Finance

What Does SL Mean In Stocks

Published: January 18, 2024

SL in stocks stands for Stop Loss, which is a crucial tool used in finance to limit potential losses and protect investments. Explore the significance and benefits of SL in the world of stocks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in the stock market, managing risk is crucial. One popular tool that traders and investors use to control losses is the stop loss order, often abbreviated as “SL”. In this article, we will explore the meaning and significance of SL in stocks, discuss the different types of stop loss orders, and examine their benefits and drawbacks.

At its core, SL refers to a predetermined price level at which an investor is willing to sell a stock to limit potential losses. By setting a SL order, traders aim to protect their investments from significant downturns in the market. In other words, it acts as a safety net that automatically triggers the sale of a stock when its price reaches a specified threshold.

Understanding how stop loss orders work is essential for any trader or investor looking to protect their capital and minimize losses. By setting a SL order, individuals can minimize emotional decision-making during times of market volatility and ensure disciplined risk management.

Throughout this article, we will delve into the various aspects of stop loss orders, including their benefits and potential drawbacks. We will also discuss different types of stop loss orders and explain how to set an effective stop loss level.

Additionally, we will illustrate the concept of SL in trading through real-life examples, shedding light on how this powerful tool can help you navigate the stock market with confidence.

While stop loss orders are not foolproof solutions, they are valuable tools that can help traders protect their investments and maintain control over their trading strategies. So, read on to learn more about stop loss orders, their significance in stock trading, and how they can be effectively utilized to mitigate risks in the market.

Definition of SL in Stocks

SL stands for “stop loss” in the world of stocks and investing. It refers to a predetermined price level at which an investor is willing to sell a stock in order to limit potential losses. The stop loss order is a tool used by traders and investors to automatically trigger the sale of a stock when its price reaches a certain threshold.

The concept of a stop loss order is based on the idea of risk management. It allows traders and investors to set a specific exit point in case the stock price starts to move against their expectations. By doing so, it helps minimize potential losses and protects their capital.

Setting a stop loss level is crucial because it helps traders and investors maintain discipline and remove emotions from their decision-making process. It ensures that they stick to their predetermined risk tolerance and do not let losses spiral out of control.

For example, let’s say an investor buys a stock at $50 per share. However, the investor wants to limit potential losses to 10% of the purchase price. In this case, they could set a stop loss order at $45 per share. If the stock price were to drop to $45 or below, the stop loss order would trigger, and the investor’s shares would automatically be sold, preventing further losses.

It’s important to note that setting a stop loss order does not guarantee that an investor will sell the stock at the exact predetermined price. In highly volatile market conditions or during periods of rapid price movements, the actual execution price may differ from the stop loss level. This is known as slippage.

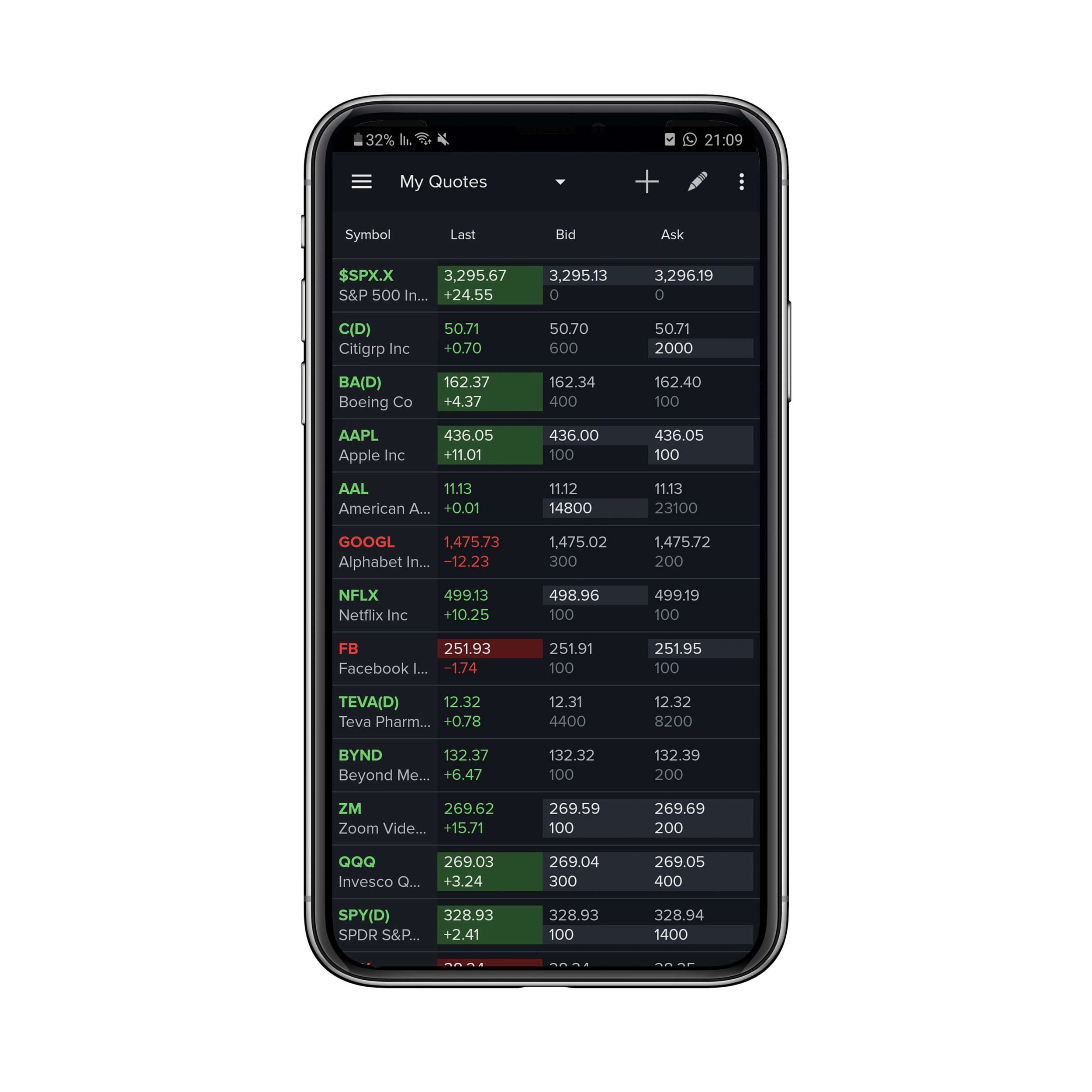

Stop loss orders are typically offered by brokerage firms as a standard feature for traders and investors. They can usually be placed through online trading platforms or by contacting a broker directly.

Overall, understanding the definition of SL in stocks is crucial for risk management and protecting investments. By setting a stop loss order, investors can minimize potential losses and ensure disciplined decision-making in the stock market.

Understanding Stop Loss Orders

Stop loss orders are a popular tool used by traders and investors to manage risk in the stock market. They are designed to automatically trigger the sale of a stock when its price reaches a pre-determined level, known as the stop price. Understanding how stop loss orders work is essential in implementing an effective risk management strategy.

The main purpose of a stop loss order is to protect against potential losses by limiting downside risk. By setting a stop price, investors can specify the maximum amount they are willing to lose on a particular trade. Once the stock price reaches or falls below the stop price, the stop loss order is triggered, and the stock is sold at the prevailing market price.

Stop loss orders offer several advantages. Firstly, they provide a level of protection for investors in case the market moves against their expectations. This helps to prevent significant losses and allows traders to exit a losing position before it deteriorates further. Secondly, stop loss orders help investors manage their emotions during periods of market volatility. By relying on a predetermined exit strategy, traders can avoid making impulsive and emotionally-driven decisions that may lead to detrimental outcomes.

It is worth noting that while stop loss orders aim to limit downside risk, they do not guarantee that the stock will be sold at the exact stop price. In fast-moving markets or during periods of extreme price volatility, the execution price may deviate from the stop price. This is known as slippage, and it’s important for investors to be aware of this potential discrepancy.

Stop loss orders can be set at different levels depending on an investor’s risk tolerance and trading strategy. Some traders prefer to set a tight stop loss, just a few percentage points below the buy price, in order to minimize potential losses. Others may opt for a looser stop loss, allowing for greater price fluctuations before triggering the order. The choice of stop loss level depends on various factors, including market conditions, the investor’s risk appetite, and the volatility of the stock being traded.

It’s important for investors to regularly review and adjust their stop loss orders as the stock price moves. This can help to lock in profits and protect against potential losses. Additionally, stop loss orders should be based on careful analysis and consideration of the stock’s historical price movements, support and resistance levels, and overall market trends.

Overall, understanding stop loss orders is an essential aspect of risk management in stock trading. By effectively utilizing stop loss orders, investors can protect their capital, minimize losses, and maintain discipline in their trading strategies.

Benefits of Using Stop Losses in Trading

Stop losses are an invaluable tool for traders in managing risk and preserving capital in the stock market. Here are some key benefits of incorporating stop loss orders into your trading strategy:

- Limit Potential Losses: One of the primary advantages of using stop loss orders is the ability to limit potential losses. By setting a predetermined exit level, you can ensure that your losses are contained within a defined risk tolerance. This helps prevent emotional decision-making and avoids the potential for catastrophic losses.

- Protect Profits: Stop loss orders not only help limit losses but also protect profits. Once a trade starts moving in your favor, you can adjust the stop loss order to a higher level, thereby locking in some of the gains. This allows you to capture profits and prevent a winning trade from turning into a losing one.

- Maintain Discipline: Implementing stop loss orders encourages disciplined trading. It helps traders stick to their predefined risk management plan and avoid impulsive decisions based on emotions or short-term market fluctuations. By having a clear exit strategy, you can avoid making irrational decisions that may negatively impact your trading performance.

- Reduce Emotional Stress: Trading can be emotionally taxing, especially during periods of high market volatility. The use of stop loss orders can alleviate some of this stress by providing peace of mind. Traders can rest assured knowing that if the market moves against their position, they have a predetermined exit point to protect their capital.

- Time Management: Stop loss orders can also help traders manage their time effectively. Instead of constantly monitoring stock prices or being glued to the computer screen, traders can set their stop loss orders and allow the market to take its course. This frees up time for other important tasks, research, and analysis.

It is important to note that while stop loss orders offer several benefits, they are not foolproof solutions. Financial markets can be unpredictable and subject to sudden fluctuations. Market gaps, slippage, and other unforeseen circumstances can result in executions at prices different from the specified stop loss levels. Therefore, it is essential to stay vigilant and monitor your positions accordingly.

In summary, incorporating stop loss orders into your trading strategy provides significant benefits. It helps limit potential losses, protect profits, maintain discipline, reduce emotional stress, and manage your time more efficiently. By utilizing this risk management tool effectively, traders can increase their chances of success and achieve their long-term trading goals.

Potential Drawbacks of Stop Loss Orders

While stop loss orders offer numerous benefits, it is important for traders and investors to be aware of their potential drawbacks. Understanding these drawbacks can help you make informed decisions and use stop loss orders effectively:

- Execution at Suboptimal Prices: During times of high market volatility or gaps in trading, stop loss orders may be executed at prices significantly different from the specified stop price. This is known as slippage and can result in larger-than-expected losses or missed opportunities to exit at a better price.

- Whipsaw Price Movements: In fast-moving markets, stop loss orders may be triggered by short-lived price fluctuations or market noise. These whipsaw movements can result in unnecessary stop outs, where the stock briefly drops below the stop price and then quickly recovers, leaving traders in a losing position.

- Inadequate Protection from Market Gaps: Stop loss orders may not protect against extreme market events or gaps. In situations where the market opens significantly lower or higher than the previous day’s closing price, a stop loss order may be executed at a significantly different price, leading to unexpected losses.

- Psychological Impact: Depending solely on stop loss orders to exit trades can have psychological implications. Traders may become overly reliant on stop loss orders and neglect other important factors, such as technical analysis or fundamental research, which could impact their overall trading performance.

- Manipulation by Market Makers: In certain cases, market makers or large institutions may intentionally trigger stop loss orders to create price volatility or force smaller traders out of their positions. This can lead to increased market manipulation and potential losses for unsuspecting investors.

Despite these potential drawbacks, stop loss orders remain valuable risk management tools. Traders and investors should consider these drawbacks and account for them in their trading strategies. It is crucial to set appropriate stop loss levels based on careful analysis, market conditions, and individual risk tolerance.

Additionally, it is important to regularly monitor and adjust stop loss orders as the market and price dynamics change. Traders should be proactive in reviewing their positions and updating their stop loss orders to align with changing market conditions and their trading objectives.

By being aware of the potential drawbacks of stop loss orders and taking appropriate measures to mitigate them, traders can maximize the benefits of this risk management tool and improve their overall trading success.

Different Types of Stop Loss Orders

Stop loss orders come in various forms, allowing traders and investors to customize their risk management strategies to suit their individual needs. Here are some of the different types of stop loss orders:

- Market Order Stop Loss: This is the most common type of stop loss order. It is designed to trigger a market order to sell the stock once the stop price is reached. The stock is sold at the prevailing market price, which may be higher or lower than the stop price depending on market conditions and liquidity.

- Limit Order Stop Loss: With a limit order stop loss, traders can specify a minimum price at which they are willing to sell their stock. Once the stop price is reached, the order is triggered as a limit order to sell at the specified price or better. This type of stop loss provides greater control over the execution price but may not guarantee immediate sale if the price does not reach the specified limit.

- Trailing Stop Loss: A trailing stop loss is a dynamic order that adjusts the stop price as the stock price moves in the trader’s favor. It helps to protect gains by allowing the stop price to trail higher, a specified percentage or dollar amount, below the highest price reached since entering the trade. This type of stop loss order can be useful during trending markets and allows traders to lock in profits while giving the trade room to move.

- Volatility-Based Stop Loss: Volatility-based stop loss orders take into account the price volatility of a stock. These orders are triggered based on a percentage or fixed value related to the stock’s volatility, such as average true range (ATR). For example, a trader may set a stop loss order at 2 times the ATR below the current price, providing a buffer against price fluctuations.

- Time-Based Stop Loss: Unlike the previously mentioned types, time-based stop loss orders focus on the duration of the trade rather than specific price levels. Traders may set a time limit for their trades and exit the position if it does not reach their desired price target within a specified timeframe. This can help protect against prolonged losses and unproductive trades.

It’s important for traders to understand the characteristics and implications of each type of stop loss order. Different types may be suitable for different market conditions, trading styles, and individual preferences. Traders should consider factors such as liquidity, volatility, and execution speed when selecting the most appropriate stop loss order for their specific trades.

Ultimately, the choice of stop loss order type depends on the trader’s risk tolerance, trading strategy, and objectives. Exploring and experimenting with different types of stop loss orders can help traders find the right balance between risk management and trade flexibility.

How to Set an Effective Stop Loss Level

Setting an effective stop loss level is crucial for managing risk and protecting your capital in the stock market. Here are some key considerations to help you determine the appropriate stop loss level for your trades:

- Support and Resistance Levels: Analyzing support and resistance levels on a stock chart can provide insights into potential stop loss levels. Support levels, where the price has historically bounced higher, can be used as a reference point for setting a stop loss below. Resistance levels, where the price has struggled to break through, can be used as a stop loss reference above.

- Volatility and Average True Range (ATR): Consider the volatility of the stock you are trading. More volatile stocks may require wider stop loss levels to accommodate price fluctuations, while less volatile stocks may have tighter stop losses. Using indicators such as average true range (ATR), which measures the stock’s average price range over a specific period, can help in setting stop loss levels based on the stock’s volatility.

- Timeframe and Trading Strategy: Determine your trading timeframe and strategy. Short-term traders may set tighter stop loss levels to exit positions quickly, while longer-term investors may opt for wider stop losses to withstand market fluctuations. Your trading strategy and time horizon will dictate the appropriate stop loss level.

- Risk-Reward Ratio: Consider the risk-reward ratio for each trade. Ideally, you want to set a stop loss level that allows for a reasonable potential profit relative to the potential loss. A favorable risk-reward ratio can help ensure that your winning trades outweigh your losing trades in the long run.

- Trailing Stop Loss: In certain situations, using a trailing stop loss can be effective. By adjusting the stop loss level as the trade moves in your favor, you can protect profits while giving the trade room to breathe. Trailing stop losses can be set based on specific price movements or using technical indicators like moving averages.

- Consider Market Conditions: Take into account the overall market conditions and sentiment. During periods of heightened volatility or market uncertainty, wider stop loss levels may be necessary. Conversely, in calmer market environments, tighter stop losses may be appropriate.

Remember that setting an effective stop loss level is not a one-size-fits-all approach. It requires careful analysis of individual stocks, market conditions, and your own risk tolerance. It is important to stay disciplined and avoid moving your stop loss level based on short-term market fluctuations or emotions.

Regularly monitor your positions and adjust stop loss levels as necessary. As the trade progresses, consider trailing stops or tightening stop losses to protect profits. Staying vigilant and proactive in managing your stop loss levels will help you navigate the stock market with confidence and improve your overall trading success.

Examples of SL in Trading

To better understand how stop loss orders work in real trading scenarios, let’s explore a couple of examples:

Example 1: John decides to invest in Company XYZ, which is currently trading at $50 per share. He sets a stop loss order at $45 per share, intending to limit his potential losses to 10%. If the stock price drops to $45 or below, the stop loss order automatically triggers, and John’s shares are sold to prevent further losses.

Example 2: Sarah is a swing trader who wants to protect her profits while still giving her trades room to play out. She buys shares of Company ABC at $100 per share. As the stock price rises to $120 per share, Sarah adjusts her stop loss order to trail at 10% below the highest price reached, meaning her stop loss order is now at $108 per share. If the stock price starts to decline and reaches $108 or below, the stop loss order triggers, allowing Sarah to lock in a portion of her profits.

In both examples, the stop loss orders serve as risk management tools, helping traders protect their capital and lock in gains. By using stop loss orders, traders can minimize emotional decision-making, maintain discipline, and ensure that potential losses are contained.

It’s important to note that stop loss orders are not foolproof and can be subject to market conditions and execution factors. Slippage, gaps, and rapid price movements can impact the execution price, leading to some deviation from the specified stop loss level. Traders should stay informed and adjust their stop loss levels accordingly.

Additionally, the specific stop loss level and strategy will vary depending on individual risk tolerance, trading style, and market conditions. Some traders may prefer tighter stop loss levels for short-term trades, while others may opt for wider stop losses for longer-term investments.

Understanding and effectively utilizing stop loss orders can significantly enhance risk management and trading success. By tailoring stop loss levels to individual trades and actively managing them, traders can protect their capital and increase the chances of achieving their trading objectives.

Conclusion

Stop loss orders are invaluable tools for traders and investors seeking to manage risk and preserve capital in the stock market. By setting a predetermined exit level, stop loss orders provide a means to limit potential losses and protect profits. They allow traders to maintain discipline and minimize emotional decision-making, particularly during times of market volatility.

Throughout this article, we have explored the meaning of SL in stocks and discussed the various types of stop loss orders, including market orders, limit orders, trailing stop losses, and time-based stop losses. We have also examined the benefits of using stop loss orders, such as limiting losses, protecting profits, and reducing emotional stress.

However, it is essential to be aware of the potential drawbacks of stop loss orders, including execution at suboptimal prices, whipsaw price movements, and inadequate protection from extreme market events. By understanding these drawbacks, traders can make informed decisions and adjust their strategies accordingly.

Setting an effective stop loss level involves considering factors such as support and resistance levels, volatility, risk-reward ratios, and overall market conditions. Regularly monitoring and adjusting stop loss levels is key to successful risk management and trade optimization.

In conclusion, incorporating stop loss orders into a trading strategy can significantly enhance risk management and improve overall trading performance. By effectively utilizing stop loss orders, traders can protect their capital, minimize losses, and maintain discipline in their trading approach. It is important to understand the characteristics and implications of stop loss orders, customize their use to individual trading needs, and continuously adapt strategies in response to market dynamics.