Finance

What Is A Loss Run In Insurance?

Published: November 5, 2023

Learn about loss runs in insurance and how they are used in the finance industry. Explore what they are, their purpose, and how they impact insurance premiums.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Loss Run

- Purpose of Loss Run

- Contents of a Loss Run Report

- Importance of Loss Runs for Insurance Companies

- Importance of Loss Runs for Policyholders

- How Loss Run Reports Are Generated

- How to Obtain a Loss Run Report

- Understanding the Information in a Loss Run Report

- Key Terminology in a Loss Run Report

- Potential Issues and Challenges with Loss Runs

- Conclusion

Introduction

When it comes to managing risk, insurance plays a crucial role in providing financial protection. Insurance companies rely on various tools and data to assess and price risks accurately. One such tool is the loss run report, a document that provides invaluable insights into an insured party’s claims history.

A loss run report is a comprehensive record of insurance claims filed by an individual or business. It provides a detailed overview of past losses, including the type of claim, date of occurrence, amount paid, and other relevant information. Insurance companies use loss run reports to evaluate the risk profile of potential policyholders, determine premium rates, and make informed underwriting decisions.

Policyholders can also benefit from reviewing their loss run reports. It allows them to assess their claims history, identify patterns of losses, and implement risk management strategies to reduce future incidents. By understanding the contents of a loss run report and its significance, both insurance companies and policyholders can make informed decisions to mitigate risks and ensure appropriate coverage.

In this article, we will delve deeper into the concept of loss run reports, exploring their purpose, contents, and importance to both insurance companies and policyholders. We will also discuss how loss run reports are generated, how to obtain them, and provide guidance on interpreting the information contained within. By the end, you will have a comprehensive understanding of what a loss run report is and its role in the insurance industry.

Definition of Loss Run

A loss run is a detailed and chronological report that provides information about insurance claims filed by an individual or business. It serves as a comprehensive record of past losses, capturing essential details such as claim dates, types of claims, amounts paid, and any outstanding or open claims. Loss run reports are a valuable tool used by insurance companies to assess risk and make informed decisions regarding policy pricing and underwriting.

The term “loss run” originated from the practice of insurance companies running a report to determine an insured party’s claim history. The report, often generated by the insurance company or a third-party provider, is a compilation of claim-related data collected from various sources such as insurance carriers, claims adjusters, and policy documentation.

Loss run reports are essential for insurance companies as they provide a snapshot of an insured party’s risk profile. By analyzing the claims history, insurance companies can evaluate the likelihood of future claims, identify trends or patterns of losses, and adjust pricing or coverage accordingly. Additionally, loss run reports help insurers assess the overall claims experience and determine if policyholders are adequately managing their risks.

For policyholders, loss run reports are a valuable tool for understanding and monitoring their claims history. By reviewing the report, they can identify any inaccuracies, discrepancies, or fraudulent claims. Policyholders can also utilize the information provided in the loss run report to implement risk management strategies to mitigate future losses and potentially lower insurance premiums.

In summary, a loss run report is a comprehensive document that provides a detailed overview of an insured party’s claims history. It serves as a vital tool for insurance companies to assess risk and determine appropriate coverage and pricing. For policyholders, loss run reports enable them to monitor, analyze, and manage their claims history effectively.

Purpose of Loss Run

The primary purpose of a loss run is to provide insurance companies with a comprehensive and accurate summary of an insured party’s claims history. This information is crucial for insurers to evaluate risk, underwrite policies, and determine appropriate premium rates. Loss run reports allow insurance companies to assess the frequency and severity of past losses, identify trends or patterns, and make informed decisions regarding coverage and pricing.

Loss run reports also serve as a valuable tool for policyholders. They provide a detailed record of their claims history, allowing them to review past losses, identify any inaccuracies or discrepancies, and take steps to mitigate future risks. By understanding their claims history, policyholders can implement risk management strategies to reduce the likelihood of future claims and potentially lower their insurance premiums.

Additionally, loss run reports help insurance companies and policyholders detect and prevent fraudulent claims. By analyzing the information in the report, insurers can identify any suspicious or exaggerated claims and take appropriate action. Policyholders, on the other hand, can review the report to ensure that their claims history is accurate and report any fraudulent activity to their insurance company.

Furthermore, loss run reports support data-driven decision making for insurance companies. By analyzing the claims history of a specific insured party or a portfolio of policies, insurers can assess the overall claims experience and identify areas for improvement. This analysis can help insurers refine their underwriting guidelines, pricing models, and risk management strategies to enhance profitability and customer satisfaction.

Lastly, loss run reports are often required during the insurance renewal process. Insurance companies may request loss run reports from policyholders to assess the current claims experience and make decisions about policy renewals, endorsements, or modifications. Timely and accurate loss run reports can facilitate a smooth renewal process and ensure that policyholders receive the appropriate coverage and pricing for their risk profile.

In summary, the purpose of a loss run is to provide insurance companies with a detailed record of an insured party’s claims history, allowing them to evaluate risk, underwrite policies, and determine premium rates. Loss run reports also serve as a valuable tool for policyholders to monitor their claims history, detect any inaccuracies or fraudulent claims, and implement risk management strategies.

Contents of a Loss Run Report

A loss run report contains a wealth of information that provides a comprehensive overview of an insured party’s claims history. While the exact format and contents may vary between insurance companies, typical elements found in a loss run report include:

- Policy Information: This section includes details about the insured party’s insurance policy, including policy number, effective dates, limits, deductibles, and coverage types. It helps to identify the specific policy associated with the claims reported.

- Claims Details: Each claim reported in the loss run is listed separately, with details such as the date of occurrence, claim number, and a description of the incident or loss. This section outlines the specific events that led to the claim being filed.

- Claim Amounts: The loss run report provides information on the amounts paid out for each claim, including any deductibles that were applied. It details the financial impact of the claims on the insurance company and provides insights into the severity of the losses.

- Claims Status: This section indicates the current status of each claim, whether it is open, closed, or still in progress. For open claims, additional information may be provided, such as the estimated reserves or the actions being taken to resolve the claim.

- Subrogation: If the insurance company has pursued subrogation for any claims, this section will detail any recoveries made from third parties responsible for the losses. It helps the insurance company and the insured party understand any reimbursements or offsets related to the claims.

- Reserves: Insurance companies often set aside reserves to cover anticipated claim expenses. The loss run report may include information on the reserves established for each claim, providing insights into the financial impact expected in the future.

- Loss Ratio: The loss run report may calculate and display the loss ratio, which is the ratio of incurred losses to earned premiums. This helps insurance companies evaluate the profitability of the insured party and make decisions regarding coverage and pricing.

The contents of a loss run report provide valuable insights into an insured party’s claims history. By reviewing these details, insurance companies can assess the risk profile of the insured party, identify any patterns or trends in losses, and make informed decisions about underwriting and pricing. For policyholders, the loss run report allows them to monitor their claims history, verify the accuracy of the reported information, and implement risk management strategies to mitigate future losses.

Importance of Loss Runs for Insurance Companies

Loss run reports play a critical role for insurance companies in managing risk and making informed business decisions. They provide valuable insights that help insurers evaluate the risk profile of potential policyholders, accurately price policies, and make underwriting decisions. Here are some key reasons why loss runs are important for insurance companies:

1. Risk Assessment: Loss run reports allow insurance companies to assess the frequency and severity of past losses for a particular insured party. By analyzing the claims history, insurers can identify potential risks and evaluate the likelihood of future claims. This analysis is crucial in determining the appropriate coverage and pricing for a policy.

2. Underwriting Decisions: Loss run reports provide insurers with valuable information to make informed underwriting decisions. By reviewing the claims history, insurers can assess the overall claims experience of an insured party and determine the level of risk they pose. This information helps insurers decide whether to offer coverage, the terms and conditions of the policy, and the premiums to be charged.

3. Pricing Accuracy: Loss run reports enable insurance companies to accurately price policies based on the insured party’s claims history. Insurers can analyze past losses and adjust premiums to reflect the level of risk associated with the insured party. This ensures that the premiums charged are fair and appropriate for the coverage provided.

4. Fraud Detection: Loss run reports help insurance companies detect and prevent fraudulent claims. By analyzing the claims history and comparing it to other available data, insurers can identify any suspicious or exaggerated claims. This helps insurers take appropriate action and mitigate the financial impact of fraudulent activities.

5. Claims Management: Loss runs provide insurers with a comprehensive overview of an insured party’s claims history, enabling them to manage and prioritize claims effectively. By understanding past losses, insurers can allocate resources, streamline claims processes, and ensure prompt and fair settlements.

6. Portfolio Analysis: Insurance companies use loss runs to analyze the overall claims experience of their portfolio of policies. By aggregating and analyzing claims data, insurers can identify trends, patterns, and areas of concern. This analysis helps insurers refine their underwriting guidelines, pricing models, and risk management strategies to enhance profitability and customer satisfaction.

7. Policy Renewals and Modifications: Loss run reports are often required during the insurance renewal process. Insurers review loss run reports to assess the current claims experience of a policyholder, evaluate any changes in risk profile, and make decisions regarding policy renewals, endorsements, or modifications.

In summary, loss run reports are of paramount importance to insurance companies. They provide critical information for risk assessment, underwriting decisions, accurate pricing, fraud detection, claims management, portfolio analysis, and policy renewals. By leveraging the insights from loss run reports, insurers can make informed decisions to manage risk effectively and provide appropriate coverage to their policyholders.

Importance of Loss Runs for Policyholders

Loss run reports not only serve insurance companies but also hold significant importance for policyholders. These reports provide policyholders with valuable insights into their claims history and enable them to make informed decisions regarding their insurance coverage and risk management strategies. Here are some key reasons why loss runs are important for policyholders:

1. Claims History Verification: Loss run reports allow policyholders to verify the accuracy of their claims history. By reviewing the report, policyholders can ensure that all claims are accurately recorded and that any inaccuracies or discrepancies are promptly addressed. This helps prevent potential issues and ensures that policyholders have an up-to-date and accurate record of their claims.

2. Claims Patterns and Trends: Loss run reports provide policyholders with insights into their claims patterns and trends. By reviewing past losses, policyholders can identify any recurring issues or patterns that may indicate the need for additional risk management measures. This enables policyholders to proactively address potential risks and mitigate future losses.

3. Risk Management Strategies: Loss run reports help policyholders develop and implement effective risk management strategies. By understanding their claims history and the types of losses they have experienced, policyholders can take steps to mitigate risks. This may include investing in safety measures, implementing training programs, or adjusting business practices to reduce the likelihood of future losses.

4. Premium Reduction Opportunities: Loss run reports provide policyholders with the opportunity to potentially lower their insurance premiums. By demonstrating effective risk management through a favorable claims history, policyholders may be eligible for premium discounts or better policy terms. Loss run reports can be instrumental in negotiating lower premiums or seeking alternative insurance options with more competitive pricing.

5. Fraud Prevention: Policyholders can utilize loss run reports to detect and prevent fraudulent activities. By reviewing the report, policyholders can identify any suspicious or fraudulent claims filed on their behalf. This allows them to promptly report such activities to their insurance company and take appropriate action to mitigate any potential financial losses due to fraudulent claims.

6. Insurance Coverage Evaluation: Loss run reports help policyholders evaluate their current insurance coverage. By analyzing past losses and the associated payouts, policyholders can assess whether their existing coverage adequately protects them against potential risks. This evaluation allows policyholders to make informed decisions regarding their coverage limits, deductibles, and additional endorsements or riders that may be necessary.

7. Insurance Renewals: Loss run reports are often required during the insurance renewal process. By reviewing the loss run report, insurance companies assess the claims experience of policyholders. A favorable claims history reflected in the report can result in smooth policy renewals with potentially better terms and premiums.

In summary, loss run reports are valuable tools for policyholders. They enable policyholders to verify their claims history, identify claims patterns and trends, implement risk management strategies, potentially lower premiums, prevent fraud, evaluate insurance coverage, and facilitate smooth insurance renewals. By leveraging the information contained in loss run reports, policyholders can make informed decisions that protect their assets, mitigate risks, and ensure adequate insurance coverage.

How Loss Run Reports Are Generated

Loss run reports are generated through a systematic process that involves collecting and compiling data from various sources. The exact method of generating the report may vary between insurance companies, but the general steps involved are as follows:

1. Data Collection: Insurance companies collect data from multiple sources to gather information on policyholders’ claims history. These sources may include internal claims databases, insurance carriers, claims adjusters, and policy documentation. The data collected typically includes details such as claim dates, types of claims, amounts paid, and claim status.

2. Data Formatting and Standardization: Once the data is collected, it goes through a process of formatting and standardization to ensure consistency and uniformity. This includes verifying the accuracy of the information, removing any duplicate or erroneous entries, and standardizing data fields for consistency across the report.

3. Data Analysis: After the data is formatted and standardized, insurance companies analyze the claims data to identify patterns, trends, and other relevant information. This analysis allows insurers to gain insights into the insured party’s claims history, assess the risk profile, and make informed underwriting decisions.

4. Report Compilation: After the data analysis is complete, the loss run report is compiled. The report includes relevant information such as the insured party’s policy details, a list of claims with their accompanying details (such as claim dates, descriptions, and amounts paid), current claim statuses, and any additional information deemed necessary by the insurance company.

5. Report Customization: Insurance companies may also have the capability to customize the loss run report based on specific requirements or preferences. This may include adding additional analytics, graphs, or other visual representations to provide a more comprehensive understanding of the insured party’s claims history.

6. Report Delivery: Once the loss run report is generated and customized, it is typically delivered to the requesting party. This can be the insured party themselves, another insurance company, or a third-party service provider. The delivery method may vary, ranging from email or online portals to physical mail.

It is important to note that the process of generating loss run reports is complex and requires careful attention to detail to ensure accuracy. Insurance companies invest in robust data management systems and employ skilled professionals who are trained in handling claims data and generating comprehensive loss run reports.

In summary, loss run reports are generated through a process that involves data collection from various sources, data formatting and standardization, data analysis, report compilation, customization, and ultimately, report delivery. This process ensures that insurance companies have accurate and informative loss run reports to assess risk, make underwriting decisions, and provide policyholders with valuable insights into their claims history.

How to Obtain a Loss Run Report

If you are a policyholder or an entity requesting a loss run report, there are several steps you can follow to obtain the report. The process may vary depending on your specific insurance company and their preferred methods of communication and data access. Here are some general guidelines on how to obtain a loss run report:

1. Contact Your Insurance Company: Start by reaching out to your insurance company’s customer service department. Inquire about their process for requesting a loss run report and any specific requirements they may have. They will guide you through the necessary steps and provide you with the relevant contact information or forms to complete.

2. Submit a Request: Once you have the necessary information from your insurance company, fill out the required request form or provide the requested information to initiate the loss run report. The form may ask for details such as your policy number, contact information, and a reason for requesting the loss run report.

3. Specify Reporting Period: Some loss run report requests may require you to specify the desired reporting period or time frame for the claims history you are seeking. Provide any specific dates or time ranges that are relevant to your request.

4. Determine Delivery Method: Discuss with your insurance company the available options for receiving the loss run report. They may offer delivery through email, secure online portals, or traditional mail. Choose a method that is convenient and secure for you.

5. Provide Authorization, if Necessary: In certain cases, insurance companies may require an authorization form to release the loss run report to a third party, such as another insurance company or a service provider. If this is the case, complete and submit the authorization form along with your request to ensure the report is released to the appropriate party.

6. Follow Up: After submitting your request, it is advisable to follow up with your insurance company to confirm that they have received your request and to inquire about the estimated timeframe for receiving the loss run report. This provides an opportunity to address any questions or concerns that may arise during the process.

It’s essential to note that the process of obtaining a loss run report may vary depending on the insurance company and their procedures. Some insurance companies may provide online portals or self-service options for policyholders to access their loss run reports directly. In such cases, you may be able to generate the report yourself by logging into your account or by following the steps outlined on their website.

In summary, to obtain a loss run report, contact your insurance company, submit a request form with the necessary information, specify the desired reporting period, determine the delivery method, provide authorization if required, and follow up to ensure a smooth and timely process. Understanding the specific requirements and processes of your insurance company will help ensure a successful request for a loss run report.

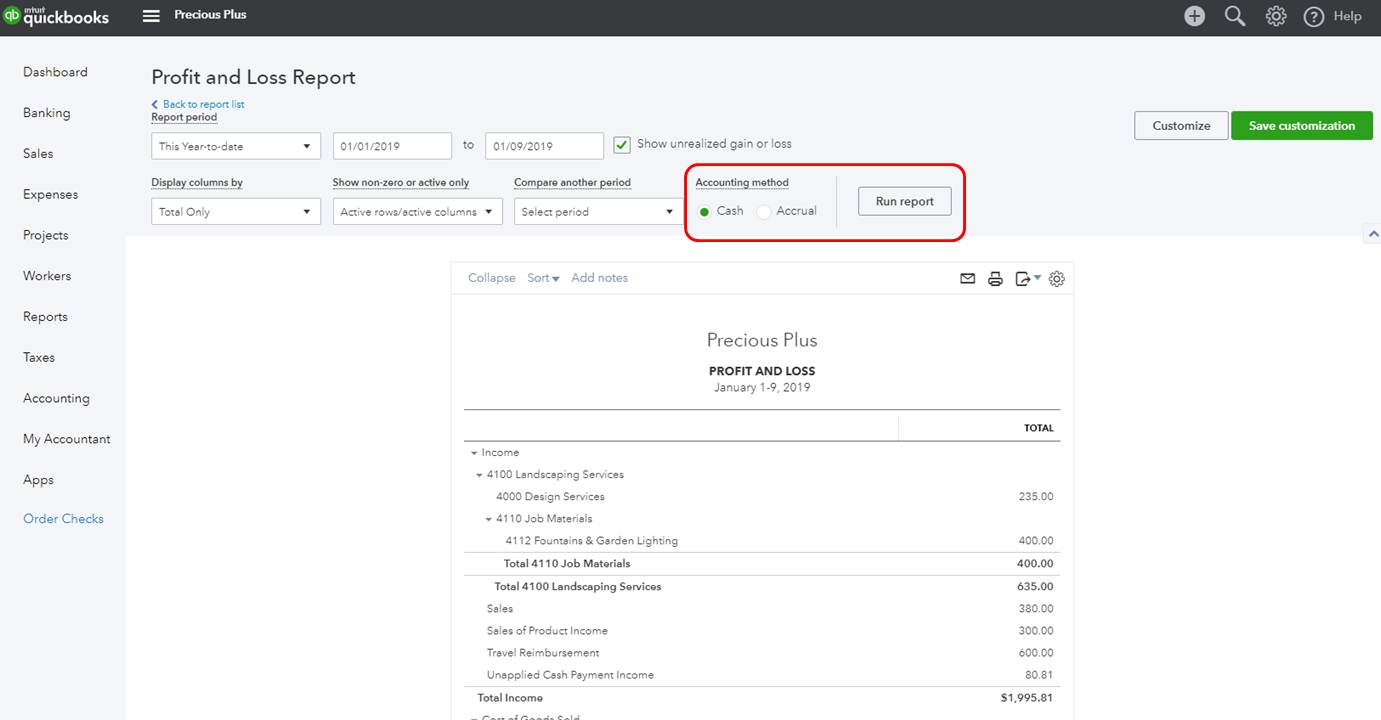

Understanding the Information in a Loss Run Report

A loss run report contains valuable information about an insured party’s claims history. To effectively interpret and understand the information provided in a loss run report, it is crucial to familiarize yourself with the specific terminology and data presented. Here are some key aspects to consider when comprehending a loss run report:

1. Policy Information: The loss run report typically begins with details about the insured party’s insurance policy. This includes the policy number, effective dates, coverage types, limits, and deductibles. Understanding the policy information helps ensure that the claims listed in the report correspond to the correct policy.

2. Claims Details: The loss run report lists each individual claim separately. The date of occurrence, claim number, and a description of the incident or loss are provided. Pay close attention to the details of each claim, as it helps to understand the nature of the loss and its impact.

3. Claim Amounts: The loss run report includes information on the amounts paid for each claim. This section outlines the financial impact of the claims on the insurance company, as well as any deductibles that were applied. Reviewing the claim amounts provides insights into the severity of the losses and their cumulative effect.

4. Claims Status: The status of each claim is indicated in the loss run report, whether it is open, closed, or still in progress. For open claims, additional information may be provided, such as the estimated reserves or the actions being taken to resolve the claim. Understanding the claims status helps assess the current state of each claim.

5. Subrogation: Loss run reports may include information on subrogation, which refers to the insurance company’s efforts to recover funds from responsible third parties. This section highlights any recoveries made and offsets related to the claims. Reviewing subrogation details provides insights into any reimbursements or recoveries made in relation to the losses.

6. Reserves: Loss run reports may contain information on reserves set aside for each claim. Reserves represent the estimated future costs associated with the claim. Understanding reserve amounts helps insurance companies and policyholders evaluate the potential financial impact of open or ongoing claims.

7. Loss Ratio: Some loss run reports may include the loss ratio, which is the ratio of incurred losses to earned premiums. The loss ratio is calculated to assess the profitability of the insured party. Reviewing the loss ratio helps evaluate the claims experience and assess the financial performance in relation to the premiums paid.

8. Additional Analytics: Depending on the insurer and reporting capabilities, loss run reports may provide additional analytics, graphs, or visual representations. These tools can offer a deeper understanding of the insured party’s claims history, trends, and patterns. Exploring these analytics aids in identifying any recurring issues or areas for improvement.

It is important to closely review and analyze the information presented in the loss run report, as it provides valuable insights into the insured party’s claims history. By understanding the policy information, claims details, claim amounts, status, subrogation, reserves, loss ratio, and any additional analytics, insurance companies and policyholders can make informed decisions regarding coverage, risk management, and future insurance needs.

Key Terminology in a Loss Run Report

When reviewing a loss run report, it’s essential to understand the key terminology used. Familiarizing yourself with these terms helps you interpret the information accurately and make informed decisions based on the report. Here are some key terms commonly found in a loss run report:

1. Policy Number: This is a unique identifier assigned to an insurance policy. The policy number serves as a reference for the specific coverage associated with the claims listed in the report.

2. Effective Dates: The effective dates indicate the period during which the insurance policy is in force and provides coverage. It helps determine the timeframe for the claims listed in the report.

3. Coverage Types: This refers to the specific types of insurance coverage provided under the policy. Common coverage types include property, general liability, auto, workers’ compensation, and professional liability. Understanding the coverage types listed helps identify the scope of the claims in the report.

4. Limits: Limits represent the maximum amount an insurance company will pay for a particular claim or within a specified period. The report may include different limits for various types of coverage. Knowing the limits helps assess the extent of coverage available for each claim.

5. Deductibles: Deductibles are the amount the insured party must pay out of pocket before the insurance coverage begins. The report may indicate the deductibles applied to each claim, which helps understand the insured party’s financial responsibility for each loss.

6. Date of Occurrence: This refers to the date on which the incident resulting in the claim occurred. It provides a chronological order of the reported losses, helping to track the occurrence pattern and assess the potential impact on future premiums.

7. Claim Number: Each claim listed in the loss run report is assigned a unique claim number. It acts as an identifier for the specific claim, facilitating communication and reference between the insured party and the insurance company.

8. Description of Incident or Loss: The description provides a brief explanation of the incident or loss associated with each claim. It helps understand the nature of the loss and the circumstances surrounding it.

9. Amount Paid: This indicates the total amount paid by the insurance company for each claim. It includes any reimbursements made to the insured party for covered losses, minus any deductibles or subrogation recoveries.

10. Claim Status: The status of each claim is typically stated in the report, indicating whether it is open, closed, or still in progress. For open claims, additional information may be provided, such as the estimated reserves or actions being taken to resolve the claim.

11. Subrogation: Subrogation refers to the insurance company’s right to recover funds from responsible third parties for losses they have covered. The report may specify any subrogation activities related to the claims, including recoveries made and offsets applied.

12. Reserves: Reserves represent the estimated future costs associated with an open claim. They indicate the amount of funds set aside by the insurance company to cover potential claim expenses that may arise in the future.

13. Loss Ratio: The loss ratio is the ratio of incurred losses to earned premiums. It helps evaluate the financial performance and profitability of the insured party. A higher loss ratio indicates a higher claims-to-premium ratio.

Understanding these key terms in a loss run report is crucial for comprehending the information provided accurately. By familiarizing yourself with the terminology, you can effectively analyze the report, assess the claims history, and make informed decisions regarding insurance coverage and risk management.

Potential Issues and Challenges with Loss Runs

While loss run reports serve as valuable tools for insurance companies and policyholders, there can be potential issues and challenges associated with their interpretation and use. It is important to recognize these factors when reviewing loss run reports. Here are some potential issues and challenges to consider:

1. Incomplete or Inaccurate Data: Loss run reports heavily rely on the accuracy and completeness of the data provided. However, there may be instances where the data collected from various sources contains errors, omissions, or inconsistencies. It is crucial to cross-reference the information with other available records and address any discrepancies to ensure the accuracy of the report.

2. Time Lag in Reporting: Loss run reports may not capture the most up-to-date claims information at the time of request. There can be a time lag between the occurrence of a claim and its inclusion in the report due to processing and reporting delays. It is essential to consider this time gap when analyzing the claims history and making decisions based on the report.

3. Claims Under Investigation or Litigation: Loss run reports may include claims that are still under investigation or in the process of litigation. As a result, the ultimate resolution of these claims, including the final claim amounts, may not be reflected in the report. Policyholders and insurance companies should be aware of the potential impact of pending claims on the accuracy of the report.

4. Limited Contextual Information: Loss run reports often provide limited contextual information about each claim. While the dates, claim numbers, and amounts paid are included, the report may not provide comprehensive details about the circumstances surrounding the loss. Additional context can be crucial for assessing the severity and likelihood of future claims.

5. Differences in Reporting Formats: The format and organization of loss run reports can vary among insurance companies. This can make it challenging to compare reports from different insurers or to aggregate and analyze data across multiple policies. Understanding and adapting to different reporting formats may require additional effort and attention to ensure proper interpretation.

6. Lack of Standardized Terminology: Terminology may differ between insurance companies, making it necessary to familiarize oneself with the specific definitions used in the report. Differences in terminology can lead to misunderstandings or confusion when comparing reports or discussing claims with different insurers.

7. Complex Claims Notation: The notation used to describe claims in a loss run report may involve technical language or abbreviations that are not easily understood by policyholders or individuals unfamiliar with the insurance industry. It is important to seek clarification or refer to glossaries provided by the insurance company to ensure a clear understanding of the claims notation.

8. Privacy and Data Security: Loss run reports contain sensitive and confidential information about the insured party and their claims history. It is essential for insurance companies to handle and transmit this data securely to protect the privacy of policyholders. Policyholders should also take precautions to handle loss run reports with care and ensure they are securely stored or transmitted.

When reviewing loss run reports, being aware of these potential issues and challenges can help mitigate any misinterpretations or misunderstandings. Open communication with the insurance company, seeking clarification when needed, and conducting thorough analysis can contribute to a more accurate understanding of the claims history and informed decision-making.

Conclusion

Loss run reports play a crucial role in the insurance industry, providing both insurance companies and policyholders with valuable insights into claims history. These reports help insurance companies assess risk, make underwriting decisions, and determine appropriate pricing and coverage. Policyholders can also benefit from loss run reports by monitoring their claims history, verifying accuracy, implementing risk management strategies, and potentially reducing insurance premiums.

In order to effectively utilize loss run reports, it is important to understand the key elements and terminology within the report. Reviewing policy information, claims details, amounts paid, claim status, subrogation information, reserves, and loss ratio helps policyholders and insurance companies assess the severity and patterns of losses, identify potential risks, and make informed decisions.

While loss run reports are valuable, it is essential to be aware of potential challenges, such as incomplete or inaccurate data, time lags in reporting, and differences in reporting formats and terminology. By recognizing these challenges, policyholders and insurance companies can navigate through the interpretation process and ensure accurate analysis of the claims history.

Ultimately, loss run reports serve as a vital tool for insurance companies and policyholders to assess risk, manage claims, and implement effective risk management strategies. By understanding the information presented in the loss run report, policyholders and insurance companies can make informed decisions that protect assets, mitigate risks, and ensure appropriate coverage in the ever-changing landscape of the insurance industry.