Finance

What Is A Special Journal In Accounting

Published: October 7, 2023

Learn what a special journal is in accounting and how it relates to finance. Master the basics of journaling and streamline your financial processes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the field of accounting, special journals play a crucial role in organizing financial transactions and maintaining accurate records. They are designed to record specific types of transactions in a systematic and efficient manner, providing a streamlined approach to recording and analyzing financial information.

Special journals, also known as subsidiary journals, are used alongside the general journal in the double-entry bookkeeping system. While the general journal is used to record non-routine transactions or those that don’t belong to a specific journal, special journals are created to record frequently occurring transactions. By using special journals, accountants can categorize and summarize similar transactions, making the overall accounting process more efficient and manageable.

Each special journal focuses on a particular type of transaction, such as sales, purchases, cash receipts, cash payments, or a combination of these. By having separate journals for these common transactions, businesses can ensure a more organized and systematic approach to their accounting processes.

In this article, we will delve into the concept of a special journal in accounting, explore its purpose, discuss the different types of special journals, highlight their advantages, and shed light on their limitations. By the end, you will have a clear understanding of how special journals contribute to effective financial management and reporting.

Definition of a Special Journal in Accounting

A special journal, also referred to as a subsidiary journal, is a specific type of accounting journal that is used to record and categorize similar types of financial transactions. It is designed to streamline and organize the recording process by grouping transactions of the same nature into separate journals.

Special journals are used alongside the general journal in the double-entry bookkeeping system. While the general journal is a catch-all journal used for non-routine or infrequent transactions, special journals are created to handle routine and recurring transactions. This helps to simplify the accounting process and allows for easier retrieval and analysis of financial data.

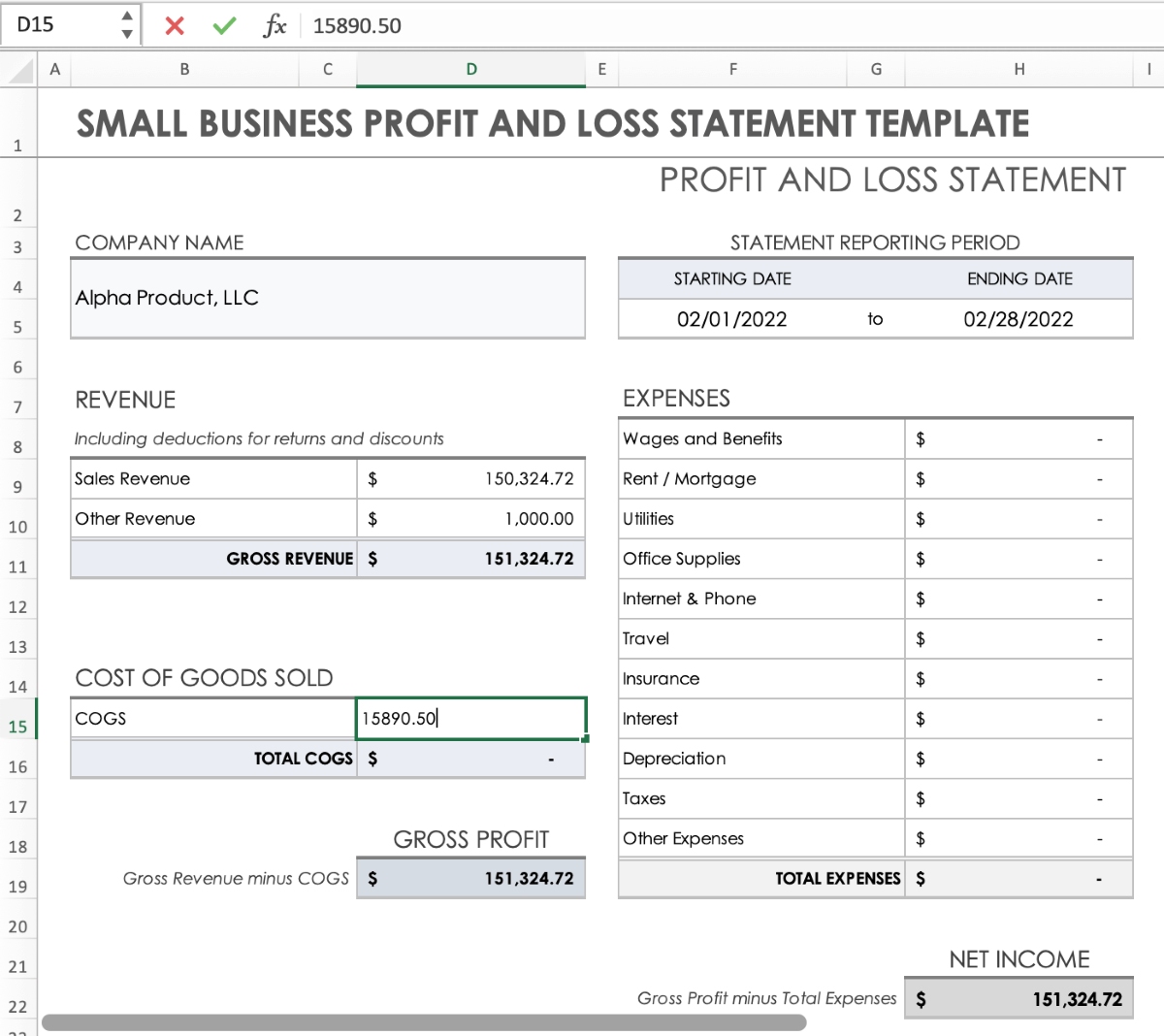

Each special journal is dedicated to recording a specific type of transaction. For example, a sales journal is used to record all sales transactions, a purchases journal is used for purchases made by the business, and a cash receipts journal is used to record all cash payments received by the business. These specialized journals allow for efficient and accurate recording, as well as easy reference when analyzing financial data or preparing financial statements.

Special journals are typically designed with columns that correspond to the relevant information for each type of transaction. This can include details such as the date of the transaction, the names of the parties involved, a description of the transaction, the amount of the transaction, and any applicable account numbers. By providing specific columns for these details, special journals facilitate quick and accurate entry of the transaction information.

It’s important to note that special journals are not a replacement for the general journal. The general journal is still used to record non-routine transactions or transactions that do not fit into any of the special journals. The special journals complement the general journal by providing a more organized and efficient way to record and track routine transactions.

Overall, the purpose of a special journal in accounting is to streamline the recording process, improve efficiency, and enhance the accuracy of financial data. By separating and categorizing transactions based on their nature, special journals provide a systematic approach to recording and analyzing financial information, ultimately contributing to the effective management of a business’s finances.

Purpose of Using Special Journals

The use of special journals in accounting serves several important purposes that contribute to the efficiency and accuracy of recording financial transactions. Let’s explore the key purposes of using special journals:

- Organization and categorization: Special journals provide a systematic way to organize and categorize similar types of transactions. By having separate journals for different transaction types, such as sales, purchases, cash receipts, and cash payments, businesses can easily locate and reference specific transactions when needed. This helps to improve the overall organization of financial records and simplifies the process of retrieving and analyzing data.

- Efficiency in data entry: Special journals are designed with pre-defined columns that correspond to the relevant information needed for each type of transaction. This allows for efficient data entry, as accountants can quickly input transaction details into the appropriate columns. For example, a sales journal may have columns for the date of sale, customer name, description of the product or service sold, sales amount, and sales tax. By having dedicated columns, special journals streamline the data entry process and reduce the chances of errors or omissions.

- Accurate and consistent record keeping: Using special journals ensures that similar transactions are consistently recorded in a standardized format. This helps to maintain accuracy and consistency in financial records, making it easier to track and reconcile transactions. By having uniformity in recording, businesses can rely on the information provided by special journals for financial analysis, reporting, and decision-making.

- Easier financial analysis: Special journals provide a means to analyze financial data more efficiently. Since transactions are grouped by type, it becomes easier to see patterns, trends, and insights related to specific areas of the business. For example, a sales journal can provide valuable insights into sales performance, customer behavior, and product popularity. By analyzing the data recorded in special journals, businesses can make informed strategic decisions and identify areas for improvement.

- Facilitating financial reporting: Special journals contribute to the preparation of financial statements. The data recorded in special journals can be easily summarized and transferred to the general ledger or financial statement templates. This simplifies the process of compiling financial information for reporting purposes, such as income statements, balance sheets, and cash flow statements. The use of special journals enhances the accuracy and efficiency of financial reporting, which is crucial for both internal and external stakeholders.

By serving these purposes, special journals enhance the efficiency, accuracy, and analysis of financial transactions. They provide a structured approach to recording and organizing data, making the accounting process more effective and contributing to the overall financial management of a business.

Types of Special Journals in Accounting

In accounting, there are several types of special journals, each dedicated to recording specific types of transactions. Let’s explore the most common types of special journals:

- Sales Journal: The sales journal is used to record all sales transactions made by a business. It includes information such as the date of sale, customer’s name, description of the product or service sold, sales amount, and any applicable sales tax. The sales journal helps in tracking sales revenue, analyzing customer buying patterns, and preparing financial statements.

- Purchases Journal: The purchases journal is used to record all purchases made by a business, whether for inventory or other items. This journal typically includes details such as the date of purchase, supplier’s name, description of the item purchased, purchase amount, and any applicable taxes. The purchases journal assists in keeping track of expenses, managing inventory, and evaluating supplier relationships.

- Cash Receipts Journal: The cash receipts journal is used to record all cash payments received by a business. This includes cash sales, customer payments, and any other cash inflows. Common details recorded in the cash receipts journal include the date of receipt, name of the payer, reason for payment, and the amount received. The cash receipts journal helps in monitoring cash flow, reconciling bank statements, and analyzing customer payment trends.

- Cash Payments Journal: The cash payments journal is used to record all cash payments made by a business. This includes payments to suppliers, employees, and other expenses. The cash payments journal typically includes information such as the date of payment, recipient’s name, purpose of payment, and the amount paid. This journal assists in monitoring cash outflows, tracking expenses, and ensuring proper record-keeping for tax purposes.

- General Journal: The general journal is not a specialized journal like the others mentioned above. It is a catch-all journal used to record non-routine or infrequent transactions that do not fit into any of the special journals. The general journal includes transactions such as adjusting entries, depreciation, journal entries for unusual transactions, and corrections of errors. It provides flexibility in recording transactions that cannot be recorded in any specific special journal.

These types of special journals help in organizing and categorizing transactions, allowing businesses to maintain accurate records and analyze financial information more effectively. By utilizing the appropriate special journals for different types of transactions, businesses can streamline their accounting processes and gain valuable insights into their financial activities.

Sales Journal

The sales journal is a type of special journal used in accounting to record all sales transactions made by a business. It provides a dedicated space for recording sales-related information in a systematic manner. The sales journal captures the details of each sale, allowing for easy tracking, analysis, and reporting of sales activity.

When using a sales journal, each entry typically includes the date of the sale, the customer’s name or account number, a description of the product or service sold, the sales amount, and any applicable sales tax. These columns help organize the information and provide a clear and structured record of each sales transaction.

One of the primary purposes of the sales journal is to monitor sales revenue and track the performance of the business. By recording individual sales transactions in the sales journal, businesses can calculate total sales, track sales trends over time, and assess the profitability of different products or services. This information is crucial for making informed business decisions and developing effective sales strategies.

In addition to monitoring sales performance, the sales journal also facilitates the preparation of financial statements. The data recorded in the sales journal is typically summarized periodically, and the totals are transferred to the general ledger or financial statement templates. This simplifies the process of compiling financial information for reporting purposes, such as income statements and sales reports.

Furthermore, the sales journal enables businesses to maintain accurate and consistent records of customer sales. By recording the customer’s name or account number with each transaction, businesses can easily track individual customer purchasing patterns, identify loyal customers, and personalize marketing efforts. This information is valuable in establishing and nurturing customer relationships, improving customer service, and implementing targeted marketing strategies.

Using a sales journal provides several benefits to businesses. It helps in organizing and categorizing sales transactions, simplifies the data entry process, enhances accuracy, facilitates financial analysis, and supports effective customer relationship management. By utilizing the sales journal effectively, businesses can gain valuable insights into their sales activities and drive their growth and success.

Purchases Journal

The purchases journal is a specialized accounting journal used to record all purchases made by a business. It provides a systematic and organized approach to documenting purchase transactions, ensuring accurate record-keeping and efficient analysis of expenses.

When using a purchases journal, each entry typically includes the date of the purchase, the supplier’s name or account number, a description of the item or service purchased, the purchase amount, and any applicable taxes. These columns allow for easy categorization and tracking of purchase transactions, providing a clear overview of expenses.

The primary purpose of the purchases journal is to track and monitor expenses related to procurement. By recording all purchases in a dedicated journal, businesses can easily analyze their spending patterns, identify cost-saving opportunities, and make informed decisions regarding suppliers and inventory management.

Additionally, the purchases journal facilitates the accurate recording of inventory costs. For businesses that deal with inventory, the purchases journal allows for the tracking of inventory purchases and the cost of goods sold. This information is essential for accurate inventory valuation, cost analysis, and financial reporting.

Furthermore, the purchases journal allows for streamlined financial reporting. The data recorded in the purchases journal is typically summarized periodically, and the totals are transferred to the general ledger or financial statement templates. This simplifies the process of compiling financial information for reporting purposes, such as income statements, balance sheets, and cash flow statements.

Using a purchases journal also assists in maintaining orderly records for tax purposes. By accurately recording all purchases, businesses can easily retrieve supporting documentation and ensure compliance with tax regulations. This can save time and effort during tax audits and help prevent potential issues with tax authorities.

Overall, the purchases journal contributes to effective expense management and financial control. It provides businesses with a structured method for recording and analyzing purchase transactions, resulting in improved decision-making, better cost management, and accurate financial reporting. By using the purchases journal in conjunction with other accounting processes, businesses can enhance their financial management practices and drive their success.

Cash Receipts Journal

The cash receipts journal is an important special journal used in accounting to record all cash payments received by a business. It provides a systematic and organized way to document incoming cash transactions, allowing for efficient tracking, analysis, and reconciliation of cash receipts.

When utilizing a cash receipts journal, each entry typically includes the date of receipt, the name of the payer, a description of the reason for payment, and the amount received. Optionally, it may also include columns for the customer account number or any specific payment codes. These columns help categorize and organize the cash receipts, making it easier to analyze the sources and purposes of cash inflows.

The primary purpose of the cash receipts journal is to monitor and manage cash inflows. By recording cash receipts in a dedicated journal, businesses can have a clear overview of their cash flow, identify patterns in customer payments, and track the effectiveness of their collection efforts. This information is crucial for effective cash management and financial planning.

In addition to monitoring cash flow, the cash receipts journal aids in the reconciliation of bank statements. By recording all cash receipts in the journal, businesses can compare their journal entries with bank deposits, ensuring that all payments have been accurately recorded. This helps in identifying discrepancies, reconciling any differences, and maintaining accurate financial records.

The cash receipts journal also facilitates the accurate recording of customer payments. By capturing the name of the payer with each receipt, businesses can easily track individual customer payment history, identify delinquent accounts, and implement appropriate collection strategies. This information is valuable for maintaining healthy customer relationships and optimizing cash flow.

Furthermore, the cash receipts journal aids in financial reporting. The data recorded in the cash receipts journal is periodically summarized, and the totals are transferred to the general ledger or financial statement templates. This simplifies the process of compiling financial information for reporting, such as generating income statements, cash flow statements, or reports on customer payment trends.

Using a cash receipts journal provides numerous benefits to businesses. It helps in organizing and categorizing cash receipts, ensures accurate record-keeping, assists in cash flow management, aids in bank reconciliation, and supports effective customer account management. By utilizing the cash receipts journal, businesses can enhance their cash management practices and ensure a healthy financial position.

Cash Payments Journal

The cash payments journal is a specialized accounting journal used to record all cash payments made by a business. It provides a structured and organized approach to documenting outgoing cash transactions, ensuring accurate record-keeping and effective analysis of expenses.

When utilizing a cash payments journal, each entry typically includes the date of payment, the recipient’s name, a description of the purpose of payment, and the amount paid. Optionally, it may also include columns for specific expense categories or payment methods. These columns help categorize and track the cash payments, providing a clear overview of cash outflows.

The primary purpose of the cash payments journal is to closely monitor and control cash expenditures. By recording all cash payments in a dedicated journal, businesses can easily analyze their spending patterns, identify cost-saving opportunities, and manage their cash flow effectively. This information is crucial for budgeting, expense management, and financial planning.

In addition to monitoring expenses, the cash payments journal helps in maintaining orderly records for financial documentation and tax purposes. By accurately recording all cash payments, businesses can ensure compliance with tax regulations, easily retrieve supporting documentation, and simplify the annual tax preparation process.

The cash payments journal also aids in maintaining accurate payables records. By recording each payment in the journal, businesses can track outstanding balances, monitor payment due dates, and manage their relationships with suppliers and vendors. This information helps businesses avoid late payment penalties, negotiate better terms with suppliers, and maintain strong supplier relationships.

Furthermore, the cash payments journal facilitates the preparation of financial statements. The data recorded in the cash payments journal is periodically summarized, and the totals are transferred to the general ledger or financial statement templates. This simplifies the process of compiling financial information for reporting purposes, such as generating income statements, cash flow statements, or expense analysis reports.

Using a cash payments journal offers several advantages to businesses. It helps in organizing and categorizing cash payments, ensures accurate record-keeping, aids in cash flow management, supports effective expense control, and assists in financial reporting and compliance. By employing a cash payments journal, businesses can enhance their financial management practices, make strategic spending decisions, and maintain a strong financial position.

General Journal

The general journal, often referred to as the “book of original entry,” is a fundamental accounting journal used to record non-routine, infrequent, or adjusting transactions that do not belong to any of the specialized journals. It serves as a catch-all journal, where miscellaneous transactions are recorded in a systematic and chronological order.

The general journal contains columns for the date of the transaction, a description of the entry, the accounts debited and credited, and the corresponding amounts. Unlike the specialized journals, which are designed to record specific types of transactions, the general journal provides flexibility in recording various types of transactions that do not fit into a predetermined template.

One of the primary purposes of the general journal is to record adjusting entries. Adjusting entries are made at the end of an accounting period to rectify errors, allocate revenues and expenses correctly, or account for accruals and deferrals. These entries ensure that financial statements reflect the accurate financial position and performance of the business.

In addition to adjusting entries, the general journal is also used to record non-routine transactions such as depreciation, amortization, bad debts, and disposals of assets. It serves as a centralized location to record unique or extraordinary transactions that may not occur regularly in the business operations.

The general journal is essential for maintaining the integrity of the accounting system and ensuring accurate financial reporting. It provides a complete audit trail of all financial transactions, enabling transparency and accountability in the recording of entries. By using the general journal, businesses can adhere to the principles of double-entry bookkeeping and maintain proper checks and balances in their financial records.

Furthermore, the general journal allows for easy identification and correction of errors. If a mistake is made in one of the specialized journals, the general journal can be used to record an adjusting entry to rectify the error. It provides a centralized location for making corrections and ensures that the financial statements accurately reflect the true financial position of the business.

While the specialized journals focus on routine and recurring transactions, the general journal provides flexibility for recording one-time or non-typical entries. It complements the specialized journals by capturing transactions that may not fit into any specific category. By maintaining a comprehensive general journal, businesses can ensure proper recording of all significant financial events and maintain accurate and reliable financial records.

Advantages of Using Special Journals

Special journals offer several advantages in the field of accounting. Let’s explore some of the key benefits of using special journals:

- Efficiency: Special journals enhance efficiency in the accounting process. By categorizing similar transactions and providing pre-defined columns for relevant information, special journals streamline data entry and make it quicker and more accurate. This saves time and reduces the chances of errors or omissions, resulting in a more efficient accounting workflow.

- Organization and categorization: Special journals help in organizing and categorizing transactions. By having separate journals for different transaction types, such as sales, purchases, cash receipts, and cash payments, businesses can easily locate and reference specific transactions when needed. This improves the overall organization of financial records and simplifies the process of retrieving and analyzing data.

- Accuracy: Special journals contribute to maintaining accurate and reliable financial records. By providing standardized formats for recording specific transaction types, special journals ensure consistency in the recording process. This reduces the scope for mistakes, improves data accuracy, and helps in producing reliable financial statements and reports.

- Financial analysis: Special journals facilitate financial analysis by providing a means to analyze specific types of transactions more easily. Since transactions are grouped by type, it becomes simpler to identify patterns, trends, and insights related to specific areas of the business. This information is valuable for making informed strategic decisions and identifying areas for improvement.

- Reporting: Special journals contribute to the preparation of accurate and efficient financial statements. The data recorded in special journals can be summarized and transferred to the general ledger or financial statement templates. This simplifies the process of compiling financial information for reporting purposes, such as income statements, balance sheets, and cash flow statements. Accurate reporting is crucial for both internal decision-making and external stakeholder communication.

Overall, using special journals improves efficiency, organization, accuracy, financial analysis, and reporting in the accounting process. By utilizing specialized journals alongside the general journal, businesses can adopt a systematic and streamlined approach to recording and managing financial transactions, resulting in improved financial management and decision-making.

Limitations of Special Journals

While special journals offer numerous advantages in accounting, it is important to be aware of their limitations. Let’s discuss some of the key limitations of using special journals:

- Restricted to specific transaction types: Special journals are designed to record specific transaction types, such as sales, purchases, cash receipts, and cash payments. This means that transactions that don’t fit into these predefined categories must be recorded in the general journal. As a result, special journals may not cover all transaction types, limiting their effectiveness in capturing certain non-routine or complex transactions.

- Not suitable for every business: Special journals may not be suitable for every type of business. Small businesses with limited transaction volumes may find it more efficient to use a simplified accounting system without the need for specialized journals. In such cases, using only a general journal along with appropriate subsidiary ledgers may be more practical and sufficient to meet the accounting needs of the business.

- Increased complexity: Using special journals adds a layer of complexity to the accounting system. Accountants must navigate between multiple journals, ensuring that each transaction is recorded in the appropriate journal. This can be time-consuming and may increase the likelihood of errors or confusion if entries are recorded in the wrong journal. Proper training and meticulous attention to detail are necessary to mitigate these risks.

- Additional record-keeping requirements: Special journals require additional record-keeping efforts. Businesses must ensure that all relevant transaction details are transferred from the special journals to the general ledger accurately. Failure to do so may result in incomplete or inconsistent financial records. This can pose challenges during audits or when preparing financial statements, requiring additional time and effort to reconcile the two sets of records.

- Less flexibility for unique transactions: Special journals may not provide the flexibility needed to handle unique or complex transactions. Transactions that deviate from the predefined format of the special journals must be recorded in the general journal. This can make it more challenging to track and analyze these unique transactions separately, as they may be mixed in with routine transactions in the general journal entries.

Despite these limitations, special journals remain a valuable tool in accounting, providing efficiency, organization, and accuracy in recording routine transactions. It is important for accountants and businesses to understand these limitations and assess whether the benefits of special journals outweigh the challenges based on their specific accounting needs and transaction volumes.

Conclusion

In conclusion, special journals play a significant role in the field of accounting by providing a systematic, efficient, and organized approach to recording and managing financial transactions. They enhance the efficiency and accuracy of the accounting process by categorizing and summarizing similar types of transactions. Special journals, such as the sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal, offer specific benefits and serve different purposes within the accounting system.

The use of special journals offers advantages such as improved efficiency, better organization of financial records, more accurate record-keeping, enhanced financial analysis capabilities, and streamlined financial reporting. Special journals allow businesses to track and analyze specific types of transactions, monitor revenue and expenses, manage cash flow, and make informed financial decisions. They contribute to the overall effectiveness and reliability of financial management and reporting.

However, it is important to acknowledge the limitations of special journals, such as their specificity to certain transaction types, potential complexity, additional record-keeping requirements, and limited flexibility for unique transactions. These limitations need to be considered when implementing special journals in an accounting system and assessing their appropriateness for a particular business’s needs.

Overall, special journals are a valuable tool in modern accounting practices. By utilizing specialized journals alongside the general journal, businesses can achieve greater organization, accuracy, and efficiency in recording and managing financial transactions. As technology continues to evolve, integrating special journals into accounting software systems can further streamline processes and enhance the benefits of using specialized journals.

Understanding the purposes, advantages, and limitations of special journals allows businesses to make informed decisions regarding their implementation and optimize their accounting practices. By leveraging the benefits of special journals while addressing their limitations, businesses can maintain accurate financial records, improve decision-making, and achieve greater financial success.