Finance

Treasurer’s Draft Definition

Published: February 11, 2024

Learn the treasurer's draft definition and its importance in finance. Gain insights into how treasurer's drafts are used and their impact on financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Treasurer’s Draft Definition: Understanding the Basics

Welcome to our FINANCE category, where we provide valuable insights and expert knowledge on all things related to finance. In this blog post, we are going to delve into the world of treasurer’s draft and explore its definition and significance in the financial realm. If you’ve ever wondered what exactly a treasurer’s draft is and how it can impact your financial transactions, you’ve come to the right place!

Key Takeaways:

- A treasurer’s draft is a financial instrument issued by a bank on behalf of the bank’s customer, guaranteeing payment to a third party.

- This instrument provides a secure form of payment, often used for large transactions or when the payee requires assurance of funds.

Now let’s dive into the details and shed some light on the treasurer’s draft definition.

What is a Treasurer’s Draft?

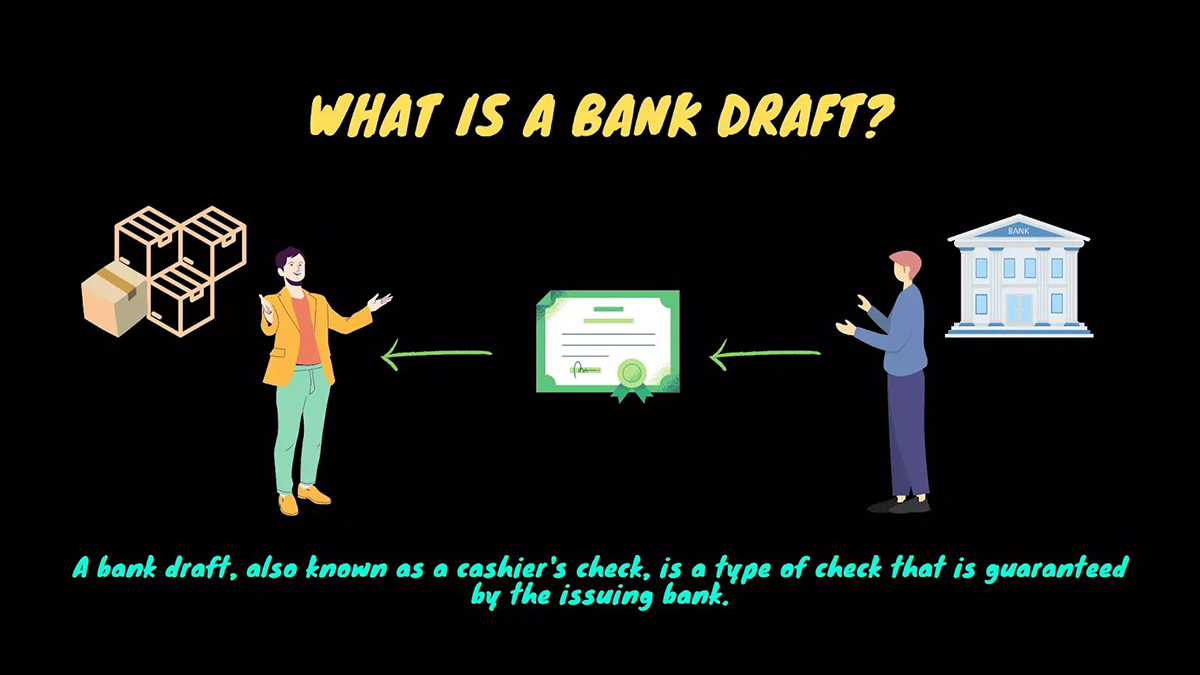

A treasurer’s draft, also known as a banker’s draft or cashier’s check, is a financial instrument issued by a bank on behalf of its customer. It serves as a guarantee of payment to a third party, assuring the recipient that funds are available and will be transferred without any risks.

This method of payment is commonly used for substantial transactions where a personal or business check is deemed too risky or not acceptable. For instance, when purchasing real estate, a treasurer’s draft often provides the required level of security for both the buyer and seller.

How Does a Treasurer’s Draft Work?

When an individual or organization requires a treasurer’s draft, they approach their bank, provide the necessary funds, and request the issuance of a draft made payable to a specific payee. The bank then deducts the funds from the customer’s account and verifies its availability.

Once confirmed, the bank draws a draft, usually on its own account, and guarantees payment to the payee as specified on the draft. The treasurer’s draft is typically treated as cash, ensuring that the recipient will receive the full amount without any risk of insufficient funds.

Upon receiving the treasurer’s draft, the payee can deposit it into their own bank account or convert it into cash, depending on their needs and preferences.

The Significance of Treasurer’s Draft

Treasurer’s drafts serve as a secure form of payment, offering peace of mind to both the payer and the payee. Here’s why treasurer’s drafts are significant:

- Reliable Payment: The draft guarantees payment to the payee, reducing the risk of bounced or fraudulent checks.

- Certified Funds: A treasurer’s draft confirms that funds are available and will be transferred, ensuring a seamless transaction.

- Larger Transactions: It is commonly used for high-value transactions, such as real estate purchases or large business transactions, where the involvement of substantial funds requires additional security.

Overall, treasurer’s drafts provide a reliable and secure method of payment, promoting trust and confidence in financial transactions.

In Conclusion

Understanding the treasurer’s draft definition is crucial when engaging in high-value transactions or situations where secure payments are required. With their reliable and certified funds, treasurer’s drafts offer an added layer of security and assurance to both payers and payees, ensuring smooth and worry-free financial transactions.

We hope this article has shed light on the treasurer’s draft definition and its significance in the finance world. Stay tuned for more insightful blog posts on finance in our dedicated category!