Home>Finance>What Do Investment Banks Do In Mergers And Acquisitions

Finance

What Do Investment Banks Do In Mergers And Acquisitions

Published: February 24, 2024

Discover the role of investment banks in finance, mergers, and acquisitions. Learn how they facilitate deals and provide financial advisory services. Gain insights into the world of finance and investment banking.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

Welcome to the dynamic realm of mergers and acquisitions (M&A), where companies come together to create new opportunities, drive growth, and reshape industries. In this fast-paced landscape, investment banks play a pivotal role in facilitating M&A transactions, offering a wide array of services that are instrumental in navigating the complexities of such deals. Let’s delve into the multifaceted world of investment banks and explore their indispensable contributions to mergers and acquisitions.

Investment banks are financial institutions that specialize in providing a range of advisory, financing, and risk management services to corporations, institutional investors, and governments. When it comes to M&A, these institutions act as trusted advisors, leveraging their expertise and extensive networks to orchestrate seamless transactions that align with the strategic objectives of the companies involved.

From devising M&A strategies to executing financial transactions, investment banks bring a wealth of knowledge and resources to the table, serving as catalysts for transformative deals that shape the corporate landscape. Let’s unravel the intricate web of services offered by investment banks in the realm of mergers and acquisitions, shedding light on their instrumental role in driving strategic partnerships and fostering corporate growth.

Investment Banks’ Role in Mergers and Acquisitions

Investment Banks’ Role in Mergers and Acquisitions

Investment banks are integral players in the realm of mergers and acquisitions, offering a comprehensive suite of services that are essential for facilitating successful transactions. Their involvement spans the entire M&A process, from strategic planning and valuation to deal structuring and financing. Let’s explore the multifaceted role of investment banks in M&A and gain insight into the value they bring to the table.

When companies embark on the journey of mergers and acquisitions, investment banks serve as trusted advisors, guiding them through every phase of the transaction. Their expertise in financial analysis, market trends, and industry dynamics equips companies with the strategic insights needed to make informed decisions and navigate the complexities of M&A. By leveraging their deep understanding of the market landscape, investment banks help companies identify potential targets or suitable acquirers, laying the groundwork for transformative partnerships.

Furthermore, investment banks play a crucial role in facilitating negotiations between the involved parties, helping them navigate intricate deal structures and terms. Their proficiency in deal structuring and risk management enables companies to craft agreements that align with their strategic objectives while mitigating potential challenges. Additionally, investment banks provide invaluable support in conducting due diligence, ensuring that all aspects of the transaction are thoroughly evaluated to minimize risks and maximize value.

As financial intermediaries, investment banks also play a key role in facilitating communication between buyers and sellers, fostering an environment of transparency and collaboration throughout the M&A process. Their ability to bridge the gap between the parties involved and facilitate open dialogue is instrumental in overcoming potential hurdles and driving the transaction towards a successful outcome.

Overall, investment banks serve as strategic partners to companies engaging in mergers and acquisitions, offering unparalleled expertise, market insights, and financial acumen to navigate the complexities of such transactions. Their holistic approach to M&A advisory and their commitment to driving value for their clients underscore the indispensable role they play in shaping the corporate landscape through transformative partnerships and strategic alliances.

Advising on M&A Strategy

Advising on M&A Strategy

One of the primary roles of investment banks in mergers and acquisitions is providing strategic counsel to companies embarking on these transformative transactions. As trusted advisors, investment banks leverage their industry expertise, market knowledge, and financial acumen to guide companies in formulating and executing effective M&A strategies that align with their long-term objectives.

When companies contemplate M&A activities, investment banks play a pivotal role in conducting comprehensive strategic assessments, evaluating potential synergies, and identifying suitable targets or acquirers. Through meticulous analysis and market research, investment banks help companies assess the viability of M&A opportunities, considering factors such as market positioning, competitive landscape, and growth prospects. This strategic guidance enables companies to make well-informed decisions regarding potential M&A transactions, ensuring that they are aligned with their overarching business goals.

Moreover, investment banks assist companies in structuring their M&A strategies to optimize value creation and mitigate risks. By collaborating closely with their clients, investment banks help define the strategic rationale behind the proposed transactions, identifying key value drivers and potential challenges. This involves evaluating various strategic options, such as mergers, acquisitions, divestitures, or strategic partnerships, and determining the most viable path forward based on the company’s unique objectives and market dynamics.

Additionally, investment banks provide invaluable insight into the financial implications of M&A strategies, conducting rigorous financial modeling and analysis to assess the potential impact on the company’s performance, capital structure, and shareholder value. This financial expertise allows companies to evaluate the feasibility of proposed transactions, understand the associated risks, and optimize the financial terms to achieve their desired outcomes.

Overall, investment banks serve as strategic partners to companies, offering tailored guidance and actionable insights to shape their M&A strategies. By leveraging their deep industry knowledge and financial expertise, investment banks empower companies to navigate the complexities of M&A, capitalize on growth opportunities, and drive sustainable value creation through strategic partnerships and transformative transactions.

Valuation Services

Valuation Services

Valuation lies at the heart of mergers and acquisitions, playing a critical role in determining the financial terms and assessing the intrinsic worth of the entities involved in a transaction. Investment banks are instrumental in providing comprehensive valuation services, leveraging their financial expertise and analytical rigor to ascertain the fair value of businesses, assets, and securities involved in M&A transactions.

One of the key responsibilities of investment banks in the realm of M&A is conducting thorough valuations of companies, taking into account various factors such as historical financial performance, market dynamics, growth prospects, and industry benchmarks. By employing robust valuation methodologies, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions analysis, investment banks provide companies with a holistic understanding of the value drivers and potential risks associated with the proposed transactions.

Furthermore, investment banks play a crucial role in assessing the synergies and potential cost savings that may arise from M&A transactions, factoring these considerations into the overall valuation analysis. This comprehensive approach enables companies to evaluate the strategic rationale behind the transactions and assess the potential value creation opportunities, ultimately facilitating informed decision-making and negotiation strategies.

Moreover, investment banks assist companies in navigating the complexities of intangible asset valuation, including intellectual property, brand equity, and technology assets, which are increasingly prevalent in today’s M&A landscape. By leveraging their expertise in intangible asset valuation and financial modeling, investment banks ensure that these critical components are accurately reflected in the overall valuation process, providing a comprehensive assessment of the entities involved in the transaction.

Overall, investment banks’ valuation services are essential in providing companies with a comprehensive understanding of the financial implications and value creation opportunities associated with M&A transactions. By employing rigorous analytical frameworks and industry expertise, investment banks empower companies to make well-informed decisions, negotiate favorable terms, and unlock the full potential of strategic partnerships and transformative transactions.

Structuring and Negotiating Deals

Structuring and Negotiating Deals

Structuring and negotiating deals are pivotal aspects of the mergers and acquisitions (M&A) process, and investment banks play a central role in facilitating these critical components. With their expertise in deal structuring, financial modeling, and negotiation strategies, investment banks provide invaluable support to companies, ensuring that M&A transactions are structured to optimize value creation and mitigate potential risks.

One of the key responsibilities of investment banks in this domain is devising optimal deal structures that align with the strategic objectives of the companies involved. By leveraging their financial acumen and market insights, investment banks collaborate with their clients to design transaction structures that optimize tax efficiency, capital allocation, and financial flexibility. This involves evaluating various options, such as stock transactions, asset acquisitions, or mergers, and determining the most suitable structure to achieve the desired outcomes while minimizing potential risks.

Furthermore, investment banks assist companies in formulating negotiation strategies that are geared towards achieving favorable terms and maximizing value creation. Through meticulous financial modeling and scenario analysis, investment banks provide companies with a comprehensive understanding of the potential outcomes and risks associated with different negotiation approaches, empowering them to make informed decisions and navigate the complexities of deal negotiations with confidence.

Moreover, investment banks play a crucial role in facilitating communication and collaboration between the parties involved in the M&A transactions, fostering an environment of transparency and constructive dialogue. By serving as intermediaries, investment banks help bridge potential gaps in negotiations, facilitate consensus-building, and ensure that the interests of all stakeholders are effectively represented throughout the deal structuring and negotiation process.

Overall, investment banks’ expertise in structuring and negotiating deals is instrumental in driving successful M&A transactions, enabling companies to optimize value creation, mitigate risks, and forge strategic partnerships that align with their long-term objectives. By leveraging their financial acumen and negotiation prowess, investment banks empower companies to navigate the complexities of deal-making with confidence, ultimately driving transformative outcomes in the corporate landscape.

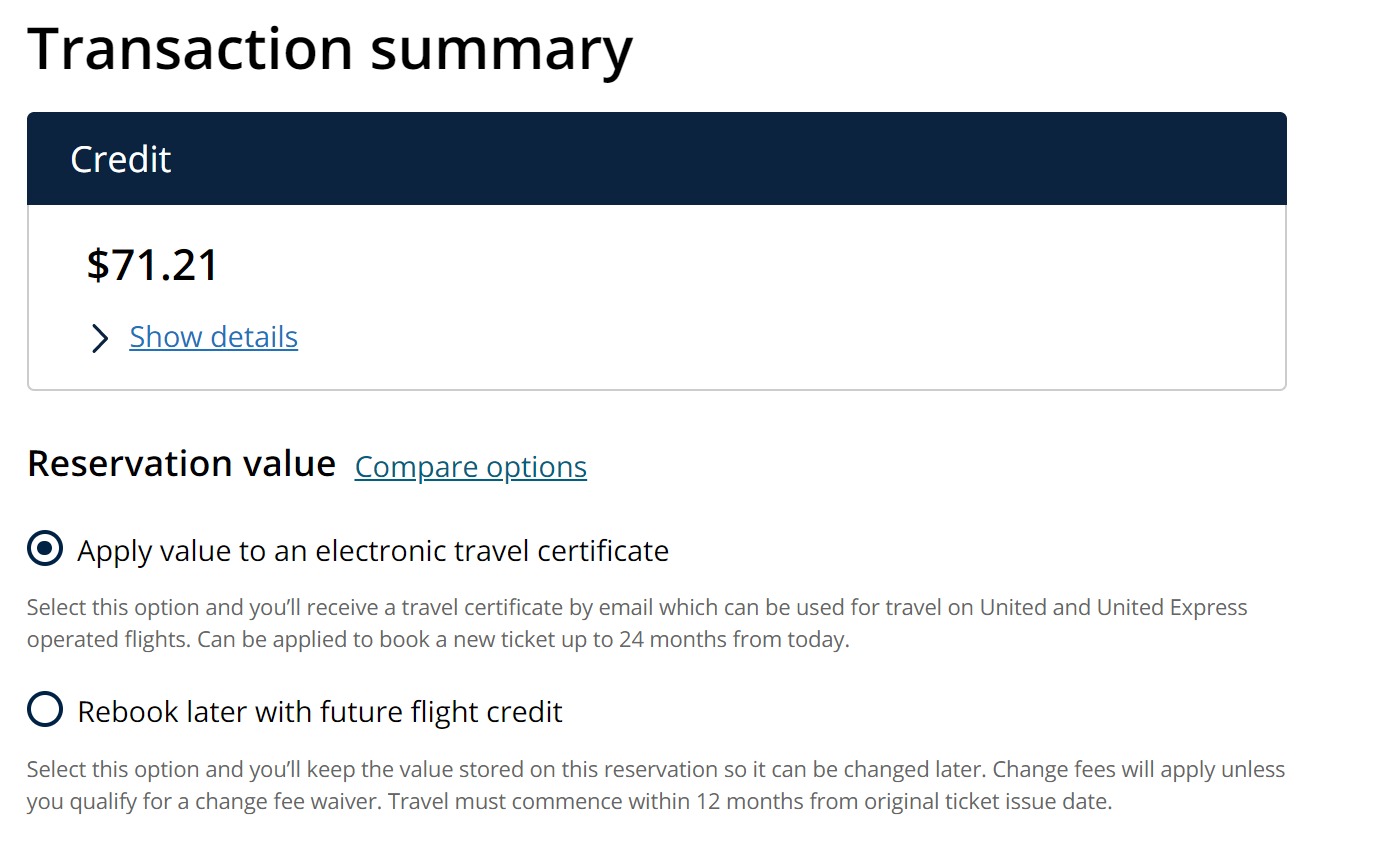

Financing M&A Transactions

Financing is a critical component of mergers and acquisitions (M&A) transactions, and investment banks play a pivotal role in orchestrating the necessary capital to facilitate these transformative deals. Leveraging their expertise in capital markets, debt financing, and structured finance, investment banks provide comprehensive financing solutions that enable companies to execute M&A transactions while optimizing their capital structure and financial flexibility.

One of the key responsibilities of investment banks in the realm of M&A is structuring and arranging the financing needed to support the transaction. This involves assessing the capital requirements, evaluating various financing options, and designing tailored solutions that align with the strategic objectives of the companies involved. Investment banks collaborate closely with their clients to determine the most suitable mix of debt, equity, and other financial instruments, ensuring that the financing structure is optimized to support the transaction while mitigating potential risks.

Furthermore, investment banks play a crucial role in accessing the capital markets to raise the necessary funding for M&A transactions. Whether through public offerings, private placements, or syndicated loans, investment banks leverage their extensive networks and capital raising expertise to secure the required funding on behalf of their clients. This involves conducting thorough due diligence, preparing comprehensive offering materials, and engaging with potential investors or lenders to structure financing arrangements that are conducive to the success of the transaction.

Moreover, investment banks provide strategic advice on capital allocation and balance sheet management, ensuring that companies have a clear understanding of the financial implications of the proposed M&A transactions. By conducting rigorous financial analysis and scenario modeling, investment banks empower companies to make informed decisions regarding the optimal use of capital, the impact on shareholder value, and the long-term financial sustainability of the transaction.

Overall, investment banks’ expertise in financing M&A transactions is instrumental in providing companies with the necessary capital and financial guidance to execute transformative deals. By leveraging their capital markets prowess and financial acumen, investment banks enable companies to navigate the complexities of M&A financing, optimize their capital structure, and unlock the full potential of strategic partnerships and growth opportunities.

Regulatory and Compliance Guidance

Amid the intricate landscape of mergers and acquisitions (M&A), navigating the regulatory and compliance aspects is paramount, and investment banks play a crucial role in providing comprehensive guidance to ensure adherence to legal frameworks and regulatory requirements. With their in-depth understanding of regulatory environments and compliance protocols, investment banks offer invaluable support to companies, mitigating potential risks and ensuring seamless compliance throughout the M&A process.

One of the primary responsibilities of investment banks in this domain is conducting thorough regulatory due diligence to assess the legal and compliance implications of proposed M&A transactions. By scrutinizing regulatory frameworks, industry-specific regulations, and antitrust considerations, investment banks help companies identify potential hurdles and devise strategies to address regulatory challenges proactively. This proactive approach is instrumental in mitigating risks and ensuring that the M&A transactions adhere to the requisite legal and compliance standards.

Furthermore, investment banks provide strategic counsel on navigating the complexities of cross-border M&A transactions, addressing the intricacies of international regulations, foreign investment laws, and jurisdiction-specific compliance requirements. By leveraging their global expertise and network of legal advisors, investment banks assist companies in understanding and addressing the regulatory nuances associated with cross-border deals, ensuring that the transactions are executed in full compliance with the relevant regulatory frameworks.

Moreover, investment banks collaborate with legal and compliance experts to devise comprehensive risk mitigation strategies, ensuring that companies are well-equipped to address potential regulatory challenges that may arise during the M&A process. By conducting scenario analysis and compliance assessments, investment banks empower companies to proactively address regulatory concerns, thereby minimizing the likelihood of regulatory impediments that could derail the transaction.

Overall, investment banks’ expertise in regulatory and compliance guidance is instrumental in facilitating seamless M&A transactions, enabling companies to navigate the complexities of legal frameworks and regulatory environments with confidence. By offering strategic counsel, proactive risk mitigation, and comprehensive compliance support, investment banks empower companies to execute M&A transactions in a manner that aligns with legal requirements, mitigates potential risks, and fosters sustainable growth and value creation.

Conclusion

As we conclude our exploration of the multifaceted role of investment banks in mergers and acquisitions (M&A), it becomes evident that these financial institutions are indispensable partners in shaping transformative transactions and fostering corporate growth. Throughout the M&A process, investment banks serve as trusted advisors, leveraging their financial acumen, industry expertise, and extensive networks to orchestrate seamless transactions that align with the strategic objectives of the companies involved.

From advising on M&A strategies to providing comprehensive valuation services, structuring deals, financing transactions, and offering regulatory and compliance guidance, investment banks play a pivotal role in every phase of the M&A journey. Their holistic approach to M&A advisory, coupled with their commitment to driving value for their clients, underscores the indispensable role they play in shaping the corporate landscape through strategic partnerships and transformative alliances.

By providing strategic counsel, actionable insights, and comprehensive support, investment banks empower companies to navigate the complexities of M&A, capitalize on growth opportunities, and drive sustainable value creation through strategic partnerships and transformative transactions. Their expertise in financial analysis, market trends, and industry dynamics equips companies with the strategic insights needed to make informed decisions and navigate the complexities of M&A, ultimately driving transformative outcomes in the corporate landscape.

In essence, investment banks are not merely facilitators of financial transactions; they are architects of strategic partnerships, enablers of growth, and catalysts for innovation. Their unwavering commitment to driving value creation and fostering sustainable corporate growth underscores their pivotal role in shaping the future of the business landscape through mergers and acquisitions.

As companies continue to seek growth opportunities, expand their market presence, and drive strategic transformations, investment banks will remain instrumental in guiding them through the complexities of M&A, enabling them to capitalize on opportunities, mitigate risks, and forge alliances that shape the corporate landscape for years to come.