Finance

What Does ODP Mean In Banking

Published: October 11, 2023

Discover the Meaning of ODP in Banking and its Significance in the Finance Industry. Gain Insights into Overdraft Protection and its Role in Financial Management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing personal finances, unexpected expenses can often catch us off guard. Whether it’s an emergency medical bill, a car repair, or an unexpected home repair, unforeseen costs can put a strain on our budget. This is where Overdraft Protection (ODP) comes into play, providing a safety net for individuals who may find themselves short on funds.

Overdraft Protection is a service offered by banks that allows customers to make transactions even if they do not have enough funds in their checking account. It acts as a cushion, preventing checks from bouncing and transactions from being declined due to insufficient funds. ODP provides peace of mind and financial flexibility for individuals, ensuring that they can meet their immediate financial obligations.

But what exactly does ODP mean in the context of banking? In this article, we will delve deeper into the concept of Overdraft Protection, exploring its definition, purpose, benefits for customers, associated fees and charges, qualification requirements, limits and conditions, and how it differs from other similar services. Additionally, we will also highlight some of the ODP facilities offered by different banks, allowing you to choose the one that best fits your financial needs.

By understanding the ins and outs of Overdraft Protection, you can make informed financial decisions and prevent any unnecessary penalties or inconvenience associated with insufficient funds in your checking account. So, let’s delve into the world of ODP and explore the ways in which it can provide you with the financial security you need.

Definition of ODP

Overdraft Protection (ODP) is a financial service offered by banks that allows customers to make transactions using their checking account, even if they do not have sufficient funds to cover the transaction. ODP acts as a safety net, protecting customers from bounced checks, declined transactions, and potential fees and penalties.

When a customer attempts to make a transaction that exceeds the available balance in their checking account, the bank may choose to honor the transaction and cover the shortfall using ODP. This allows the customer to complete the transaction without facing the embarrassment of a declined transaction or the inconvenience of a bounced check.

Typically, ODP is associated with checking accounts, as these accounts are commonly used for day-to-day transactions and bill payments. It provides customers with a temporary extension of credit, allowing them to access funds up to a predetermined limit.

It is important to note that ODP is not free money or an unlimited source of funds. It is a service provided by the bank, and customers are required to repay the overdraft amount along with any applicable fees and charges. The bank may charge interest on the overdraft amount, or they may apply a flat fee per transaction or a daily fee for utilizing ODP.

ODP can be an invaluable tool for customers who are facing a short-term financial crunch or unexpected expenses. It provides a buffer zone, preventing financial disruptions and allowing individuals to meet their financial obligations.

While ODP can be a useful service, it’s essential to use it responsibly. Customers should be aware of the terms and conditions associated with their bank’s ODP offering and strive to maintain regular financial monitoring and budgeting practices to avoid reliance on ODP in the long term.

Purpose of ODP in Banking

The primary purpose of Overdraft Protection (ODP) in banking is to provide customers with a financial safety net, allowing them to make transactions even when their checking account balance is insufficient. ODP serves as a convenient solution for individuals who face temporary cash flow challenges or unexpected expenses.

One of the main goals of ODP is to prevent the inconvenience and potential penalties associated with bounced checks. When a customer writes a check or authorizes a payment, but their available balance is not enough to cover the transaction, the check may bounce. This can lead to a cascade of negative consequences, such as fees from the merchant, damage to the customer’s credit score, and strained relationships with payees.

By utilizing ODP, customers can avoid these repercussions. The bank covers the insufficient funds, allowing the transaction to be completed successfully. This ensures that payments are made promptly, avoiding any late fees and preserving the customer’s reputation.

Another purpose of ODP is to provide customers with financial flexibility. Life is filled with unexpected expenses, such as emergency medical bills, car repairs, or home repairs. ODP offers customers a buffer zone, allowing them to make necessary payments when they are temporarily short on funds. This flexibility can alleviate stress and prevent individuals from falling behind on their financial obligations.

Furthermore, ODP also helps to protect the reputation and relationship between the customer and the bank. When a customer faces a financial shortfall and tries to make a transaction without sufficient funds, the bank has the option to either honor or decline the transaction. By offering ODP, the bank demonstrates its commitment to supporting its customers during challenging times, fostering trust and loyalty.

Overall, the purpose of ODP in banking is to provide customers with peace of mind and financial security. It ensures that critical transactions can be completed, prevents the inconvenience of bounced checks, and allows individuals to navigate temporary financial challenges more effectively.

Benefits of ODP for Customers

Overdraft Protection (ODP) offers several benefits to customers, providing them with financial security and convenience. Here are some key advantages of utilizing ODP:

- Financial flexibility: ODP allows customers to make necessary transactions even if they don’t have sufficient funds in their checking account. This flexibility can be essential during emergencies or unexpected expenses, ensuring that individuals can meet their immediate financial obligations.

- Avoidance of fees and penalties: By utilizing ODP, customers can avoid the potential fees and penalties associated with bounced checks or declined transactions. This includes fees from the payee, as well as any fees that the bank may charge for insufficient funds. ODP provides a safety net, preventing financial disruptions and negative consequences.

- Maintaining relationships and reputation: Bounced checks not only lead to financial consequences but can also strain relationships with payees. By using ODP to cover the shortfall, customers can maintain a positive reputation, goodwill, and trust with those they do business with.

- Convenience: ODP allows for seamless and uninterrupted financial transactions. Customers don’t have to worry about declined payments or the hassle of finding alternative means of payment. They can confidently make transactions, knowing that their bank will cover the shortfall up to their ODP limit.

- Preservation of credit score: Bounced checks and declined transactions can negatively impact an individual’s credit score. By utilizing ODP, customers can avoid the damage to their credit history and maintain a healthy credit score, which is crucial for future financial endeavors and borrowing.

- Peace of mind: Knowing that they have ODP as a backup gives customers peace of mind. They can navigate temporary financial challenges without undue stress, knowing that they have a safety net to rely on when needed.

It is important to note that while ODP offers benefits, customers should use it responsibly and not rely on it as a long-term solution. It is still crucial to maintain good financial habits, such as budgeting and regularly monitoring account balances, to avoid excessive reliance on ODP and potential financial strain.

Fees and Charges Associated with ODP

While Overdraft Protection (ODP) provides customers with financial flexibility and convenience, it is important to be aware of the fees and charges associated with this service. The specific fees and charges may vary depending on the bank and the ODP program offered. Here are some common fees and charges you may encounter:

- Overdraft Fee: This is a fee charged by the bank for utilizing ODP. It is typically a flat fee per transaction, meaning that each time you exceed your account balance and a transaction is covered, you will be charged an overdraft fee.

- Interest Charges: Some banks may charge interest on the overdraft amount. This is usually calculated as an annual percentage rate (APR) and may accrue on a daily or monthly basis.

- Daily or Monthly Service Fee: Some banks charge a flat fee for each day or month that you have an outstanding overdraft balance. This fee applies regardless of whether you have any transactions that overdraw your account during that period.

- Extended Overdraft Fee: If you fail to repay the overdraft amount within a certain period of time, the bank may charge an extended overdraft fee. This fee is in addition to any overdraft fees or interest charges already incurred.

- Transfer Fee: In some cases, banks may offer overdraft protection by linking your checking account to another savings or credit account. If funds are transferred from the linked account to cover an overdraft, a transfer fee may be charged.

It’s important to review your bank’s fee schedule and terms and conditions for their specific ODP program. Understanding the fees and charges associated with ODP can help you make informed financial decisions and avoid any unexpected costs.

To minimize the fees and charges associated with ODP, it is advisable to monitor your account balance regularly, keep track of your expenses, and maintain good financial habits like budgeting. By doing so, you can minimize reliance on ODP and potentially avoid unnecessary fees and charges.

How to Qualify for ODP

Qualifying for Overdraft Protection (ODP) may vary depending on the bank and their specific requirements. In general, banks have certain criteria that customers must meet to be eligible for ODP. Here’s a guide on how to qualify for ODP:

- Open a checking account: ODP is typically offered to customers who have an active checking account with the bank. If you don’t already have a checking account, you’ll need to open one before you can apply for ODP.

- Maintain a positive account history: Banks consider the customer’s account history, including factors such as responsible account management, regular deposits, and timely bill payments. Maintaining a positive account history demonstrates your financial responsibility and may increase your chances of qualifying for ODP.

- Meet minimum eligibility criteria: Banks may have specific eligibility criteria for ODP, such as age restrictions and minimum income requirements. Ensure that you meet these criteria to be considered for ODP.

- Consent to the bank’s ODP program: Some banks require customers to give explicit consent to be enrolled in their ODP program. You may need to sign an agreement or opt-in to the program to activate ODP on your account.

- Set up direct deposit: Some banks may require customers to have regular direct deposits into their checking account in order to qualify for ODP. Direct deposit provides the bank with assurance of a consistent income source, reducing the risk associated with overdrafts.

It is important to note that each bank may have its own specific requirements and eligibility criteria for ODP. It is recommended to check with your bank to understand their specific qualifications and any additional documentation or processes that may be required.

If you meet the necessary qualifications, you can then request to have ODP activated on your checking account. The bank will inform you of the ODP limit and any associated fees and charges. It’s crucial to understand the terms and conditions of the ODP program before utilizing the service to avoid any surprises.

Remember, ODP should be used responsibly and as a temporary solution. It’s essential to regularly monitor your account balance, practice good financial habits, and strive to maintain a positive account history to minimize reliance on ODP in the long term.

ODP Limits and Conditions

Overdraft Protection (ODP) comes with specific limits and conditions that customers should be aware of. These limits and conditions may vary depending on the bank and the specific ODP program. Here’s what you need to know:

ODP Limit: Each customer is typically assigned an ODP limit, which is the maximum amount they can overdraw their account using ODP. This limit may be determined by factors such as the customer’s credit history, income, and overall relationship with the bank. It’s important to understand your specific ODP limit to avoid exceeding it and potentially incurring additional fees.

Conditions: While ODP provides a safety net for customers, there are conditions that must be met for it to be utilized effectively. Some common conditions include:

- Repayment: Customers are required to repay the overdraft amount, along with any fees and charges, within a specified period. The timeframe for repayment can vary depending on the bank’s policies.

- Notification: Some banks may require customers to notify them if they wish to utilize ODP. This can be done through various channels, such as calling the bank or opting into ODP through online banking.

- Account balances: Customers must monitor their account balances to avoid exceeding their ODP limit. It’s crucial to be mindful of the available funds and take necessary steps to replenish the account balance as soon as possible.

- Good standing: Banks typically require customers to maintain their account in good standing to be eligible for ODP. This includes keeping up with any required payments and having a positive account history.

It’s essential to be aware of the specific conditions and limitations set by your bank for their ODP program. Understanding these conditions will help you utilize ODP effectively and avoid any unnecessary fees or penalties.

It’s important to note that regularly relying on ODP for long periods of time may not be financially sustainable. ODP should be used as a temporary solution, and it’s advisable to work towards building a strong financial foundation by practicing responsible money management and budgeting.

If you have any questions or concerns about your bank’s ODP limits and conditions, it’s best to reach out to a representative at your bank who can provide you with the necessary information and guidance.

ODP vs Overdraft Protection

Overdraft Protection (ODP) and Overdraft are terms that are often used interchangeably, but they actually refer to different concepts in the realm of banking. Here’s a breakdown of the key differences between ODP and Overdraft Protection:

Definition: Overdraft refers to the situation where a customer makes a transaction that exceeds the available balance in their account. Overdraft Protection, on the other hand, is a service offered by banks that covers the shortfall when a customer attempts to make a transaction without sufficient funds.

Mechanism: Overdraft occurs when a transaction is honored by the bank, even if the customer doesn’t have enough funds in their account. This results in a negative balance, and the customer is required to repay the overdraft amount. Overdraft Protection, on the other hand, is a service that can be set up by customers to link their checking account with another account (such as a savings account or a credit line). In case of an overdraft, funds are automatically transferred from the linked account to cover the shortfall.

Cost: Overdraft comes with potential fees and charges, such as overdraft fees and interest on the overdraft amount. Overdraft Protection, while it may have its own fees and charges, can be seen as a measure to avoid or minimize the costs associated with overdraft. The fees and charges for Overdraft Protection will vary depending on the bank and the specific arrangement.

Limit: Overdraft does not have a predetermined limit, and the maximum amount that can be overdrawn depends on factors like the customer’s account history and relationship with the bank. Overdraft Protection, however, typically has a predetermined limit set by the bank or linked account. Customers can only overdraw up to this limit.

Enrollment: Overdraft is a default feature offered by banks, and customers may automatically have access to it unless they choose to opt-out. Overdraft Protection, on the other hand, usually requires customers to specifically enroll and set up the service. This may involve signing agreements and providing consent for the linked accounts.

It’s important to note that each bank may have its own specific terms and conditions for both Overdraft and Overdraft Protection. It’s crucial to review the terms and understand the associated fees, limits, and requirements before utilizing these services.

By understanding the distinctions between Overdraft and Overdraft Protection, customers can make informed decisions when it comes to managing their banking needs and avoiding unnecessary fees and penalties related to insufficient funds in their accounts.

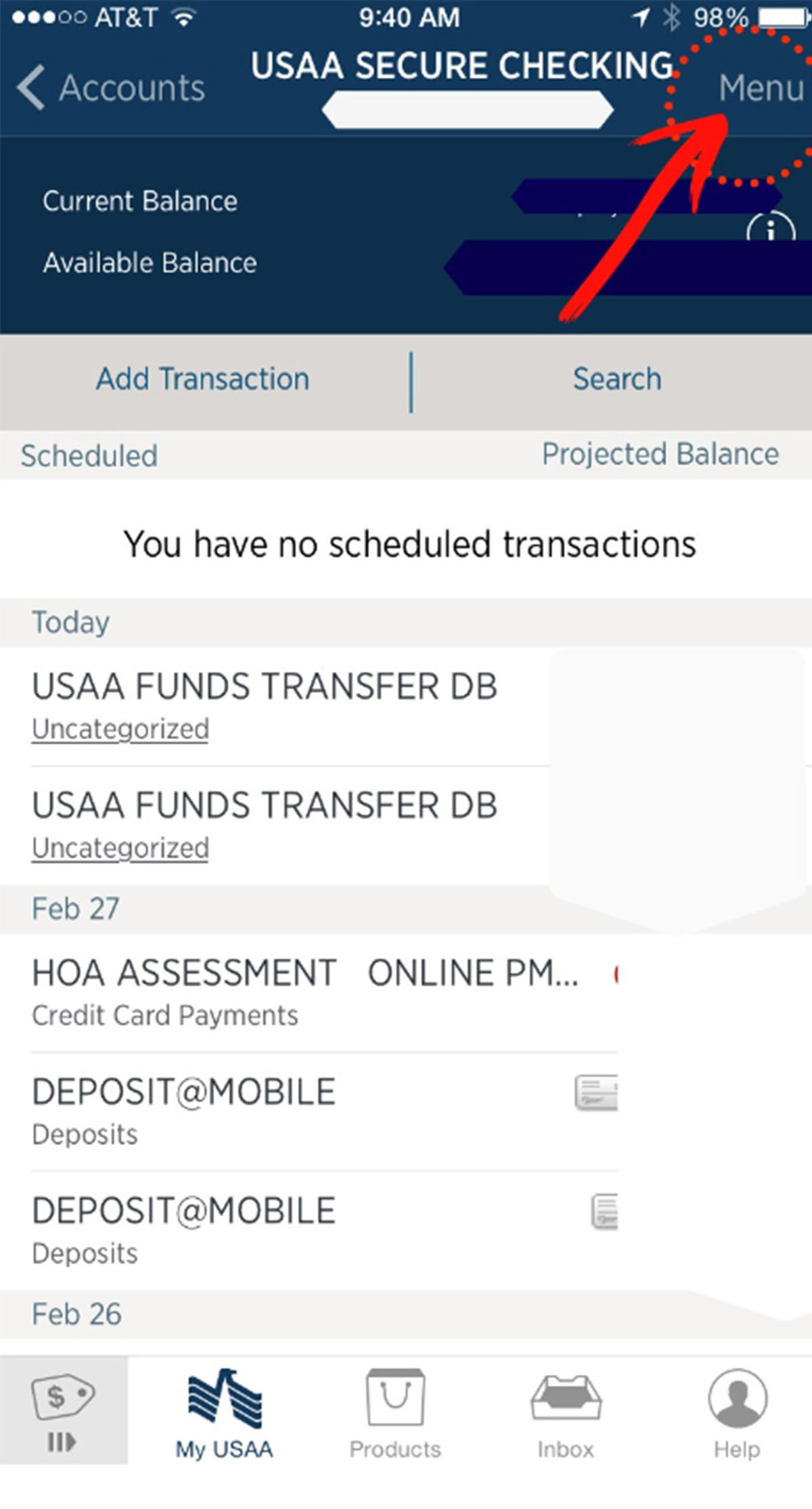

ODP Facilities Offered by Different Banks

Overdraft Protection (ODP) is a service offered by many banks, each with its own unique features and benefits. Here are some examples of the ODP facilities offered by different banks:

- Bank A: Bank A offers a standard ODP service where customers can link their checking account to a savings account. In case of an overdraft, funds are automatically transferred from the savings account to cover the shortfall. Bank A also provides customers with the option to set a specific ODP limit, allowing them to have better control over their overdrafts.

- Bank B: Bank B offers a tiered ODP program, providing customers with different levels of overdraft coverage based on their account history and relationship with the bank. Customers with a longer and more positive history may have higher ODP limits and lower associated fees.

- Bank C: Bank C provides an overdraft line of credit as part of their ODP service. Customers can apply for an overdraft line of credit that acts as a revolving credit facility. Instead of drawing from a linked account, customers can access funds from the line of credit to cover their overdrafts.

- Bank D: Bank D offers an ODP program that allows customers to link their checking account to a credit card. When an overdraft occurs, Bank D automatically charges the transaction to the linked credit card, providing customers with immediate access to credit to cover their shortfall.

- Bank E: Bank E provides a “grace period” ODP facility, where customers have a certain timeframe to replenish their account balance after an overdraft occurs. As long as the account is replenished within the grace period, no overdraft fees are charged.

It’s important to note that the specific ODP facilities offered by different banks can vary. Some banks may provide multiple options for customers to choose from, while others may have a standard ODP service. Fees, limits, and conditions associated with ODP can also differ between banks.

Before choosing a bank or utilizing their ODP facilities, it’s crucial to carefully review the terms and conditions specific to their ODP programs. Compare the features, fees, and benefits offered by different banks to determine which one best suits your financial needs.

Whether you prefer a basic ODP service or an option that includes additional credit facilities, there are various choices available to help you manage your transactions and avoid the potential inconvenience and fees associated with insufficient funds in your account.

Conclusion

Overdraft Protection (ODP) plays a crucial role in providing financial security and convenience for individuals with checking accounts. It acts as a safety net, allowing customers to make transactions even if they don’t have sufficient funds in their account, thereby preventing bounced checks and declined transactions.

ODP offers several benefits to customers, including financial flexibility during temporary cash flow challenges, avoidance of fees and penalties associated with insufficient funds, preservation of relationships with payees, convenience in making transactions, and the ability to maintain a positive credit score.

It’s important to be aware of the fees and charges associated with ODP, such as overdraft fees and interest charges, and to use the service responsibly. Regularly monitoring account balances, practicing good financial habits, and striving to maintain a positive account history can help minimize reliance on ODP and potential financial strain.

Qualifying for ODP typically involves maintaining an active checking account, meeting minimum eligibility criteria set by the bank, and consenting to the bank’s ODP program. Customers should understand their specific ODP limits and conditions, repay any overdraft amounts promptly, and notify the bank if they wish to utilize ODP.

While ODP and Overdraft Protection are terms sometimes used interchangeably, it’s important to note the distinctions. Overdraft refers to a transaction that exceeds the available balance, while Overdraft Protection is the service provided by the bank to cover the shortfall through various mechanisms, such as linking accounts or providing lines of credit.

Different banks offer various ODP facilities, including linking checking accounts to savings accounts, credit cards, or lines of credit. The specific features, fees, and benefits of these ODP facilities may vary between banks. It’s important to review the terms and conditions of each bank’s ODP program to find one that aligns with your financial needs.

In conclusion, Overdraft Protection is a valuable service that provides customers with the flexibility and security to manage their transactions effectively. By understanding how ODP works, its benefits, associated fees and charges, qualifying criteria, limits and conditions, and the options available from different banks, individuals can make informed financial decisions and avoid unnecessary penalties and inconvenience related to insufficient funds in their checking accounts.