Finance

Where Does Land Go On A Balance Sheet

Published: December 27, 2023

Learn about the financial implications of land ownership and how it is reported on a balance sheet. Gain insights into where land fits in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

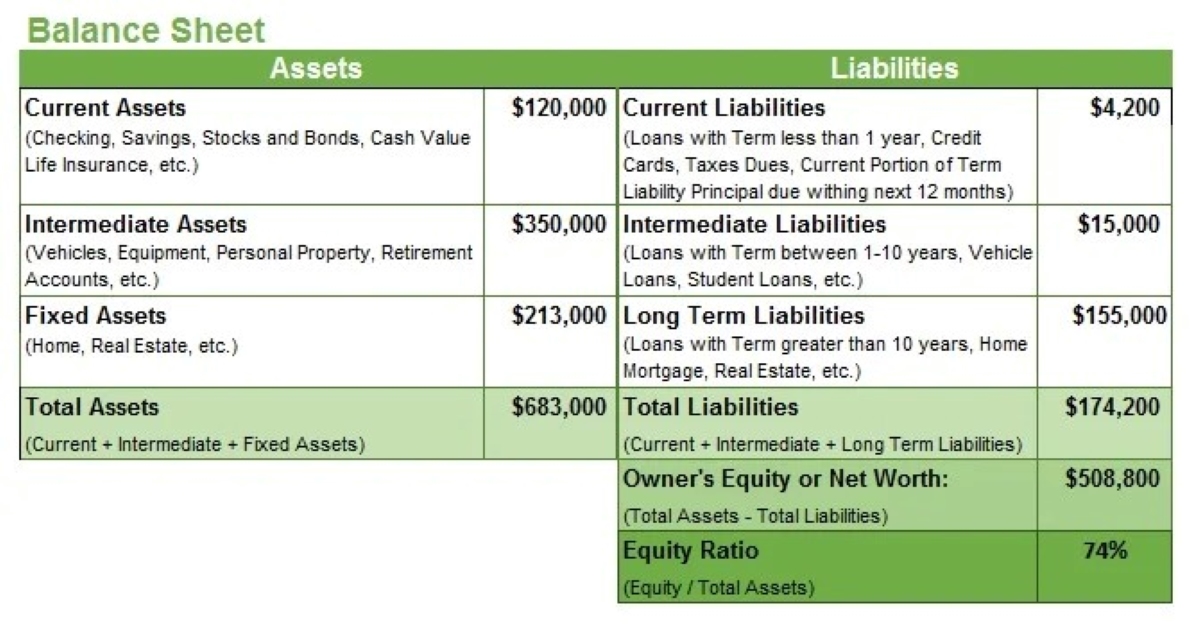

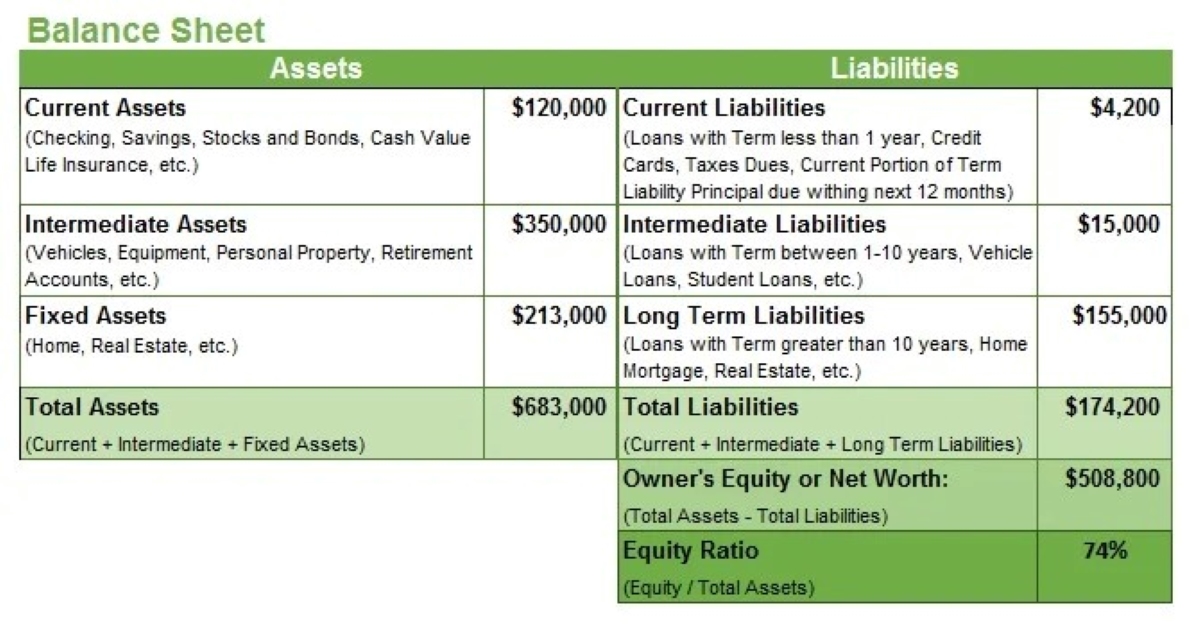

A balance sheet is a crucial financial statement that provides a snapshot of a company’s financial position at a specific point in time. It allows businesses to assess their assets, liabilities, and equity, giving investors, lenders, and stakeholders a comprehensive view of the company’s financial health. While balance sheets typically encompass various assets and liabilities, one of the key elements that can significantly impact a company’s financial standing is land.

In this article, we will explore where land fits in a balance sheet, discuss the importance of including land as an asset, and delve into how land is valued on a balance sheet. Furthermore, we will examine potential factors that can affect the value of land and ultimately impact a company’s financial position.

Understanding the role of land on a balance sheet is crucial for both businesses and investors as it provides insight into the value and potential growth of a company’s land assets. This information helps stakeholders make informed decisions regarding investments, expansions, and strategic planning.

Definition of a Balance Sheet

A balance sheet is a financial statement that presents a company’s financial position at a specific point in time. It is one of the key financial documents used by businesses, investors, and lenders to gain a comprehensive understanding of a company’s financial health.

The balance sheet follows a basic accounting equation: Assets = Liabilities + Equity. This equation highlights the fundamental principle that a company’s assets are financed by its liabilities and equity. The balance sheet provides a detailed breakdown of the company’s assets, liabilities, and equity, thereby giving stakeholders a clear picture of the company’s financial standing.

By examining the components of a balance sheet, one can gain insights into the company’s liquidity, solvency, and overall financial stability. The balance sheet also helps in tracking changes in a company’s financial position over time by comparing current and previous balance sheets.

Overall, the balance sheet serves as a crucial tool for financial analysis and decision-making, providing stakeholders with essential information to evaluate the company’s ability to meet its financial obligations, manage its assets, and generate profits.

Components of a Balance Sheet

A balance sheet consists of three main components: assets, liabilities, and equity. Let’s take a closer look at each of these components:

- Assets: Assets represent what a company owns and include both tangible and intangible items. Tangible assets include cash, accounts receivable, inventory, equipment, and, most importantly for our discussion, land. Land is considered a long-term asset as its value generally appreciates over time. Intangible assets, on the other hand, encompass intellectual property, patents, and copyrights.

- Liabilities: Liabilities represent what a company owes to external parties. This includes loans, accounts payable, and other debts. Liabilities can be further divided into short-term and long-term liabilities. Short-term liabilities are obligations that need to be paid within a year, while long-term liabilities have longer repayment terms. It is important to note that including land on the balance sheet does not create any liabilities.

- Equity: Equity represents the residual interest in the assets of an entity after deducting liabilities. It is essentially the ownership interest in the company. Equity can be broken down into two main components: contributed capital, which refers to the funding provided by the shareholders, and retained earnings, which are the accumulated profits that have not been distributed as dividends.

Together, these three components provide a comprehensive overview of a company’s financial position. The balance sheet equation, Assets = Liabilities + Equity, ensures that the total value of the company’s assets is equal to the total value of its liabilities and equity.

Now that we understand the components of a balance sheet, let’s explore where land fits in and why it is important to include it as an asset on the balance sheet.

Assets

Assets are one of the key components of a balance sheet and represent what a company owns or controls. They are categorized into current assets and non-current assets. Current assets are those that are expected to be converted into cash or used up within one year, while non-current assets are held for longer periods.

When it comes to a balance sheet, assets can take on various forms, including cash, accounts receivable, inventory, equipment, and investments. One asset that holds significant value and contributes to a company’s financial strength is land.

Land is classified as a non-current asset because it is typically held for long-term use rather than being sold or consumed in the normal course of business. It is important to note that land does not depreciate in value over time, unlike some other tangible assets. In fact, land is often considered a sound investment as its value tends to appreciate over the long term.

The inclusion of land as an asset on the balance sheet is crucial for several reasons. Firstly, it provides a tangible representation of the company’s real estate holdings. Whether the land is used for business operations or held for investment purposes, its presence on the balance sheet signifies the company’s ownership and potential for future returns.

Secondly, the value of land can significantly impact the overall financial position of the company. As land appreciates in value, it can contribute to the company’s equity and enhance its net worth. Conversely, if the value of the land decreases, it may have a negative effect on the company’s financial standing.

Lastly, including land as an asset on the balance sheet allows for a more comprehensive evaluation of the company’s financial performance and potential. Stakeholders, such as investors and lenders, can assess the value and growth potential of the company’s land assets, which may influence their decisions regarding investments, loans, and partnerships.

Now that we understand the importance of land as an asset on the balance sheet, let’s explore how land is valued and its potential impacts on a company’s financial position when it is included on the balance sheet.

Liabilities

Liabilities are an integral part of a balance sheet and represent what a company owes to external parties. They have a time-bound nature, with some obligations requiring repayment in the short term and others in the long term.

When it comes to a balance sheet, liabilities can take various forms, including loans, accounts payable, accrued expenses, and other outstanding debts. It is important to note that liabilities do not include any assets owned by the company.

Liabilities can be further classified into current liabilities and long-term liabilities. Current liabilities are obligations that are expected to be settled within a year, while long-term liabilities have a longer repayment timeframe.

It’s worth highlighting that including land as an asset on a balance sheet does not create any liabilities. Instead, liabilities come into play when a company utilizes financing options, such as taking out loans for the acquisition of land or development projects.

When a company borrows money to purchase land or fund real estate projects, the resulting debt is recorded as a liability on the balance sheet. This liability represents the company’s obligation to repay the borrowed funds over a specified period, typically with interest.

By including liabilities on the balance sheet, stakeholders gain insight into the company’s financial obligations and its ability to meet them. It helps investors and lenders gauge the company’s debt level, assess its ability to manage debt payments, and evaluate its overall financial health.

It is important for companies to strike a balance between utilizing borrowed funds for land acquisition or real estate development and managing their debt load effectively. Too much debt can strain the company’s finances and raise concerns about its solvency, while too little debt may limit potential growth opportunities.

Understanding the liabilities recorded on a balance sheet allows stakeholders to assess the company’s financial risk and make informed decisions regarding investments, partnerships, or lending.

Now let’s explore the third component of a balance sheet, equity, and its relationship with land and liabilities on the balance sheet.

Equity

Equity is a vital component of a balance sheet and represents the residual interest in a company’s assets after deducting liabilities. It reflects the ownership interest and the shareholders’ claims on the company’s assets.

Equity can be further divided into two main components: contributed capital and retained earnings. Contributed capital refers to the funds provided by the shareholders to the company in exchange for ownership. This includes the issuance of common stock or preferred stock. Retained earnings, on the other hand, represent the accumulated profits that the company has retained for reinvestment into the business rather than distributing them as dividends.

When it comes to land, it plays a crucial role in the determination of equity. As land appreciates in value, it increases the company’s equity, contributing to its overall net worth. However, it is important to note that equity is not solely determined by land value. It also takes into account other assets, liabilities, and factors affecting the company’s financial performance.

Equity provides stakeholders with a measure of the company’s financial strength and the shareholders’ ownership stake. It serves as an indicator of the company’s ability to generate profits, manage its assets, and navigate financial risks.

By including equity on the balance sheet, stakeholders can assess the company’s overall financial position and make decisions regarding investments, expansion, or future financial strategies. It also provides a foundation for evaluating the company’s return on investment and assessing its long-term growth potential.

It is essential for companies to maintain a healthy level of equity to ensure financial stability and support future growth initiatives. Striking a balance between debt, equity, and asset allocation is crucial for sustainable and prosperous business operations.

Now that we have explored the components of a balance sheet, including assets, liabilities, and equity, let’s dive into where land fits within this financial statement and its importance for evaluating a company’s financial position.

Where Land Fits In

Land is an essential component of a company’s assets and plays a prominent role in the balance sheet. It is categorized as a non-current asset and falls under the broader category of property, plant, and equipment (PPE).

Within the PPE category, land is often considered a unique and valuable asset. Unlike other tangible assets that may depreciate over time, land generally maintains or appreciates in value. Its inclusion on the balance sheet provides an accurate representation of the company’s real estate holdings and the potential for future growth and profitability.

When land is included on the balance sheet, it contributes to the overall asset value, increasing the company’s total net worth and equity. Additionally, the value of land can have a significant impact on other financial metrics such as return on equity (ROE) and return on assets (ROA).

Land serves various purposes for businesses. It can be used for operational activities, such as constructing facilities or generating rental income by leasing out the land to third parties. Alternatively, companies may hold land for investment purposes, anticipating its appreciation over time and potential resale at a higher value.

Including land on the balance sheet allows stakeholders to evaluate the company’s investment in real estate and assess the potential risks and rewards associated with these assets. It provides transparency and a comprehensive view of the company’s physical assets, enabling stakeholders to make more informed decisions regarding the company’s financial health and growth prospects.

It’s important to note that the value of land on the balance sheet is typically recorded at the historical cost or fair market value. However, land values may fluctuate over time due to market conditions, changes in zoning regulations, or other factors. Therefore, companies should regularly assess the value of their land holdings and adjust the balance sheet accordingly to reflect any changes in its value.

Now that we understand where land fits in on the balance sheet, let’s explore the significance of including land as an asset and how it is valued to determine its presence on the balance sheet.

Importance of Land on a Balance Sheet

The inclusion of land as an asset on a balance sheet holds significant importance for businesses and stakeholders. Here are several reasons why land is crucial on a balance sheet:

- Enhances Financial Visibility: Including land on the balance sheet provides a clear and transparent view of the company’s real estate holdings. It allows stakeholders to assess the overall value of the company’s tangible assets and gain insights into potential growth opportunities.

- Determines Net Worth: Land contributes to the company’s net worth and equity by increasing the total asset value. As land tends to appreciate over time, its presence on the balance sheet positively impacts the company’s financial position.

- Facilitates Strategic Decision-making: Land ownership and its value on the balance sheet influence strategic decisions regarding expansion, investment, and development. Stakeholders can evaluate the potential for utilizing the land for operational purposes or assess its potential resale value for profit generation.

- Potential for Future Revenue: Land can produce income through various means, such as leasing it to tenants or using it for business operations. Including land on the balance sheet allows stakeholders to assess its income-generating potential and consider it as a valuable asset for future revenue streams.

- Value Appreciation: Land is often considered a long-term investment, appreciating in value over time. By including land on the balance sheet, stakeholders can gain confidence in the company’s potential for long-term growth and value appreciation.

- Evaluates Risk and Collateral: Land holds value as collateral for loans and other financial agreements. Its inclusion on the balance sheet helps stakeholders evaluate the company’s risk exposure and assess the available assets that can be used as collateral for borrowing funds.

Overall, the presence of land on the balance sheet provides a comprehensive understanding of a company’s real estate holdings, potential for growth, and financial position. It aids stakeholders in making informed decisions, assessing risk, and determining the company’s overall value and potential for future success.

Valuing Land on a Balance Sheet

Assigning the appropriate value to land on a balance sheet is important for providing an accurate representation of the company’s assets. Land valuation involves determining the fair market value or the historical cost of the land. Here are some common methods used to value land:

- Appraisal Method: An independent appraiser assesses the land’s value based on factors such as location, size, zoning regulations, market demand, and comparable sales in the area. This method provides an objective estimate of the land’s fair market value.

- Cost Approach: This method involves evaluating the cost required to replace the land with a similar property, taking into account factors such as acquisition expenses, development costs, and any improvements made to the land. The cost approach provides an estimate of the land’s value based on the historic cost incurred.

- Income Approach: This method is typically used when the land generates income through rentals or leases. The value of the land is determined by estimating the net present value of the future income it is expected to generate. This approach considers factors such as rental rates, expenses, and the overall income potential of the land.

It’s important to note that the valuation method chosen may vary depending on the purpose and context of the land’s evaluation. Different industries and organizations may follow specific guidelines or regulations for valuing land.

Companies should regularly review and update the land’s value on the balance sheet to reflect any changes in market conditions or factors that may impact its worth. This ensures that the balance sheet accurately represents the current value of the land and provides stakeholders with reliable information for decision-making.

It’s worth mentioning that land values can fluctuate over time due to various factors such as changes in market demand, economic conditions, and regulatory developments. Therefore, periodic reassessment of land valuation is essential for maintaining the integrity of the balance sheet and providing accurate insights into the company’s financial position.

Accurately valuing land on the balance sheet allows stakeholders to evaluate the company’s asset base, assess its real estate holdings, and make informed decisions regarding investments, partnerships, or loan collateral. It enhances transparency and ensures that the balance sheet reflects the true value of the company’s land assets.

Potential Impacts on Land’s Value

The value of land on a balance sheet can be influenced by various factors that impact the real estate market and overall economic conditions. These factors can have both positive and negative effects on the land’s value. Here are some potential impacts to consider:

- Location: The location of land plays a significant role in determining its value. Prime locations, such as urban centers or areas with high demand for commercial or residential development, tend to have higher land values. On the other hand, remote or less desirable locations may have lower land values.

- Supply and Demand: The balance between the supply of available land and the demand for it can greatly influence land values. Areas with limited available land and high demand can experience increased land values, while areas with oversupply may see downward pressure on land prices.

- Economic Conditions: Economic factors, such as interest rates, inflation, and overall market stability, can impact land values. During periods of economic expansion, land values may rise as investment and development activities increase. Conversely, during economic downturns, land values may decline due to reduced investment and weaker demand.

- Government Regulations: Changes in zoning laws, land use regulations, and government policies can have a significant impact on land values. For example, rezoning land for commercial purposes can increase its value, while stricter development restrictions can decrease its value.

- Infrastructure and Amenities: The presence of infrastructure, such as transportation networks, utilities, and access to amenities like schools, parks, and shopping centers, can positively influence land values. Areas with well-developed infrastructure and desirable amenities often command higher land values.

- Demographic Trends: Population growth, migration patterns, and changes in demographics can affect land values. Areas experiencing population growth or attracting a certain demographic group may see increased demand for land, leading to higher values.

- Environmental Factors: Environmental considerations, such as the presence of natural resources, environmental regulations, and sustainability initiatives, can impact land values. Land with valuable resources or land that meets certain environmental standards may command higher values.

It’s important to note that land values can be highly localized, and the impacts can vary depending on the specific market conditions and circumstances. Companies and stakeholders should closely monitor these factors to understand and anticipate potential impacts on the land’s value.

By considering these factors, stakeholders can assess the potential risks and opportunities associated with land investments and make informed decisions when evaluating the land’s value on the balance sheet. Understanding the potential impacts on land values allows for better financial planning, risk management, and valuation accuracy.

Conclusion

Land holds significant value and importance on a balance sheet. It is classified as a non-current asset and plays a vital role in representing a company’s real estate holdings and potential for growth. Including land on the balance sheet enhances financial transparency, allowing stakeholders to assess the company’s tangible assets and evaluate its overall financial position.

Valuing land on the balance sheet requires careful consideration, utilizing methods such as appraisals, cost approaches, or income approaches to determine its fair market value or historical cost. Regular reassessment of land values is essential to reflect any changes in market conditions or factors that may impact its worth.

The value of land on the balance sheet can be influenced by various factors, such as location, supply and demand dynamics, economic conditions, government regulations, infrastructure, demographic trends, and environmental considerations. Monitoring and analyzing these factors help stakeholders evaluate the potential impacts on land values and make informed decisions regarding investments and growth strategies.

Land’s inclusion on the balance sheet contributes to the overall net worth and equity of the company. It provides important insights into the company’s asset base, risk exposure, and potential for generating future revenue streams.

Understanding where land fits in the balance sheet and its importance helps stakeholders make informed decisions regarding investments, partnerships, and strategic planning. By considering the value and potential impacts of land on the balance sheet, stakeholders can evaluate the financial health, growth prospects, and overall value of the company.

In conclusion, land is a valuable asset that significantly impacts a company’s financial position. Its inclusion on the balance sheet enhances transparency, facilitates decision-making, and provides stakeholders with important information for assessing the company’s financial health and potential for future growth.