Home>Finance>What Type Of Policy Can Group Term Life Insurance Normally Be Converted To?

Finance

What Type Of Policy Can Group Term Life Insurance Normally Be Converted To?

Modified: December 29, 2023

Explore the various options for converting group term life insurance policies in the field of finance. Discover which policies are readily available for conversion.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of group term life insurance! If you are part of a group or organization that offers this type of coverage, you may be wondering what options you have in the event that you leave the group or retire. Fortunately, group term life insurance policies often come with conversion options that allow you to continue your coverage on an individual basis.

In this article, we will explore the ins and outs of group term life insurance conversions. We will discuss the various types of policies that group term life insurance can be converted to, as well as the factors you should consider when making this important decision. Whether you are already a policyholder or are simply exploring your options, this article will provide valuable insight into the world of group term life insurance conversions.

Before we dive into the specifics, let’s first understand what group term life insurance is and how it works.

Group term life insurance is a type of life insurance coverage that is typically offered to employees or members of a group or organization. It provides a death benefit to the beneficiaries named in the policy in the event of the insured individual’s death. The premiums for group term life insurance are typically more affordable compared to individual life insurance policies, as they are spread across a larger group of individuals.

Now, let’s explore the conversion options available for group term life insurance policies.

Understanding Group Term Life Insurance

Before delving into the conversion options for group term life insurance, it’s important to have a solid understanding of how this type of coverage works. Group term life insurance is typically provided by employers or organizations as a benefit to their employees or members. It offers a level of financial protection to individuals and their families in the event of the insured’s death.

Group term life insurance policies are usually annual contracts that can be renewed on a yearly basis. The coverage amount, also known as the death benefit, is determined by the employer or organization offering the policy. This amount is commonly a multiple of the insured person’s annual salary, such as one or two times their income.

One key advantage of group term life insurance is the lower cost compared to individual life insurance policies. Since the risk is spread across a larger group, the premiums tend to be more affordable. Group term life insurance also generally does not require a medical examination, making it accessible to individuals with pre-existing health conditions.

It’s important to note that group term life insurance is typically tied to the employment or membership with the specific group or organization offering the coverage. This means that if you leave the group or retire, you may lose your coverage. However, many group term life insurance policies come with conversion options that allow you to convert your coverage to an individual policy.

Now that we have a clear understanding of group term life insurance, let’s explore the different conversion options available.

Conversion Options for Group Term Life Insurance

When it comes to converting your group term life insurance policy, it’s essential to know the available options. Conversions allow you to continue your coverage on an individual basis, ensuring that you and your loved ones remain protected. The specific conversion options depend on the insurance company and policy provisions, so it’s important to review your policy documents or consult with your insurance provider for precise details.

Here are some common conversion options for group term life insurance:

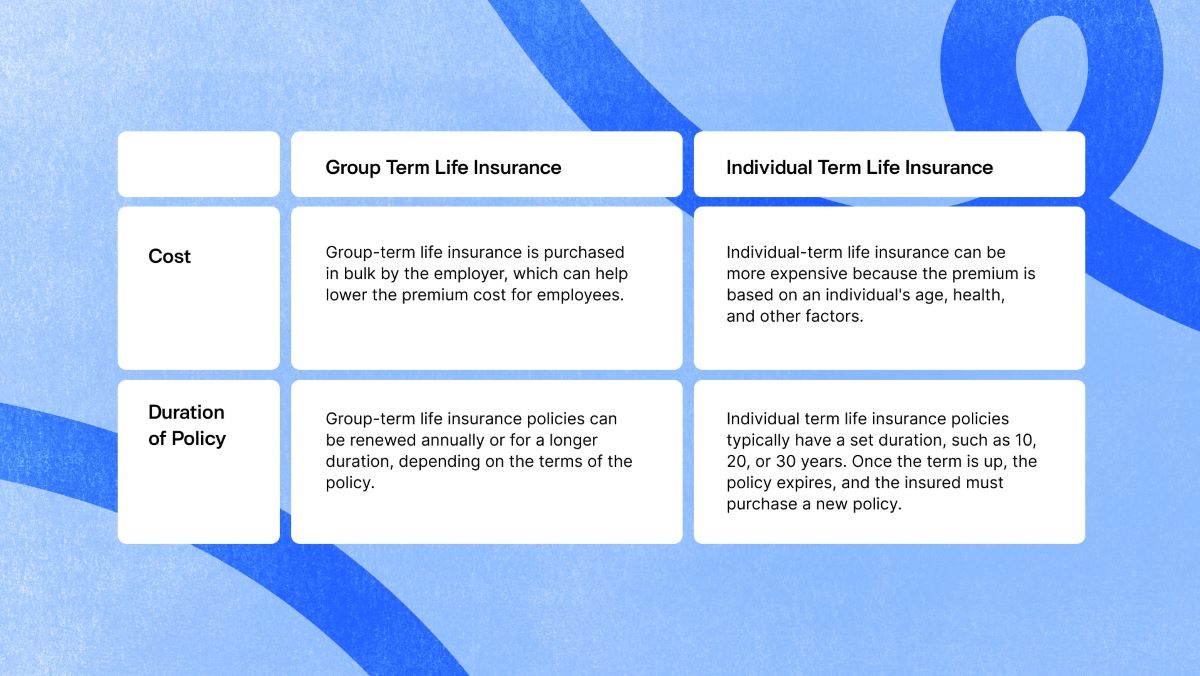

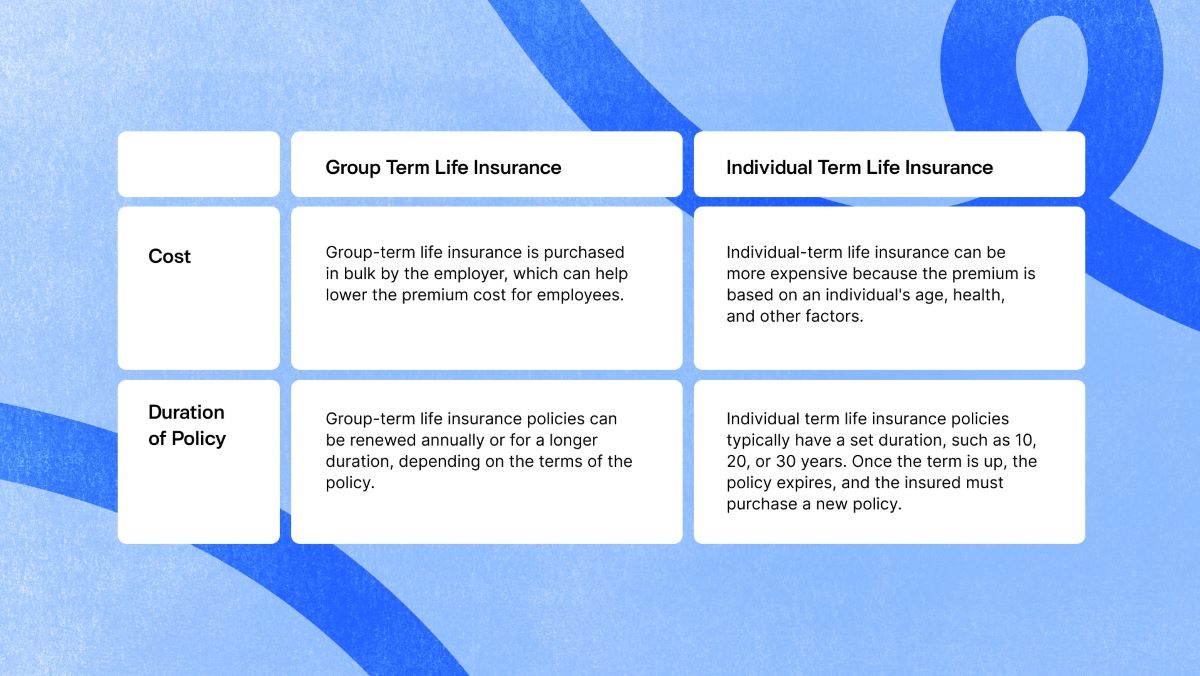

- Conversion to an Individual Term Life Insurance Policy: This option allows you to convert your group term life insurance policy to an individual term life insurance policy. Term life insurance provides coverage for a specified term, such as 10 or 20 years, and pays a death benefit if you pass away during the term. Converting to an individual term life insurance policy allows you to continue coverage while potentially locking in a fixed premium for the duration of the term.

- Conversion to a Whole Life Insurance Policy: Whole life insurance provides coverage for your entire life, as long as premiums are paid. The policy builds cash value over time, which you can borrow against or use as an investment vehicle. Converting to a whole life insurance policy offers permanent coverage and the potential for cash value accumulation, but it typically comes with higher premiums compared to term life insurance.

- Conversion to a Universal Life Insurance Policy: Universal life insurance is a flexible type of permanent life insurance that combines a death benefit with a savings component. While it offers lifelong coverage, it allows policyholders to adjust their premium payments and death benefit amounts over time. Converting to a universal life insurance policy provides flexibility in terms of premium payments and death benefit options.

It’s important to note that conversion options may have specific terms and conditions, such as a time limit for conversion or limitations on the coverage amount. Additionally, the premiums for converted policies may be higher than what you were paying for the group term life insurance.

Now that we understand the conversion options available, let’s dive into the specific types of policies that group term life insurance can be converted to.

Types of Policies Group Term Life Insurance Can Be Converted To

When it comes to converting your group term life insurance policy, you have several options to choose from. The type of policy you can convert to depends on the insurance company and the provisions of your policy. Let’s explore some common types of policies that group term life insurance can be converted to:

- Level Term Insurance: Level term insurance is a type of policy that provides coverage for a specific term, such as 10, 20, or 30 years. The death benefit remains constant throughout the policy term, and the premiums are typically fixed. Converting to a level term insurance policy allows you to continue your coverage for a specific duration, providing protection to your loved ones in the event of your passing.

- Whole Life Insurance: Whole life insurance is a permanent policy that provides coverage for your entire life, as long as premiums are paid. This type of policy not only offers a death benefit but also accumulates cash value over time. Converting to a whole life insurance policy ensures that you have lifelong coverage and the potential for cash value growth. However, it’s important to note that whole life insurance policies typically come with higher premiums compared to term insurance.

- Universal Life Insurance: Universal life insurance is another type of permanent policy that offers death benefit coverage along with a savings component. With universal life insurance, policyholders have the flexibility to adjust premium payments and death benefit amounts over time. Converting to a universal life insurance policy allows you to have lifelong coverage while having the ability to customize your premium and death benefit options.

It’s important to carefully review the terms and conditions of each type of policy before making a conversion decision. Consider factors such as premium costs, death benefit amounts, cash value growth potential, and your long-term financial goals.

Keep in mind that the availability of conversion options may vary between insurance companies and policies. Some policies may offer additional conversion options or variations of the policies mentioned above. It’s advisable to consult with your insurance provider or agent to fully understand the conversion options available to you.

Now that we have explored the types of policies that group term life insurance can be converted to, let’s discuss the factors you should consider when making this conversion decision.

Level Term Insurance

One type of policy that group term life insurance can often be converted to is level term insurance. Level term insurance provides coverage for a specified term, such as 10, 20, or 30 years, with a fixed death benefit and premium throughout that term.

When you convert your group term life insurance to a level term insurance policy, you continue to have the peace of mind knowing that your loved ones will be financially protected in case of your untimely passing. The fixed death benefit ensures that the specified amount will be paid out to your beneficiaries if you were to pass away during the term of the policy.

Level term insurance is a popular choice for individuals who need coverage for a specific period, such as until their mortgage is paid off or until their children are financially independent. It provides a straightforward and affordable way to ensure your loved ones are taken care of during a set timeframe.

When considering the conversion to level term insurance, there are a few factors to take into account:

- Policy Terms: Determine the length of coverage you need. Consider your financial obligations, such as mortgage payments or children’s education, and choose a term that aligns with those needs.

- Death Benefit: Assess the amount of coverage you require to financially protect your beneficiaries. It’s essential to consider factors such as outstanding debts, future income needs, and potential expenses.

- Premiums: Understand the premium structure of the level term insurance policy and ensure it fits within your budget. Take into account any potential future premium increases, as rates may differ once you convert from group term insurance.

- Convertibility: Review the terms and conditions related to the conversion of your group term life insurance to level term insurance. Ensure that the policy provides a seamless and straightforward conversion process.

Level term insurance provides a reliable and customizable solution for continuing your life insurance coverage. By converting your group term life insurance to level term insurance, you can have peace of mind knowing that your loved ones will be protected financially during a specific period.

It’s important to consult with your insurance provider or agent to understand the specific details, options, and limitations associated with converting to level term insurance. They can help guide you through the process and ensure that you make an informed decision that aligns with your financial goals.

Now, let’s move on to discussing another option for converting group term life insurance: whole life insurance.

Whole Life Insurance

Another type of policy that group term life insurance can be converted to is whole life insurance. Whole life insurance is a permanent life insurance policy that provides coverage for your entire life, as long as premiums are paid. Unlike term life insurance, which covers you for a specific term, whole life insurance offers lifelong protection and builds cash value over time.

When you convert your group term life insurance to a whole life insurance policy, you continue to have the peace of mind knowing that your loved ones will be financially protected no matter when you pass away. The death benefit of a whole life insurance policy is paid out to your beneficiaries upon your death, providing them with financial support during a difficult time.

One of the significant advantages of whole life insurance is the cash value component. As you pay premiums, a portion of the money goes towards building cash value within the policy. This cash value grows over time, tax-deferred, and can be accessed through policy loans or withdrawals for various purposes, such as supplementing retirement income or meeting unforeseen financial needs.

When considering the conversion to whole life insurance, there are several factors to consider:

- Lifetime Coverage: Evaluate if you need coverage for your entire life or if a specific term is more suitable for your needs. Whole life insurance ensures that your loved ones will receive a death benefit whenever you pass away, providing long-term financial protection.

- Cash Value Accumulation: Understand the potential for cash value growth within the whole life insurance policy. This accumulated cash value can serve as a financial resource during your lifetime and can be accessed for various purposes.

- Premiums: Consider the cost of premiums for whole life insurance. They are typically higher compared to term life insurance but remain level throughout the life of the policy.

- Convertibility: Review the terms and conditions related to converting your group term life insurance to whole life insurance. Ensure that the policy offers a straightforward and seamless conversion process.

Whole life insurance offers the benefits of lifelong coverage and cash value accumulation, providing stability and flexibility for your financial planning. By converting your group term life insurance to whole life insurance, you can continue to protect your loved ones while gaining the potential for long-term financial growth.

It’s important to consult with your insurance provider or agent to discuss the specific details, options, and limitations associated with converting to whole life insurance. They can help you navigate the conversion process and tailor a policy that aligns with your financial goals.

Now, let’s move on to discussing the last option for converting group term life insurance: universal life insurance.

Universal Life Insurance

Universal life insurance is another type of policy that group term life insurance can be converted to. Universal life insurance is a flexible and permanent life insurance policy that offers both a death benefit and a savings component.

When you convert your group term life insurance to a universal life insurance policy, you gain the advantages of lifelong coverage and the flexibility to adjust your premium payments and death benefit amounts over time. This allows you to customize your policy to meet your evolving financial needs and goals.

One of the key features of universal life insurance is the ability to accumulate cash value. A portion of your premium payments goes into an account that grows over time, typically earning interest at a competitive rate. This cash value can be accessed through policy loans or withdrawals, providing you with a potential source of funds for emergencies, education expenses, or supplementing your retirement income.

When considering the conversion to universal life insurance, there are important factors to take into account:

- Lifetime Coverage: Evaluate if you need coverage that extends beyond a specific term. Universal life insurance provides lifelong protection and ensures that your loved ones will receive a death benefit whenever you pass away.

- Flexibility: Consider the ability to adjust premium payments and death benefit amounts over time to align with your changing financial circumstances. This flexibility allows you to adapt your policy to major life events, such as marriage, having children, or a change in income.

- Cash Value Accumulation: Understand the potential for cash value growth within a universal life insurance policy. The accumulated cash value can serve as a valuable asset for future financial needs.

- Premiums: Consider the cost of premiums for universal life insurance. The premium payments can vary depending on factors such as the death benefit amount, cash value accumulation, and overall policy performance.

- Policy Loans and Withdrawals: Assess the policy’s provisions regarding the accessibility of cash value through loans or withdrawals. Understand any associated fees or interest rates that may apply.

Universal life insurance offers a combination of permanent coverage, cash value accumulation, and flexibility. By converting your group term life insurance to universal life insurance, you can tailor your policy to your unique financial situation and future goals.

Consulting with your insurance provider or agent is crucial when considering the conversion to universal life insurance. They can provide further details, explain the specific terms and conditions of the policy, and help you determine if it’s the right choice for your financial needs.

Now that we have explored the various types of policies that group term life insurance can be converted to, let’s move on to discussing important factors to consider when making the conversion decision.

Factors to Consider When Converting Group Term Life Insurance

When considering the conversion of your group term life insurance to an individual policy, there are several important factors that you should take into account. These factors can help guide you in making an informed decision that aligns with your financial goals and provides adequate protection for your loved ones. Here are some key factors to consider:

- Cost: Evaluate the potential increase in premiums when converting to an individual policy. Group term life insurance often offers lower premiums due to the larger group coverage. Consider your budget and ensure that you can afford the premiums for the converted policy.

- Coverage Amount: Assess your current and future financial obligations and determine the appropriate coverage amount. Consider factors such as outstanding debts, income replacement needs, educational expenses, and potential healthcare costs. Ensure that the coverage amount of the converted policy adequately provides for your loved ones in case of your passing.

- Policy Flexibility: Review the flexibility of the converting policy. Some policies offer options to adjust the coverage amount or premium payments over time. This can be beneficial if your financial situation changes, allowing you to modify the policy to suit your evolving needs.

- Policy Features: Understand the features and benefits of the converted policy. Consider factors such as the death benefit payout options, cash value accumulation, and any additional riders or options that may enhance the policy’s coverage.

- Conversion Deadline: Be mindful of any time restrictions for converting your group term life insurance policy. Some policies have specific deadlines or age limitations for conversion. Ensure that you understand and meet the requirements before the opportunity for conversion expires.

- Insurability: Take into account any changes in your health or medical condition since obtaining your group term life insurance policy. Conversion to an individual policy may require medical underwriting, which could affect your insurability and premium rates. Evaluate whether your current health status may have an impact on the conversion process.

By carefully considering these factors, you can make an informed decision when converting your group term life insurance policy. It is crucial to thoroughly review the terms and conditions of the converting policy and consult with your insurance provider or agent for guidance.

Keep in mind that everyone’s financial situation and insurance needs are unique, so it’s important to assess your individual circumstances when making the conversion decision. By taking these factors into consideration, you can select the most suitable policy type and ensure continued protection for yourself and your loved ones.

Now, let’s conclude our discussion on converting group term life insurance.

Conclusion

Converting your group term life insurance policy to an individual policy is a crucial decision that requires careful consideration. Understanding the available conversion options and considering various factors can help you make the right choice for your financial needs and the well-being of your loved ones.

Group term life insurance provides a valuable form of coverage, typically at affordable rates, during your association with a specific group or organization. However, when circumstances change, and you leave the group or retire, converting your policy becomes necessary to maintain insurance protection.

Depending on your needs and preferences, you have several options for converting group term life insurance. Level term insurance provides coverage for a specific term, whole life insurance offers lifelong protection with the potential for cash value growth, and universal life insurance combines coverage with flexibility in premium payments and death benefit adjustments.

When considering the conversion, factors such as cost, coverage amount, policy flexibility, and policy features should be carefully evaluated. Additionally, be mindful of conversion deadlines and potential changes in insurability based on your health condition.

To make an informed decision, review your group term life insurance policy documents and consult with your insurance provider or agent. They can provide guidance on conversion options, policy features, and any restrictions or requirements associated with the conversion process.

Remember, converting your group term life insurance ensures that you continue to protect your loved ones in the event of your passing. It allows you to customize your coverage, address your evolving financial needs, and secure peace of mind for yourself and your beneficiaries.

Now that you have a comprehensive understanding of group term life insurance conversions, the available policy options, and the important factors to consider, you can confidently navigate the conversion process and make a decision that aligns with your long-term financial goals.

Ensure you review and compare conversion options, gather the necessary information, and consult with professionals to make an informed choice that provides the best possible protection for yourself and your loved ones.