Finance

What Insurance Covers Hearing Aids?

Published: November 6, 2023

Looking for insurance coverage for hearing aids? Discover what finance options are available to help you afford this essential medical device.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the coverage for hearing aids under insurance

- Types of insurance that may cover hearing aids

- Health insurance

- Medicare

- Medicaid

- Veterans Administration (VA) Benefits

- Employer-sponsored insurance

- Private insurance plans

- Additional resources for obtaining hearing aid coverage

- Conclusion

Introduction

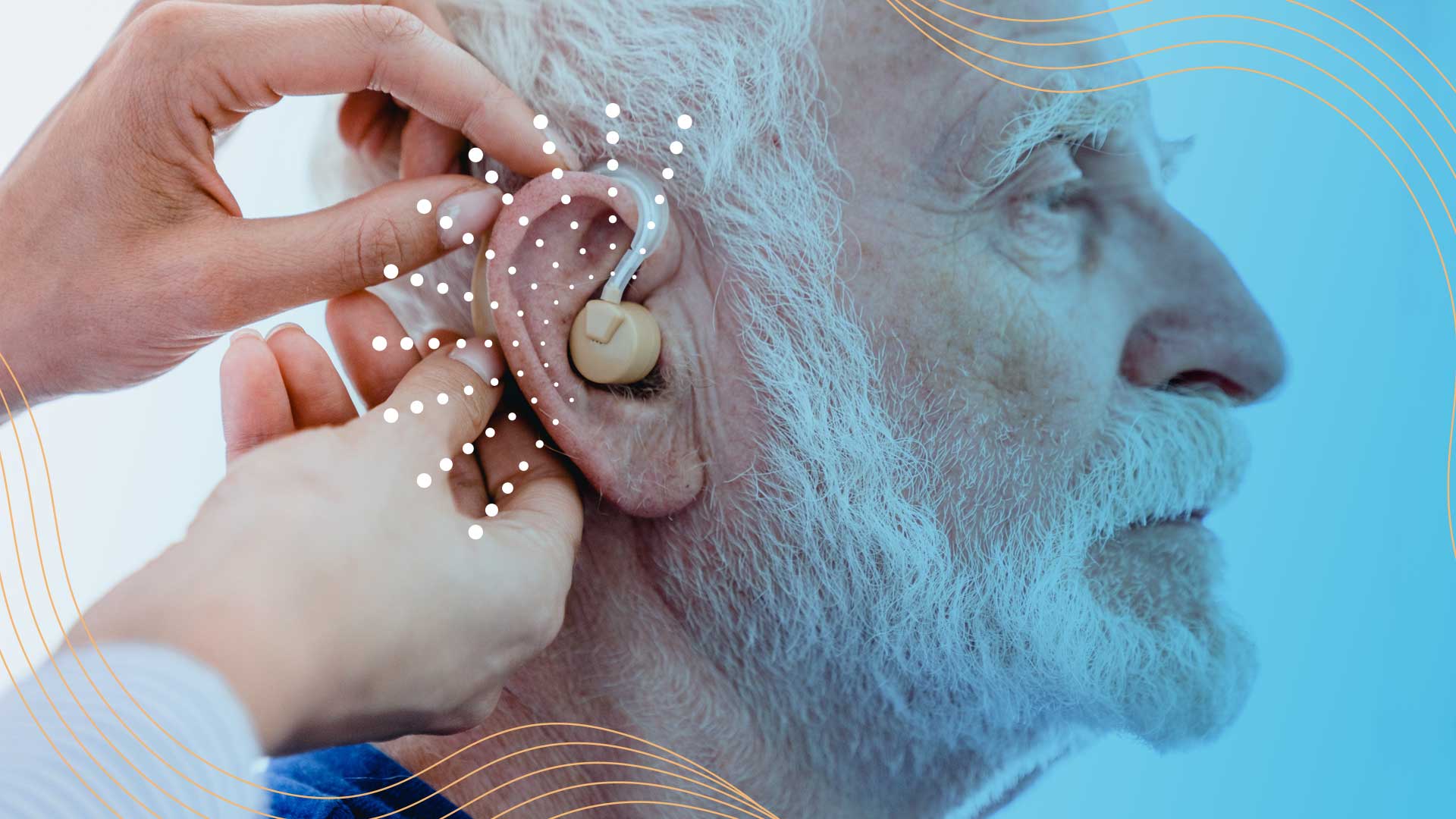

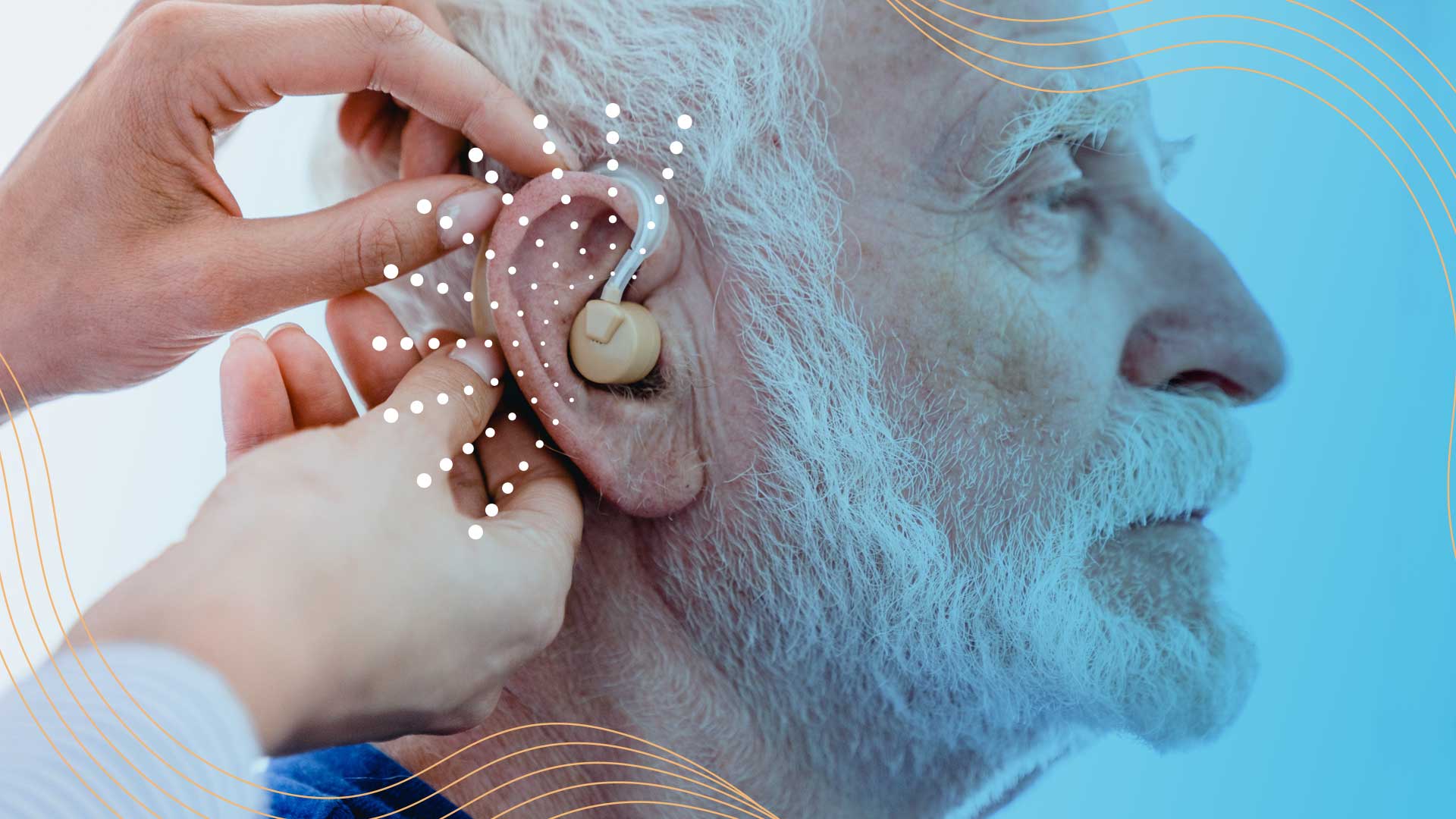

As hearing loss becomes a more common issue, the need for hearing aids has increased. However, hearing aids can be quite expensive, with costs ranging from a few hundred to several thousand dollars per device. This leaves many individuals wondering if their insurance will cover the cost of these essential devices. Understanding the coverage for hearing aids under insurance can help individuals navigate their options and explore potential avenues for financial assistance.

Insurance coverage for hearing aids can vary depending on the type of insurance policy and the specific terms and conditions. While some insurance plans provide partial or complete coverage for hearing aids, others may not provide any coverage at all. It is important for individuals to explore their insurance options and understand the coverage available to them.

In this article, we will explore the different types of insurance that may cover hearing aids, including health insurance, Medicare, Medicaid, Veterans Administration (VA) benefits, as well as employer-sponsored and private insurance plans. We will also provide additional resources for obtaining hearing aid coverage, ensuring that individuals have access to the necessary information to make informed decisions regarding their insurance coverage for hearing aids.

Understanding the coverage for hearing aids under insurance

Insurance coverage for hearing aids can be complex and varies depending on the insurance provider and policy. While some insurance plans may offer comprehensive coverage for hearing aids, others may provide limited coverage or exclude hearing aids altogether. It is crucial to understand the terms and conditions of your insurance policy to determine the level of coverage available to you.

When reviewing your insurance policy for hearing aid coverage, consider the following factors:

- Eligibility: Some insurance plans may require specific criteria to be met in order to qualify for hearing aid coverage. This may include a documented hearing loss diagnosis or a recommendation from a qualified healthcare professional.

- Limitations: Many insurance plans have limitations on coverage, such as a maximum benefit amount or a limit on the number of devices covered. It is important to be aware of these limitations to avoid any unexpected expenses.

- Co-pays and deductibles: Insurance plans often require individuals to pay a portion of the cost out-of-pocket in the form of co-pays or deductibles. Understanding these additional costs can help you budget for your hearing aid expenses.

- Network providers: Some insurance plans have a network of preferred providers, and coverage may be limited to these providers. If you have a specific hearing healthcare professional or clinic in mind, check if they are included in your insurance network.

It is essential to contact your insurance provider directly to inquire about the coverage for hearing aids and to clarify any questions or concerns you may have. They can provide you with specific information regarding your policy and any requirements or documentation needed to initiate a claim for hearing aid coverage.

If your insurance policy does not offer coverage for hearing aids or the coverage is limited, do not lose hope. There are other avenues to explore for financial assistance, which we will discuss in the following sections.

Types of insurance that may cover hearing aids

While insurance coverage for hearing aids may vary, there are several types of insurance that commonly offer coverage for these devices. Understanding these different types of insurance can help individuals determine if they have access to potential hearing aid coverage options.

Here are some types of insurance that may cover hearing aids:

- Health insurance: Many health insurance plans offer coverage for hearing aids as part of their overall coverage for healthcare services. It is important to review your health insurance policy or contact your insurance provider to understand the specific terms and conditions related to hearing aid coverage.

- Medicare: Original Medicare (Parts A and B) typically does not cover hearing aids or routine hearing exams. However, some Medicare Advantage (Part C) plans may provide coverage for hearing aids. It is crucial to review your specific Medicare plan or contact your plan provider for details regarding hearing aid coverage.

- Medicaid: Medicaid is a government-funded program that provides health coverage to individuals with low income. Medicaid coverage for hearing aids varies by state, with some states offering comprehensive coverage and others offering limited coverage or none at all. It is advisable to contact your state’s Medicaid office for information on hearing aid coverage under the program.

- Veterans Administration (VA) benefits: Veterans who receive care through the VA healthcare system may be eligible for hearing aid coverage. The VA offers comprehensive audiology services, including hearing aids, to eligible veterans. It is recommended that veterans contact their local VA healthcare facility to explore their options for hearing aid coverage.

- Employer-sponsored insurance: Many employer-sponsored insurance plans offer coverage for hearing aids as part of their employee benefits package. It is advisable to review your plan’s coverage details or contact your human resources department to inquire about hearing aid coverage options.

- Private insurance plans: Some private insurance plans specifically offer coverage for hearing aids. These plans may have different coverage options and requirements, so it is important to review the terms and conditions of your policy or contact your insurance provider to determine the extent of your hearing aid coverage.

Remember that the availability and extent of hearing aid coverage may vary within each of these insurance types. It is recommended to contact your insurance provider or explore the specific policies available to you to understand the coverage options in detail.

Health insurance

Health insurance plays a critical role in providing coverage for various healthcare services, including hearing aids. While not all health insurance plans cover hearing aids, many do offer some level of coverage to assist individuals in obtaining these essential devices.

When reviewing your health insurance policy for hearing aid coverage, consider the following:

- Coverage details: Review the specific terms and conditions related to hearing aid coverage in your health insurance policy. Some plans may provide full coverage for hearing aids, while others may offer partial coverage or have specific limitations.

- Deductibles and co-pays: Understand the portion of the cost that you are responsible for, such as deductibles and co-pays. These out-of-pocket expenses can vary depending on your insurance plan.

- In-network providers: Determine if your health insurance has a network of preferred providers for hearing aids. Choosing an in-network provider may result in reduced costs or enhanced coverage. It is important to check if your preferred hearing healthcare professional or clinic is included in your insurance network.

- Documentation required: Some insurance plans may require specific documentation, such as a hearing test or a recommendation from a healthcare provider, to approve coverage for hearing aids. Familiarize yourself with any paperwork or requirements needed to initiate a claim.

- Plan limitations: Be aware of any limitations within your health insurance plan, such as a cap on the total benefit amount or a limit on the number of devices covered. Understanding these limitations will help you manage your expectations and plan accordingly.

If your health insurance does not offer coverage for hearing aids or the coverage is limited, consider exploring other avenues for assistance, such as alternate insurance plans, governmental programs like Medicaid, or other resources specifically dedicated to hearing aid coverage.

Remember to contact your health insurance provider directly to obtain precise information about the hearing aid coverage available under your specific policy. They can guide you through the claims process and address any questions or concerns you may have regarding your coverage.

Medicare

Medicare is a federal health insurance program primarily available for individuals aged 65 and older. While Medicare provides coverage for various healthcare services, the coverage for hearing aids is limited under Original Medicare (Parts A and B).

Under Original Medicare, routine hearing exams and hearing aids are generally not covered. However, it is important to note that coverage may vary depending on the specific Medicare Advantage (Part C) plan that you have chosen. Medicare Advantage plans are offered by private insurance companies approved by Medicare.

If you are enrolled in a Medicare Advantage plan, it is advisable to review the plan’s details and contact the provider directly to inquire about hearing aid coverage. Some Medicare Advantage plans may offer coverage or discounts for hearing aids, while others may include additional benefits like hearing exams or discounts on related services.

Alternatively, you may have the option to purchase supplemental insurance known as Medigap (Medicare Supplement Insurance) to help cover the costs not covered by Original Medicare. Medigap plans are offered by private insurance companies and can provide additional coverage for services like hearing aids. However, the availability and extent of hearing aid coverage through Medigap plans may vary, so it is important to review the specific details of the plan.

To understand the hearing aid coverage available to you under Medicare, it is crucial to review your individual plan or contact the plan provider directly. They can provide you with detailed information about your coverage options and any requirements or limitations that may apply.

Additionally, if you have a low income and limited resources, you may be eligible for the Extra Help program, also known as the Low-Income Subsidy (LIS). This program helps individuals with limited income pay for their prescription drugs, including hearing aids and related devices. Contact the Social Security Administration or visit their website to determine if you qualify for this assistance program.

Remember to explore all available options to ensure you make the most informed decision regarding hearing aid coverage under Medicare.

Medicaid

Medicaid is a joint federal and state program that provides health coverage to individuals with low income. The coverage and eligibility requirements for hearing aids under Medicaid vary from state to state. While Medicaid is required to cover certain medically necessary services, including hearing-related services, the extent of coverage for hearing aids may differ.

To determine if Medicaid covers hearing aids in your state, it is important to contact your state’s Medicaid office or visit their website. They can provide you with information on the specific requirements, limitations, and processes for obtaining hearing aid coverage.

Here are some key points to consider regarding Medicaid coverage for hearing aids:

- State-specific coverage: Each state has its own rules and regulations regarding Medicaid coverage for hearing aids. Some states offer comprehensive coverage, while others may provide limited coverage or none at all. It is essential to research the coverage specific to your state.

- Eligibility requirements: Medicaid eligibility is primarily based on income and other factors. To qualify for Medicaid coverage for hearing aids, you may need to meet certain income and asset criteria and provide documentation of your hearing loss diagnosis.

- Managed care plans: Some states have Medicaid managed care plans for the administration of Medicaid benefits. If you are enrolled in a managed care plan, it is important to understand the specific coverage and procedures related to hearing aids.

- Prior authorization and documentation: Medicaid may require prior authorization for hearing aid coverage. This typically involves submitting detailed documentation, such as a hearing evaluation report or a recommendation from a qualified healthcare professional. Familiarize yourself with the requirements and procedures for obtaining prior authorization.

If you qualify for Medicaid and require hearing aids, it is essential to follow the specific procedures and guidelines outlined by your state’s Medicaid office. They can provide guidance on how to access hearing aid coverage and may be able to connect you with approved providers or resources in your area.

Remember to stay informed about any updates or changes to Medicaid coverage for hearing aids in your state, as policies can evolve over time.

Veterans Administration (VA) Benefits

The Veterans Administration (VA) provides comprehensive healthcare benefits to eligible veterans, including coverage for hearing aids. If you are a veteran enrolled in the VA healthcare system, you may have access to hearing aid coverage through the VA.

The VA offers a range of audiology services, including hearing exams, evaluations, and the provision of hearing aids. Here are some key points to understand about VA benefits for hearing aids:

- Eligibility: To be eligible for VA benefits, you must be a veteran who meets specific criteria, such as having served in the military and receiving an honorable discharge. Enrollment in the VA healthcare system is typically required to access hearing aid coverage.

- Audiology services: The VA provides comprehensive audiology services, including hearing evaluations and the fitting and provision of hearing aids. The VA’s team of audiologists will work with you to determine the most appropriate hearing aids for your individual needs.

- Coverage: The VA generally provides coverage for hearing aids for eligible veterans. However, the specific details of the coverage may vary depending on factors such as your service-connected disability status and the availability of hearing aid models through the VA system.

- Process: To access hearing aid coverage through the VA, you will typically need to schedule an audiology appointment at your local VA healthcare facility. The audiologist will assess your hearing needs and guide you through the process of obtaining and fitting hearing aids.

- Additional services: In addition to hearing aids, the VA may offer additional services related to hearing health, including assistive listening devices, auditory rehabilitation, and ongoing support and maintenance for your hearing aids.

If you are a veteran and have questions or need more information about hearing aid coverage through the VA, it is recommended to contact your local VA healthcare facility. They can guide you through the process, provide information about the specific benefits available to you, and schedule any necessary appointments for hearing evaluation and aid selection.

Remember to take advantage of the resources and benefits offered by the VA to ensure you receive the necessary support for your hearing health as a veteran.

Employer-sponsored insurance

Many individuals receive health insurance coverage through their employers as part of their employee benefits package. Employer-sponsored insurance plans can vary significantly in terms of coverage and benefits, including coverage for hearing aids.

Here are some key points to consider regarding employer-sponsored insurance and its potential coverage for hearing aids:

- Review your plan: Take the time to carefully review the details of your employer-sponsored insurance plan. Look for information specifically related to hearing aid coverage, including any limits or restrictions.

- Check with human resources: Reach out to your company’s human resources department to inquire about hearing aid coverage. They can answer specific questions about your plan and provide guidance on eligibility requirements and the claims process.

- Network providers: Employer-sponsored insurance plans often have a network of preferred providers. Find out if your preferred hearing healthcare professional or clinic is within the network, as this can impact coverage and costs.

- Cost sharing: Familiarize yourself with any deductibles, co-pays, or co-insurance amounts associated with hearing aid coverage. Understanding your financial responsibility will help you budget for the cost of acquiring hearing aids.

- Additional benefits: Some employer-sponsored insurance plans may offer additional benefits, such as discounts or assistance programs, to help offset the cost of hearing aids. Be sure to explore any available resources provided by your employer.

If your current employer-sponsored insurance plan does not provide coverage for hearing aids, consider discussing with your employer the possibility of adding or enhancing this benefit. Employers may be open to negotiating coverage options, especially if it can positively impact employee well-being and productivity.

Remember to reach out to your employer’s human resources department or insurance provider directly to obtain accurate and up-to-date information about hearing aid coverage under your specific employer-sponsored insurance plan.

Private insurance plans

Private insurance plans are policies that individuals can purchase directly, often through an insurance provider or broker. These plans may offer coverage for a wide range of healthcare services, including hearing aids.

When it comes to private insurance plans and their coverage for hearing aids, there are a few key points to consider:

- Review your policy: Carefully review the details of your private insurance policy to determine if it includes coverage for hearing aids. Look for specific language or sections related to hearing aids and related services.

- Speak with your insurance provider: Contact your insurance provider directly to inquire about hearing aid coverage. They can provide you with information about the specific terms and conditions, any limitations, and the claims process.

- Out-of-pocket expenses: Understand your financial responsibility when it comes to hearing aid coverage. Review any deductibles, co-pays, or co-insurance amounts that may apply, as well as any annual or lifetime coverage limits.

- Preferred providers: Private insurance plans often have networks of preferred providers. Check if your preferred hearing healthcare professional or clinic is within the network, as choosing an in-network provider may result in reduced costs or enhanced coverage.

- Coverage for different types of hearing aids: Some private insurance plans may have specific coverage guidelines for different types of hearing aids, such as digital or implantable devices. Understand the coverage options available for the specific hearing aids you require.

- Additional benefits: Private insurance plans may offer additional benefits or discounts related to hearing aids. Explore any supplementary services or resources provided by your insurance plan that can help offset the cost of hearing aids.

Private insurance plans can vary in terms of coverage, so it is essential to review your policy and contact your insurance provider for precise information regarding hearing aid coverage under your specific plan. They can guide you through the process and answer any questions you may have.

Remember to keep an open line of communication with your insurance provider and explore all available options to ensure that you make the best possible use of your private insurance plan for hearing aid coverage.

Additional resources for obtaining hearing aid coverage

In addition to insurance coverage, there are other resources available to assist individuals in obtaining coverage for hearing aids. These resources can provide financial assistance or connect individuals with programs specifically designed to support their hearing healthcare needs.

Here are some additional resources to consider:

- Non-profit organizations: There are various non-profit organizations dedicated to providing financial assistance and support for hearing aid coverage. These organizations may offer grants, loans, or other forms of financial aid to individuals in need. Research and reach out to these organizations to explore potential assistance options.

- State assistance programs: Some states offer assistance programs to help individuals access hearing aids. These programs may be income-based or offered through state departments of health or social services. Contact your local government office or explore their websites for information on available assistance programs.

- Audiology clinics and universities: Local audiology clinics and universities may have programs or initiatives that provide hearing aids at reduced costs or on a sliding scale based on income. Reach out to these institutions to inquire about any programs or partnerships they may have in place to assist individuals with hearing aid coverage.

- Hearing aid manufacturers: Some hearing aid manufacturers offer their own programs to support individuals in obtaining hearing aids. These programs may include discounts, financing options, or charitable initiatives to help those in need. Research different manufacturers and reach out to them directly to inquire about any available programs.

- Community resources: Local community resources, such as charitable foundations, service organizations, or fundraisers, may provide assistance for hearing aid coverage. Stay connected with your community and explore opportunities for support.

By tapping into these additional resources, individuals experiencing hearing loss can increase their chances of accessing the necessary financial assistance or support needed to obtain hearing aids. It is important to research and reach out to these resources to explore the available options and determine eligibility requirements.

Remember to be proactive in seeking assistance and exploring all potential avenues to secure hearing aid coverage that fits your individual needs and circumstances.

Conclusion

Having comprehensive insurance coverage for hearing aids can make a significant difference in the lives of individuals experiencing hearing loss. While not all insurance plans provide full coverage for hearing aids, it is important to explore the options available to obtain the necessary assistance.

Understanding the coverage for hearing aids under insurance is crucial. Whether it’s health insurance, Medicare, Medicaid, Veterans Administration (VA) benefits, employer-sponsored insurance, or private insurance plans, each type of insurance has its own set of coverage guidelines and requirements.

If your insurance does not provide coverage or the coverage is limited, there are additional resources available. Non-profit organizations, state assistance programs, audiology clinics, and universities, hearing aid manufacturers, and community resources can offer financial assistance or access to reduced-cost hearing aids.

It is recommended to review your insurance policy, contact your insurance provider, and explore alternative resources to ensure you have the information needed to make informed decisions about hearing aid coverage.

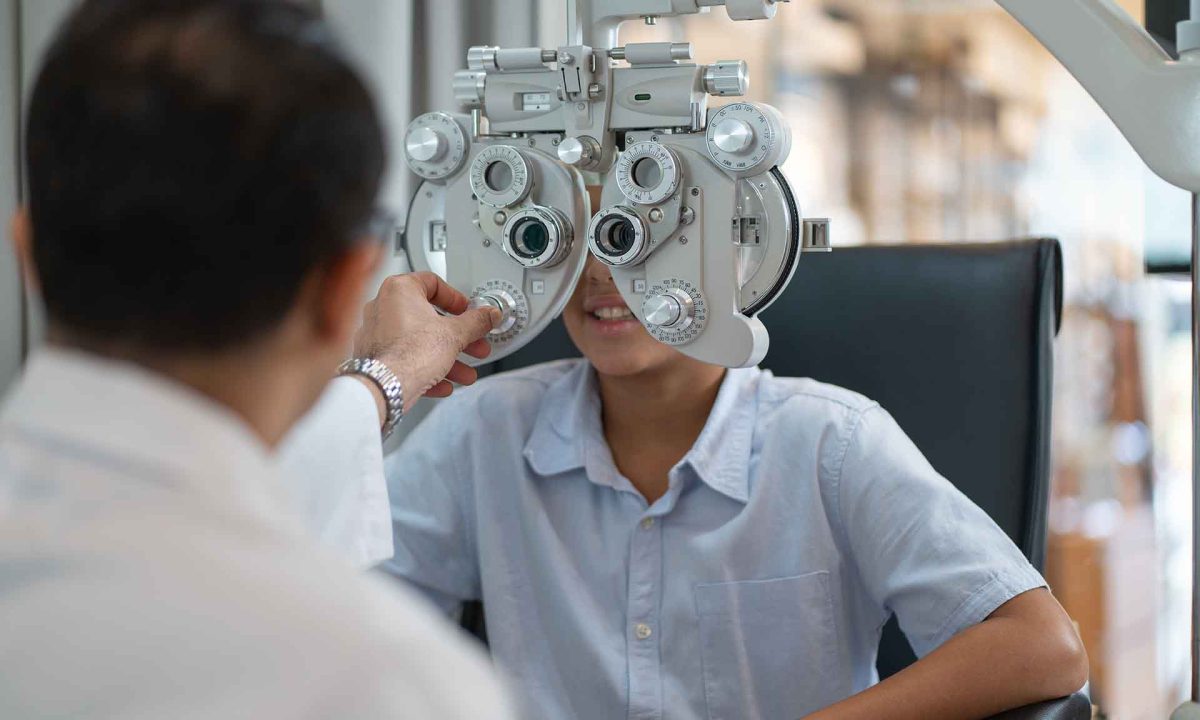

Remember, obtaining the right hearing aids is not just about insurance coverage. It is also important to consult with a qualified hearing healthcare professional who can assess your specific needs and recommend the most suitable hearing aids for you.

By being proactive, thorough, and resourceful, individuals can improve their chances of obtaining the assistance they need to enhance their hearing and overall quality of life.