Home>Finance>What Is A Convertible Term Life Insurance Policy?

Finance

What Is A Convertible Term Life Insurance Policy?

Published: October 15, 2023

Learn about convertible term life insurance policies and how they can provide financial security. Find out how these policies work and explore their benefits in terms of flexibility and affordability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a Convertible Term Life Insurance Policy

- Benefits of a Convertible Term Life Insurance Policy

- How Does a Convertible Term Life Insurance Policy Work?

- Factors to Consider before Choosing a Convertible Term Life Insurance Policy

- Comparison between Convertible Term Life Insurance and Traditional Term Life Insurance

- Common Misconceptions about Convertible Term Life Insurance Policies

- Is a Convertible Term Life Insurance Policy Right for You?

- Conclusion

Introduction

Welcome to the world of insurance! If you’re in the market for a life insurance policy, you might have come across the term “convertible term life insurance.” But what exactly does it mean? And how does it differ from other types of life insurance? In this article, we will unravel the mysteries of convertible term life insurance and explore its benefits, working mechanism, and factors to consider before choosing this type of policy.

Life insurance is a financial tool that provides a safety net for your loved ones in the event of your untimely demise. It offers a payout, known as the death benefit, to your designated beneficiaries. There are several types of life insurance policies available, each with its own unique features and benefits.

A convertible term life insurance policy, as the name suggests, combines the benefits of both convertible and term life insurance. Term life insurance is a type of insurance that provides coverage for a specific period, typically 10, 20, or 30 years. Convertible term life insurance takes it a step further by allowing policyholders to convert their term policy into a permanent life insurance policy, such as whole life or universal life insurance.

Convertible term life insurance policies offer policyholders flexibility and peace of mind. They have the option to start with a term policy, which is generally more affordable, and convert it into a permanent policy at a later stage if their needs or financial situation changes. This means you can get the protection you need now and have the opportunity to adjust your coverage in the future without having to undergo medical underwriting or providing proof of insurability.

Now that you have a basic understanding of convertible term life insurance, let’s dive deeper into the benefits it offers and how it works. This knowledge will equip you with the necessary information to make an informed decision when selecting a life insurance policy that best suits your needs.

Definition of a Convertible Term Life Insurance Policy

A convertible term life insurance policy is a type of life insurance that allows policyholders to convert their term life insurance coverage into a permanent life insurance policy. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. With a convertible term life insurance policy, policyholders have the option to convert their term policy into a permanent policy, such as whole life or universal life insurance, without the need for a new medical examination or proving insurability.

Convertible term life insurance offers flexibility and versatility to policyholders. It allows individuals to start with a term policy, which often has lower premiums, and later convert it into a permanent policy to enjoy lifelong coverage and potential cash accumulation components.

One of the key advantages of a convertible term life insurance policy is that it provides a safety net during the initial term period, which is crucial for individuals who may not be able to afford the higher premiums of permanent life insurance. This type of policy ensures that policyholders have coverage during their most vulnerable years, such as while they are raising a family, paying off a mortgage, or starting a business.

Another important feature of convertible term life insurance is the ability to lock in insurability. As individuals age, their health conditions may change, making it difficult or expensive to obtain new life insurance coverage. By converting a term policy to a permanent policy, policyholders can secure coverage regardless of any developments in their health.

It is important to note that the conversion option usually comes with specific terms and conditions, which may include a deadline by which the conversion must be exercised, restrictions on the type of permanent policy that can be chosen, and potential additional fees or charges associated with the conversion process. These details vary across insurance providers, so it is vital to carefully review the terms of the policy and consult with an insurance professional before making any decisions.

In summary, a convertible term life insurance policy provides the flexibility to convert a term policy into a permanent policy, allowing policyholders to adjust their coverage as their needs change. It combines the affordability of term life insurance with the lifelong protection and potential cash accumulation of permanent life insurance.

Benefits of a Convertible Term Life Insurance Policy

Convertible term life insurance offers a range of benefits that make it an attractive option for individuals looking for life insurance coverage. Let’s explore some of the key advantages of choosing a convertible term life insurance policy:

1. Flexibility: A significant benefit of convertible term life insurance is its flexibility. It allows policyholders to start with a term policy, which typically has lower premiums, and later convert it into a permanent policy without having to go through medical underwriting or prove insurability. This flexibility gives individuals the opportunity to adjust their coverage to meet changing needs or financial situations.

2. Affordability: Term life insurance is generally more affordable compared to permanent life insurance. By opting for a convertible term policy initially, individuals can secure the coverage they need while keeping the premiums manageable. This is particularly beneficial for young families or individuals on a tight budget.

3. Locking in Insurability: As individuals age, their health conditions may change, making it harder to obtain new life insurance coverage. However, with a convertible term life insurance policy, policyholders have the advantage of locking in insurability. This means that even if health conditions change in the future, policyholders can convert to a permanent policy without undergoing additional medical examinations or facing increased premiums.

4. Long-Term Protection: While term life insurance provides coverage for a specific period, convertible term life insurance allows individuals to extend their coverage indefinitely. By converting to a permanent policy, policyholders can enjoy lifelong protection, ensuring that their loved ones are financially secure even after the initial term period ends.

5. Cash Accumulation: Permanent life insurance policies, such as whole life or universal life insurance, often include a cash value component. This means that policyholders can accumulate cash over time, which can be accessed through policy loans or withdrawals. By converting a term policy into a permanent policy, individuals have the opportunity to build cash value and potentially use it for future financial needs.

6. Estate Planning: Permanent life insurance policies offer valuable estate planning benefits. The death benefit from a permanent policy can be used to pay estate taxes, ensuring that beneficiaries receive their inheritance without the burden of estate tax liabilities. By converting a term policy to a permanent one, policyholders can incorporate these estate planning advantages into their overall financial strategy.

7. Peace of Mind: Perhaps the most significant benefit of convertible term life insurance is the peace of mind it provides. Knowing that you have the flexibility to adjust your coverage as your needs evolve and that your loved ones will be financially protected in the event of your death can provide invaluable peace of mind.

It is important to note that the specific benefits and options available may vary depending on the insurance provider and the terms of the policy. It is crucial to review and understand the details of the policy and consult with a knowledgeable insurance professional to determine if a convertible term life insurance policy is the right choice for your individual circumstances.

How Does a Convertible Term Life Insurance Policy Work?

Understanding how a convertible term life insurance policy works can help you make an informed decision when choosing the right life insurance coverage for your needs. Let’s dive into the workings of a convertible term life insurance policy:

1. Selecting a Term Life Insurance Policy: The first step in the process is to choose a term life insurance policy that aligns with your coverage needs and budget. You will need to decide on the duration of the term, such as 10, 20, or 30 years, and the amount of coverage you require.

2. Conversion Option: When purchasing a convertible term life insurance policy, make sure it includes a conversion option. This option allows you to convert your term policy into a permanent life insurance policy, such as whole life or universal life insurance, at a later date.

3. Conversion Period: The policy will typically specify a conversion period, which is the timeframe during which you can exercise the conversion option. This period is usually within the first few years of the policy term, but the specific duration can vary depending on the insurance provider and the policy terms.

4. No Medical Underwriting: One of the significant advantages of a convertible term life insurance policy is that you can convert to a permanent policy without having to undergo a new medical examination or prove insurability. This means that any changes in health conditions that may have occurred since the start of the term policy will not affect your ability to convert.

5. Choosing a Permanent Policy: When you decide to exercise the conversion option, you will need to select a permanent life insurance policy to convert your term coverage into. The options available may vary depending on the insurance provider, and there may be certain restrictions on the types of permanent policies you can choose.

6. Premium Adjustment: Upon conversion, the premium for the permanent policy will be adjusted based on factors such as your age, health, and the coverage amount. Keep in mind that permanent life insurance premiums are generally higher than term life insurance premiums due to the added benefits and cash value component.

7. Lifelong Coverage: By converting to a permanent policy, you will have lifelong coverage. This means that as long as you continue to pay the premiums, your policy will remain in force, providing protection for your loved ones when you pass away.

8. Cash Value Accumulation: Permanent life insurance policies often come with a cash value component that grows over time. This cash value can be accessed through policy loans or withdrawals, providing a potential source of funds for future needs such as education expenses or supplemental retirement income.

It is important to note that there may be specific terms and conditions associated with the conversion option, including any additional fees or charges. Additionally, the conversion option may expire if not exercised within the specified conversion period. Therefore, it is crucial to review the policy details and consult with an insurance professional to fully understand the workings of a convertible term life insurance policy and ensure it aligns with your long-term financial goals.

Factors to Consider before Choosing a Convertible Term Life Insurance Policy

When deciding on a convertible term life insurance policy, it’s essential to consider various factors to ensure it aligns with your financial goals and coverage needs. Here are some important factors to consider:

1. Conversion Options: Review the policy terms to understand the specific conversion options available. Note the conversion period, which is the timeframe during which you can convert the policy. Additionally, check if there are any restrictions on the types of permanent policies you can convert into. Understanding these options will help ensure the policy provides the flexibility you need.

2. Premiums: Compare the premiums of the convertible term life insurance policy with other types of life insurance policies, such as traditional term or permanent life insurance. Evaluate whether the premiums are affordable and fit within your budget, both during the term period and after conversion to a permanent policy.

3. Coverage Needs: Assess your current and future coverage needs. Consider factors such as outstanding debts, financial responsibilities (e.g., mortgage, education expenses), and provision for your loved ones. Ensure that both the term policy and the potential permanent policy provide sufficient coverage to meet your obligations and protect your dependents.

4. Health Considerations: As with any life insurance policy, your health plays a role in the premiums and the ability to convert. Assess your current health status and consider any pre-existing medical conditions. If you anticipate changes in your health condition, a convertible term life insurance policy can provide the advantage of locking in insurability without having to undergo additional medical exams in the future.

5. Long-Term Financial Goals: Evaluate your long-term financial goals and how a convertible term life insurance policy fits into your overall financial plan. Consider factors such as retirement savings, investment strategies, and other insurance coverage you may need. Determine if a convertible term policy aligns with your objectives or if other types of life insurance policies would be more suitable.

6. Policy Details: Carefully review the terms and conditions of the policy, including any fees, charges, or limitations associated with the conversion option. Understand the rules regarding the conversion period, as the ability to convert may expire if not exercised within a specified timeframe.

7. Seek Professional Advice: Consult with a knowledgeable insurance professional who can help assess your specific needs and provide guidance on selecting the most appropriate life insurance policy. They can help analyze the various options available, explain the potential benefits and drawbacks, and assist in determining the right coverage for your unique circumstances.

By considering these factors before choosing a convertible term life insurance policy, you can make an educated decision that suits your financial situation, lifestyle, and long-term objectives. Remember that life insurance is a long-term commitment, so taking the time to evaluate and compare options is essential to select the policy that provides the necessary protection and flexibility you need.

Comparison between Convertible Term Life Insurance and Traditional Term Life Insurance

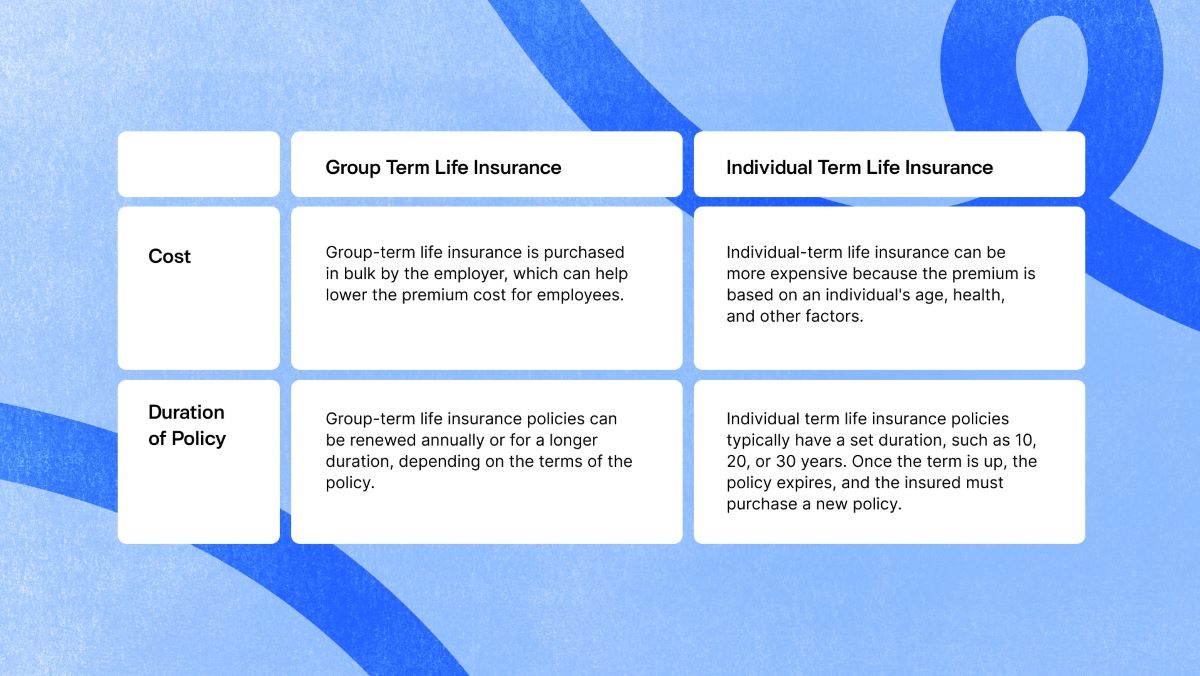

When choosing a life insurance policy, one common decision individuals face is whether to opt for convertible term life insurance or traditional term life insurance. Let’s compare these two options to help you understand their similarities and differences:

Convertible Term Life Insurance:

– Flexibility: Convertible term life insurance offers the flexibility to convert the policy into a permanent policy, such as whole life or universal life insurance, without the need for a new medical examination or proving insurability. This allows policyholders to adjust their coverage to meet changing needs or financial situations.

– Initial Affordability: Convertible term life insurance policies generally have lower premiums compared to permanent life insurance policies. This affordability can be beneficial for individuals on a tight budget or those who need temporary coverage during specific life stages.

– Insurability Lock: The conversion option in a convertible term policy allows individuals to lock in insurability. Regardless of any changes in health conditions, the policyholder can convert the term policy to a permanent policy without undergoing additional medical underwriting or facing increased premiums.

Traditional Term Life Insurance:

– Lower Premiums: Traditional term life insurance policies generally have lower premiums compared to permanent life insurance policies. This affordability makes it an attractive option for individuals looking for straightforward coverage at a lower cost.

– Fixed Term: Traditional term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. The coverage remains in force as long as the premiums are paid during the term period. After the term ends, the policy typically expires unless renewed or converted, without any cash value or lifelong coverage.

– No Cash Value: Traditional term life insurance policies do not accumulate cash value over time. They solely provide a death benefit to beneficiaries if the policyholder passes away during the term period.

– Specific Coverage : Traditional term life insurance is suitable for individuals who have a specific coverage need for a predetermined period, such as paying off a mortgage or providing income replacement during the working years. It is often chosen to protect dependents and provide financial security during critical years.

Considerations:

– Price Comparison: Compare the premiums of convertible term life insurance policies with traditional term life policies based on the coverage amount and term duration. Evaluate how the premiums fit into your budget and consider the long-term costs for maintaining coverage.

– Coverage Needs: Assess your coverage needs and decide if you require temporary coverage or if long-term or lifelong coverage is more suitable.

– Future Plans: Consider your future plans, such as marriage, starting a family, career progression, or retirement goals. Determine if your coverage needs may change over time or if you would prefer the option to convert to a permanent policy.

Making the right choice between convertible term life insurance and traditional term life insurance depends on your individual circumstances, financial goals, and coverage needs. It is crucial to carefully evaluate the features and benefits of each policy type, and consult with a knowledgeable insurance professional for guidance tailored to your specific situation.

Common Misconceptions about Convertible Term Life Insurance Policies

Convertible term life insurance policies offer valuable features and benefits, but there are some common misconceptions that can often lead to confusion. Let’s address these misconceptions associated with convertible term life insurance:

Misconception 1: Convertible Term Life Insurance is Expensive

This is a common misconception. While permanent life insurance tends to have higher premiums than term life insurance, convertible term life insurance initially offers the affordability of term coverage. The conversion option provides the opportunity to secure permanent coverage without premiums being based on the insured’s current age or health condition.

Misconception 2: Conversion Can Only Be Done at the End of the Term

This is not accurate. Conversion options typically have specified periods within the term where they can be exercised. It is essential to review the policy terms to determine the specific timeframe during which the conversion can take place. Waiting until the end of the term may result in the expiration of the conversion option.

Misconception 3: Conversion Requires Additional Underwriting

A significant advantage of convertible term life insurance is the ability to convert without the need for a new medical examination or proving insurability. The conversion allows policyholders to secure permanent coverage based on their original health when purchasing the term policy. However, it is important to remember that conversion options differ between policies and insurance providers, so it’s necessary to verify the specific requirements for conversion in the policy language.

Misconception 4: Convertible Term Life Insurance is Only Suitable for Young Individuals

While convertible term life insurance is often popular among younger individuals due to its lower initial premiums, it can be beneficial for individuals of all age groups. The flexibility to convert to a permanent policy without going through medical underwriting is advantageous for individuals who may anticipate changes in their health conditions or insurance needs in the future.

Misconception 5: Conversion Options Are Limited to Specific Policies

Convertible term life insurance policies typically offer a range of options for conversion, including various types of permanent life insurance policies. While there may be restrictions on the available policies, such as limited options or specific coverage amounts, policyholders usually have the flexibility to choose the type of permanent policy that best suits their needs and financial goals.

It is crucial to thoroughly review the terms and conditions of the convertible term life insurance policy, including the conversion option details, specific deadlines for conversion, and any associated fees or charges. Consulting with an experienced insurance professional can help clarify any misconceptions and ensure that you fully understand the benefits and limitations of a convertible term life insurance policy before making a decision.

Is a Convertible Term Life Insurance Policy Right for You?

Choosing the right life insurance policy requires careful consideration of your individual circumstances, coverage needs, and long-term goals. While convertible term life insurance offers unique advantages, it may not be the ideal choice for everyone. Here are some factors to consider when deciding if a convertible term life insurance policy is right for you:

Long-Term Coverage: If you require coverage beyond the initial term period and want the option to extend it indefinitely without the need for additional underwriting or proving insurability, a convertible term life insurance policy may be a suitable choice. This is particularly beneficial if you anticipate changes in your health or anticipate the need for coverage later in life.

Flexibility and Adjustability: If you prefer having the flexibility to adjust your coverage as your needs evolve, a convertible term life insurance policy can provide that option. If your financial situation changes, or if you experience life events such as marriage, having children, or starting a business, the ability to convert to a permanent policy without further underwriting can be valuable.

Affordability: Convertible term life insurance policies often have more affordable premiums during the term period compared to permanent life insurance premiums. If lower initial premiums are important to you, convertible term life insurance may be a suitable choice, allowing you to secure coverage even on a limited budget.

Locking in Insurability: If you have concerns about potential changes in health or anticipate difficulty in obtaining coverage later in life, a convertible term life insurance policy can provide a valuable advantage. By converting to a permanent policy within the designated conversion period, you can lock in your insurability, ensuring that you have coverage regardless of any future health developments.

Flexibility in Choosing Permanent Coverage: If you want the option to choose from a range of permanent life insurance policies, convertible term life insurance can be beneficial. It allows you to select the type of permanent policy that aligns with your financial goals, risk tolerance, and long-term plans.

Ultimately, the decision of whether a convertible term life insurance policy is right for you depends on your unique circumstances and objectives. It is crucial to evaluate your coverage needs, future plans, budget, and health considerations. Working with a knowledgeable insurance professional can help you understand the specifics of the policy, compare it with alternative options, and determine the most suitable coverage for your individual situation.

Remember, life insurance is a long-term commitment, so take the time to thoroughly review and understand the policy terms, benefits, and limitations before making a decision. This will ensure that you choose a policy that provides the necessary protection and aligns with your financial goals for the future.

Conclusion

Choosing the right life insurance policy is a crucial step in securing financial protection for your loved ones. Convertible term life insurance provides a unique blend of flexibility, affordability, and long-term coverage options. By starting with a term policy and having the ability to convert to a permanent policy, policyholders can adapt their coverage as their needs evolve without the requirement of additional medical underwriting.

Convertible term life insurance offers several benefits, including the ability to lock in insurability, flexibility in choosing permanent coverage, and affordable premiums during the term period. This type of policy provides peace of mind, knowing that you have the option to extend your coverage indefinitely without the need for new medical examinations or proving insurability.

However, convertible term life insurance may not be the right choice for everyone. It’s important to carefully consider factors such as long-term coverage needs, future plans, affordability, and health considerations before making a decision.

Remember to thoroughly review the policy terms and conditions, including any restrictions, conversion deadlines, and associated fees. Consulting with an experienced insurance professional can provide invaluable guidance and help you make an informed decision based on your individual circumstances.

Ultimately, the goal of any life insurance policy is to protect the financial well-being of your loved ones. Whether you choose convertible term life insurance or another type of life insurance, ensure that it aligns with your coverage needs, long-term financial goals, and provides the necessary peace of mind for you and your family.

Take the time to evaluate your options, ask questions, and seek professional advice to make a confident and well-informed decision. With the right life insurance policy in place, you can have the peace of mind knowing that your loved ones will be financially supported even if you’re no longer there to provide for them.