Home>Finance>Why Is The Amount Of Debt In A Companys Capital Structure Important To The Financial Analyst

Finance

Why Is The Amount Of Debt In A Companys Capital Structure Important To The Financial Analyst

Modified: December 29, 2023

Understand the significance of debt in a company's capital structure and its role in financial analysis. Gain valuable insights into finance and capital allocation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of financial analysis, where understanding a company’s capital structure is crucial for evaluating its financial health and stability. One of the key components of a company’s capital structure is debt. Debt plays a significant role in determining the financial position of a company and has a direct impact on its ability to generate profits and meet its obligations.

Debt, in simple terms, refers to the borrowed funds that a company utilizes to finance its operations or make investments. It can take various forms, such as bank loans, bonds, or lines of credit. By incorporating debt into its capital structure, a company aims to leverage its financial resources and potentially enhance its returns for shareholders.

Understanding the importance of a company’s capital structure is essential because it influences its risk profile, financial stability, and future growth prospects. Financial analysts are often tasked with assessing a company’s capital structure to determine its ability to sustain and grow its business in the long term. This analysis involves evaluating the amount of debt a company holds and its impact on various financial metrics.

In this article, we will explore why the amount of debt in a company’s capital structure is important to financial analysts. We will delve into the role of debt in the capital structure, its impact on financial analysis, and the significance of key debt-related ratios. By the end, you will have a comprehensive understanding of the importance of debt in analyzing a company’s financial health and performance.

Definition of Debt

Before we delve deeper into the importance of debt in a company’s capital structure, let’s first define what debt is. In finance, debt refers to an obligation or liability incurred by a company or individual to repay borrowed funds. When a company takes on debt, it essentially borrows money from lenders or investors and agrees to repay the principal amount with interest over a specified period of time.

Debt can take various forms, each with its own characteristics and terms. Some common types of debt instruments include:

- Bank Loans: These are loans provided by commercial banks to companies, usually with predetermined interest rates and repayment schedules.

- Bonds: Bonds are fixed-income securities issued by corporations or governments to investors. They represent a loan made by the investor to the issuer, who promises to pay periodic interest payments and repay the principal amount at maturity.

- Lines of Credit: A line of credit is a flexible borrowing arrangement in which a company can access funds as needed, up to a predetermined credit limit. Interest is only charged on the amount borrowed.

Debt serves as a source of financing that allows companies to fund their operations, make strategic investments, and fuel growth. However, it also comes with certain obligations and risks. Companies must repay the borrowed funds within the specified time frame and make regular interest payments, which can impact their cash flow and overall financial stability.

It’s important to distinguish between debt and equity, another key component of a company’s capital structure. While debt represents borrowed money that must be repaid, equity represents ownership in a company and is reflected as shareholders’ equity on the balance sheet. Equity holders do not have the same obligation to repay their investment as debt holders.

Now that we have a clear understanding of what debt entails, let’s explore the importance of debt in a company’s capital structure and its role in financial analysis.

Importance of Capital Structure

Capital structure refers to the way a company finances its operations and investments by combining debt and equity. It is a crucial aspect of financial management as it determines the risk profile, financial stability, and cost of capital for a company. Achieving an optimal capital structure is essential for maximizing shareholder value and ensuring long-term sustainability.

Here are some key reasons why capital structure is important:

- Financial Stability: A well-balanced capital structure helps maintain financial stability for a company. By incorporating an appropriate mix of debt and equity, a company can ensure it has access to the necessary funding to meet its obligations and weather economic downturns.

- Risk Management: Capital structure plays a critical role in managing risk. By spreading the risk between debt and equity holders, a company can reduce its overall financial risk. Debt holders have a legal right to repayment, which can provide a cushion for equity holders if the company faces financial difficulties.

- Cost of Capital: The cost of capital is the return required by investors to provide funds to a company. The capital structure affects the cost of capital, as debt generally carries a lower cost compared to equity. Incorporating an appropriate amount of debt in the capital structure can help reduce the average cost of capital, making it more affordable for the company to finance its operations and investments.

- Tax Advantages: Debt financing offers tax advantages that can benefit companies. Interest payments on debt are tax-deductible expenses, which can lower a company’s taxable income and ultimately reduce its tax liability. This makes debt financing an attractive option for companies looking to optimize their tax strategy.

- Flexibility: Having a diverse capital structure gives companies more flexibility in managing their financial resources. It provides options for raising funds through debt or equity depending on market conditions, capital requirements, and the company’s growth strategy.

Understanding and analyzing a company’s capital structure is essential for financial analysts as it provides insights into the risk and financial stability of the company. By evaluating the composition of a company’s capital structure, analysts can assess its ability to generate profits, meet its obligations, and make sound investment decisions.

Next, we will explore the role of debt within a company’s capital structure and how it impacts financial analysis.

Role of Debt in a Company’s Capital Structure

Debt plays a crucial role in a company’s capital structure by providing a source of financing that can fuel growth and optimize the use of financial resources. It represents the borrowed funds that a company utilizes to meet its financial needs and strategic objectives. Understanding the role of debt within a company’s capital structure is essential for financial analysts to evaluate the company’s risk profile, financial health, and profitability.

Here are some key roles of debt in a company’s capital structure:

- Financing Operations and Investments: Debt allows companies to access capital beyond their existing resources. By borrowing funds, companies can finance their day-to-day operations, expand their business, invest in new projects, and acquire assets. This enables companies to take advantage of growth opportunities and maximize shareholder value.

- Enhancing Returns on Equity: Debt can amplify the returns for equity holders. When a company utilizes debt financing to invest in projects or assets that generate higher returns than the cost of borrowing, the remaining profits accrue to equity shareholders. This phenomenon, known as financial leverage, magnifies the gains for equity holders but also increases the risk.

- Tax Shield: Interest payments on debt are tax-deductible expenses for companies. As a result, debt financing provides a tax shield that reduces a company’s taxable income and lowers its overall tax liability. This tax advantage makes debt an attractive financing option and can contribute to increased profitability and cash flows.

- Influencing Cost of Capital: The capital structure of a company affects its cost of capital. Debt financing typically carries lower costs compared to equity financing due to the tax shield and the presence of collateral. By incorporating debt in the capital structure, companies can reduce their average cost of capital, making it more cost-effective to finance their operations and investments.

- Influencing Financial Risk: Debt introduces financial risk to a company’s capital structure. Unlike equity, debt holders have a legal claim on company assets and the right to receive repayment. This increases the financial obligations of the company and can create financial distress if the company experiences cash flow difficulties. Therefore, it is crucial for analysts to carefully assess the level of debt to ensure it is sustainable and manageable.

By understanding the role of debt in a company’s capital structure, financial analysts can evaluate the implications of debt on financial performance, risk, and profitability. Analyzing key debt-related ratios and metrics can provide valuable insights into the company’s ability to meet its financial obligations and generate sustainable returns for its shareholders.

Next, we will explore the impact of debt on financial analysis and the significance of key debt-related ratios.

Impact of Debt on Financial Analysis

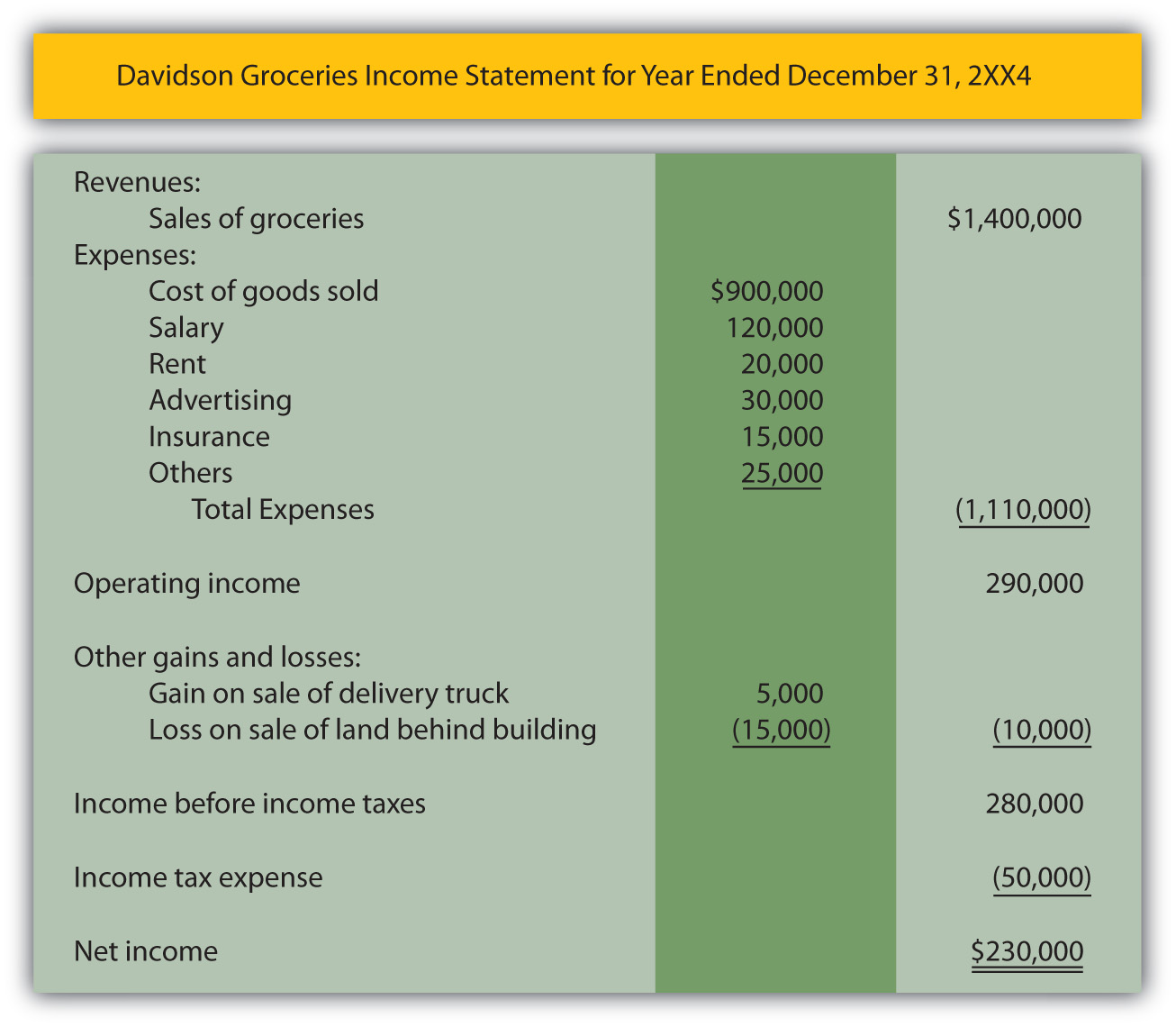

Debt has a significant impact on financial analysis as it affects various key financial metrics and ratios. Analyzing the amount of debt and its impact on a company’s financials is crucial for financial analysts to accurately assess the company’s risk profile, profitability, and financial health. Let’s explore some of the key areas where debt influences financial analysis:

- Leverage and Solvency Ratios: Debt affects leverage ratios, such as the debt-to-equity ratio and the debt ratio, which measure the proportion of debt relative to a company’s equity or total assets. These ratios provide insights into the company’s leverage and risk profile. Higher debt levels increase these ratios, indicating higher financial risk and potential difficulties in meeting financial obligations.

- Profitability Ratios: Debt can impact profitability ratios such as return on assets (ROA) and return on equity (ROE). Debt financing can enhance returns for equity holders through financial leverage, but it also requires interest payments, which reduce the company’s net income. Financial analysts need to assess whether the company’s profitability is sufficiently high to cover the interest expense.

- Interest Coverage Ratio: The interest coverage ratio measures a company’s ability to meet its interest payments. A high ratio indicates a company’s ability to comfortably cover its interest expenses, while a low ratio suggests potential difficulties in meeting interest obligations. Analysts use this ratio to evaluate how the company’s earnings can cover its interest expenses.

- Cash Flow Analysis: Debt impacts a company’s cash flow due to interest and principal repayments. Financial analysts evaluate a company’s cash flow generation capability to determine if it can meet its debt obligations and fund future growth. A significant portion of operating cash flows being allocated to debt repayment may limit the amount of cash available for other purposes.

- Debt Maturity Profile: The maturity profile of a company’s debt plays a critical role in its financial analysis. Assessing the distribution of debt maturities allows analysts to estimate the company’s repayment obligations and evaluate its ability to refinance or pay off debt when it becomes due.

- Debt Covenant Analysis: Debt agreements often include certain terms and restrictions called debt covenants. Financial analysts need to analyze the covenants to understand any limitations imposed on the company’s operations, investments, or financial decisions. Violating these covenants could have severe consequences, such as accelerating debt repayment or triggering default.

By considering the impact of debt on these financial analysis metrics, analysts can assess the company’s financial risk, stability, and ability to generate sustainable returns. It is important to not only analyze the absolute amount of debt but also evaluate it in relation to the company’s industry benchmarks and peers.

Next, let’s delve into some of the key ratios and metrics used to assess a company’s debt position in financial analysis.

Debt-to-Equity Ratio

The debt-to-equity ratio is a key financial ratio used by analysts to assess the financial leverage and risk of a company. It compares a company’s total debt to its shareholders’ equity, which represents the ownership interest of shareholders in the company. This ratio helps determine the extent to which a company relies on debt financing compared to equity.

The formula to calculate the debt-to-equity ratio is as follows:

Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

A higher debt-to-equity ratio indicates that a company has a larger portion of its funding from debt sources, which can increase financial risk. Conversely, a lower ratio suggests a lower reliance on debt financing, indicating a more conservative financial structure. However, the optimal debt-to-equity ratio varies across industries, and what may be considered high or low depends on the specific characteristics and risk tolerance of the industry.

Financial analysts use the debt-to-equity ratio to assess the company’s ability to meet its financial obligations and evaluate its overall financial health. Here are some key insights that can be gleaned from analyzing the debt-to-equity ratio:

- Risk Assessment: A higher debt-to-equity ratio suggests that the company has a higher level of financial risk. This is because an increasing proportion of the company’s assets are financed by debt, which means higher interest expenses and potential difficulties in meeting debt obligations.

- Financial Stability: A lower debt-to-equity ratio generally indicates a more stable financial position for the company. It suggests that the company relies less on borrowed funds and has a healthier balance between debt and equity financing. This may be preferred by lenders and investors as it signifies a lower risk of financial distress.

- Growth Potential: Companies with higher debt-to-equity ratios may be more aggressive in pursuing growth opportunities. By utilizing debt financing, they can invest in expansion, acquisitions, or R&D, potentially generating higher returns for shareholders. However, this strategy also carries higher financial risks.

- Comparative Analysis: Analyzing the debt-to-equity ratio of a company in comparison to its industry peers can provide insights into its financial position. If a company’s ratio is significantly higher or lower than its peers, this may indicate a unique financial strategy or financial health that warrants further investigation.

It’s important to note that the debt-to-equity ratio is just one metric to consider in financial analysis. It should be evaluated in conjunction with other ratios and measures to gain a comprehensive understanding of a company’s financial position.

Next, we will explore other key debt-related ratios that analysts commonly use in financial analysis.

Debt Coverage Ratios

Debt coverage ratios are a set of financial ratios used by analysts to assess a company’s ability to meet its debt obligations. They provide insights into the company’s ability to generate cash flow to cover its interest and principal payments. These ratios are essential for evaluating a company’s financial health and its capacity to manage its debt load effectively.

Here are some commonly used debt coverage ratios:

- Interest Coverage Ratio: The interest coverage ratio measures a company’s ability to cover its interest expenses. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expense. A higher ratio indicates a better ability to service the interest payments and suggests a lower risk of financial distress.

- Debt Service Coverage Ratio (DSCR): The DSCR measures a company’s ability to cover its total debt payments, including both interest and principal repayments. It is calculated by dividing a company’s operating income (EBITDA) by its total debt service payments. A DSCR above 1 indicates that the company generates sufficient cash flow to meet its debt obligations.

- Fixed Charge Coverage Ratio (FCCR): The FCCR is similar to the DSCR but includes other fixed charges, such as lease payments and preferred stock dividends. It measures a company’s ability to cover all of its fixed payment obligations. A higher FCCR indicates a stronger ability to meet its fixed financial obligations.

- Cash Flow to Debt Ratio: The cash flow to debt ratio compares a company’s operating cash flow to its total debt. It provides insights into the company’s ability to generate sufficient cash flow to service its debt. A higher ratio suggests a healthier financial position and a greater ability to handle debt obligations.

Analysts use debt coverage ratios to assess the financial risk and stability of a company. These ratios help determine if the company has the financial resources to meet its debt payments and whether it has a reasonable margin of safety. Additionally, they are often used by lenders and creditors to evaluate the creditworthiness of a company before extending further debt.

It’s important to analyze debt coverage ratios in conjunction with other financial metrics and the company’s specific circumstances. For example, certain industries may have higher debt tolerance or rely more on debt financing due to their capital-intensive nature. Therefore, it’s crucial to consider industry benchmarks and peer comparisons when evaluating these ratios.

Next, we will discuss the significance of debt maturity in financial analysis.

Significance of Debt Maturity

Debt maturity refers to the period of time over which a company is required to repay its outstanding debt. It is an important factor to consider in financial analysis as it affects a company’s cash flow, financial flexibility, and risk profile. Analyzing the debt maturity profile helps financial analysts evaluate a company’s ability to meet its debt obligations and manage its debt repayment schedule effectively.

Here are some key reasons why debt maturity is significant in financial analysis:

- Cash Flow Planning: Analyzing the debt maturity schedule allows analysts to assess the company’s cash flow requirements over time. By understanding when various debt obligations come due, analysts can forecast the cash flow needs of the company and evaluate its ability to generate sufficient cash flow to meet these obligations.

- Refinancing Risk: Debt maturity analysis helps assess the risk associated with refinancing. When debt reaches maturity, companies may face challenges in refinancing if market conditions are unfavorable or if there are changes in the company’s creditworthiness. High levels of debt maturing in a short period may indicate a higher risk of potential refinancing difficulties.

- Financial Flexibility: The debt maturity profile reflects a company’s financial flexibility. A well-diversified maturity schedule, with debts maturing at different intervals, provides the company with flexibility in managing its cash flow and refinancing options. A concentrated maturity schedule can limit the company’s options and increase the risk of liquidity constraints.

- Interest Rate Risk: Debt maturity analysis helps evaluate the company’s exposure to interest rate risk. If a significant portion of the debt is tied to variable interest rates, the company may face higher interest expenses if interest rates rise. Assessing the maturity profile can provide insights into the potential impact of changing interest rates on the company’s financials.

- Debt Capacity: The maturity profile can provide insights into a company’s debt capacity. A highly leveraged company with limited remaining debt capacity may face challenges in taking on additional debt or generating future growth. Analyzing the maturity profile helps determine whether a company has room for additional debt financing or if its current debt load may limit its financial flexibility.

Financial analysts evaluate the debt maturity profile to gain a comprehensive understanding of a company’s debt management practices and potential risks. A well-managed and appropriately diversified maturity schedule can enhance a company’s financial stability, while a concentrated or poorly managed maturity schedule may increase risk and affect the company’s long-term viability.

Continued financial analysis will address the important aspect of debt covenant analysis.

Debt Covenant Analysis

Debt covenant analysis is a crucial aspect of financial analysis that focuses on evaluating the terms and restrictions associated with a company’s debt agreements. Debt covenants are contractual provisions designed to protect lenders’ interests by setting limits on the company’s financial and operational activities. Analyzing and understanding these covenants helps financial analysts assess the company’s compliance with its debt obligations and evaluate its financial flexibility.

Here are some key points to consider in debt covenant analysis:

- Types of Covenants: Debt covenants can be broadly categorized into two types: affirmative covenants and negative (restrictive) covenants. Affirmative covenants specify actions that the company must take, such as regularly providing financial statements or maintaining specific insurance coverage. Negative covenants impose restrictions on the company’s actions, such as limitations on additional debt issuance or restrictions on asset sales.

- Impact on Operations: Debt covenants can significantly impact a company’s operations and financial decisions. They may restrict the company’s ability to undertake certain activities, such as making large capital expenditures, entering into new contracts, or paying dividends. It is crucial for analysts to understand the implications of these restrictions on the company’s growth prospects and financial flexibility.

- Compliance Monitoring: Analysts need to monitor the company’s compliance with its debt covenants on an ongoing basis. Any violations of the covenants can have serious consequences, such as triggering default, accelerating debt repayment, or giving lenders the right to seize collateral. Tracking covenant compliance provides insight into the company’s ability to meet its debt obligations and potential risks associated with non-compliance.

- Financial Reporting and Disclosure: Debt covenants often require companies to provide regular financial statements and other disclosures to lenders. Analysts can assess the company’s financial health and performance by reviewing these reports. Any discrepancies or issues raised in these reports may indicate potential covenant violations or financial difficulties.

- Covenant Flexibility: Some debt agreements may have provisions for amending or negotiating covenant terms if the company’s financial situation changes significantly. Financial analysts should evaluate the flexibility offered by the debt covenants to determine the company’s ability to respond to unforeseen circumstances or changing market conditions.

Debt covenant analysis is crucial for evaluating a company’s compliance with its debt agreements and understanding the impact of these provisions on its financial operations. It helps analysts assess the level of financial discipline, risk management, and restrictions imposed on the company by its debt providers.

Financial analysts must carefully review and understand all debt covenant terms and their implications on the company’s financial performance and strategic decisions. By doing so, they can evaluate the risks and constraints associated with the company’s debt obligations and make informed investment or lending decisions.

Next, we will explore the relationship between debt and the cost of capital.

Debt and Cost of Capital

The cost of capital is an essential concept in finance that refers to the return required by investors to provide funds to a company. It represents the cost incurred by the company to raise funds through different sources, including debt and equity. Debt plays a crucial role in determining the cost of capital for a company, as it influences the overall risk perception and financing structure.

Here are some key points to consider regarding the relationship between debt and the cost of capital:

- Debt and Cost of Debt: The cost of debt reflects the interest rate or yield that lenders require for providing funds to the company. Debt is typically less expensive than equity financing due to the presence of collateral and the tax-deductibility of interest payments. As a result, the cost of debt is generally lower than the cost of equity. Companies with lower debt levels or better credit ratings can typically secure debt at lower interest rates, reducing their overall cost of capital.

- Weighted Average Cost of Capital (WACC): The weighted average cost of capital is the average cost of debt and equity financing weighted by their respective proportions in the company’s capital structure. Debt contributes to the WACC calculation by reducing the overall cost of capital due to its lower cost compared to equity. A higher proportion of low-cost debt in the capital structure can significantly impact the WACC, making it more cost-effective for the company to finance its investments and operations.

- Capital Structure and WACC Optimization: Companies aim to optimize their capital structure to minimize the WACC and maximize shareholder value. By incorporating an optimal amount of debt in the capital structure, companies can reduce their overall cost of capital and increase their financial efficiency. However, this optimization requires a careful balance as excessive debt can lead to higher financial risk and potentially increase the cost of debt in the future.

- Risk Perception and Cost of Capital: Debt increases the financial risk perception of a company, which can impact the cost of capital. Lenders and investors demand higher returns for taking on the risk associated with debt financing. A higher amount of debt in the capital structure can raise the perceived risk of the company and increase its cost of capital. Analysts must evaluate the company’s ability to manage its debt load effectively to mitigate the risk and minimize the cost of capital.

- Market Conditions and Cost of Debt: The cost of debt can vary depending on market conditions, such as interest rate fluctuations and credit availability. Changes in market conditions can impact the borrowing costs for a company and thus influence the overall cost of capital. Financial analysts must consider the prevailing market conditions and their potential impact on the cost of debt when evaluating a company’s cost of capital.

Understanding the relationship between debt and the cost of capital is crucial for financial analysts. By evaluating the company’s capital structure, debt levels, and cost of debt, analysts can assess the overall cost of capital and its influence on the company’s financing decisions and profitability.

Next, let’s summarize the key points discussed in this article on the importance of debt in a company’s capital structure.

Conclusion

In conclusion, the amount of debt in a company’s capital structure plays a crucial role in financial analysis and evaluating a company’s financial health. Debt represents borrowed funds that a company utilizes to finance its operations, investments, and growth. Understanding the importance of debt in a company’s capital structure allows financial analysts to assess its risk profile, financial stability, and profitability accurately.

Throughout this article, we explored the various aspects related to debt and its significance in financial analysis. We discussed the definition of debt and its different forms, highlighted the importance of capital structure, and examined the role of debt within that structure. We also explored the impact of debt on financial analysis, including key ratios such as the debt-to-equity ratio and debt coverage ratios.

We further examined the significance of debt maturity, debt covenant analysis, and the relationship between debt and the cost of capital. Debt maturity analysis helps assess a company’s cash flow requirements and refinancing risk, while debt covenant analysis evaluates the terms and restrictions associated with debt agreements. Understanding the relationship between debt and the cost of capital allows analysts to assess the company’s overall cost of financing and its risk perception.

Financial analysts must consider all these factors collectively to form a comprehensive view of a company’s financial health and performance. By evaluating the amount of debt and its impact on various financial metrics, analysts can assess the company’s risk, financial stability, and ability to generate sustainable returns.

In conclusion, debt is a valuable financing tool that, when managed effectively, can enhance a company’s growth and profitability. However, excessive debt can increase financial risk and limit a company’s financial flexibility. Therefore, financial analysts need to carefully evaluate a company’s debt position within its capital structure and consider industry benchmarks and peer comparisons for a comprehensive assessment.

By gaining a deep understanding of the importance of debt in a company’s capital structure, financial analysts can make informed investment decisions, assess risks, and contribute to the long-term success of the company.