Finance

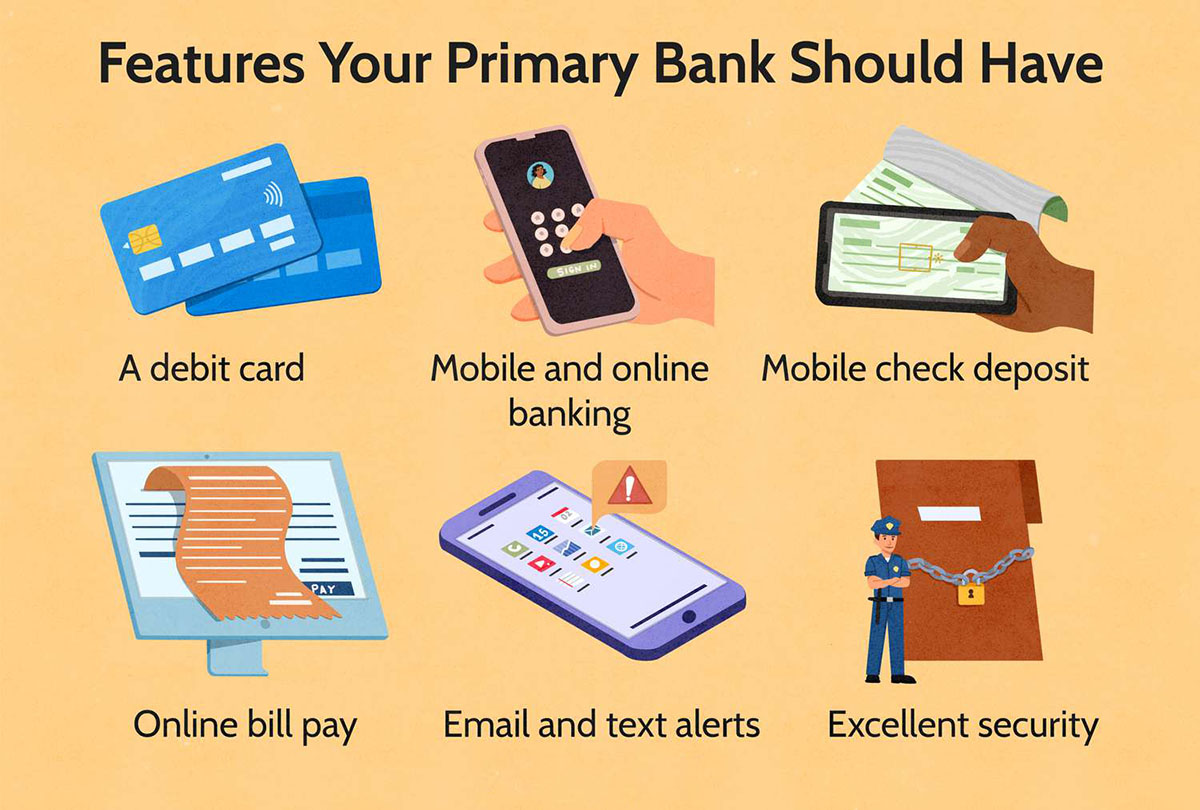

What Are Some Features Of Online Banking?

Published: November 27, 2023

Discover the essential features of online banking that simplify your finance management. Monitor transactions, transfer funds, and pay bills conveniently with online banking.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Online banking has become an integral part of our daily lives, revolutionizing the way we manage our finances. With the advent of technology, traditional banking practices have been transformed, providing us with a range of features that enhance convenience, accessibility, and security. In this article, we will explore some of the key features of online banking and how they have shaped the financial landscape.

One of the most notable advantages of online banking is the ability to access your accounts anytime, anywhere. Gone are the days of waiting in long queues at the bank or limiting your banking activities to regular business hours. With online banking, you can log in to your account securely using your credentials and manage your finances from the comfort of your own home. Whether you need to transfer funds, pay bills, or check your account balance, it’s all just a few clicks away.

Account management is another feature that sets online banking apart. You can easily view your account statements, track your transaction history, and monitor your spending habits right from your computer or mobile device. This level of visibility allows you to stay on top of your finances and make informed decisions about your money.

Bill payment is no longer a tedious chore thanks to online banking. With just a few simple steps, you can set up recurring payments for your regular bills, such as utilities or credit card payments. Some online banking platforms even offer the ability to make one-time payments to individuals or businesses, making it a quick and hassle-free process.

The ability to transfer funds between accounts is a key feature of online banking. Whether you need to transfer money between your own accounts or send funds to someone else, online banking platforms make it seamless. With just a few clicks, you can initiate transfers and have the funds available almost instantly.

Online banking also provides access to your electronic statements and transaction history. Instead of receiving paper statements in the mail, you can view and download your statements online. This not only reduces clutter but also allows you to access your financial records whenever you need them.

Convenience and Accessibility

One of the most significant advantages of online banking is the unparalleled convenience and accessibility it offers. Traditional banking methods often require customers to visit physical branches during limited operating hours, leading to long wait times and restricted access to financial services. However, with online banking, managing your finances is just a few clicks away, available 24/7.

With online banking, you can access your accounts from the comfort of your own home or anywhere with an internet connection. You no longer have to worry about rushing to the bank before it closes or adjusting your schedule to fit within their operating hours. This freedom and flexibility allow you to bank on your own terms, saving you time and reducing the stress associated with traditional banking.

Additionally, online banking provides a wide range of services at your fingertips. Whether you need to check your account balance, review transaction history, transfer funds, or pay bills, you can do it all online. This eliminates the need for physical paperwork and reduces the risk of errors or missing out on important financial tasks.

Mobile banking has further enhanced the convenience and accessibility of online banking. With smartphones becoming an integral part of our lives, many banks now offer mobile apps that allow customers to access their accounts on the go. These apps provide a user-friendly interface and secure access to your financial information, ensuring that you can manage your finances anytime, anywhere.

Another aspect of convenience is the ability to set up alerts and notifications. Online banking platforms give you the option to receive email or text alerts for various activities such as low balance notifications, bill due dates, or suspicious account activity. These alerts help you stay on top of your finances and prevent any unexpected surprises, allowing you to proactively manage your financial situation.

Lastly, online banking also offers the convenience of electronic statements. Instead of receiving paper statements in the mail, you can view and download your account statements online. This not only reduces paper waste but also provides easy access to your financial records whenever you need them.

Overall, the convenience and accessibility offered by online banking have transformed the way we manage our finances. With 24/7 access to a wide range of services, the ability to bank from anywhere, and the option to receive real-time alerts and notifications, online banking has made financial management easier and more convenient than ever before.

Account Management

One of the key features of online banking is the ability to manage your accounts with ease and efficiency. Online banking platforms provide a wide range of account management tools that enable you to stay on top of your finances and make informed decisions. Whether you need to check your account balance, review transaction history, or update your personal information, online banking makes it convenient and accessible.

Checking your account balance is a fundamental aspect of managing your finances, and online banking allows you to do this effortlessly. With just a few clicks, you can log into your online banking portal and view your current balance, providing you with an up-to-date snapshot of your financial situation. This real-time information helps you track your spending, ensure sufficient funds for upcoming expenses, and make informed financial decisions.

Transaction history is another essential tool provided by online banking platforms. Instead of sorting through paper receipts or contacting customer service, you can simply log into your online banking account to review your transaction history. This allows you to track your expenses, identify any discrepancies, and keep a record of your financial activities. Many online banking platforms also offer search and filtering options, making it easy to find specific transactions or categorize your expenses.

Online banking platforms also make it seamless to update your personal information. Whether you’ve changed your address, phone number, or email, you can easily make those updates online. This eliminates the need to visit a branch or fill out lengthy forms, saving you time and simplifying the process of keeping your account information current.

Additionally, online banking provides tools for managing multiple accounts. If you have multiple accounts with the same bank, such as a checking account, savings account, or credit card, you can link them together and view them all in one consolidated view. This makes it easier to track your overall financial picture, transfer funds between accounts, and allocate your funds accordingly.

Some online banking platforms also offer budgeting and financial tracking tools. These tools allow you to set financial goals, track your spending patterns, and create budgets to manage your money effectively. With visual representations and interactive features, these tools provide valuable insights into your financial habits and help you make more informed financial decisions.

Overall, online banking provides a comprehensive suite of account management tools that empower you to have greater control over your finances. From checking your account balance and reviewing transaction history to updating your personal information and utilizing budgeting tools, online banking offers a seamless and efficient way to manage your accounts anytime, anywhere.

Bill Payment

Online banking has revolutionized the way we pay our bills, making the process faster, more convenient, and hassle-free. With just a few clicks, you can set up recurring payments or make one-time payments for all your bills, eliminating the need for writing checks or mailing invoices. The bill payment feature of online banking streamlines the payment process and offers several benefits to both individuals and businesses.

One of the key advantages of online bill payment is the convenience it offers. Instead of manually writing checks and mailing them, you can simply log into your online banking account and schedule your payments. This saves you time, effort, and the hassle of organizing paperwork associated with traditional bill payments.

Many online banking platforms offer the option to set up recurring payments. This feature is especially useful for bills that remain constant every month, such as utilities or mortgage payments. Once you have set up the recurring payment, the online banking system will automatically process the payment on the specified date, ensuring that your bills are paid on time without any manual intervention.

For bills that may vary from month to month, such as credit card payments or medical bills, online banking allows you to make one-time payments. You can enter the payment amount and select the date for the payment to be processed. This flexibility gives you full control over when and how much you pay towards your bills.

Another advantage of online bill payment is the ability to track your payment history. Instead of keeping paper receipts or relying on your memory, you can easily view your payment history online. This allows you to keep a record of your payments, track any discrepancies, and have a clear overview of your financial obligations.

Online bill payment is also secure, with multiple layers of authentication and encryption to protect your sensitive information. Banks invest heavily in security measures to ensure the safety of online transactions, giving you peace of mind when making payments through online banking platforms.

Furthermore, online bill payment reduces the risk of late or missed payments. You can set up reminders or alerts to notify you of upcoming due dates, ensuring that you never miss a payment. Late payments can result in penalties, fees, and potential damage to your credit score. With online bill payment, you can avoid these consequences and maintain a positive financial standing.

To summarize, online bill payment offers convenience, flexibility, and peace of mind. It simplifies the payment process, provides options for recurring and one-time payments, allows you to track your payment history, and reduces the risk of late or missed payments. By utilizing the bill payment feature of online banking, you can effectively manage your financial obligations and streamline your bill payment process.

Transfer of Funds

The ability to transfer funds is a key feature of online banking that has greatly simplified and expedited the process of moving money between accounts. Whether you need to transfer funds between your own accounts or send money to someone else, online banking platforms offer a seamless and convenient transfer of funds.

One of the main advantages of online fund transfers is the speed at which the transaction is processed. With just a few clicks, you can initiate a transfer and have the funds available almost instantly. This is particularly useful in situations where immediate access to money is crucial, such as paying bills with approaching due dates or providing financial assistance to a family member in need.

Online banking provides the flexibility to transfer funds between your own accounts within the same bank. Whether you want to move money from your savings account to your checking account or vice versa, online banking allows you to do so effortlessly. This feature enables you to manage and allocate your funds to meet your financial goals and obligations.

In addition to internal transfers, online banking platforms also facilitate external fund transfers. You can easily send money to individuals or businesses outside of your bank. This is particularly helpful for situations like repaying a friend or family member, paying a freelancer or contractor, or settling bills with service providers who do not accept online payments.

Online banking platforms provide several methods for transferring funds externally. These include electronic funds transfers (EFT), which allow you to transfer money directly from your bank account to another bank account, and wire transfers, which are typically used for urgent or international transactions. By offering multiple options, online banking ensures that you have the flexibility to choose the most suitable method based on the urgency and nature of the transfer.

Security is another essential aspect of online fund transfers. Banks employ robust encryption techniques and authentication measures to ensure the safety and privacy of your financial transactions. This, combined with the convenience and efficiency of online transfers, provides peace of mind and reduces the risk of fraudulent activity.

Furthermore, online banking platforms often provide features such as transaction tracking and confirmation notifications. These features allow you to stay informed about the progress of your transfer and ensure that the transaction is successfully completed. In case of any concerns or issues, you can reach out to customer support for assistance.

In summary, the transfer of funds feature in online banking has revolutionized the way we move money between accounts. Whether it’s transferring funds internally or externally, online banking offers speed, convenience, and security. By leveraging the transfer of funds feature, you can efficiently manage your finances, meet your financial obligations, and easily send money to others.

Online Statements and Transaction History

Online banking provides the convenience and accessibility of accessing your account statements and transaction history digitally. Instead of waiting for paper statements to arrive in the mail or requesting copies from your bank, online banking platforms offer the ability to view and download your statements and transaction history at any time. This feature provides several benefits and enhances your overall financial management experience.

One of the key advantages of online statements is the reduction in paper waste. By opting for electronic statements, you contribute to environmental sustainability by eliminating the need for paper, printing, and delivery. This not only reduces your ecological footprint but also minimizes clutter and the need for physical storage space.

With online statements, you have quick and easy access to your financial records. Instead of searching through stacks of paper or filing cabinets, you can simply log into your online banking account and retrieve your statements within seconds. This accessibility allows you to review your financial history, track your spending habits, and gain insights into your financial patterns.

Online banking platforms often provide search and filtering options for your transaction history. This allows you to search for specific transactions, categorize your expenses, or track a particular type of payment. By leveraging these tools, you can analyze your spending, identify areas for improvement, and make informed financial decisions.

Furthermore, online banking platforms typically retain a longer history of your transactions compared to paper statements. Instead of receiving statements for a few months or a year, you can typically access several years’ worth of transaction history online. This long-term record-keeping simplifies the process of revisiting past transactions, reconciling your accounts, or preparing financial reports for tax purposes.

Online banking also provides enhanced security for your statements and transaction history. Banks invest heavily in secure platforms, encryption techniques, and authentication measures to protect your sensitive financial information. This ensures that your statements and transaction history are safely stored and accessible only to you.

Additionally, some online banking platforms offer the option to download your statements in various formats, such as PDF or CSV. This feature enables you to save digital copies of your statements for offline access, printing, or sharing with other parties, such as accountants or financial advisors.

Overall, online statements and transaction history offer a range of benefits, including convenience, accessibility, sustainability, and enhanced security. By leveraging this feature in online banking, you can easily access your financial records, track your transactions, and make informed financial decisions based on your spending patterns and history.

Mobile Banking

Mobile banking has emerged as a significant feature in online banking, providing users with the convenience of managing their finances on the go. With the increasing popularity of smartphones and mobile apps, banks have adapted their online banking platforms to offer seamless and secure mobile banking experiences. Whether you’re checking your account balance, transferring funds, or paying bills, mobile banking provides a range of features that make financial management more accessible and convenient.

One of the primary advantages of mobile banking is the ability to access your accounts anytime, anywhere. Whether you’re at home, at work, or traveling, as long as you have an internet connection, you can log into your mobile banking app and manage your finances with ease. This convenience allows you to stay on top of your financial situation and make informed decisions on the go.

Mobile banking apps provide a user-friendly interface specifically tailored for smartphones. These apps are designed to provide a seamless and intuitive user experience, allowing you to navigate through your accounts, view your transactions, and access various banking services with ease. The user-friendly design ensures that you can quickly and efficiently complete your banking tasks, saving you time and effort.

Mobile banking apps often offer features such as fingerprint or facial recognition for secure login. This provides an added layer of security compared to traditional username and password combinations. Additionally, many mobile banking apps also utilize encryption and other security measures to protect your financial information, ensuring that your transactions are secure and your data is protected.

One of the key features of mobile banking is the ability to make quick and convenient transfers. Whether you need to transfer funds between your accounts or send money to someone else, mobile banking apps allow you to initiate and complete transfers with just a few taps on your phone screen. This real-time functionality ensures that you can manage your finances on the go and respond promptly to any financial needs or obligations.

Mobile banking apps also offer bill payment options, allowing you to pay your bills directly from your smartphone. Whether it’s setting up recurring payments or making one-time payments, mobile banking makes the bill payment process fast, efficient, and hassle-free. You can schedule payments, receive reminders, and track your payment history, eliminating the need for writing checks or mailing invoices.

Furthermore, mobile banking apps provide access to your electronic statements and transaction history. Instead of relying on paper statements or accessing them through a web browser, you can view and download your account statements and transaction history directly from your mobile banking app. This ensures that you have quick and convenient access to your financial records whenever you need them.

In summary, mobile banking offers a range of features that provide convenience, accessibility, and security. With the ability to access your accounts anytime, anywhere, make transfers, pay bills, and access your statements and transaction history, mobile banking has become an essential tool for managing finances on the go. By leveraging mobile banking apps, you can streamline your financial management and have complete control over your finances right at your fingertips.

Alerts and Notifications

Alerts and notifications are an essential feature of online banking that helps keep users informed about their account activity and financial transactions. By enabling alerts and notifications, users can receive real-time updates and stay on top of their finances, providing peace of mind and enhancing their overall banking experience.

One of the primary benefits of alerts and notifications is the ability to stay informed about account balances. Users can set up alerts to receive notifications when their account balances fall below a certain threshold. This feature helps users proactively monitor their account and avoid overdrafts or insufficient funds, preventing potential financial difficulties.

Online banking platforms also offer alerts for transaction activities. Users can receive instant notifications for activities such as deposits, withdrawals, or any large transactions. This feature provides an added layer of security and allows users to quickly identify and address any unauthorized or suspicious transactions promptly.

Besides account balance and transaction alerts, users can also set up reminders for bill payments. By enabling payment reminders, users can receive notifications for upcoming due dates, ensuring that bills are paid on time. This feature helps users avoid missed payments, late fees, and potential damage to their credit score.

Some online banking platforms offer customizable alerts, allowing users to choose the specific events they want to be notified about. This flexibility enables users to tailor their alert preferences based on their individual needs and financial goals. Whether it’s alerts for low balances, specific transaction types, or account activity outside of normal patterns, customizable alerts provide a personalized banking experience.

Mobile banking apps often support push notifications, which send alerts directly to users’ smartphones. These notifications can provide real-time updates on account activity, balance changes, or payment reminders. Push notifications ensure that users receive timely updates, even when they are not actively using the banking app.

By receiving alerts and notifications, users can also quickly detect and resolve any potential issues with their accounts. For example, if a scheduled payment fails or if there are insufficient funds for a transaction, users can be immediately notified, allowing them to take appropriate action to avoid any negative consequences.

Beyond the convenience and security benefits, alerts and notifications also play a role in financial management. Users can leverage these alerts to track their spending, monitor savings progress, or receive updates on investment performance. By staying informed about their financial activities, users can make informed decisions and stay on track with their financial goals.

In summary, alerts and notifications in online banking provide users with real-time updates and keep them informed about their account activity, balances, and transactions. This feature helps users stay on top of their finances, avoid potential issues, and make informed financial decisions. By setting up customizable alerts and enabling push notifications, users can personalize their banking experience and have greater control over their financial well-being.

Enhanced Security Measures

Enhanced security measures are a critical component of online banking platforms. Banks invest considerable resources and employ advanced technologies to ensure the protection of customer data and prevent unauthorized access. By implementing robust security measures, online banking platforms provide users with a safe and secure environment for their financial transactions and personal information.

One of the primary security measures used in online banking is encryption. Banks encrypt sensitive data, such as account numbers, passwords, and transaction details, using sophisticated algorithms. Encryption transforms the data into an unreadable format, making it extremely difficult for unauthorized individuals to decipher the information. This secure transmission of data helps protect against eavesdropping and intercepting during online transactions.

Secure authentication methods are another significant security measure used in online banking. Banks employ a variety of authentication techniques to verify the identity of users and ensure that only authorized individuals have access to the accounts. This can include a combination of username and password, security questions, unique security codes or tokens, biometric verification (such as fingerprint or facial recognition), or two-factor authentication (requiring a secondary verification method in addition to a password).

Multi-factor authentication is becoming increasingly prevalent in online banking as an additional layer of security. This method requires users to provide multiple pieces of evidence to authenticate their identity. For example, in addition to entering a password, users may need to provide a unique code sent to their mobile device or answer a security question. Multi-factor authentication adds an extra level of security by ensuring that only authorized individuals can gain access to the accounts.

Online banking platforms also employ monitoring systems to detect and prevent fraudulent activities. These systems use various algorithms and pattern recognition techniques to identify irregular or suspicious transactions. If any anomalies are detected, the system may flag the transaction for further investigation or even temporarily freeze the account to protect the customer’s funds.

User education and awareness play a vital role in enhancing security in online banking. Banks provide resources and guidance to educate users about safe online practices, such as creating strong and unique passwords, avoiding suspicious links or emails, and keeping their devices and software up to date. Regularly educating users about potential risks and how to protect themselves helps to prevent common security breaches and phishing attacks.

Financial institutions also perform regular security audits and vulnerability assessments to identify and address any potential weaknesses in their online banking platforms. These assessments often involve third-party security firms that conduct penetration tests and evaluate the overall security posture of the system. By continuously monitoring and testing their systems, banks can stay one step ahead of evolving cyber threats and ensure the security of their customers’ financial data.

In summary, enhanced security measures in online banking platforms aim to protect users’ personal information, financial transactions, and funds. Encryption, secure authentication methods, multi-factor authentication, monitoring systems, user education, and security audits all contribute to a comprehensive security framework. By implementing these measures, online banking platforms create a safe and secure environment for users to conduct their financial transactions with confidence.

Customer Support

Customer support is an essential component of online banking platforms, ensuring that users have access to assistance when needed and providing peace of mind throughout their banking experience. Banks recognize the importance of providing reliable and efficient customer support to address inquiries, resolve issues, and offer personalized assistance to their customers.

One of the primary avenues for customer support in online banking is through the availability of a dedicated support team. Banks provide various channels for users to reach out for assistance, including phone support, online chat, and email. These communication channels allow users to connect with a live representative who can provide guidance, answer questions, and help with any issues they may encounter.

Online banking platforms often include a comprehensive knowledge base or frequently asked questions (FAQ) section. These resources contain valuable information about the platform’s features, troubleshooting steps, and answers to common inquiries. Users can access these self-service resources at any time, without the need to wait for assistance.

Many banks also offer personalized support through relationship managers or financial advisors. They can provide guidance on various financial matters, such as investment planning, retirement savings, or loan options. Having access to a knowledgeable professional who understands your financial situation can be invaluable in making informed decisions and achieving your financial goals.

In addition to traditional customer support channels, online banking platforms often integrate in-app messaging or secure messaging systems. These features allow users to communicate directly with the bank, addressing specific account inquiries or concerns. This secure and convenient method facilitates swift resolution of issues and promotes effective communication between users and the bank.

Another aspect of customer support in online banking is proactive communication. Banks frequently use email or push notifications to inform users about important updates, such as changes to terms and conditions, system maintenance, or security-related announcements. By proactively keeping users informed, banks ensure transparency and foster a sense of trust.

Good customer support goes beyond just providing assistance when issues arise. It also involves continuously improving the user experience based on customer feedback. Banks often welcome user suggestions, comments, and complaints and use them as valuable insights for enhancing their online banking platforms and services.

Moreover, banks prioritize security and privacy during customer support interactions. They implement measures to verify the identity of users and ensure the confidentiality of their personal and financial information. This ensures that users can have confidence in sharing their concerns and seeking assistance without compromising their security.

Overall, customer support is a vital component of online banking platforms, providing users with guidance, assistance, and reassurance throughout their banking journey. Through dedicated support teams, knowledge bases, personalized guidance, in-app messaging, proactive communication, and a focus on security, banks strive to offer a seamless and supportive customer experience in their online banking services.