Home>Finance>What Is A Bank Draft? Definition, How It Works, And Example

Finance

What Is A Bank Draft? Definition, How It Works, And Example

Published: October 13, 2023

Learn what a bank draft is in finance, its definition, how it works, and get an example. Understand the fundamentals of this financial instrument.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Bank Drafts: A Financial Tool Explained

When it comes to managing your finances, it’s essential to have a clear understanding of various financial instruments, such as bank drafts. But what exactly is a bank draft, and how does it work? In this article, we’ll break down the definition of a bank draft, explain how it works, and provide you with an easy-to-understand example.

Key Takeaways:

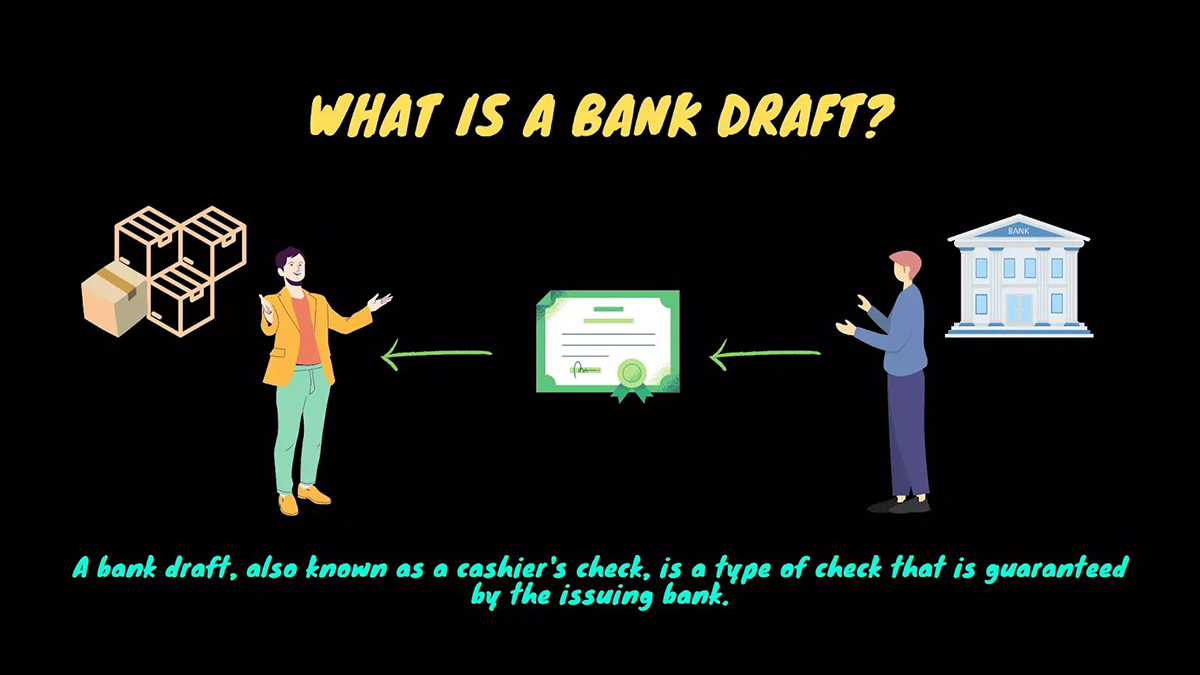

- A bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. It guarantees the funds will be available.

- Bank drafts are commonly used for large transactions, international payments, or when a seller requires a secure form of payment.

What is a bank draft?

Simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. It’s a secure way of making payments, ensuring that the funds are available and will be transferred to the recipient. Bank drafts are commonly used for large transactions, international payments, or when a seller requires a more secure form of payment.

How does a bank draft work?

Let’s imagine you want to purchase a new car from a private seller, and they require a bank draft as payment. Here’s how the process typically works:

- You visit your bank and request a bank draft for the amount agreed upon with the seller.

- The bank deducts the specified amount from your account and issues a bank draft in the seller’s name.

- The bank now guarantees the funds and marks them as held for the recipient, ensuring they are available.

- You provide the bank draft to the seller as payment.

- The seller can be confident that the bank draft is legitimate and that the funds are secure.

- The seller can then deposit the bank draft into their own account and access the funds.

It’s important to note that bank drafts are different from personal checks. While both are payment instruments, bank drafts are considered more secure because they are guaranteed by the issuing bank.

An example of using a bank draft

Let’s say you’re living in the United States, and you decide to purchase a vacation home in another country. The seller requests payment in their local currency, which means you’ll need to convert your dollars. In this scenario, a bank draft can be a convenient and secure option:

- You contact your bank and request a bank draft in the currency requested by the seller.

- Your bank converts your dollars into the seller’s currency and issues the bank draft.

- You provide the bank draft to the seller as payment.

- The seller can deposit the bank draft into their local bank account, ensuring a secure transfer of funds.

By using a bank draft, you minimize the risk of currency conversion fluctuations and provide a secure form of payment for the seller.

In conclusion

Bank drafts are an important financial tool designed to provide security and convenience for both buyers and sellers. They offer a guaranteed payment method, making them particularly useful for large transactions, international payments, and situations where a more secure form of payment is required. Understanding how bank drafts work can help you make informed financial decisions and facilitate seamless transactions in various scenarios.

If you have any questions or need assistance with using bank drafts, it’s always a good idea to consult with your bank or financial advisor. They can provide further guidance and ensure you make the most of this valuable financial instrument.