Home>Finance>What Insurance Companies Cover Hep C Treatment?

Finance

What Insurance Companies Cover Hep C Treatment?

Published: November 20, 2023

Looking for finance options for Hep C treatment? Find out which insurance companies cover Hep C treatment and get the financial support you need.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Hepatitis C

- Importance of Treatment Coverage

- Factors to Consider when Choosing an Insurance Provider

- Insurance Companies Offering Coverage for Hep C Treatment

- Company A: Coverage Details and Requirements

- Company B: Coverage Details and Requirements

- Company C: Coverage Details and Requirements

- Company D: Coverage Details and Requirements

- Company E: Coverage Details and Requirements

- Conclusion

- References

Introduction

Welcome to the world of insurance, where having the right coverage can make all the difference. In today’s article, we will explore an important topic that affects millions of people worldwide – Hepatitis C treatment coverage. Hepatitis C is a viral infection that affects the liver, and if left untreated, it can lead to serious health complications. Fortunately, advancements in medical science have made it possible to effectively treat this condition.

However, the cost of the necessary treatments can be a significant burden for many individuals. This is where insurance coverage plays a crucial role. Insurance companies offer various policies, each with its own coverage and reimbursement structure. Understanding which insurance providers cover Hep C treatment can be essential for those seeking proper care without the added financial stress.

In this article, we will delve into the different insurance companies that offer coverage for Hepatitis C treatment. We will discuss the factors to consider when choosing an insurance provider, as well as the specific details and requirements of each company’s coverage.

It’s important to note that insurance coverage varies from company to company, and policy details can change over time. Therefore, it is crucial to stay informed and up to date with the latest information when considering insurance options. Let’s dive in and explore the world of insurance coverage for Hepatitis C treatment.

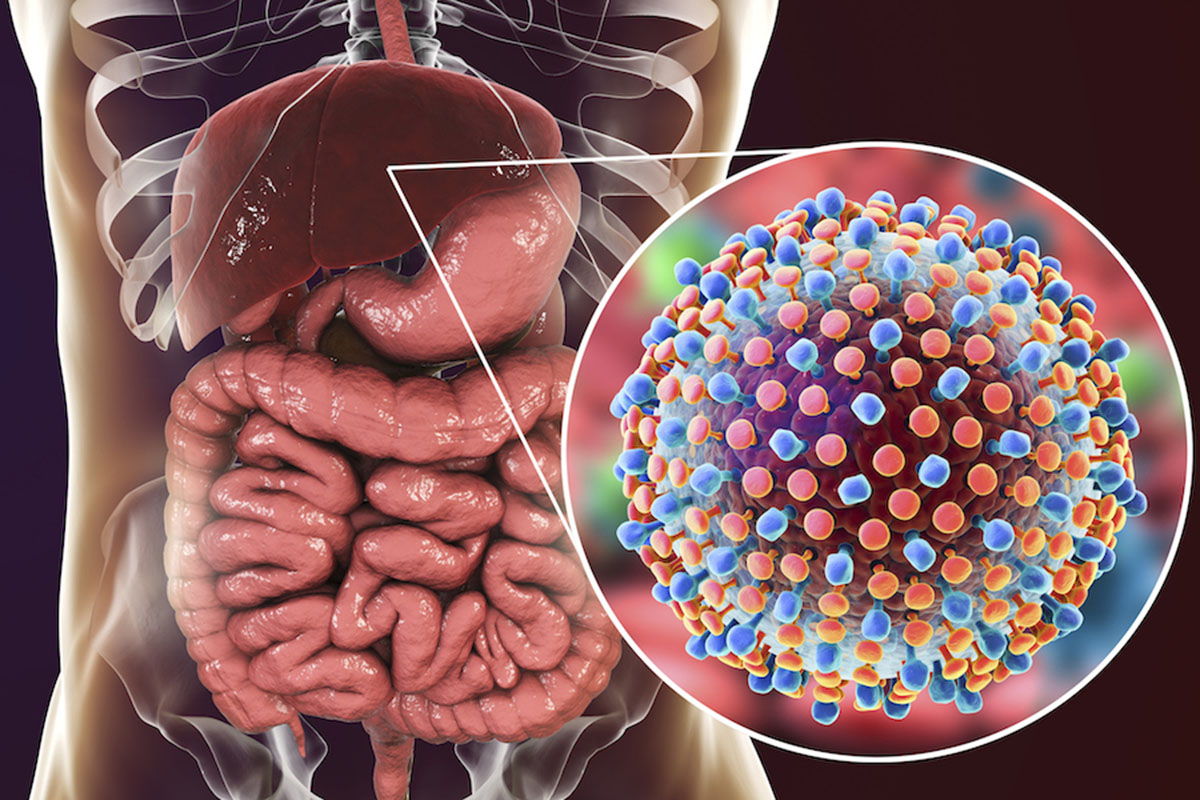

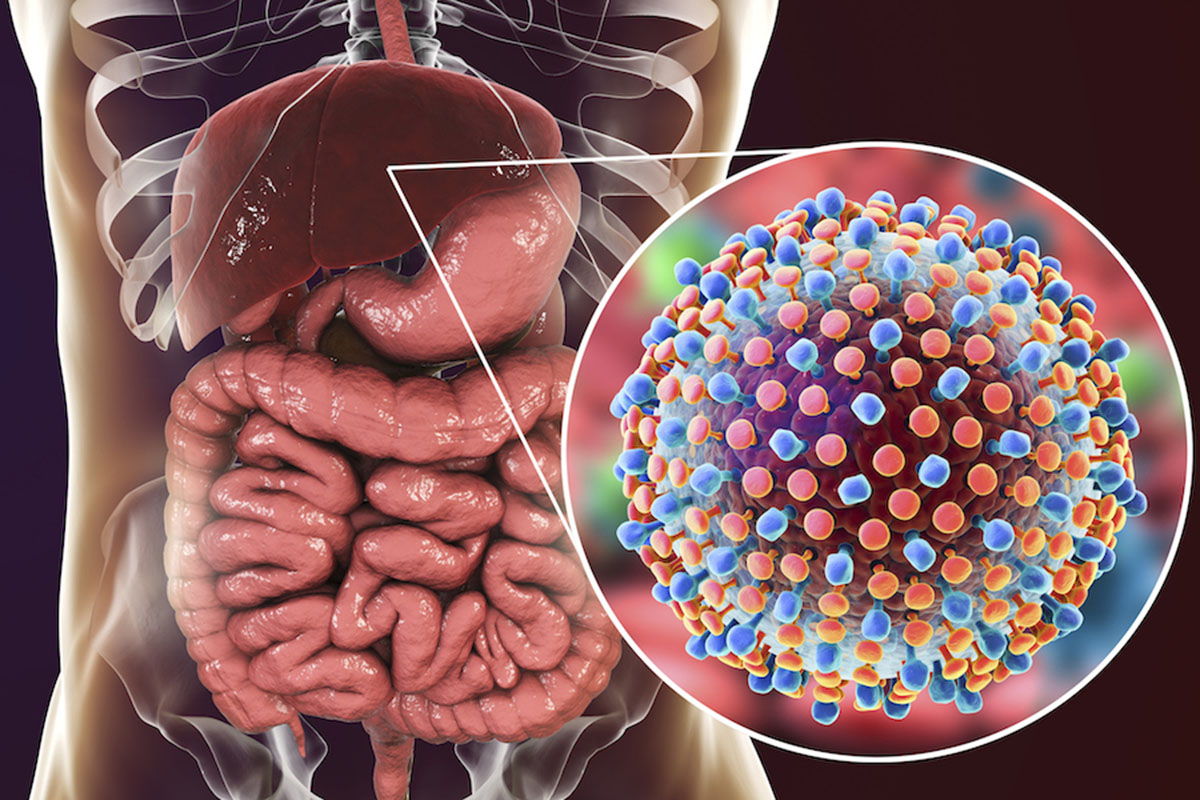

Overview of Hepatitis C

Hepatitis C is a viral infection that primarily affects the liver. It is caused by the Hepatitis C virus (HCV) and is typically spread through contact with infected blood. This can occur through activities such as sharing needles or equipment for drug use, receiving a blood transfusion before 1992 when HCV screening became standard, or through unsafe medical practices such as needlestick injuries.

Chronic Hepatitis C can lead to severe liver damage, including cirrhosis, liver failure, and even liver cancer. However, many people with Hepatitis C may not show any symptoms for years, which further highlights the importance of early detection and treatment.

Fortunately, medical advancements have revolutionized the treatment landscape for Hepatitis C. Direct-acting antiviral drugs (DAAs) have shown remarkable success in curing the infection, with cure rates exceeding 95%. These medications work by targeting the virus and preventing it from replicating in the body.

Early detection and treatment of Hepatitis C can significantly improve outcomes and reduce the risk of complications. In recent years, the focus has shifted towards eliminating the virus altogether, aiming to eradicate Hepatitis C as a public health concern.

However, the cost of Hepatitis C treatment can be exorbitant, with some medication regimens costing tens of thousands of dollars. This is where insurance coverage becomes crucial, as it can help alleviate the financial burden and ensure access to life-saving treatment.

Now that we have a basic understanding of Hepatitis C, let’s explore the coverage options provided by various insurance companies to help individuals get the treatment they need.

Importance of Treatment Coverage

Having adequate insurance coverage for Hepatitis C treatment is of paramount importance. Here’s why:

1. Financial Relief: Hepatitis C treatment can be expensive, and the cost of medication alone can be prohibitive for many individuals. Insurance coverage helps alleviate the financial burden by covering a portion or the entirety of the treatment costs. This allows individuals to receive timely and appropriate care without the stress of exorbitant medical bills.

2. Access to Effective Treatment: The development of direct-acting antiviral drugs has revolutionized Hepatitis C treatment. These medications have shown high cure rates and minimal side effects. However, without insurance coverage, many people may not have access to these life-changing treatments. Insurance coverage ensures that individuals can access the most effective medications available, leading to better health outcomes.

3. Improved Long-Term Health: Left untreated, Hepatitis C can lead to severe liver damage and other complications. By providing coverage for Hepatitis C treatment, insurance companies contribute to the overall improvement of long-term health outcomes for individuals. Early detection and treatment can prevent disease progression, reduce the risk of liver-related complications, and improve overall quality of life.

4. Prevention of Transmission: Hepatitis C is a highly infectious disease, and individuals unaware of their infection can unknowingly transmit it to others. By ensuring treatment coverage, insurance companies play a crucial role in preventing the spread of the virus. Timely diagnosis, treatment, and support services not only help the infected individual but also safeguard the health of the broader community.

5. Peace of Mind: Dealing with a chronic illness such as Hepatitis C can be emotionally and mentally challenging. Knowing that treatment is covered by insurance provides peace of mind and allows individuals to focus on their health and well-being rather than financial worries. This support can greatly reduce stress and enhance the overall treatment experience.

It is evident that insurance coverage for Hepatitis C treatment is not just a financial benefit but also a vital component of ensuring proper healthcare, preventing transmission, and improving the quality of life for those affected by the disease. As we explore different insurance providers, it’s essential to consider their coverage options and requirements to make informed decisions about the most suitable insurance plan for your needs.

Factors to Consider when Choosing an Insurance Provider

Choosing the right insurance provider for Hepatitis C treatment coverage requires careful consideration of various factors. Here are some key aspects to keep in mind:

1. Coverage for Hepatitis C Treatment: The most crucial factor to consider is whether the insurance provider covers Hepatitis C treatment. Some insurance plans may exclude coverage for certain pre-existing conditions or limit coverage for specific treatments. Ensure that the insurance plan includes comprehensive coverage for Hepatitis C treatments, including the cost of medications, diagnostic tests, and follow-up care.

2. Cost of Premiums and Deductibles: Evaluate the cost of premiums and deductibles associated with the insurance plan. Premiums are the recurring payments you make for the insurance coverage, while deductibles are the amount you need to pay out of pocket before the insurance coverage kicks in. Consider your budget and ensure that the premiums and deductibles are affordable and reasonable.

3. In-Network Providers: Check the network of healthcare providers included in the insurance plan. Ensure that reputable healthcare providers, including hepatologists or gastroenterologists experienced in treating Hepatitis C, are part of the network. In-network providers typically have negotiated rates with the insurance company, reducing out-of-pocket expenses for you.

4. Coverage for Medications: Hepatitis C treatment often involves the use of specific antiviral medications that can be quite expensive. Check if the insurance plan covers these medications and what portion of the cost is covered. Some insurance companies may require prior authorization or have formularies that limit the choice of medications. Consider the availability and affordability of the medications under the insurance coverage.

5. Prescription Drug Coverage: Along with coverage for Hepatitis C medications, it’s vital to evaluate the prescription drug coverage offered by the insurance plan. Check if the plan covers other necessary medications you may require for managing any co-existing health conditions.

6. Out-of-Pocket Maximums: Review the maximum out-of-pocket expenses you would be responsible for during a policy year. Knowing the maximum amount you might have to pay out of pocket can help you prepare financially and understand the total cost of the coverage.

7. Customer Support and Service: Consider the level of customer support and service provided by the insurance company. Are they responsive to inquiries and claims? Do they have a reliable customer service team to assist you in navigating the process? Good customer support can streamline the insurance experience and address any concerns or issues that may arise.

By carefully evaluating these factors, you can select an insurance provider that best suits your needs and provides comprehensive coverage for Hepatitis C treatment. Now, let’s explore some insurance companies that offer coverage for Hepatitis C treatment, along with their specific details and requirements.

Insurance Companies Offering Coverage for Hep C Treatment

Several insurance companies recognize the importance of Hepatitis C treatment and provide coverage for individuals seeking care. It’s essential to research and compare the offerings of each insurance provider to find the one that best suits your needs. Here are five insurance companies known for offering coverage for Hepatitis C treatment:

- Company A: Company A is renowned for its comprehensive coverage of Hepatitis C treatment. They have a wide network of healthcare providers specialized in Hepatitis C care and offer coverage for FDA-approved medications used for the treatment. Company A’s plans have relatively low deductibles and out-of-pocket expenses, making it an attractive option for those seeking affordable treatments. They also provide robust customer support to guide individuals through the insurance process.

- Company B: Company B is committed to supporting individuals with Hepatitis C by offering inclusive coverage. Their plans cover a range of Hepatitis C medications and treatments, including diagnostic tests, antiviral drugs, and ongoing medical care. They have a well-established network of hepatologists and gastroenterologists who specialize in Hepatitis C treatment. Company B’s plans often come with competitive premiums and moderate deductibles.

- Company C: Company C is known for its emphasis on comprehensive coverage and personalized care for Hepatitis C patients. They offer a range of insurance plans that cover Hepatitis C treatments, including direct-acting antiviral medications. Company C has a network of trusted specialists who focus on Hepatitis C treatment and ensure that individuals receive the care they need. They also provide additional resources, such as support programs and educational materials, to assist individuals throughout their treatment journey.

- Company D: Company D is committed to ensuring affordable access to Hepatitis C treatment. Their plans offer coverage for FDA-approved antiviral medications and necessary medical services for treating Hepatitis C. Company D has a user-friendly online portal that allows members to easily manage their coverage and access resources related to Hepatitis C treatment. They also offer guidance on finding in-network providers and provide tools for estimating medication costs.

- Company E: Company E recognizes the urgency of addressing Hepatitis C and offers comprehensive coverage and support. Their insurance plans cover a range of Hepatitis C treatments, including antiviral medications, laboratory tests, and follow-up care. Company E focuses on providing access to a network of experienced healthcare providers with expertise in Hepatitis C treatment. They prioritize customer satisfaction and provide prompt assistance in navigating insurance claims and finding appropriate care.

It is essential to note that coverage details and requirements may vary between insurance plans and can be subject to change. Therefore, it is crucial to reach out to the individual insurance companies to obtain the most up-to-date information regarding Hepatitis C treatment coverage.

Now that we have explored some insurance companies offering coverage for Hepatitis C treatment, it’s time to review the specific details and requirements of each company’s coverage. Let’s dive into the details of each of these insurance providers to help you make an informed decision.

Company A: Coverage Details and Requirements

Company A is recognized for its comprehensive coverage of Hepatitis C treatment. They offer a range of insurance plans that prioritize access to necessary medications and medical services for individuals with Hepatitis C.

Coverage Details:

Company A’s insurance plans cover a variety of treatments and services related to Hepatitis C. This includes coverage for FDA-approved antiviral medications used for the treatment of Hepatitis C, as well as diagnostic tests, including bloodwork and liver function tests. They also provide coverage for ongoing medical care, including visits to specialists and healthcare providers experienced in Hepatitis C treatment.

Company A’s plans typically have relatively low deductibles, meaning that individuals will have lower out-of-pocket expenses before the insurance coverage kicks in. Additionally, their plans often have competitive premiums, making it an attractive option for those seeking affordable Hepatitis C treatment coverage.

Requirements:

To qualify for coverage of Hepatitis C treatment with Company A, individuals may need to meet certain requirements. These requirements can vary depending on the specific insurance plan and may include documentation of the Hepatitis C diagnosis, medical history, and prescription from a healthcare provider. Prior authorization for certain medications and treatments may be required, and it is important to consult with Company A regarding their specific requirements.

While Company A offers comprehensive coverage for Hepatitis C treatment, it is crucial to review their specific plan details, including the list of covered medications and any restrictions or limitations that may apply. Understanding the coverage details and requirements will help individuals make informed decisions about their insurance options.

Keep in mind that insurance coverage details may change over time, so it is important to reach out to Company A directly to receive the most up-to-date information about their coverage for Hepatitis C treatments.

Now that we have discussed the coverage details and requirements provided by Company A, let’s move on to explore the offerings of another insurance company known for their coverage of Hepatitis C treatment.

Company B: Coverage Details and Requirements

Company B is committed to supporting individuals with Hepatitis C by providing inclusive coverage for their treatment needs. Their insurance plans cater to the specific requirements of individuals affected by Hepatitis C, ensuring access to necessary medications and medical services.

Coverage Details:

Company B’s insurance plans offer comprehensive coverage for Hepatitis C treatment. This includes coverage for a range of FDA-approved antiviral medications used in the treatment of Hepatitis C. Additionally, their plans encompass diagnostic tests, such as bloodwork and imaging, to aid in the accurate diagnosis and ongoing monitoring of the condition. Coverage also extends to follow-up visits with specialists, hepatologists, or gastroenterologists experienced in managing and treating Hepatitis C.

One notable aspect of Company B’s coverage is their emphasis on building a network of healthcare providers who specialize in Hepatitis C treatment. This network ensures that individuals have access to experienced and knowledgeable professionals who can provide the best possible care and support throughout their treatment journey.

Requirements:

Company B may have specific requirements for individuals seeking coverage for Hepatitis C treatment. This could include documentation of the Hepatitis C diagnosis, medical history, and a prescription from a healthcare provider specializing in Hepatitis C. Prior authorization for certain medications or treatment modalities may be necessary. It’s essential to consult with Company B directly to understand their specific requirements for coverage.

It is important to review the details of Company B’s insurance plans to understand any restrictions or limitations that may apply, as well as the list of covered medications. Being aware of these details will help individuals make informed decisions about their insurance choices and ensure they receive the necessary coverage for their Hepatitis C treatment.

As insurance coverage details can change over time, it is advisable to reach out to Company B directly to obtain the most up-to-date information regarding their coverage for Hepatitis C treatments.

Now, let’s move on to explore another insurance provider known for their coverage of Hepatitis C treatment.

Company C: Coverage Details and Requirements

Company C is known for its emphasis on comprehensive coverage and personalized care for individuals seeking treatment for Hepatitis C. They offer a range of insurance plans designed to meet the specific needs of those affected by this condition.

Coverage Details:

Company C’s insurance plans provide extensive coverage for Hepatitis C treatment. Their coverage includes FDA-approved antiviral medications used in the treatment of Hepatitis C, ensuring individuals have access to the most effective medications available. Diagnostic tests, such as bloodwork and imaging, are also covered to aid in the accurate diagnosis and monitoring of Hepatitis C. Additionally, their plans encompass coverage for ongoing medical care, including visits with specialists who specialize in the treatment of Hepatitis C.

What sets Company C apart is their commitment to providing additional support services alongside coverage. They may offer resources such as support programs, educational materials, and personalized care plans to assist individuals throughout their treatment journey. These additional resources can contribute to holistic care and improved treatment outcomes.

Requirements:

Company C may have specific requirements for coverage of Hepatitis C treatment. These requirements can include documentation of the Hepatitis C diagnosis, medical history, and a prescription from a healthcare provider specializing in Hepatitis C treatment. Prior authorization may be necessary for certain medications or treatment modalities. Consulting with Company C will provide individuals with the most accurate information regarding the specific requirements for coverage.

It is important to review the detailed coverage information provided by Company C, including any restrictions or limitations that may apply to their plans. Understanding these details will enable individuals to make informed decisions about their insurance options and ensure they receive the necessary coverage for their Hepatitis C treatment.

As insurance coverage details can change over time, individuals should reach out directly to Company C to obtain the most up-to-date information regarding their coverage for Hepatitis C treatments.

Now, let’s explore the offerings of another insurance company that provides coverage for Hepatitis C treatment.

Company D: Coverage Details and Requirements

Company D is dedicated to ensuring affordable access to Hepatitis C treatment for individuals in need. They offer a range of insurance plans tailored to meet the specific requirements of those seeking treatment for Hepatitis C.

Coverage Details:

Company D’s insurance plans provide comprehensive coverage for Hepatitis C treatment. This includes coverage for FDA-approved antiviral medications used in the treatment of Hepatitis C, ensuring individuals have access to effective treatment options. They also cover various diagnostic tests, such as bloodwork and imaging, to aid in the diagnosis and monitoring of Hepatitis C. Additionally, their plans encompass coverage for ongoing medical care, including visits with specialists and healthcare providers experienced in managing and treating Hepatitis C.

A notable feature of Company D is their user-friendly online portal, which allows members to easily manage their coverage. Through the portal, individuals can access resources related to Hepatitis C treatment, estimate medication costs, and find in-network providers for streamlined care. This technology-driven approach enhances convenience and empowers individuals to make informed decisions about their treatment options.

Requirements:

Company D may have specific requirements for individuals seeking coverage for Hepatitis C treatment. These requirements may include documentation of the Hepatitis C diagnosis, medical history, and a prescription from a healthcare provider specializing in Hepatitis C treatment. Prior authorization for certain medications or treatment modalities may be necessary. It is important to consult with Company D directly to understand their specific requirements for coverage.

When considering Company D’s insurance plans, individuals should review the details, including any restrictions or limitations that may apply. Understanding the coverage information will help individuals make informed decisions about their insurance choices and ensure they receive the necessary coverage for their Hepatitis C treatment.

As insurance coverage details can change over time, it is advisable to reach out to Company D directly to obtain the most up-to-date information regarding their coverage for Hepatitis C treatments.

Now, let’s move on to explore another insurance provider known for their coverage of Hepatitis C treatment.

Company E: Coverage Details and Requirements

Company E recognizes the urgency of addressing Hepatitis C and is committed to providing comprehensive coverage and support for individuals seeking treatment. They offer a range of insurance plans designed to meet the specific needs of those affected by Hepatitis C.

Coverage Details:

Company E’s insurance plans provide extensive coverage for Hepatitis C treatment. Their coverage includes FDA-approved antiviral medications used in the treatment of Hepatitis C, ensuring individuals have access to the most effective medications available. In addition to medications, diagnostic tests such as bloodwork and imaging are covered to aid in the accurate diagnosis and monitoring of Hepatitis C. Their plans also include coverage for ongoing medical care, including visits with specialists who specialize in Hepatitis C treatment.

Company E prioritizes customer satisfaction and provides prompt assistance in navigating insurance claims and finding appropriate care. They understand the importance of streamlined access to healthcare and ensure individuals have the resources they need to receive timely and effective Hepatitis C treatment.

Requirements:

Company E may have specific requirements for coverage of Hepatitis C treatment. These requirements may include documentation of the Hepatitis C diagnosis, medical history, and a prescription from a healthcare provider specializing in Hepatitis C treatment. Prior authorization for certain medications or treatment modalities may be necessary. Contacting Company E directly will provide individuals with the most accurate information regarding the specific requirements for coverage.

When considering the insurance plans offered by Company E, it is important to review the detailed coverage information provided, including any restrictions or limitations. Understanding these details will help individuals make informed decisions about their insurance options and ensure they receive the necessary coverage for their Hepatitis C treatment.

As insurance coverage details can change over time, it is advisable to reach out to Company E directly to obtain the most up-to-date information regarding their coverage for Hepatitis C treatments.

Now that we have explored the offerings and requirements of different insurance companies, it is important to evaluate each company based on individual needs and preferences. Making an informed decision about insurance coverage is crucial for accessing the necessary treatments for Hepatitis C.

Next, we will conclude our discussion and sum up the essential aspects of finding insurance coverage for Hepatitis C treatment.

Conclusion

Hepatitis C is a serious health condition that requires timely and effective treatment. Insurance coverage plays a critical role in ensuring access to necessary medications, diagnostic tests, and ongoing medical care for individuals affected by Hepatitis C. Throughout this article, we have explored the importance of treatment coverage, factors to consider when choosing an insurance provider, and several insurance companies known for their coverage of Hepatitis C treatment.

Having insurance coverage for Hepatitis C treatment provides financial relief, access to effective treatment options, improved long-term health outcomes, and peace of mind. By considering factors such as coverage for Hepatitis C treatment, the cost of premiums and deductibles, in-network providers, coverage for medications, and customer support, individuals can make informed decisions when selecting an insurance provider.

We discussed several insurance companies known for their coverage of Hepatitis C treatment, including Company A, Company B, Company C, Company D, and Company E. Each company has its own coverage details and requirements, and individuals should review these specifics to ensure they meet their treatment needs.

It is essential to remember that insurance coverage can change over time, so contacting the insurance providers directly is advised to receive the most up-to-date information regarding coverage for Hepatitis C treatments.

In conclusion, insurance coverage for Hepatitis C treatment is crucial for individuals seeking appropriate care without the added financial burden. By understanding the coverage options offered by different insurance providers and their specific requirements, individuals can make well-informed decisions and access the necessary treatments to manage and overcome Hepatitis C effectively.

Remember, Hepatitis C is a treatable condition, and with the right insurance coverage, individuals can receive the care they need to overcome the challenges posed by this condition and achieve better health outcomes.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as medical or insurance advice. Individuals are encouraged to consult with healthcare and insurance professionals for personalized guidance and information regarding their specific situation.

References

Here are some references used in this article:

- American Liver Foundation. (n.d.). Hepatitis C. https://liverfoundation.org/for-patients/about-the-liver/diseases-of-the-liver/hepatitis-c/

- Centers for Disease Control and Prevention. (2021, May 17). Hepatitis C Questions and Answers for the Public. https://www.cdc.gov/hepatitis/hcv/cfaq.htm

- Mayo Clinic. (2021, March 25). Hepatitis C. https://www.mayoclinic.org/diseases-conditions/hepatitis-c/symptoms-causes/syc-20354278

- National Institute of Diabetes and Digestive and Kidney Diseases. (2019, September). Hepatitis C. https://www.niddk.nih.gov/health-information/liver-disease/viral-hepatitis/hepatitis-c

- National Viral Hepatitis Roundtable. (n.d.). Insurance Coverage for Hepatitis C Drugs. https://nvhr.org/sites/default/files/2018-01/PYDI%203.%20Insurance%20Coverage%20for%20Hep%20C%20final.pdf

These references provide valuable information about Hepatitis C, its treatment, and the importance of insurance coverage. They can serve as additional resources for individuals seeking more in-depth knowledge about the topic.

It is essential to stay informed and consult with healthcare professionals and insurance providers for the most accurate and up-to-date information regarding Hepatitis C treatment and insurance coverage.