Finance

What Credit Score Do You Need For Sallie Mae

Published: October 23, 2023

Find out what credit score is required to qualify for Sallie Mae financing and start managing your finances with confidence. Take control of your future today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of student loans, where understanding credit scores is crucial. When it comes to financing your education, Sallie Mae is one of the leading providers of student loans. But just how important is your credit score when it comes to securing a loan through Sallie Mae?

Before we dive into the specific credit score requirements for Sallie Mae, let’s take a moment to understand what Sallie Mae is and why your credit score matters. Sallie Mae is a financial services company specializing in providing student loans to help students and their families cover the cost of education.

When you apply for a loan, lenders like Sallie Mae assess your creditworthiness to determine if you are a reliable borrower. Your credit score plays a significant role in this assessment process. It serves as a snapshot of your credit history, indicating to lenders how responsible you have been with credit in the past and how likely you are to repay your loan on time.

A credit score is a three-digit number that ranges from 300 to 850. The higher your score, the better your creditworthiness. A good credit score can open doors to better loan terms and interest rates, while a lower score may limit your options or result in higher borrowing costs. Understanding the minimum credit score requirements for Sallie Mae can help you navigate the application process with confidence.

Now that we have a basic understanding of Sallie Mae and the importance of credit scores, let’s explore what specific credit score is needed to secure a loan through Sallie Mae and the factors they consider in their lending decisions.

Understanding Sallie Mae

Before we delve into the credit score requirements for Sallie Mae, let’s take a closer look at the company itself. Sallie Mae, or the SLM Corporation, is a financial services company specializing in providing student loans. Established in 1972 as a government-sponsored enterprise, Sallie Mae was initially a federally chartered organization that offered federally guaranteed loans.

However, in 2004, Sallie Mae transitioned into a private entity and no longer originates federally guaranteed loans. Instead, it focuses on offering private student loans, as well as other financial products and services related to education. With over 40 years of experience in the industry, Sallie Mae has become a trusted and well-known name in the student loan market.

Sallie Mae offers a wide range of loan options to help students and their families finance their education. These include undergraduate loans, graduate loans, career and technical student loans, and parent loans. Additionally, Sallie Mae provides tools and resources to help borrowers navigate the loan process and manage their finances effectively.

One of the key advantages of choosing Sallie Mae as your student loan provider is the flexibility it offers. Sallie Mae provides competitive interest rates, multiple repayment options, and a variety of loan terms to choose from. This allows borrowers to customize their loan to suit their financial needs and goals.

It is important to note that while Sallie Mae is a reputable and widely-used provider of student loans, it is always beneficial to shop around and compare loan offers from different lenders. By exploring multiple options, you can ensure that you secure the best possible terms and rates for your specific situation.

Now that we have a solid understanding of Sallie Mae and its role in the student loan market, let’s move on to discuss the significance of credit scores in the loan application process.

Importance of Credit Scores

When it comes to borrowing money, your credit score plays a vital role in determining your eligibility and the terms of your loan. A credit score is a numerical representation of your creditworthiness, indicating your ability to repay borrowed funds. It reflects your borrowing and repayment history, as well as other factors such as the length of your credit history, the types of credit you have, and your credit utilization.

For lenders like Sallie Mae, your credit score acts as an indicator of your financial responsibility and reliability. A high credit score signals that you have a history of managing credit well and are likely to make your loan payments on time. As a result, lenders may offer you more favorable loan terms such as lower interest rates and higher borrowing limits.

On the other hand, a low credit score may raise red flags for lenders, suggesting that you may have struggled with managing credit in the past. This could result in limited loan options and higher interest rates, as lenders perceive you as a higher risk borrower.

It is important to note that credit scores are not the sole factor considered by lenders when evaluating loan applications. Lenders also take into account other aspects, such as your income, employment history, and debt-to-income ratio. However, credit scores carry significant weight and can greatly impact your ability to secure a loan and the affordability of that loan.

Besides student loans, credit scores also play a crucial role in various other financial aspects of your life. They affect your ability to qualify for credit cards, car loans, mortgages, and even rental agreements. Landlords, insurance companies, and employers may also review your credit score to assess your reliability and financial stability.

Now that we understand the importance of credit scores in the lending process, let’s explore the specific credit score requirements for Sallie Mae student loans.

Minimum Credit Score Requirements for Sallie Mae

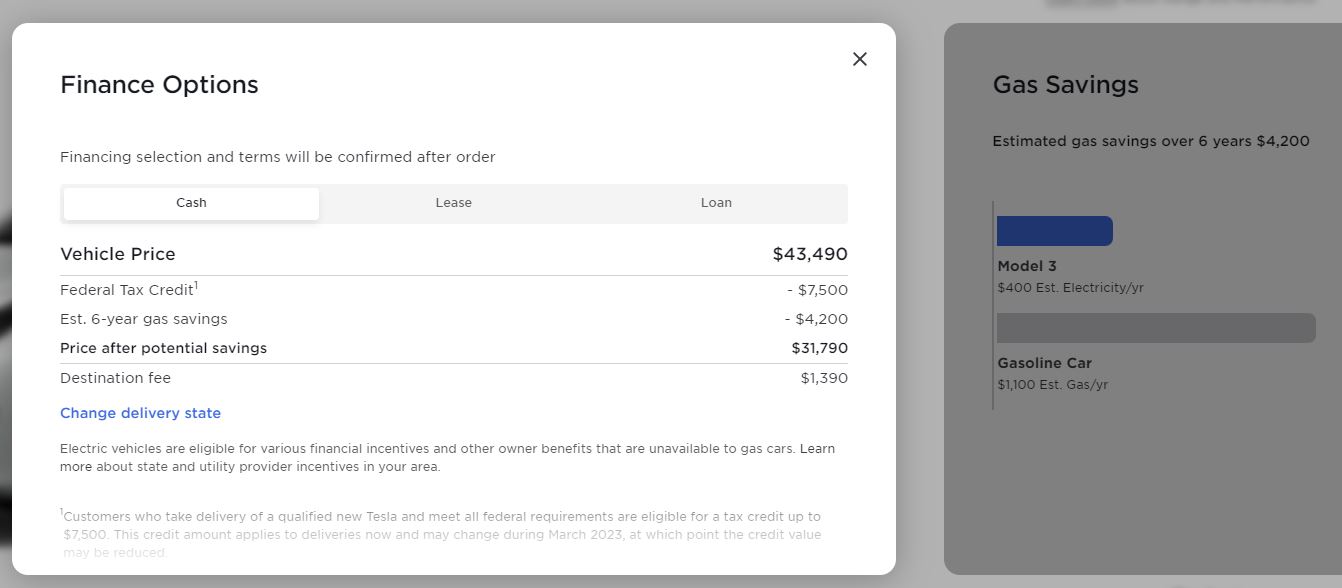

When applying for a student loan through Sallie Mae, having a good credit score can increase your chances of approval and help you secure more favorable loan terms. While Sallie Mae does not publicly disclose specific credit score requirements, a strong credit history is typically necessary to qualify for their loans.

In general, Sallie Mae expects borrowers to have a credit score in the range of 650 to 700 or higher to be considered for their loan programs. However, it’s important to note that meeting the minimum credit score requirement does not guarantee loan approval. Other factors, such as income, employment history, and debt-to-income ratio, also play a role in the loan decision process.

If your credit score falls below Sallie Mae’s preferred range, it may still be possible to secure a loan by adding a cosigner with a higher credit score. A cosigner is someone who agrees to share the responsibility of repaying the loan and has a stronger credit profile. Adding a cosigner can improve your chances of loan approval and result in more favorable loan terms.

It’s worth mentioning that while a good credit score is important, Sallie Mae understands that many students and recent graduates may not have an extensive credit history. In such cases, they may take other factors into consideration, such as your enrollment status, expected graduation date, and future earning potential.

It’s essential to keep in mind that meeting the minimum credit score requirement is just the first step. Maintaining a responsible credit profile throughout the life of your loan is equally crucial. Making timely loan payments, keeping credit card balances low, and managing other debts responsibly can help you build a strong credit history and improve your financial standing in the long run.

Now that we have a clear understanding of the credit score requirements for Sallie Mae, let’s explore other factors that Sallie Mae considers when evaluating loan applications.

Other Factors Considered by Sallie Mae

While credit scores are an essential factor in the loan application process, Sallie Mae takes into account various other factors when evaluating loan applications. These factors provide a more comprehensive view of your financial situation and help lenders assess your ability to repay the loan. Understanding these additional factors can give you a clearer picture of what Sallie Mae considers when making loan decisions.

1. Income: Sallie Mae takes into consideration your income and employment history. A stable and sufficient income demonstrates your ability to make loan payments on time. If you have a part-time job or plan to work while attending school, it’s important to provide documentation of your income to strengthen your loan application.

2. Debt-to-Income Ratio: Sallie Mae looks at your debt-to-income ratio, which is the percentage of your monthly income that goes towards paying debts. A lower debt-to-income ratio indicates that you have a manageable level of debt relative to your income, making you a more favorable candidate for a loan.

3. Enrollment Status: Sallie Mae considers your current enrollment status when evaluating loan applications. Whether you are a full-time or part-time student can influence their decision. Full-time students may have better prospects for loan approval, as they typically have more stable schedules and higher earning potential upon graduation.

4. Expected Graduation Date: Sallie Mae also takes into account your expected graduation date when assessing your loan application. This helps them evaluate your future earning potential and the likelihood of your ability to repay the loan after completing your education.

5. Loan Amount and Purpose: The loan amount and the purpose for which you are seeking the loan may also impact the approval process. Sallie Mae may vary their requirements based on the specific loan program or the purpose of the funds, such as undergraduate study, graduate study, or career and technical education.

Remember, while credit scores and these additional factors are important, it’s crucial to present a comprehensive picture of your financial situation. Providing accurate information and documentation, along with a well-prepared loan application, can greatly increase your chances of securing a loan through Sallie Mae.

Now that we understand the various factors considered by Sallie Mae, let’s explore some tips to help improve your credit score and increase your eligibility for student loans.

Tips to Improve Your Credit Score

If your credit score falls below the desired range for Sallie Mae student loans, don’t worry. There are several steps you can take to improve your credit score and increase your eligibility for student loans. Here are some useful tips to help you boost your creditworthiness:

1. Check your credit report: Start by obtaining a copy of your credit report from the three major credit bureaus – Experian, TransUnion, and Equifax. Review the report for any errors or discrepancies and report them immediately for correction.

2. Pay bills on time: Consistently making your bill payments on time is one of the most important factors in building a good credit score. Set up automatic payments or reminders to ensure you never miss a payment.

3. Reduce credit card balances: High credit card balances can negatively impact your credit score. Aim to keep your credit card balances below 30% of your available credit limit. Consider paying off your balances in full, or at least paying more than the minimum payment each month.

4. Limit new credit applications: Every time you apply for new credit, it triggers a hard inquiry on your credit report, which can temporarily lower your credit score. Minimize new credit applications unless necessary.

5. Maintain a mix of credit types: Having a diverse credit portfolio, including a mix of credit cards, student loans, and other installment loans, can positively impact your credit score. However, avoid opening unnecessary credit accounts just for the sake of variety.

6. Keep old credit accounts open: The length of your credit history is an essential factor in determining your credit score. If you have old credit accounts in good standing, keep them open to demonstrate a longer credit history.

7. Become an authorized user: If you have a family member or a close friend with a good credit history, ask them to add you as an authorized user on one of their credit cards. Their positive credit history can benefit your score, as long as the primary account holder uses credit responsibly.

8. Monitor your credit regularly: Regularly monitoring your credit will help you stay on top of any changes or issues that could affect your credit score. Utilize free tools and services like credit monitoring or credit score tracking to stay informed.

Improving your credit score takes time and discipline, but the effort is worthwhile. By implementing these tips and consistently practicing healthy credit habits, you can enhance your creditworthiness and increase your eligibility for Sallie Mae student loans.

Now that you have a better understanding of credit score improvement, let’s round up our discussion.

Conclusion

Securing student loans through Sallie Mae is a common choice for many individuals pursuing higher education. Understanding the importance of credit scores and meeting the minimum requirements is crucial to increase your chances of approval and secure favorable loan terms.

We explored the significance of having a good credit score and its impact on loan eligibility and interest rates. While Sallie Mae does not publicly disclose specific credit score requirements, maintaining a credit score in the range of 650 to 700 or higher can be advantageous.

Additionally, we discussed other factors considered by Sallie Mae during the loan application process, including income, debt-to-income ratio, enrollment status, expected graduation date, loan amount, and purpose. These factors provide a more holistic picture of your financial situation and help lenders assess your ability to repay the loan.

To improve your credit score and increase your eligibility for student loans, we provided several actionable tips. These include paying bills on time, reducing credit card balances, limiting new credit applications, maintaining a mix of credit types, keeping old credit accounts open, becoming an authorized user on a responsible person’s credit card, and monitoring your credit regularly.

Improving your credit score requires consistent effort and responsible financial habits. By following these tips and actively managing your credit, you can enhance your creditworthiness and increase your chances of securing student loans through Sallie Mae.

Remember, it’s essential to research and compare multiple loan options to find the best fit for your financial needs. Besides Sallie Mae, there are other lenders and financial institutions that offer student loan products, and you should explore all your options before making a decision.

With a solid understanding of the credit score requirements, additional factors considered, and steps to improve your credit, you are now better prepared to navigate the loan application process with confidence. Achieving your educational goals is within reach, and with the right financial knowledge and planning, you can make your dream of higher education a reality.