Home>Finance>Unlocking Financial Doors: Understanding the Significance of Credit History

Finance

Unlocking Financial Doors: Understanding the Significance of Credit History

Published: March 4, 2024

Explore the importance of credit history in accessing financial opportunities and how it opens doors to a brighter financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Your credit history plays a pivotal role in determining your financial opportunities and access to credit. With lenders relying on credit scores to make lending decisions.

Having a strong credit profile can unlock doors to better interest rates. Also, provide more favorable loan terms. This article explains the structure of a credit, and the factors impacting your creditworthiness. Follow some strategies to rebuild or maintain robust credit.

The Pivotal Role of Credit History in Financial Decisions

90% of top lenders struggle to rely on FICO scores for their lending decisions. It’s evident that credit history plays a monumental role in financial decisions. Your credit score gives lenders an overview of how you’ve managed credit in the past. That allows them to analyze your creditworthiness.

People who have higher credit scores usually get benefits. With lower interest rates, higher credit limits, and access to the top credit card and loan deals. A score greater than 760 increases the likelihood of being approved for the best deal lenders and credit card issuers have to offer. Besides, poor credit history can lead to rejection, higher rates, and limited options.

Credit history has ripple effects on everything from buying a home to leasing a car. Understanding its significance is key to financial health. In fact, credit history and its significance have broader societal impacts as well. This contributes to financial inequality.

The Anatomy of a Credit Report

While many are familiar with the term FICO Score 8. Note for lenders and insurance companies. They might use various versions or completely different credit scores. But what exactly comprises this score? Your credit report provides the data used to calculate your creditworthiness. Let’s explore its key components:

Personal Information: Your identifying details like name, address, and date of birth. Accurate information is crucial.

Credit Accounts: This includes all the credit accounts in your name, such as credit cards, retail accounts, and loans. Lists account numbers, dates opened, credit limits, balances owed, and payment history.

Credit Inquiries: Lists every entity that accessed your credit report. In the form of lenders reviewing a loan application. Too many inquiries can affect your score.

Public Records: Bankruptcies, foreclosures, wage garnishments, or other financial judgments. This can result in poor credit scores.

Understanding the sections that shape your credit report. It enables you to identify errors or potential issues so you can take corrective steps if needed.

Factors That Shape Your Credit History

To hold the weight of a credit score, we must uncover the key factors that shape it. Here are some of the most influential elements molding your credit history:

Payment History: Paying your bills on time has a significant impact. Payment delinquencies or collections can lower your score.

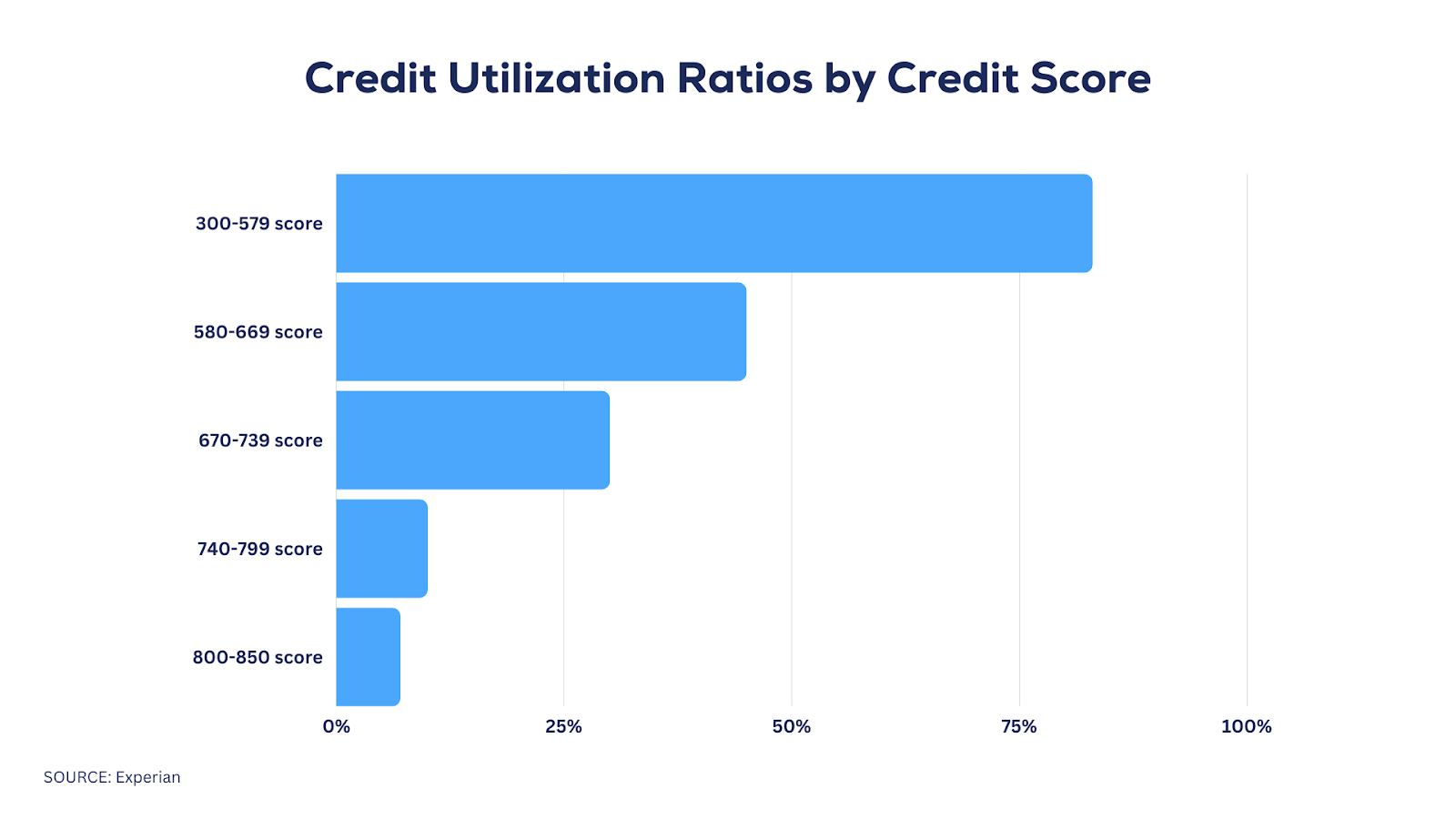

Credit Usage: Keeping balances low compared to your total available credit limits. This shows responsible usage and high use damages your score.

Length of Credit History: Your credit score shows how long your oldest account has been open and the average age of all your accounts. A longer established history is beneficial.

Types of Credit: Having a mix of credit cards, retail accounts, mortgages, auto loans, and more. This demonstrated experience managing different types of credit.

Recent Credit Activity: Opening many new accounts or having too many inquiries when seeking new credit can impact your score.

Monitoring these critical factors provides insights into maintaining or rebuilding your credit.

Rebuilding and Maintaining a Strong Credit History

It’s important to keep in mind that not all credit report information or transactions. The specific data that each credit bureau monitors may differ. So, how can you make sure you’re heading in the right direction with your credit? Here are useful tips:

Review Credit Reports: Make sure to review your reports from all three credit bureaus. Once a year to catch any errors that could harm your credit score. Dispute any inaccuracies.

Pay Bills On Time: Set up automatic payments or payment reminders to avoid missed payments. Even one late payment can hurt.

Lower Credit: To maintain low balances, it’s a good practice to pay your bills. You might also want to think about asking for increases in your credit limits to reduce your ratio.

Avoid Closing Old Accounts: Keep your accounts open to build a robust credit history. Close newer accounts first if needed.

Limit New Credit Applications: Be cautious about making too many credit inquiries when applying for new accounts. As this can cause a temporary dip in your credit score. Only open accounts you need.

Enroll in Credit Monitoring: Ongoing monitoring can alert you to report changes so you can address issues.

By developing diligent credit management habits. You can open doors to the best interest rates and financial opportunities available to you.

The Broader Implications of Credit History

Beyond influencing access to loans and credit products. Your credit profile has wider societal impacts to consider. Landlords often check credit reports and scores before approving rental applications.

It’s worth noting that many employers consider your credit history. This is to be a measure of responsibility. This may reviewed while evaluating job applicants. Even auto insurance companies may use credit-based insurance scores to set premiums.

Poor credit or lack of credit history altogether can limit your rental and employment options or lead to paying higher premiums. Credit deserts, defined as areas with limited credit access, are more common in low-income or minority communities.

Lack of established credit in these areas can perpetuate systemic disadvantages. When you understand the point, it becomes clear that improve financial knowledge. This ensures get access to credit can open up a world of greater opportunities.

Frequently Asked Questions

Why does my credit score fluctuate even if I haven’t made any significant financial changes?

Credit scores are set by a variety of ever-changing factors. Factors such as your account balances and how you use your credit. This can lead to some fluctuations from month to month. Even if there haven’t been significant credit-related events. Small changes in these amounts can impact your score.

How often should I check my credit report and what should I look for?

Experts recommend checking your credit reports from each bureau at least yearly. Look for any mismatched information, account activity, or errors in your payment history. This ensures all information is current.

Can I still get a loan or credit card if I have a poor credit history?

While it may be more challenging. It is still possible to get approved for credit with poor credit or limited history. But you will likely pay much higher interest rates. Improving your score first will lead to better rates.

Key Takeaway

Your credit history opens or closes doors to financial opportunities. So understanding its impact is imperative. Being cautious about taking on new credit, and practicing good credit habits.

You’re setting the foundation to reach your financial goals. Treat your credit with care, and it will open doors for years to come.