Home>Finance>What Are The Easiest Online Payday Loans To Get?

Finance

What Are The Easiest Online Payday Loans To Get?

Modified: February 6, 2024

Looking for the easiest online payday loans to get? Explore hassle-free finance options and quick approval process for your financial needs. Apply now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Understanding the Easiest Online Payday Loans to Get

Introduction

When unexpected expenses arise and your next paycheck is still a distant prospect, online payday loans can provide a convenient solution to bridge the financial gap. These short-term, small-dollar loans are designed to offer quick access to funds, often with minimal requirements and a straightforward application process. As a result, they have become a popular option for individuals facing urgent financial needs.

In this comprehensive guide, we will delve into the world of online payday loans, exploring the factors that make them easy to obtain and highlighting some of the most accessible options available. By understanding the nuances of these financial products, you can make informed decisions when seeking the right solution for your immediate monetary concerns.

Whether you're navigating unexpected medical bills, car repairs, or other unforeseen expenses, the accessibility and speed of online payday loans can be a lifeline in times of financial strain. However, it's essential to approach these financial tools with a clear understanding of their terms, potential risks, and the easiest options to secure. Let's embark on this journey to uncover the easiest online payday loans to get and empower ourselves with the knowledge needed to make sound financial choices.

Understanding Online Payday Loans

Online payday loans, also known as cash advances or paycheck advances, are short-term loans typically characterized by small loan amounts and a brief repayment period. These loans are designed to provide quick access to funds to cover unexpected expenses or financial emergencies before the borrower’s next paycheck. The application process for online payday loans is usually conducted through internet platforms, allowing borrowers to apply and receive funds without visiting a physical location.

One of the defining features of online payday loans is their accessibility, which is often emphasized as a key advantage for individuals facing urgent financial needs. Unlike traditional bank loans that may involve extensive paperwork and credit checks, online payday loans generally have minimal eligibility requirements, making them more attainable for a broader range of borrowers. This streamlined approach to lending enables individuals with varying credit backgrounds to apply for these loans, potentially receiving approval within a short timeframe.

It’s important to note that online payday loans typically come with higher interest rates and fees compared to traditional loans, reflecting the short-term nature of the borrowing and the perceived risk to the lender. As a result, borrowers should exercise caution and carefully consider the total cost of borrowing before committing to an online payday loan. Understanding the terms and conditions, including repayment schedules and potential penalties, is crucial for making informed financial decisions.

Despite the potential drawbacks, online payday loans can serve as a valuable financial tool for addressing immediate monetary challenges. When used responsibly and repaid on time, these loans can provide relief in situations where traditional lending options may not be readily available. By gaining a clear understanding of online payday loans and their implications, borrowers can navigate their financial hurdles with greater confidence and awareness.

Factors That Make Payday Loans Easy to Get

Several factors contribute to the accessibility and ease of obtaining payday loans, distinguishing them from traditional lending options. Understanding these factors can shed light on the appeal and practicality of payday loans for individuals facing urgent financial needs.

- Minimal Eligibility Requirements: Unlike conventional bank loans that often necessitate extensive credit checks and stringent eligibility criteria, payday loans typically have minimal prerequisites for approval. This inclusivity allows individuals with varying credit backgrounds to apply for these loans, increasing the accessibility of financial assistance during times of need.

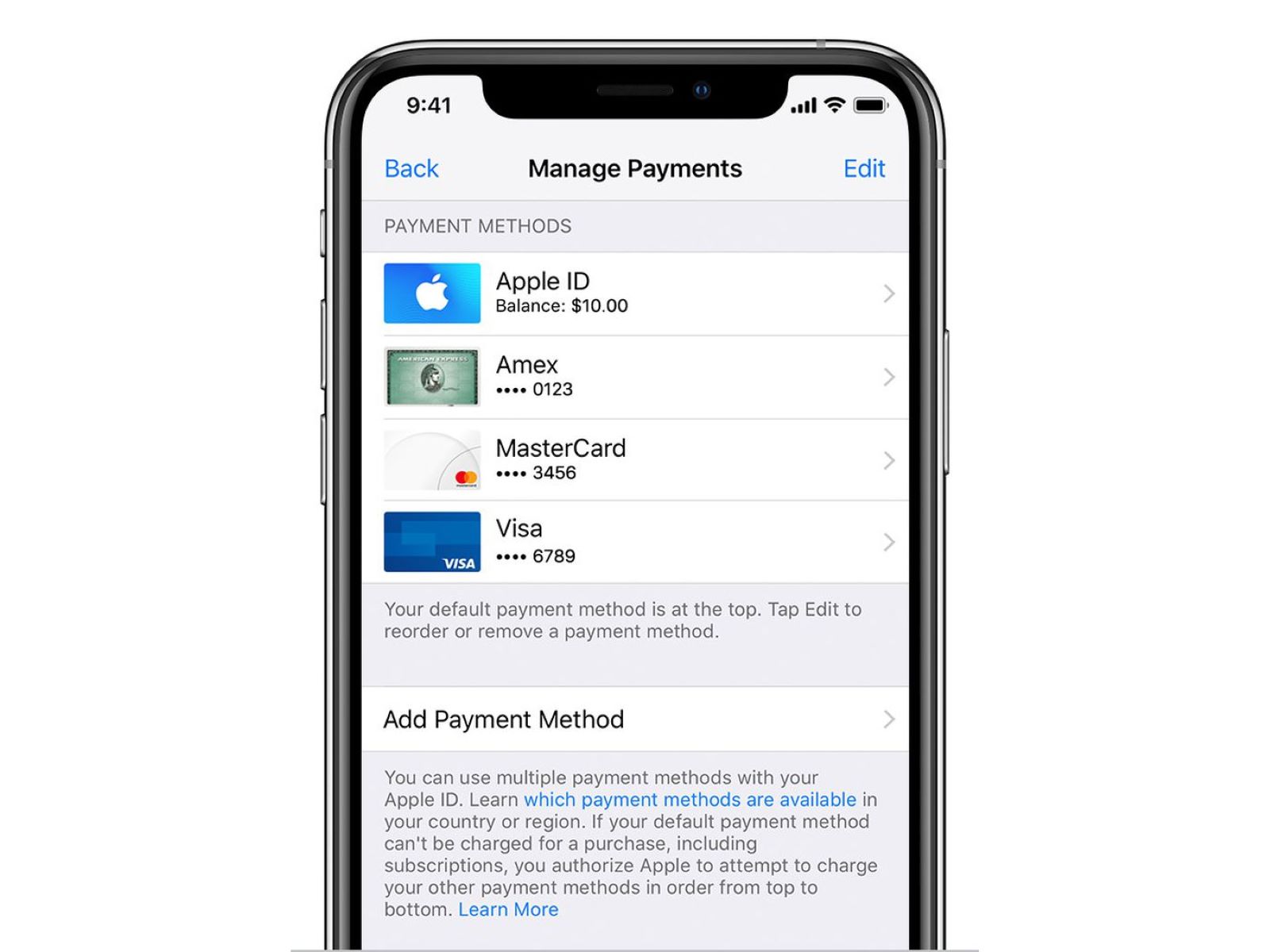

- Streamlined Application Process: Online payday loans, in particular, offer a streamlined application process that can be completed from the comfort of one’s home. The digital nature of these transactions expedites the loan approval and fund disbursement, providing a swift solution for pressing financial concerns.

- Rapid Fund Disbursement: Payday loans are designed to provide quick access to funds, often disbursing the approved amount within a short timeframe. This rapid turnaround is especially beneficial for individuals facing urgent expenses or unexpected emergencies.

- Flexible Repayment Options: Payday loan lenders may offer flexible repayment options, accommodating the diverse financial situations of borrowers. This adaptability can make it easier for individuals to manage their repayment schedules according to their specific circumstances.

- Online Accessibility: The online nature of payday loans enables borrowers to submit applications and receive funds without visiting physical locations. This accessibility is particularly advantageous for individuals with limited mobility or those seeking a discreet and convenient borrowing experience.

While these factors contribute to the ease of obtaining payday loans, it’s essential for borrowers to approach these financial products responsibly and be mindful of the associated costs and repayment obligations. By understanding the accessibility-enhancing elements of payday loans, individuals can make informed decisions when considering these short-term borrowing options.

The Easiest Online Payday Loans to Secure

When seeking the most accessible online payday loans, several lenders stand out for their streamlined application processes and borrower-friendly terms. While it’s crucial to conduct thorough research and carefully review the terms and conditions of any loan offer, the following options are known for their relative ease of access and quick approval turnaround:

- LendUp: LendUp offers online payday loans with a focus on accessibility and transparency. The application process is designed to be straightforward, and the company considers applicants with varying credit backgrounds, aiming to provide a responsible lending solution for those in need.

- CashNetUSA: CashNetUSA is recognized for its efficient online application process and rapid approval timelines. Borrowers can complete the application in minutes and, if approved, receive funds as soon as the next business day, making it a convenient option for urgent financial needs.

- Check Into Cash: Check Into Cash provides online payday loans with a simple application process and same-day funding options for approved borrowers. The accessibility of their services makes it easier for individuals to address unforeseen expenses without prolonged waiting periods.

- ACE Cash Express: ACE Cash Express offers online payday loans with a focus on accessibility and convenience. Their user-friendly online platform and quick approval process contribute to a seamless borrowing experience for individuals seeking immediate financial assistance.

- Speedy Cash: Speedy Cash is known for its expedited online payday loan services, allowing borrowers to complete the application process quickly and receive funds promptly upon approval. The accessibility of their offerings caters to the urgent financial needs of applicants.

While these lenders are recognized for their relatively accessible online payday loans, it’s essential for borrowers to carefully review the terms, interest rates, and repayment options before committing to any loan agreement. Additionally, exploring customer reviews and seeking recommendations can provide valuable insights into the borrowing experience with these and other payday loan providers.

Ultimately, the easiest online payday loans to secure are those that align with the borrower’s financial needs and are obtained from reputable, transparent lenders committed to responsible lending practices.

Conclusion

Online payday loans offer a lifeline for individuals facing unexpected expenses or financial emergencies, providing quick access to funds with minimal eligibility requirements and a streamlined application process. The ease of obtaining these short-term loans can be attributed to factors such as minimal eligibility requirements, rapid fund disbursement, and online accessibility, making them a practical solution for urgent financial needs.

While various lenders offer accessible online payday loans, it’s crucial for borrowers to approach these financial products with careful consideration of the associated costs and repayment obligations. Conducting thorough research, reviewing the terms and conditions, and seeking transparent, reputable lenders are essential steps in securing an online payday loan that aligns with one’s financial circumstances.

By understanding the nuances of online payday loans and the factors that contribute to their accessibility, individuals can navigate their financial challenges with greater confidence and informed decision-making. It’s important to use these financial tools responsibly, ensuring timely repayment and mitigating the potential risks associated with short-term borrowing.

As borrowers explore the easiest online payday loans to secure, they should prioritize lenders known for their transparency, efficient application processes, and commitment to responsible lending practices. By leveraging these accessible financial resources wisely, individuals can address immediate monetary concerns while maintaining financial stability and peace of mind.

In conclusion, the accessibility of online payday loans underscores their role as a valuable financial option for individuals in need of prompt assistance. By approaching these financial tools with awareness and discernment, borrowers can harness the benefits of online payday loans while mitigating potential drawbacks, ultimately fostering a more secure financial future.