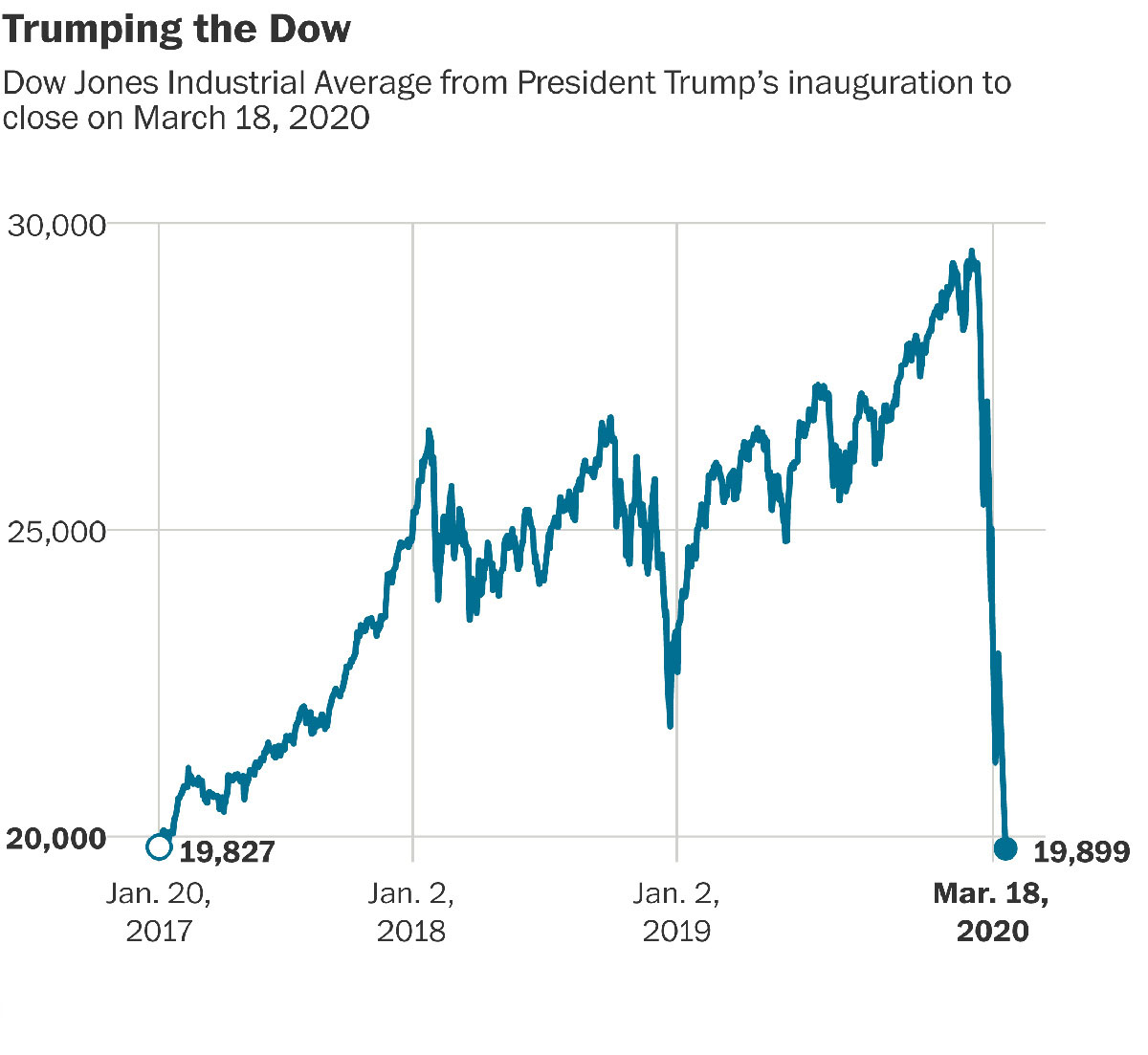

Under Trump’s leadership, the stock market witnessed a considerable rally during his first term. The S&P 500 and Dow Jones Industrial Average reached record levels, fuelled by investor optimism surrounding tax reform and deregulation. However, the market has also endured significant swings in response to geopolitical tensions, trade disputes, and uncertainties surrounding economic policies.

If Trump is re-elected, it is anticipated that the stock market will continue to be influenced by his administration’s policies and initiatives. The impact of his second term on stocks will largely depend on a variety of factors, including economic conditions, trade relations, fiscal policies, and geopolitical developments.

In this article, we will explore the potential impacts of a second Trump term on stocks and discuss the policies and initiatives that could shape the stock market climate. We will also analyze the potential reactions from major industries and sectors, as well as investor sentiment and market volatility under a Trump presidency.

It’s important to note that the stock market’s behavior is influenced by a multitude of factors, including global economic conditions, corporate earnings, interest rates, and investor sentiment. While the presidency can shape certain policies and market dynamics, it is just one piece of the puzzle when it comes to stock market performance.

Now, let’s delve into the potential implications of a Trump re-election on the stock market and how various factors could shape its trajectory in the coming years.

Background on Donald Trump’s presidency

Donald Trump was inaugurated as the 45th President of the United States in January 2017. His presidency has been marked by a distinct approach to economic policy and trade relations, which have had a significant impact on the stock market.

One of the key aspects of Trump’s economic policy has been the emphasis on deregulation. Shortly after taking office, his administration began rolling back various regulations across industries, with the aim of reducing the regulatory burden on businesses. This was met with enthusiasm from investors and led to a surge in stock prices, as it was seen as a positive development for corporate profitability.

In addition to deregulation, Trump implemented significant tax cuts. The Tax Cuts and Jobs Act of 2017 reduced the corporate tax rate from 35% to 21%, providing a boost to corporate earnings and stimulating investment. This policy move, coupled with the expectation of increased infrastructure spending, fueled optimism among investors and contributed to the stock market rally.

However, Trump’s presidency has also been marked by trade tensions and the implementation of tariffs, particularly with respect to China. Trump aimed to address what he perceived as unfair trade practices and protect American industries. The imposition of tariffs on Chinese imports and the subsequent retaliatory measures triggered uncertainties and market volatility, as investors closely watched the developments and their potential impact on global trade.

Another significant event during Trump’s presidency was the negotiation and signing of new trade agreements, such as the United States-Mexico-Canada Agreement (USMCA) to replace NAFTA. While the successful negotiation of these agreements brought some certainty to the market, there were concerns about the potential disruption and the impact on specific industries.

Overall, Trump’s presidency has been characterized by a mix of deregulation, tax cuts, trade tensions, and negotiations. The stock market has responded to these policy moves with periods of optimism and volatility. As we explore the potential impacts of a second Trump term on stocks, it is crucial to keep these factors in mind and recognize the complex interplay between economic policies and market dynamics.

Stock market performance under Trump’s presidency

During Donald Trump’s presidency, the stock market has experienced both highs and lows, reflecting a mix of optimism and uncertainties. The policies and initiatives undertaken by his administration have had a notable impact on the performance of the stock market.

Shortly after Trump assumed office, the stock market experienced a significant rally, which became known as the “Trump Bump.” Investor sentiment was boosted by the anticipation of pro-growth policies, such as tax cuts and deregulation. This optimism led to a sustained upward trend in stock prices, with major indices reaching record levels.

One of the notable developments during Trump’s presidency was the passage of the Tax Cuts and Jobs Act in late 2017. The sharp reduction in corporate tax rates, along with tax cuts for individuals, was seen as a positive catalyst for corporate profitability and economic growth. As a result, the stock market experienced further gains, with the S&P 500 and Dow Jones Industrial Average reaching new all-time highs.

Moreover, Trump’s focus on deregulation was well-received by investors. The rollback of regulations across various sectors was viewed as a positive step towards creating a more business-friendly environment. It was particularly beneficial for industries such as banking, energy, and technology, which saw significant gains during this period.

However, the stock market has also been influenced by uncertainties and fluctuations related to trade tensions and geopolitical developments. Trump’s aggressive stance on trade, particularly with China, has resulted in the implementation of tariffs and retaliatory measures, triggering market volatility. Trade negotiations, progress, or setbacks have had a direct impact on market sentiment and stock prices, leading to periods of sell-offs and recoveries.

Furthermore, geopolitical events, such as tensions with North Korea and the uncertainty surrounding Brexit, have added to market volatility during Trump’s presidency. These external factors, alongside domestic policies, have contributed to shifts in investor sentiment and fluctuations in the stock market.

Overall, the stock market performance under Trump’s presidency has been characterized by a combination of optimism driven by pro-growth policies, such as tax cuts and deregulation, and volatility resulting from trade tensions and geopolitical uncertainties. As we examine the potential impacts of a second Trump term on stocks, it is crucial to consider these past trends and the potential influence of future policies and events.

Potential impacts on stocks if Trump is re-elected

If Donald Trump secures another term in office, it is expected that his policies and initiatives will continue to shape the stock market climate. Here are some potential impacts on stocks if Trump is re-elected:

1. Continuity of pro-business policies: With Trump’s emphasis on deregulation and tax cuts, a second term would likely see a continuation of these pro-business policies. This could provide a favorable environment for corporations, potentially leading to increased profits and stock market gains.

2. Infrastructure spending: Trump has expressed a desire to invest in infrastructure projects, which could boost sectors like construction and engineering. Increased government spending in these areas could have a positive impact on related stocks, driving growth and creating investment opportunities.

3. Trade tensions and tariffs: While Trump’s tough stance on trade has led to market volatility and uncertainties, a re-election could mean a continuation of his trade policies. This could include ongoing negotiations and potential implementation of tariffs, impacting specific industries and causing fluctuations in stock prices.

4. Healthcare sector: The healthcare industry is likely to face significant changes under a second Trump term. Trump has vowed to repeal and replace the Affordable Care Act (ACA), which could have implications for various healthcare-related stocks. Reforms in healthcare policy and potential changes in regulations could create opportunities for investors in this sector.

5. Technology and defense sectors: Trump’s focus on national security and defense spending could benefit companies in the technology and defense sectors. Increased defense budgets and investments in areas such as cybersecurity and military technology could drive growth and have a positive impact on related stocks.

6. Energy policies: Trump has been supportive of the domestic energy industry during his presidency. A re-election could mean continued support for fossil fuel industries, potentially leading to increased production and investment in these sectors. This may have implications for stocks in the energy sector, including both traditional and renewable energy companies.

It is important to note that the potential impacts on stocks if Trump is re-elected are not guaranteed and can be influenced by various factors. Global economic conditions, geopolitical developments, and unforeseen events can also play a significant role in shaping market dynamics.

As an investor, it is crucial to monitor policy proposals and market trends closely and consider the potential risks and opportunities associated with a second Trump term. Diversification and a long-term investment strategy can help mitigate potential volatility and capitalize on potential growth areas in the stock market.

Policies and initiatives that could affect the stock market

If Donald Trump is re-elected, his policies and initiatives will have a significant impact on the stock market. Here are some key policies and initiatives that could affect the stock market:

1. Tax and regulatory policies: Trump’s focus on deregulation and tax cuts has been a cornerstone of his economic agenda. A continuation of these policies could enhance corporate profitability and stimulate investment, leading to potential stock market gains. However, changes to tax policies, such as adjustments to capital gains taxes or corporate tax rates, could also influence investor behavior and stock prices.

2. Trade and tariff policies: Trump’s approach to trade and tariffs has been a driver of market volatility. A second term could see the continuation of his trade policies, including negotiations with China and potential tariffs on specific products. These policies can have direct implications for industries impacted by trade tensions, such as manufacturing, agriculture, and technology. Any progress or setbacks in trade negotiations could significantly impact the stock market.

3. Infrastructure spending: Trump has expressed a desire to invest in infrastructure projects to boost the economy. Increased government spending in areas such as transportation, telecommunications, and energy infrastructure could benefit related industries and have a positive impact on stocks in those sectors. Companies involved in construction, engineering, and materials could see increased demand and performance in the stock market.

4. Healthcare reforms: Trump has been a vocal critic of the Affordable Care Act (ACA). If re-elected, he may continue efforts to repeal and replace the ACA. Changes in healthcare policy could impact various segments of the healthcare industry, including insurance companies, pharmaceuticals, and healthcare providers. Investors in these sectors will need to closely monitor policy developments that could potentially affect stock performance.

5. Energy policies: Trump’s administration has been supportive of the domestic energy industry, particularly fossil fuels. A second term could see the continuation of policies aimed at promoting energy independence and expanding domestic energy production. This could have implications for stocks in the energy sector, including companies involved in oil, natural gas, and renewable energy. Policy changes and government support in the energy sector can shape stock market dynamics in this industry.

6. Financial sector reforms: Trump has advocated for rolling back certain financial regulations implemented after the 2008 financial crisis. A re-election could lead to further deregulation of the financial sector, potentially impacting banks, investment firms, and other financial institutions. Changes in regulations can have significant effects on the stock market, especially in sectors closely tied to the financial industry.

It is important to note that these policies and initiatives are subject to various factors of implementation and potential opposition. Changes in policy can create both opportunities and challenges for investors. It is crucial to closely monitor political developments, policy announcements, and market trends to make informed investment decisions.

Additionally, it is important to remember that the stock market is influenced by a wide range of factors, including global economic conditions, investor sentiment, and corporate earnings. While policies and initiatives can shape market dynamics, they are just one piece of the puzzle. A diversified investment strategy and long-term perspective are crucial for navigating the stock market under any administration.

Trade and tariff policies under Trump’s second term

If Donald Trump is re-elected, his trade and tariff policies are likely to continue to have a significant impact on the stock market. Throughout his first term, Trump introduced and escalated trade disputes with several countries, most notably China. Here are some potential scenarios regarding trade and tariff policies under Trump’s second term and their potential impacts on the stock market:

1. Trade negotiations with China: The ongoing trade tensions between the United States and China have been a major driver of market volatility. In a second term, Trump is expected to continue pressing for additional concessions from China. This could involve further negotiations, discussions on intellectual property protection, and a potential reevaluation of existing tariffs. Progress in trade negotiations could ease market uncertainty and lead to positive reactions in stock prices, particularly for sectors with significant exposure to China, such as technology and manufacturing. However, any setbacks or failure to reach agreements could lead to increased volatility and potential stock market declines.

2. Expansion of tariffs: Trump’s first term saw the implementation of tariffs on several trade partners, including China, the European Union, and Canada. If re-elected, Trump may continue to employ tariffs as a tool to protect American industries and address what he perceives as unfair trade practices. The expansion of tariffs into other sectors or on additional countries could have widespread implications for the stock market, affecting industries that rely heavily on international trade. Companies in industries such as automotive, aerospace, and consumer goods may face increased costs and potential disruptions to their supply chains, impacting their stock performance.

3. Impact on specific industries: Trump’s trade and tariff policies have had varying effects on different industries. For example, the technology sector has faced challenges due to restrictions on access to Chinese markets and concerns over intellectual property theft. On the other hand, sectors like steel and aluminum have benefited from tariffs that protect domestic industries. A continuation of these policies could mean continued vulnerabilities or advantages for specific industries in the stock market.

4. Market reaction to trade developments: Trade-related news, especially those concerning tariffs and negotiations, have frequently led to market volatility. Stock prices have shown sharp reactions to positive or negative progress in trade talks. The stock market, under Trump’s second term, is likely to be sensitive to trade-related developments, with investor sentiment and market performance influenced by updates on negotiations, agreements, or escalations in trade tensions.

It is important to remember that trade and tariff policies are complex and interwoven with global economic dynamics. The impact on the stock market will depend not only on Trump’s policies but also on how other countries and international players respond. Investors should closely monitor developments, assess potential risks and opportunities, and diversify their portfolios to mitigate potential trade-related volatility.

Potential reactions from major industries and sectors

If Donald Trump is re-elected, various industries and sectors are likely to have different reactions based on his policies and initiatives. Here are some potential reactions from major industries and sectors under a second Trump term:

1. Technology sector: The technology sector has been a focal point of trade tensions between the United States and China. Continued tariffs and restrictions on technology transfers could impact the supply chains and profitability of technology companies. However, a re-election may also drive renewed focus on domestic technology and innovation, potentially benefiting U.S.-based tech companies in areas such as cybersecurity, artificial intelligence, and cloud computing.

2. Manufacturing and automotive sector: Trump’s focus on revitalizing U.S. manufacturing and protecting American jobs may lead to policies that support domestic production. This could have a positive impact on manufacturing and automotive companies, particularly those with operations in the United States. However, ongoing trade tensions and potential retaliatory tariffs from other countries also pose challenges for these industries.

3. Financial sector: The financial sector could experience mixed reactions under a second Trump term. Trump has advocated for deregulation, which has been welcomed by many financial institutions. Further rollbacks of regulations could potentially reduce compliance costs and bureaucratic burdens. However, uncertainties surrounding trade tensions and global economic stability may create volatility in the financial markets and impact the overall performance of the sector.

4. Healthcare sector: Trump’s efforts to repeal and replace the Affordable Care Act could have varying effects on the healthcare sector. Changes to healthcare policies may impact different segments of the industry, including pharmaceuticals, health insurance providers, and healthcare service providers. Investors in the healthcare sector will need to closely monitor policy developments and assess potential opportunities and risks as a result of changes in healthcare regulation.

5. Energy sector: Trump’s support for the fossil fuel industry and focus on energy independence could continue to benefit companies in the energy sector. Favorable policies and potential deregulation in the energy industry may lead to increased domestic production and investment. This could positively impact stocks of oil and gas companies, as well as those involved in renewable energy sectors, which may also see continued government support.

6. Agriculture sector: The agriculture sector has been significantly impacted by trade tensions and retaliatory tariffs. Continued trade disputes could affect agricultural exports and farm incomes. However, ongoing efforts to negotiate trade agreements could provide opportunities for the agriculture sector, especially if access to new markets and favorable trade terms are secured.

It’s important to note that the reactions from major industries and sectors may also depend on factors beyond Trump’s policies, such as global economic conditions, technological advancements, and geopolitical developments. Investors should stay informed about specific industry dynamics and carefully assess the potential risks and opportunities associated with a second Trump term.

Investor sentiment and market volatility under a Trump presidency

Investor sentiment and market volatility have been prominent features of the stock market during Donald Trump’s presidency. Various factors contribute to shifts in sentiment and levels of volatility, creating a dynamic market environment. Here are some factors to consider regarding investor sentiment and market volatility under a Trump presidency:

1. Policy uncertainty: Trump’s presidency has been characterized by a degree of unpredictability and policy volatility. From trade negotiations to tax reform, policy announcements and shifts in stance can lead to market volatility as investors adjust their strategies accordingly. Uncertainty surrounding policy changes can create fluctuations in investor sentiment and impact market volatility.

2. Geopolitical events: Global events, such as geopolitical tensions, conflicts, and diplomatic developments, can significantly impact investor sentiment and market volatility. Trump’s foreign policy decisions and reactions to international events can create uncertainties that reverberate through financial markets. Investors closely monitor these events and their potential implications for global economic stability.

3. Trade tensions and tariffs: Trump’s trade policies, particularly the use of tariffs and ongoing trade disputes with China, have heightened market volatility. Ups and downs in negotiations, announcements of new tariffs, and retaliatory measures from other countries can create uncertainty, affecting both investor sentiment and stock market performance. Trade-related developments are closely watched by investors for potential impacts on various industries and sectors.

4. Economic indicators and corporate earnings: Beyond policy-specific factors, investor sentiment and market volatility are also influenced by economic indicators and corporate earnings. The health of the overall economy, including factors such as GDP growth, inflation, and employment, can shape investor sentiment. Additionally, quarterly earnings reports and guidance from companies have the potential to impact market volatility as investors assess the financial health and future prospects of individual stocks and sectors.

5. Access to information and media coverage: The accessibility of information and the impact of media coverage can also influence investor sentiment and market volatility. News reports and analysis regarding policy developments, economic data, and corporate events can shape market perception and drive short-term fluctuations. Investors should exercise caution and maintain objectivity, considering various sources of information to form well-informed investment decisions.

It is important to note that investor sentiment and market volatility are influenced by a wide range of factors, and not solely determined by the actions and policies of the President. The stock market is driven by a complex interplay of economic forces, industry-specific dynamics, and global events. Long-term investors often focus on fundamental analysis, diversification, and a disciplined investment strategy to navigate market volatility and minimize the impact of short-term fluctuations.

Under a Trump presidency, investor sentiment and market volatility are likely to remain influenced by policy developments, geopolitical events, and economic indicators. Staying informed and understanding the broader context surrounding market fluctuations can help investors make informed decisions and effectively navigate the stock market landscape.

Conclusion

The upcoming US presidential election has significant implications for the stock market, and the potential outcomes of a second Trump term have captured the attention of investors and market participants. Understanding the potential impacts and reactions in the stock market is crucial for making informed investment decisions.

If Donald Trump is re-elected, his policies and initiatives are likely to shape the stock market climate. Continuity of pro-business policies, potential infrastructure spending, trade and tariff policies, healthcare reforms, energy policies, and financial sector reforms are among the key areas to watch. These policies will have varying effects on different industries and sectors, depending on their exposure to specific policy changes.

Furthermore, investor sentiment and market volatility are expected to continue under a Trump presidency. Uncertainty surrounding policy changes, geopolitical events, and trade tensions can contribute to fluctuations in investor sentiment and market volatility. Economic indicators, corporate earnings, and media coverage also play a role in shaping market behavior.

It is important for investors to stay informed, assess risks and opportunities, and maintain a diversified investment strategy. Focusing on long-term goals and fundamentals can help mitigate the impact of short-term market volatility and navigate the complexities of the stock market. While the presidency is a significant factor, it is important to consider the broader economic landscape, global events, and industry-specific dynamics that influence stock market performance.

In conclusion, a second term for Donald Trump as president could have profound effects on the stock market. The policies and initiatives pursued under his administration, coupled with global economic conditions and geopolitical developments, will shape investor sentiment and market volatility. By staying informed, taking a long-term perspective, and adapting to changing market dynamics, investors can position themselves to make sound investment decisions in the face of potential market fluctuations.