Finance

What Insurance Companies Cover Dry Needling?

Published: November 15, 2023

Find out which insurance companies provide coverage for dry needling and how it can be financed. Discover the options available to help you manage the cost.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

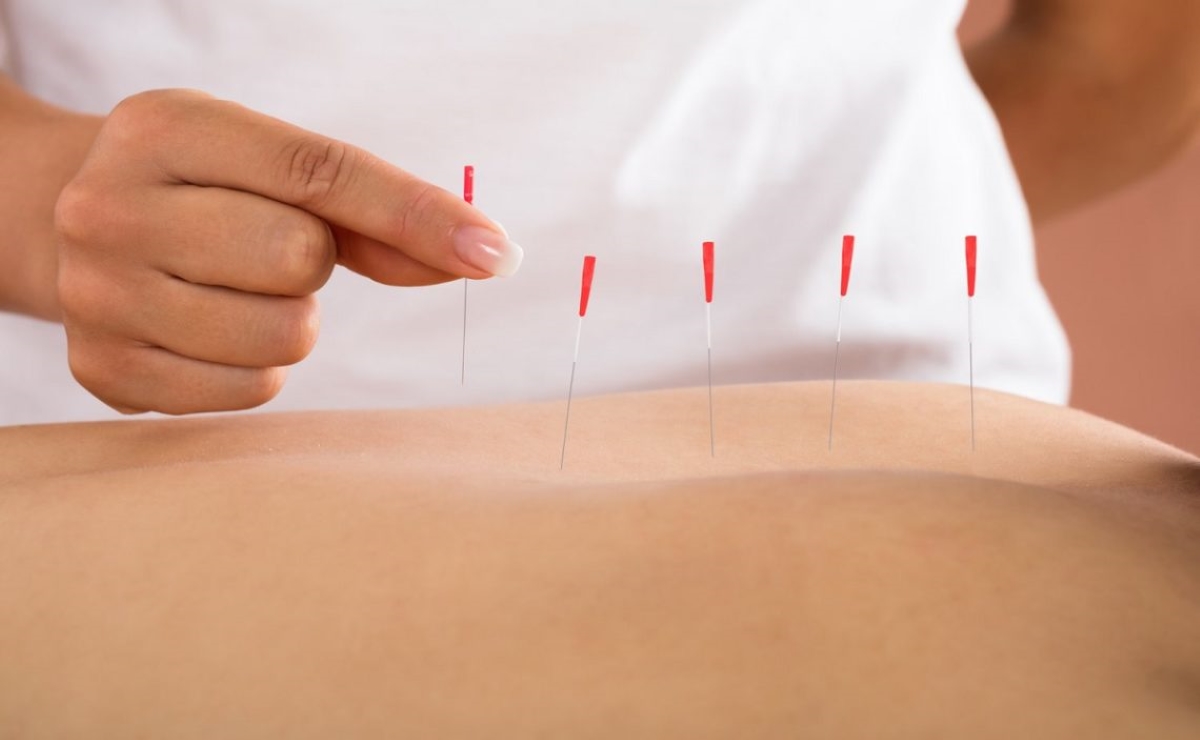

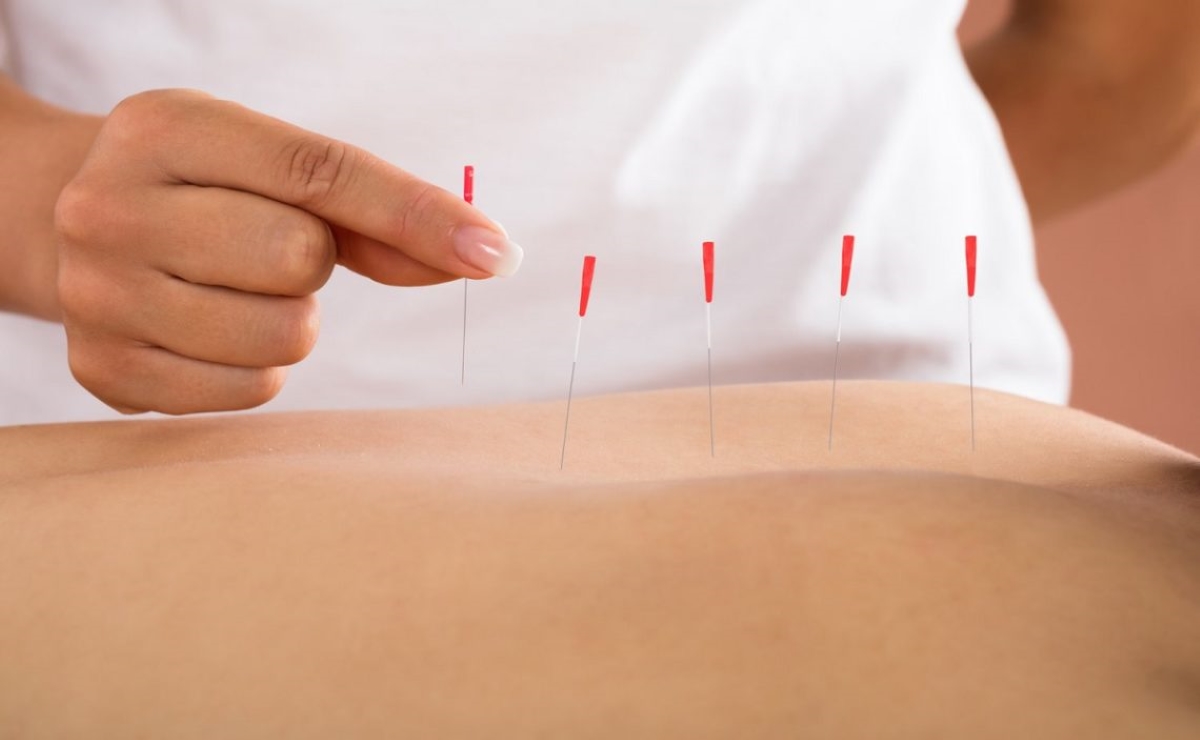

Welcome to the world of dry needling! Dry needling is a therapeutic technique that involves inserting thin needles into specific trigger points in the body to alleviate pain and promote healing. This practice has gained popularity in recent years for its effectiveness in treating musculoskeletal conditions such as chronic pain, muscle spasms, and sports-related injuries.

However, one common concern for individuals considering dry needling is whether it is covered by insurance. Understanding insurance coverage for this therapy is crucial, as it can help ease the financial burden and ensure that you receive the necessary treatment without depleting your savings.

In this article, we will delve into the world of insurance coverage for dry needling. We will explore the importance of insurance coverage, factors to consider when choosing an insurance company, and provide a list of insurance companies that cover dry needling. Additionally, we will share valuable tips for navigating insurance coverage and shed light on common misconceptions surrounding this topic.

So, if you’ve been wanting to try dry needling but are unsure about insurance coverage, fear not! By the end of this article, you’ll be armed with the knowledge and confidence to make informed decisions regarding your insurance coverage for dry needling.

Understanding Dry Needling

Dry needling is a technique that is used by healthcare professionals, such as physical therapists or chiropractors, to relieve pain and improve musculoskeletal function. Contrary to acupuncture, which is rooted in Chinese medicine and focuses on balancing the body’s energy flow, dry needling is based on the principles of modern Western medicine.

The practice of dry needling involves inserting thin, hollow needles into specific points in the body known as trigger points. These trigger points are tight knots or bands of muscle that can cause pain, restricted range of motion, and other musculoskeletal issues. By inserting a needle into a trigger point, the healthcare professional aims to release tension, reduce pain, improve blood flow, and stimulate the body’s natural healing response.

During a dry needling session, the practitioner will carefully insert the needles into the appropriate trigger points, often targeting areas near the site of pain or dysfunction. The needles used are typically much thinner than those used for injections and are designed to minimize discomfort during the procedure.

Once the needles are inserted, the practitioner may gently manipulate or twirl them to stimulate the trigger points further. This can produce a localized twitch response, which is a brief, involuntary muscle contraction. While the twitch response may cause momentary discomfort, it is a positive sign that the trigger point is being effectively targeted.

The duration and frequency of dry needling sessions will vary depending on the individual’s condition and response to treatment. Some people experience immediate relief, while others may require several sessions to notice significant improvements. It’s important to communicate with your healthcare provider about your progress and any changes in symptoms to guide the treatment plan effectively.

Dry needling has shown promising results in treating a wide range of conditions, including chronic pain, muscle spasms, tendonitis, fibromyalgia, headaches, and sports injuries. While it is generally considered safe, it’s essential to receive dry needling from a licensed healthcare professional trained in this technique for optimal results and to minimize any potential risks.

Now that we have a solid understanding of what dry needling entails, let’s explore why insurance coverage for this therapy is significant.

The Importance of Insurance Coverage

Having insurance coverage for dry needling can make a significant difference in your ability to access the therapy and receive the necessary treatment without financial strain. Here are a few reasons why insurance coverage is important:

1. Affordability: Dry needling sessions can be costly, especially when multiple sessions are required for optimal results. Insurance coverage helps alleviate the financial burden by reducing out-of-pocket expenses, allowing you to receive the recommended number of sessions without breaking the bank.

2. Accessibility: Insurance coverage increases accessibility to dry needling services. With coverage, you can choose from a broader network of healthcare providers who offer dry needling, increasing the chances of finding a qualified practitioner near you.

3. Continuity of care: If you require ongoing dry needling treatments as part of your overall healthcare plan, having insurance coverage ensures continuity of care. You won’t have to worry about interruptions in your treatment due to financial constraints.

4. Peace of mind: Knowing that you have insurance coverage for dry needling provides peace of mind. It eliminates the worry and stress of trying to pay for the therapy out-of-pocket, allowing you to focus on your healing and recovery.

5. Preventive care: In some cases, dry needling can be used as a preventive measure to address potential musculoskeletal issues before they become chronic or debilitating. With insurance coverage, you may have access to preventive care benefits that can help you proactively manage your musculoskeletal health.

6. Improved treatment outcomes: When you have insurance coverage for dry needling, you are more likely to receive consistent and timely treatment. This can lead to improved treatment outcomes, reduced pain, enhanced functionality, and a better overall quality of life.

Now that we understand the importance of insurance coverage for dry needling, let’s explore the factors you should consider when choosing an insurance company.

Factors to Consider when Choosing an Insurance Company

When it comes to choosing an insurance company that provides coverage for dry needling, there are several factors to consider. Here are some key factors to keep in mind:

1. In-network providers: Check if the insurance company has a network of healthcare providers who offer dry needling services. In-network providers often have negotiated rates with the insurance company, resulting in lower out-of-pocket costs for you.

2. Coverage details: Review the insurance policy to understand the specific details of the coverage for dry needling. Look for information on the number of sessions covered, any limitations or restrictions, and whether a referral or pre-authorization is required.

3. Cost of coverage: Consider the cost of the insurance plan, including the monthly premiums, deductibles, co-pays, and co-insurance. Evaluate how the cost aligns with your budget and healthcare needs.

4. Provider qualifications: Ensure that the insurance company’s network includes qualified healthcare providers who have the necessary training and experience in dry needling. Check if the providers are licensed, certified, and have a good reputation.

5. Customer service: Evaluate the insurance company’s customer service reputation. Can you easily reach them for inquiries or assistance? Do they have a responsive and helpful customer support team?

6. Additional coverage benefits: Consider other coverage benefits offered by the insurance company. For example, some insurance plans may include coverage for related therapies or services, such as physical therapy or chiropractic care, which can complement the benefits of dry needling.

7. Network size and accessibility: Assess the size and accessibility of the insurance company’s network. A larger network generally provides more options for healthcare providers, flexibility in choosing a practitioner, and easier access to care.

8. Reputation and financial stability: Research the insurance company’s reputation and financial stability. Look for customer reviews, ratings from independent rating agencies, and information about the company’s financial health. A stable and reputable insurance company is more likely to fulfill its commitments and provide reliable coverage.

By considering these factors, you can make an informed decision when choosing an insurance company that best fits your needs for dry needling coverage. Now, let’s explore some insurance companies that are known to cover dry needling.

Insurance Companies that Cover Dry Needling

While insurance coverage for dry needling may vary depending on the specific insurance plan and region, several insurance companies are known to provide coverage for this therapy. Here are some prominent insurance companies that often cover dry needling:

- Blue Cross Blue Shield (BCBS): BCBS is a widely recognized insurance provider that often includes coverage for dry needling as part of its physical therapy benefits. However, coverage may vary depending on the specific plan and state.

- Cigna: Cigna is another insurance company that commonly covers dry needling. It is important to review the policy details to understand the specific coverage limits and requirements.

- Aetna: Aetna is known to offer coverage for dry needling, typically as part of its physical therapy or chiropractic care benefits. As always, it is advisable to check the plan details for coverage specifics.

- UnitedHealthcare: UnitedHealthcare is a major insurance provider that often includes coverage for dry needling. However, coverage may be subject to certain conditions and limitations outlined in the policy.

- Humana: Humana is another insurance company that may cover dry needling, particularly as part of its physical therapy benefits. It is important to review the policy details to confirm the coverage specifics.

It’s important to keep in mind that insurance coverage can vary widely among different plans offered by these companies, so it’s essential to review the policy details or contact the insurance provider directly to confirm the coverage and any requirements.

In addition to these insurance companies, it’s worth exploring other regional or local insurance providers in your area, as they may also provide coverage for dry needling. Consulting with your healthcare provider or contacting the insurance company directly can help you clarify the coverage details specific to your individual policy.

Now that we have explored some insurance companies that commonly cover dry needling, let’s delve into some tips for navigating insurance coverage for this therapy.

Tips for Navigating Insurance Coverage for Dry Needling

Navigating insurance coverage for dry needling can sometimes be confusing and overwhelming. To help you make the most of your insurance benefits, here are some useful tips to consider:

- Review your insurance policy: Carefully review your insurance policy to understand the coverage for dry needling. Look for any specific limitations, requirements, or conditions that need to be met in order to receive coverage.

- Contact your insurance provider: If you have any doubts or questions about your coverage or need clarification, don’t hesitate to contact your insurance provider. They can provide you with accurate information and guide you through the process.

- Get a referral if needed: Some insurance plans may require a referral from your primary care physician or a specialist before receiving coverage for dry needling. Ensure that you follow this requirement if it applies to your policy.

- Choose an in-network provider: Opt for an in-network healthcare provider who is covered by your insurance plan. This can help reduce your out-of-pocket costs and ensure that you receive the maximum coverage available to you.

- Document your treatment plan: Keep records of your dry needling sessions, including any medical documentation, invoices, and receipts. This documentation can be useful for reimbursement claims or for reference in case of any disputes with the insurance company.

- Submit claims promptly: If your insurance policy allows for reimbursement, make sure to submit your claims in a timely manner. Delaying the submission of claims may result in longer processing times or potential claim denials.

- Stay informed: Stay updated on any changes to your insurance policy, including coverage limits, network providers, and any updates to the terms and conditions. This can help you make informed decisions and prevent any surprises when seeking coverage for dry needling.

- Advocate for yourself: If you encounter any challenges or issues with your insurance coverage for dry needling, advocate for yourself. Keep detailed records of any communication and escalate the matter to higher levels within the insurance company if necessary.

Remember, each insurance plan is unique, and the coverage for dry needling can vary. By following these tips and being proactive in understanding your policy, you can navigate the insurance coverage process more effectively and ensure that you receive the benefits you are entitled to.

Now, let’s address some common misconceptions about insurance coverage for dry needling.

Common Misconceptions about Insurance Coverage for Dry Needling

Despite the growing popularity of dry needling as a therapeutic technique, there are still several misconceptions surrounding insurance coverage for this treatment. Let’s debunk some common misconceptions:

1. Dry needling is not covered by insurance: This is a common misconception. While insurance coverage for dry needling may vary depending on the specifics of your insurance plan, there are many insurance companies that do provide coverage for this therapy. It’s important to review your policy and contact your insurance provider to understand your coverage options.

2. All insurance plans cover dry needling: While many insurance companies cover dry needling, not all insurance plans will include this therapy as a covered benefit. The coverage may depend on the specific plan or the region in which you live. Reviewing your policy and contacting your insurance provider will help you understand whether dry needling is covered under your plan.

3. Dry needling is always billed separately from other services: Some individuals believe that dry needling is always billed separately from other services, leading to additional expenses. While separate billing may occur in some cases, it is not always the norm. Dry needling may be billed as part of a broader treatment session, such as physical therapy or chiropractic care. Understanding how billing works for dry needling will help you avoid unnecessary surprises.

4. Insurance coverage for dry needling is unlimited: Unfortunately, insurance coverage for dry needling is not always unlimited. Many insurance plans have specific limits on the number of sessions or a predetermined dollar amount for this therapy. It is vital to review your insurance policy to understand any coverage limits and work with your healthcare provider to develop a treatment plan that aligns with your coverage.

5. Out-of-network providers are not covered: While it is generally more cost-effective to choose an in-network provider for insurance coverage, some insurance plans offer out-of-network benefits. This means that you may still receive coverage for dry needling, albeit at a different reimbursement rate. If you prefer to see an out-of-network provider, contact your insurance provider to understand your coverage and potential reimbursement options.

6. Insurance coverage for dry needling requires a medical necessity: While some insurance plans may require medical necessity documentation for coverage, it is not always a universal requirement. Each insurance plan has its own guidelines and criteria for coverage. It’s important to familiarize yourself with your policy to understand any specific requirements and work with your healthcare provider to meet them if necessary.

By debunking these misconceptions, you can have a clearer understanding of insurance coverage for dry needling. Remember that specific coverage details may vary depending on your insurance plan, so it’s essential to consult your policy and communicate directly with your insurance provider to get accurate and up-to-date information.

Now, let’s wrap up our discussion.

Conclusion

Insurance coverage for dry needling is an important consideration for individuals seeking this therapeutic technique to address musculoskeletal issues and improve their overall well-being. While coverage may vary depending on the insurance plan and region, it is reassuring to know that many insurance companies do provide coverage for dry needling.

Understanding the importance of insurance coverage for dry needling is crucial in alleviating financial strain and ensuring accessibility to necessary treatments. By choosing an insurance company that covers dry needling and considering factors such as in-network providers, coverage details, and cost, you can make informed decisions about your insurance choices.

Remember to review your insurance policy, contact your insurance provider for clarification, and understand any limitations or requirements associated with coverage. Keep track of your treatment records and promptly submit any necessary claims to maximize your benefits.

While there are some common misconceptions regarding insurance coverage for dry needling, it’s important to dispel these myths and approach the topic with accurate information. Insurance coverage for dry needling is not a one-size-fits-all scenario, and understanding the specifics of your insurance plan is key to navigating the coverage process effectively.

In conclusion, with the right knowledge, research, and communication, you can navigate insurance coverage for dry needling and access the therapy you need to address your musculoskeletal concerns. Remember to advocate for yourself and stay informed about any changes to your insurance policy.

Now that you are equipped with the information and tips provided in this article, you can confidently explore your insurance options and make informed decisions regarding your coverage for dry needling. Don’t let misconceptions hold you back from accessing this effective and transformative therapy.

So, take the next step, consult with your insurance provider, and embark on your journey to pain relief, improved function, and better overall musculoskeletal health through dry needling.