Finance

What Does Current Mean In Banking

Modified: February 21, 2024

Discover the meaning of "current" in banking and its relevance to the world of finance. Explore the dynamic nature of financial transactions and accounts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and banking, the term “current” holds a significant meaning. From current accounts to current assets, understanding the concept behind this term is crucial for anyone looking to navigate the financial landscape. In this article, we will explore the various facets of what “current” means in banking and how it impacts our financial transactions.

The term “current” is generally used to describe assets or accounts that are readily available or can be readily converted into cash. It signifies a level of immediacy, indicating that these assets or accounts can be accessed and utilized without significant delays or hurdles. This concept lies at the heart of the banking industry, where individuals and businesses rely on current accounts for their day-to-day financial transactions.

Current accounts are a popular type of bank account that provides individuals and businesses with a safe and convenient way to manage their finances. These accounts offer a range of features and benefits that make them an essential tool for everyday banking needs.

In the following sections, we will delve deeper into the definition of current in banking, explore the features and benefits of current accounts, examine the usage and fees associated with these accounts, and provide a comparison of different current account options available in the market. By the end of this article, you will have gained a comprehensive understanding of what “current” means in banking and its relevance to your financial affairs.

Definition of Current in Banking

In the context of banking, the term “current” refers to assets, accounts, or transactions that are characterized by their immediate availability and liquidity. It signifies that these assets or accounts can be used for daily transactions, payments, and withdrawals without any significant restrictions or delay.

When it comes to assets, a current asset typically refers to any asset that is expected to be converted into cash within a year or the operating cycle of a business. Examples of current assets include cash, marketable securities, accounts receivable, and inventory.

However, in the realm of banking, the term “current” is most commonly associated with current accounts. A current account is a type of bank account that enables individuals and businesses to manage their day-to-day financial transactions. It serves as a central hub for receiving and making payments, allowing account holders to deposit and withdraw funds whenever needed.

Unlike savings accounts or term deposits, which are primarily designed for long-term savings and accrue interest, current accounts focus on providing quick and easy access to funds. This makes them an ideal choice for frequent transactions, such as salary deposits, bill payments, and business expenses.

In addition to the immediate availability of funds, current accounts also offer a range of other features. These may include the issuance of checkbooks, debit cards, online banking facilities, and overdraft facilities. These features provide flexibility and convenience in managing financial transactions, giving account holders the ability to make payments in different forms and access their funds through various channels.

Furthermore, current accounts often provide the option for direct deposit, allowing employers to transfer salaries directly into the account. This eliminates the need for physical checks or cash transactions, making the process more efficient and secure.

In summary, the term “current” in banking refers to assets, accounts, or transactions that possess immediate availability and liquidity. In the context of banking, it primarily applies to current accounts, which serve as a versatile tool for day-to-day financial management.

Current Accounts

Current accounts are a type of bank account that provides individuals and businesses with a flexible and convenient way to manage their daily financial transactions. These accounts are designed for frequent use, offering immediate access to funds for payments, withdrawals, and deposits. They are often the go-to choice for individuals who need to receive salaries, make regular bill payments, and manage their expenses efficiently.

One of the key features of current accounts is the ability to write checks. This allows account holders to make payments to third parties without the need for physical cash or online transfers. Checkbooks issued with current accounts provide a convenient and widely accepted method of payment, making it easier to settle bills or make purchases.

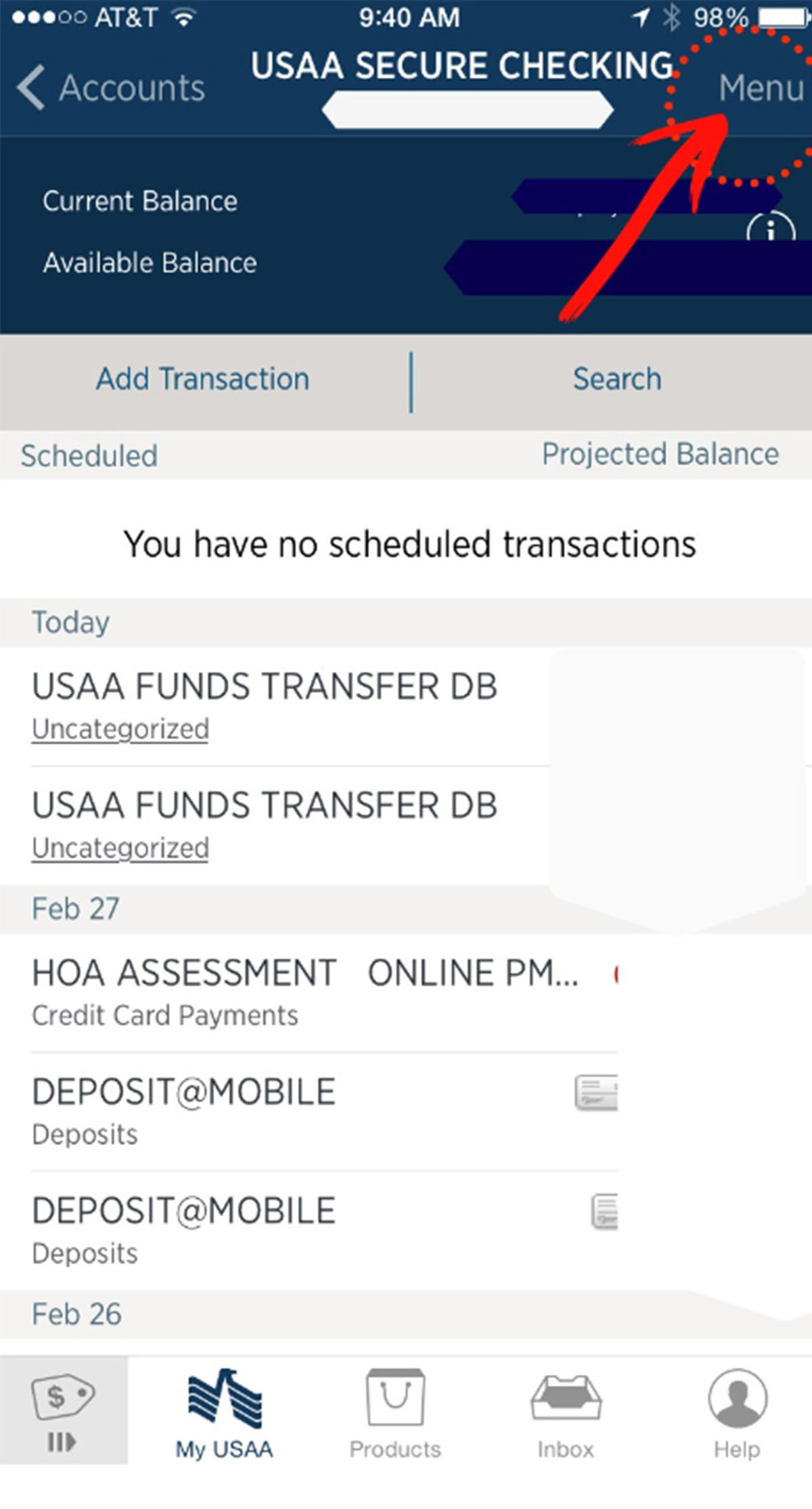

In addition to check-writing capabilities, current accounts also provide account holders with a debit card. The debit card can be used for point-of-sale transactions, online purchases, and ATM withdrawals. This adds further flexibility and convenience, enabling account holders to access their funds in various ways.

Current accounts also commonly offer online banking facilities, allowing account holders to manage their finances from the comfort of their own homes. Online banking enables users to check their account balances, view transaction history, transfer funds between accounts, and even set up automatic bill payments. This convenience saves time and effort, making it easier to stay on top of financial matters.

Furthermore, current accounts often come with overdraft facilities. This means that account holders can withdraw more funds from their account than the available balance, up to a predetermined limit. Overdrafts can be useful in cases of unexpected expenses or temporary cash flow shortages. However, it is important to note that overdrafts usually come with interest charges and fees, so they should be used judiciously.

Current accounts can be opened by individuals, as well as businesses of all sizes. Many banks offer specific current account options tailored to the unique needs of businesses, including features such as multi-level approvals for transactions, integration with accounting software, and detailed transaction statements for easy tracking.

In summary, current accounts are versatile and user-friendly accounts that provide immediate access to funds for day-to-day financial transactions. With features such as check-writing capabilities, debit cards, online banking facilities, and overdraft options, these accounts offer the flexibility and convenience needed to manage personal and business finances efficiently.

Features and Benefits of Current Accounts

Current accounts come with a variety of features and benefits that make them an essential tool for individuals and businesses seeking convenience and efficiency in their financial management. Understanding these features can help account holders make the most out of their current accounts and reap the associated benefits.

One of the key features of current accounts is the ability to make and receive payments. Whether it’s paying bills, settling invoices, or receiving salary deposits, current accounts serve as a central hub for all transactions. With features such as check-writing capabilities and debit cards, account holders have multiple options for making payments conveniently.

Current accounts also offer the flexibility of online banking. This allows individuals and businesses to access their accounts anywhere, anytime, through a secure internet connection. Online banking features enable users to check account balances, view transaction history, transfer funds, and set up automatic bill payments, making financial management quick and hassle-free.

Overdraft facilities are another valuable feature of current accounts. They provide account holders with the option to withdraw more funds than the available balance, up to a predetermined limit. This can be particularly useful in times of unexpected expenses or temporary cash flow shortages. However, it is important to use overdrafts with caution, as they may incur interest charges and fees.

Current accounts often come with the convenience of receiving direct deposits. This means that employers can transfer salaries directly into the account, eliminating the need for physical checks or cash transactions. Direct deposits provide a secure and efficient way of receiving income, saving time and effort for both employers and employees.

One of the key benefits of current accounts is the accessibility and availability of funds. Account holders have the freedom to withdraw funds whenever needed, either through ATM withdrawals or over-the-counter transactions. This immediate access to funds ensures that account holders can meet their payment obligations and manage their expenses efficiently.

Furthermore, current accounts provide account holders with a comprehensive record of transactions. This makes it easier to track expenses, monitor cash flows, and reconcile accounts. Detailed transaction statements and online banking features offer transparency and enhance financial control.

In summary, the features and benefits of current accounts include the ability to make and receive payments, online banking convenience, overdraft facilities, direct deposits, accessibility to funds, and comprehensive transaction records. By utilizing these features effectively, individuals and businesses can streamline their financial management and enjoy the convenience and flexibility provided by current accounts.

Usage of Current Accounts

Current accounts are used for a wide range of financial transactions and serve as a primary tool for day-to-day banking needs. Their versatility and convenience make them an essential component of personal and business financial management. Let’s explore some common use cases for current accounts:

Receiving and Making Payments: Current accounts are widely used for receiving and making payments. Individuals can receive salary deposits directly into their current accounts, allowing for easy access to funds and seamless management of personal expenses. Businesses can use current accounts to receive payments from customers, pay invoices, and manage their cash flow efficiently.

Bill Payments: Current accounts are often used for bill payments, including utility bills, rent, mortgage payments, and subscription services. With the ability to write checks, make online transfers, or set up automatic bill payments through online banking, current accounts provide a convenient way to stay on top of financial obligations.

Daily Expenses: Current accounts are ideal for managing daily expenses, such as groceries, transportation costs, and entertainment expenses. The availability of debit cards linked to current accounts ensures that individuals have quick and easy access to funds for these routine expenses.

Business Expenses: For businesses, current accounts serve as a hub for managing various expenses, including employee salaries, supplier payments, inventory purchases, and overhead costs. The online banking features and transaction records offered by current accounts make it easier for businesses to track expenses, maintain financial records, and reconcile accounts.

Withdrawals and Cash Management: Current accounts provide individuals and businesses with the flexibility to withdraw cash as needed. This can be done through ATM withdrawals or over-the-counter transactions. The availability of funds in current accounts ensures that account holders have immediate access to cash for emergencies or unplanned expenses.

Overdraft Facilities: Many current accounts offer overdraft facilities, allowing account holders to withdraw more funds than are actually available in their accounts, up to a predetermined limit. This feature can be useful in managing short-term cash flow shortages or unexpected expenses. However, it’s important to use overdrafts responsibly and be aware of associated interest charges and fees.

In summary, current accounts are utilized for a range of purposes, including receiving and making payments, bill payments, managing daily and business expenses, cash management, and utilizing overdraft facilities. The versatility and accessibility of current accounts make them a valuable tool for efficiently managing personal and business finances.

Current Account Charges and Fees

While current accounts provide a wide range of features and benefits, it is important to be aware of the charges and fees associated with these accounts. Financial institutions typically apply various charges to cover administrative expenses and provide additional services. Here are some common charges and fees that may be applicable to current accounts:

Maintenance Fees: Many banks charge a monthly or annual maintenance fee for maintaining a current account. This fee covers the cost of account management and operation. The amount of the maintenance fee can vary depending on the bank and the specific type of current account.

Transaction Fees: Banks may charge transaction fees for certain types of transactions conducted through a current account. These fees can include charges for checkbook issuance, depositing or withdrawing cash over a certain limit, transferring funds to other accounts, or making foreign currency transactions.

Overdraft Fees: If you utilize the overdraft facility of your current account and withdraw more funds than are available, you may be subject to overdraft fees. These fees are typically charged based on the amount overdrawn or a percentage of the overdraft limit and can accumulate daily until the account is brought back to a positive balance.

ATM Usage Fees: Some banks charge a fee when you use an ATM that is not part of their network. This fee may be in addition to any charges levied by the ATM provider. It’s important to be aware of the ATM usage fees to minimize any unnecessary costs when accessing cash from an ATM.

International Transaction Fees: If you make transactions or withdrawals in a foreign currency, your bank may charge an international transaction fee. This fee typically includes a foreign exchange fee and any additional charges related to processing international transactions.

Additional Services Fees: Banks may offer additional services, such as account statements, check copies, or wire transfers, that come with specific fees. It’s essential to be aware of these fees and understand the costs associated with these additional services.

It’s important to carefully review the terms and conditions provided by your bank for your current account to understand all the charges and fees, as they can vary between different banks and account types. Consider comparing the fee structures of different banks and exploring any fee waiver options provided by your bank based on maintaining a minimum balance or meeting certain criteria.

By being aware of the charges and fees and effectively managing your current account, you can minimize unnecessary costs and make informed decisions to optimize your financial management.

Current Account Comparison

When choosing a current account, it’s important to compare different options available in the market to find the one that best suits your needs. Here are some key factors to consider when comparing current accounts:

Fees and Charges: Compare the maintenance fees, transaction fees, overdraft fees, and other charges associated with different current accounts. Look for accounts that offer competitive fee structures or fee waivers based on maintaining a minimum balance or meeting certain criteria.

Interest Rates: While current accounts are not typically known for offering high interest rates, some banks may provide nominal interest rates on balances. Compare the interest rates offered by different banks, keeping in mind that the primary purpose of a current account is immediate access to funds rather than long-term savings.

Online and Mobile Banking: Evaluate the features and usability of online and mobile banking platforms offered by different banks. Look for features like easy fund transfers, bill payment options, account management tools, and the ability to view transaction history and statements online.

ATM Network: Consider the size and coverage of the ATM network offered by the bank. A wider network can provide more convenience and accessibility without incurring additional usage fees for ATM withdrawals.

Customer Service: Take into account the quality of customer service provided by different banks. Look for banks with good customer support, whether it’s through online chat, phone, or in-person assistance at bank branches.

Additional Services: Some banks offer additional services and benefits with their current accounts, such as cashback programs, discounts on certain purchases, or access to exclusive events. Consider these additional services if they align with your specific preferences and requirements.

Reviews and Reputation: Research the reputation of different banks and read customer reviews and testimonials. This can give you insights into the level of customer satisfaction, reliability, and overall banking experience provided by each bank.

Comparing these factors will help you make an informed decision when choosing a current account. Consider your personal financial needs, spending habits, and banking preferences to find the account that aligns best with your requirements. Remember, the perfect current account is one that meets your banking needs while minimizing costs and providing convenient access to your funds.

Conclusion

Understanding the concept of “current” in banking is crucial for anyone looking to navigate the world of finance and manage their day-to-day financial transactions effectively. Current accounts play a vital role in facilitating these transactions, providing immediate access to funds and a range of features that make banking convenient and efficient.

In this article, we explored the definition of current in banking and how it applies to assets, accounts, and transactions that possess immediate availability and liquidity. We discussed the features and benefits of current accounts, including check-writing capabilities, debit cards, online banking, and overdraft facilities. We also examined the usage of current accounts, from receiving and making payments to managing daily and business expenses.

Additionally, we highlighted the importance of being aware of the charges and fees associated with current accounts. By understanding these fees, individuals and businesses can make informed decisions and optimize their financial management. We also emphasized the importance of comparing different current account options to find the one that best meets their specific needs and preferences.

In conclusion, current accounts serve as a versatile and indispensable tool for personal and business financial management. They provide a convenient way to receive and make payments, manage expenses, and access funds when needed. By utilizing the features and benefits of current accounts wisely and comparing different options, individuals and businesses can make the most out of their banking experience and achieve their financial goals.