Home>Finance>What Formula In Retirement Planning Incorporates Return On Assets

Finance

What Formula In Retirement Planning Incorporates Return On Assets

Published: January 21, 2024

Discover the essential formula in retirement planning that takes into account return on assets. Get expert financial advice and guidance to secure your future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Retirement planning is a crucial aspect of financial management that enables individuals to secure their financial future and maintain a comfortable lifestyle during their golden years. It involves assessing one’s current financial standing, setting retirement goals, and implementing strategies to achieve those goals. One important factor in retirement planning is the concept of return on assets.

Return on assets (ROA) is a metric that evaluates the profitability of investments and measures the efficiency of utilizing assets to generate income. It is a vital indicator of financial performance and plays a significant role in retirement planning. Understanding how ROA impacts retirement planning can help individuals make informed decisions to optimize their financial resources.

In this article, we will delve into the importance of return on assets in retirement planning and explore the different formulas used in this process. We will also discuss the factors to consider when calculating ROA and address the challenges involved in incorporating ROA into retirement planning strategies.

By examining the role of ROA in retirement planning, individuals can gain valuable insights into optimizing their investment returns and ensuring a financially sound future.

Understanding Retirement Planning

Retirement planning is the process of setting financial goals and creating a strategy to achieve them during one’s retirement years. It involves evaluating current financial resources, estimating future expenses, and implementing investment strategies to accumulate wealth for retirement.

At its core, retirement planning aims to ensure financial security and maintain a comfortable lifestyle after one’s working years are over. It requires careful consideration of various factors, such as life expectancy, projected expenses, inflation rates, and investment returns.

One key objective of retirement planning is to build a retirement fund that will generate income and cover expenses when regular employment income is no longer available. This fund typically includes savings, investments, and other income sources, such as pensions or social security benefits.

Retirement planning is a long-term process that involves making informed decisions about savings and investments. The earlier individuals start planning for retirement, the more time they have to accumulate wealth and benefit from the power of compound interest.

Importantly, retirement planning is not a one-size-fits-all approach. Every individual’s financial situation and retirement goals are unique, necessitating a personalized strategy. Factors such as expected lifestyle, health care costs, and desired retirement age should be taken into account when formulating a retirement plan.

To ensure a successful retirement plan, individuals should consider working with financial advisors who possess expertise in retirement planning. These professionals can provide guidance on investment strategies, tax optimization, and risk management, helping individuals make informed decisions and achieve their retirement goals.

In the next sections, we will explore the importance of return on assets in retirement planning and how it influences the overall financial well-being during retirement.

Importance of Return on Assets

Return on assets (ROA) is a crucial metric in retirement planning as it directly influences the growth and sustainability of an individual’s retirement portfolio. ROA measures the efficiency with which a person’s assets generate income and helps evaluate the profitability of investments.

One of the primary reasons for considering ROA in retirement planning is to ensure that the retirement portfolio generates sufficient income to sustain the desired lifestyle throughout retirement. By carefully monitoring and maximizing ROA, individuals can optimize their investment returns and potentially generate higher income from their assets.

Having a high ROA can also aid in achieving long-term financial goals, such as leaving a legacy for future generations or pursuing dreams and passions in retirement. By effectively managing and maximizing the return on assets, individuals can enhance their financial stability and create a secure foundation for their family’s future.

Moreover, ROA is closely tied to the sustainability of retirement funds. A low ROA can lead to a depletion of assets over time, posing the risk of running out of funds during retirement. By focusing on improving ROA, individuals can mitigate this risk and ensure a steady income stream throughout their retirement years.

Higher ROA can also provide a sense of financial peace of mind, reducing the stress and uncertainty associated with retirement. When individuals have confidence in the profitability of their assets, they can enjoy their retirement without constantly worrying about their financial situation. This peace of mind can significantly enhance the overall quality of life during retirement.

Additionally, return on assets plays a crucial role in managing and adjusting retirement plans over time. By periodically monitoring and evaluating the ROA, individuals can make informed decisions about rebalancing their investment portfolio, adjusting the asset allocation, or exploring new investment opportunities. This adaptability ensures that the retirement plan stays aligned with changing circumstances and maintains optimal returns.

Incorporating ROA as a key consideration in retirement planning helps individuals make informed decisions about their investments, optimize their asset allocation, and maintain financial stability throughout retirement. It ultimately enhances the overall success and longevity of the retirement plan.

Different Formulas in Retirement Planning

Retirement planning involves calculating and projecting various financial aspects to ensure a secure retirement. Several different formulas are used to assess different aspects of retirement planning, including savings, income needs, and investment returns. Let’s explore some of the key formulas frequently used:

- Future Value (FV): The Future Value formula calculates the value of an investment at a specific point in the future, taking into account factors such as the initial investment, time horizon, and expected rate of return. This formula helps individuals determine how much their current investments may grow over time with compound interest.

- Present Value (PV): The Present Value formula calculates the current value of a future sum of money, considering the time value of money and discount rates. It helps individuals determine the amount they need to invest now to achieve a desired future financial goal.

- Withdrawal Rate: The Withdrawal Rate formula determines the percentage of retirement savings that can be safely withdrawn each year without depleting the portfolio prematurely. It takes into account factors such as life expectancy, expected rate of return, and inflation to ensure sustainable withdrawals throughout retirement.

- Asset Allocation: Asset Allocation refers to the distribution of investment assets among different asset classes, such as stocks, bonds, and cash. There are various formulas and methodologies, such as the rule of 100 or the age-based allocation approach, that help individuals determine the appropriate mix of assets based on their risk tolerance, time horizon, and financial goals.

- Required Minimum Distributions (RMD): RMD is a formula used for individuals with retirement accounts like IRAs or 401(k)s who are required to withdraw a certain minimum amount each year after reaching a specific age (typically age 72). The RMD formula considers the account balance, life expectancy, and IRS guidelines to determine the minimum distribution amount.

These are just a few examples of the formulas commonly used in retirement planning. Each formula serves a specific purpose and helps individuals make informed decisions about their savings, investments, and distribution strategies to ensure a financially secure retirement.

The Role of Return on Assets in Retirement Planning

Return on assets (ROA) is a critical factor in retirement planning as it directly impacts the growth and sustainability of an individual’s retirement portfolio. ROA measures the efficiency with which assets generate income and evaluates the profitability of investments. Here’s a closer look at the role of ROA in retirement planning:

Optimizing Investment Returns: ROA helps individuals maximize their investment returns by assessing the profitability of different investment options. By carefully analyzing the potential return on assets, individuals can make informed decisions about where to allocate their funds and strive for higher returns.

Increasing Retirement Income: A higher ROA translates to a higher income generated by retirement assets. By focusing on improving ROA, individuals can potentially increase their retirement income, providing them with a more comfortable lifestyle during their golden years.

Maintaining Portfolio Sustainability: ROA plays a crucial role in ensuring the longevity of a retirement portfolio. A low ROA can lead to a depletion of assets over time, posing the risk of running out of funds during retirement. By monitoring and optimizing ROA, individuals can help maintain the sustainability of their portfolio and ensure it lasts throughout their retirement.

Managing Retirement Risks: ROA helps individuals assess and manage the risks associated with their retirement investments. By knowing the expected return on assets, individuals can evaluate the risk-reward tradeoff and make informed decisions about diversifying their portfolio, adjusting asset allocation, or considering risk mitigation strategies.

Adapting to Changing Financial Circumstances: Monitoring ROA allows individuals to adapt and adjust their retirement plans based on changing market conditions and personal circumstances. If the return on assets falls short of expectations, individuals can make strategic changes such as exploring new investment opportunities, adjusting the asset allocation, or seeking advice from financial professionals.

Aligning Retirement Goals: ROA helps individuals align their retirement goals and expectations with their investment strategy. By understanding the potential return on assets, individuals can set realistic goals and make necessary adjustments to their retirement plan, ensuring their financial expectations are achievable during retirement.

Incorporating return on assets into retirement planning allows individuals to optimize their investment returns, ensure sustainable income, manage risks, adapt to changing circumstances, and align their goals. By considering ROA, individuals can make more informed decisions to secure their financial future and enjoy a comfortable retirement.

Factors to Consider in Calculating Return on Assets

Calculating return on assets (ROA) involves considering several factors that contribute to the profitability of investments and the efficiency of asset utilization. By understanding and evaluating these factors, individuals can obtain a more accurate assessment of their ROA. Here are key factors to consider when calculating ROA:

Net Income: Net income is a vital factor in calculating ROA. It represents the total revenue generated by investments minus expenses, taxes, and any other deductions. By analyzing net income, individuals can determine the profitability of their investments.

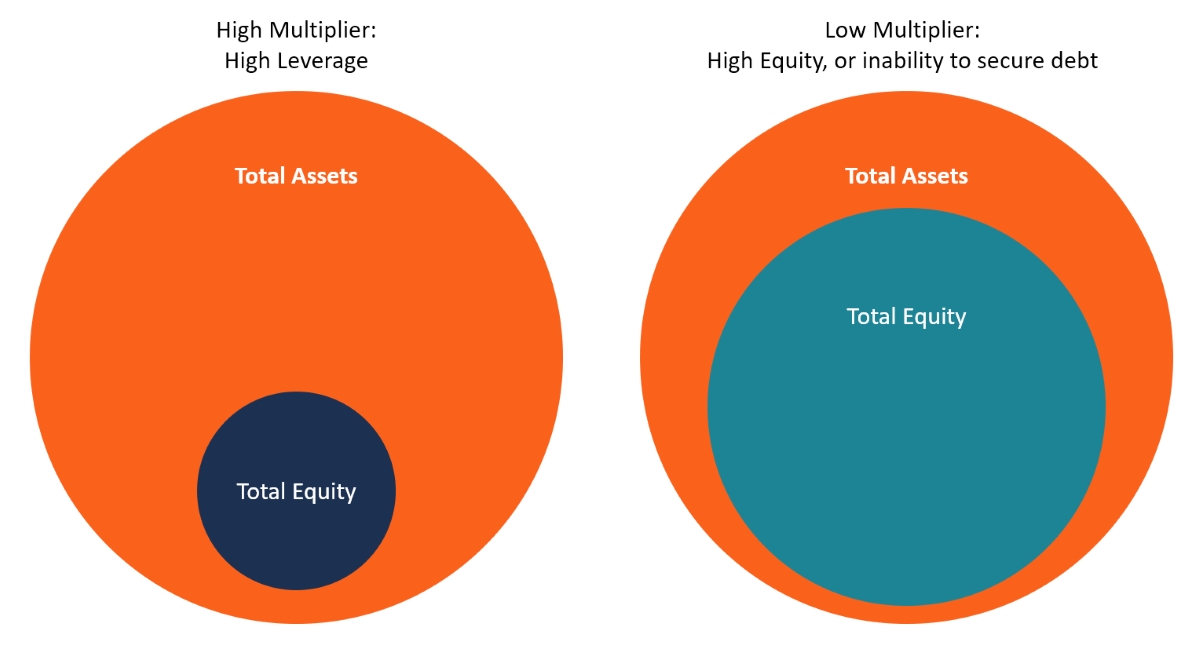

Total Assets: Total assets encompass all the financial resources at an individual’s disposal, including cash, investments, properties, and other tangible or intangible assets. Calculating ROA involves considering the total value of assets, as it reflects the capital employed in generating income.

Asset Valuation: Proper valuation of assets is crucial when calculating ROA. Different assets may have varying market values, and accurately determining their worth is essential for an accurate calculation of ROA.

Depreciation: Depreciation is the decrease in value of an asset over time due to wear and tear, obsolescence, or other factors. In ROA calculations, accounting for depreciation helps provide a more realistic assessment of asset utilization and profitability.

Amortization: Amortization refers to the gradual reduction of an intangible asset’s value over time. It typically applies to assets such as patents, trademarks, and copyrights. Factoring in amortization is important in calculating ROA, especially for individuals who hold intangible assets.

Interest Expense: Interest expense represents the cost of borrowing money to finance investments. When calculating ROA, subtracting the interest expense from the net income provides a clearer picture of the profitability of assets owned.

Non-Operating Income/Expenses: Non-operating income or expenses refer to the revenue or costs that are not directly related to an individual’s primary operations or investments. These items may include interest income, gains or losses from the sale of assets, or other incidental income or expenses that impact the overall ROA calculation.

Time Period: The time period considered for calculating ROA is crucial. It can be measured annually or on a more granular level, such as quarterly or monthly. The chosen time frame should align with individual goals, preferences, and industry standards.

Industry Benchmark: Comparing an individual’s ROA to industry benchmarks or averages can provide valuable insights. It helps individuals assess their performance relative to others in the same industry and identify areas for improvement.

Considering these factors enables individuals to obtain a more accurate understanding of their return on assets. By incorporating these elements into their calculations, individuals can make informed decisions about their investment strategies and optimize their ROA for a fulfilling and financially secure retirement.

Challenges in Incorporating Return on Assets in Retirement Planning

Incorporating return on assets (ROA) into retirement planning comes with its fair share of challenges. As individuals strive to optimize their investment returns and secure their financial future, they must navigate these obstacles. Here are some challenges commonly encountered when incorporating ROA into retirement planning:

Market Volatility: The financial markets are inherently volatile, and investment returns can fluctuate significantly. Unpredictable market conditions can make it difficult to accurately project ROA and plan for retirement. It requires individuals to carefully monitor and adjust their investment strategies to navigate market turbulence.

Changing Economic Environment: The economic landscape is constantly evolving, and factors such as interest rates, inflation, and government policies can impact investment returns. Incorporating ROA into retirement planning requires individuals to stay informed about economic trends and adjust their strategies accordingly.

Investment Risk: Different investment options come with varying levels of risk. While higher-risk investments may offer potential for greater returns, they also carry a higher likelihood of losses. Balancing risk and return is a challenge in retirement planning, as individuals must account for their risk tolerance and ensure their investments align with their long-term goals.

Diversification: Achieving a balanced and diversified investment portfolio can be challenging, particularly for individuals with limited financial resources. Diversification helps spread risk and optimize ROA, but finding suitable investment opportunities across different asset classes can require careful research and consideration.

Inflation: Inflation erodes the purchasing power of money over time. When calculating ROA, it’s crucial to account for the impact of inflation on investment returns. If the returns fail to outpace inflation, the real purchasing power of assets can diminish, affecting the sustainability of retirement funds.

Longevity Risk: Individuals are living longer, and retirement can span several decades. Prolonged life expectancy presents a challenge in retirement planning, as individuals must ensure their retirement funds last throughout their lifetime. Balancing the desire for a comfortable lifestyle with the need for long-term financial security is a complex task.

Changing Personal Circumstances: Personal circumstances can change over time, impacting retirement planning. Factors such as health issues, family obligations, or unexpected financial challenges can disrupt the original retirement plan and require adjustments to the ROA calculation and overall retirement strategy.

Uncertain Social Security Benefits: For individuals relying on social security benefits in retirement, the uncertainty surrounding future benefit amounts can pose challenges. Fluctuations in government policies and financial stability can impact the calculation of ROA and necessitate adjustments to retirement plans.

Complexity of Financial Instruments: The financial landscape offers a wide range of investment vehicles, each with its unique complexities. Understanding and effectively incorporating these instruments into retirement planning can be challenging. Seeking professional advice or conducting thorough research is essential to make informed decisions.

Despite these challenges, individuals can navigate the complexities of incorporating ROA into retirement planning by staying informed, seeking professional guidance, and regularly reviewing and adjusting their strategies as needed. By addressing these challenges head-on, individuals can better position themselves for a financially secure retirement.

Conclusion

Return on assets (ROA) plays a pivotal role in retirement planning by evaluating investment profitability and ensuring sustainable income generation. Incorporating ROA into retirement planning allows individuals to optimize their investment returns, manage risks, and maintain financial stability throughout retirement.

Understanding the different formulas used in retirement planning, such as future value, present value, withdrawal rate, asset allocation, and required minimum distributions, provides individuals with valuable tools to make informed decisions about their finances.

However, incorporating ROA into retirement planning comes with challenges. Market volatility, changing economic environments, investment risk, and inflation can complicate the calculation of ROA and require individuals to stay vigilant and adapt their strategies accordingly. Longevity risk, changing personal circumstances, and the complexity of financial instruments further add to the complexity of retirement planning.

Despite the challenges, individuals can navigate the complexities of ROA in retirement planning by seeking professional advice, staying informed about market trends, and regularly reviewing and adjusting their strategies. By incorporating ROA into their retirement plans, individuals can optimize their investment returns, ensure a sustainable income stream, and attain a financially secure and comfortable retirement.

Ultimately, ROA serves as a crucial factor in retirement planning, enabling individuals to make informed decisions about their savings, investments, and distribution strategies, ensuring a bright and stable financial future during their golden years.