Home>Finance>What Is Online Banking? Definition And How It Works

Finance

What Is Online Banking? Definition And How It Works

Published: January 3, 2024

Learn about online banking and how it works in the finance industry. Understand the definition and benefits of online banking for better financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Online Banking: The Definition and How It Works

Welcome to the “Finance” category of our blog, where we explore various aspects of personal finance, banking, and money management. In this article, we are going to delve into the concept of online banking, what it entails, and how it works. So, if you’ve ever wondered about the convenience and benefits of managing your finances online, this is the perfect read for you.

Key Takeaways:

- Online banking allows individuals to conduct financial transactions and manage their accounts through the internet.

- It provides convenience, flexibility, and easy access to banking services from anywhere and at any time.

What is Online Banking?

Online banking, also known as internet banking or e-banking, refers to the electronic platform provided by banks that allows customers to manage their financial transactions and accounts via the internet. By adopting online banking, individuals are no longer limited to traditional brick-and-mortar branches and can complete various banking activities using their computers or mobile devices.

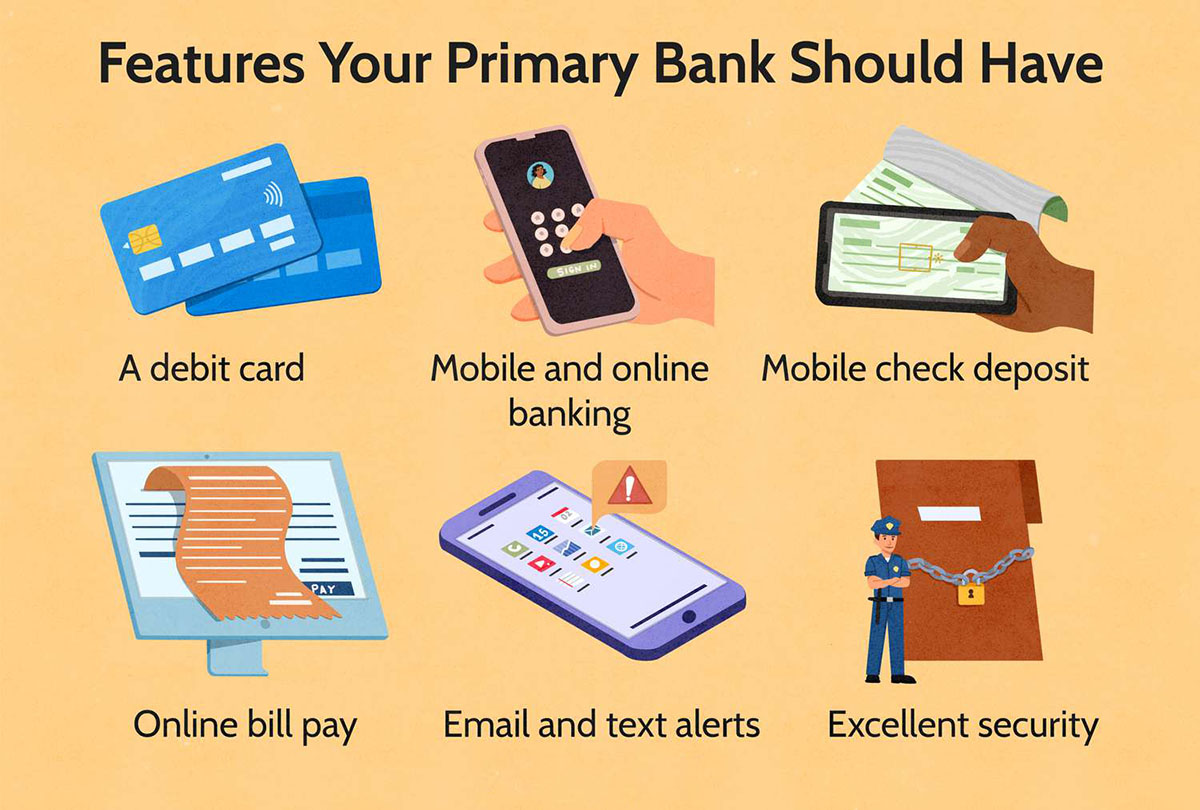

With online banking, customers can enjoy a wide range of services, including but not limited to:

- Account Access: Check account balances, view transaction history, and monitor account activity in real-time.

- Transfer of Funds: Easily transfer funds between different accounts, set up recurring or one-time transfers, and even send money to other individuals or institutions.

- Bill Payments: Pay bills electronically, set up automatic payments, and receive electronic billing statements.

- Online Statements: Access electronic statements directly through the online banking portal, eliminating the need for paper statements.

- Mobile Banking: Utilize banking applications on mobile devices for added convenience and flexibility.

- Apply for Financial Products: Apply for loans, credit cards, mortgages, or other financial products from the comfort of your own home.

How Does Online Banking Work?

Online banking operates through secure and encrypted websites or mobile applications, with each bank providing a unique platform for their customers. Here’s a breakdown of how online banking generally works:

- Registration: Customers must first register for online banking by providing their personal and account information to create a secure login.

- Verification: Banks verify the customer’s identity through various security measures such as unique usernames, passwords, and two-factor authentication.

- Security: Banks employ advanced security measures, including encryption and firewalls, to protect customer information and prevent unauthorized access.

- Authentication: Customers log in to the online banking portal using their secure credentials, typically a username and password. Some banks may also require additional verification through personal security questions or fingerprint recognition.

- Navigation: Once logged in, customers can navigate through the various features and services offered by the online banking portal. They can access account information, perform transactions, and manage their finances with ease.

- Transaction Authorization: For certain transactions, such as transferring funds or making online payments, customers may be required to authorize the action using unique verification methods or one-time passwords.

- Logout: To ensure security, users should always log out of their online banking session after completing their tasks, especially when using public computers or shared devices.

It’s important to note that every online banking platform may have its own specific features and functionalities, but the core principle remains the same – providing customers with a convenient and secure way to manage their finances remotely.

Now that you have a better understanding of online banking, its definition, and how it works, you can take advantage of this modern banking method to simplify your financial management and take control of your money with just a few clicks.