Finance

What Does FBO Mean In Banking

Published: October 11, 2023

Learn the meaning of FBO in banking and its significance in the world of finance. Discover how FBO impacts the financial industry and banking operations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to navigating the complex world of finance and banking, it is essential to understand the various terms and acronyms used in the industry. One such acronym that you may come across is FBO, which stands for “For Benefit Of” in the context of banking. FBO is a term that is commonly used to designate a specific type of account or ownership arrangement.

Essentially, when an account is designated as FBO, it means that the funds and assets contained within that account are being held for the benefit of another individual or entity. This arrangement is often used in trust accounts, custodial accounts, and other similar financial structures. Understanding the purpose and implications of FBO can be crucial for anyone involved in the financial industry, including bankers, investors, and account holders.

In this article, we will delve deeper into the meaning and functions of FBO in banking, explore its advantages and disadvantages, and provide real-life examples of how FBO is utilized in practice. By the end of this article, you will have a comprehensive understanding of FBO and its significance in the banking world.

Definition of FBO in Banking

In the banking industry, FBO is a commonly used acronym that stands for “For Benefit Of.” When an account is designated as FBO, it means that the funds and assets within that account are being held on behalf of another individual or entity. This arrangement ensures that the designated beneficiary has certain rights and benefits associated with the account.

FBO accounts are often used in trust and custodial arrangements. Trust accounts are created when one party (the settlor or grantor) transfers assets to another party (the trustee) to hold and manage for the benefit of a third party (the beneficiary). In this case, the trust account could be labeled as “FBO [Beneficiary’s Name]” to clearly indicate the purpose of the account.

Custodial accounts, on the other hand, are established to hold and manage assets on behalf of a minor or person who is unable to manage their finances independently. The custodian is responsible for making investment decisions and managing the account until the beneficiary reaches a certain age or meets specific conditions.

By designating an account as FBO, it ensures that the assets within that account are legally protected and only utilized for the benefit of the specified individual or entity. This provides a clear framework for managing and distributing funds and ensures transparency in financial transactions.

It is important to note that FBO is not limited to individual accounts. It can also apply to business accounts or other types of financial arrangements, where the funds are held for the benefit of a specific entity or organization.

Overall, the key concept behind FBO in banking is to ensure that the assets within the account are being held and managed in a way that is solely for the benefit of the designated beneficiary.

Functions of FBO in Banking

The designation of FBO in banking serves several important functions and plays a crucial role in managing and protecting the assets held within the account. Let’s explore some of the key functions of FBO in banking:

- Identification of Beneficiary: By labeling an account as FBO, it clearly identifies the intended beneficiary who will ultimately benefit from the funds and assets within the account. This is particularly important in trust and custodial arrangements, where multiple parties may be involved.

- Asset Protection: Designating an account as FBO provides a layer of legal protection for the assets held within that account. This ensures that the funds and assets are separate from the personal holdings of the account holder or the financial institution, and are reserved solely for the benefit of the specified beneficiary.

- Transparency and Accountability: FBO accounts require the financial institution to maintain clear records and documentation regarding the ownership and management of the assets. This promotes transparency and accountability, as it provides a clear trail of transactions and ensures that the funds are being managed according to the beneficiary’s best interests.

- Smooth Transfer of Assets: With FBO accounts, the transfer of assets to the designated beneficiary is typically a seamless process. Once the conditions or requirements specified in the account agreement are met, the assets can be transferred to the beneficiary without the need for lengthy legal procedures.

- Estate Planning: FBO accounts play a critical role in estate planning. By designating certain accounts as FBO, individuals can ensure that their assets are protected and can be efficiently transferred to their intended beneficiaries upon their passing. This helps streamline the distribution of assets and minimizes potential conflicts or disputes.

Overall, the functions of FBO in banking encompass the identification and protection of beneficiaries, asset management, transparency, and promoting a smooth transfer of assets. These functions are essential in ensuring that the funds and assets held within FBO accounts are managed in a responsible and beneficial manner for the designated beneficiaries.

Advantages of FBO in Banking

FBO, or “For Benefit Of”, designation in banking offers several advantages for both the account holder and the designated beneficiary. Let’s explore some of the key advantages of FBO in the banking industry:

- Asset Protection: One of the primary advantages of FBO in banking is the protection it provides for the assets held within the account. By designating an account as FBO, the assets are legally separate from the personal holdings of the account holder or the financial institution. This protects the assets from potential creditors, ensuring that they are solely used for the benefit of the specified beneficiary.

- Efficient Transfer of Assets: FBO accounts facilitate the smooth and efficient transfer of assets to the designated beneficiary. Since FBO accounts typically have clear guidelines and conditions for asset distribution, the transfer process can be carried out without the need for extensive legal procedures or delays. This advantage is particularly advantageous in estate planning, ensuring that assets can be transferred seamlessly to the intended beneficiaries upon the account holder’s passing.

- Transparency and Accountability: FBO accounts promote transparency and accountability in the management of assets. The financial institution holding the FBO account is required to maintain clear records and documentation of all transactions and activities related to the account. This ensures that the funds are managed in the best interests of the beneficiary and provides a transparent trail of the account’s activity.

- Flexibility in Account Types: FBO designation can be applied to various types of accounts, including trust accounts, custodial accounts, and business accounts. This flexibility allows individuals and organizations to choose the most suitable account type that aligns with their specific needs and objectives.

- Estate Planning: FBO accounts are widely utilized in estate planning to ensure the efficient and orderly distribution of assets to beneficiaries. By designating certain accounts as FBO, individuals can clearly outline their intentions regarding the distribution of assets, minimizing potential conflicts or disputes among heirs.

In summary, FBO designation in banking offers advantages such as asset protection, efficient transfer of assets, transparency, accountability, flexibility in account types, and streamlined estate planning. These benefits make FBO accounts a valuable tool for individuals and organizations seeking to manage and protect their assets for the benefit of specific beneficiaries.

Disadvantages of FBO in Banking

While FBO, or “For Benefit Of,” designation in banking offers various advantages, it also comes with a few potential disadvantages that account holders and beneficiaries should be aware of. Let’s explore some of the key disadvantages of FBO in the banking industry:

- Loss of Control: When an individual designates their assets as FBO, they are essentially relinquishing direct control over those assets. The financial institution or trustee becomes responsible for managing and making decisions regarding the assets on behalf of the designated beneficiary. This loss of control may not be ideal for individuals who desire more direct involvement in managing their assets.

- Dependency on Trustee: In the case of trust accounts, the designated trustee becomes responsible for managing the assets in the best interests of the beneficiary. This reliance on the trustee can pose a risk if the trustee does not fulfill their duties accurately or acts in a way that goes against the beneficiary’s best interests. It is crucial to carefully select a reliable and trustworthy trustee to mitigate this potential disadvantage.

- Limited Flexibility: FBO accounts often have specific conditions and guidelines regarding asset distribution. While this can streamline the transfer of assets, it may limit the account holder’s flexibility to make changes or modify the arrangements in the future. Any changes to the FBO account may require legal procedures, which can be time-consuming and costly.

- Loss of Privacy: FBO accounts may involve sharing personal and financial information with the financial institution and the designated trustee. This loss of privacy may not be ideal for individuals who value their financial affairs being kept confidential. It is important to consider the level of privacy desired before opting for an FBO arrangement.

- Costs and Fees: FBO accounts may incur additional costs and fees, such as trustee fees or administrative charges. These expenses should be factored in when considering the overall benefits and implications of an FBO arrangement.

It is essential for account holders and beneficiaries to carefully weigh the advantages and disadvantages of FBO designations in banking and consider their specific needs and preferences. Consulting with financial and legal advisors can provide valuable insights and advice to navigate these potential drawbacks and make informed decisions.

Examples of FBO in Banking

To better illustrate the practical application of FBO in banking, let’s explore a few examples:

- Trust Accounts: One common example of FBO in banking is trust accounts. For instance, a settlor may establish a trust for the benefit of their children or grandchildren. The trust account would be labeled as “FBO [Beneficiary’s Name]” to indicate that the funds and assets within the account are being held for their benefit. The trustee then manages and distributes the assets according to the terms outlined in the trust agreement.

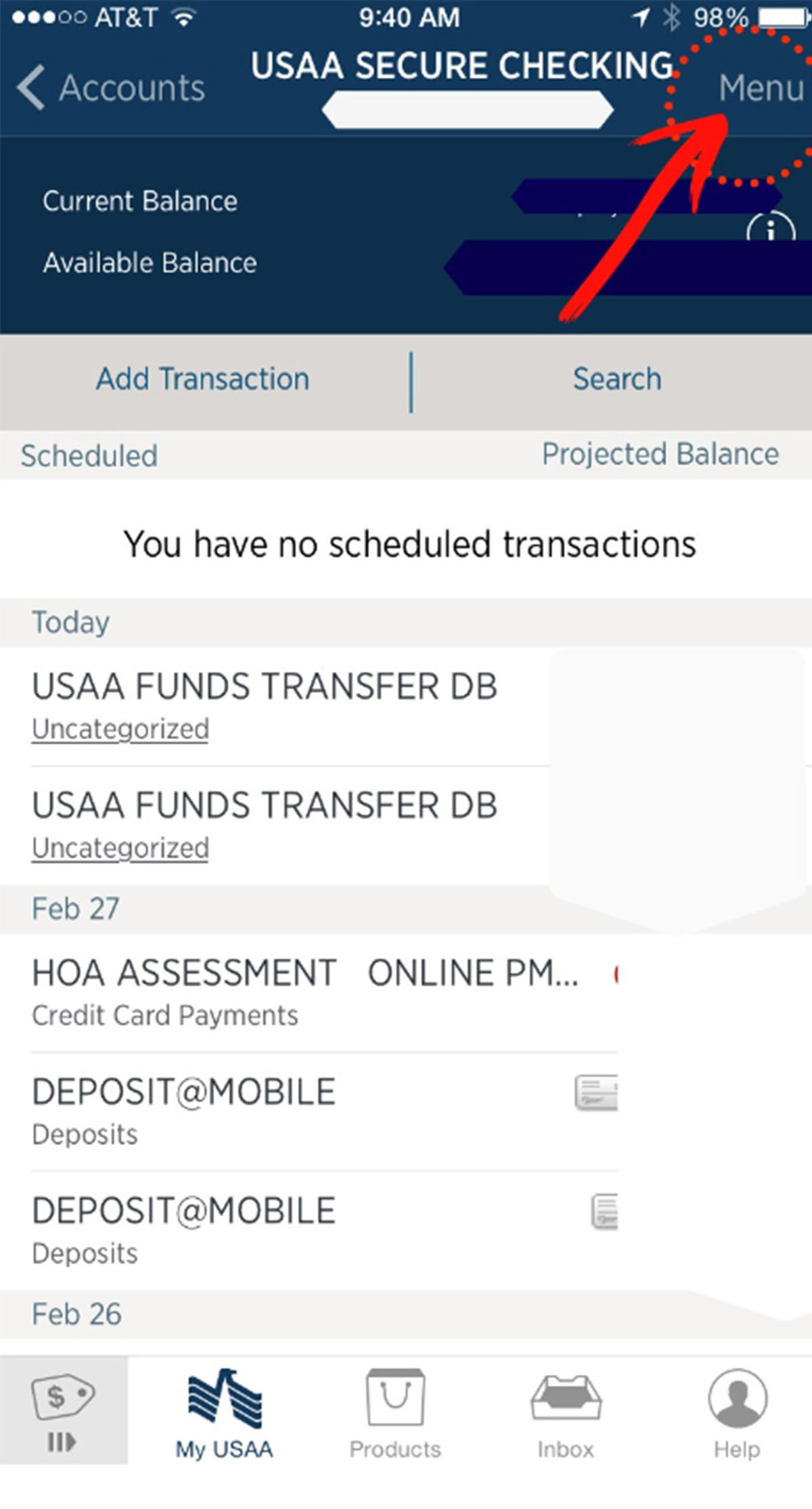

- Custodial Accounts: FBO designations are frequently used in custodial accounts for minors. Parents or legal guardians may establish custodial accounts on behalf of their children, designating them as FBO accounts. The custodian manages the funds until the child reaches a certain age, at which point the assets are transferred to the child.

- Business Accounts: FBO designations can also be applied to business accounts. In this scenario, an account may be labeled “FBO [Business Name]” to indicate that the funds in the account are being held for the benefit of the business. The designated beneficiary may be a specific individual within the business or the business itself.

- Retirement Accounts: In retirement planning, FBO designations are commonly used for individual retirement accounts (IRAs). For example, an individual may choose to designate a spouse as the primary beneficiary of their IRA, with the account labeled as “FBO [Spouse’s Name]”. This ensures that the funds are transferred directly to the spouse upon the account holder’s passing.

- Charitable Accounts: FBO designations can also be utilized in charitable accounts. Individuals may establish accounts with the intention of benefiting a specific charity or nonprofit organization. The account would be labeled “FBO [Charity’s Name]”, ensuring that the funds are reserved for the benefit of the designated charitable entity.

These examples demonstrate how FBO designations are used in various banking contexts to indicate that the funds and assets within the account are being held for the exclusive benefit of a specified individual or entity.

Conclusion

FBO, or “For Benefit Of,” designations play a significant role in the banking industry, particularly in trust accounts, custodial accounts, and various other banking arrangements. By designating an account as FBO, it signifies that the funds and assets within that account are being held for the exclusive benefit of a specified individual or entity. Understanding the meaning, functions, advantages, and disadvantages of FBO in banking is crucial for both account holders and beneficiaries.

The advantages of FBO designation include asset protection, efficient asset transfer, transparency, accountability, flexibility in account types, and streamlined estate planning. These benefits make FBO accounts a valuable tool for individuals and organizations seeking to manage their assets and ensure their proper distribution to beneficiaries.

However, it is essential to consider the potential disadvantages of FBO accounts, such as the loss of control over assets, dependency on trustees, limited flexibility, loss of privacy, and potential costs and fees. Careful consideration of these factors can help individuals make informed decisions when opting for an FBO arrangement.

Through examples of FBO in banking, such as trust accounts, custodial accounts, business accounts, retirement accounts, and charitable accounts, it becomes clear how FBO designations are utilized in real-life scenarios to protect and manage assets for the benefit of specified individuals or organizations.

In conclusion, FBO in banking is a valuable tool for asset protection, efficient transfer, and management for the benefit of designated beneficiaries. It is essential to fully understand the implications and considerations associated with FBO designations in order to make informed decisions when establishing and managing such accounts.