Finance

What Does It Mean Remaining Statement Balance

Published: March 2, 2024

Learn what it means to have a remaining statement balance and how it impacts your finances. Get insights and tips on managing your financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Understanding your financial statements is crucial for managing your personal or business finances effectively. One key element of financial statements is the statement balance, which provides a snapshot of your financial position at a specific point in time. However, it's equally important to comprehend the concept of remaining statement balance, as it can significantly impact your financial decisions and stability.

The remaining statement balance refers to the amount of funds left in your account after accounting for all transactions up to a certain date. This figure is derived from your statement balance, which reflects the total amount of money in your account at the end of a billing cycle or statement period. By understanding the remaining statement balance, individuals and businesses can gauge their available funds and make informed decisions regarding expenses, investments, and savings.

In this article, we will delve into the intricacies of the remaining statement balance, its significance, and the factors that influence it. Furthermore, we will explore practical tips for managing your remaining statement balance effectively, empowering you to navigate your financial landscape with confidence and prudence. Whether you're striving for personal financial stability or seeking to optimize your business's financial health, grasping the concept of remaining statement balance is pivotal for making sound financial choices.

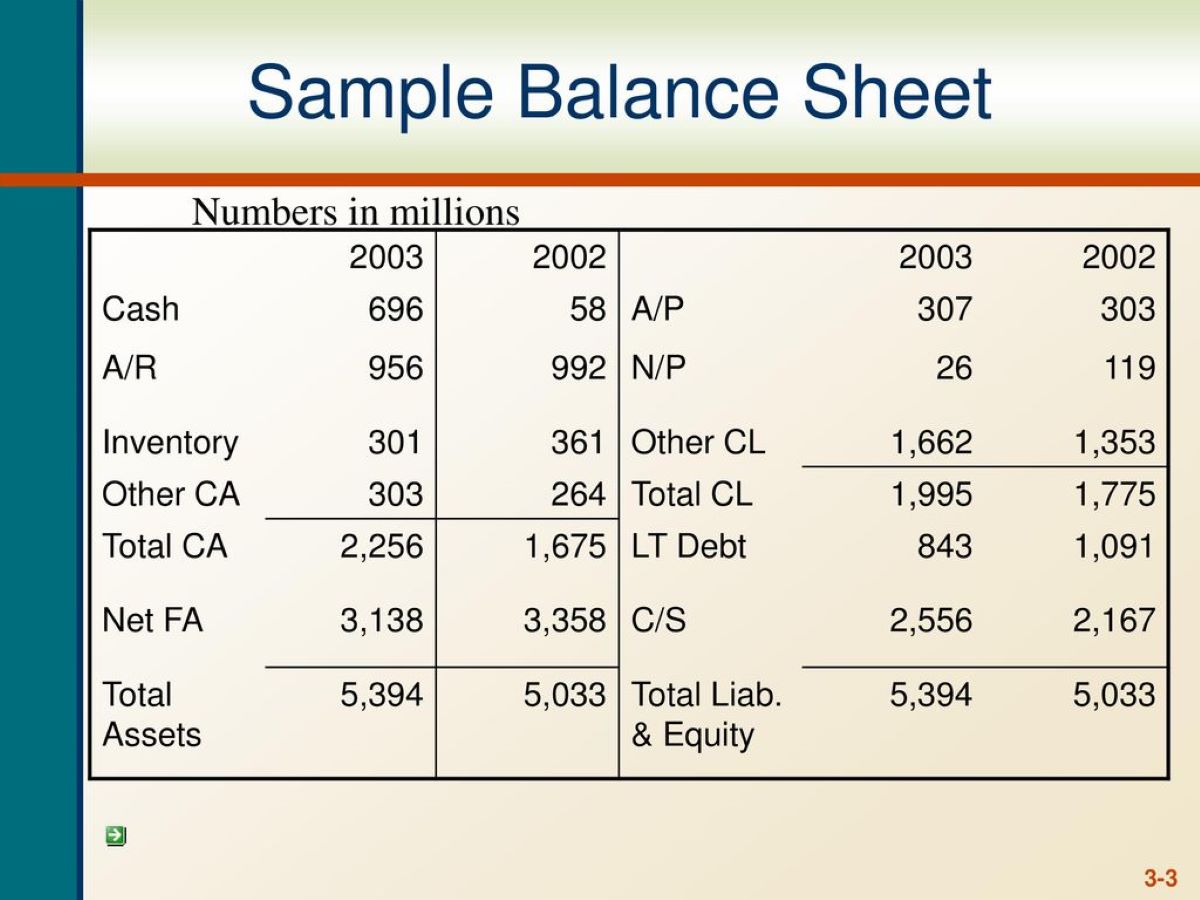

Understanding Statement Balance

Before delving into the intricacies of the remaining statement balance, it’s essential to grasp the concept of the statement balance itself. The statement balance represents the total amount of funds in your account at the end of a specific billing cycle or statement period. It encompasses all deposits, withdrawals, and any interest or fees accrued during that period.

When you receive your bank or credit card statement, the statement balance is prominently featured, serving as a snapshot of your financial position at that particular moment. It’s important to note that the statement balance may not reflect pending transactions, such as recent purchases or deposits that have not yet been processed by the financial institution.

Understanding your statement balance is crucial for maintaining financial awareness and making informed decisions about your monetary resources. By regularly monitoring your statement balance, you can track your spending, identify any discrepancies or unauthorized charges, and ensure that you have sufficient funds to cover upcoming expenses.

Moreover, comprehending your statement balance empowers you to assess your financial habits, identify areas where you may be overspending, and make adjustments to align with your budget and financial goals. Whether you’re managing personal finances or overseeing the financial accounts of a business, the statement balance serves as a fundamental indicator of your financial health.

By gaining a clear understanding of your statement balance, you can proactively manage your finances, avoid potential overdrafts, and cultivate healthy financial habits. This foundational knowledge sets the stage for comprehending the significance of the remaining statement balance and its implications for your financial well-being.

Importance of Remaining Statement Balance

The remaining statement balance holds significant importance in financial management, offering valuable insights into available funds and influencing financial decision-making. It serves as a pivotal indicator of your current financial standing, enabling you to gauge the funds at your disposal after accounting for recent transactions up to the statement date.

For individuals, the remaining statement balance plays a crucial role in budgeting and expense planning. By knowing the exact amount of funds remaining in their account after considering all processed transactions, individuals can make informed decisions about discretionary spending, bill payments, and savings contributions. This awareness helps prevent overspending and ensures that there are adequate funds to cover essential expenses and financial obligations.

Moreover, the remaining statement balance serves as a foundation for assessing one’s financial stability and liquidity. It provides clarity on the available resources and informs individuals about their capacity to pursue investment opportunities, handle unforeseen expenses, or build an emergency fund. Understanding the remaining statement balance empowers individuals to make prudent financial choices and maintain a healthy financial cushion for future needs.

For businesses, the remaining statement balance holds similar significance, albeit on a larger scale. It aids in cash flow management, allowing businesses to assess their available funds for operational expenses, payroll, and strategic investments. By closely monitoring the remaining statement balance, businesses can optimize their financial strategies, mitigate cash flow challenges, and make informed decisions to support sustainable growth and stability.

Furthermore, the remaining statement balance serves as a key metric for financial analysis and forecasting. It provides valuable data for assessing spending patterns, revenue cycles, and overall financial performance. This insight enables businesses to refine their financial planning, capitalize on opportunities, and navigate economic fluctuations with prudence and agility.

In essence, the importance of the remaining statement balance lies in its ability to provide clarity and empower individuals and businesses to manage their finances effectively. By understanding the available funds after accounting for recent transactions, individuals and organizations can make informed financial decisions, cultivate financial resilience, and pursue their long-term financial objectives with confidence.

Factors Affecting Remaining Statement Balance

Several factors can influence the remaining statement balance, impacting the available funds and shaping the financial landscape for individuals and businesses. Understanding these factors is essential for managing finances prudently and anticipating potential fluctuations in the remaining statement balance.

- Transaction Timing: The timing of transactions, such as deposits, withdrawals, and bill payments, directly affects the remaining statement balance. Transactions initiated close to the statement date may not be reflected in the current statement, potentially impacting the available funds in subsequent periods.

- Outstanding Authorizations: Pending authorizations, such as card transactions that have been initiated but not yet processed by the financial institution, can influence the accuracy of the remaining statement balance. These outstanding authorizations may affect the available funds until they are fully processed.

- Interest and Fees: Accrued interest on savings or investment accounts, as well as fees charged by financial institutions, can alter the remaining statement balance. It’s essential to consider these financial implications when assessing the available funds for future financial activities.

- Recurring Payments: Automatic bill payments and recurring charges, such as subscription fees or loan installments, impact the remaining statement balance. Anticipating these recurring payments is crucial for managing available funds and avoiding potential overdrafts or insufficient fund scenarios.

- Deposits and Inflows: Incoming funds, including salary deposits, business revenue, or investment returns, directly contribute to the remaining statement balance. Timely and accurate recording of these deposits is essential for maintaining an up-to-date understanding of available funds.

- Unexpected Expenses: Unforeseen expenses, such as emergency repairs or medical bills, can swiftly impact the remaining statement balance. Establishing an emergency fund and considering potential contingencies are vital for mitigating the impact of unexpected expenses on available funds.

By recognizing these factors and their influence on the remaining statement balance, individuals and businesses can proactively manage their finances, anticipate cash flow dynamics, and make informed decisions to maintain a healthy financial position.

Tips for Managing Remaining Statement Balance

Effectively managing the remaining statement balance is essential for maintaining financial stability and making sound financial decisions. By implementing practical strategies and cultivating mindful financial habits, individuals and businesses can optimize their available funds and navigate their financial journeys with confidence.

- Regular Monitoring: Consistently monitor your account activity and review your statement balances to stay informed about your financial standing. This proactive approach enables you to identify discrepancies, track your spending, and anticipate potential impacts on the remaining statement balance.

- Budgeting: Create a comprehensive budget that aligns with your financial goals and priorities. By tracking your income and expenses, you can allocate funds strategically, avoid unnecessary expenditures, and ensure that your remaining statement balance supports your financial objectives.

- Emergency Fund: Establish an emergency fund to cushion unexpected expenses and mitigate the impact of financial emergencies on your remaining statement balance. Aim to set aside a portion of your income regularly to build a robust financial safety net.

- Timely Deposits and Payments: Ensure that incoming deposits, such as paychecks or business revenues, are promptly credited to your account. Additionally, schedule bill payments and recurring expenses strategically to align with your remaining statement balance and avoid potential cash flow challenges.

- Review Recurring Charges: Regularly review and assess recurring charges, such as subscription fees and memberships. Evaluate the necessity of these expenses and consider adjusting or eliminating non-essential recurring charges to optimize your remaining statement balance.

- Anticipate Pending Transactions: Be mindful of pending transactions and outstanding authorizations that may impact your remaining statement balance. Factor in these pending transactions when making financial decisions to ensure that you have a clear understanding of your available funds.

- Financial Planning: Engage in comprehensive financial planning to align your financial activities with your long-term goals. Whether it involves savings, investments, or major purchases, thoughtful financial planning contributes to a balanced and sustainable remaining statement balance.

By incorporating these tips into your financial management practices, you can effectively manage your remaining statement balance, optimize your available funds, and cultivate a resilient financial foundation for the future.

Conclusion

The concept of remaining statement balance holds profound significance in the realm of personal and business finance, serving as a crucial metric for assessing available funds and making informed financial decisions. By understanding the interplay between statement balances, pending transactions, and financial dynamics, individuals and organizations can navigate their financial landscapes with prudence and foresight.

From the meticulous monitoring of account activity to the strategic management of recurring charges and pending transactions, the management of remaining statement balances necessitates a proactive and disciplined approach. By embracing prudent financial habits, such as budgeting, establishing emergency funds, and engaging in comprehensive financial planning, individuals and businesses can optimize their available funds and cultivate financial resilience.

Furthermore, recognizing the diverse factors that influence remaining statement balances, including transaction timing, interest accrual, and unexpected expenses, empowers individuals and businesses to anticipate potential fluctuations and mitigate cash flow challenges effectively.

Ultimately, the ability to manage remaining statement balances effectively contributes to financial stability, informed decision-making, and the pursuit of long-term financial objectives. Whether it involves maintaining a healthy personal account balance or optimizing cash flow for business operations, the conscientious management of remaining statement balances is instrumental in fostering financial well-being and sustainability.

By integrating the insights and strategies outlined in this article into their financial management practices, individuals and businesses can embark on a journey towards financial empowerment, equipped with the knowledge and tools to navigate the complexities of remaining statement balances with confidence and prudence.