Finance

Strategic Asset Allocation Definition, Example

Published: February 3, 2024

Learn the definition of strategic asset allocation in finance and explore an example. Discover how it can optimize your investment portfolio for long-term growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Strategic Asset Allocation: Maximizing Your Financial Potential

When it comes to your personal finances, making smart investment decisions is crucial. One strategy that can help you maximize your financial potential is strategic asset allocation. In this blog post, we will explore the definition of strategic asset allocation, provide an example, and highlight its importance in building a strong investment portfolio.

Key Takeaways:

- Strategic asset allocation involves allocating your investment portfolio across different asset classes based on your long-term financial goals and risk tolerance.

- By diversifying your investments across various asset classes, you can potentially reduce risk and optimize returns.

What is Strategic Asset Allocation?

Strategic asset allocation is an investment strategy that involves dividing your investment portfolio among different asset classes, such as stocks, bonds, real estate, and commodities, based on your long-term financial goals and risk tolerance. The goal of strategic asset allocation is to create a diversified portfolio that can weather market fluctuations and deliver consistent returns over time.

When constructing a strategic asset allocation plan, it’s essential to consider your investment horizon, financial objectives, and risk tolerance. For example, if you are investing for retirement and have a long time horizon, you may choose to allocate a larger portion of your portfolio to growth-oriented assets like stocks. On the other hand, if you are approaching retirement and have a lower risk tolerance, you may opt for a higher allocation to more conservative assets like bonds.

Example of Strategic Asset Allocation

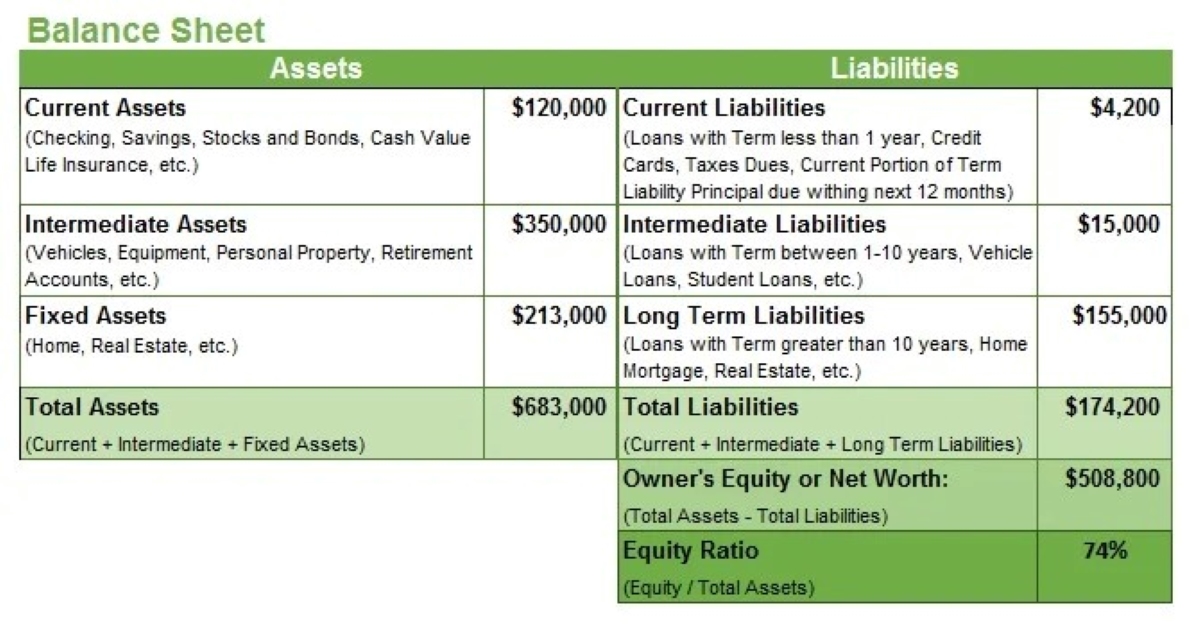

Let’s say you are a 35-year-old investor with a moderate risk tolerance and a goal of retirement at age 65. Based on your risk profile, a typical strategic asset allocation split might look like this:

- 60% stocks: Investing in a mix of domestic and international stocks

- 30% bonds: Allocating a portion of your portfolio to government or corporate bonds

- 10% alternative investments: Diversifying your holdings with real estate, commodities, or other non-traditional assets

This allocation provides exposure to different asset classes, each with its own risk and return characteristics. Over time, as the market fluctuates, the value of each asset class may change. A disciplined approach to strategic asset allocation involves periodically rebalancing your portfolio to maintain the desired asset allocation percentages. This ensures that you stay in line with your long-term financial goals and risk tolerance.

The Importance of Strategic Asset Allocation

Strategic asset allocation plays a vital role in building a resilient and successful investment portfolio. Here’s why it’s important:

- Diversification: By spreading your investments across different asset classes, you can potentially reduce the impact of market downturns on your portfolio. A well-diversified portfolio can cushion losses in one asset class with gains in another, helping to minimize risk.

- Optimizing Returns: Strategic asset allocation allows you to align your investment portfolio with your long-term financial goals and risk tolerance. By investing in a mix of assets, you have the opportunity to capture the potential return offered by each asset class while managing risk.

In conclusion, strategic asset allocation is a powerful investment strategy that can help you maximize your financial potential. By diversifying your portfolio across different asset classes and regularly rebalancing it to maintain your desired allocation, you can increase your chances of achieving long-term financial success. Make sure to consult with a financial advisor to tailor a strategic asset allocation plan that aligns with your unique financial goals and risk profile.