Home>Finance>What Is Spouse Life Insurance Through Employer?

Finance

What Is Spouse Life Insurance Through Employer?

Modified: February 21, 2024

Spouse life insurance through an employer is a financial option that provides coverage for your partner's life, offering security and peace of mind. Learn more about this valuable insurance plan today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Spouse Life Insurance

- Benefits of Spouse Life Insurance Through Employer

- Coverage Options for Spouse Life Insurance

- Premiums and Cost of Spouse Life Insurance

- Qualifications and Eligibility for Spouse Life Insurance

- Enrollment Process for Spouse Life Insurance

- Considerations and Limitations of Spouse Life Insurance

- Comparison to Individual Spouse Life Insurance Policies

- Conclusion

Introduction

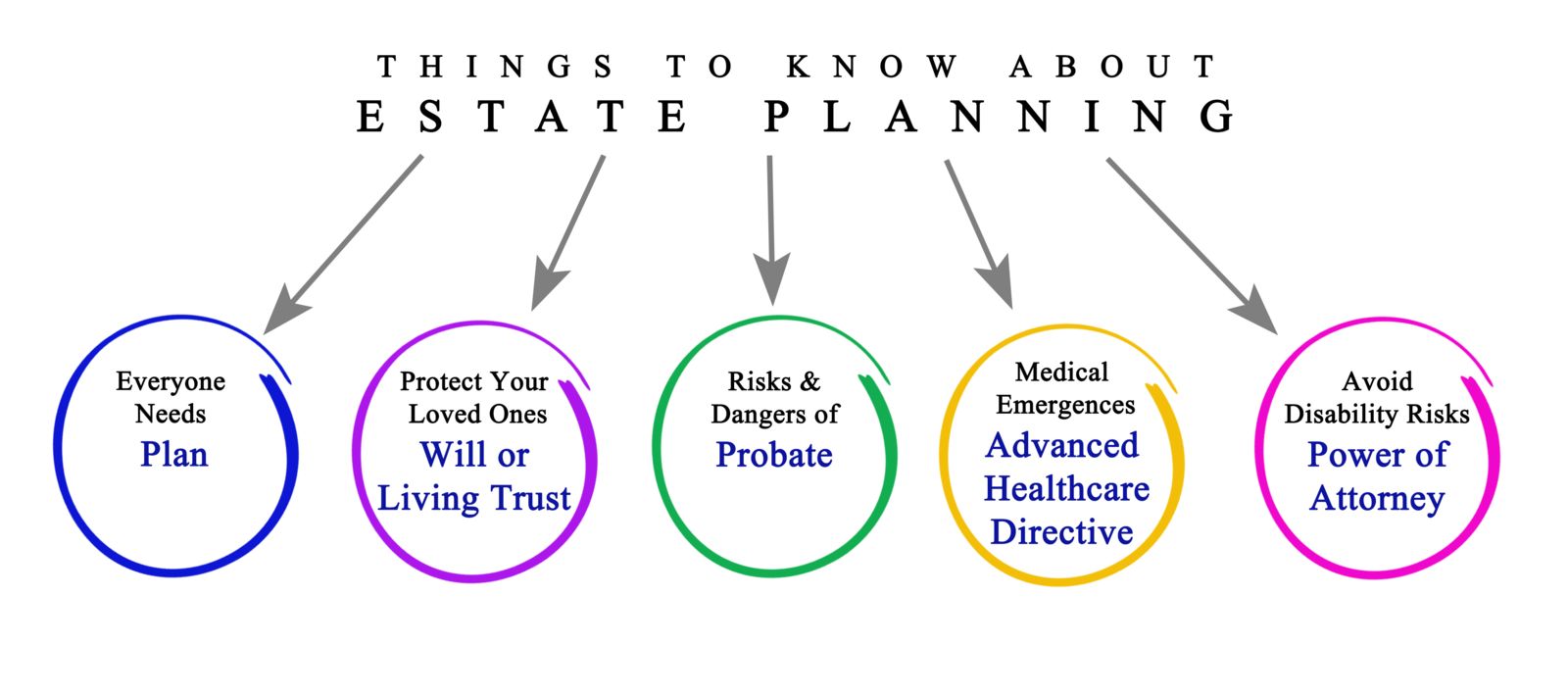

Spouse life insurance through an employer is a type of coverage that provides financial protection for the spouse of an employee in the event of their premature death. It is a benefit offered by some employers as part of their overall employee benefits package.

While many people are familiar with life insurance for individuals, spouse life insurance is specifically designed to provide a death benefit to the surviving partner if the covered employee passes away. This can help alleviate the financial burden that may arise from losing a loved one, including funeral expenses, mortgage payments, household bills, and other financial obligations.

Spouse life insurance through an employer is typically an affordable option for employees, as the group coverage provided by the employer often results in lower premiums compared to individual life insurance policies. This can be especially beneficial for couples who may find it challenging to secure affordable life insurance coverage on their own due to factors such as age, health conditions, or lifestyle choices.

Having spouse life insurance through an employer can offer peace of mind to the employee and their spouse, knowing that there is a safety net in place to protect their financial future in the event of a tragedy.

In the following sections, we will explore the definition of spouse life insurance, the benefits it offers, coverage options, premiums and costs, qualifications and eligibility requirements, the enrollment process, considerations and limitations, and how it compares to individual spouse life insurance policies.

Definition of Spouse Life Insurance

Spouse life insurance is a type of life insurance policy that specifically covers the life of the spouse of an insured individual. It provides a lump-sum death benefit to the surviving spouse in the event of the insured spouse’s death. This financial protection helps ease the financial burden that may arise from the loss of a spouse, such as paying off debts, covering living expenses, or funding future financial goals.

Spouse life insurance can be obtained through various means, including purchasing an individual policy or through an employer-sponsored group policy. When obtained through an employer, it is often referred to as spouse life insurance through an employer.

The coverage amount for spouse life insurance can vary, usually based on the preferences of the policyholder and the policy’s underwriting guidelines. The death benefit is typically paid out in a tax-free lump sum, providing immediate financial support to the surviving spouse.

It is important to note that spouse life insurance is not limited to heterosexual marriages. Many policies now offer coverage for same-sex spouses and domestic partners as well, providing equal protection and benefits to all legally recognized relationships.

The purpose of spouse life insurance is to provide the surviving spouse with financial stability and security in the face of a tragic loss. It helps ensure that the surviving spouse can maintain their current standard of living, meet ongoing financial obligations, and potentially have funds available for future needs, such as education expenses for children or retirement planning.

The specific terms and conditions of spouse life insurance policies may vary depending on the insurance provider and the policy chosen. It is important for individuals considering spouse life insurance to carefully review and understand the policy details, including coverage limits, exclusions, and any additional riders or benefits included.

Benefits of Spouse Life Insurance Through Employer

Spouse life insurance through an employer offers numerous benefits for both the employee and their spouse. Here are some of the key advantages:

- Financial Protection: The primary benefit of spouse life insurance is providing financial protection to the surviving spouse in case of the employee’s untimely demise. It ensures that the spouse will have funds to cover immediate expenses, such as funeral costs, outstanding debts, and daily living expenses.

- Group Coverage Advantage: Employer-sponsored spouse life insurance is often offered as part of a group policy. Group coverage typically results in lower premiums compared to individual policies since the risk is spread across a larger pool of participants. This makes it a cost-effective option for employees and their spouses.

- No Medical Underwriting: In most cases, spouse life insurance through an employer does not require extensive medical underwriting. This means that even if the spouse has pre-existing health conditions, they can still be eligible for coverage. This can be highly beneficial for individuals who may face challenges in obtaining individual life insurance due to health or other factors.

- Convenience and Streamlined Enrollment: Obtaining spouse life insurance through an employer is often a simple and hassle-free process. The employer handles the administrative tasks, such as enrollment and premium deductions, making it convenient for the employee and their spouse.

- Portability: Some employer-sponsored spouse life insurance policies are portable, meaning that if the employee changes jobs, they can typically continue the coverage, either by converting it to an individual policy or by continuing coverage through a new employer’s group policy. This ensures that the spouse’s coverage remains uninterrupted.

- Additional Benefits: Some employer-sponsored spouse life insurance policies may offer additional benefits, such as the ability to add supplemental coverage or the option to purchase riders for additional financial protection, such as accidental death or dismemberment coverage.

Overall, spouse life insurance through an employer provides peace of mind and valuable financial protection to both the employee and their spouse. It offers a convenient and cost-effective way to ensure that the surviving spouse is financially supported during a difficult time, helping them maintain their quality of life and meet their financial obligations.

Coverage Options for Spouse Life Insurance

When it comes to spouse life insurance through an employer, there are typically different coverage options available for employees to choose from. The specific options may vary depending on the employer and the insurance provider. Here are some common coverage options:

- Basic Coverage: Basic coverage is the standard level of spouse life insurance provided by the employer as part of the employee benefits package. It usually offers a fixed death benefit amount, which may be a multiple of the employee’s salary or a predetermined flat amount. Basic coverage is often provided to employees at no cost or at a minimal cost.

- Voluntary Coverage: In addition to basic coverage, employers may offer employees the option to purchase additional voluntary coverage for their spouse. Voluntary coverage allows employees to increase the death benefit amount beyond what is provided in the basic coverage. This additional coverage is typically optional and requires the employee to pay an additional premium.

- Dependent Coverage: Some employer-sponsored spouse life insurance policies also include coverage for dependent children. This provides a death benefit in the event of the death of a covered dependent child. The coverage amount for dependent coverage is usually a fraction of the spouse’s death benefit.

- Conversion Option: In certain situations, employees may have the option to convert their spouse life insurance coverage to an individual policy if they leave their current job or retire. This can be a valuable option to maintain coverage for the spouse in case the employee no longer has access to employer-sponsored coverage.

- Supplemental Riders: Depending on the insurance provider, employees may have the opportunity to add supplemental riders to their spouse life insurance policy. These riders provide additional benefits or coverage options, such as accidental death and dismemberment coverage or waiver of premium in the event of disability.

It is important for employees to review the available coverage options and choose the one that best suits their needs and budget. Having a thorough understanding of the coverage options can help employees make an informed decision about the amount of coverage they want to provide for their spouse and other dependents.

Employees should also consider factors such as their spouse’s financial needs, existing life insurance coverage, expected future expenses, and any specific circumstances that may require additional coverage or riders.

By carefully evaluating the coverage options, employees can ensure that their spouse and dependents are adequately protected and that their spouse life insurance policy aligns with their overall financial goals and circumstances.

Premiums and Cost of Spouse Life Insurance

The cost of spouse life insurance through an employer can vary depending on several factors, including the coverage amount, the age of the spouse, the employee’s salary, and the insurance provider. Here are some key points to consider regarding premiums and costs:

- Group Insurance Advantage: One of the main advantages of spouse life insurance through an employer is that it is usually offered as part of a group insurance policy. Group coverage often results in lower premiums compared to individual life insurance policies. This is because the risk is spread among a larger pool of participants, reducing the cost for each individual.

- Employer Contributions: In some cases, the employer may cover the cost of the basic spouse life insurance coverage as part of the employee benefits package. This means that the employee and their spouse do not have to pay anything out of pocket for the basic coverage. However, if the employee chooses to add voluntary coverage or additional riders, they may be required to pay a premium for those options.

- Premiums Based on Employee’s Salary: The premium for spouse life insurance is often based on a percentage of the employee’s salary. The exact percentage may vary depending on the employer and the insurance provider. As the employee’s salary increases, the premium for spouse life insurance may also increase.

- Age of the Spouse: The age of the spouse is another factor that influences the cost of spouse life insurance. Generally, younger spouses may have lower premium rates compared to older spouses, as they are considered to have a lower risk of premature death.

- Health Factors: Unlike individual life insurance policies, spouse life insurance through an employer often does not require extensive medical underwriting. This means that the premium is not directly affected by the spouse’s health conditions. However, if the employee chooses to purchase additional coverage or riders that require medical underwriting, the premium may be influenced by the spouse’s health.

- Additional Riders or Benefits: The cost of spouse life insurance may also vary based on any supplemental riders or additional benefits added to the policy. If the employee chooses to include riders such as accidental death coverage or waiver of premium, the premium will generally increase accordingly.

It is important for employees and their spouses to carefully review the cost of spouse life insurance and consider it as part of their overall financial plan. They should assess their budget, their spouse’s financial needs in the event of their death, and any existing life insurance coverage they may have. By understanding the premiums and costs associated with spouse life insurance, employees can make a well-informed decision about the coverage they need to provide for their spouse.

Qualifications and Eligibility for Spouse Life Insurance

Qualifications and eligibility for spouse life insurance through an employer vary depending on the specific policy and the requirements set by the insurance provider. However, here are some common factors to consider:

- Marital Status: Typically, to be eligible for spouse life insurance, the employee must be legally married to their spouse. Some policies may also extend coverage to domestic partners or same-sex spouses if their relationship is legally recognized.

- Employment Status: The employee must be actively employed by the company offering the spouse life insurance coverage. In most cases, employees must meet certain criteria, such as working full-time or being eligible for benefits, to qualify for the coverage.

- Enrollment Periods: Employers typically have specific enrollment periods during which employees can enroll themselves and their spouses in the spouse life insurance policy. It is important for employees to be aware of these enrollment periods and submit the necessary paperwork within the designated time frame.

- Dependent Age: Some policies may specify an age limit for a spouse to be eligible for coverage. For example, the spouse may need to be under a certain age, such as 70 or 75, to be eligible for the policy. It is important to review the specific age restrictions outlined in the policy.

- Evidence of Insurability: In most cases, spouse life insurance through an employer does not require extensive medical underwriting. Therefore, evidence of insurability, such as medical exams or health questionnaires, is not typically required. This makes it easier for spouses to qualify for coverage, even if they have pre-existing health conditions.

- Active Coverage: For a spouse to be covered under the policy, the employee must also be enrolled and covered under the employer-sponsored life insurance policy. Spouse life insurance is often offered as a dependent policy that is tied to the employee’s own coverage.

It is important for employees to carefully review the eligibility requirements and ensure that they meet the qualifications for spouse life insurance. Employers will typically provide employees with information regarding eligibility criteria, enrollment periods, and any necessary forms or documentation needed to enroll their spouse in the policy.

If an employee experiences a change in marital status, such as a divorce or a spouse’s death, they should promptly notify their employer to update their spouse life insurance coverage accordingly.

By understanding the qualifications and eligibility requirements for spouse life insurance, employees can ensure that they take full advantage of the coverage available to protect their spouse’s financial future.

Enrollment Process for Spouse Life Insurance

The enrollment process for spouse life insurance through an employer is typically straightforward and facilitated by the employer HR department. Here are the general steps involved in enrolling for spouse life insurance:

- Eligibility Verification: Employees should first review the eligibility requirements for spouse life insurance coverage. They must ensure that they meet the necessary criteria, such as being legally married and actively employed by the company offering the coverage.

- Enrollment Period: Employers have specific enrollment periods during which employees can enroll themselves and their eligible dependents, including their spouse, in the spouse life insurance policy. It is important for employees to be aware of these enrollment periods and submit the necessary paperwork within the designated time frame.

- Enrollment Forms: During the enrollment period, employees will need to complete the required enrollment forms for spouse life insurance. These forms typically require basic information about the spouse, such as their name, date of birth, and social security number. The forms may also include questions about the spouse’s existing health conditions, although extensive medical underwriting is usually not required.

- Beneficiary Designation: Employees may also be required to designate a beneficiary for the spouse life insurance policy. The beneficiary is the individual who will receive the death benefit in the event of the insured spouse’s death. It is important for employees to carefully consider and update their beneficiary designation as needed to ensure the benefit goes to the intended recipient.

- Submission and Confirmation: Once the enrollment forms are completed, employees typically submit them to the employer’s HR department or the designated benefits administrator. After submission, employees should receive a confirmation of enrollment, either in the form of a confirmation letter or an online notification. It is important to keep a copy of this confirmation for future reference.

Employees should be proactive and ensure that they understand the enrollment process and any specific requirements set by their employer. They may need to attend informational meetings, review benefit materials, or consult with the HR department for any additional guidance or clarification.

In the event that there are changes to marital status or dependent status, such as marriage, divorce, or the birth of a child, employees should promptly update their spouse life insurance coverage through the HR department. Failure to update the policy with accurate information could lead to complications in the future when filing a claim.

By following the enrollment process and submitting the necessary forms accurately and on time, employees can ensure that their spouse is enrolled in the employer-sponsored life insurance policy and provided with the financial protection they need.

Considerations and Limitations of Spouse Life Insurance

While spouse life insurance through an employer offers valuable financial protection, it is important for employees and their spouses to understand the considerations and limitations of this type of coverage. Here are some key factors to consider:

- Coverage Limitations: Spouse life insurance typically provides a death benefit to the surviving spouse in the event of the insured spouse’s death. However, coverage may be limited to certain circumstances, such as death due to natural causes or accidental death. It is essential to review the policy’s terms and conditions to determine the exact scope of coverage.

- Dependency on Employment: Spouse life insurance coverage is tied to the employment of the insured spouse. If the employee changes jobs or loses their job, they may lose access to the employer-sponsored coverage. Some policies offer the option to convert the coverage to an individual policy, but it may come with increased premiums. Employees should consider the impact on coverage in case of job changes or transitions.

- Insufficient Coverage Amount: The basic spouse life insurance coverage offered through an employer may have a predetermined death benefit amount that may not fully address the financial needs of the surviving spouse and dependents. Employees should evaluate their spouse’s financial needs and consider whether additional coverage, either through voluntary options or separate individual policies, should be pursued to adequately protect their loved ones.

- Tax Considerations: The death benefit received from a spouse life insurance policy is typically tax-free. However, if the coverage exceeds certain limits set by the Internal Revenue Service (IRS), it may be subject to taxation. It is advisable to consult with a tax professional to understand the potential tax implications of the policy.

- Employment Changes: In the event an employee changes jobs, it is crucial to review the options for continuing coverage. Some policies may allow for conversion to an individual policy or portability to a new employer’s group policy. Being aware of these options ensures uninterrupted coverage for the spouse.

- Additional Coverage Needed: Depending on the specific financial circumstances, the coverage provided through an employer-sponsored policy might not be sufficient. Employees should assess their overall financial needs, including outstanding debts, mortgage payments, education expenses, and future financial goals, and consider supplementing with individual life insurance policies if necessary.

Employees and their spouses should carefully assess the considerations and limitations of spouse life insurance and determine whether additional coverage or financial planning is needed to ensure comprehensive financial protection. It is advisable to seek advice from an insurance professional to navigate through the complexities associated with spouse life insurance and make informed decisions.

Comparison to Individual Spouse Life Insurance Policies

When considering spouse life insurance, employees may have the option to choose between employer-sponsored coverage and individual spouse life insurance policies. Here’s a comparison between the two:

Employer-Sponsored Spouse Life Insurance

- Group Coverage: Employer-sponsored spouse life insurance is typically offered as part of a group policy, which often results in lower premiums compared to individual policies. Group coverage spreads the risk among a larger pool of participants, making it a cost-effective option for employees and their spouses.

- Simplified Underwriting: Spouse life insurance through an employer generally does not require extensive medical underwriting. This means that spouses with pre-existing health conditions may still qualify for coverage, providing a simplified application process compared to individual policies that may involve more thorough medical evaluations.

- Convenient Enrollment: Enrollment for spouse life insurance through an employer is often a simple and streamlined process. Employees can typically enroll their spouse during the designated enrollment period, facilitated by their HR department or benefits administrator, making it a convenient option.

Individual Spouse Life Insurance Policies

- Customized Coverage: Individual spouse life insurance policies offer more flexibility in terms of coverage options and benefit amounts. Policyholders can tailor the policy to suit their specific needs and goals, allowing for a more personalized approach to financial protection.

- Portability: Unlike employer-sponsored coverage, individual spouse life insurance policies are not tied to employment. If the policyholder changes jobs, the coverage remains intact and can be maintained independently of the employer.

- Continued Coverage: With individual policies, there is no concern about losing coverage if the insured spouse retires or leaves their job. The policy remains in force as long as the premiums are paid, providing continued protection for the spouse.

- More Comprehensive Coverage: Individual spouse life insurance policies often offer a wider range of coverage options, including added features like riders for critical illness, disability income, or long-term care. These additional benefits can enhance the overall protection and address different financial needs.

- Ownership and Control: Individual policies provide the policyholder with complete ownership and control over the policy. They can choose the insurance company, select the policy features, and make changes as needed without dependence on an employer’s offerings.

Ultimately, the decision between employer-sponsored spouse life insurance and individual policies depends on the specific needs and circumstances of the employee and their spouse. It is essential to assess factors such as cost, coverage requirements, flexibility, and future job prospects when evaluating the best option for financial protection.

Seeking guidance from an insurance professional can help employees and their spouses navigate the differences and make an informed decision that aligns with their unique needs and goals.

Conclusion

Spouse life insurance through an employer provides an important financial safety net for employees and their spouses in the event of an untimely death. It offers numerous benefits, including financial protection, affordability, convenience, and the ability to secure coverage without extensive medical underwriting.

Employees should carefully review the coverage options, premiums, and eligibility requirements offered by their employer. They should also consider the limitations and potential need for additional coverage based on their spouse’s financial needs and their long-term financial goals.

While employer-sponsored coverage is a practical and cost-effective option, individual spouse life insurance policies bring added flexibility, portability, and greater customization. However, these policies may come with higher premiums and additional requirements, such as medical underwriting.

Ultimately, the decision between employer-sponsored spouse life insurance and individual policies depends on individual circumstances and preferences. It is advisable to seek guidance from insurance professionals or financial advisors to evaluate the available options and make an informed decision that best suits the needs of both the employee and their spouse.

Regardless of the chosen route, securing spouse life insurance is an essential step in protecting the financial future of loved ones. It offers peace of mind and ensures that the surviving spouse and dependents have the financial resources necessary to maintain their standard of living and meet ongoing financial obligations.

By carefully considering the available coverage options, understanding the enrollment process, and reviewing the associated costs and benefits, employees can make informed decisions about spouse life insurance to provide effective financial protection for their loved ones.