Home>Finance>Return On Assets (ROA): Formula And ‘Good’ ROA Defined

Finance

Return On Assets (ROA): Formula And ‘Good’ ROA Defined

Published: January 20, 2024

Learn about Return on Assets (ROA) in finance. Discover the formula and understand what constitutes a 'good' ROA.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Power of Return on Assets (ROA) in Finance

When it comes to evaluating the financial performance of a company, one key metric that often takes center stage is Return on Assets (ROA). This metric provides valuable insights into a company’s efficiency in utilizing its assets to generate profits. But what exactly is ROA, how is it calculated, and what constitutes a ‘good’ ROA? In this blog post, we will delve into the world of ROA, unravel its formula, and define what a ‘good’ ROA looks like.

Key Takeaways:

- Return on Assets (ROA) measures a company’s profitability by assessing how effectively it uses its assets to generate profits.

- The ROA formula is net income divided by average total assets, expressed as a percentage.

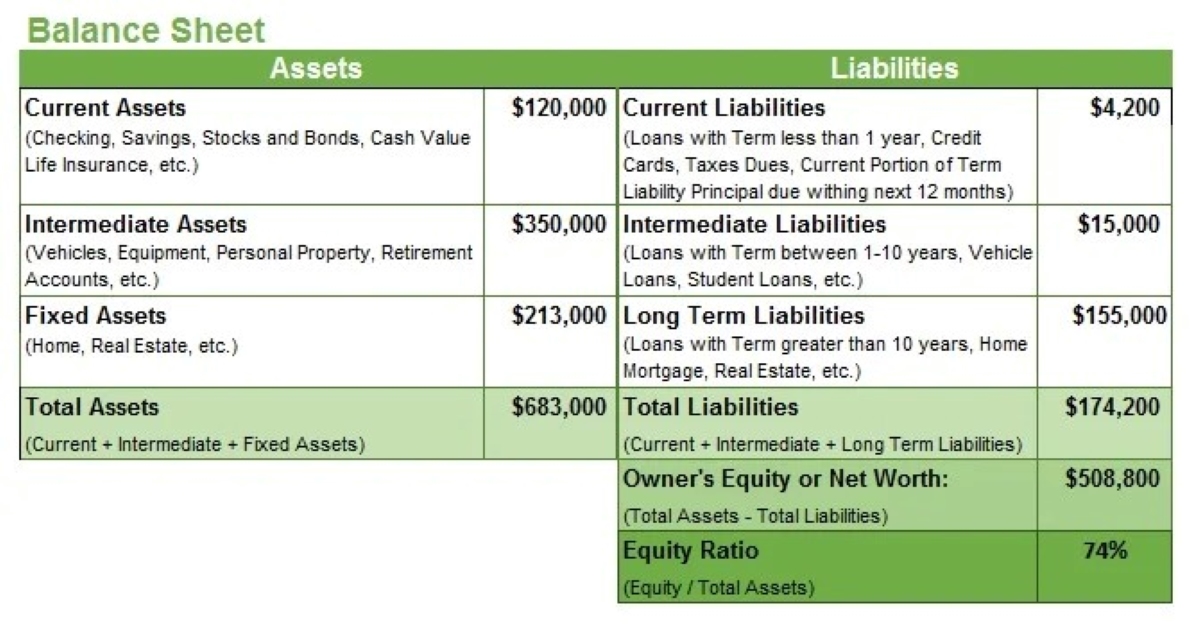

Now, let’s dive right into the heart of the matter and understand the ROA formula. To calculate ROA, you need two key pieces of information: net income and average total assets. Net income represents the company’s total profit after deducting all expenses and taxes. Average total assets, on the other hand, refers to the average value of all the company’s assets over a specific period.

The formula for ROA is relatively straightforward: ROA = (Net Income / Average Total Assets) x 100%. This calculation expresses ROA as a percentage, allowing for easy comparisons across different companies or time periods.

Now that we know how to calculate ROA, let’s address the burning question: what constitutes a ‘good’ ROA? The answer to this question varies across industries, as each sector operates under different economic conditions. However, a higher ROA generally indicates better financial management and a more efficient allocation of assets. While there is no one-size-fits-all benchmark for a ‘good’ ROA, a healthy range is typically considered to be between 5% and 10%.

Key Takeaways:

- Return on Assets (ROA) measures a company’s profitability by assessing how effectively it uses its assets to generate profits.

- The ROA formula is net income divided by average total assets, expressed as a percentage.

- A higher ROA generally indicates better financial management and a more efficient allocation of assets.

- A healthy range for a ‘good’ ROA is typically considered to be between 5% and 10%.

ROA is a powerful tool that allows investors, analysts, and business managers to gain valuable insights into a company’s financial performance. By focusing on the efficiency of asset utilization, ROA helps to identify companies that are generating substantial profits with minimal reliance on assets. Additionally, comparing a company’s ROA to industry peers can provide a benchmark for performance evaluation and help identify areas for improvement.

While ROA offers valuable information, it’s important to remember that it should be interpreted in conjunction with other financial metrics to gain a comprehensive understanding of a company’s financial health. Additionally, it’s crucial to consider industry-specific factors and the company’s stage of growth when assessing the significance of ROA.

In conclusion, ROA is a vital metric in the world of finance that sheds light on a company’s ability to generate profits using its assets. By understanding the ROA formula and what constitutes a ‘good’ ROA, investors, analysts, and business managers can make more informed decisions and gain a deeper understanding of a company’s financial performance.