Finance

What Is Foreign Bonds

Published: October 11, 2023

Learn about foreign bonds and their role in finance. Explore how these bonds work and their potential benefits for investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

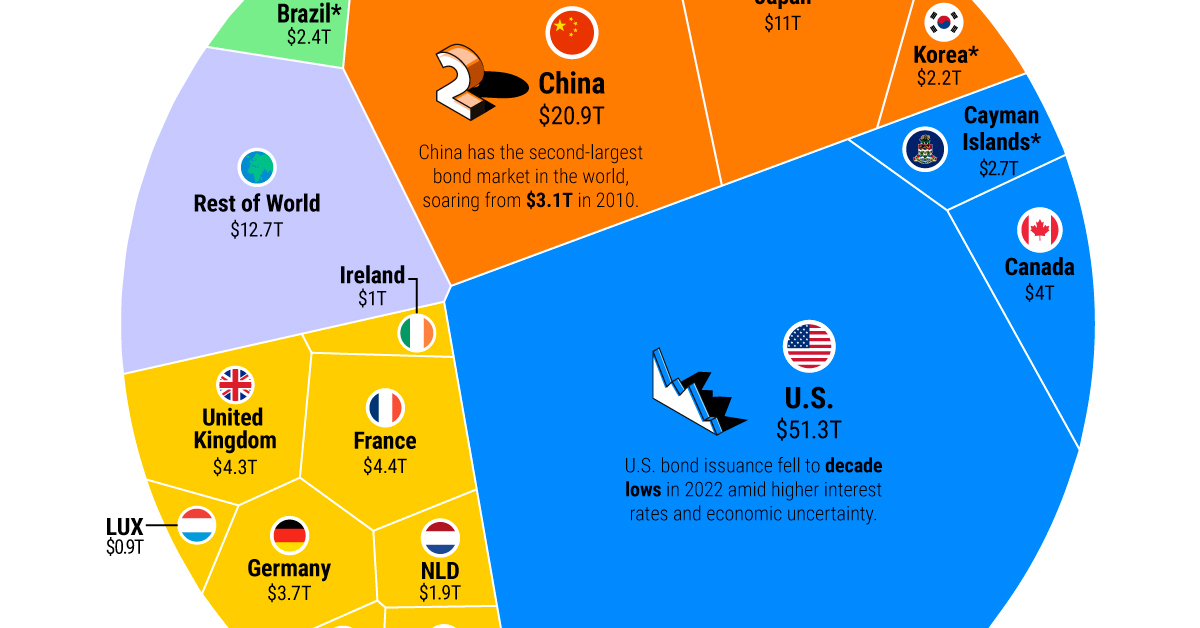

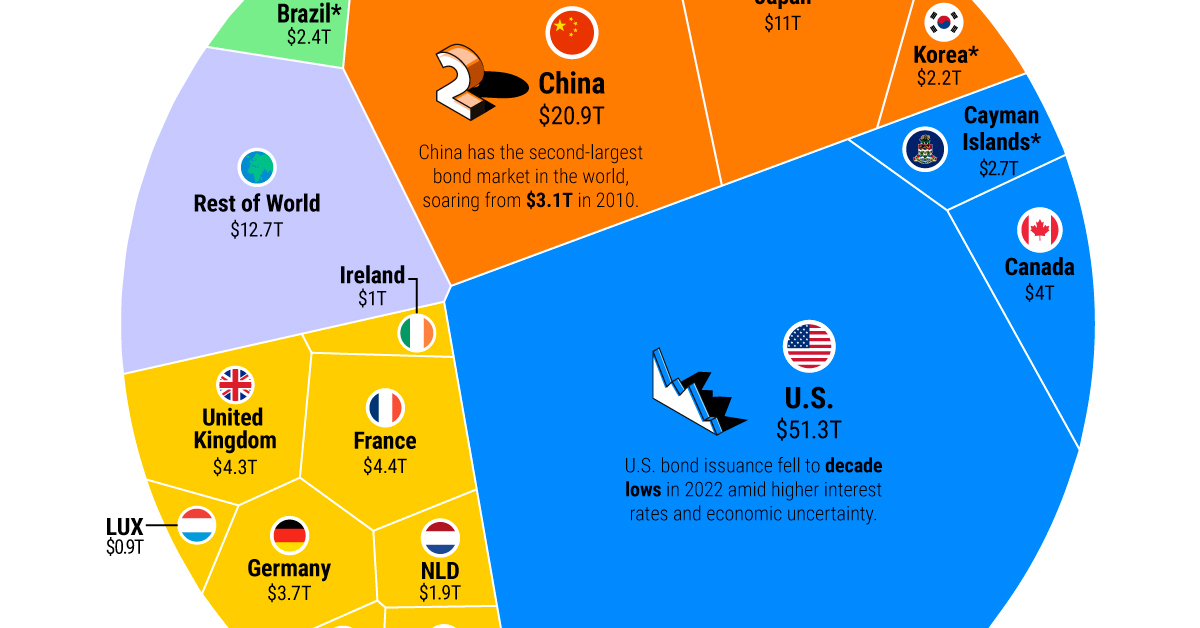

Foreign bonds are an essential aspect of the global financial market that can provide investors with diverse opportunities to expand their investment portfolios. In simple terms, foreign bonds refer to fixed income securities issued by foreign governments, municipalities, or corporations in a currency different from the one in which the investor resides.

Investing in foreign bonds has become increasingly popular as it allows individuals and institutional investors to diversify their holdings and potentially generate higher returns. Not only does it offer exposure to different geographic regions, but it also provides a chance to take advantage of interest rate differentials and currency fluctuations.

Foreign bonds are an attractive option for investors seeking to diversify their portfolio beyond domestic bonds and equities. They offer the potential for higher yields as well as the opportunity to participate in the growth of emerging markets.

In this article, we will explore the definition of foreign bonds, discuss the differences between foreign bonds and domestic bonds, highlight the advantages and risks of investing in foreign bonds, and provide key factors to consider before investing in these securities. Additionally, we will delve into the process of buying and selling foreign bonds, empowering investors with the knowledge they need to navigate this complex market.

Whether you are an experienced global investor or a novice looking to expand your horizons, understanding the intricacies of foreign bonds is crucial for making informed investment decisions. So, let’s dive into the world of foreign bonds and discover the myriad opportunities and challenges it presents.

Definition of Foreign Bonds

Foreign bonds, also known as international bonds or offshore bonds, are debt instruments issued by foreign entities such as governments, municipalities, or corporations to raise capital from global investors. These bonds are denominated in a currency different from that of the issuing country.

The primary purpose of issuing foreign bonds is to tap into international capital markets and attract investors from around the world. By issuing bonds in foreign currencies, issuers can diversify their funding sources and potentially access cheaper borrowing costs by taking advantage of differences in interest rates between countries.

Foreign bonds come in various forms, including sovereign bonds, which are issued by national governments, and corporate bonds, which are issued by companies. They can be further classified into developed market bonds and emerging market bonds, depending on the country of origin.

These bonds offer investors an opportunity to gain exposure to different countries and economies, diversify their investment portfolios, and potentially benefit from higher interest rates or currency appreciation. Investors can choose to invest directly in individual foreign bonds or indirectly through mutual funds or exchange-traded funds (ETFs) that focus on international fixed income securities.

It is important to note that investing in foreign bonds carries certain risks and considerations. Currency risk, interest rate risk, and political and economic stability of the issuing country are some of the factors that need careful evaluation before investing in foreign bonds.

Overall, foreign bonds are an important component of the global financial market, providing both issuers and investors with opportunities for diversification, access to capital, and potentially attractive returns. Understanding their definition and characteristics is essential for investors looking to expand their investment horizons beyond domestic bonds.

Differences between Foreign Bonds and Domestic Bonds

Foreign bonds and domestic bonds may appear similar at first glance, as they both represent debt instruments issued by governments or corporations. However, there are several key differences between the two that investors should understand before venturing into the international bond market.

1. Currency: One of the main distinctions between foreign bonds and domestic bonds is the currency denomination. Domestic bonds are issued in the currency of the country in which they are issued, while foreign bonds are denominated in a currency different from that of the investor’s home country. This introduces currency risk, as fluctuations in exchange rates can impact the returns of foreign bond investments.

2. Market Access: Domestic bonds are typically more accessible to local investors, as they are listed and traded on the national exchanges. On the other hand, foreign bonds may have limited availability and can be more difficult to access for individual investors. However, with the advent of electronic trading platforms and global investment vehicles, access to foreign bonds has improved over time.

3. Interest Rates: Another difference lies in the interest rates offered on foreign bonds compared to domestic bonds. Foreign bonds may have higher or lower interest rates depending on the issuing country’s economic conditions, credit rating, and borrowing costs. Investing in foreign bonds can provide opportunities to benefit from interest rate differentials and potentially earn higher yields.

4. Credit Risk: Credit risk refers to the likelihood that the issuer of the bond will default on its payment obligations. Foreign bonds may carry higher credit risk compared to domestic bonds, especially when investing in emerging markets or countries with unstable political or economic conditions. It is important for investors to carefully assess the creditworthiness of the issuing entity before investing in foreign bonds.

5. Regulatory Environment: The regulatory environment governing foreign bonds may differ from that of domestic bonds. Investors need to be aware of any legal or regulatory restrictions on investing in foreign bonds, including tax implications, reporting requirements, and any specific rules imposed by the issuing country.

6. Diversification: Investing in foreign bonds allows investors to diversify their portfolios beyond domestic assets. By adding foreign bonds to their holdings, investors can reduce their exposure to a single economy and potentially benefit from the performance of different countries and currencies.

Understanding the differences between foreign bonds and domestic bonds is crucial for investors looking to expand their investment strategies. Each type of bond comes with its own set of risks and opportunities, and it is important to conduct thorough research and seek professional advice before investing in foreign bonds.

Advantages of Investing in Foreign Bonds

Investing in foreign bonds offers a range of advantages that can enhance an investor’s portfolio and potential returns. Here are some key advantages to consider:

- Diversification: One of the primary benefits of investing in foreign bonds is the ability to diversify an investment portfolio. By adding foreign bonds to the mix, investors can reduce their exposure to a single economy or currency. This diversification helps spread risk and potentially increases the stability of the overall portfolio.

- Higher Yields: Foreign bonds can provide the opportunity to earn higher yields compared to domestic bonds. In some cases, foreign countries or companies may offer higher interest rates to attract global investors. By investing in these bonds, investors can potentially earn a higher return on their investment.

- Access to Emerging Markets: Foreign bonds provide investors with the chance to participate in the growth and development of emerging markets. These markets often offer higher growth rates and can deliver significant returns. Investing in foreign bonds allows investors to capture these opportunities and potentially benefit from the economic progress of these countries.

- Portfolio Hedging: Foreign bonds can act as a hedge against currency risk. When an investor holds foreign bonds denominated in a different currency, any appreciation in that currency can boost the overall return on the investment. This can help counterbalance potential losses in other areas of the portfolio due to currency fluctuations.

- Geographical Diversification: Investing in foreign bonds not only provides diversification across currencies but also across geographical regions. Different countries may have different economic cycles and may perform differently during various market conditions. By investing in foreign bonds, investors can benefit from the performance of multiple countries, reducing the impact of any single country’s economic fluctuations.

It is important for investors to carefully consider these advantages and align them with their investment goals and risk tolerance before investing in foreign bonds. While foreign bonds offer opportunities for diversification and potentially higher yields, they also come with risks and challenges that need to be taken into account.

Risks and Challenges of Foreign Bonds

While investing in foreign bonds can bring several benefits, it is crucial for investors to be aware of the inherent risks and challenges associated with these investments. Here are some key risks and challenges to consider:

- Currency Risk: One of the significant risks of investing in foreign bonds is currency risk. As foreign bonds are denominated in a currency different from the investor’s home currency, fluctuations in exchange rates can impact the overall returns. If the currency depreciates against the investor’s currency, it can result in lower returns or even losses.

- Interest Rate Risk: Interest rate risk is another important consideration when investing in foreign bonds. Changes in interest rates in the issuing country can affect the bond’s value and yield. For example, if interest rates rise, bond prices may fall, leading to potential capital losses for investors. It is important to carefully analyze the interest rate environment and the impact it can have on the foreign bonds being considered.

- Political and Economic Stability: The political and economic stability of the issuing country is a crucial factor to consider. Investing in bonds issued by countries with unstable governments or uncertain economic conditions can be risky. Events such as political unrest, policy changes, or economic downturns can impact the bond’s value and the ability of the issuer to meet its payment obligations.

- Credit Risk: Credit risk refers to the likelihood of the issuer defaulting on its payment obligations. Foreign bonds, particularly those issued by entities with lower credit ratings, can carry a higher credit risk. Investors should thoroughly assess the creditworthiness of the issuer and consider the issuer’s financial health and credit rating agencies’ assessments before investing.

- Volatility and Liquidity: Some foreign bond markets can be more volatile and less liquid compared to domestic bond markets. This means that it may be more challenging to buy or sell foreign bonds at desired prices, especially during periods of market stress. It is important to consider the liquidity and volatility of the foreign bond market in order to manage potential risks and ensure the ability to exit or adjust positions when needed.

It is crucial for investors to carefully evaluate these risks and challenges before investing in foreign bonds. Conducting thorough research, diversifying investments, consulting with financial professionals, and monitoring market conditions are key steps to mitigate risks and make informed investment decisions.

Factors to Consider before Investing in Foreign Bonds

Investing in foreign bonds requires careful consideration of various factors to make informed decisions. Here are key factors that investors should evaluate before investing in foreign bonds:

- Economic and Political Conditions: Assess the economic and political stability of the issuing country. Look at factors such as GDP growth, inflation rates, fiscal policies, and political stability. A stable economic and political environment can contribute to the issuer’s ability to meet its payment obligations.

- Currency Analysis: Evaluate the strength and stability of the currency in which the foreign bond is denominated. Consider factors such as exchange rate trends, central bank policies, and economic indicators that can impact the currency’s performance. Currency fluctuations can affect returns, so understanding the currency dynamics is crucial.

- Creditworthiness: Carefully evaluate the creditworthiness and credit rating of the issuer. Look at the issuer’s financial statements, debt-to-GDP ratio, historical default rates, and assessments from credit rating agencies. Higher credit ratings indicate lower credit risk and a higher likelihood of timely interest payments and principal repayment.

- Interest Rate Analysis: Analyze the interest rate environment in both the issuing country and the investor’s home country. Consider the current and expected future interest rates, as well as any divergences or potential convergence between the two. Changes in interest rates can impact the bond’s value and overall return.

- Diversification: Diversify investments across different countries, currencies, and bond issuers. This helps to spread risk and reduce the impact of any single investment. Consider investing in bonds issued by countries with different economic cycles, industries, and levels of risk.

- Liquidity and Market Access: Assess the liquidity and accessibility of the foreign bond market. Determine if there are any restrictions on buying or selling foreign bonds in the issuing country. Evaluate whether there are efficient trading platforms in place and if there are any specific requirements for non-resident investors.

- Professional Advice: Consider seeking advice from financial professionals or investment advisors who specialize in international bond markets. They can provide valuable insights, guidance, and help assess the risks and rewards of investing in foreign bonds.

By carefully considering these factors, investors can make well-informed decisions when investing in foreign bonds. Conducting thorough research, staying updated on economic and political developments, and understanding the unique aspects of the international bond market are essential for successful and prudent investing.

How to Buy and Sell Foreign Bonds

Investing in foreign bonds requires navigating the global financial market and understanding the process of buying and selling these securities. Here are the key steps to follow:

- Educate Yourself: Start by educating yourself about the international bond market and the specific foreign bonds you are interested in. Understand the different types of foreign bonds, countries, and issuers, as well as the risks and potential returns associated with these investments.

- Research and Select Bonds: Conduct thorough research on the bonds you are considering. Evaluate factors such as the issuer’s creditworthiness, yield, maturity date, and any other relevant financial information. Compare different bonds to identify the ones that align with your investment objectives and risk tolerance.

- Choose a Brokerage: Select a brokerage account that provides access to the international bond market. Ensure that the brokerage offers trading services for foreign bonds and has the necessary expertise and resources to support your investment needs.

- Place the Order: Once you have chosen the desired foreign bonds and established a brokerage account, place the order to buy the bonds. Provide the necessary details such as the bond name, quantity, and price. The brokerage will facilitate the purchase on your behalf.

- Payment and Settlement: Make the payment for the purchased bonds based on the terms and conditions set by the brokerage. The settlement process may vary depending on the market and the bond. It typically involves the transfer of funds to the seller and the delivery of the bonds to your brokerage account.

- Monitor Your Investments: Regularly monitor the performance of your foreign bond investments. Stay informed about any updates on the issuer’s financial health, changes in economic conditions, and any other factors that may impact the bond’s value or your investment strategy.

- Sell or Hold: Decide whether to sell or hold your foreign bond investments based on your investment goals, market conditions, and any changes in the issuer’s creditworthiness. If you choose to sell, place a sell order through your brokerage to initiate the sale process.

- Consider Tax Implications: Be aware of the tax implications associated with investing in foreign bonds. Different countries may have different tax laws and regulations governing the taxation of investment income from foreign securities. Consult with a tax advisor or financial professional to understand the tax obligations related to your foreign bond investments.

It is important to note that investing in foreign bonds can be complex, and it is advisable to seek guidance from a financial advisor with expertise in international investments. Their insights and experience can help navigate the intricacies of the international bond market and make informed decisions.

Conclusion

Investing in foreign bonds can be a valuable addition to an investor’s portfolio, providing opportunities for diversification, potentially higher yields, and exposure to different economies and currencies. However, it is crucial to approach this market with careful consideration and understanding of the risks involved.

By researching and analyzing the economic and political conditions of the issuing country, evaluating currency dynamics and interest rates, and assessing the creditworthiness of the issuer, investors can make informed decisions about investing in foreign bonds. It is also important to consider factors such as diversification, liquidity, and seeking professional advice to navigate the international bond market successfully.

The benefits of investing in foreign bonds, such as portfolio diversification, access to higher yields, exposure to emerging markets, and potential currency hedging, can be attractive for investors. However, it is equally crucial to be aware of the risks, including currency risk, interest rate risk, credit risk, volatility, and market liquidity.

Before entering the world of foreign bonds, investors should carefully evaluate their investment goals, risk tolerance, and time horizon. Conducting thorough research, staying informed about global economic developments, and engaging with financial professionals can help mitigate risks and optimize investment strategies.

Overall, foreign bonds can be a valuable tool for investors looking to broaden their portfolios and capture opportunities beyond their domestic market. By understanding the intricacies of investing in foreign bonds and taking a well-informed approach, investors can harness the potential of this global asset class and strive towards their financial goals.