Home>Finance>How To Correct The Beginning Statement Balance In QuickBooks Online

Finance

How To Correct The Beginning Statement Balance In QuickBooks Online

Published: March 2, 2024

Learn how to correct the beginning statement balance in QuickBooks Online with our comprehensive finance tutorial. Simplify your accounting process today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Beginning Statement Balance in QuickBooks Online

When it comes to managing your finances, QuickBooks Online is a powerful tool that simplifies the process. One crucial aspect of using this platform effectively is ensuring that your beginning statement balance is accurate. This balance serves as the starting point for your financial records and plays a pivotal role in maintaining the integrity of your accounts.

By understanding the significance of the beginning statement balance and knowing how to rectify any discrepancies, you can streamline your financial management process and gain a clearer picture of your company’s financial health. In this article, we will delve into the intricacies of the beginning statement balance in QuickBooks Online, explore the common discrepancies that may arise, and provide actionable steps to correct and reconcile the balance effectively.

Whether you’re a seasoned user of QuickBooks Online or just getting started with the platform, having a solid grasp of the beginning statement balance is essential for maintaining accurate financial records and making informed business decisions. Let’s embark on this journey to demystify the beginning statement balance and equip you with the knowledge and tools to ensure the financial accuracy of your business.

Understanding Beginning Statement Balance

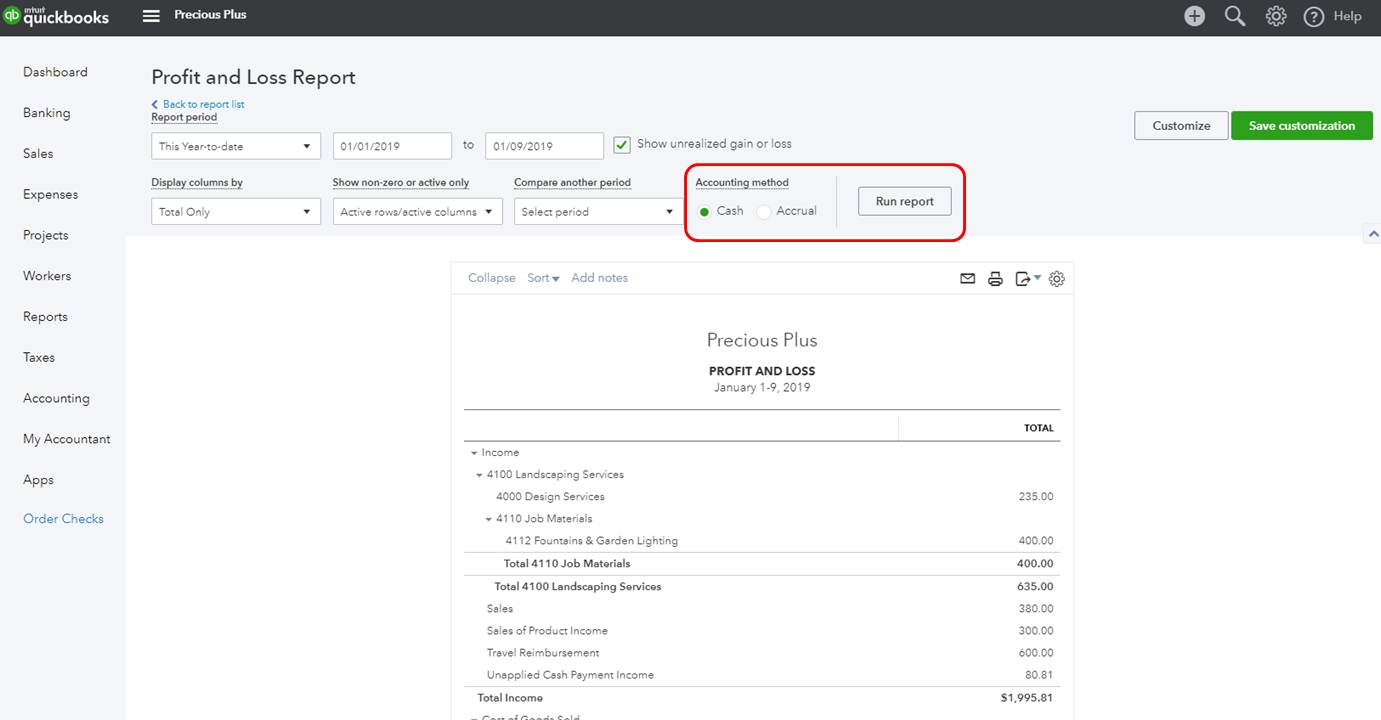

Before delving into the process of correcting the beginning statement balance in QuickBooks Online, it’s essential to grasp the fundamental concept of this crucial financial indicator. The beginning statement balance represents the starting point of your financial records for a specific account, typically a bank account or credit card. It reflects the balance on the account at the beginning of a designated accounting period, such as a month or a fiscal year.

When you initiate the process of reconciling an account in QuickBooks Online, the beginning statement balance serves as the reference point for comparing and verifying the accuracy of your recorded transactions against the actual transactions reflected in your bank or credit card statements. In essence, it sets the stage for aligning your internal financial records with the external records provided by your financial institution.

It’s important to note that discrepancies in the beginning statement balance can lead to inaccuracies in your financial records, potentially resulting in erroneous financial reporting and decision-making. Therefore, having a clear understanding of how the beginning statement balance is calculated and its implications is paramount for maintaining the integrity of your financial data.

In QuickBooks Online, the beginning statement balance is typically determined by the closing balance of the previous accounting period. This balance should ideally match the closing balance on the corresponding bank or credit card statement. However, factors such as unrecorded transactions, banking fees, and timing differences can contribute to disparities between the recorded beginning statement balance and the actual starting balance provided by the financial institution.

By comprehending the significance of the beginning statement balance and the potential factors that can affect its accuracy, you are better equipped to identify and address discrepancies, ensuring that your financial records align with the actual transactions and balances reflected by your financial institution.

Checking for Discrepancies

Before proceeding with the correction of the beginning statement balance in QuickBooks Online, it’s crucial to conduct a thorough assessment to identify any potential discrepancies. Discrepancies can arise due to various factors, including unrecorded transactions, banking fees, timing differences, and errors in data entry. Detecting and addressing these inconsistencies is essential for ensuring the accuracy of your financial records and the reconciliation process.

One of the primary steps in checking for discrepancies involves comparing the beginning statement balance in QuickBooks Online with the corresponding balance provided by your bank or credit card statement. If there is a variance between the two balances, it’s imperative to investigate the underlying causes of the disparity. This may entail reviewing the transaction history, scrutinizing the timing of recorded transactions, and confirming the inclusion of all relevant fees and charges.

Furthermore, examining the transaction details within the specified accounting period is crucial for identifying any unrecorded transactions that could contribute to discrepancies in the beginning statement balance. This entails meticulously reviewing the recorded transactions in QuickBooks Online and cross-referencing them with the transactions reflected in the bank or credit card statement. Any disparities should be carefully documented for further analysis and resolution.

Banking fees and charges can also impact the accuracy of the beginning statement balance. It’s essential to verify that all applicable fees levied by the financial institution are accurately recorded in QuickBooks Online. Failure to account for these fees can lead to discrepancies between the recorded balance and the actual starting balance provided by the bank or credit card statement.

Moreover, timing differences between the recording of transactions in QuickBooks Online and their reflection in the bank or credit card statement can contribute to discrepancies in the beginning statement balance. It’s crucial to align the timing of recorded transactions with the corresponding dates in the financial statements to ensure consistency and accuracy.

By meticulously examining the beginning statement balance, transaction history, banking fees, and timing of recorded transactions, you can effectively identify and document any discrepancies that require correction. This diligent assessment sets the stage for the subsequent steps in rectifying the beginning statement balance and reconciling your accounts with precision and confidence.

Correcting Beginning Statement Balance

Once discrepancies in the beginning statement balance in QuickBooks Online have been identified through a comprehensive assessment, the next crucial step is to initiate the correction process. Rectifying the beginning statement balance is essential for ensuring the accuracy of your financial records and laying the foundation for a successful reconciliation of your accounts.

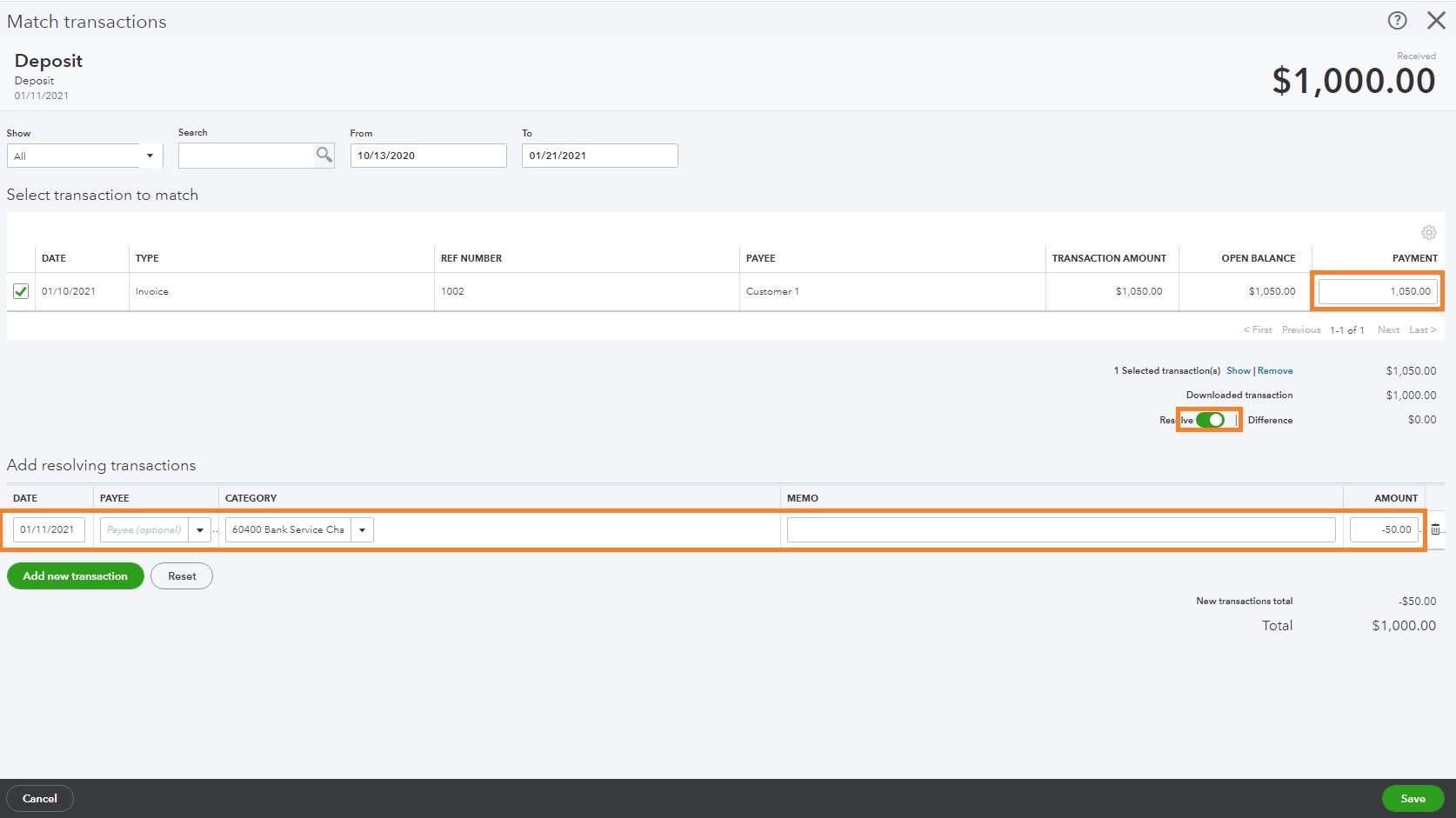

One of the primary methods for correcting the beginning statement balance involves addressing unrecorded transactions that may have contributed to the discrepancies. This entails meticulously reviewing the transaction history and identifying any transactions that were not initially recorded in QuickBooks Online. Once these transactions are identified, they should be accurately entered into the system to align the internal records with the actual transactions reflected in the bank or credit card statement.

Furthermore, if banking fees and charges were not accurately accounted for in the initial records, it is imperative to incorporate these fees into the financial data in QuickBooks Online. Verifying that all relevant fees and charges are accurately reflected in the system is essential for reconciling the beginning statement balance and ensuring the precision of your financial records.

Addressing timing differences in the recording of transactions is also crucial for correcting the beginning statement balance. Ensuring that the timing of recorded transactions aligns with the corresponding dates in the bank or credit card statement is essential for mitigating discrepancies and achieving an accurate beginning statement balance.

In some cases, errors in data entry or reconciliation may have contributed to inaccuracies in the beginning statement balance. It is essential to conduct a thorough review of the data entry process and the reconciliation procedures to identify and rectify any potential errors that may have impacted the accuracy of the beginning statement balance.

By systematically addressing unrecorded transactions, banking fees, timing differences, and potential errors in data entry or reconciliation, you can effectively correct the beginning statement balance in QuickBooks Online. This meticulous approach not only ensures the accuracy of your financial records but also sets the stage for a seamless reconciliation process, enabling you to maintain precise and reliable accounting records for your business.

Reconciling Accounts

Once the beginning statement balance in QuickBooks Online has been corrected and discrepancies have been addressed, the next critical step is reconciling your accounts to ensure that your internal financial records align with the external records provided by your financial institution. Reconciliation is a fundamental process that verifies the accuracy of your financial data and enhances the integrity of your accounting records.

The reconciliation process involves comparing the transactions and balances in your QuickBooks Online account with the corresponding transactions and balances in your bank or credit card statements. This meticulous comparison serves to identify any discrepancies and ensure that all recorded transactions are accurately reflected in both sets of records.

To initiate the reconciliation process, it is essential to meticulously review the transaction history in QuickBooks Online and cross-reference it with the transactions reflected in your bank or credit card statement. Any disparities should be carefully documented and investigated to ascertain the root causes and rectify the discrepancies effectively.

During the reconciliation process, it’s crucial to verify that all deposits, withdrawals, checks, and other transactions recorded in QuickBooks Online align with the transactions reflected in the bank or credit card statement. Any inconsistencies should be thoroughly examined and addressed to ensure the accuracy and completeness of your financial records.

Furthermore, reconciling accounts involves confirming that the closing balance in QuickBooks Online matches the closing balance provided by your financial institution. Any disparities in the closing balance should be meticulously reviewed and resolved to achieve a precise reconciliation of your accounts.

Throughout the reconciliation process, it’s essential to maintain meticulous documentation of any identified discrepancies and the corresponding corrective actions taken. This documentation serves as a vital record of the reconciliation process and provides valuable insights into the accuracy and reliability of your financial records.

By diligently reconciling your accounts, you can ensure the accuracy and integrity of your financial data, enabling you to make informed business decisions and maintain precise accounting records. The reconciliation process not only enhances the reliability of your financial records but also instills confidence in the financial health of your business.

Conclusion

Understanding and correcting the beginning statement balance in QuickBooks Online is a fundamental aspect of maintaining accurate financial records and ensuring the integrity of your accounting processes. By delving into the intricacies of the beginning statement balance and diligently addressing any discrepancies, you can fortify the foundation of your financial management and make informed decisions based on reliable data.

Throughout this journey, we’ve explored the significance of the beginning statement balance as the starting point for your financial records and the linchpin of the reconciliation process. We’ve delved into the common discrepancies that may arise, including unrecorded transactions, banking fees, timing differences, and errors in data entry, and outlined actionable steps to correct and reconcile the balance effectively.

By meticulously checking for discrepancies, rectifying the beginning statement balance, and reconciling your accounts with precision, you can instill confidence in the accuracy of your financial records and empower yourself to make informed business decisions based on reliable data. This meticulous approach not only enhances the reliability of your financial records but also streamlines your financial management processes, allowing you to focus on driving the success and growth of your business.

As you navigate the realm of financial management in QuickBooks Online, remember that attention to detail and a proactive approach to addressing discrepancies are key elements in maintaining the accuracy and integrity of your financial records. By leveraging the tools and insights provided by QuickBooks Online and adhering to best practices in financial management, you can establish a robust foundation for your business’s financial health and success.

Ultimately, the journey to correct the beginning statement balance and reconcile your accounts is a testament to your commitment to precision and excellence in financial management. By embracing this journey with diligence and determination, you are poised to elevate the financial integrity of your business and pave the way for informed decision-making and sustainable growth.