Home>Finance>What Happens When You Cancel A Whole Life Insurance Policy

Finance

What Happens When You Cancel A Whole Life Insurance Policy

Published: November 23, 2023

Discover the consequences of canceling a whole life insurance policy and the financial implications it may have. Explore the impact on your finances with our expert insights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Whole life insurance is a type of permanent life insurance policy that provides coverage for the entire lifetime of the insured person. Unlike term life insurance, which only provides coverage for a specific period, whole life insurance offers lifelong protection along with a cash value component.

While whole life insurance can offer financial security and stability, there may come a time when you decide to cancel your policy. This could be due to various reasons, such as changes in financial circumstances, the need for cash, or simply a reevaluation of your insurance needs.

In this article, we will explore what happens when you cancel a whole life insurance policy. We will discuss the basics of whole life insurance, reasons for canceling, the cancellation process, and the effects of canceling. Furthermore, we will provide you with alternative options to consider before deciding to cancel your policy.

It’s important to note that canceling a whole life insurance policy is a significant financial decision and should be considered carefully. It is recommended to consult with a financial advisor or insurance professional before taking any action.

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance policy that provides both a death benefit and a cash value component. Unlike term life insurance, which provides coverage for a specific period (such as 10, 20, or 30 years), whole life insurance offers coverage for the entire lifetime of the insured person, as long as the premiums are paid.

One of the key features of whole life insurance is the cash value accumulation. As you pay your premiums, a portion of the payment goes towards the cost of insurance, while the remainder is invested by the insurance company. Over time, the cash value grows tax-deferred and can be accessed through policy loans or withdrawals.

Whole life insurance policies come with a fixed premium, which means that the premium amount remains the same throughout the policy’s duration. This provides stability and predictability in terms of your insurance costs. Additionally, whole life insurance policies typically have a guaranteed death benefit, meaning that the beneficiary will receive a predetermined amount upon the death of the insured person.

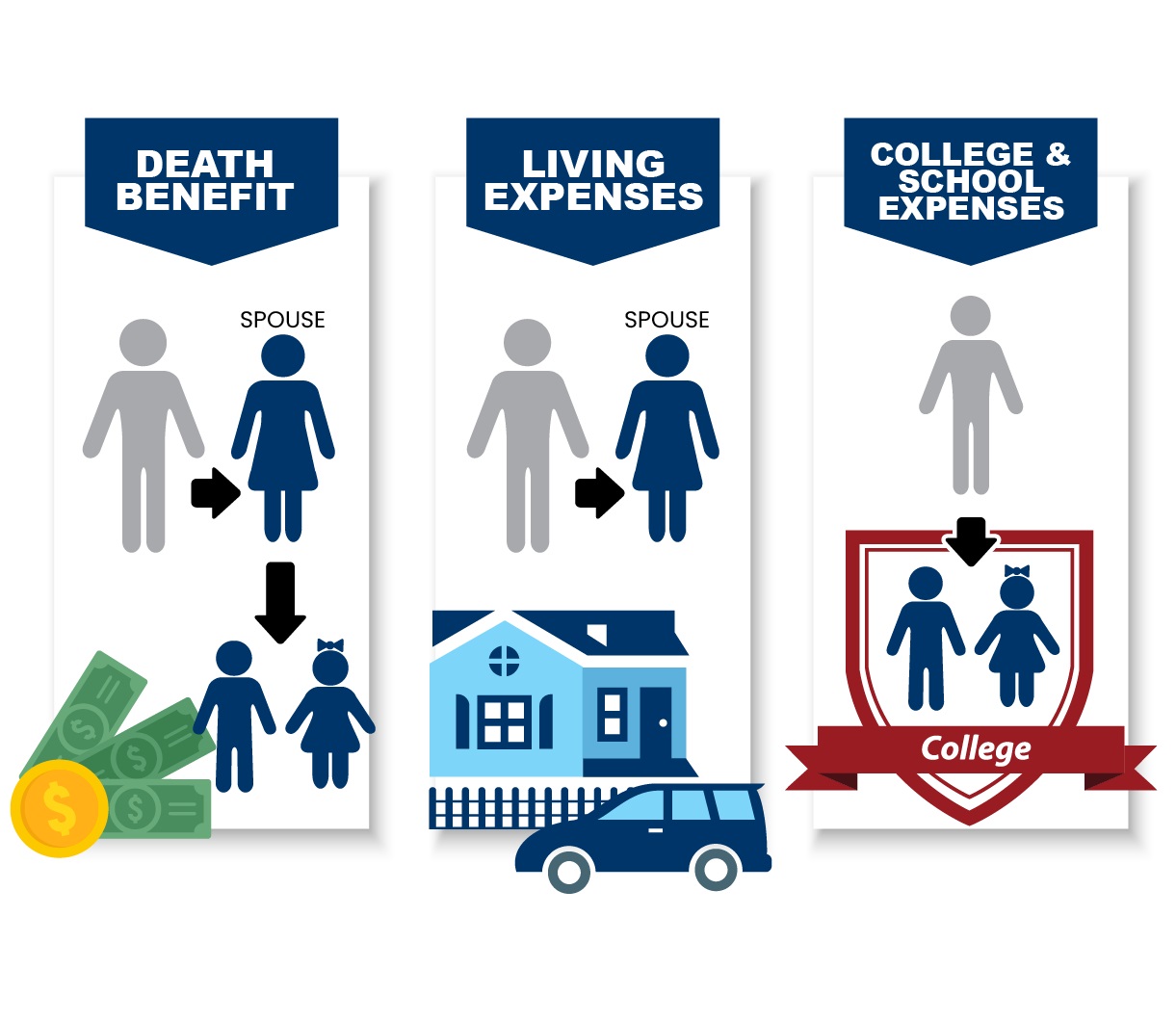

One of the advantages of whole life insurance is its lifelong coverage. It can be a particularly valuable financial tool for individuals who want to provide for their loved ones, cover funeral expenses, or leave behind a legacy. The cash value component can also be used for various purposes such as supplementing retirement income or paying for unexpected expenses.

It is important to note that whole life insurance premiums tend to be higher compared to term life insurance because of the additional benefits and coverage offered. However, the premium payments can be seen as a long-term investment due to the cash value growth and the guaranteed death benefit.

Reasons for Canceling a Whole Life Insurance Policy

While whole life insurance offers a range of benefits, there may be circumstances where canceling the policy becomes necessary or advantageous. Here are some common reasons why individuals consider canceling their whole life insurance policies:

- Changed Financial Circumstances: Life is full of unexpected twists and turns. If you find yourself experiencing a significant change in your financial circumstances, such as a job loss, divorce, or the need for additional funds for other financial priorities, you may consider canceling your whole life insurance policy to free up cash.

- Unaffordable Premiums: Whole life insurance premiums tend to be higher compared to term life insurance. If you are struggling to keep up with your premium payments due to financial constraints, canceling the policy may be a viable option.

- No Longer Need the Coverage: As time goes by, your insurance needs may change. For example, if your children have grown up and are financially independent, or if you have built up significant assets that can provide for your loved ones in the event of your death, you may no longer require the coverage provided by a whole life insurance policy.

- Better Investment Opportunities: Some individuals may choose to cancel their whole life insurance policies if they believe they can generate higher returns through other investments. It is essential, however, to carefully evaluate the potential returns and risks associated with alternative investments before making a decision.

- Lack of Trust in the Insurance Company: If you have lost faith in the financial stability or trustworthiness of your insurance company, you may decide to cancel your policy and seek coverage elsewhere. It is crucial to research and choose a reputable and financially sound insurance company to provide you with the coverage you need.

Before canceling your whole life insurance policy, it is advisable to consult with a financial advisor or insurance professional. They can assess your specific situation, provide guidance on the potential consequences of canceling, and explore alternative options that may better suit your needs.

Cancellation Process for Whole Life Insurance

Canceling a whole life insurance policy is a straightforward process, but it is essential to follow the proper steps to ensure a smooth transition. Here is a general outline of the cancellation process:

- Review the Policy Terms: Before initiating the cancellation process, carefully review your whole life insurance policy to understand any potential penalties or surrender charges that may apply. These charges can vary depending on the duration of the policy, and they are meant to compensate the insurance company for the loss of future premiums.

- Contact Your Insurance Company: Reach out to your insurance company’s customer service or your designated insurance agent to initiate the cancellation process. They will guide you through the specific steps and requirements for canceling your whole life insurance policy.

- Submit a Written Request: In most cases, the insurance company will require a written request for cancellation. This request should include your policy details, your signature, and the effective date of cancellation.

- Provide Necessary Documentation: The insurance company may ask for additional documentation, such as proof of identification or proof of ownership of the policy, to process the cancellation request. Be prepared to provide any requested documents promptly.

- Confirm Cancellation: After submitting your written request and necessary documentation, the insurance company will review your request and confirm the cancellation of your whole life insurance policy. They will provide you with a confirmation letter or notification of the policy termination.

- Return the Policy: In some cases, the insurance company may require you to return the original policy documents as part of the cancellation process. Make sure to follow their instructions regarding the return of the policy.

It is important to note that canceling a whole life insurance policy may have financial implications, such as the loss of the cash value component or potential tax consequences. It is advised to consult with a financial advisor or insurance professional to understand the specific impact on your financial situation.

Additionally, if you have any outstanding loans against the cash value of your policy, canceling the policy may require you to repay those loans in full. Make sure to discuss this aspect with your insurance company to fully understand the financial obligations involved.

Effects of Canceling a Whole Life Insurance Policy

Canceling a whole life insurance policy can have several effects on your financial situation. It is crucial to consider these implications before making a decision. Here are some key effects you should be aware of:

- Loss of Death Benefit: One of the primary consequences of canceling a whole life insurance policy is the loss of the death benefit. Upon cancellation, your beneficiaries will no longer be eligible to receive the predetermined payout in the event of your death. This loss of financial protection should be carefully evaluated, particularly if you have dependents or outstanding financial obligations.

- Loss of Cash Value: Whole life insurance policies accumulate cash value over time, resulting from part of the premiums being invested by the insurance company. Cancelling your policy means surrendering the accumulated cash value. Depending on the age and duration of the policy, as well as any surrender charges, the cash value may provide a significant amount of money that can be accessed through policy loans or withdrawals.

- Impact on Life Goals: Whole life insurance policies are often used as part of a financial plan to achieve specific life goals. Cancelling the policy may affect your ability to reach those goals, such as funding your retirement, covering long-term care expenses, or leaving a legacy for your loved ones. Consider the long-term implications and explore alternative options before canceling your policy.

- Tax Considerations: Withdrawing the cash value from your whole life insurance policy may have tax consequences. If the amount you receive upon cancellation exceeds the amount you have paid in premiums, it may be subject to taxation. Additionally, policy loans that are not repaid before cancellation could be considered taxable income. Consult with a tax advisor to understand the potential tax implications of canceling your policy.

- Future Insurability: Canceling your whole life insurance policy means giving up the ability to reinstate or convert the policy in the future. If you need life insurance coverage again down the road, you may have to go through the underwriting process, which can be more challenging as you get older or if your health conditions have changed.

It is essential to carefully evaluate the potential effects of canceling your whole life insurance policy and consider alternative options before making a final decision. Consult with a financial advisor or insurance professional who can help you assess your specific situation and guide you towards the best course of action.

Alternatives to Canceling a Whole Life Insurance Policy

Before deciding to cancel your whole life insurance policy, it is worth exploring alternative options that may better suit your needs. Here are a few alternatives to consider:

- Reduced Coverage: If the premium payments are becoming unaffordable, you may be able to reduce the coverage amount of your whole life insurance policy. This can help lower the premium while still maintaining some level of protection. Contact your insurance company or agent to discuss the possibility of adjusting the coverage to better align with your budget.

- Paid-Up Insurance: Some whole life insurance policies offer the option to convert the policy into a paid-up policy. This means that you stop paying premiums, but the policy remains in force with a reduced death benefit. This can be a good option if you want to maintain coverage while eliminating future premium obligations.

- Policy Loans: If you need access to cash but do not want to cancel your whole life insurance policy, you can explore the option of taking a policy loan. The cash value in your policy can serve as collateral, allowing you to borrow against it. Keep in mind that policy loans are subject to interest charges and should be repaid to avoid reducing the death benefit.

- Exchange for a Different Policy: Depending on your insurance needs, you may consider exchanging your whole life insurance policy for a different type of policy, such as a term life insurance policy. This can provide more affordable coverage for a specific period while allowing you to allocate funds towards other financial priorities.

- Use the Cash Value Wisely: Instead of canceling the policy, you can explore ways to utilize the cash value within your whole life insurance policy. This can include taking partial withdrawals, using the cash value to pay premiums, or taking a policy loan to meet specific financial needs.

It is crucial to evaluate these alternatives carefully and consider their long-term implications before making a decision. Each option may have its own advantages and disadvantages based on your specific circumstances and financial goals. Consulting with a financial advisor or insurance professional can provide valuable guidance in navigating these alternatives and determining the best course of action.

Conclusion

Canceling a whole life insurance policy is a significant decision that should be carefully considered. While there are valid reasons for canceling, such as changes in financial circumstances or no longer needing the coverage, it is essential to understand the effects and explore alternatives before taking action.

Whole life insurance offers lifelong coverage and a cash value component that can be valuable for financial security and future planning. Cancelling the policy means losing the death benefit, surrendering the cash value, and potentially facing tax consequences.

Before canceling, alternatives such as reducing coverage, converting to a paid-up policy, or utilizing the cash value wisely should be explored. These options can provide a balance between meeting your financial needs and maintaining insurance protection.

It is strongly advised to consult with a financial advisor or insurance professional who can assess your specific situation, provide personalized recommendations, and help you make an informed decision. They can evaluate the potential impact on your financial goals, assess the tax implications, and guide you towards the best course of action.

Ultimately, the decision to cancel a whole life insurance policy should be based on a thorough understanding of your financial needs, goals, and the long-term implications. By carefully considering your options and seeking expert advice, you can make the best choice for your financial future.