Finance

What Is My Amex Credit Limit

Published: January 5, 2024

Wondering about your American Express (Amex) credit limit? Discover the details and find out how it can impact your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of American Express, where your credit card can provide you with a range of financial benefits. One important aspect of credit cards is the credit limit, which determines how much you can spend on your card. Understanding the concept of credit limits is crucial for responsible credit card usage and financial planning.

American Express, also known as Amex, is one of the leading credit card companies in the world and offers a variety of credit card options to suit different needs. Each Amex credit card comes with a credit limit, which is the maximum amount of money you can borrow on your card. Your credit limit determines how much you can charge to your card and affects your purchasing power and overall financial flexibility.

Whether you are considering applying for an Amex credit card or already own one, it is essential to have a clear understanding of how credit limits work and what factors influence them. By knowing how to manage your credit limit effectively, you can make the most of your Amex card and maintain a healthy credit profile.

In this article, we will delve into the world of Amex credit limits, exploring the factors that affect them, how to check your credit limit, and strategies for increasing your credit limit. Understanding these key concepts will empower you to make informed decisions regarding your credit card usage and financial goals.

Understanding Amex Credit Limits

In simple terms, an Amex credit limit is the maximum amount of money that you can borrow on your American Express credit card. It acts as a cap on your spending and represents the total credit extended to you by the card issuer.

When you apply for an Amex credit card, the issuer assesses your creditworthiness to determine the appropriate credit limit for your card. This assessment takes into account factors such as your credit score, credit history, income, and existing debts. Based on this evaluation, the issuer assigns a credit limit that reflects your ability to manage your credit responsibly.

The credit limit plays a crucial role in determining your financial flexibility and purchasing power. It sets the boundary for your card usage and helps prevent excessive debt accumulation. It is important to note that exceeding your credit limit can lead to penalties, fees, and potential damage to your credit score. Therefore, it is essential to understand your credit limit and use your card responsibly within its boundaries.

Amex credit limits can vary widely depending on several factors, including the type of credit card you have, your creditworthiness, and your income. Higher-end Amex cards, such as the Platinum Card or the Centurion Card, typically come with higher credit limits to accommodate their premium benefits and services.

Managing your credit limit effectively is important for maintaining a good credit standing. This involves keeping your credit utilization ratio (the amount of credit you use compared to your total credit limit) within a manageable range. A lower credit utilization ratio demonstrates responsible credit usage and can have a positive impact on your credit score.

Next, we will explore the various factors that can influence your Amex credit limit, helping you better understand why it may be set at a certain amount.

Factors Affecting Amex Credit Limits

Several factors can influence the Amex credit limit assigned to your credit card. Understanding these factors can give you insights into why your credit limit may be set at a specific amount and how you can potentially increase it in the future.

1. Credit Score:

Your credit score is one of the most important factors considered by Amex when assessing your creditworthiness. A higher credit score signifies a lower risk of default, which may result in a higher credit limit. Maintain a good credit score by paying your bills on time, keeping your credit utilization low, and managing your debts responsibly.

2. Credit History:

An established credit history can demonstrate your ability to manage credit responsibly. The length of your credit history and your payment track record can influence the credit limit assigned to your Amex card. Make sure to maintain a positive credit history by paying your debts on time and avoiding any negative marks on your credit report.

3. Income Level:

Your income plays a significant role in determining your credit limit. A higher income generally indicates a higher repayment capacity and can influence the credit limit set by Amex. Be sure to provide accurate information about your income during the credit card application process.

4. Existing Debts:

Amex will consider your existing debts, such as loans and credit card balances, when assessing your credit limit. If you have a high level of outstanding debt, it may impact the credit limit assigned to your Amex card. Reducing your existing debts and maintaining a healthy debt-to-income ratio can improve your chances of receiving a higher credit limit.

5. Financial Stability:

Amex may also take into account your overall financial stability when determining your credit limit. Factors such as employment history, job stability, and assets can contribute to this assessment. Demonstrating financial stability can increase your chances of receiving a higher credit limit.

It’s important to note that each individual’s credit limit may be unique and influenced by a combination of these factors. While you cannot directly control certain factors like your credit history or income level, you can focus on maintaining a good credit score, managing your debts responsibly, and providing accurate information during the application process.

In the next section, we will explore how you can check your Amex credit limit to stay informed about your card’s purchasing power.

How to Check Your Amex Credit Limit

Checking your Amex credit limit is a straightforward process that allows you to stay informed about the maximum amount you can spend on your card. Here are a few methods you can use to check your credit limit:

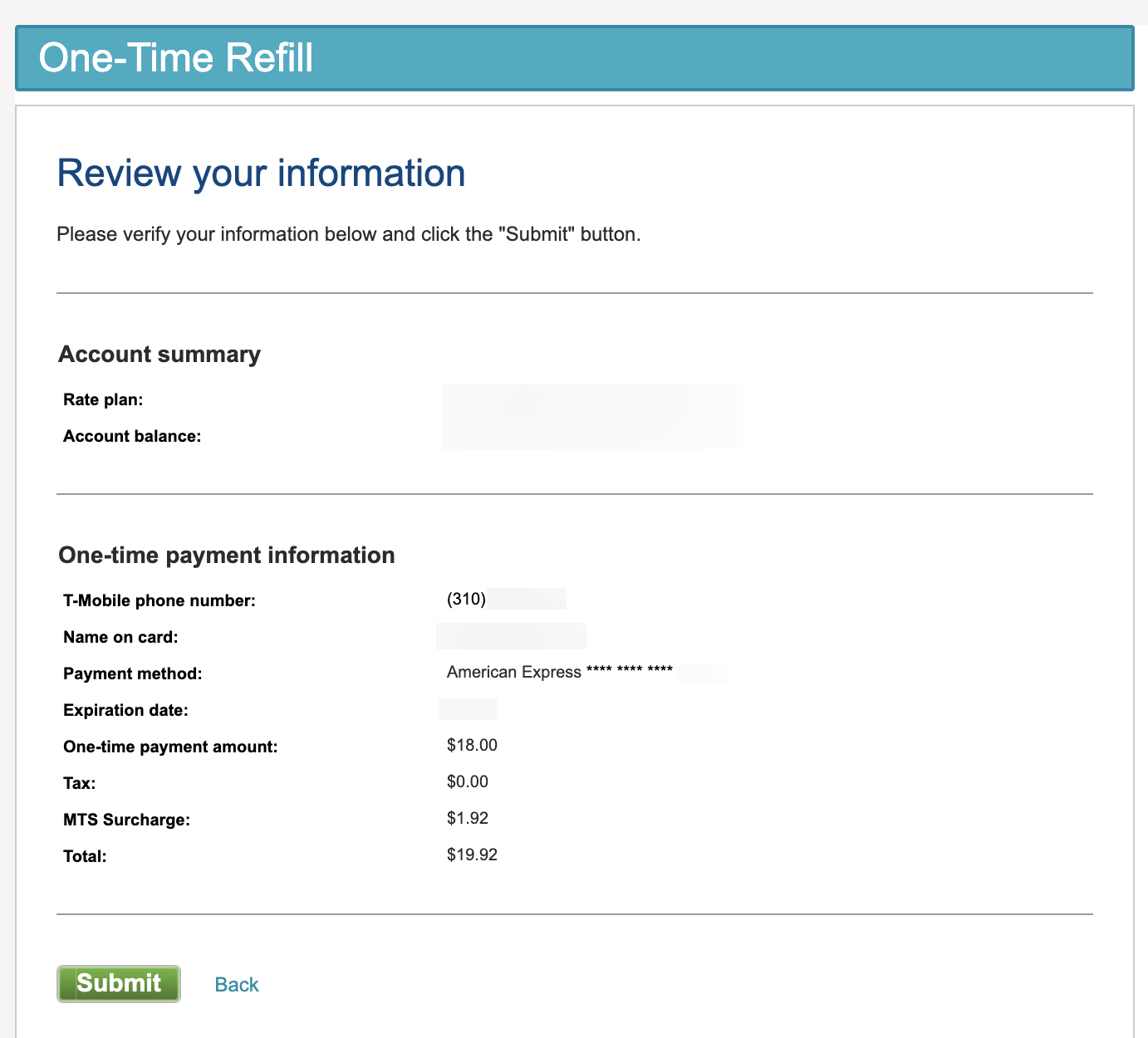

1. Online Account: Amex provides online account access, either through their website or mobile app. By logging into your account, you can view your credit limit, as well as other important account information, such as recent transactions and payment due dates.

2. Customer Service: If you prefer to speak with a representative, you can call the Amex customer service line and inquire about your credit limit. The customer service team will be able to provide you with the necessary information and answer any questions you may have.

3. Monthly Statement: Your Amex credit limit is typically included in your monthly statement. Reviewing your statement each month allows you to keep track of your credit limit and monitor your spending habits.

It is important to note that your credit limit may not be fixed and can be subject to change. Amex periodically reviews cardholder accounts and may adjust credit limits based on various factors, such as changes in your creditworthiness or overall financial profile.

To ensure that you are aware of any changes to your credit limit, it is recommended to regularly check your Amex account, especially before making significant purchases that may approach or exceed your existing credit limit.

Now that you know how to check your Amex credit limit, let’s move on to exploring strategies for increasing your credit limit if you find it insufficient for your needs.

Increasing Your Amex Credit Limit

If you feel that your current Amex credit limit is not sufficient for your needs, there are several strategies you can employ to request an increase:

1. Automatic Increases:

Amex periodically reviews cardholder accounts and may provide automatic credit limit increases based on factors such as your payment history, overall credit usage, and creditworthiness. By consistently making on-time payments and keeping your credit utilization low, you increase the likelihood of receiving an automatic increase.

2. Request an Increase Online:

Amex provides an option to request a credit limit increase through their online account management portal. Log in to your account and navigate to the credit limit increase section. Follow the instructions and provide any necessary financial information or documentation. Amex will review your request and respond accordingly.

3. Contact Customer Service:

If you prefer a more direct approach, you can contact Amex customer service and request a credit limit increase over the phone. Be prepared to provide information regarding your income, employment, and any other relevant financial details that can support your request.

4. Improve Your Credit Profile:

Continuously working on improving your credit profile can increase your chances of receiving a credit limit increase. Pay your bills on time, reduce your outstanding debt, and demonstrate responsible credit usage. Regularly monitoring your credit report can also help identify any errors or inaccuracies that may be negatively impacting your creditworthiness.

5. Use Your Card Responsibly:

Show Amex that you can handle a higher credit limit by using your card responsibly. Avoid maxing out your credit limit and aim to keep your credit utilization ratio low. Making regular, on-time payments and managing your debts effectively can positively impact your creditworthiness.

Remember, there is no guarantee that your request for a credit limit increase will be approved. Amex considers various factors when evaluating such requests. However, by responsibly managing your credit and maintaining a good financial track record, you improve your chances of receiving a higher credit limit.

Now that you are equipped with the knowledge of how to increase your Amex credit limit, let’s wrap up our discussion.

Conclusion

Understanding and managing your Amex credit limit is essential for maximizing the benefits of your credit card and maintaining a healthy financial profile. The credit limit represents the maximum amount you can borrow on your card and is influenced by factors such as your credit score, credit history, income, and existing debts.

By having a clear grasp of your credit limit, you can make informed decisions about your card usage, keeping your credit utilization ratio in check and avoiding unnecessary fees or penalties. Regularly checking your credit limit through your online account, monthly statements, or by contacting customer service ensures that you are aware of any changes or adjustments made by Amex.

If you find your current credit limit inadequate, you have several options to request an increase. You can take advantage of automatic increases and periodically check if Amex has adjusted your credit limit based on your creditworthiness. Alternatively, you can proactively request a credit limit increase online or by contacting customer service, providing supporting documentation if necessary. Improving your credit profile and demonstrating responsible credit usage will also enhance your chances of receiving a higher limit.

Remember, responsible credit card usage is key to maintaining a healthy financial standing. Utilize your credit limit wisely, make timely payments, and manage your debts effectively. By doing so, you can leverage the benefits of your Amex credit card while building a strong credit history.

In conclusion, understanding your Amex credit limit, being aware of the factors that influence it, and taking proactive steps to manage and potentially increase it can empower you to make the most of your credit card and improve your overall financial well-being.