Finance

What Is A Bull Trap In Stocks

Published: January 18, 2024

Discover what a bull trap is in stocks and learn how it affects your finances. Gain insights into this common market phenomenon and avoid falling into its deceptive trap.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and investing, navigating the stock market can be both exhilarating and challenging. Investors and traders are constantly on the lookout for profitable opportunities, trying to capitalize on market trends and price movements. However, not all market moves are as they seem, and sometimes investors can fall into traps that result in financial losses.

One such trap is known as a “bull trap.” Understanding what a bull trap is and how to avoid falling into one is crucial for any investor looking to safeguard their portfolio and make informed decisions.

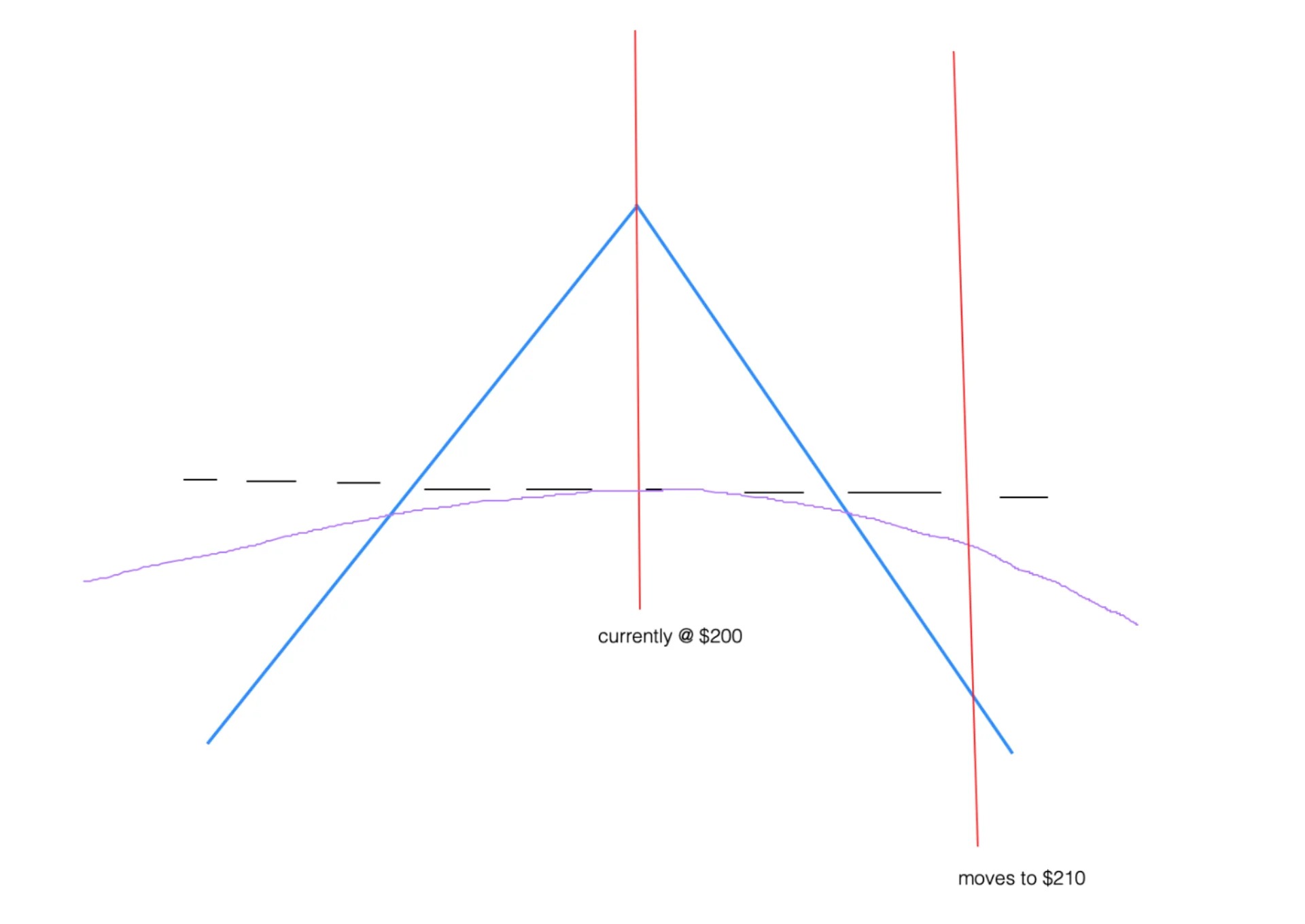

A bull trap is a deceptive market pattern that tricks investors into thinking a stock or the overall market is experiencing a significant upward trend, leading them to buy or hold onto their positions. However, instead of the anticipated continuation of the upward trend, the market suddenly reverses, leading to substantial losses for those caught in the trap.

This phenomenon is often observed in a bullish market, where investor sentiment is generally positive, pushing prices higher. The bull trap plays on this optimism, luring investors into thinking that a stock or the market has broken through a significant resistance level or reached a new high, only to suffer a sudden reversal.

In simple terms, a bull trap sets up investors to believe that a stock or the market is heading higher, but in reality, it is a false signal that leads to significant losses.

Recognizing and avoiding a bull trap requires careful analysis and understanding of market dynamics. In the following sections, we will explore the characteristics of a bull trap, how they are formed, how to spot them, and the risks and implications that come with falling into one.

Definition of a Bull Trap

A bull trap is a market phenomenon characterized by a false signal of an upward trend, enticing investors to buy or hold onto their positions, only to experience a sudden reversal and significant price decline. It is a deceptive move that traps investors who are anticipating further price appreciation.

In technical analysis, a bull trap occurs when a stock or the overall market breaks through a significant resistance level or reaches a new high, creating the illusion of a bullish breakout. As a result, investors become optimistic and believe that the upward trend will continue, leading them to enter or hold onto their long positions.

However, the market then abruptly reverses direction, catching these investors off guard and causing substantial losses. The stock or market may decline rapidly, erasing any gains made during the supposed bull run.

It’s important to note that a bull trap is often fueled by market manipulation or false information spread by certain market participants who stand to benefit from the trap. These individuals may create a false sense of optimism by spreading positive news or rumors, enticing others to buy into the rising market.

To understand a bull trap better, let’s consider an example. Imagine Company X has been trading in a range-bound pattern, with its price fluctuating between a support level of $50 and a resistance level of $60. Investors who have been closely monitoring the stock notice that it breaks through the $60 resistance level, triggering a buy signal for many traders.

Due to the breakout, more investors start buying the stock, expecting it to continue its upward trajectory. However, the market suddenly reverses, and the stock price plunges below the $50 support level, resulting in substantial losses for those who fell into the bull trap.

Overall, a bull trap deceives investors by creating the illusion of a breakout and luring them into buying or holding onto their positions. It is important for investors to be aware of this market phenomenon and take necessary precautions to avoid falling into this trap.

Characteristics of a Bull Trap

To effectively recognize and navigate a bull trap, it is essential to understand its key characteristics. By familiarizing yourself with these traits, you can become more adept at spotting potential bull traps and taking appropriate action to protect your investments. Here are some notable characteristics:

- False Breakout: One of the primary characteristics of a bull trap is a false breakout or a breach of a resistance level. It creates an illusion of a bullish trend and leads investors to believe that the price will continue to rise. However, this breakout is short-lived, and the market reverses, trapping the unsuspecting investors.

- Volume and Momentum: A bull trap often exhibits high trading volume and positive momentum during the illusionary breakout. The increased buying activity can create a sense of confirmation and enthusiasm among traders, further cementing the belief in the upward trend.

- Market Manipulation: Bull traps can be initiated through market manipulation tactics by certain market participants. These individuals may spread false news, create a buzz, or artificially inflate the stock price to lure investors into the trap. Their intention is to create a buying frenzy and profit from the subsequent reversal.

- Lack of Sustained Buying: One key characteristic of a bull trap is the absence of sustained buying interest. While there might be initial excitement and a surge in buying activity, it doesn’t continue for an extended period. This lack of follow-through buying allows the market to reverse abruptly, catching investors off guard.

- Quick Price Reversal: A defining feature of a bull trap is the rapid reversal in price after the false breakout. The bullish sentiment is suddenly shattered, and the stock or market declines swiftly, leading to significant losses for those who fell into the trap.

- Common in Bullish Markets: Bull traps are most prevalent in bullish markets where investor sentiment is generally positive, and prices are rising. The optimistic environment creates fertile ground for deceptive market moves, as investors are more inclined to believe in the continuation of the upward trend.

It’s important to remember that not every breakout or price surge is a bull trap. These characteristics should be used as guidelines to distinguish between genuine price movements and potential traps. Conducting thorough analysis, using technical indicators, and considering market fundamentals can help investors make more informed decisions and reduce the risk of falling into a bull trap.

How Bull Traps are Formed

Bull traps are formed through a combination of market dynamics, investor behavior, and potentially manipulative actions by certain market participants. Understanding the factors that contribute to the formation of bull traps can help investors better identify and avoid them. Here are some key elements that play a role in the formation of bull traps:

- Market Sentiment: Bull traps often occur in bullish markets when investor sentiment is high and optimism prevails. During such times, investors are more inclined to believe in the continuation of the upward trend and can be easily lured into false signals.

- Resistance Levels: Bull traps are commonly associated with the breach of significant resistance levels. A resistance level is a price level at which selling pressure historically outweighs buying pressure, causing the price to struggle to break through. When the price finally surpasses the resistance level, it can create a sense of optimism and trigger buying activity. However, it can also be a false breakout, leading to a bull trap.

- Lack of Confirmation: One factor that contributes to the formation of a bull trap is the lack of confirmation. While the initial breakout may appear convincing, it is essential to seek confirmation from other technical indicators or supporting market factors before assuming a genuine trend reversal.

- Market Manipulation: Bull traps can be shaped by market manipulators who seek to benefit from trapping unsuspecting investors. These manipulators may spread false information, create a buzz around a stock or market, or artificially manipulate prices to create the illusion of a breakout. Their actions can deceive investors and lead them into the trap.

- False News or Rumors: False news or rumors can contribute to the formation of a bull trap. Manipulators may disseminate positive news or rumors about a particular stock or market, creating a buying frenzy and pushing prices higher. Investors who act based on false information may find themselves trapped when the truth emerges.

- Psychological Factors: Investor psychology also plays a role in the formation of bull traps. As prices rise and optimism grows, investors may become more susceptible to believing in the continuation of the trend. This psychological bias can cloud judgment and make investors more vulnerable to falling into a bull trap.

It’s crucial for investors to be aware of these factors when analyzing market trends and making investment decisions. By understanding how bull traps are formed and carefully evaluating market conditions, investors can minimize the risk of falling into these deceptive traps and protect their portfolios from significant losses.

Recognizing a Bull Trap

Recognizing a bull trap is imperative for investors who aim to navigate the stock market successfully and avoid significant losses. While bull traps can be deceiving, there are several key indicators and strategies that can help investors identify and differentiate between genuine market trends and potential traps. Here are some effective methods for recognizing a bull trap:

- Confirming Breakouts: When a stock or market breaks through a resistance level, it is essential to seek confirmation before assuming it as a genuine breakout. Look for additional technical indicators, such as volume and momentum, as well as supporting market factors to validate the upward trend.

- Market Volume: Pay attention to trading volume during breakout periods. A genuine breakout is often accompanied by increased trading volume, indicating strong market participation and conviction. Conversely, a bull trap may exhibit lower trading volume, suggesting a lack of sustained buying interest.

- Technical Analysis: Utilize technical analysis tools and indicators to identify potential bull traps. Pay attention to oscillators, such as the Relative Strength Index (RSI), which can highlight overbought conditions and provide insight into possible market reversals.

- Market Fundamentals: Consider the broader market fundamentals in conjunction with technical analysis. Evaluate factors such as company earnings reports, industry trends, economic indicators, and geopolitical events. If the fundamental picture does not support the supposed breakout, it may be a warning sign of a bull trap.

- Timing and Pattern Recognition: Assess the timing of the supposed breakout and the overall market trend. Look for patterns that resemble previous bull traps and analyze them for similarities. Understanding historical price patterns can provide valuable insights into the potential development of bull traps.

- Be Skeptical: Maintain a healthy dose of skepticism and question the validity of breakouts. Remember that not every price surge is a genuine trend reversal. Analyze the market objectively and avoid making impulsive decisions based solely on initial price movements.

Recognizing a bull trap requires a combination of technical analysis, market observation, and critical thinking. It is essential to remain vigilant, stay informed about market dynamics, and use a variety of tools and indicators to confirm the legitimacy of a breakout. By adopting a cautious approach and being proactive in assessing potential traps, investors can reduce the risk of falling into a bull trap and safeguard their investments.

Risk and Implications of Falling into a Bull Trap

Falling into a bull trap can have significant risks and implications for investors. It is crucial to understand the potential consequences of being caught in this deceiving market phenomenon. Here are some of the risks and implications associated with falling into a bull trap:

- Financial Losses: The primary risk of falling into a bull trap is incurring substantial financial losses. Investors who buy or hold onto positions based on a false breakout or an illusionary upward trend may experience a sudden reversal in prices. This can result in significant declines in their investments and potential loss of capital.

- Damaged Investor Confidence: Being trapped in a bull trap can erode investor confidence and trust in the market. Experiencing significant losses due to a deceptive market move can make investors hesitant and skeptical about future opportunities. It may take time to rebuild confidence and regain a sense of trust in making investment decisions.

- Psychological Impact: Falling into a bull trap can have psychological repercussions for investors. Emotions such as frustration, disappointment, and regret can arise from making decisions based on false signals. These negative emotions can, in turn, impact future investment decisions and cloud judgment.

- Missed Opportunities: Being trapped in a bull trap can lead to missed opportunities in the market. While investors are caught in a losing position, they may miss out on other potential profitable investments. This can delay portfolio growth and limit the ability to capitalize on genuine market trends.

- Extended Recovery Time: Recovering from the financial losses incurred in a bull trap can take time. Depending on the severity of the market reversal, investors may need to devise a new strategy, reassess their risk tolerance, and rebuild their portfolio. It may take a while to regain the losses and return to a profitable position.

- Opportunity Cost: Falling into a bull trap can result in an opportunity cost for investors. The capital tied up in a losing position could have been allocated to other potentially profitable investments. Missing out on these opportunities can impact long-term investment returns.

Recognizing the risks and implications of falling into a bull trap underscores the importance of careful analysis, risk management, and a disciplined investment approach. Investors should prioritize comprehensive research, rely on technical analysis and market fundamentals, and maintain a diversified portfolio to mitigate the impact of bull traps and other market traps.

Examples of Bull Traps in Stock History

Throughout stock market history, numerous instances of bull traps have occurred, catching investors off guard and resulting in significant financial losses. Understanding these examples can provide valuable lessons and insights into the deceptive nature of bull traps. Here are a few notable examples:

- Dotcom Bubble: One of the most famous examples of a bull trap occurred during the dotcom bubble in the late 1990s. Technology stocks experienced an unprecedented surge in value, with investors flocking to buy these stocks based on the belief that internet companies were the future. However, this optimism was short-lived, as the bubble eventually burst, leading to massive losses for investors who were caught in the trap.

- Real Estate Market Crash: In the mid-2000s, the real estate market in the United States experienced a significant bull trap. Housing prices were skyrocketing, fueled by low-interest rates and easy access to credit. Many investors believed that real estate was a foolproof investment, leading to a surge in buying activity. However, the market suddenly reversed, and the housing bubble burst, resulting in a widespread financial crisis and substantial losses for those who fell into the trap.

- Bitcoin Bubble: In 2017, the cryptocurrency market witnessed a massive bull trap with the ascent of Bitcoin. Bitcoin prices skyrocketed to unprecedented levels, attracting a frenzy of investor interest. However, the market soon experienced a sudden reversal, leading to a significant decline in prices. Investors who bought into the hype and held onto their positions endured substantial losses.

- Oil Price Collapse: The oil market has also witnessed bull traps. For instance, in 2014, crude oil prices reached high levels, leading many to anticipate a prolonged upward trend. However, the market dynamics suddenly shifted, oversupply flooded the market, and prices plummeted, trapping investors who believed in the continued rally.

- Short Squeeze on GameStop: A recent example of a bull trap took place in January 2021, when retail investors on a popular internet forum initiated a short squeeze on GameStop stock. The stock price soared to astronomical levels, luring in unsuspecting investors who joined the rally. However, the market eventually corrected, causing significant losses for investors caught in the bull trap.

These examples highlight the deceptive nature of bull traps and the potential financial consequences for investors. They serve as reminders to exercise caution, conduct thorough research, and critically analyze market dynamics before making investment decisions.

How to Avoid Falling into a Bull Trap

Falling into a bull trap can result in significant financial losses and have a detrimental impact on an investor’s portfolio. However, there are several strategies and precautions that investors can take to help avoid falling into these deceptive market traps. Here are some key steps to consider:

- Thorough Research: Conduct comprehensive research before making any investment decision. Utilize both fundamental and technical analysis to evaluate the underlying strength of a stock or market. Understand the company’s financials, industry trends, and market conditions to make informed investment choices.

- Utilize Multiple Indicators: Rely on a combination of technical indicators and market analysis tools to confirm the validity of price movements. Look for indicators such as volume, momentum, and trend lines to help identify potential bull traps. Avoid making decisions solely based on one indicator or single piece of information.

- Be Wary of Volume and Momentum: Pay attention to trading volume and momentum during price surges. A true market rally is often accompanied by high trading volume and sustained momentum. Conversely, a bull trap may have low volume and lackluster momentum, indicating a lack of conviction from market participants.

- Watch for Confirmation: Seek confirmation from other indicators, trend lines, or technical patterns before assuming a breakout is genuine. Look for consistent price movements, supportive market factors, and confirmation from multiple sources to validate a potential trend reversal.

- Manage Risk: Implement proper risk management strategies to protect your investments. Set stop-loss orders to limit potential losses and diversify your portfolio across different asset classes and sectors. By spreading your investments, you reduce the risk of being overly exposed to a single stock or market.

- Stay Informed: Continuously monitor market news, industry developments, and macroeconomic factors that can impact the market. Stay abreast of any potential market manipulations or false information that may contribute to the formation of bull traps.

- Maintain Emotional Discipline: Keep your emotions in check and avoid making impulsive decisions based on market movements. Maintain a disciplined approach to investing and follow your predetermined investment strategy. Avoid falling victim to fear, greed, or market hype.

- Seek Professional Advice: Consider consulting with a qualified financial advisor or professional who can provide guidance and expertise. They can help analyze market trends, identify potential traps, and offer personalized investment recommendations based on your financial goals and risk tolerance.

Remember, while bull traps can be challenging to avoid entirely, implementing these strategies can significantly reduce the risk of falling into these deceptive market traps. By conducting thorough research, utilizing multiple indicators, and staying informed, investors can make more informed decisions and safeguard their portfolios from the potential losses associated with bull traps.

Conclusion

Navigating the stock market requires vigilance and a keen understanding of market dynamics. Falling into a bull trap can have devastating financial consequences for investors. However, by being aware of the characteristics of a bull trap, recognizing the signs, and implementing risk management strategies, investors can minimize the risk of being caught in these deceptive market moves.

Thorough research, utilizing multiple indicators, and staying informed are key factors in avoiding bull traps. By conducting comprehensive analysis, confirming breakouts, and assessing market fundamentals, investors can make more informed investment decisions. It is crucial to remain skeptical and avoid making impulsive decisions based solely on initial price movements.

Managing risk, diversifying one’s portfolio, and maintaining emotional discipline are essential components of avoiding bull traps. Implementing proper risk management strategies, such as setting stop-loss orders and maintaining a diversified portfolio, can help limit potential losses and protect against individual stock or market risks. Emotionally disciplined investors are less likely to fall for market hype or make decisions driven by fear or greed.

Recognizing the risks and implications of falling into a bull trap, as demonstrated by historical examples, underscores the importance of cautious and informed decision-making. Investors should remain vigilant, stay updated on market developments, and consult with professionals if needed to navigate through the complexities and challenges of the stock market.

Ultimately, by arming themselves with knowledge, conducting thorough research, and utilizing various indicators, investors can minimize the risk of falling into bull traps and increase their chances of making successful and profitable investment decisions.