Finance

What Insurance Covers Ophthalmologist

Published: November 13, 2023

Finance your eye care with insurance plans that cover ophthalmologist visits and treatments. Find the right coverage for your vision needs today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Basics of Ophthalmology

- Understanding Insurance Coverage

- Comprehensive Eye Exams

- Treatment for Eye Conditions and Diseases

- Surgical Procedures

- Vision Correction Options

- Prescription Glasses and Contact Lenses

- Specialized Eye Care

- Insurance Coverage for Ophthalmologist Services

- Common Insurance Questions

- Conclusion

Introduction

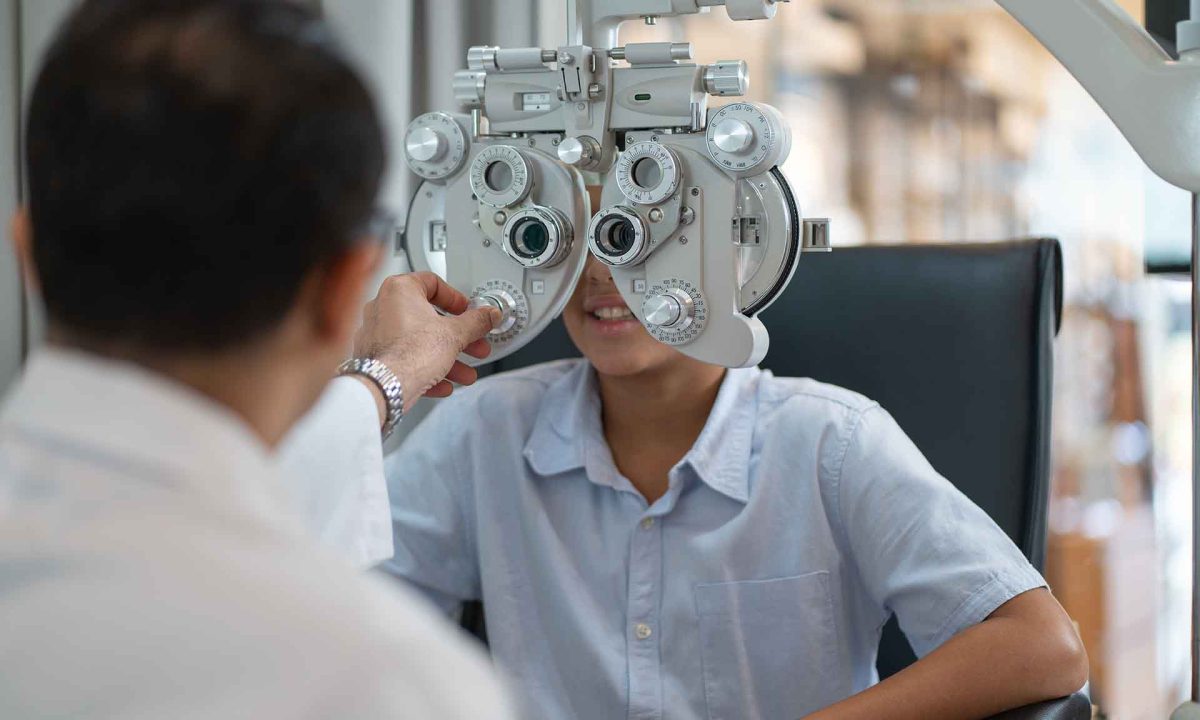

Welcome to the world of ophthalmology! In this article, we will explore the fascinating field of ophthalmology and delve into the topic of insurance coverage for ophthalmologist services. Whether you are considering visiting an ophthalmologist for a routine eye exam, seeking treatment for an eye condition, or exploring vision correction options, understanding your insurance coverage is essential.

Ophthalmology is the branch of medicine that focuses on the diagnosis, treatment, and prevention of diseases and disorders related to the eyes. Ophthalmologists are highly trained medical professionals who specialize in providing comprehensive eye care, from prescribing eyewear to performing complex surgeries. They play a crucial role in maintaining and improving our vision, ensuring that we can see the world clearly.

When it comes to healthcare expenses, navigating insurance coverage can sometimes be a daunting task. Understanding what services are covered by your insurance plan, what costs you can expect, and any limitations or restrictions is key to making informed decisions about your eye care. By familiarizing yourself with the basics of insurance coverage for ophthalmology services, you can ensure that you receive the necessary care without unexpected financial burden.

Whether you have private insurance through your employer, are covered by a government program such as Medicare or Medicaid, or have individual health insurance, it’s important to understand how your specific plan operates in terms of ophthalmologist services coverage. Different insurance plans have varying levels of coverage, and it’s crucial to be aware of any co-pays, deductibles, or limitations that may apply.

In the following sections, we will explore the specific areas of ophthalmology services and the types of coverage typically provided by insurance plans. From comprehensive eye exams to surgical procedures and vision correction options, we will arm you with the knowledge to navigate your insurance coverage effectively. So, let’s dive in and embark on this eye-opening journey!

Basics of Ophthalmology

Ophthalmology is a specialized field of medicine that focuses on the eyes and visual system. Ophthalmologists are medical doctors who have completed extensive training and education to diagnose and treat a wide range of eye conditions and diseases. They have the expertise to provide comprehensive eye care, from routine eye exams to advanced surgical procedures.

The eyes are complex organs that allow us to see the world around us. The field of ophthalmology encompasses the study and treatment of various eye structures, including the cornea, retina, iris, lens, and optic nerve. Ophthalmologists are skilled in diagnosing and managing conditions such as cataracts, glaucoma, macular degeneration, diabetic retinopathy, and many others.

One of the primary responsibilities of an ophthalmologist is to conduct comprehensive eye exams. These exams evaluate visual acuity, assess eye health, and detect any signs of eye diseases or abnormalities. During a comprehensive eye exam, the ophthalmologist may perform tests such as visual field tests, retinal imaging, and measurement of intraocular pressure to screen for conditions like glaucoma.

If an eye condition or disease is detected, ophthalmologists can provide various treatment options. They may prescribe medications, recommend lifestyle changes, or perform surgical procedures to improve or preserve vision. Surgical interventions undertaken by ophthalmologists can include cataract surgery, LASIK vision correction, corneal transplantation, and retinal surgery.

In addition to treating medical conditions, ophthalmologists also play a crucial role in vision correction. They can prescribe corrective lenses, such as glasses or contact lenses, to improve visual acuity. Ophthalmologists may also provide consultations and recommendations for refractive surgeries like LASIK or PRK, which can permanently correct vision and reduce the need for glasses or contact lenses in certain individuals.

Overall, ophthalmology is a vital specialty that focuses on the diagnosis, treatment, and management of various eye conditions and diseases. Ophthalmologists are at the forefront of ensuring that our eyes stay healthy and our vision is optimized. With their expertise and knowledge, they help us maintain clear vision and enhance our quality of life.

Understanding Insurance Coverage

Insurance coverage for ophthalmology services is an essential consideration when it comes to managing your eye care expenses. Understanding the details of your insurance plan can help you make informed decisions about your eye health and ensure that you receive the necessary treatments without facing unexpected financial burdens.

When it comes to insurance coverage for ophthalmology, it’s important to be familiar with the terms and concepts commonly used in insurance policies. Here are a few key terms to know:

- Premium: This is the amount you pay to the insurance company regularly, usually on a monthly basis, to maintain your coverage.

- Deductible: The deductible is the amount you need to pay out of pocket before your insurance coverage kicks in. It’s important to know the deductible amount specified in your policy.

- Co-payment: A co-payment, or co-pay, is a fixed amount you are required to pay for specific medical services, such as office visits or treatments. The co-pay amount is often determined by your insurance plan.

- Co-insurance: Co-insurance is the percentage of covered medical expenses that you are responsible for paying after meeting your deductible. For example, if your plan has a 20% co-insurance, you would pay 20% of the covered expenses, and your insurance would cover the remaining 80%.

- Out-of-pocket maximum: This is the maximum amount you will have to pay out of pocket for covered medical expenses during a specific time period. Once this limit is reached, your insurance will typically cover all remaining eligible expenses.

Every insurance plan is different, so it’s crucial to review your policy or contact your insurance provider to understand the specific coverage for ophthalmology services. While some plans may provide comprehensive coverage for both routine eye care and medical treatments, others may have limitations or exclusions.

It’s also important to note that insurance coverage may vary depending on the specific procedure or service. For example, while routine eye exams and preventive care may be fully covered, certain elective procedures or cosmetic treatments may not be covered by insurance.

Additionally, insurance plans may require pre-authorization or referrals for certain ophthalmology services. It’s important to follow the guidelines outlined by your insurance company to ensure coverage and minimize any potential out-of-pocket expenses.

Understanding the specifics of your insurance coverage for ophthalmology services is crucial for managing your eye care expenses. By familiarizing yourself with your policy, asking questions, and working closely with your ophthalmologist and insurance provider, you can ensure that your eye health is taken care of while maximizing the benefits provided by your insurance coverage.

Comprehensive Eye Exams

When it comes to maintaining optimal eye health, regular comprehensive eye exams are the foundation. These exams not only assess your visual acuity but also evaluate the overall health of your eyes. Understanding the coverage provided by your insurance for comprehensive eye exams is crucial for preventive care and early detection of eye conditions or diseases.

During a comprehensive eye exam, an ophthalmologist will perform various tests and evaluations to assess your visual function and eye health. These tests may include:

- Visual acuity test: This test measures how well you can see at various distances using an eye chart.

- Refraction test: This test determines your exact prescription for glasses or contact lenses.

- Slit-lamp examination: This examination allows the ophthalmologist to examine the front structures of your eyes, including the cornea, iris, and lens.

- Retinal examination: The ophthalmologist may dilate your pupils to examine the back of your eyes, including the retina and optic nerve.

- Eye pressure measurement: This test, called tonometry, measures the pressure inside your eyes and helps detect glaucoma.

Comprehensive eye exams not only help in identifying refractive errors, such as nearsightedness, farsightedness, or astigmatism, but they are also crucial for the early detection of eye conditions and diseases. Many eye conditions, such as glaucoma, macular degeneration, and diabetic retinopathy, can be asymptomatic in the early stages. Regular eye exams provide an opportunity for early intervention and treatment, which can help prevent vision loss or further complications.

When it comes to insurance coverage for comprehensive eye exams, it’s important to review your policy specifics. Some insurance plans may cover a routine annual eye exam as part of preventive care, while others may require a co-payment or have certain limitations.

Keep in mind that coverage for additional tests or procedures, such as retinal imaging or visual field tests, may vary. Some insurance plans may cover these additional tests as part of a comprehensive eye exam, while others may require separate coverage or co-payments.

Understanding the coverage provided by your insurance for comprehensive eye exams is essential for maintaining your eye health. Regular eye exams not only ensure that your vision is optimal but also allow for the early detection and management of potential eye conditions or diseases. By utilizing your insurance coverage for comprehensive eye exams, you can prioritize preventive care and take proactive steps towards preserving your eye health in the long run.

Treatment for Eye Conditions and Diseases

When it comes to treating eye conditions and diseases, ophthalmologists play a critical role in providing specialized care and helping patients maintain healthy vision. Understanding the coverage provided by your insurance for these treatments is essential for managing the cost of your eye care.

Ophthalmologists are trained to diagnose and treat a wide range of eye conditions and diseases, including cataracts, glaucoma, macular degeneration, diabetic retinopathy, and more. The treatment options vary depending on the specific condition and its severity.

Medication is often a primary form of treatment for many eye conditions. Prescription eye drops, ointments, or oral medications may be recommended to manage symptoms, reduce inflammation, or control intraocular pressure in conditions like glaucoma.

In certain cases, ophthalmologists may recommend laser therapy as a treatment option. Laser treatments, such as laser trabeculoplasty for glaucoma or photocoagulation for diabetic retinopathy, can help manage and control the progression of these conditions.

For some eye conditions, surgery may be necessary. Ophthalmologists are skilled in performing various surgical procedures to correct or manage eye conditions. Common surgical procedures include cataract surgery, corneal transplantation, retinal detachment repair, and glaucoma surgery. These surgeries are often covered by insurance, but it’s important to review your policy to understand the specific coverage and any associated costs.

When it comes to insurance coverage for eye condition and disease treatments, it’s important to know the specifics of your policy. Certain treatments, such as eye surgeries, may require pre-authorization, which means getting approval from your insurance company before the procedure can be performed. It’s important to work closely with your ophthalmologist and insurance provider to ensure that all necessary steps are taken to verify coverage and minimize out-of-pocket costs.

Understanding the coverage provided by your insurance for the treatment of eye conditions and diseases allows you to make informed decisions about your healthcare. By utilizing the benefits available to you and working closely with your ophthalmologist, you can receive the necessary treatments and maintain good eye health without facing excessive financial burdens.

Surgical Procedures

Surgical procedures are an integral part of ophthalmology and are often necessary for managing certain eye conditions and improving vision. Ophthalmologists are highly skilled in performing a variety of surgical procedures to address different eye conditions and restore visual function. Understanding the coverage provided by your insurance for these procedures is crucial for planning and managing the cost of your eye care.

One of the most common surgical procedures performed by ophthalmologists is cataract surgery. During this procedure, the cloudy lens of the eye is replaced with an artificial intraocular lens (IOL). Cataract surgery is typically performed on an outpatient basis and has a high success rate in restoring clear vision. Most insurance plans cover cataract surgery, although additional fees or co-payments may apply, depending on your specific policy.

Another commonly performed surgical procedure is laser-assisted in situ keratomileusis (LASIK) surgery. LASIK is a refractive surgery that corrects nearsightedness, farsightedness, and astigmatism by reshaping the cornea. While LASIK is considered an elective procedure for vision correction, some insurance plans may offer partial coverage or discounts depending on the chosen provider or the specific policy details.

Other surgical procedures performed by ophthalmologists include corneal transplantation, retinal surgery, and glaucoma surgery. Corneal transplantation, also known as a corneal graft, is the surgical replacement of damaged or diseased cornea with a healthy donor cornea. Retinal surgery is performed to treat conditions such as retinal detachments, macular holes, or diabetic retinopathy, aiming to restore or preserve vision. Glaucoma surgery is carried out to enhance the drainage of fluid from the eye and control intraocular pressure in glaucoma patients.

Insurance coverage for surgical procedures can vary depending on the specific procedure and your insurance policy. While some surgical procedures may be covered by insurance plans, others may be considered elective or cosmetic and may not be covered. It is crucial to review your policy or contact your insurance provider to understand the coverage for specific surgical procedures.

It’s important to note that insurance coverage may also depend on medical necessity. Your ophthalmologist will work with you and your insurance provider to determine the medical necessity of a surgical procedure and establish if the procedure is covered by your insurance plan.

Understanding the coverage provided by your insurance for surgical procedures is essential for preparing financially and making informed decisions about your eye health. By working closely with your ophthalmologist and insurance provider, you can ensure that you receive the necessary surgical interventions while managing your out-of-pocket expenses effectively.

Vision Correction Options

Vision correction plays a significant role in enhancing visual acuity and reducing the reliance on prescription eyewear. Ophthalmologists offer various vision correction options, ranging from non-surgical treatments to surgical interventions. Understanding the coverage provided by your insurance for these options can help you explore the best solution for your visual needs.

One of the most popular non-surgical vision correction options is the prescription of eyeglasses or contact lenses. Eyeglasses correct refractive errors, such as nearsightedness, farsightedness, and astigmatism, by precisely focusing light onto the retina. Contact lenses provide similar correction while directly placed on the surface of the eye. These options are often covered by insurance plans, but it’s important to review your policy to understand any limitations or requirements, such as coverage for specific types of lenses or frames.

For some individuals seeking a more permanent solution, ophthalmologists may recommend refractive surgeries. These surgical procedures aim to reshape the cornea to correct refractive errors and reduce or eliminate the need for corrective eyewear. The most common refractive surgeries include LASIK (laser-assisted in situ keratomileusis) and PRK (photorefractive keratectomy). While these surgeries are considered elective and not typically covered by insurance, some insurance plans may offer partial coverage or discounts through affiliated providers.

Another vision correction option for certain individuals is the implantation of an intraocular lens (IOL). IOLs are artificial lenses that replace the eye’s natural lens to correct refractive errors or age-related lens changes, such as cataracts. Insurance coverage for IOL implantation may vary based on the specific procedure and your insurance policy. While cataract surgery involving IOL implantation is generally covered by insurance, additional fees or co-payments may apply.

It’s important to consult with your ophthalmologist and discuss your vision correction goals to determine the best option for you. They can guide you through the various options available and provide recommendations based on your eye health, visual needs, and insurance coverage.

When exploring vision correction options, it’s crucial to review your insurance policy and contact your insurance provider to understand the coverage details. Some insurance plans offer vision discount programs or affiliated providers that may provide coverage or discounts on certain vision correction procedures. Understanding your insurance coverage allows you to make informed decisions and choose the most suitable option while effectively managing the financial aspect of your eye care.

Prescription Glasses and Contact Lenses

Prescription glasses and contact lenses are popular and effective solutions for correcting refractive errors and improving vision. Whether you prefer the classic appeal of glasses or the convenience of contact lenses, understanding the coverage provided by your insurance for these vision correction options is crucial for managing your eye care expenses.

Prescription glasses have long been a go-to choice for many individuals with refractive errors. They offer a simple and versatile solution for correcting nearsightedness, farsightedness, astigmatism, or presbyopia. Prescription eyeglasses consist of lenses that are precisely ground to your unique prescription and placed in a frame that suits your style preferences. The frames can be made from various materials and come in a wide range of styles, ensuring that you find a pair that not only corrects your vision but also reflects your personal taste.

Contact lenses, on the other hand, provide an alternative to eyeglasses and offer the advantage of a natural, unobstructed field of vision. Contact lenses are thin, curved discs that are placed directly on the surface of the eye. They correct refractive errors while providing vision correction that moves with your eyes. Contact lenses come in various types, including soft lenses, rigid gas permeable lenses, toric lenses for astigmatism, and multifocal lenses for presbyopia.

When it comes to insurance coverage for prescription glasses and contact lenses, it’s important to review your policy specifics. Some insurance plans may offer coverage for a set amount toward frames and lenses, while others may provide a discount or partial reimbursement for the cost of vision correction materials. It’s important to understand any limitations, such as covered frame brands or lens options, and any requirements, such as obtaining a prescription from a specific provider or adhering to a specific network of eyewear vendors.

Additionally, some insurance plans may have a vision discount program that offers reduced prices or preferred rates through affiliated providers. These programs can help you save on the cost of prescription glasses or contact lenses, reducing your out-of-pocket expenses.

It’s important to schedule regular eye exams and work closely with your ophthalmologist to ensure that your prescription for glasses or contact lenses is up to date. This will ensure that you are using the correct prescription to maintain optimal vision and maximize the benefits provided by your insurance coverage.

Understanding the coverage provided by your insurance for prescription glasses and contact lenses allows you to make informed decisions about your vision correction options. By utilizing the benefits available to you and working within your insurance coverage, you can obtain the necessary eyewear to achieve clear and comfortable vision while managing your eye care costs efficiently.

Specialized Eye Care

In addition to routine eye exams and vision correction options, ophthalmologists provide specialized eye care for various conditions and specific needs. Understanding the coverage provided by your insurance for specialized eye care is essential for accessing the necessary treatments and managing your eye health effectively.

Specialized eye care encompasses a range of services tailored to address specific eye conditions and concerns. Some examples of specialized eye care include:

- Pediatric Eye Care: Ophthalmologists with expertise in pediatric ophthalmology specialize in diagnosing and treating eye conditions in children. This can include common issues like refractive errors, lazy eye (amblyopia), and strabismus (misalignment of the eyes).

- Retina Care: Retina specialists focus on the diagnosis and treatment of diseases and conditions affecting the retina, such as age-related macular degeneration, diabetic retinopathy, and retinal detachments. Treatment options may include injections, laser therapy, or surgical interventions.

- Cornea Care: Ophthalmologists specializing in corneal diseases and conditions provide care for issues like corneal infections, corneal dystrophies, and corneal transplantation. These specialists have expertise in managing corneal health and preserving vision.

- Neuro-Ophthalmology: Neuro-ophthalmologists combine the fields of neurology and ophthalmology to address vision problems caused by neurological disorders, such as optic nerve diseases, double vision, or visual field defects associated with conditions like multiple sclerosis or brain tumors.

- Low Vision Services: Low vision specialists help individuals with significant visual impairments that cannot be adequately corrected with standard eyewear. They provide strategies and assistive devices to help optimize remaining vision and improve quality of life.

Insurance coverage for specialized eye care may vary depending on your insurance policy and the specific services required. Some insurance plans may offer coverage for specialized consultations, diagnostic tests, and treatments related to these areas. It’s important to review your policy details and contact your insurance provider to understand the coverage provided and any requirements or limitations.

It’s worth noting that specialized eye care may require referrals from a primary care physician or another healthcare professional. Your insurance plan may require pre-authorization or a specific referral process for accessing specialized eye care services. It’s important to follow the guidelines outlined by your insurance company to ensure proper coverage and minimize out-of-pocket expenses.

By understanding the coverage provided by your insurance for specialized eye care, you can ensure that you receive the necessary treatments and support for your specific eye health needs. Working closely with your ophthalmologist and insurance provider will help you navigate the process, optimize your coverage, and receive the specialized care required to maintain and improve your visual health.

Insurance Coverage for Ophthalmologist Services

Insurance coverage for ophthalmologist services is an essential consideration when it comes to managing your eye care expenses. Ophthalmologists provide a wide range of services, from routine eye exams and vision correction to specialized treatments and surgical procedures. Understanding the coverage provided by your insurance for these services is crucial for accessing quality eye care and minimizing out-of-pocket costs.

The extent of insurance coverage for ophthalmologist services can vary depending on your insurance plan and the specific services required. Some common ophthalmologist services and their insurance coverage considerations include:

- Comprehensive Eye Exams: Many insurance plans cover routine eye exams as preventive care. However, there may be limitations on the frequency of covered exams or requirements for pre-authorization or co-payments.

- Treatment for Eye Conditions and Diseases: Insurance coverage for the treatment of eye conditions and diseases, such as glaucoma, cataracts, or macular degeneration, will depend on the specific procedure, medical necessity, and your insurance policy. Some treatments, like surgeries or laser therapies, may require pre-authorization or have specific coverage criteria.

- Vision Correction Options: Insurance coverage for vision correction options like prescription glasses, contact lenses, or refractive surgeries (e.g., LASIK) can vary. While some insurance plans may provide coverage or discounts for eyewear or offer benefits for affiliated providers, refractive surgeries are often considered elective and may not be fully covered.

- Surgical Procedures: Insurance coverage for ophthalmic surgeries, such as cataract surgery or corneal transplantation, may be provided; however, additional fees, co-payments, or specific coverage criteria may apply. It’s important to review your policy to understand the coverage limitations for surgical procedures.

- Specialized Eye Care: Insurance coverage for specialized eye care, such as pediatric eye care, retina care, or neuro-ophthalmology, can vary. Referrals or pre-authorization may be required, and coverage is often contingent upon medical necessity and adherence to insurance network guidelines.

To fully understand the coverage provided by your insurance for ophthalmologist services, it is crucial to review your policy details or contact your insurance provider. They can provide information about coverage levels, limitations, out-of-pocket costs, and any requirements such as referrals or pre-authorization.

When seeking ophthalmologist services, it’s important to communicate with your ophthalmologist and insurance provider to ensure proper coordination of care. This includes verifying coverage and understanding any financial responsibilities or potential out-of-pocket expenses associated with the recommended services.

Remember that insurance coverage is subject to change, and it’s important to stay informed about updates and changes in your plan. Regularly reviewing your insurance policy and communicating with your insurance provider and ophthalmologist will help ensure that you receive optimal eye care while managing the financial aspect of your treatments effectively.

Common Insurance Questions

Understanding your insurance coverage for ophthalmologist services can sometimes be complex. To help clarify some common questions, here are answers to frequently asked questions regarding insurance and eye care:

- What does my insurance cover for routine eye exams? Many insurance plans cover routine eye exams as preventive care, allowing for a specific frequency of covered exams. However, it is essential to review your policy to understand the coverage limitations, pre-authorization requirements, or any associated co-payments.

- What eye conditions or diseases are covered by my insurance? The coverage for eye conditions or diseases depends on your specific insurance plan and policy. Some conditions, such as glaucoma, cataracts, or macular degeneration, may be covered, but the extent of coverage may vary. It is important to review your policy or contact your insurance provider for details.

- Does my insurance cover vision correction options like glasses or contact lenses? Many insurance plans provide coverage or discounts for prescription eyeglasses or contact lenses. However, the specific coverage, limitations, and requirements may vary. It’s important to review your policy or contact your insurance provider to understand what is covered and any associated costs.

- Will my insurance cover refractive surgeries like LASIK? Refractive surgeries, such as LASIK, are usually considered elective procedures and are not typically fully covered by insurance. However, some insurance plans may offer partial coverage or discounts through affiliated providers. Checking your policy or contacting your insurance provider can provide clarity on the extent of coverage.

- What is the coverage for ophthalmic surgeries? Insurance coverage for ophthalmic surgeries, such as cataract surgery or corneal transplantation, may be provided, but additional fees, co-payments, or specific coverage criteria may apply. Reviewing your policy details or contacting your insurance provider can help clarify the coverage for specific surgical procedures.

- Do I need pre-authorization for specialized eye care? Some insurance plans require pre-authorization for specialized eye care services, such as pediatric eye care, retina care, or neuro-ophthalmology. Pre-authorization helps ensure coverage and is usually obtained through a referral from a primary care physician. Contact your insurance provider to understand the pre-authorization process and any associated requirements.

- Can I go to any ophthalmologist or are there preferred providers in my insurance network? Insurance plans often have a network of preferred providers. It’s important to check if your ophthalmologist is in-network to maximize your benefits and minimize out-of-pocket costs. Out-of-network providers may have different coverage levels or higher deductibles, which could result in more significant expenses for you.

Remember, the answers to these questions may vary based on your insurance plan and policy. It is always important to review your specific policy details, contact your insurance provider, and consult with your ophthalmologist about insurance coverage to ensure you have accurate and up-to-date information relevant to your individual circumstances.

Conclusion

Understanding your insurance coverage for ophthalmologist services is crucial for managing your eye care and ensuring that you receive the necessary treatments while minimizing out-of-pocket expenses. Ophthalmologists provide a wide range of services, from routine eye exams to specialized care and surgical procedures, all aimed at maintaining and improving your eye health.

By familiarizing yourself with the basics of insurance coverage and the specific details of your policy, you can make informed decisions about your eye care. Regular comprehensive eye exams, treatment for eye conditions and diseases, vision correction options, and specialized eye care all play vital roles in maintaining optimal vision and preserving eye health.

Reviewing your insurance policy and contacting your insurance provider to understand coverage levels, limitations, and requirements will help you navigate the complexities of insurance coverage for ophthalmologist services. It’s important to work closely with your ophthalmologist and insurance provider, following guidelines for pre-authorization, referrals, and in-network providers to optimize your insurance benefits.

Remember that insurance coverage is subject to change, and it’s essential to stay informed about any updates or changes in your plan. Regularly reviewing your policy, scheduling routine eye exams, and maintaining open communication with your ophthalmologist and insurance provider will ensure that your eye care remains comprehensive, accessible, and cost-effective.

Investing in your eye health is an investment in your overall well-being. By understanding your insurance coverage for ophthalmologist services, you can access the eye care you need with confidence, knowing that you are effectively managing the financial aspect of your eye care journey. Take control of your eye health, utilize the benefits available to you, and enjoy the gift of clear vision for years to come.