Home>Finance>What Is A Basis Rate Swap? Definition, Example, And Basis Risk

Finance

What Is A Basis Rate Swap? Definition, Example, And Basis Risk

Published: October 14, 2023

Learn about basis rate swaps in finance, including the definition, example, and basis risk. Understand how these swaps work and their relevance in the financial market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Finance Made Easy: Understanding Basis Rate Swap

Have you ever come across the term “basis rate swap” and wondered what it means? Well, you’re not alone! In the world of finance, understanding complex concepts can be a challenge. But fear not, we’re here to simplify it for you! In this article, we’ll demystify the basis rate swap, provide a clear definition, walk you through an example, and explain the concept of basis risk. So, let’s dive in!

Key Takeaways:

- A basis rate swap is a financial instrument used to manage interest rate risk between two parties.

- It involves the exchange of interest payments based on different reference rates, such as LIBOR and the federal funds rate.

Understanding Basis Rate Swap

A basis rate swap, also known as a floating-to-floating interest rate swap, is a financial contract between two parties to exchange or “swap” interest payments based on different reference rates. This type of swap is commonly used to manage interest rate risk, particularly when there is a difference between two related floating rates.

In a basis rate swap, the two parties agree to exchange the interest payments on a notional principal amount for a given period. The notional principal amount represents the hypothetical value on which the interest payments are calculated and is used for contract purposes only.

Let’s understand this with an example:

Suppose Company A has a loan with an interest rate linked to the LIBOR (London Interbank Offered Rate), while Company B has a loan with an interest rate linked to the federal funds rate. These reference rates can differ due to various factors such as market conditions, credit risk, or regulatory requirements.

To mitigate any potential risks arising from the difference in interest rates, Company A and Company B enter into a basis rate swap agreement. Company A agrees to pay interest to Company B based on the Federal Funds Rate, while Company B agrees to pay interest to Company A based on the LIBOR.

The basis rate swap ensures that both companies can effectively manage their interest rate exposure by aligning their interest payments without having to incur the cost of refinancing or changing their current loan agreements. This way, both companies can benefit from more favorable borrowing terms without actually renegotiating their existing loans.

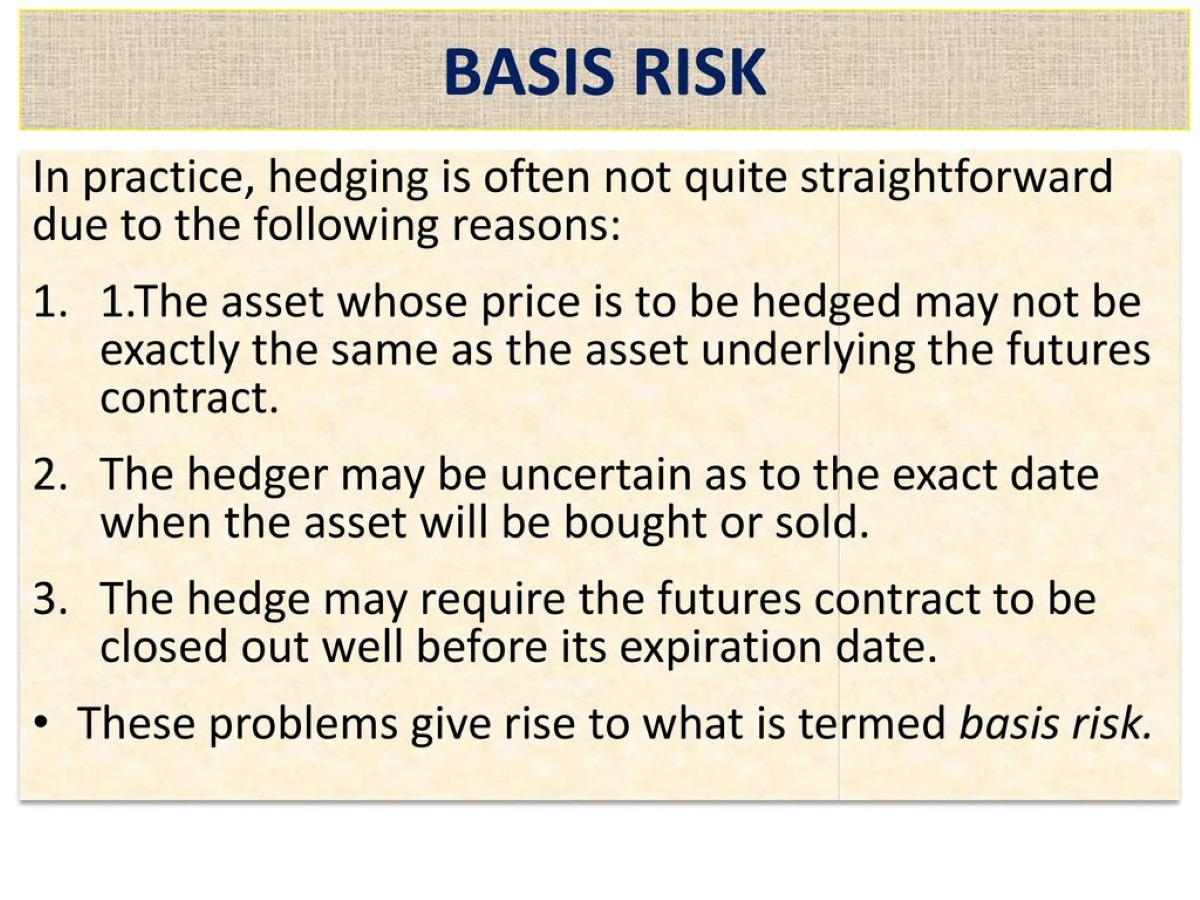

Understanding Basis Risk

Now that we’ve explored the concept of basis rate swap, it’s important to understand the potential risks associated with it, known as basis risk. Basis risk refers to the risk that the difference between the reference rates in the swap agreement may not perfectly align with the intended risk hedging.

Factors such as changes in market conditions, credit risk, or regulatory requirements can cause the difference between the reference rates to fluctuate. This means that the parties involved in a basis rate swap might not achieve the desired risk mitigation or interest rate alignment as anticipated.

To minimize basis risk, it’s crucial for the parties involved to carefully assess and monitor market conditions, credit risk, and regulatory factors that may impact the reference rates. Regular evaluation and adjustments of the swap agreement can help mitigate the potential effects of basis risk.

Conclusion

Understanding basis rate swaps can be instrumental in managing interest rate risks and ensuring favorable borrowing terms for businesses. By entering into a basis rate swap agreement, companies can align their interest payments based on different reference rates, mitigating the effects of interest rate discrepancies. However, it’s essential to remain vigilant of basis risk and regularly assess market conditions to achieve the desired outcomes.

So, the next time you come across the term “basis rate swap,” you can confidently grasp its significance in the financial landscape.