Finance

What Are Basis Points In Interest Rates?

Published: November 2, 2023

Discover what basis points are in interest rates and how they impact the world of finance. Gain a deeper understanding of this fundamental concept in interest rate calculations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where every penny matters. In the complex realm of interest rates, there is a term that holds significant importance – basis points. If you have ever wondered what basis points are and how they affect interest rates, you have come to the right place. In this article, we will explore the concept of basis points and delve into their calculation and implications in the financial world.

When it comes to measuring changes in interest rates, basis points are the go-to unit of measurement. Understanding basis points is crucial for investors, economists, and anyone interested in the intricacies of the financial markets. By grasping the concept of basis points, you will gain a deeper understanding of how even the minutest changes in interest rates can have significant consequences.

But what exactly are basis points? Put simply, basis points are a unit of measurement used to express changes in interest rates. One basis point is equal to one-hundredth of a percentage point, or 0.01%. So, if an interest rate increased by 25 basis points, it means that it has gone up by 0.25%.

Basis points are a commonly used metric because they allow for precise measurement and comparison of interest rate movements. By using basis points as a standard unit, it becomes easier to interpret interest rate changes across various financial instruments and markets.

Now that we have a basic understanding of what basis points are, let’s explore how they are calculated. This will enable us to comprehend their significance and how they are used in real-world scenarios.

Definition of Basis Points

Before we dive into the calculation and importance of basis points, let’s take a moment to understand exactly what basis points are. As mentioned earlier, basis points are a unit of measurement used to express changes in interest rates. One basis point is equal to one-hundredth of a percentage point, or 0.01%.

This may seem like a small increment, but in the world of finance, every basis point matters. Interest rates play a critical role in the global economy, affecting everything from borrowing costs to investment returns. By using basis points, we can accurately measure and compare these differences, providing a standardized way to discuss and analyze interest rate changes.

For example, if the interest rate on a loan increases by 50 basis points, it means that the rate has gone up by 0.50%. Similarly, if the interest rate on a savings account decreases by 25 basis points, it means that the rate has dropped by 0.25%.

Basis points are particularly useful when dealing with small changes in interest rates. They allow for precise measurement and comparison, enabling investors and analysts to make informed decisions based on even the slightest shifts in the market.

To put things into perspective, let’s consider an example. Imagine you are analyzing two different investment opportunities. Investment A offers a return of 6.5% and Investment B offers a return of 6.6%. At first glance, it may seem like a negligible difference. However, by expressing this difference in basis points, we can see that Investment B offers a higher return by 10 basis points.

Basis points eliminate the ambiguity and make it easier to compare investment options, assess potential risks, and analyze market trends. They serve as a common language in the finance industry, allowing professionals to communicate and understand interest rate changes with precision.

Now that we have a clear understanding of what basis points are and how they are used in expressing changes in interest rates, let’s explore how to calculate them.

Calculation of Basis Points

Calculating basis points is a straightforward process that involves converting a percentage change into a numerical value. As mentioned earlier, one basis point is equivalent to 0.01% or one-hundredth of a percentage point. To calculate basis points, you need to determine the difference between two interest rates and multiply it by 100.

Here’s the formula for calculating basis points:

Basis Points = (Difference in Interest Rates) x 100

Let’s walk through an example to illustrate how it works. Suppose the interest rate on a mortgage loan was initially 4.5% and increased to 5.2%. To calculate the basis points, you would subtract the initial interest rate from the new interest rate to find the difference:

Difference in Interest Rates = 5.2% – 4.5% = 0.7%

Next, multiply the difference by 100 to convert it into basis points:

Basis Points = 0.7% x 100 = 70 basis points

Therefore, the increase in the interest rate on the mortgage loan is 70 basis points.

By using this calculation method, you can measure the magnitude of changes in interest rates in a standardized format. Whether you are analyzing the impact of a central bank’s decision on borrowing costs or evaluating the competitiveness of different financial products, calculating basis points helps you quantify and comprehend the significance of these changes.

Remember, basis points provide a precise way to express interest rate movements, making it easier to compare and understand fluctuations across various financial instruments and markets.

Now that we know how to calculate basis points, let’s explore the importance of basis points in the context of interest rates.

Importance of Basis Points in Interest Rates

Basis points may seem like a small unit of measurement, but their importance in interest rates cannot be understated. They play a vital role in various aspects of the financial world, impacting borrowers, lenders, investors, and even the overall economy. Understanding the significance of basis points in interest rates is essential for making informed financial decisions and staying abreast of market trends.

Here are some key reasons why basis points are important in the context of interest rates:

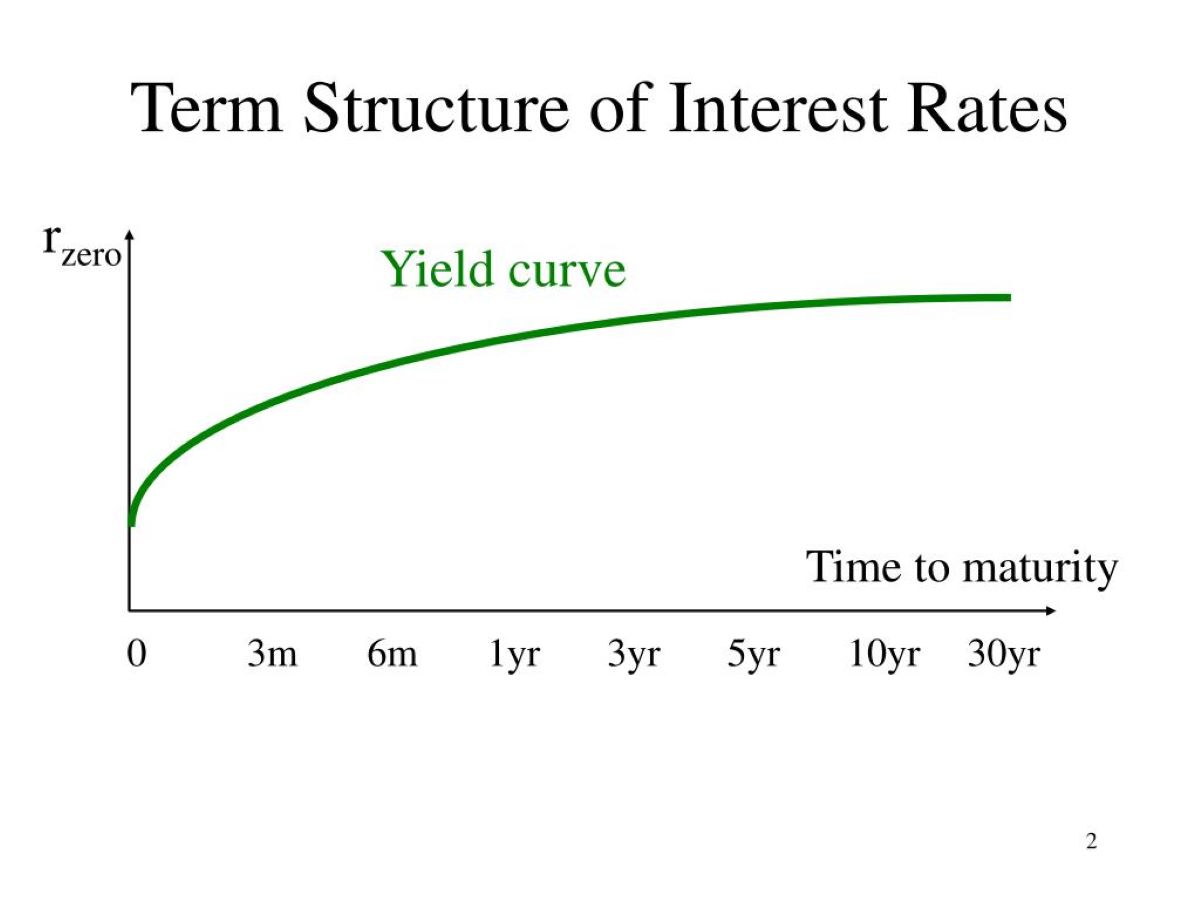

- Measuring Small Changes: Interest rates often fluctuate by small increments. Basis points provide a precise way to measure these changes, allowing for accurate comparisons between different interest rates and financial products.

- Sensitivity Analysis: By quantifying interest rate changes in basis points, analysts and investors can perform sensitivity analysis to assess the impact on various financial instruments. This helps in evaluating the risk associated with different investments and making informed decisions accordingly.

- Implications for Borrowers and Lenders: Basis point changes in interest rates have a direct impact on borrowers and lenders. For borrowers, even a slight increase in basis points can lead to higher borrowing costs, affecting their ability to make loan payments. On the other hand, lenders can adjust interest rates based on basis point changes to ensure profitability and manage risk.

- Central Bank Policy: Central banks often use basis points to communicate changes in monetary policy. A rate cut or hike by, for example, 25 basis points indicates a specific adjustment in the economy’s lending conditions. These changes can have wide-ranging effects on borrowing costs, economic activity, and inflation.

- Investment Return Evaluation: Basis points are crucial when evaluating investment returns. Even a minor change in interest rates can significantly impact the profitability of investment vehicles, such as bonds, fixed deposits, or mutual funds. Being able to measure these changes in basis points helps investors gauge potential returns and assess risk-reward scenarios.

By understanding the importance of basis points in interest rates, individuals and financial professionals can make more informed decisions. Whether it’s determining the affordability of a loan, assessing investment opportunities, or analyzing market trends, basis points serve as a valuable tool for evaluating the impact of interest rate changes and managing financial risk.

Now, let’s explore some examples to further illustrate the concept of basis points in interest rates.

Examples of Basis Points in Interest Rates

To understand the practical implications of basis points in interest rates, let’s explore some examples that depict their significance in real-world scenarios:

- Mortgage Rates: Suppose you are in the process of purchasing a home and comparing mortgage rates offered by different lenders. Lender A offers an interest rate of 3.75%, while Lender B offers a rate of 3.95%. The difference between the two rates is 20 basis points. This means that Lender B’s rate is 0.20% higher than Lender A’s rate. This seemingly small difference can have a significant impact on your monthly mortgage payments and the overall cost of your home loan over time.

- Bond Yields: When analyzing fixed-income investments like bonds, basis points are crucial for evaluating yields. For example, let’s say you are considering two corporate bonds. Bond X offers a yield of 5.2%, while Bond Y offers a yield of 4.9%. The difference between the yields of the two bonds is 30 basis points. This means that Bond X offers a higher return of 0.30% compared to Bond Y. This difference becomes even more significant when dealing with large investment amounts or long-term bond maturities.

- Central Bank Decisions: Central banks around the world closely monitor basis point changes in interest rates to manage monetary policy. For instance, if the central bank announces a rate cut of 50 basis points, it means that it has reduced the benchmark interest rate by 0.50%. This decision can have a ripple effect on various sectors of the economy, potentially stimulating borrowing and economic growth.

- Investment Portfolios: Basis points play a crucial role in portfolio management and asset allocation. For example, if you have a diversified investment portfolio consisting of stocks, bonds, and cash, the interest rate changes in the fixed-income portion can affect the overall performance of your portfolio. Even a small change of, let’s say, 10 basis points in bond yields can have an impact on your investment returns and asset allocation strategies.

These examples highlight how basis points are used to analyze and communicate changes in interest rates across various financial products and markets. Precise measurement using basis points allows for better understanding, comparison, and decision-making, enabling individuals and financial professionals to navigate the complexities of the financial landscape.

Now that we have explored the examples, let’s conclude our discussion on basis points and their significance in interest rates.

Conclusion

Basis points are a crucial unit of measurement in the world of finance, specifically when it comes to understanding and analyzing interest rates. While they may seem small, they hold significant importance in various aspects of financial decision-making.

By using basis points, we can precisely measure and compare changes in interest rates, allowing for accurate assessments of borrowing costs, investment returns, and economic conditions. These small increments of measurement provide a standardized way to discuss interest rate changes, enabling individuals and financial professionals to communicate effectively.

From calculating the difference between two interest rates to evaluating the sensitivity of various financial instruments, basis points allow us to quantify and comprehend the implications of even the slightest shifts in the market. They play a vital role in assessing risk, making informed investment decisions, and managing economic policy.

Whether you are a borrower, lender, investor, or analyst, understanding basis points empowers you to navigate the complex world of interest rates with greater confidence and precision. By incorporating basis points into your financial analysis and decision-making processes, you can make more informed choices and adapt to changing market conditions.

So next time you come across discussions or analyses involving basis points in interest rates, you can appreciate the significance of these small units and their far-reaching impact on the financial world.

Continue to explore and deepen your understanding of basis points, as they form a fundamental component of financial literacy and empower you to make sound financial decisions in a dynamic and evolving landscape.