Finance

What Happens To Bonds During A Recession

Published: October 14, 2023

Discover how bonds are affected during a recession and their role in finance. Learn how to navigate the financial landscape and make informed investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Bonds?

- How Bonds Perform in Normal Economic Conditions

- The Impact of a Recession on Bonds

- Factors That Affect Bond Performance During a Recession

- Government Bonds During a Recession

- Corporate Bonds During a Recession

- Municipal Bonds During a Recession

- High-Yield (Junk) Bonds During a Recession

- Strategies for Investing in Bonds During a Recession

- Conclusion

Introduction

A recession is a challenging period for the economy, characterized by a significant decline in economic activity. During recessions, many individuals and investors become concerned about the performance of their investments, including bonds. Bonds are a popular investment option for individuals looking for income and stability in their portfolios. They are often considered safer than stocks during uncertain economic times. However, it is important to understand how bonds are affected by a recession and how they can be used effectively to navigate through these challenging times.

Before diving into the impact of a recession on bonds, it is essential to understand what bonds are. Bonds are debt securities issued by companies, governments, and municipalities to raise capital. Basically, when you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of your principal when the bond matures.

In normal economic conditions, bonds are known for their stability and reliability. They provide regular interest payments, known as coupon payments, which are fixed for a specific period. Additionally, bonds have a predetermined maturity date, at which point the issuer repays the principal amount to the bondholder. This makes bonds an attractive investment option for investors seeking steady income and capital preservation.

However, during a recession, the landscape for bonds can change, and their performance may be influenced by various factors. In this article, we will explore the impact of a recession on different types of bonds and discuss strategies for investing in bonds during these challenging economic times.

What are Bonds?

Bonds are a type of financial instrument that represents a loan made by investors to a government, corporation, or municipality. When you invest in a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of your principal investment when the bond matures.

There are various types of bonds, including government bonds, corporate bonds, municipal bonds, and high-yield (junk) bonds. Each type of bond carries different levels of risk and return potential.

Government bonds, also known as sovereign bonds, are issued by national governments to finance their operations or fund infrastructure projects. These bonds are typically considered safer investments since governments have the power to tax and print money to meet their debt obligations. Examples of government bonds include U.S. Treasury bonds, German Bunds, and Japanese Government Bonds (JGBs).

Corporate bonds, on the other hand, are issued by companies to raise capital for various purposes, such as expansion, acquisitions, or debt refinancing. Corporate bonds offer higher interest rates compared to government bonds to compensate for the additional risk involved. The risk of default on corporate bonds is influenced by the financial health and creditworthiness of the issuing company. Examples of corporate bonds include those issued by multinational corporations like Apple, Microsoft, and Coca-Cola.

Municipal bonds are issued by local governments, such as cities, states, or counties, to finance public projects, such as schools, hospitals, and transportation infrastructure. Municipal bonds are usually exempt from federal income tax and, in some cases, state and local taxes. These bonds vary in risk based on the financial stability of the issuing municipality. Examples of municipal bonds include those issued by cities like New York City and states like California.

High-yield bonds, also known as junk bonds, are issued by companies with lower credit ratings or financial instability. These bonds carry higher risk but also offer higher yields to compensate for the increased likelihood of default. High-yield bonds are typically issued by companies in sectors such as technology, energy, or telecommunications. Investors who are willing to take on more risk may find high-yield bonds attractive for their income potential.

Overall, bonds provide investors with a stable income stream and a level of security during uncertain economic times. However, it is important to understand how different types of bonds perform during a recession and how to evaluate their risk-reward profiles to make informed investment decisions.

How Bonds Perform in Normal Economic Conditions

In normal economic conditions, bonds are known for their stability and reliable performance. They are considered relatively safer investments compared to stocks, offering investors a steady income stream and a level of capital preservation.

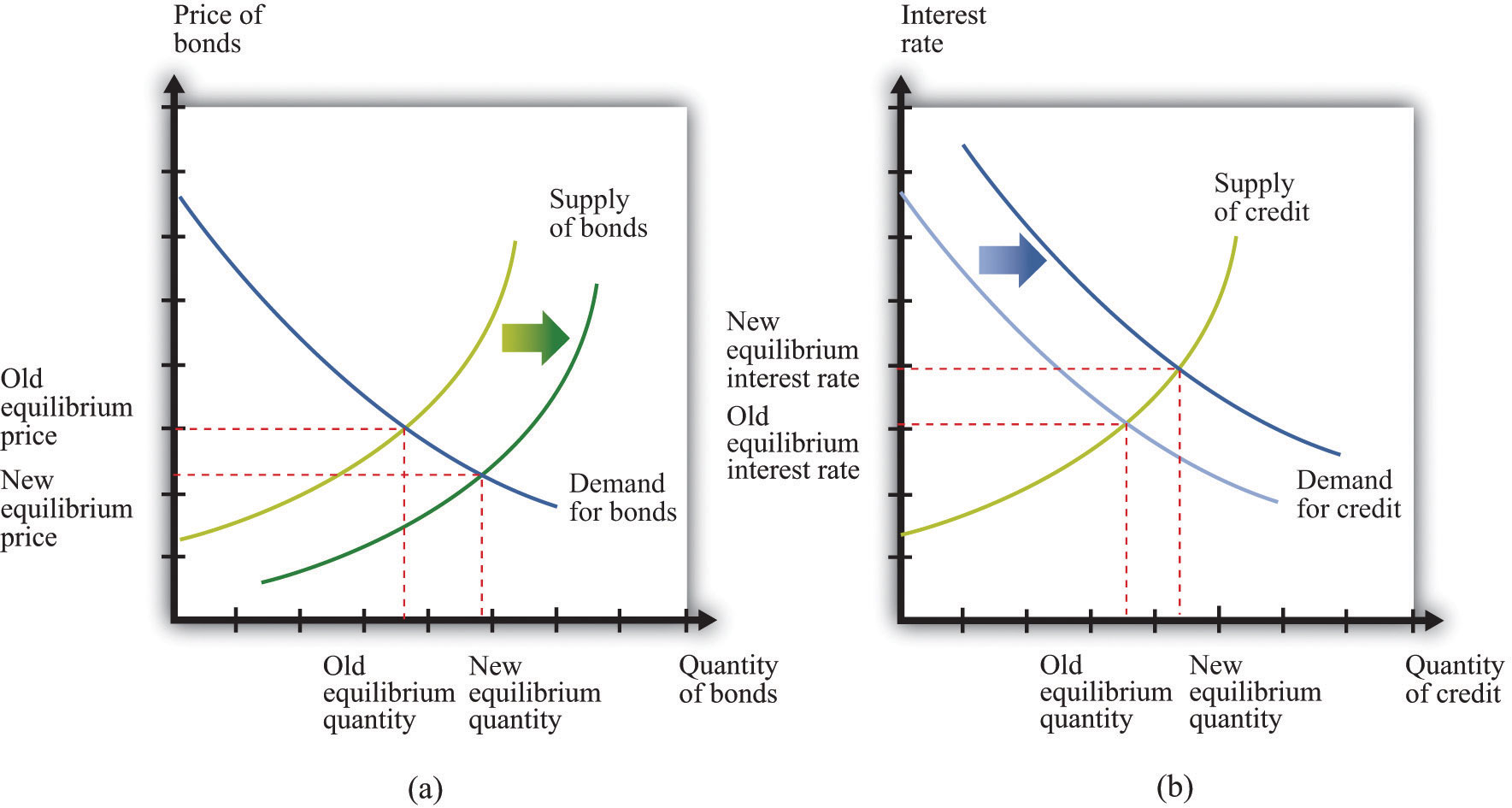

One of the key factors that determine the performance of bonds in normal economic conditions is interest rates. When interest rates are low, bond prices tend to be higher, and vice versa. This is because when interest rates decline, existing bonds with higher coupon rates become more attractive, leading to an increase in demand and a rise in bond prices. On the other hand, when interest rates rise, newly issued bonds offer higher coupon rates, making existing bonds with lower coupon rates less appealing, resulting in a decrease in bond prices.

Another important concept to understand is bond duration. Duration measures the sensitivity of a bond’s price to changes in interest rates. Bonds with longer durations are more sensitive to interest rate changes, meaning their prices will fluctuate more when interest rates rise or fall. On the other hand, bonds with shorter durations will experience smaller price movements in response to interest rate changes. Therefore, investors seeking stability in their bond investments may opt for bonds with shorter durations.

In addition to interest rates and duration, credit quality plays a significant role in bond performance in normal economic conditions. Bonds issued by entities with higher creditworthiness, such as governments or highly-rated companies, tend to have lower default risk and offer lower interest rates. These bonds are referred to as investment-grade bonds. On the other hand, bonds issued by companies with lower credit ratings or financial instability offer higher interest rates to compensate for the increased risk of default. These bonds are known as high-yield or junk bonds.

Furthermore, market conditions and investor sentiment can also affect bond performance in normal economic conditions. When the economy is strong, corporate bonds may perform well as companies generate higher profits and have lower default risk. Government bonds, especially those issued by stable economies, may see increased demand during periods of uncertainty, serving as safe havens for investors. Overall, in stable economic conditions, bonds provide investors with consistent income and potential capital appreciation.

The Impact of a Recession on Bonds

A recession is a challenging period for the economy, and it can have a significant impact on the performance of bonds. During a recession, several key factors come into play that affect bond prices, yields, and investor sentiment.

One of the primary factors that impact bonds during a recession is interest rates. In an effort to stimulate economic growth, central banks often lower interest rates during recessions to encourage borrowing and investment. While lower interest rates can benefit certain sectors of the economy, they can have adverse effects on bond prices. As interest rates decline, existing bonds with higher coupon rates become more attractive, leading to increased demand and higher bond prices. Conversely, when interest rates rise, newly issued bonds offer higher coupon rates, making existing bonds less attractive and resulting in decreased bond prices.

During a recession, there is also an increased risk of default on corporate bonds. Companies may face financial difficulties due to reduced consumer spending, decreasing revenues, and higher unemployment rates. This heightened default risk can cause the prices of corporate bonds to decline, as investors demand higher yields to compensate for the increased uncertainty and possibility of default. As a result, investors may see a decrease in the value of their bond holdings during a recession.

Furthermore, investor sentiment and risk aversion play a vital role in bond performance during a recession. When economic uncertainty prevails, investors typically seek safer investments, such as government bonds, as they are considered less risky. This increased demand for government bonds can drive bond prices up and reduce their yields. On the other hand, corporate bonds and high-yield bonds may experience heightened selling pressure, leading to lower prices and higher yields.

Additionally, the overall economic conditions during a recession can impact the creditworthiness of bond issuers. Companies may face challenges in meeting their debt obligations, which can lead to credit rating downgrades or even defaults. This deterioration in credit quality can affect the performance of corporate bonds, causing prices to decline further.

Despite the challenges posed by a recession, bonds still offer certain advantages over other investments. Government bonds, specifically those issued by stable economies, are often considered safe havens during economic downturns, providing a level of stability and income. Additionally, bonds with shorter durations may be less impacted by interest rate changes and offer more stability compared to long-term bonds.

In summary, a recession can have a significant impact on the performance of bonds. Interest rates, default risk, investor sentiment, and creditworthiness all contribute to the fluctuations in bond prices and yields. It is crucial for investors to carefully evaluate the risk-reward profiles of different types of bonds and consider diversification strategies to navigate through a recession effectively.

Factors That Affect Bond Performance During a Recession

Several factors come into play that can significantly impact the performance of bonds during a recession. It is important to understand these factors in order to make informed investment decisions and manage risk effectively.

Interest Rates: During a recession, central banks often implement monetary policies aimed at stimulating the economy by lowering interest rates. This can have both positive and negative effects on bond performance. Existing bonds with higher coupon rates become more attractive as interest rates decline, leading to increased demand and higher bond prices. Conversely, newly issued bonds offer higher coupon rates, decreasing the appeal of existing bonds and resulting in lower bond prices. It is essential to monitor changes in interest rates and their impact on bond yields and prices.

Credit Quality: The creditworthiness of bond issuers is a critical factor during a recession. Companies may face financial difficulties, leading to increased default risk. Bonds issued by companies with lower credit ratings or financial instability are more susceptible to default, which can have a negative impact on their prices. On the other hand, government bonds, particularly those issued by stable economies, are often considered safe-haven investments during economic downturns.

Investor Sentiment and Risk Aversion: During a recession, investor sentiment tends to shift towards safer investments, such as government bonds, due to increased risk aversion. As a result, demand for government bonds may increase, causing their prices to rise and yields to decline. At the same time, corporate bonds and high-yield bonds may experience selling pressure, leading to lower prices and higher yields. Investor sentiment and risk appetite play a crucial role in determining the performance of different types of bonds during a recession.

Liquidity: Liquidity refers to the ease with which bonds can be bought or sold without significantly impacting their prices. During a recession, market liquidity may decline as trading volume decreases and investors become more cautious. This reduced liquidity can make it challenging to sell bonds at desired prices and can lead to wider bid-ask spreads. In illiquid markets, investors may face difficulties in adjusting their bond holdings or rebalancing their portfolios.

Inflation Expectations: Inflation expectations play a role in bond performance during a recession. If investors anticipate higher inflation, they may demand higher yields to compensate for the erosion of purchasing power. This could lead to a decrease in bond prices. It is important to consider inflation expectations and their potential impact on bond yields and prices, especially during periods of economic uncertainty.

Fiscal Policy and Government Intervention: During a recession, governments often implement fiscal policies and intervention measures to stimulate economic growth and provide support to financial markets. These measures can have significant implications for bond performance. Government intervention, such as quantitative easing or bond-buying programs, can influence bond prices and yields. It is important to stay updated on government actions and their potential impact on the bond market.

Understanding these factors and how they interact with each other is crucial for assessing the performance of bonds during a recession. It is recommended to diversify bond investments across different bond types and maturities to manage risk effectively and preserve capital during challenging economic times.

Government Bonds During a Recession

Government bonds, especially those issued by stable economies, are often considered safe-haven investments during a recession. They provide investors with a level of stability and income, making them an attractive option in times of economic uncertainty.

During a recession, central banks typically implement expansionary monetary policies by lowering interest rates and implementing quantitative easing measures. These actions aim to stimulate economic growth by increasing the money supply and encouraging borrowing and spending. As a result, the demand for government bonds tends to increase. When interest rates decline, existing government bonds with higher coupon rates become more desirable, driving their prices up and reducing their yields.

One advantage of government bonds during a recession is their relatively low risk of default. Governments have the power to tax and control their currency, which gives them a higher ability to repay their debt obligations compared to corporations or municipalities. This default risk is perceived as being lower for government bonds, making them a safer investment choice for risk-averse investors during a recession.

Moreover, governments often issue bonds to finance fiscal stimulus packages and infrastructure projects aimed at boosting the economy during a recession. The increased demand for government bonds, coupled with the potential for future economic recovery, can positively impact their prices and yields.

Investing in government bonds during a recession can provide investors with steady income through coupon payments and the potential for capital appreciation if bond prices increase. However, it is important to consider several factors when investing in government bonds:

- Diversification: Investors should consider diversifying their government bond holdings across different countries and maturities to spread risk and potentially benefit from varying economic conditions.

- Interest Rate Risk: While government bonds are relatively stable, they are still subject to interest rate risk. If interest rates rise, bond prices will decline, potentially leading to capital losses for investors holding bonds with longer maturities. It is crucial to consider the impact of changing interest rates on bond prices.

- Inflation Risk: Government bonds are not immune to inflation risk. If inflation rates rise significantly, the purchasing power of bond coupon payments and principal may be eroded. Investors should evaluate inflation expectations and choose bonds with yields that provide a sufficient cushion against inflation.

- Currency Risk: Investing in government bonds issued in foreign currencies introduces currency risk. Exchange rate fluctuations can impact the returns of these bonds when converted back into the investor’s home currency. It is important to consider the potential impact of currency movements on returns.

Overall, government bonds can be a valuable component of a diversified portfolio during a recession. They provide stability, income, and potential capital appreciation, making them an attractive investment option for risk-averse investors seeking to preserve wealth in uncertain economic times.

Corporate Bonds During a Recession

Corporate bonds are debt securities issued by companies to raise capital. They offer investors the opportunity to earn regular interest payments and the return of principal upon maturity. During a recession, corporate bonds face unique challenges and opportunities that can impact their performance.

One of the key factors that affect corporate bonds during a recession is the creditworthiness of the issuing company. Economic downturns can lead to financial difficulties for corporations, which can increase the risk of default on their bond obligations. As a result, investors may demand higher yields to compensate for the increased credit risk. The credit rating of a corporate bond, assigned by credit rating agencies, provides an indication of the issuer’s creditworthiness. Bonds with higher credit ratings are considered less risky and typically offer lower yields compared to lower-rated bonds.

During a recession, the performance of corporate bonds is heavily influenced by the financial health of the issuing companies. Industries that are particularly vulnerable to economic downturns, such as retail, hospitality, and manufacturing, may experience higher default rates on their bonds. On the other hand, companies operating in industries that are more resilient during recessions, such as healthcare or consumer staples, may be viewed as more stable and attract investor interest.

It is important to note that corporate bonds offer higher yields compared to government bonds to compensate investors for the additional risk involved. Therefore, during a recession, when risk aversion increases, bond prices for lower-rated corporate bonds may decline as investors demand higher yields. Conversely, bond prices for higher-rated corporate bonds may be relatively more stable due to their perceived lower default risk.

During a recession, central banks may implement monetary policies to stimulate economic growth, which can indirectly impact corporate bonds. Lower interest rates can reduce borrowing costs for companies and potentially improve their financial positions. This, in turn, may positively affect the performance of corporate bonds issued by financially sound companies.

When investing in corporate bonds during a recession, investors should consider several factors:

- Credit Quality: Carefully assess the creditworthiness of the issuing company, including its financial statements, credit rating, and industry outlook. Higher-rated bonds may provide more stability, while lower-rated bonds may offer higher yields but come with an increased risk of default.

- Diversification: Spread investments across different industries and issuers to mitigate risk. Diversification can help reduce the potential impact of default or underperformance by any single company or sector.

- Duration: Consider the duration of corporate bonds to gauge their sensitivity to interest rate changes. Bonds with longer durations may experience more significant price fluctuations as interest rates change.

- Research and Analysis: Stay updated on company news, industry trends, and economic indicators to make informed investment decisions. Research and analysis can provide insights into the financial health and prospects of the issuing companies.

Overall, while corporate bonds carry higher risk during a recession, they also offer the potential for higher returns compared to government bonds. By carefully evaluating credit quality, diversifying investments, and conducting thorough analysis, investors can navigate the corporate bond market during a recession and potentially benefit from attractive yields and capital appreciation opportunities.

Municipal Bonds During a Recession

Municipal bonds, commonly known as munis, are debt securities issued by local governments, such as cities, states, or counties, to fund public projects and infrastructure. These bonds can provide investors with a stable income stream and potential tax advantages. Understanding the dynamics of municipal bonds during a recession is crucial for investors seeking stability and income during challenging economic times.

During a recession, municipalities may face reduced tax revenues and increased financial pressure due to decreased economic activity. As a result, the creditworthiness of municipal bonds may be affected. It is important to carefully evaluate the financial stability of the issuing municipality and its ability to meet its debt obligations.

Municipal bonds offer potential tax advantages, which can be particularly appealing to investors during a recession. Interest income from municipal bonds issued in the investor’s home state is often exempt from federal income tax. In some cases, interest income may also be exempt from state and local taxes. These tax benefits can enhance the after-tax yield of municipal bonds and make them attractive for investors looking to minimize their tax liabilities.

One notable category of municipal bonds is general obligation (GO) bonds. These bonds are backed by the full faith and credit of the issuing municipality, meaning that the municipality pledges its taxing power to repay the bondholders. GO bonds generally have a lower default risk compared to revenue bonds, which are backed by the revenues generated from specific projects, such as toll roads or airports. However, it is important to carefully evaluate the creditworthiness and financial stability of the municipality to assess the risk associated with municipal bonds.

During a recession, investor sentiment towards municipal bonds can be influenced by multiple factors. Certain sectors, such as healthcare, education, and utilities, are relatively less affected by economic downturns and may be viewed as more stable. Investors may find municipal bonds issued by these sectors more appealing during a recession. On the other hand, bonds issued by municipalities more reliant on economically sensitive areas, such as tourism or real estate, may face increased scrutiny and higher perceived risk.

Investors considering municipal bonds during a recession should keep in mind the following:

- Credit Risk: Evaluate the creditworthiness of the issuing municipality, including its financial health, budgetary discipline, and debt levels. Higher-rated bonds typically offer lower yields but come with reduced credit risk.

- Tax Considerations: Understand the potential tax advantages offered by municipal bonds, including the exemption from federal income tax and, in some cases, state and local taxes. Consider the after-tax yield to assess the attractiveness of these bonds.

- Interest Rate Risk: Consider the impact of interest rate fluctuations on municipal bond prices. While municipal bonds are generally less sensitive to interest rate changes compared to corporate bonds, significant interest rate movements can still impact their prices.

- Diversification: Spread investments across different municipalities, sectors, and bond types to manage risk effectively. Diversification can help reduce exposure to any single issuer or sector.

In summary, municipal bonds can offer investors stability, income, and potential tax advantages during a recession. However, careful credit analysis, consideration of tax implications, and a diversified approach are essential to navigate the municipal bond market effectively during challenging economic times.

High-Yield (Junk) Bonds During a Recession

High-yield bonds, commonly referred to as junk bonds, are debt securities issued by companies with lower credit ratings or higher perceived default risk. These bonds offer higher yields compared to investment-grade bonds to compensate investors for the increased risk they carry. Understanding the dynamics of high-yield bonds during a recession is crucial for investors seeking potentially higher returns but also willing to accept higher risk.

During a recession, high-yield bonds can be particularly vulnerable due to the increased financial stress faced by companies. As economic conditions deteriorate, companies may experience cash flow problems, reduced profitability, and a higher likelihood of default. Consequently, the risk of default on high-yield bonds tends to rise during a recession.

Investors should be aware that high-yield bonds have lower credit ratings compared to investment-grade bonds. Credit rating agencies assign these lower ratings based on the issuer’s perceived ability to meet its debt obligations. It is crucial to carefully evaluate the creditworthiness of companies issuing high-yield bonds and their financial health, industry dynamics, and business prospects.

Despite the higher default risk, high-yield bonds can offer attractive income potential during a recession. The higher yields on these bonds can be appealing to investors seeking income and potentially higher returns. However, investors should carefully assess the balance between the yield offered and the associated risk.

During a recession, market conditions and investor sentiment play a significant role in high-yield bond performance. Increased risk aversion can lead investors to sell high-yield bonds, resulting in lower prices and higher yields. Conversely, when market sentiment improves, high-yield bonds may experience price appreciation as investors seek out riskier assets for potentially higher returns.

Investors considering high-yield bonds during a recession should keep in mind the following:

- Due Diligence: Conduct thorough research and analysis of the issuing companies, including their financial statements, industry position, debt levels, and business prospects. Understanding the specific risks associated with each high-yield bond is crucial for making informed investment decisions.

- Diversification: Implement a diversified approach to high-yield bond investing. Spreading investments across different issuers, industries, and maturities can help manage risk by reducing exposure to any single company or sector.

- Monitoring and Active Management: High-yield bonds require active monitoring and management due to their higher risk profile. Keeping track of the issuer’s financial health and industry conditions is vital to assess ongoing creditworthiness and make necessary adjustments to the investment portfolio.

- Risk and Return Assessment: Evaluate the risk-reward profile of high-yield bonds relative to other investment options. Consider the potential for higher returns but also be prepared for the increased volatility and default risk associated with these bonds.

High-yield bonds can offer attractive income potential to investors during a recession, but they come with higher risks compared to investment-grade bonds. Careful due diligence, diversification, and active management are essential for managing the unique risks associated with high-yield bonds and potentially benefiting from their income and return potential.

Strategies for Investing in Bonds During a Recession

During a recession, investing in bonds requires careful consideration of market conditions and investment strategies. Here are some strategies that investors can employ when investing in bonds during a recession:

1. Focus on High-Quality Bonds: During a recession, investors often seek safety and stability. Investing in high-quality bonds, such as government bonds or highly rated corporate bonds, can provide a level of security and income. These bonds generally have lower default risk and tend to perform relatively well during economic downturns.

2. Shorten Bond Duration: Duration measures the sensitivity of a bond’s price to changes in interest rates. Shorter-duration bonds are less sensitive to interest rate changes, making them more stable during uncertain economic times. Investors can focus on bonds with shorter maturities or consider bond funds with shorter duration portfolios to manage interest rate risk.

3. Diversify Bond Holdings: Diversification is a key risk management strategy in any investment portfolio, including bond investments. Spreading investments across different types of bonds, sectors, and issuers can reduce exposure to any single issuer or industry. Diversification helps mitigate the impact of a potential default or underperformance by a specific bond.

4. Consider Floating Rate Bonds: Floating rate bonds, also known as adjustable-rate bonds, have interest rates that adjust periodically based on a benchmark rate, such as the LIBOR. These bonds can be beneficial during a recession as their interest payments can increase when interest rates rise. Floating rate bonds offer a level of protection against rising interest rates and can provide a hedge against inflation.

5. Evaluate Credit Risk: Assessing the creditworthiness of bond issuers becomes even more crucial during a recession. Investors should carefully evaluate the financial health, cash flow, and debt levels of the issuing companies or municipalities. Considering the credit ratings assigned by rating agencies can provide an initial indication of the issuer’s credit quality.

6. Monitor Economic Indicators: Keep an eye on economic indicators, such as GDP growth, unemployment rates, and consumer spending. These indicators can provide insights into the overall health of the economy and potential impact on bond performance. Understanding the macroeconomic conditions can help make informed investment decisions.

7. Seek Professional Advice: During a recession, market conditions can be challenging and unpredictable. Seeking advice from a qualified financial advisor or investment professional can provide valuable insights and guidance. They can help assess individual risk tolerance, recommend suitable bond investments, and assist in creating a well-diversified portfolio.

8. Stay Updated and Active: Continuously monitor bond investments and stay updated on market trends, news, and shifts in economic conditions. Be proactive in adjusting bond holdings based on evolving market dynamics and changing investment objectives. Regular portfolio reviews and adjustments can help navigate effectively through a recessionary environment.

It is important to remember that there is no one-size-fits-all approach to investing in bonds during a recession. Each investor’s risk tolerance, investment goals, and time horizon may vary. By considering the strategies mentioned above, investors can tailor their bond investments to their specific circumstances and potentially benefit from income, stability, and opportunities for capital appreciation during challenging economic times.

Conclusion

Investing in bonds during a recession requires careful consideration of various factors, including interest rates, credit quality, investor sentiment, and market conditions. While recessions can introduce challenges and uncertainties, bonds can play a crucial role in providing stability, income, and potential capital appreciation for investors.

Government bonds, with their lower risk of default and potential tax advantages, can serve as safe havens during economic downturns. Investors seeking steady income and capital preservation may find government bonds an attractive option.

Corporate bonds carry higher risk but offer higher yields to compensate for that risk. Credit quality and sector analysis are critical when considering corporate bonds during a recession. It is essential to carefully evaluate the financial health of the issuing companies and their ability to weather challenging economic conditions.

Municipal bonds can provide stability and income while potentially offering tax advantages. Evaluating the creditworthiness of the issuing municipality and diversifying bond holdings are key strategies for investing in municipal bonds during a recession.

High-yield bonds come with higher risk but can offer attractive income potential. Extensive due diligence, diversification, and active management are crucial when considering high-yield bonds during a recession.

Overall, diversification, risk assessment, and actively monitoring market conditions are important strategies to employ when investing in bonds during a recession. Shortening bond duration and considering floating rate bonds can help manage interest rate risk. Monitoring economic indicators and seeking professional advice can provide valuable insights for making informed investment decisions.

It is important to remember that investing always carries risks, and past performance is not indicative of future results. Each investor’s risk tolerance and investment goals may vary, and it is advisable to consult with a qualified financial advisor or investment professional to tailor investment strategies to individual circumstances.

By understanding the dynamics of different types of bonds, evaluating their risk-reward profiles, and implementing sound investment strategies, investors can navigate through a recession and potentially benefit from the stability, income, and potential growth that bonds can offer in challenging economic times.