Home>Finance>How To Compute The Minimum Payment For Balance Transfer At 0% APR

Finance

How To Compute The Minimum Payment For Balance Transfer At 0% APR

Published: February 27, 2024

Learn how to calculate the minimum payment for a balance transfer at 0% APR. Get expert finance tips and advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Balance transfer offers can be an enticing means to manage credit card debt more effectively. In essence, a balance transfer involves moving the outstanding balance from one credit card to another, typically with the aim of securing a lower interest rate. This can provide relief for individuals struggling with high-interest debt, as it allows them to consolidate their balances onto a single card with a more favorable interest rate, potentially saving a significant amount of money in the process.

However, it's crucial to understand the intricacies of balance transfer offers, particularly when it comes to computing the minimum payment for a balance transfer at a 0% annual percentage rate (APR). While the prospect of a 0% APR may seem like a financial reprieve, it's essential to grasp the nuances of calculating the minimum payment to ensure responsible and sustainable debt management.

In this comprehensive guide, we will delve into the process of understanding and computing the minimum payment for a balance transfer at 0% APR. By exploring the factors that influence this calculation and the considerations that borrowers should bear in mind, we aim to equip readers with the knowledge needed to navigate balance transfer offers effectively. Whether you're considering a balance transfer or seeking to optimize your existing arrangement, this guide will provide valuable insights to aid you in making informed financial decisions.

Understanding the Balance Transfer Process

Before delving into the intricacies of computing the minimum payment for a balance transfer at 0% APR, it’s essential to grasp the fundamental principles of the balance transfer process. A balance transfer involves moving existing credit card debt from one or multiple cards to a new credit card, typically with a lower interest rate, to facilitate easier debt management and potentially reduce interest payments.

When considering a balance transfer, it’s crucial to be aware of the potential benefits and drawbacks. On the positive side, a balance transfer can offer relief from high-interest debt, especially when transferring balances to a card with a 0% introductory APR. This can provide a temporary respite from interest charges, allowing individuals to focus on paying down the principal amount of their debt more effectively.

However, it’s important to approach balance transfers with a clear understanding of the associated terms and conditions. These may include balance transfer fees, introductory APR periods, ongoing APR rates after the introductory period, and the impact of late or missed payments on the promotional APR. Additionally, not all individuals may qualify for the advertised promotional APR, and the credit limit on the new card may not accommodate the full transfer amount.

Furthermore, the act of transferring a balance does not eliminate the debt; it merely moves it to a different account. Without a strategic repayment plan, individuals may find themselves in a worse financial position once the promotional period ends. Therefore, it’s imperative to approach balance transfers with a comprehensive understanding of the process and a clear plan for debt repayment.

By comprehending the dynamics of the balance transfer process, individuals can make informed decisions regarding their debt management strategies. With this foundational knowledge in place, we can now delve into the essential steps for calculating the minimum payment for a balance transfer at 0% APR.

Calculating the Minimum Payment for Balance Transfer at 0% APR

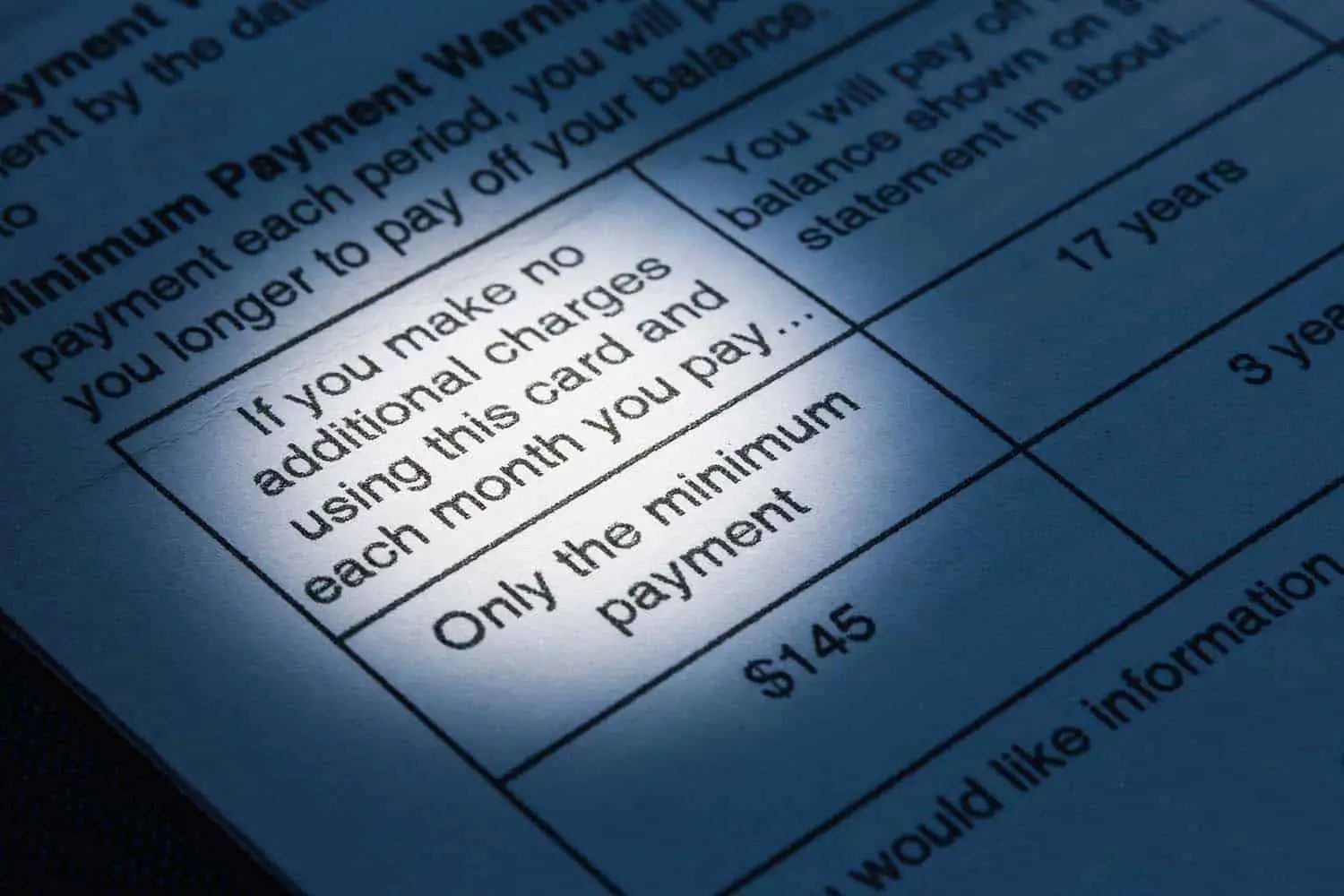

When it comes to computing the minimum payment for a balance transfer at a 0% annual percentage rate (APR), it’s essential to understand the factors that influence this calculation. The minimum payment is the least amount that a cardholder must pay each month to keep the account in good standing. While the 0% APR may alleviate the burden of interest charges during the promotional period, it’s crucial to determine the minimum payment required to ensure responsible debt management.

The minimum payment for a balance transfer at 0% APR is typically calculated as a percentage of the outstanding balance, subject to a minimum dollar amount. This percentage is commonly around 1%-3% of the total balance, but it can vary based on the terms and conditions of the credit card agreement. It’s important to review the specific terms of the balance transfer offer to ascertain the minimum payment requirements.

For example, if an individual transfers a $5,000 balance to a credit card offering a 0% APR on balance transfers with a minimum payment requirement of 2% of the balance or $25, whichever is greater, the minimum payment would be $100 (2% of $5,000). However, if 2% of the balance amounts to less than $25, the cardholder would be required to pay $25 to meet the minimum payment threshold.

It’s crucial to note that while the 0% APR may provide relief from accruing interest, it does not negate the requirement to make at least the minimum payment each month. Failing to meet the minimum payment can result in late fees, penalty interest rates, and potential damage to the cardholder’s credit score.

Moreover, to effectively manage the balance transfer, individuals should aim to pay more than the minimum amount due each month to expedite the repayment of the transferred balance. By allocating additional funds toward the principal amount, cardholders can reduce the debt more rapidly and potentially avoid a substantial balance remaining at the end of the promotional period.

Understanding the mechanics of calculating the minimum payment for a balance transfer at 0% APR empowers individuals to navigate their debt obligations responsibly. However, it’s imperative to consider additional factors that can impact the minimum payment computation, which we will explore in the following section.

Factors to Consider When Computing Minimum Payments

Several crucial factors come into play when computing the minimum payments for balance transfers at 0% APR. Understanding these elements is essential for borrowers seeking to manage their debt effectively and avoid potential pitfalls associated with balance transfer arrangements.

- Minimum Payment Terms: The specific terms and conditions of the credit card agreement dictate the minimum payment requirements. Cardholders should carefully review the disclosure documents to ascertain the minimum payment percentage and any minimum dollar amount stipulated by the issuer.

- Introductory APR Period: The duration of the 0% APR promotional period significantly influences the minimum payment computation. During this period, the absence of interest charges may allow individuals to allocate more funds toward reducing the principal balance, potentially expediting the repayment process.

- Post-Promotional APR: Understanding the APR that will apply after the promotional period is crucial. Cardholders should consider the impact of the post-promotional APR on the minimum payment and formulate a repayment strategy that accounts for the resumption of interest charges.

- Balance Transfer Fees: Some credit card issuers impose balance transfer fees, typically calculated as a percentage of the transfer amount. These fees add to the overall balance and may affect the minimum payment calculation, warranting careful consideration.

- Available Repayment Funds: Cardholders should assess their financial capacity to determine the amount they can comfortably allocate toward repaying the transferred balance. While the minimum payment is the least amount required, aiming to pay more each month can expedite debt repayment and mitigate the risk of a substantial remaining balance at the end of the promotional period.

By taking these factors into account, individuals can make informed decisions regarding their balance transfer arrangements and develop a proactive approach to managing their debt. It’s crucial to approach balance transfers with a comprehensive understanding of the associated terms and potential implications, empowering borrowers to leverage these financial tools effectively while maintaining sound financial health.

Conclusion

Effectively managing credit card debt through balance transfers at 0% APR requires a comprehensive understanding of the minimum payment calculation and the factors that influence it. By grasping the dynamics of this process, individuals can navigate their debt obligations responsibly and optimize the benefits of balance transfer offers.

When considering a balance transfer, it’s essential to carefully review the terms and conditions of the credit card agreement, particularly regarding the minimum payment requirements. Understanding the minimum payment percentage and any minimum dollar amount stipulated by the issuer is crucial for maintaining the account in good standing and avoiding potential penalties.

While the allure of a 0% APR on balance transfers may provide temporary relief from interest charges, it’s imperative to approach this arrangement with a strategic repayment plan. By allocating more than the minimum payment each month, individuals can expedite the repayment of the transferred balance and mitigate the risk of a substantial remaining balance at the end of the promotional period.

Furthermore, considering factors such as the duration of the promotional APR period, the post-promotional APR, balance transfer fees, and available repayment funds is essential for making informed financial decisions. By evaluating these elements, borrowers can proactively manage their debt and optimize the benefits of balance transfer offers.

In conclusion, while balance transfers at 0% APR can provide a valuable opportunity to consolidate and manage credit card debt more effectively, responsible and informed decision-making is paramount. By understanding the minimum payment calculation and considering the relevant factors, individuals can leverage balance transfer offers as a strategic tool for debt management, ultimately working towards achieving greater financial stability and well-being.