Finance

What Credit Score For Amex Gold

Published: October 22, 2023

Discover the credit score you need to qualify for the American Express Gold card. Learn how to improve your finance and boost your chances of approval.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to credit cards, the American Express Gold Card is highly regarded for its exclusive benefits and rewards program. Whether it’s earning generous Membership Rewards points on dining and travel purchases or enjoying travel insurance and airport lounge access, the Amex Gold Card is a coveted choice for many consumers.

However, before applying for the Amex Gold Card, it’s important to understand the credit score requirements. Your credit score plays a significant role in determining your eligibility for this prestigious credit card.

In this article, we will delve into the credit score requirements for the Amex Gold Card and explore the factors that influence credit score eligibility. We will also provide tips on how to build and improve your credit score to increase your chances of qualifying for this remarkable credit card.

Whether you’re a frequent traveler or a food enthusiast, the Amex Gold Card offers an array of benefits that can enhance your lifestyle. Let’s dive into the credit score requirements and discover how you can position yourself to obtain this remarkable piece of financial luxury.

Understanding the Amex Gold Card

The Amex Gold Card is more than just a regular credit card. It is a premium card that offers a plethora of exclusive benefits and rewards to its cardholders. Whether you’re a frequent traveler or a food enthusiast, this card is designed to elevate your experiences.

One of the standout features of the Amex Gold Card is its rewards program. Cardholders earn Membership Rewards points for every dollar spent, with substantial bonus points for dining and travel purchases. These points can be redeemed for a variety of options, including airline miles, hotel stays, gift cards, and more. The card also offers a generous welcome bonus for new applicants, providing an excellent jumpstart to your rewards earning journey.

Beyond the rewards program, the Amex Gold Card provides additional perks that make it a desirable choice. Cardholders enjoy travel benefits such as travel insurance, baggage insurance, and car rental loss and damage insurance. Additionally, the card also offers access to airport lounges, giving you the opportunity to relax and unwind before your flights.

The Amex Gold Card also caters to food lovers with a $120 annual dining credit. This credit can be used towards purchases at select restaurants and food delivery services, making it a valuable benefit for those who enjoy dining out or ordering in.

The card boasts a beautiful and robust design, made of metal and available in various colors. This premium aesthetic adds to the overall appeal and luxury of the Amex Gold Card.

It is important to note that while the Amex Gold Card offers an array of benefits, it does come with an annual fee. However, the value of the rewards and benefits often outweighs the cost for those who maximize their card usage.

Now that we have a solid understanding of the Amex Gold Card and its numerous advantages, let’s explore the credit score requirements necessary to become a proud cardholder.

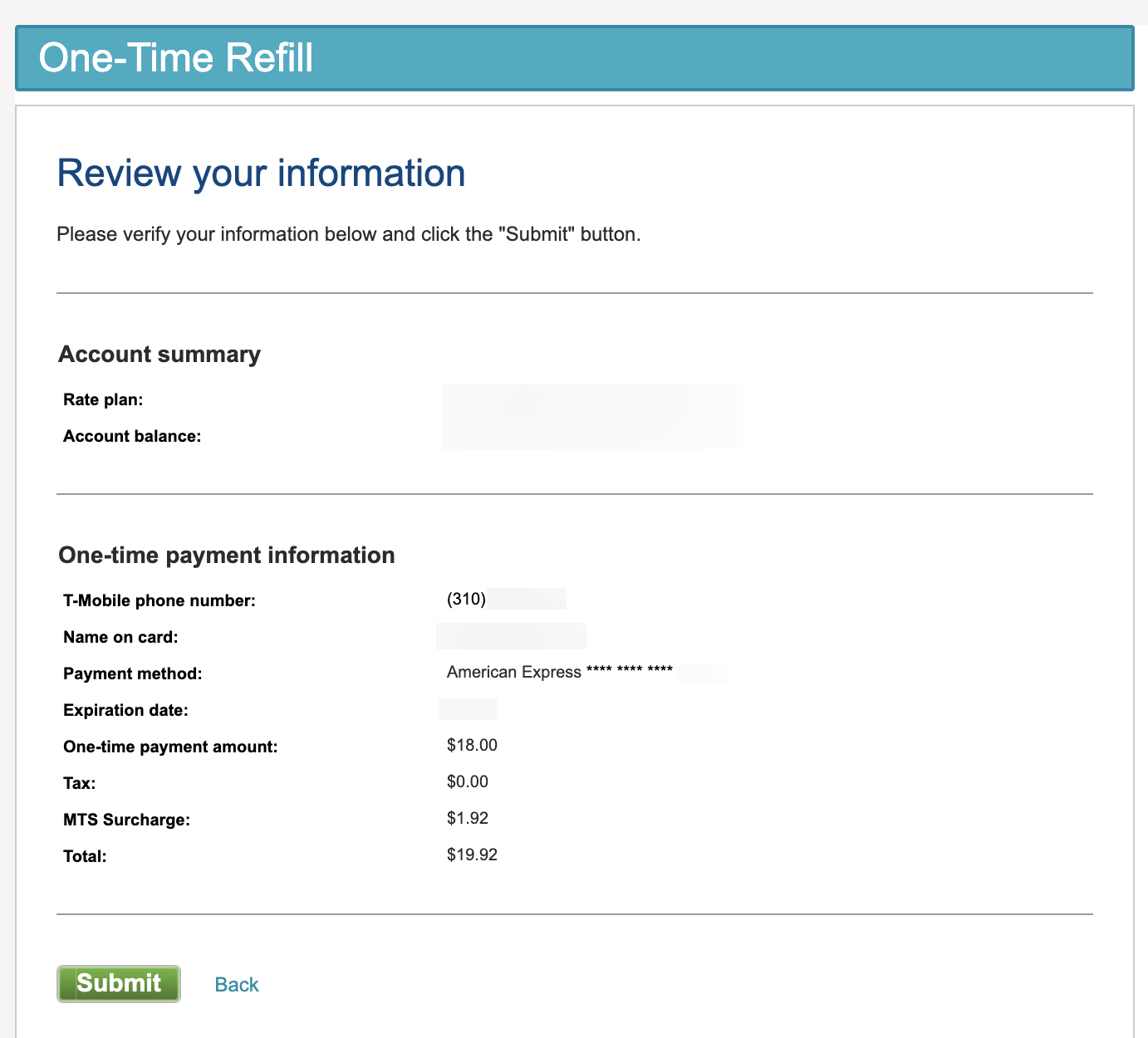

Credit Score Requirements for Amex Gold

The Amex Gold Card is known for its exclusivity and premium features, which means that it requires a certain credit score to qualify. While American Express does not publicly disclose the specific credit score requirement for the Amex Gold Card, it is generally recommended to have a good to excellent credit score to increase your chances of approval.

A good credit score typically falls within the range of 670 to 739, while an excellent credit score is considered to be 740 or above. These scores are based on the FICO credit score model, which is widely used by lenders to determine creditworthiness.

While credit score alone is not the only factor in the approval process, it plays a significant role. American Express evaluates various aspects of your credit profile, including your payment history, credit utilization, length of credit history, and recent credit inquiries. A strong credit score demonstrates your ability to manage credit responsibly and reduces the risk for the card issuer.

In addition to the credit score, American Express also considers other factors such as income, employment status, and existing debt obligations when evaluating credit card applications. These factors help the card issuer assess your ability to handle the financial responsibility that comes with a premium credit card like the Amex Gold Card.

It’s important to keep in mind that meeting the minimum credit score requirement does not guarantee approval. Other elements of your credit profile, as well as your overall financial situation, will also be taken into consideration.

If your credit score falls below the recommended range, there are steps you can take to improve it before applying for the Amex Gold Card. Building a strong credit history takes time and effort, but it is a worthwhile endeavor. Focus on making timely payments, keeping your credit utilization low, and avoiding excessive new credit inquiries. Over time, these positive credit habits will reflect in your credit score and enhance your eligibility for premium credit cards.

Now that we understand the credit score requirements for the Amex Gold Card, let’s delve into the factors that influence credit score eligibility and explore ways to build and improve your credit score.

Factors That Influence Credit Score Eligibility

When it comes to credit score eligibility for the Amex Gold Card, several key factors come into play. Understanding these factors can help you assess your creditworthiness and take proactive steps to improve your chances of qualifying for this prestigious credit card.

- Payment History: Your payment history is one of the most crucial factors that lenders consider when evaluating your creditworthiness. Making your credit card payments on time consistently and keeping a record of responsible repayment behavior will have a positive impact on your credit score.

- Credit Utilization: Credit utilization refers to the percentage of available credit that you are currently using. Keeping your credit utilization ratio low, ideally below 30%, demonstrates responsible credit management and can positively influence your credit score.

- Length of Credit History: The length of your credit history is an important factor in determining your creditworthiness. A longer credit history gives lenders more data to assess your past financial behavior. If you have a limited credit history, it may be beneficial to build credit by opening a credit card or becoming an authorized user on someone else’s credit account.

- New Credit Inquiries: Applying for multiple new credit accounts within a short period can negatively impact your credit score. Lenders may view this as a sign of financial strain or potential reliance on credit. Limiting the number of credit inquiries and spacing them out over time can help maintain a healthy credit score.

- Mix of Credit: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can demonstrate your ability to manage different types of credit. This factor may contribute positively to your credit score.

- Public Records and Collections: Negative records like bankruptcies, liens, and collections can significantly impact your credit score and may hinder your eligibility for premium credit cards like the Amex Gold Card. It’s essential to address any outstanding issues and work towards resolving them.

These factors collectively contribute to your overall credit score and determine your creditworthiness. Improving and maintaining a strong credit profile can increase your eligibility for premium credit cards like the Amex Gold Card.

Now that we’ve explored the factors that influence credit score eligibility, let’s dive into strategies to build and improve your credit score, regardless of whether you meet the current requirements for the Amex Gold Card or not.

Building and Improving Your Credit Score

Building and improving your credit score is an important step in increasing your eligibility for premium credit cards like the Amex Gold Card. While it requires time and effort, there are several strategies you can implement to enhance your creditworthiness and increase your chances of qualifying for this coveted credit card.

- Make Payments on Time: Consistently making your credit card and loan payments on time is crucial for building a positive credit history. Late payments can have a significant negative impact on your credit score, so ensure that all your payments are made by the due date.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This means using only a portion of your available credit. Keeping balances low and paying off credit card debt regularly will demonstrate responsible credit management and positively impact your credit score.

- Monitor Your Credit Report: Regularly check your credit report for any errors or discrepancies that could be negatively affecting your credit score. If you find any inaccuracies, dispute them with the credit bureaus to have them corrected.

- Diversify Your Credit Mix: If you have only one type of credit, such as a credit card, consider diversifying your credit mix. Opening a different type of credit account, such as a personal loan or a mortgage, can show lenders your ability to manage different types of credit responsibly.

- Avoid Excessive New Credit Inquiries: Applying for multiple new credit accounts within a short period can lower your credit score. Limit credit inquiries and apply for new credit strategically, only when necessary.

- Keep Old Accounts Open: Closing old credit card accounts may negatively impact your credit history and, therefore, your credit score. It’s generally advisable to keep old accounts open, especially if they have a positive payment history. If necessary, use them occasionally to maintain their active status.

- Manage Debt Responsibly: Paying down existing debt, whether it’s credit card balances or loans, demonstrates responsible financial management. Prioritize repaying debt to decrease your debt-to-income ratio and improve your creditworthiness.

Building and improving your credit score takes time and patience. It’s important to practice responsible credit habits consistently and be proactive in managing your credit profile. Over time, you’ll see the positive impact on your credit score, opening up doors to better credit card options like the Amex Gold Card.

Remember, the key is to be patient and diligent in your efforts. Even if you don’t meet the current credit score requirements for the Amex Gold Card, implementing these strategies will position you well for future applications and improve your overall financial health.

Now that we’ve covered building and improving your credit score, let’s conclude our discussion on the credit score requirements for the Amex Gold Card.

Conclusion

Obtaining the Amex Gold Card is a goal for many individuals who seek exclusive benefits and an elevated credit card experience. While American Express does not publicly disclose the specific credit score requirements for the Amex Gold Card, having a good to excellent credit score is generally recommended for a higher chance of approval.

In this article, we’ve explored the various aspects of the Amex Gold Card and the factors that influence credit score eligibility. We discussed the importance of payment history, credit utilization, length of credit history, new credit inquiries, mix of credit, and the impact of public records on your credit score.

To increase your eligibility for the Amex Gold Card, it’s essential to practice responsible credit habits and improve your credit score. Making payments on time, keeping credit utilization low, and monitoring your credit report for errors are crucial steps in building a strong credit profile. Additionally, diversifying your credit mix, avoiding excessive credit inquiries, and managing debt responsibly contribute towards enhancing your creditworthiness.

Remember, building and improving your credit score is a gradual process that requires patience and perseverance. As you adopt these strategies, your creditworthiness will grow, increasing your chances of qualifying for premium credit cards like the Amex Gold Card.

Even if you don’t meet the current credit score requirements for the Amex Gold Card, implementing these strategies will benefit your overall financial health. By building a strong credit profile, you open up opportunities for other premium credit cards and financial offerings in the future.

Now armed with a better understanding of the credit score requirements for the Amex Gold Card and the steps to build and improve your credit score, you’re on your way to achieving your financial goals. Whether it’s enjoying luxurious travel benefits or maximizing rewards on dining and travel purchases, the Amex Gold Card can truly enhance your lifestyle.

Take the necessary steps to improve your credit score, monitor your progress, and soon enough, you may find yourself relishing in the exceptional rewards and perks that the Amex Gold Card has to offer.