Finance

What Are Yankee Bonds

Published: October 14, 2023

Learn about Yankee Bonds and their role in international finance. Find out how these bonds are issued by foreign entities in the United States.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where investment opportunities abound. One such investment vehicle, popular among investors, is the Yankee Bond. While the term may sound unfamiliar, Yankee Bonds have been a staple in the global financial market for many years.

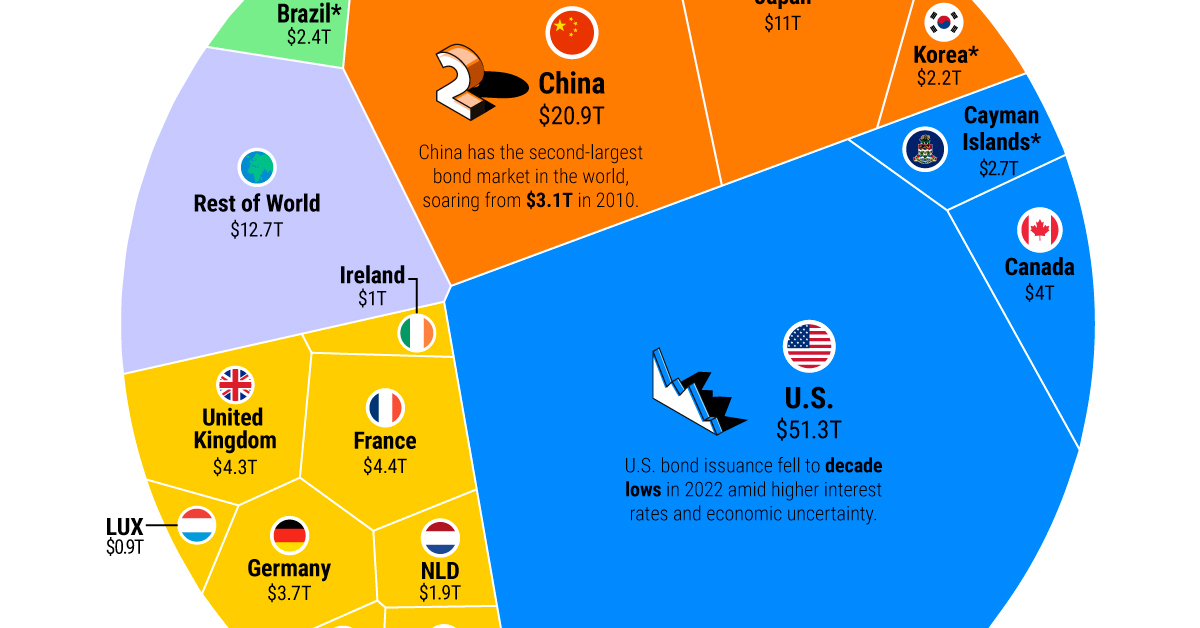

Yankee Bonds are a type of bond denomination issued by foreign entities in the United States. These bonds allow foreign companies, governments, and organizations to raise capital in the U.S. market. The name “Yankee Bond” is derived from the colloquial term for a U.S. citizen, aptly reflecting the bonds’ connection to the American financial system.

With their unique characteristics, Yankee Bonds provide a unique avenue for investors looking to diversify their portfolios or tap into international markets. In this article, we will delve deeper into the world of Yankee Bonds, exploring their definition, characteristics, benefits, risks, and factors to consider when investing in them.

So, whether you’re a seasoned investor or just beginning to explore the world of finance, join us on this educational journey as we unravel the mysteries of Yankee Bonds.

Definition of Yankee Bonds

Yankee Bonds are a type of bond denomination issued by foreign entities in the United States. These bonds provide overseas companies, governments, and organizations with a means to raise funds from American investors. The proceeds from the bond issuance are usually used by the issuing entity for various purposes, such as funding infrastructure projects, expanding operations, or refinancing existing debt.

For a bond to be classified as a Yankee Bond, it must meet certain criteria. Firstly, the bond must be issued in the United States, denominated in U.S. dollars, and subject to U.S. regulations. Secondly, the issuer must be a foreign entity, meaning it is not based or domiciled in the United States. This can include foreign companies, governments, or supranational organizations.

Yankee Bonds can be issued in different forms, including corporate bonds, government bonds, or supranational bonds. Each type of issuer has its own set of characteristics and credit ratings, which affect the overall risk and return associated with the bonds.

Furthermore, Yankee Bonds can have varying maturities, ranging from a few years to several decades. The terms of the bonds, such as interest rates and repayment schedules, are typically detailed in the bond’s prospectus.

In terms of liquidity, Yankee Bonds are usually traded on major U.S. exchanges or over-the-counter (OTC) markets. This provides investors with the flexibility to buy or sell the bonds, enhancing their marketability. The prices of Yankee Bonds are influenced by factors such as interest rates, credit ratings, economic conditions, and investor demand.

Overall, Yankee Bonds serve as a bridge between foreign entities and American investors, enabling the former to tap into the vast pool of capital available in the United States. In turn, investors have the opportunity to diversify their portfolios and gain exposure to international markets.

Characteristics of Yankee Bonds

Yankee Bonds possess unique characteristics that distinguish them from other types of bonds. These features make them attractive to both issuers and investors alike.

1. Foreign Issuer: Yankee Bonds are issued by foreign entities, such as corporations, governments, or supranational organizations. This allows these entities to access the U.S. capital market and raise funds from American investors.

2. U.S. Dollar Denomination: Yankee Bonds are denominated in U.S. dollars, which eliminates the currency exchange risk for U.S.-based investors. This makes them more accessible and convenient for American investors to invest in.

3. Regulatory Compliance: Yankee Bonds are subject to U.S. regulations and oversight, ensuring transparency and providing a level of comfort for investors. Issuers need to meet specific disclosure requirements and comply with U.S. securities laws.

4. Diversification: Investing in Yankee Bonds offers diversification benefits as it allows investors to add international exposure to their investment portfolios. By investing in bonds from different countries, investors can potentially reduce risk and gain exposure to various economic and market conditions.

5. Higher Yields: Yankee Bonds often provide higher yields compared to domestic bonds in the U.S. market. This higher yield, known as a yield spread, compensates for the additional risk associated with investing in foreign entities.

6. Credit Ratings: Yankee Bonds are assigned credit ratings by rating agencies based on the issuer’s creditworthiness. These ratings provide investors with an indication of the bond’s risk and potential return. It is important to consider the creditworthiness of the issuer when investing in Yankee Bonds.

7. Secondary Market Availability: Yankee Bonds are actively traded in secondary markets, providing liquidity to investors. This allows investors to buy or sell the bonds before their maturity dates, providing flexibility and the opportunity to adjust their investment strategy.

8. Interest Rate and Yield: Yankee Bonds may have fixed or variable interest rates. Fixed-rate bonds offer a predetermined interest rate for the bond’s duration, while variable-rate bonds have interest rates tied to a reference rate, such as LIBOR (London Interbank Offered Rate). The yield of a Yankee Bond refers to the return an investor receives based on the bond’s price and coupon payments.

These characteristics make Yankee Bonds an attractive investment option for those seeking diversification, higher yields, and exposure to international markets within the framework of U.S. regulations. However, it is important for investors to carefully evaluate the risks associated with investing in Yankee Bonds before making investment decisions.

Benefits of Yankee Bonds

Investing in Yankee Bonds offers a range of benefits for both issuers and investors. These benefits contribute to the popularity of Yankee Bonds in the global financial market. Let’s explore some of the key advantages:

1. Access to Capital: For foreign entities, issuing Yankee Bonds provides access to the vast pool of capital available in the United States. This enables these entities to raise funds for various purposes, such as funding expansion projects, refinancing debt, or supporting infrastructure development.

2. Diversification: Yankee Bonds allow investors to diversify their portfolios geographically. By investing in bonds issued by foreign entities, investors can reduce their exposure to domestic markets and gain exposure to the economic and market conditions of other countries. This diversification can help mitigate risk and potentially enhance returns.

3. Higher Yields: Yankee Bonds often offer higher yields compared to domestic bonds in the U.S. market. The yield spread reflects the additional risk associated with investing in foreign entities. Investors seeking higher returns may find Yankee Bonds an attractive investment option.

4. Currency Denomination: Yankee Bonds are denominated in U.S. dollars, eliminating the currency exchange risk for U.S.-based investors. This makes them more accessible and convenient to invest in, as investors do not need to worry about currency fluctuations and conversion costs.

5. Liquidity: Yankee Bonds are actively traded in secondary markets, providing liquidity to investors. This means that investors can buy or sell the bonds before their maturity dates, allowing flexibility and the ability to adjust investment strategies as market conditions change.

6. Regulatory Standards: Yankee Bonds are subject to U.S. regulations and oversight, ensuring transparency and investor protection. Issuers must comply with specific disclosure requirements, offering investors a level of comfort when investing in these bonds.

7. Credit Ratings: Yankee Bonds are assigned credit ratings by rating agencies, providing investors with an indication of the bond’s creditworthiness. These ratings help investors assess the risk associated with investing in a particular bond and make informed investment decisions.

8. Portfolio Diversification: Investing in Yankee Bonds allows portfolio diversification not only in terms of geography, but also in terms of sectors and industries. Different types of issuers, such as corporations, governments, or supranational organizations, offer bonds with varying risk profiles and potential returns, providing further diversification opportunities.

Overall, Yankee Bonds provide issuers with access to U.S. capital, while offering investors the opportunity to diversify their portfolios, earn potentially higher yields, and gain exposure to international markets. However, investors should carefully assess the risks associated with investing in Yankee Bonds and consult with financial advisors before making investment decisions.

Risks of Investing in Yankee Bonds

While investing in Yankee Bonds can offer attractive benefits, it is essential to consider the risks associated with these investments. Here are some key risks to be aware of:

1. Currency Risk: As Yankee Bonds are denominated in U.S. dollars, investors outside of the United States face currency risk. Fluctuations in exchange rates between the U.S. dollar and the investor’s local currency can impact the bond’s value when converted back into the investor’s currency.

2. Interest Rate Risk: Changes in interest rates can affect the value of Yankee Bonds. When interest rates rise, bond prices generally decline, and vice versa. Therefore, if an investor sells a bond before its maturity date, they may receive a price that is lower than their initial investment.

3. Credit Risk: Yankee Bonds are subject to the credit risk of the issuing entity. If the issuer experiences financial difficulties or defaults on their bond payments, investors may face a loss of principal or missed coupon payments. It is important to assess the creditworthiness of the issuer before investing.

4. Economic and Political Risks: Investing in Yankee Bonds involves exposure to the economic and political conditions of the issuing entity’s home country. Economic downturns, political instability, or policy changes can impact the issuer’s ability to make timely payments on the bond or even result in a default.

5. Liquidity Risk: While Yankee Bonds are traded in secondary markets, there may be instances where liquidity is limited. Investors may find it challenging to buy or sell bonds at their desired price, especially during periods of market stress. Illiquidity can also result in wider bid-ask spreads and potential price volatility.

6. Regulatory and Legal Risk: Yankee Bonds are subject to U.S. regulations, and changes in these regulations can impact the bond’s terms and conditions. Additionally, legal disputes or changes in the legal framework of the issuer’s home country can introduce additional risks that may affect the bond’s value.

7. Market Risk: The overall market conditions, including economic trends, investor sentiment, and geopolitical events, can influence the value of Yankee Bonds. Market volatility can lead to fluctuations in bond prices, potentially affecting returns and investor portfolios.

It is important for investors to conduct thorough research and due diligence before investing in Yankee Bonds. Assessing the creditworthiness of the issuer, understanding the economic and political landscape, and evaluating the potential risks are crucial steps to make informed investment decisions.

Comparison with Other Types of Bonds

When considering different types of bonds, it is important to understand how Yankee Bonds compare to other options. Here, we will explore the key differences between Yankee Bonds and other popular types of bonds:

1. Domestic Bonds: The primary distinction between Yankee Bonds and domestic bonds is the issuer’s location. Yankee Bonds are issued by foreign entities in the United States, while domestic bonds are issued by entities based in the country where the bond is denominated. Domestic bonds may provide investors with exposure to the local economy and currency.

2. Eurobonds: Eurobonds, like Yankee Bonds, are issued by foreign entities; however, they are denominated in a currency other than the issuer’s home currency. For example, a European company issuing bonds in U.S. dollars would be considered a Eurobond. Yankee Bonds are specifically denominated in U.S. dollars, making them more accessible to U.S.-based investors.

3. Sovereign Bonds: Sovereign bonds are issued by national governments to finance their operations or projects. Yankee Bonds may include sovereign bonds issued by foreign governments in the United States. Investing in sovereign bonds allows investors to gain exposure to a specific country’s economy and creditworthiness.

4. Corporate Bonds: Corporate bonds are issued by private companies to raise funds for business operations. Yankee Bonds can include corporate bonds issued by foreign corporations in the United States. Investing in corporate bonds offers exposure to specific companies, with the potential for higher yields compared to government bonds.

5. Supranational Bonds: Supranational bonds are issued by international organizations such as the World Bank or International Monetary Fund (IMF). These bonds finance global projects and initiatives. Yankee Bonds may include supranational bond offerings in the United States, providing investors with exposure to global development efforts.

6. Risk and Return Profile: The risk and return profile of Yankee Bonds can differ from other types of bonds. Depending on the creditworthiness of the issuer, the risk associated with investing in Yankee Bonds may vary. Generally, corporate bonds tend to carry higher credit risk compared to sovereign or supranational bonds. Investors should carefully evaluate the risks and potential returns of each bond type.

7. Regulations and Oversight: Yankee Bonds, being issued in the United States, are subject to U.S. regulations and oversight. Domestic bonds are governed by the regulations of the country where they are issued. The regulatory framework and requirements can vary, and investors should be aware of the specific rules and protections in place for each bond type.

Each type of bond offers unique advantages and considerations. Understanding the differences and evaluating factors like risk, return, issuer creditworthiness, and regulatory environment can help investors make informed decisions when diversifying their bond portfolios.

Factors to Consider When Investing in Yankee Bonds

Investing in Yankee Bonds can be a valuable addition to an investor’s portfolio, but it is essential to consider several factors before making investment decisions. Here are key factors to evaluate when investing in Yankee Bonds:

1. Creditworthiness of the Issuer: Assessing the creditworthiness of the issuer is crucial. Analyze the issuer’s financial health, debt levels, cash flow, and revenue sources. Ratings from credit agencies can provide insight into the issuer’s credit quality and help evaluate the risk associated with the bond.

2. Interest Rate and Yield: Understand the interest rate and yield of the Yankee Bond. Compare the yield to similar bonds in the market and assess whether it compensates for the risk associated with the investment.

3. Maturity and Duration: Evaluate the maturity and duration of the bond. Longer-maturity bonds typically offer higher yields but carry a higher risk of interest rate fluctuations. Consider the investment horizon and risk tolerance when selecting maturity durations.

4. Market Conditions: Consider the prevailing market conditions. Assess factors such as interest rate trends, economic indicators, and geopolitical events that may impact the bond market. These factors can influence the bond’s performance and potential returns.

5. Currency Risk: Evaluate the currency risk associated with investing in Yankee Bonds. If the bond is denominated in a currency different from the investor’s home currency, fluctuations in exchange rates can affect investment returns. Consider the potential impact of currency movements on the bond’s value.

6. Liquidity and Trading: Consider the liquidity and trading volume of the Yankee Bond. Higher liquidity allows for ease of trading and potential price transparency. Assess the availability of the bond on major exchanges and secondary markets to ensure efficient trading.

7. Issuer’s Country Risk: Evaluate the economic, political, and regulatory risks associated with the issuer’s home country. Factors such as economic stability, legal framework, political stability, and government policies can impact the issuer’s ability to fulfill its obligations. Consider the country risk when assessing the overall risk profile of the bond.

8. Diversification: Consider the role of Yankee Bonds in achieving portfolio diversification. Assess how investing in Yankee Bonds will complement existing holdings and provide exposure to different geographies, sectors, or industries. Ensure that the overall portfolio remains diversified and aligned with investment goals.

9. Professional Advice: Seek advice from financial professionals or investment advisors who have expertise in fixed-income securities and international markets. Their insights can provide valuable guidance in selecting suitable Yankee Bond investments based on individual financial goals, risk tolerance, and investment strategies.

By carefully evaluating these factors, investors can make informed decisions when investing in Yankee Bonds. It is important to conduct thorough research, monitor market conditions, and stay updated on the issuer’s financial health and global economic trends to maximize the potential benefits of investing in Yankee Bonds.

Conclusion

Yankee Bonds offer investors a unique opportunity to diversify their portfolios and tap into international markets. As a type of bond denomination issued by foreign entities in the United States, Yankee Bonds provide access to a wide range of issuers, including corporations, governments, and supranational organizations.

Throughout this article, we have explored the definition, characteristics, benefits, risks, and factors to consider when investing in Yankee Bonds. Understanding these elements is crucial for investors to make informed decisions and navigate the global bond market successfully.

Yankee Bonds provide benefits such as access to capital, diversification, higher yields, and liquidity. However, investors must also consider the risks associated with investing in Yankee Bonds, including currency risk, interest rate risk, credit risk, and regulatory risk.

When investing in Yankee Bonds, it is essential to evaluate factors such as the creditworthiness of the issuer, the interest rate and yield, the bond’s maturity and duration, market conditions, currency risk, liquidity, issuer’s country risk, and the role of the bond in your portfolio diversification strategy.

It is recommended to consult with financial professionals or investment advisors who can provide guidance and insights based on their expertise in fixed-income securities and international markets.

Yankee Bonds offer an avenue for investors to diversify their portfolios, gain exposure to international markets, and potentially earn attractive returns. By carefully considering the factors outlined and staying informed about market developments, investors can make well-informed decisions to optimize their investment portfolios.

Remember, investing in bonds involves risks, and it is important to conduct thorough research, stay informed, and assess individual risk tolerance and investment objectives before making investment decisions in the Yankee Bond market.