Home>Finance>What Happens To Your Life Insurance When You Retire?

Finance

What Happens To Your Life Insurance When You Retire?

Published: October 16, 2023

Plan for your retirement with peace of mind - discover what happens to your life insurance when you retire. Ensure your finances are protected.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Life Insurance

- Life Insurance Policy Types

- Term Life Insurance

- Permanent Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

- Life Insurance Benefits

- Death Benefit

- Cash Value

- Premium Payments

- Life Insurance Options at Retirement

- Continuing Coverage

- Converting Term Life Insurance

- Surrendering or Cashing Out

- Setting Up a Trust

- Life Insurance as an Asset

- Tax Implications

- Conclusion

Introduction

Retirement is a significant milestone in life that often comes with a shift in financial priorities and responsibilities. As you prepare for this new phase, it’s essential to consider what happens to your life insurance. Life insurance is designed to provide financial protection for your loved ones in the event of your death. But as you reach retirement age, you may be wondering if your life insurance needs change or if you should continue carrying a policy at all.

In this article, we will explore the various options you have regarding your life insurance when you retire. We will discuss the different types of life insurance policies available and delve into the benefits and features they offer. Additionally, we will explore how life insurance can function as an asset in your overall retirement planning and touch on the tax implications you may encounter.

Understanding your life insurance options at retirement can help you make informed decisions to ensure the financial well-being of your loved ones and secure your own peace of mind.

Understanding Life Insurance

Before diving into the specifics of life insurance in retirement, it’s essential to have a clear understanding of what life insurance is and how it works.

Life insurance is a contract between an individual and an insurance company. In exchange for regular premium payments, the insurance company promises to provide a sum of money, known as the death benefit, to the designated beneficiaries upon the insured’s death. This financial protection is designed to help loved ones meet their financial obligations, such as paying off debts, replacing lost income, covering funeral expenses, and maintaining their standard of living.

Life insurance policies come in various types to suit different needs and circumstances. The two primary categories are term life insurance and permanent life insurance.

Term Life Insurance:

Term life insurance provides coverage for a specific period, typically between 10 and 30 years. It is often the most affordable option and offers straightforward coverage without any additional features. If the insured passes away during the policy term, the death benefit is paid to the beneficiaries. However, if the policyholder outlives the term, the coverage expires, and no benefits are paid out.

Permanent Life Insurance:

Unlike term life insurance, permanent life insurance provides coverage for the entire lifetime of the insured, as long as the policy is in force and the premiums are paid. Permanent life insurance policies also have a cash value component, which allows the policy to accumulate cash value over time. This cash value can be accessed by the policyholder during their lifetime through policy loans or withdrawals.

Within the category of permanent life insurance, there are different subtypes, including whole life insurance, universal life insurance, and variable life insurance. Each subtype offers distinct features and benefits, allowing policyholders to choose the policy that aligns with their unique financial goals and risk tolerance.

Now that we have a basic understanding of life insurance, let’s explore the various types of life insurance policies in more detail.

Life Insurance Policy Types

Life insurance policies come in different types, each with its own features and benefits. Understanding these policy types can help you make an informed decision about the type of coverage that best suits your needs. Let’s take a closer look at some common life insurance options:

- Term Life Insurance:

- Whole Life Insurance:

- Universal Life Insurance:

- Variable Life Insurance:

Term life insurance provides coverage for a specified term, usually between 10 and 30 years. This type of policy offers a death benefit that is paid out to the beneficiaries if the insured passes away during the term. Term life insurance is typically more affordable and straightforward compared to permanent life insurance.

Whole life insurance is a type of permanent life insurance that provides lifelong coverage. It offers both a death benefit and a cash value component that accumulates over time. Whole life insurance premiums tend to be higher than term life insurance premiums, but policyholders have the advantage of building cash value and the potential to earn dividends.

Universal life insurance is another type of permanent life insurance that offers flexibility in premium payments and death benefit. Policyholders can adjust their premium amounts and death benefit coverage over time, providing more control and adaptability. Universal life insurance policies also have a cash value component that earns interest based on market performance.

Variable life insurance is a form of permanent life insurance that provides a death benefit and a cash value component. Unlike other types of life insurance, variable life insurance allows policyholders to invest the cash value portion in a variety of investment options, such as stocks, bonds, and mutual funds. The value of the policy will vary based on the performance of the investments.

These are just a few examples of the most common types of life insurance policies available. Each policy type has its own unique features and benefits, so it’s important to carefully consider your financial goals and needs when choosing a life insurance policy.

Term Life Insurance

Term life insurance is a popular choice for individuals who want affordable coverage for a specific period. This type of policy provides a death benefit to the beneficiaries if the insured passes away during the term of the policy. Here are some key points to know about term life insurance:

- Policy Term: Term life insurance policies have a predetermined term, typically ranging from 10 to 30 years. The policyholder selects the term based on their specific needs, such as until their mortgage is paid off or until their children are financially independent.

- Death Benefit: If the insured passes away during the policy term, the beneficiaries will receive the death benefit. This lump-sum payment can be used to cover various expenses, such as funeral costs, outstanding debts, and ongoing financial obligations.

- Affordability: Term life insurance is often more affordable than permanent life insurance because it provides coverage for a specific period. The premiums for term life insurance policies are typically lower, making it an accessible option for individuals on a budget.

- No Cash Value: Unlike permanent life insurance policies, term life insurance does not accumulate cash value over time. This means that there is no savings component within the policy, and the premiums paid solely contribute to the death benefit.

- Temporary Coverage: It’s important to note that term life insurance coverage is temporary. Once the policy term ends, the coverage expires, and no benefits are paid out if the insured is still alive. However, some term life insurance policies may offer the option to renew or convert to a permanent policy at the end of the term.

Term life insurance is ideal for individuals who have specific coverage needs for a limited period. It offers straightforward protection and is often used to provide financial security during the years when financial obligations are highest, such as raising children or paying off a mortgage.

Before purchasing a term life insurance policy, carefully consider the length of the term, the coverage amount needed, and any additional riders or optional features that may be beneficial. Taking the time to assess your specific needs and comparing quotes from different insurers can help you find the best term life insurance policy to meet your individual requirements.

Permanent Life Insurance

Permanent life insurance is a type of life insurance that provides coverage for the entire lifetime of the insured, as long as the premiums are paid. Unlike term life insurance, permanent life insurance incorporates a savings component known as the cash value. Here’s what you need to know about permanent life insurance:

- Lifetime Coverage: Permanent life insurance offers coverage for the insured’s entire lifetime. As long as the policy remains in force and the premiums are paid, the death benefit will be paid out to the beneficiaries upon the insured’s death.

- Cash Value: One of the unique features of permanent life insurance is its cash value component. A portion of the premiums paid accumulates as cash value over time, which grows on a tax-deferred basis. Policyholders have the option to access the cash value through policy loans or withdrawals if needed during their lifetime.

- Various Subtypes: Permanent life insurance includes several subtype options, such as whole life insurance, universal life insurance, and variable life insurance. Each subtype has its characteristics and benefits, providing policyholders with a range of choices to align with their financial goals and risk tolerance.

- Premiums: Premiums for permanent life insurance are generally higher compared to term life insurance. This is because a portion of the premium goes towards the cash value component, and the coverage is guaranteed for the lifetime of the insured. Premiums can either be level, where they remain the same throughout the policy, or flexible, allowing policyholders to adjust the premium amount.

- Policy Loans and Withdrawals: Permanent life insurance policies give policyholders the option to borrow against the cash value through policy loans. These loans can be helpful in times of financial need, and the policyholder pays interest on the borrowed amount. Additionally, policyholders may choose to make partial withdrawals from the cash value, which can affect the death benefit and cash value accumulation.

Permanent life insurance provides not only a death benefit but also a cash value component that offers potential tax advantages and flexibility. It is suitable for individuals who want lifelong coverage and the added benefit of building cash value over time. Before choosing a permanent life insurance policy, carefully consider the subtype that best aligns with your financial goals and consult with a financial advisor to ensure it is the right fit for your needs.

Whole Life Insurance

Whole life insurance is a subtype of permanent life insurance that provides lifelong coverage and a cash value component. It offers several unique features that set it apart from other types of life insurance. Here’s what you need to know about whole life insurance:

- Lifetime Coverage: Whole life insurance provides coverage for the entire lifetime of the insured, as long as the premiums are paid. This means that the death benefit will be paid out to the beneficiaries regardless of when the insured passes away.

- Cash Value Growth: One of the distinguishing features of whole life insurance is its ability to accumulate cash value over time. A portion of the premium payments goes towards the cash value component, which grows on a tax-deferred basis. Over the years, the cash value builds up, providing policyholders with a valuable asset that can be accessed during their lifetime.

- Guaranteed Premiums: With a whole life insurance policy, the premiums are usually fixed and remain the same throughout the policy’s duration. This gives policyholders predictability and stability in their financial planning, as they can budget for consistent premium payments.

- Dividends: Some whole life insurance policies are eligible to receive dividends from the insurance company. These dividends are not guaranteed, but if awarded, they can be used to enhance the policy’s cash value, increase the death benefit, or be received as cash.

- Policy Loans and Withdrawals: Whole life insurance policies generally allow policyholders to borrow against the accumulated cash value through policy loans. These loans can be utilized for various purposes, such as supplementing retirement income or covering unexpected expenses. Additionally, policyholders have the option to make partial withdrawals from the cash value, although it may reduce the death benefit.

- Estate Planning Benefits: Whole life insurance can serve as a valuable component of estate planning. The death benefit can help beneficiaries settle estate taxes and liabilities, ensuring the smooth transfer of assets without any financial burden.

Whole life insurance offers lifelong coverage, a cash value component, and potential dividend earnings. It is suitable for individuals who seek a policy that combines protection with the opportunity for long-term savings and asset growth. However, it’s essential to carefully review the terms and conditions of the policy and consult with a financial advisor to determine whether whole life insurance aligns with your financial goals and risk tolerance.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments, death benefit coverage, and potential cash value growth. It combines the benefits of lifelong coverage with the opportunity for policy customization. Here’s what you need to know about universal life insurance:

- Flexible Premiums: Universal life insurance allows policyholders to adjust the premium amounts within certain limits. This flexibility offers individuals the opportunity to increase or decrease their premium payments according to their financial circumstances and goals.

- Adjustable Death Benefit: With universal life insurance, policyholders can modify the death benefit coverage as their needs change. Increasing the death benefit may require additional underwriting, while decreasing it could lead to potential cost savings in premiums.

- Cash Value Accumulation: Universal life insurance policies have a cash value component that grows over time based on interest rates set by the insurance company. The cash value accumulation is tax-deferred, allowing policyholders to potentially build a valuable asset throughout the life of the policy.

- Interest-Earning Account: Universal life insurance policies typically include an interest-earning account within the cash value component. The insurance company credits interest to this account, which can be based on current market interest rates or a minimum guaranteed rate set in the policy.

- Policy Loans and Withdrawals: Universal life insurance policies may allow policyholders to access the accumulated cash value through policy loans. These loans can be utilized for various purposes, such as supplementing retirement income or covering unexpected expenses. Policyholders may also make partial withdrawals from the cash value, although it may impact the death benefit and cash value growth.

- Lifetime Coverage: Universal life insurance provides coverage for the entire lifetime of the insured, as long as the policy remains in force and the premiums are paid. This ensures that the death benefit will be paid out to the beneficiaries whenever the insured passes away.

Universal life insurance offers flexibility in premium payments, death benefit coverage, and potential cash value growth. It provides individuals with the ability to customize their policy to meet their changing needs. However, it’s important to review the policy terms, understand the potential risks involved, and consult with a financial advisor to determine if universal life insurance is the right fit for your financial goals and circumstances.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that combines a death benefit with investment opportunities. It allows policyholders to allocate a portion of their premiums to a variety of investment options, such as stocks, bonds, and mutual funds. Variable life insurance offers both potential for growth and a level of risk. Here’s what you need to know:

- Investment Component: Variable life insurance policies include a cash value component that policyholders can invest in various sub-accounts. These sub-accounts function similar to mutual funds and allow policyholders to participate in the market’s potential growth.

- Investment Options: Policyholders are typically given a range of investment options to choose from, including equity funds, bond funds, and money market funds. The performance of these investments will determine the cash value growth of the policy.

- Risk and Volatility: Since variable life insurance involves investments in the market, the cash value and death benefit can fluctuate based on market conditions. This means that there is an inherent level of risk and volatility compared to other types of life insurance.

- Death Benefit: Variable life insurance provides a death benefit to the beneficiaries upon the insured’s death. The amount of the death benefit may vary depending on the performance of the investment sub-accounts.

- Tax Advantages: Like other types of life insurance, variable life insurance offers potential tax advantages. The cash value growth is tax-deferred, allowing policyholders to potentially accumulate wealth more efficiently. Additionally, the death benefit is generally received tax-free by the beneficiaries.

- Flexibility: Variable life insurance policies may offer flexibility in premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefit coverage to align with their changing financial circumstances or risk tolerance.

Variable life insurance is suitable for individuals who have a higher risk tolerance and who want the potential for greater cash value growth. It combines life insurance protection with investment opportunities, allowing policyholders to participate in potential market gains. However, it is important to carefully review the investment options, associated fees, and potential risks involved before investing in a variable life insurance policy.

Life Insurance Benefits

Life insurance provides several key benefits that can help protect your loved ones and provide financial security. Here are some of the primary benefits of having a life insurance policy:

- Death Benefit: The death benefit is the primary benefit of life insurance. It is a lump-sum payment that is given to the beneficiaries upon the insured’s death. This financial payout can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, and daily living expenses. The death benefit helps provide financial stability and support for your loved ones during a challenging time.

- Cash Value: Permanent life insurance policies, such as whole life and universal life, incorporate a cash value component. As you pay premiums, a portion of the money accumulates as cash value over time. This cash value can be accessed during your lifetime through policy loans or withdrawals. It can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering emergency expenses.

- Financial Security: Life insurance provides peace of mind and financial security for your loved ones. It ensures that they will be cared for financially, even if something were to happen to you. The death benefit can help replace lost income, settle outstanding debts, and maintain a comfortable standard of living. This can help alleviate the financial burden on your family during a difficult time and provide them with stability and security for the future.

- Estate Planning: Life insurance can play a significant role in estate planning. It can provide funds to pay estate taxes, ensuring that your assets are transferred smoothly to your heirs without putting a financial strain on them. Life insurance can help preserve your estate and ensure that your beneficiaries receive the inheritance you intended for them.

- Business Continuity: For business owners, life insurance can be a valuable tool for business continuity planning. It can provide funds to cover business-related expenses, pay off business debts, or facilitate the smooth transfer of ownership in the event of your death. Life insurance can help protect the financial stability and continuity of your business, ensuring that it can continue to thrive even in your absence.

Life insurance offers a range of benefits that provide financial protection and peace of mind for you and your loved ones. By considering your individual needs, financial goals, and personal circumstances, you can choose the right life insurance policy to meet your specific requirements.

Death Benefit

The death benefit is a key component of life insurance policies and serves as the primary purpose of having coverage. It is the amount of money that is paid out to the beneficiaries upon the insured’s death. Here’s what you need to know about the death benefit:

- Lump-Sum Payout: The death benefit is typically paid out as a lump sum to the beneficiaries named in the policy. This means that the beneficiaries receive the full amount of the death benefit in one payment.

- Financial Protection: The death benefit provides crucial financial protection for your loved ones. It can help replace lost income, cover funeral expenses, pay off outstanding debts, and meet ongoing financial obligations. This ensures that your beneficiaries are financially supported during a difficult and challenging time.

- Tax Implications: The death benefit is generally not taxable income for the beneficiaries. This means that they can receive the full amount of the death benefit without having to pay income taxes on it. However, it’s important to consult with a tax advisor or financial professional to understand any potential tax implications that may apply in specific situations.

- Policy Limit: The death benefit amount is determined when you initially purchase the life insurance policy. The amount can vary based on factors such as your income, financial obligations, and desired level of coverage. It’s important to carefully assess your financial needs and choose a death benefit amount that will adequately protect your loved ones’ financial future.

- Beneficiary Designation: You have the freedom to choose one or more beneficiaries for your life insurance policy. Your beneficiaries can be your spouse, children, dependents, or any individual or organization you wish to leave a financial legacy to. It’s important to review and update your beneficiary designation as life circumstances change, such as getting married, having children, or experiencing major life events.

The death benefit of a life insurance policy offers invaluable financial support to your beneficiaries when they need it most. It helps ensure that they can maintain their standard of living, meet financial obligations, and have a sense of security during a challenging time. By carefully considering your financial needs and goals, you can choose an appropriate death benefit amount that provides the necessary protection for your loved ones.

Cash Value

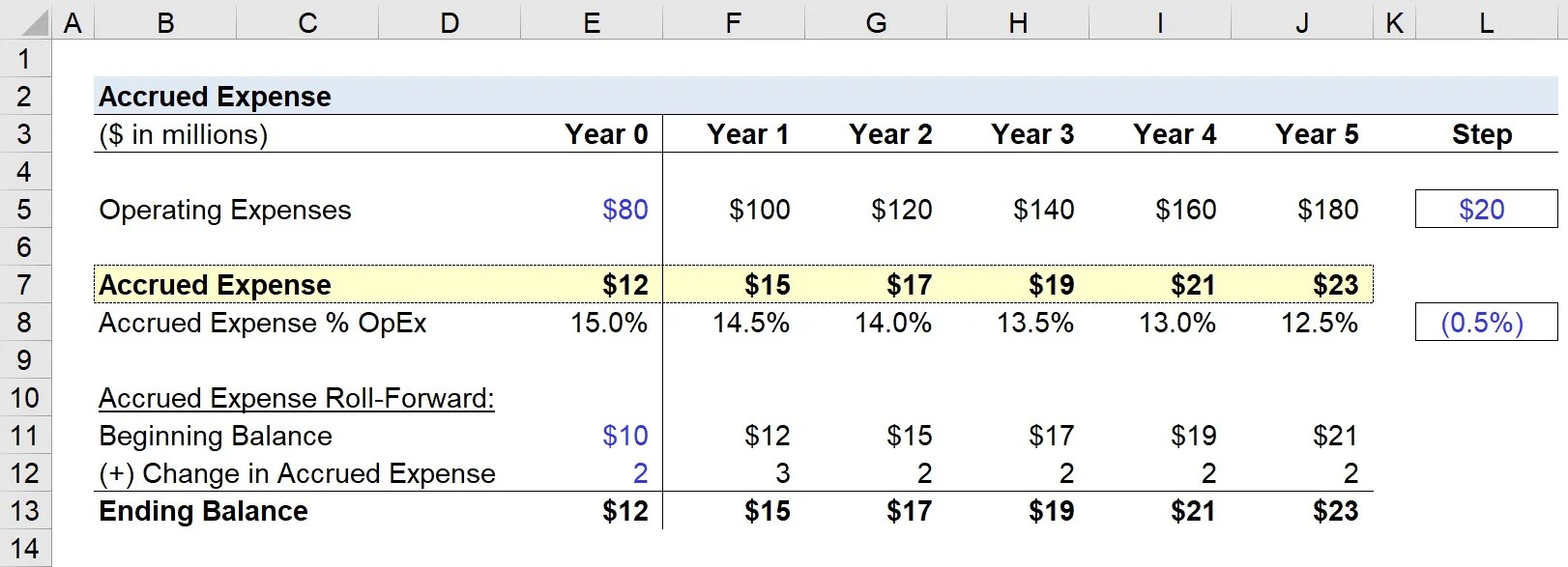

Cash value is a unique feature of permanent life insurance policies, such as whole life and universal life insurance. It is a savings component that accumulates over time, providing policyholders with additional financial flexibility. Here’s what you need to know about cash value:

- Accumulation: As you pay premiums for your permanent life insurance policy, a portion of the money goes towards building cash value. The cash value grows over time on a tax-deferred basis, meaning that you won’t owe taxes on the growth until you access the funds.

- Source of Funds: The cash value can serve as a source of funds during your lifetime. You can access the cash value through policy loans or withdrawals. Policy loans allow you to borrow against the cash value, often at a favorable interest rate, while withdrawals involve taking out a portion of the cash value. These funds can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering unforeseen financial emergencies.

- Tax-Deferred Growth: One of the advantages of cash value is that it grows on a tax-deferred basis. This means that the cash value accumulates without being subject to immediate income tax. However, it’s important to note that if you surrender the policy or receive more in withdrawals than the premiums paid, there may be tax implications. Consult with a tax professional to understand the tax consequences of accessing the cash value.

- Asset Growth Potential: Cash value has the potential to grow over time, especially in policies linked to investment sub-accounts. These sub-accounts allow you to allocate a portion of the cash value towards different investment options, such as stocks, bonds, and mutual funds. However, it’s important to note that the growth of the cash value is not guaranteed and depends on the performance of the chosen investments.

- Policy Loans: Accessing the cash value through policy loans can be a useful option for obtaining funds when needed. The loan is typically collateralized by the cash value, and interest accrues on the borrowed amount. It’s important to repay the loan to ensure that the death benefit doesn’t get reduced and to maintain the policy’s overall integrity.

Cash value in life insurance provides policyholders with the ability to accumulate savings over time and access funds when necessary. It offers a level of financial flexibility that can be valuable for supplementing income, meeting financial goals, or covering unexpected expenses. Be sure to review the specific terms of your life insurance policy to understand how the cash value accumulates, the options for accessing the funds, and any potential fees or charges associated with policy loans or withdrawals.

Premium Payments

Premium payments are an essential aspect of life insurance policies. They are the regular payments made by the policyholder to the insurance company to maintain coverage. Understanding how premium payments work is crucial for managing your life insurance policy effectively. Here’s what you need to know about premium payments:

- Frequency: Premium payments can be made on various schedules, depending on the policy and the insurer’s options. Common options include monthly, quarterly, semi-annually, or annually. The premium payment frequency is typically chosen by the policyholder at the time of policy inception.

- Level vs. Flexible Premiums: Life insurance policies can have either level premiums or flexible premiums. Level premiums remain fixed for the duration of the policy, providing stability and predictability in budgeting for premium payments. Flexible premiums, on the other hand, allow policyholders to adjust the premium amounts within certain limits, providing more flexibility and potential cost savings.

- Factors Affecting Premiums: The premium amount is determined based on several factors, including the type and amount of coverage, the insured’s age, health condition, gender, and lifestyle habits. Insurers use these factors to assess the risk level associated with providing coverage and to determine the appropriate premium rate.

- Lapse in Premium Payments: It’s crucial to pay your premiums on time to keep your life insurance policy active. If you fail to make timely premium payments, your policy may lapse, and your coverage will cease. Some insurers may offer a grace period during which premiums can still be paid without a lapse in coverage. However, it’s best to make premium payments promptly to ensure continuous coverage.

- Premium Payment Options: Insurance companies offer various payment methods for convenience. These can include electronic fund transfers, credit card payments, online payment portals, or traditional mail-in checks. Choose the payment method that is most convenient for you and ensure that you are aware of any processing fees that may apply.

- Benefit of Timely Payments: Paying your premiums on time is essential to maintain the integrity of your life insurance policy. Timely premium payments ensure that your loved ones will receive the full death benefit if you pass away. It also helps you avoid policy lapses and the need for reapplication, which may result in higher premiums or possible denial of coverage based on changes in health or insurability.

Understanding premium payments is crucial for effectively managing your life insurance policy. Be sure to review your policy documents and consult with your insurance provider to understand the specific details of premium payments, the frequency options available, and any potential grace periods in place. By making your premium payments on time, you can ensure continuous coverage and provide financial security for your loved ones.

Life Insurance Options at Retirement

Reaching retirement age is a significant milestone that often prompts a reassessment of insurance needs. While some individuals may no longer require the same level of life insurance coverage during their retirement years, others may still have financial responsibilities and dependents to consider. Here are several life insurance options to consider at retirement:

- Continuing Coverage: If you have dependents or financial obligations that extend beyond your retirement, you may choose to maintain your life insurance coverage. This ensures that your loved ones are financially protected in the event of your death and can cover expenses such as outstanding debts, funeral costs, or ongoing income replacement.

- Converting Term Life Insurance: If you have term life insurance nearing expiration, you might have the option to convert it into a permanent policy without undergoing further medical underwriting. This conversion provides the opportunity to maintain coverage without the need to reapply for a new policy. Converting can be advantageous if you still have financial dependents or want to retain cash value accumulation potential.

- Surrendering or Cashing Out: If you no longer need life insurance coverage and are looking to access the accumulated cash value, you can surrender your permanent life insurance policy. By surrendering the policy, you terminate coverage and receive the cash value amount. However, it’s important to note that surrendering a policy means you will no longer have any death benefit coverage.

- Setting Up a Trust: For individuals who have significant wealth and estate planning concerns, setting up an irrevocable life insurance trust (ILIT) can be an option. An ILIT can help manage and distribute life insurance proceeds outside of your taxable estate, providing liquidity for estate taxes or ensuring a financial legacy for beneficiaries while minimizing tax implications.

- Life Insurance as an Asset: In some cases, individuals may view their life insurance policy as an asset rather than a pure risk management tool. If you no longer need the death benefit protection, you may consider selling your policy through a life settlement or viatical settlement. These options allow you to sell your policy to a third party for a lump sum payment, providing immediate funds during retirement.

Choosing the right life insurance option at retirement depends on your financial circumstances, personal objectives, and the needs of your loved ones. It’s essential to review and evaluate your situation, consult with a financial advisor, and consider your long-term goals to make an informed decision that aligns with your financial plan. Remember, life insurance needs vary from person to person, so taking the time to assess your specific needs and options is crucial at this stage in life.

Continuing Coverage

Continuing your life insurance coverage into retirement is an option to consider if you have dependents or financial obligations that extend beyond your working years. While your life insurance needs may change as you enter retirement, maintaining coverage can provide financial protection for your loved ones even during this stage of life. Here’s what you need to know about continuing your life insurance coverage:

Financial Protection: Continuing your life insurance coverage ensures that your loved ones will be financially protected in the event of your death. Even if you have retired and no longer have the same level of income or financial responsibilities, your death could still leave behind financial obligations for your dependents, such as outstanding debts, mortgage payments, or education expenses.

Paying Off Debts: If you still have outstanding debts, such as a mortgage or car loan, continuing your life insurance coverage can help ensure that these debts can be paid off in the event of your passing. This provides peace of mind and financial stability for your family, allowing them to maintain their standard of living without facing the burden of debt.

Funeral and Final Expenses: Funeral costs and other final expenses can put a strain on your family’s finances. By maintaining life insurance coverage, you can help cover these expenses, relieving your loved ones of the financial burden during an already difficult and emotional time.

Legacy and Inheritance: Life insurance can also be used as a means to leave a financial legacy or inheritance for your loved ones. If you wish to provide a lump sum amount that can supplement their financial well-being or contribute to their long-term goals, continuing your life insurance coverage is a way to achieve this objective.

Income Replacement: If you are retired but still receive income from sources such as social security, retirement savings, or investment income, continuing your life insurance coverage can help replace that income stream for your dependents if it were to cease upon your passing. This can provide an additional financial cushion and stability for your family.

Reviewing Your Coverage: As you approach retirement, it’s a good idea to review your life insurance policy and assess if it still meets your needs and financial goals. You may consider adjusting the coverage amount to reflect your changed circumstances. Additionally, if you have multiple policies, you can review if maintaining all policies or consolidating into a single policy is more suitable for your situation.

Talking to a financial advisor can help you evaluate your life insurance needs and determine if continuing coverage is the right choice for you. By keeping your life insurance policy in force during retirement, you can provide valuable financial protection for your loved ones, ensuring their well-being and maintaining peace of mind as you enter this new phase of life.

Converting Term Life Insurance

If you have a term life insurance policy that is nearing expiration, you may have the option to convert it into a permanent life insurance policy without undergoing further medical underwriting. Converting your term life insurance policy can be a beneficial option if you still have financial dependents or want to retain the potential benefits of a permanent policy. Here’s what you need to know about converting term life insurance:

Conversion Privilege: Many term life insurance policies include a conversion privilege, which allows policyholders to convert their existing policy to a permanent policy at a later date. The conversion privilege typically has specific guidelines, including a limited conversion period (e.g., within the first 10 years of the policy) and a maximum age limit.

No Medical Underwriting: One of the advantages of converting term life insurance is that it allows you to convert to a permanent policy without the need to undergo additional medical underwriting. This means that any changes in your health or medical conditions since taking out the original policy will not impact your eligibility or premium rates for the converted policy.

Permanent Policy Benefits: By converting to a permanent life insurance policy, such as whole life or universal life, you gain the benefits of lifelong coverage and potential cash value accumulation. Permanent policies provide coverage for the entirety of your life, as long as the premiums are paid, and offer a variety of features, such as a death benefit, cash value growth, and potential dividend earnings.

Adjustable Premiums and Coverage: Converting to a permanent policy allows you to adjust both the premium amounts and the death benefit coverage. This flexibility can be advantageous if your financial circumstances have changed or if you have different goals for your life insurance coverage in this new stage of life.

Considerations for Conversion: Before converting your term life insurance policy, it’s important to review the specific details of the conversion privilege. Be sure to scrutinize the policy options, premium rates, and potential fees associated with the converted policy. Assess your financial needs, goals, and the level of coverage you require to determine if converting term life insurance is the right choice for you.

Consult with an insurance professional or financial advisor who can guide you through the conversion process and help you evaluate whether converting your term life insurance policy is the best course of action based on your individual circumstances.

Converting your term life insurance policy gives you the opportunity to maintain coverage beyond the initial term, potentially secure a permanent policy, and benefit from lifelong protection and potential cash value growth. It allows you to adapt your life insurance coverage to your changing needs and continue providing financial security for your loved ones.

Surrendering or Cashing Out

If you find that your life insurance needs have changed and you no longer require coverage, or if you wish to access the accumulated cash value of your permanent life insurance policy, you have the option to surrender or cash out your policy. Here’s what you need to know about surrendering or cashing out your life insurance policy:

Surrendering a Policy: Surrendering a life insurance policy involves terminating it and receiving the accumulated cash value. When you surrender your policy, you will no longer have any death benefit coverage, and the insurance company will return the cash value to you. The surrender value is the current amount of cash value minus any applicable surrender charges or fees imposed by the insurer.

Cashing Out a Policy: Cashing out a life insurance policy involves withdrawing funds from the accumulated cash value while keeping the policy active. This option allows you to access a portion of the cash value without terminating the coverage completely. Depending on the policy terms, you may be limited in the amount you can withdraw and may have to meet certain criteria to be eligible for partial withdrawals.

Considerations Before Surrendering or Cashing Out: Before making a decision to surrender or cash out your life insurance policy, it’s important to carefully evaluate your financial situation and goals. Consider the following factors:

- Insurance Needs: Assess whether you still require life insurance coverage to protect your loved ones or to meet any financial obligations you may have.

- Financial Impact: Review the surrender value or the potential impact of cashing out on your cash value and death benefit. Understand any surrender charges, taxes, or penalties that may apply to the withdrawal.

- Liquidity Needs: Determine if you have an immediate need for cash and whether accessing the cash value now outweighs the long-term benefits of keeping the policy.

- Estate Planning: Consider the role the policy plays in your overall estate planning strategy and if surrendering or cashing out will affect your legacy planning and goals.

- Tax Implications: Consult with a tax advisor to understand the potential tax consequences of surrendering or cashing out your policy, as it may have a taxable gain or other tax implications.

Taking the decision to surrender or cash out your life insurance policy is a personal one that should align with your specific financial circumstances and goals. It’s recommended to consult with a financial advisor or insurance professional who can provide guidance based on your individual needs and help you make an informed decision.

Keep in mind that once you surrender or cash out your policy, you will no longer have the death benefit coverage or the potential benefits of the policy, such as cash value accumulation or dividends. Weigh the advantages and disadvantages carefully before proceeding to ensure that the decision aligns with your long-term financial objectives.

Setting Up a Trust

For individuals with considerable wealth and complex estate planning concerns, setting up an irrevocable life insurance trust (ILIT) can be an option worth considering. An ILIT is a type of trust specifically designed to manage and distribute life insurance proceeds outside of your taxable estate. Here’s what you need to know about setting up a trust:

Estate Tax Planning: One of the primary reasons for setting up an ILIT is to help manage estate taxes and ensure the smooth transfer of wealth to your beneficiaries. By placing your life insurance policy within an irrevocable trust, the death benefits are not considered part of your taxable estate, potentially reducing estate tax liabilities.

Asset Protection: Assets held within an irrevocable trust, including a life insurance policy, may offer protection from creditors and potential legal claims. This can help safeguard the proceeds for the intended beneficiaries, providing an added layer of asset protection.

Control and Administration: When setting up an ILIT, you appoint a trustee who will manage the trust according to your instructions. This allows you to have control over how the life insurance proceeds are distributed and ensures that your wishes are carried out when you pass away.

Tax Advantages: ILITs can provide tax advantages, such as removing the life insurance proceeds from your estate, minimizing estate taxes, and potentially shielding the trust’s assets from generation-skipping transfer taxes. Since tax laws can be complex and subject to change, consulting with an attorney or tax professional is essential to maximize the tax benefits of an ILIT based on your unique circumstances.

Influence on Policy Designation: Once you establish an ILIT, the policy ownership is transferred to the trust. As the grantor, you can designate the beneficiaries and specify how the trust’s assets, including the life insurance proceeds, will be distributed. This provides you with control over who will receive the funds and how they will be allocated.

Professional Guidance: Establishing an ILIT can involve complex legal and financial considerations. Engaging the services of an experienced estate planning attorney and working closely with a financial advisor can help ensure that the trust is set up correctly and aligned with your goals and objectives.

It’s important to note that once you establish an irrevocable trust, it cannot be easily modified or revoked. Therefore, careful consideration and planning should go into setting up the trust, understanding its long-term implications, and how it fits into your overall estate planning strategy.

Consulting with professionals who specialize in estate planning and tax matters is crucial to navigate the complexities of setting up an ILIT. They can guide you through the process and ensure that it is structured accordingly to provide the intended benefits and protection for your loved ones and your assets.

Life Insurance as an Asset

Life insurance can be viewed not only as a risk management tool but also as an asset that can provide financial benefits during your lifetime and for your beneficiaries. Understanding how life insurance can serve as an asset can help you leverage its potential advantages. Here’s what you need to know about life insurance as an asset:

Cash Value Accumulation: Permanent life insurance policies, such as whole life or universal life insurance, have a cash value component that accumulates over time. As you pay premiums, a portion of the money goes towards building cash value, which grows on a tax-deferred basis. This accumulated cash value can be considered an asset within the policy.

Accessing Cash Value: The cash value within a life insurance policy is available for policyholders to access during their lifetime. You can borrow against the cash value through policy loans or make partial withdrawals, providing a source of funds for various purposes such as supplementing retirement income, funding education expenses, or covering unexpected financial needs.

Tax Advantages: The growth of the cash value in a life insurance policy occurs on a tax-deferred basis, meaning that you won’t owe taxes on it until you access the funds. Additionally, the death benefit received by beneficiaries is generally tax-free. These tax advantages make life insurance an attractive asset for individuals seeking to accumulate wealth efficiently or leave a tax-free legacy for their loved ones.

Asset Protection: In some cases, the cash value in a life insurance policy may offer a level of asset protection. Depending on your state’s laws, the cash value within a policy may be protected from creditors and legal claims, providing an additional layer of financial security.

Estate Planning Tool: Life insurance can play a significant role in estate planning, allowing for the efficient transfer of wealth to beneficiaries. The death benefit received by beneficiaries can help cover estate taxes and ensure that your assets are transferred smoothly without a financial burden. It can also be an effective way to provide liquidity for your estate to meet expenses and distribute assets as per your wishes.

Flexibility and Control: Some life insurance policies offer flexibility in premium payments and death benefit coverage, allowing you to adjust your policy to align with your changing financial needs and goals. This level of control makes life insurance an adaptable asset that can evolve with your circumstances over time.

It’s important to remember that each individual’s financial situation is unique, and the role of life insurance as an asset may vary based on personal goals and circumstances. Consulting with a financial advisor or insurance professional can help you evaluate your specific needs, consider the potential benefits and tax implications, and determine how to best utilize life insurance as part of your overall financial plan.

Tax Implications

When it comes to life insurance, understanding the potential tax implications is essential for making informed decisions and maximizing the benefits of your policy. Here are some key tax considerations to keep in mind:

- Death Benefit: The death benefit received by your beneficiaries is generally not subject to income tax. This means that the full amount of the death benefit passes to your beneficiaries tax-free, providing a significant financial advantage and ensuring that the intended recipients receive the full benefit.

- Cash Value Growth: The cash value component of permanent life insurance policies grows on a tax-deferred basis. This means that the cash value accumulates without being subject to immediate income tax. However, if you surrender the policy or make withdrawals or loans that exceed the amount of premiums paid, there may be taxable income.

- Policy Loans: Policy loans from the cash value of your life insurance policy are generally tax-free. Because they are considered loans rather than income, they are not subject to income tax. Keep in mind that outstanding loans reduce the death benefit if they are not repaid.

- Premium Payments: Premium payments made for personal life insurance coverage are typically not tax-deductible. They are considered personal expenses and are therefore not eligible for tax deductions. However, there may be exceptions for certain situations, such as when life insurance is used for business purposes or estate planning needs.

- Estate Taxes: If your estate exceeds the applicable exemption amount set by the IRS, it may be subject to federal estate taxes. Life insurance can help cover these estate taxes as the death benefit received by your beneficiaries is generally included in your taxable estate. However, setting up an irrevocable life insurance trust (ILIT) can remove the life insurance proceeds from your taxable estate and potentially minimize estate taxes.

- Gift Taxes: If you transfer ownership of your life insurance policy to another individual, such as a family member or a trust, it may be subject to gift taxes if the transfer exceeds the annual gift tax exclusion amount. However, specific rules and exemptions apply, so it is advisable to consult with a tax professional to understand the potential tax consequences.

It is important to note that tax laws and regulations can be complex and subject to change. The information provided serves as a general guide, but it is essential to consult with a tax advisor or financial professional to understand how specific tax rules may apply to your situation.

By understanding the tax implications of your life insurance policy, you can navigate your financial planning more effectively and potentially leverage tax advantages to maximize the benefits of your coverage.

Conclusion

Life insurance plays a vital role in ensuring the financial security of your loved ones and protecting your assets. As you approach retirement or experience changes in your financial circumstances, it’s important to evaluate your life insurance policy and consider the options available to you.

Understanding the different types of life insurance policies, such as term life insurance and permanent life insurance, empowers you to make informed decisions about coverage that aligns with your needs and goals. Term life insurance provides affordable coverage for a specific period, while permanent life insurance offers lifelong protection and potential cash value accumulation.

When retiring, you have several options to consider. You can choose to continue your coverage if you have dependents or financial obligations beyond retirement. Converting term life insurance into a permanent policy can provide lifelong coverage without the need for further medical underwriting. Alternatively, you may decide to surrender or cash out your policy to access the accumulated cash value.

For individuals with significant wealth and estate planning concerns, setting up an irrevocable life insurance trust (ILIT) can be advantageous. An ILIT can help manage and distribute life insurance proceeds outside of your taxable estate, potentially minimizing estate taxes and providing liquidity for your heirs.

It’s crucial to carefully consider the tax implications of your life insurance policy. Understanding the tax advantages, such as the tax-deferred growth of cash value and the tax-free nature of the death benefit, can help you make strategic decisions that minimize tax liabilities and maximize the benefits of your coverage.

In conclusion, life insurance is a valuable tool that ensures the financial well-being of your loved ones and can serve as a financial asset during retirement and estate planning. By understanding your options, evaluating your needs, and consulting with professionals, you can make informed choices that provide peace of mind and protection for your financial future and that of your beneficiaries.