Finance

What Is A General Journal In Accounting

Published: October 10, 2023

Learn what a general journal is in accounting and how it is used in finance. Understand the role of a general journal in financial record-keeping.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of a General Journal

- Purpose of a General Journal

- Format of a General Journal

- Examples of General Journal Entries

- Benefits of Using a General Journal

- Differences Between a General Journal and a General Ledger

- Importance of Accurate General Journal Entries

- Key Components of a General Journal

- How to Create a General Journal Entry

- Conclusion

Introduction

When it comes to managing and recording financial transactions in the field of accounting, accuracy and organization are paramount. One essential tool that helps facilitate this process is the general journal. The general journal serves as a primary record of all financial transactions that occur within a business, providing a detailed account of each transaction and its corresponding impact on the company’s financial position.

Regardless of the size or nature of the business, the general journal is a foundational component of the accounting system. It serves as a central hub where all financial activities are documented before being posted to the general ledger. From small businesses to large corporations, maintaining a general journal is crucial for accurate financial reporting and decision-making.

In this article, we will explore the purpose, format, and significance of a general journal in accounting. We will also examine the differences between a general journal and a general ledger and highlight the key components that make up a general journal entry. By the end of this article, you will have a better understanding of the importance of maintaining a well-organized general journal and how it contributes to effective financial management.

Definition of a General Journal

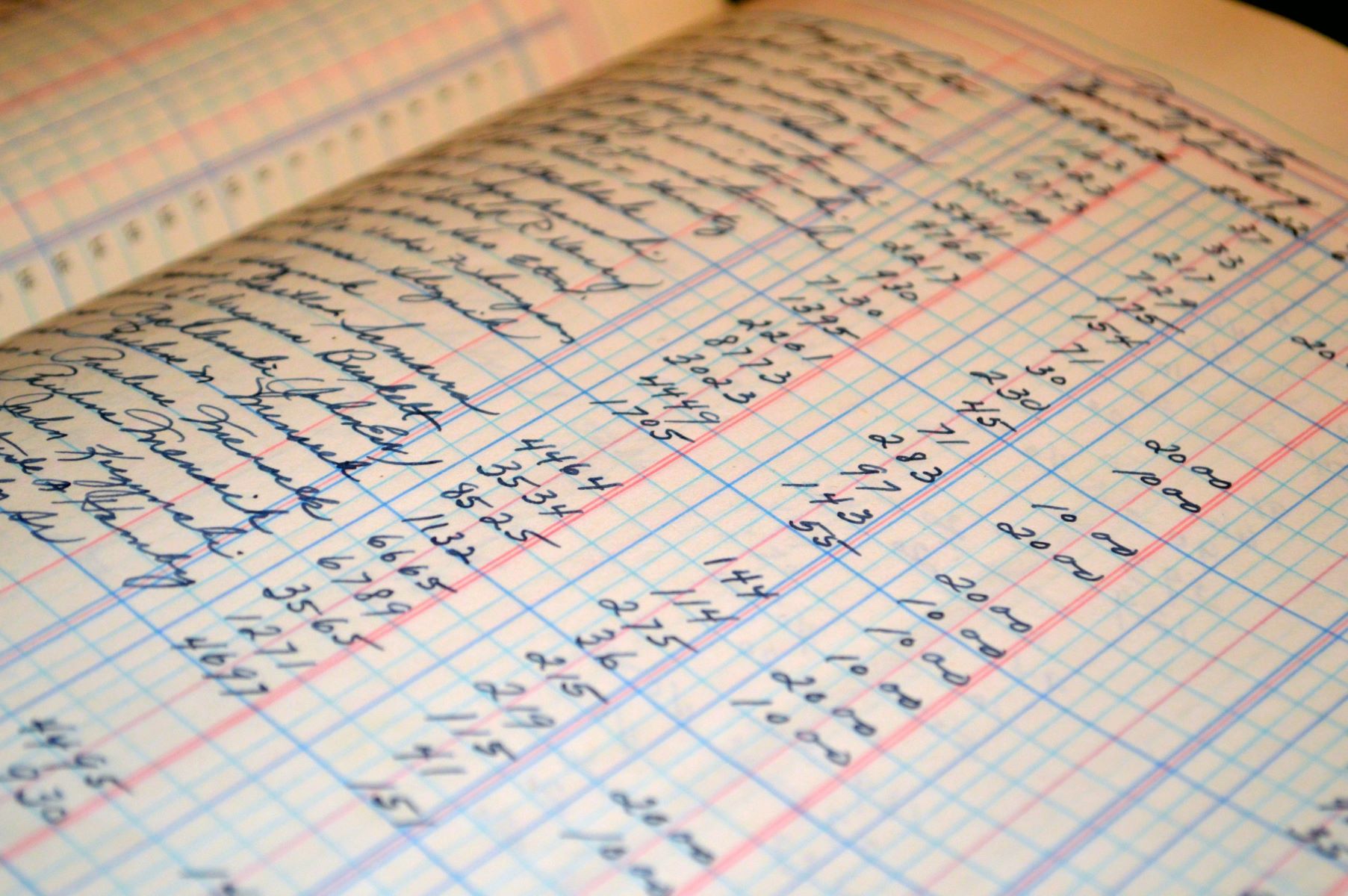

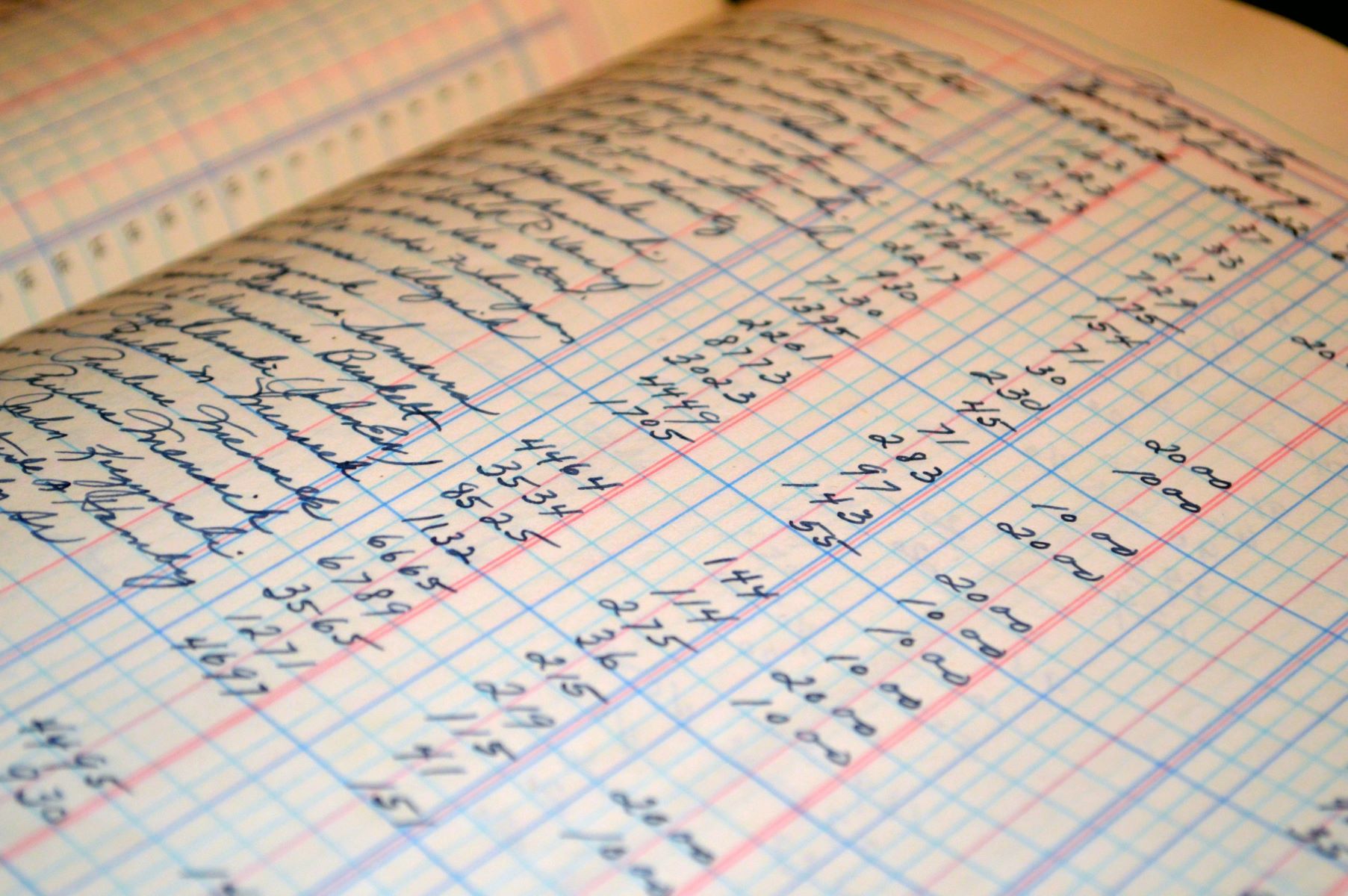

A general journal, also known as a book of original entry, is an accounting record that captures all financial transactions in chronological order. It serves as a primary source for recording and tracking business transactions, ensuring accuracy and transparency in the financial reporting process.

The general journal is a manual or digital document where each transaction is recorded using a standardized format. It provides a detailed account of the date, description, accounts involved, amounts, and reference numbers for each transaction.

Every financial transaction, such as sales, purchases, expenses, and cash inflows or outflows, is documented in the general journal. It acts as a chronological diary of all these transactions, creating a clear and comprehensive audit trail for accounting purposes.

The general journal is typically organized into columns that categorize the information for each transaction. Common columns include the date of the transaction, the account titles affected, a description of the transaction, the debit and credit amounts, and any reference number or specific details relevant to the transaction.

With the advent of accounting software, the general journal can now be maintained electronically. However, the fundamental purpose remains the same: to accurately record and track financial transactions in a consistent manner.

Overall, the general journal is an essential component of the accounting process, providing a detailed record of all company transactions. It serves as a crucial reference for financial reporting, auditing, and analysis, ensuring the integrity and accuracy of the company’s financial records.

Purpose of a General Journal

The general journal serves several purposes in the field of accounting, all of which contribute to accurate financial recording and reporting. Understanding the purpose of a general journal can help you appreciate its significance in maintaining organized and reliable financial records.

One primary purpose of a general journal is to provide a comprehensive record of all financial transactions within a business. By recording every transaction in the general journal, businesses can maintain a complete and transparent account of their financial activities. This serves as a crucial reference for auditing purposes, ensuring that all transactions are accurately reported and compliant with accounting standards.

Additionally, the general journal acts as a vital component of the double-entry bookkeeping system. This system requires every transaction to be recorded with both a debit and credit entry, ensuring that the accounting equation (assets = liabilities + equity) remains balanced. The general journal enables businesses to comply with this principle by recording the corresponding debit and credit entries for each transaction, leading to accurate and balanced financial statements.

The general journal also aids in the creation of the general ledger, the master financial record that summarizes all transactions by account. By recording transactions in the general journal, businesses can easily gather and transfer the necessary information to the general ledger. This allows for efficient reporting and analysis of financial information, facilitating informed business decisions.

Furthermore, the general journal provides a detailed record of the financial history of a business. It allows for easy retrieval of past transactions, enabling businesses to track trends, identify patterns, and analyze financial performance over time. This historical data can be useful for budgeting, forecasting, and assessing the overall financial health of the business.

Finally, the general journal is essential for ensuring accurate and timely financial reporting. By diligently recording transactions in the general journal, businesses can generate accurate financial statements, such as the balance sheet, income statement, and cash flow statement. These financial statements are crucial for external stakeholders, such as investors, creditors, and regulatory bodies, to assess the financial performance and stability of the business.

In summary, the purpose of a general journal is to provide a comprehensive and organized record of all financial transactions, maintain the integrity of the accounting system, and support accurate financial reporting and analysis. By fulfilling these purposes, the general journal plays a vital role in the smooth operation and financial management of businesses.

Format of a General Journal

The format of a general journal is designed to ensure consistency and clarity in recording financial transactions. While the specific layout may vary between organizations and accounting software systems, the fundamental elements remain relatively consistent.

A typical general journal consists of columns that capture specific details of each transaction. These columns include:

- Date: The date on which the transaction occurred is recorded in this column. It helps to maintain a chronological order of transactions and enables easy reference.

- Account Title: This column specifies the account or accounts involved in the transaction. Each account title should be accurately identified to ensure proper classification and reporting.

- Description: A brief description of the transaction is provided in this column. It should be clear and concise, conveying the nature of the transaction without ambiguity.

- Debit: The debit amount associated with the transaction is recorded in this column. Debits represent increases in assets or expenses and decreases in liabilities or equity.

- Credit: The credit amount associated with the transaction is recorded in this column. Credits represent increases in liabilities or equity and decreases in assets or expenses.

- Reference: This column may be used to provide a reference number or additional details that pertain to the transaction. It aids in cross-referencing and identifying related documents or supporting information.

The format of a general journal allows for each transaction to be recorded on a separate line or row. This layout ensures clarity and ease of reading, facilitating efficient review and analysis of the journal entries.

In manual general journals, ruled lines are often used to separate each entry, making it easier to distinguish between transactions. Additionally, the general journal is typically paginated and includes a header that identifies the company name, the accounting period, and the journal page number.

In digital accounting software systems, the general journal may be presented in a spreadsheet-like format, with cells for entering the relevant data. The software often provides validation and built-in formulas to minimize errors and automate calculations.

Overall, the format of a general journal is designed to capture and present key details of each transaction in an organized and standardized manner. This ensures consistency, accuracy, and efficient retrieval of information for financial reporting, analysis, and auditing purposes.

Examples of General Journal Entries

General journal entries are used to record various types of financial transactions that occur within a business. These entries are crucial for maintaining accurate and up-to-date financial records. Let’s explore some examples of common general journal entries:

-

Purchasing Inventory:

Date: January 5, 2022

Account Title: Inventory

Description: Purchased inventory from XYZ Supplier

Debit: Inventory $10,000

Credit: Accounts Payable $10,000

Reference: Purchase Invoice #12345

In this entry, the business records the purchase of inventory for $10,000. The inventory account is debited to reflect the increase in assets, while the accounts payable account is credited to show the liability created by the purchase.

-

Sales Revenue:

Date: February 15, 2022

Account Title: Accounts Receivable

Description: Sold product to customer XYZ Corp

Debit: Accounts Receivable $5,000

Credit: Sales Revenue $5,000

Reference: Sales Invoice #56789

This entry represents the recognition of sales revenue from a customer. The accounts receivable account is debited to record the increase in assets, while the sales revenue account is credited to reflect the revenue generated.

-

Salary Expense:

Date: March 31, 2022

Account Title: Salary Expense

Description: Paid monthly salaries to employees

Debit: Salary Expense $20,000

Credit: Cash $20,000

Reference: Payroll Register

This entry reflects the payment of salaries to employees. The salary expense account is debited to recognize the expense, while the cash account is credited to record the outflow of funds.

These examples demonstrate how general journal entries are used to record various types of transactions in an organized and consistent manner. Whether it’s purchasing inventory, recording sales revenue, or recognizing expenses, general journal entries provide a clear and detailed record of each transaction, ensuring accurate financial reporting and analysis.

Benefits of Using a General Journal

The use of a general journal in accounting brings several benefits to businesses of all sizes. Understanding these advantages can highlight the importance of maintaining a well-organized general journal as part of a company’s financial management practices.

- Accurate Financial Reporting: By recording all financial transactions in the general journal, businesses can ensure the accuracy and integrity of their financial reports. The journal serves as a primary source document, providing a detailed record of each transaction that can be used to prepare financial statements.

- Transparent Audit Trail: The general journal provides a chronological record of transactions, creating a clear audit trail for accounting purposes. This trail aids in reconciling accounts, identifying errors, and providing evidence for external audits, improving transparency and ensuring compliance with regulatory requirements.

- Effective Financial Analysis: The detailed information captured in the general journal allows for robust financial analysis. Businesses can evaluate trends, identify patterns, and assess the impact of specific transactions on the financial health of the company. This knowledge is valuable for making informed business decisions and formulating strategies.

- Efficient Bookkeeping: The general journal simplifies the bookkeeping process by providing a central location for recording and organizing transactions. It eliminates the need to search through various documents to find specific transaction details, saving time and reducing the risk of errors.

- Consistent Accounting Practices: A standardized format in the general journal ensures consistency in recording transactions. This consistency enhances accuracy and allows for easy comparison and analysis of financial data over time. It promotes best practices in accounting and ensures compliance with accounting principles and standards.

- Maintaining the Double-Entry System: The general journal is a fundamental component of the double-entry bookkeeping system, which requires every transaction to have both a debit and credit entry. By using a general journal, businesses can properly adhere to this system, ensuring that their financial records remain balanced and accurate.

- Evidence for Legal and Tax Purposes: In the event of legal disputes or tax audits, the general journal serves as critical evidence to support financial transactions. It provides a documented history of the company’s financial activities, helping to defend against inaccuracies or discrepancies.

In summary, utilizing a general journal in accounting offers several benefits, including accurate financial reporting, transparency in auditing, effective financial analysis, efficient bookkeeping, consistent accounting practices, adherence to the double-entry system, and evidence for legal and tax purposes. By leveraging these advantages, businesses can maintain accurate and reliable financial records, supporting informed decision-making and ensuring compliance with regulatory requirements.

Differences Between a General Journal and a General Ledger

While both the general journal and the general ledger are essential components of the accounting system, there are distinct differences between the two in terms of their purpose and functionality. Understanding these differences can help businesses effectively utilize both tools in the financial reporting process.

Purpose: The general journal serves as a book of original entry, recording all financial transactions in chronological order. It provides a detailed account of each transaction, including the date, description, accounts involved, and amounts. The purpose of the general journal is to capture and organize the initial transaction details before they are transferred to the general ledger.

The general ledger, on the other hand, serves as a master financial record that summarizes all transactions by account. It consolidates the information from the general journal, grouping similar transactions together under specific account titles. The purpose of the general ledger is to provide a comprehensive overview of the balances for each account, facilitating the preparation of financial statements.

Format: The general journal typically has a vertical format, with columns for the date, account title, description, debit amount, credit amount, and reference information. Each transaction is recorded on a separate line, creating a chronological record of all transactions. The general journal may span multiple pages, with each page numbered and clearly labeled.

The general ledger, on the other hand, has a horizontal format, with columns for account titles and their respective debit and credit balances. Each account has its own page or section within the general ledger, providing a centralized location for tracking the activity and balance of each account. The general ledger is organized in a systematic manner, making it easier to locate and analyze individual account balances.

Level of Detail: The general journal provides a detailed record of each transaction, capturing the specific accounts affected by the transaction and the corresponding dollar amounts. It includes descriptions and reference information to facilitate understanding and retrieval of transaction details. The general journal provides a high level of granularity, allowing for a thorough audit trail and analysis of individual transactions.

In contrast, the general ledger summarizes and consolidates the information from the general journal at an account level. It provides a snapshot of each account’s balance, which is the aggregate result of multiple transactions recorded in the general journal. While the general ledger includes the account balances, it does not provide transaction-level details.

Usage and Posting: Transactions are initially recorded in the general journal. After they are recorded, the balances from the general journal are transferred or posted to the general ledger. This posting process involves summarizing the debit and credit amounts for each account and updating the respective account balances in the general ledger. The general ledger serves as the primary reference for preparing financial statements and conducting account reconciliations.

In summary, the general journal serves as a detailed record of all financial transactions, capturing the specifics of each transaction. It acts as a book of original entry. In contrast, the general ledger consolidates and summarizes the transaction details from the general journal, providing an overview of the balances for each account. It acts as a master financial record and aids in the preparation of financial statements. Both the general journal and the general ledger play important roles in the accounting process, complementing each other to ensure accurate financial recording and reporting.

Importance of Accurate General Journal Entries

Accurate general journal entries are crucial for maintaining reliable financial records and supporting effective financial management within a business. Let’s explore the importance of accurate general journal entries:

- Financial Reporting: Accurate general journal entries form the basis for financial reporting. They provide the necessary information to prepare financial statements such as the balance sheet, income statement, and cash flow statement. These financial statements are used by stakeholders such as investors, creditors, and regulatory agencies to assess the financial health and performance of the business.

- Legal Compliance: Accurate general journal entries help businesses maintain compliance with legal and regulatory requirements. They serve as evidence of financial transactions, which can be crucial in case of audits or legal disputes. Proper documentation of transactions ensures transparency and minimizes the risk of penalties or legal repercussions.

- Decision-Making: Accurate general journal entries provide reliable financial data that is essential for making informed business decisions. Management relies on accurate financial information to evaluate the profitability of business activities, determine cost efficiency, and assess investment opportunities. Inaccurate or incomplete journal entries can lead to incorrect financial analysis and misguided decision-making.

- Audit Trail: Accurate general journal entries create a clear audit trail that facilitates financial analysis and auditing. They allow for easy tracing of financial transactions, ensuring accountability and transparency. A well-maintained audit trail helps auditors and internal control teams to quickly and accurately review transactions, detect errors or fraud, and provide assurance regarding the reliability of financial records.

- Effective Financial Analysis: Accurate general journal entries provide the foundation for meaningful financial analysis. By recording transactions accurately, businesses can generate reliable financial ratios, evaluate performance trends, monitor cash flow, and identify areas for improvement. Inaccurate or incomplete journal entries can distort financial analysis and result in incorrect assessments of an organization’s financial position.

- Efficient Tax Planning and Compliance: Accurate general journal entries are essential for tax planning and compliance. They form the basis for preparing tax returns and can impact the calculation of taxable income, deductions, and credits. Inaccurate entries can lead to over or underpayment of taxes, resulting in penalties or missed opportunities for tax savings.

In summary, accurate general journal entries have a significant impact on financial reporting, compliance, decision-making, auditability, financial analysis, and tax planning. Maintaining accurate and complete journal entries is essential for businesses to effectively manage their finances, fulfill reporting obligations, and make informed strategic decisions.

Key Components of a General Journal

The general journal is a vital tool in the accounting process, capturing and organizing financial transactions for accurate recording and reporting. Several key components make up a general journal entry, each serving a specific purpose in documenting the transaction details. Let’s explore these key components:

- Date: The date of the transaction is one of the essential components of a general journal entry. It ensures that transactions are recorded in chronological order, allowing for easy reference and tracking of financial activities over time.

- Account Titles: The account titles represent the specific accounts impacted by the transaction. It is crucial to accurately identify and record the appropriate account titles, as these entries form the basis for creating the general ledger and preparing financial statements.

- Description: The description provides a brief explanation of the transaction. It should be clear and concise, capturing the nature of the transaction and any pertinent details that help to identify and understand the entry.

- Debit and Credit Amounts: The debit and credit amounts reflect the financial impact of the transaction on the accounts involved. Debits represent increases in assets or expenses and decreases in liabilities or equity, while credits represent increases in liabilities or equity and decreases in assets or expenses. The debit and credit amounts must be recorded accurately to maintain the fundamental principle of double-entry bookkeeping.

- Reference: The reference column is often used to provide additional information related to the transaction. It may include reference numbers, such as purchase order numbers, sales invoice numbers, or check numbers. This column helps to cross-reference and link the entry to supporting documentation or other records.

It is important to note that the format and specific requirements for each component may vary based on the accounting system used by an organization. However, these key components are generally present in most general journal entries.

The proper use and accurate recording of these key components ensure that transactions are recorded correctly, financial records are complete and reliable, and financial statements are prepared accurately. They also serve as a valuable audit trail, allowing for easy review, analysis, and verification of transactions.

Overall, understanding and effectively utilizing the key components of a general journal entry are essential for maintaining accurate financial records, facilitating accurate financial reporting, and ensuring the integrity of the accounting process.

How to Create a General Journal Entry

Creating a general journal entry involves following a structured process to accurately record financial transactions. By adhering to a set of guidelines, businesses can ensure that their general journal entries are complete, organized, and aligned with accounting standards. Here is a step-by-step guide on how to create a general journal entry:

- Identify the Date: Begin by determining the date of the transaction. It is crucial to record the correct date as it establishes the chronological order of entries in the general journal.

- Select the Account Titles: Determine the accounts affected by the transaction. Identify the specific account titles that will be debited and credited based on the nature of the transaction and the accounting principles.

- Write a Description: Provide a brief description of the transaction. Ensure clarity and accuracy in describing the details of the transaction, including any relevant information that helps in understanding the entry.

- Record the Debit and Credit Amounts: Assign the appropriate debit and credit amounts to the respective account titles. Debits and credits should be recorded in separate columns of the general journal entry, aligning with the double-entry bookkeeping system to maintain balance.

- Include a Reference Number: Consider including a reference number or specific details related to the transaction. This can help in linking the journal entry to supporting documentation or cross-referencing with other records.

- Verify Accuracy: Review the general journal entry for accuracy and completeness. Ensure that all amounts and account titles are correctly recorded, and the entry aligns with the principles of debits and credits.

- Post to the General Ledger: Once the general journal entry is created and verified, post the debit and credit amounts to the respective accounts in the general ledger. This process involves updating the account balances based on the journal entry.

It is important to maintain consistency and standardization when creating general journal entries. This ensures that the entries are organized, easy to understand, and comply with accounting principles and standards.

Accounting software can streamline the process of creating general journal entries, as it often provides pre-designed templates and automated calculations. However, the underlying principles and steps remain the same.

By following these steps, businesses can create accurate and reliable general journal entries, ensuring the integrity of their financial records and supporting accurate financial reporting and analysis.

Conclusion

The general journal is a fundamental tool in the field of accounting, playing a vital role in recording, organizing, and analyzing financial transactions. By providing a detailed record of each transaction, the general journal facilitates accurate financial reporting, compliance with regulatory requirements, and informed decision-making.

In this article, we have explored the definition of a general journal, its purpose, format, and key components. We have learned that accurate general journal entries are essential for maintaining reliable financial records, supporting effective financial management, and providing a clear audit trail for auditing purposes. Additionally, we have discussed the differences between a general journal and a general ledger, highlighting the unique functions and characteristics of each.

Accurate general journal entries bring numerous benefits, such as accurate financial reporting, transparent audit trails, effective financial analysis, efficient bookkeeping, compliance with accounting standards, and support for informed decision-making. They are also crucial for tax planning, legal compliance, and providing evidence in case of audits or disputes.

To create a general journal entry, businesses should follow a structured process that includes identifying the date, selecting the account titles, writing a description, recording the debit and credit amounts, including a reference number, and verifying accuracy before posting to the general ledger. Consistency and standardization are key to ensuring accurate and organized general journal entries.

In conclusion, the general journal serves as a reliable record of financial transactions, providing a foundation for financial reporting, analysis, and decision-making. Accurate and well-maintained general journal entries are essential for maintaining the integrity of financial records and supporting the overall success and transparency of a business.