Finance

What Does Online Banking TFR Mean

Published: November 27, 2023

Discover the meaning of online banking TFR and how it relates to finance. Stay informed and manage your finances conveniently with online banking.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the digital age, where convenience and efficiency have become a top priority in our everyday lives. Gone are the days of waiting in long lines at the bank and filling out endless paperwork. With the advent of online banking, managing your finances has never been easier or more accessible.

Online banking allows individuals to handle their banking transactions electronically, using the internet as their medium. From checking account balances to transferring funds between accounts, online banking has revolutionized the way we interact with our finances.

One key feature of online banking is the ability to perform a TFR or Transfer of Funds. TFR refers to the movement of money from one bank account to another, whether it be within the same financial institution or different ones. This functionality provides users with the flexibility to manage their finances efficiently and securely.

In this article, we will delve deeper into the world of online banking TFRs, exploring the benefits, functionality, security measures, and potential challenges associated with this feature. Whether you’re a seasoned online banking user or new to the digital banking landscape, we aim to provide you with a comprehensive understanding of TFRs and equip you with tips to ensure a secure online banking experience.

What is Online Banking?

Online banking, also known as internet banking, is a service provided by financial institutions that allows customers to manage their bank accounts and conduct various financial transactions through a secure website or mobile application. It provides a convenient and efficient way for individuals to access and control their finances from the comfort of their own homes or on the go.

With online banking, users can perform a wide range of tasks, including checking account balances, viewing transaction history, transferring funds, paying bills, and even applying for loans or credit cards. This digital platform eliminates the need to visit physical bank branches, saving customers valuable time and offering unparalleled convenience.

Online banking offers several advantages. Firstly, it provides 24/7 access to your accounts, allowing you to manage your finances at any time of the day or night. This flexibility is particularly beneficial for individuals with busy schedules or those who prefer to handle their banking needs outside of traditional banking hours.

Secondly, online banking provides a higher level of control and visibility over your financial transactions. With just a few clicks, you can review your account activity, track expenses, and set up alerts for specific transactions or account balances. This enables you to stay on top of your finances, identify any unauthorized activity, and maintain better financial management.

Additionally, online banking promotes paperless transactions. Instead of receiving physical bank statements or generating paper checks, users can access electronic statements and make payments electronically. This not only saves the environment but also reduces clutter and the risk of misplacing important documents.

It is important to note that online banking is backed by robust security measures to ensure the safety of your financial information. These measures include encryption technology, secure login protocols, multi-factor authentication, and transaction monitoring. However, it is crucial for users to be vigilant and follow best practices to protect their personal and financial data.

Overall, online banking offers a convenient, efficient, and secure way to manage your finances. With its wide range of features and accessibility, it has become an essential tool for individuals seeking greater control and convenience in their financial lives.

Understanding TFR in Online Banking

In the world of online banking, one essential feature that empowers users is the ability to perform a Transfer of Funds (TFR). TFR refers to the electronic movement of money from one bank account to another, often within the same financial institution or different ones.

TFRs provide users with the flexibility to manage their finances efficiently, whether it’s transferring money between personal accounts, sending funds to another person or business, or even making payments for bills or loans. These transactions can be initiated and completed entirely online, eliminating the need for physical checks or visits to the bank.

One common type of TFR is the Internal Transfer, which involves moving money between accounts within the same financial institution. For example, if you have both a checking and savings account at a bank, you can transfer funds from your checking account to your savings account with ease. This allows for easier money management and can help you reach your savings goals.

External Transfers, on the other hand, involve moving money between accounts held at different financial institutions. This is particularly useful when you need to send money to someone who holds an account at a different bank or if you want to consolidate your finances by transferring funds from one bank to another. External Transfers may take a little longer to process, typically between one to three business days, due to the verification process between different institutions.

TFRs can also be initiated for bill payments. Many online banking platforms provide the option to set up recurring or one-time payments to pay bills such as utilities, credit cards, or loans. This allows for automatic and timely payments, reducing the risk of late fees and providing convenience and peace of mind.

It’s important to note that fees may apply for some TFRs, particularly for External Transfers. These fees can vary depending on your bank and the amount you are transferring. It’s advisable to review the terms and conditions of your bank’s online banking services to have a clear understanding of any associated fees.

Overall, TFRs in online banking provide users with a convenient and flexible way to manage their finances. Whether it’s moving money between accounts or making payments, TFRs streamline financial transactions and empower users to have greater control over their money.

Benefits of Online Banking TFR

Online banking TFR, or Transfer of Funds, offers numerous benefits that make managing your finances easier and more convenient. Here are some key advantages of utilizing TFR in online banking:

- Convenience: With online banking TFR, you have the freedom to transfer funds whenever and wherever you need to, without the need to visit a physical bank branch. Whether you’re at home, at work, or on the go, you can initiate and complete TFRs with just a few clicks, providing convenience and flexibility to manage your finances.

- Time-saving: TFRs eliminate the need for manual processes involved in traditional banking, such as writing checks or visiting the bank in person. This saves you valuable time and effort by enabling quick and efficient transfer of funds between accounts or to other individuals or businesses.

- Flexibility: Online banking TFR allows you to transfer funds between accounts held within the same financial institution or with different ones. This flexibility empowers you to manage your money as per your needs, whether it’s consolidating your finances, sending money to family or friends, or making payments for bills or loans.

- Cost-effective: TFRs conducted through online banking platforms often come with minimal or no transaction fees. This is in contrast to traditional banking methods, where fees may be charged for various transactions, such as wire transfers or issuing physical checks.

- Transaction tracking: Online banking platforms provide detailed transaction history and real-time updates, allowing you to easily track and monitor your TFRs. This visibility gives you better control over your finances, enabling you to reconcile accounts and identify any discrepancies or unauthorized transactions promptly.

- Automation and scheduling: Many online banking platforms offer the option to automate recurring TFRs or schedule future transfers. This feature is particularly useful for setting up regular bill payments or savings transfers, ensuring timely transactions without the need for manual intervention.

- Enhanced security: Online banking TFRs are protected by robust security measures, including encryption technology and multi-factor authentication. These security protocols help safeguard your financial information and prevent unauthorized access and fraud.

It’s important to note that the specific benefits of online banking TFR may vary depending on the financial institution and the features they offer. It’s advisable to explore the online banking services provided by your bank and familiarize yourself with the benefits and capabilities available to you.

Overall, online banking TFRs offer convenience, time-saving, flexibility, and enhanced security, empowering you to manage your finances with ease and confidence.

How Does Online Banking TFR Work?

Online banking TFR, or Transfer of Funds, is a secure and efficient way to move money between bank accounts through online banking platforms. Here’s a breakdown of the general process of how online banking TFR works:

- Login and authentication: To initiate a TFR, you first need to log in to your online banking account using your username and password. Many banks also employ additional authentication methods, such as one-time passwords or biometric verification, for added security.

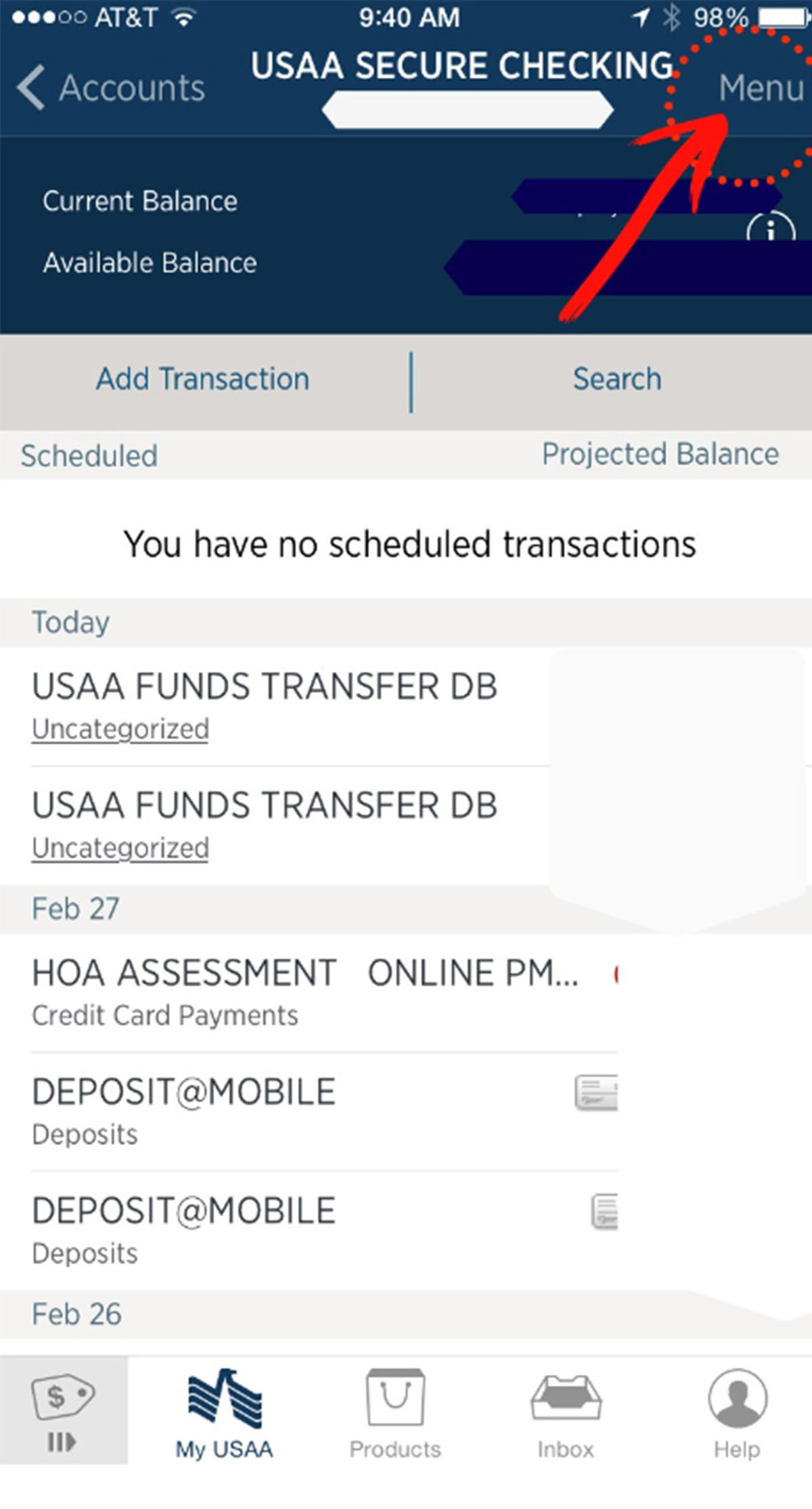

- Selecting the TFR option: Once logged in, you will navigate to the TFR section or option within your online banking platform. This option is usually found within the menu or navigation toolbar.

- Choosing the accounts involved: Next, you will specify the accounts involved in the transfer. This typically includes selecting the account from which you want to transfer funds (the “source” account) and the account to which you want to transfer funds (the “destination” account).

- Entering the transfer details: You will then be prompted to enter the transfer details, including the amount of money you wish to transfer and any additional notes or descriptions you want to include. Some platforms also allow you to schedule future-dated transfers or set up recurring transfers if needed.

- Confirming the transfer: After reviewing the transfer details, you will need to confirm the transaction before it can be processed. At this stage, double-check the accuracy of the transfer information to ensure the funds are being transferred to the intended account.

- Transaction processing: Once the transfer is confirmed, the online banking platform will initiate the processing of the TFR. The specific processing time may vary depending on various factors, such as the financial institution, the type of TFR (internal or external), and any intermediary processes involved.

- Verification and completion: For external transfers, where money is being transferred to an account at a different financial institution, there may be a verification process involved between the banks to ensure the security and accuracy of the transfer. Once the verification is complete, the funds are credited to the destination account.

- Transaction confirmation: After the TFR is successfully processed, you will typically receive a transaction confirmation or receipt. This confirmation will provide details such as the date, time, and amount of the transfer, as well as the participating accounts.

It’s important to note that the specific steps and interface of online banking TFR may vary depending on the bank’s online banking platform. Some banks may offer additional features, such as the ability to track the status of the transfer or receive notifications for completed transfers.

When using online banking TFR, it is crucial to ensure that you have entered the correct transfer details, including the account numbers and amounts, to avoid any potential errors. Additionally, it’s advisable to keep track of your banking transactions and regularly review your account statements for accuracy.

Overall, online banking TFR provides a seamless and convenient way to transfer funds between accounts, streamlining the financial management process and empowering users to have greater control over their money.

Security Measures in Online Banking TFR

Online banking TFR, or Transfer of Funds, involves the electronic movement of money between bank accounts. To ensure the safety and security of these transactions, online banking platforms implement various security measures. Here are some common security measures employed in online banking TFR:

- Encryption technology: Online banking platforms use encryption technology to protect the transmission of data between the user’s device and the bank’s servers. This ensures that sensitive information, such as login credentials and transaction details, are securely encrypted and cannot be intercepted by unauthorized individuals.

- Secure login protocols: Banks implement secure login protocols, such as strong password requirements and multi-factor authentication, to prevent unauthorized access to user accounts. Multi-factor authentication adds an extra layer of security by requiring users to provide additional verification, such as a one-time password sent to their registered mobile device.

- Transaction monitoring: Banks employ sophisticated technology to monitor and detect any suspicious or fraudulent transactions in real-time. This monitoring system analyzes various factors, including transaction patterns, location, and transaction amounts, to identify and prevent fraudulent activity.

- Fraud detection and prevention: Banks utilize robust fraud detection systems to identify potential fraudulent activity during online banking TFRs. These systems incorporate machine learning algorithms and risk scoring models to assess the legitimacy of transactions and flag any suspicious behavior for further investigation.

- Secure networks: Banks implement secure networks to protect the confidentiality and integrity of online banking transactions. These networks employ firewalls, intrusion prevention systems, and other security measures to guard against unauthorized access and external threats.

- Customer alerts and notifications: Many online banking platforms allow users to set up account alerts and notifications. These alerts can be configured to notify users of specific activities, such as large transactions, changes in account balances, or logins from unrecognized devices. By staying informed, users can quickly identify and respond to any suspicious activity.

- Secure communication: Online banking platforms ensure secure communication between the customer and the bank’s servers by using secure sockets layer (SSL) and transport layer security (TLS) protocols. These protocols encrypt communication channels, protecting sensitive information during data transmission.

- Education and awareness: Banks provide education and awareness resources to help customers understand potential online banking risks and best practices for maintaining online security. These resources may include tips on creating strong passwords, avoiding phishing scams, and regular updates on new security threats.

It’s important for users to also play an active role in maintaining the security of their online banking TFRs. This can be done by regularly updating passwords, avoiding sharing sensitive information, using secure internet connections, and keeping devices and software up to date with the latest security patches.

While banks implement robust security measures, no system is completely foolproof. It’s always advisable to stay vigilant and promptly report any suspicious activity or unauthorized transactions to your bank.

By implementing these security measures and practicing safe online banking habits, users can enjoy the convenience of online banking TFRs while minimizing the risk of unauthorized access or fraudulent activity.

Challenges and Risks in Online Banking TFR

While online banking TFR, or Transfer of Funds, offers convenience and efficiency, it is important to be aware of the potential challenges and risks associated with this feature. Here are some key challenges and risks to consider:

- Security threats: Online banking TFR is subject to security threats such as phishing attacks, malware, and hacking attempts. Cybercriminals may try to gain unauthorized access to your online banking account or trick you into revealing sensitive information. It is important to stay vigilant and follow security best practices to protect your personal and financial data.

- Fraudulent activity: There is a risk of fraudulent activity in online banking TFR. Criminals may attempt to manipulate or deceive individuals into transferring funds to fraudulent accounts. It is crucial to verify the authenticity of the recipient and exercise caution when initiating TFRs, especially to unfamiliar parties.

- User errors: Human error can lead to unintended mistakes during TFR initiation, such as inputting incorrect account numbers or transferring incorrect amounts. It is essential to double-check all transfer details before confirming a TFR to ensure accuracy and prevent any financial losses.

- Technical issues: Online banking platforms may occasionally experience technical glitches or system outages, which can disrupt TFR processes. This can result in delayed transactions or the inability to complete transfers. It is advisable to stay informed about any system maintenance or known technical issues that may affect the TFR function.

- Limitations on transactions: Banks may impose certain limits on TFRs, including maximum transfer amounts or a maximum number of transfers per day or month. These limits can vary depending on the bank and the type of account. It is important to be aware of these limits and plan accordingly when initiating TFRs.

- Unauthorized account access: While banks implement security measures, there is always a risk of unauthorized access to your online banking account. It is important to protect your login credentials and to create strong, unique passwords. Additionally, regularly monitoring your account activity and promptly reporting any suspicious transactions can help mitigate the risk of unauthorized account access.

It is crucial to stay informed about the potential challenges and risks associated with online banking TFR. By understanding these risks and taking appropriate precautions, such as using secure internet connections and keeping software up to date, you can help protect yourself and minimize the likelihood of falling victim to fraudulent activity or security breaches.

It’s also essential to maintain open communication with your bank, report any potential security issues or unauthorized transactions immediately, and follow their recommended security guidelines. By working together with your financial institution, you can ensure a secure and smooth online banking TFR experience.

Tips for Using Online Banking TFR Safely

Online banking TFR, or Transfer of Funds, provides a convenient and efficient way to manage your finances. To ensure a safe and secure experience, consider the following tips when using online banking TFR:

- Create strong and unique passwords: Use complex passwords for your online banking accounts and avoid using easily guessable information. Ensure that your password is a combination of letters, numbers, and special characters.

- Enable multi-factor authentication: Utilize the multi-factor authentication feature offered by your bank. This adds an extra layer of security by requiring additional verification, such as a one-time password sent to your mobile device, in addition to your login credentials.

- Regularly update your software: Keep your computer and mobile devices up to date with the latest security patches and updates. This will help protect against potential vulnerabilities that cybercriminals may exploit.

- Be cautious of phishing attempts: Be vigilant of phishing emails, text messages, or phone calls pretending to be from your bank. Remember that your bank will never request your login credentials or personal information via email or phone. Avoid clicking on suspicious links and report any suspicious activity to your bank.

- Verify recipient information: Before initiating a TFR, double-check the recipient’s account details, such as the account number and name. Confirm the accuracy of the information to ensure that funds are transferred to the intended recipient.

- Monitor your accounts regularly: Review your account activity and transaction history on a regular basis. This will help you spot any unauthorized transactions or suspicious activity promptly. Contact your bank immediately if you notice any discrepancies.

- Use secure networks: Connect to secure and trusted Wi-Fi networks when accessing your online banking account. Avoid using public or unsecured Wi-Fi networks, as they pose a higher risk of data interception.

- Avoid shared devices: Whenever possible, avoid accessing your online banking account from public or shared devices. If you must use a shared device, ensure that you log out completely and clear your browsing history and cache after each session.

- Keep personal information confidential: Never share your online banking login credentials or personal information with anyone. Banks will never ask for this information via email or phone. If you receive any suspicious requests, contact your bank immediately.

- Regularly review your bank’s security guidelines: Stay updated on the security guidelines provided by your bank. Banks often offer resources and advice on how to protect your online banking transactions. Following these guidelines will help you maintain a secure online banking experience.

By implementing these tips, you can enhance the security of your online banking TFR transactions and reduce the risk of falling victim to fraudulent activity or security breaches. Remember that staying informed, being vigilant, and practicing safe online banking habits are crucial for a secure and seamless banking experience.

Conclusion

Online banking TFR, or Transfer of Funds, has transformed the way we manage our finances. It offers convenience, flexibility, and efficiency, allowing users to transfer money between accounts, pay bills, and send funds to other individuals or businesses with just a few clicks. However, it is important to be aware of the challenges and risks associated with online banking TFR and take necessary precautions to ensure a safe and secure experience.

By understanding the security measures implemented by online banking platforms and following best practices, such as creating strong passwords, enabling multi-factor authentication, and regularly monitoring account activity, users can minimize the risk of unauthorized access and fraudulent activity. It is also crucial to stay informed about potential security threats, such as phishing attempts, and be cautious when providing personal information online.

While online banking TFR offers numerous benefits, it is essential to remain vigilant and proactive in safeguarding your financial information. Regularly update your software, avoid using shared or public devices for banking transactions, and utilize secure internet connections when accessing your online banking account.

Remember that communication with your bank is key. Promptly report any suspicious activity, unauthorized transactions, or potential security breaches to your bank. Stay updated on their recommended security guidelines and resources to ensure that you are utilizing the latest security measures.

Online banking TFR has revolutionized the way we manage our finances, providing us with unprecedented control, convenience, and accessibility. By following the tips and guidelines outlined in this article, you can confidently navigate the world of online banking TFR and enjoy the benefits it has to offer while keeping your financial information secure.