Finance

What Does Loss Runs Mean In Insurance

Published: November 21, 2023

Discover what "loss runs" means in the world of insurance and how it can impact your finances. Gain insights and understand the financial implications of loss runs in insurance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Loss Runs in Insurance

- Purpose of Loss Runs

- Contents of Loss Runs

- Importance of Loss Runs in Insurance

- Process of Obtaining Loss Runs

- Analyzing Loss Runs Data

- Utilizing Loss Runs for Risk Assessment

- Benefits of Using Loss Runs in Insurance Underwriting

- Challenges in Interpreting Loss Runs

- Conclusion

Introduction

Welcome to the world of insurance, where risk assessment and mitigation are paramount. In the realm of insurance, one term that often pops up is “loss runs,” which plays a crucial role in the underwriting process. If you’re new to the insurance industry or simply curious about this term, you’ve come to the right place.

Loss runs are valuable documents that provide detailed information about an insured entity’s past insurance claims. They contain a comprehensive history of claims, including details such as the type of loss, dates of occurrence, amounts paid, and reserves set aside for ongoing claims.

Insurance companies rely on loss runs to assess their clients’ risk profiles and determine appropriate premiums. Furthermore, loss runs help underwriters analyze patterns, trends, and potential risks associated with clients’ claims history.

Understanding loss runs can be complex, but with a little guidance, you’ll become proficient in deciphering these valuable documents. In this article, we’ll delve into the definition of loss runs, their purpose, as well as the contents they typically contain. We’ll also explore the significance of loss runs in insurance underwriting and discuss how they can be obtained and analyzed.

Whether you’re an insurance professional looking to expand your knowledge or an insured individual seeking insights into how your claims history affects your coverage, this article will provide you with a comprehensive understanding of loss runs and their significance in the insurance industry.

Definition of Loss Runs in Insurance

Loss runs, also known as loss histories or claims histories, refer to detailed reports that document an insured entity’s past insurance claims and their associated details. These reports are compiled by insurance companies and provide a comprehensive overview of the insured’s claims history over a specific period of time.

Loss runs are an essential tool in the insurance industry, particularly during the underwriting process. They serve as a vital source of information for insurance companies to assess the risk associated with insuring a particular entity.

Typically, loss runs contain specific data about each insurance claim, including the type of loss (such as property damage, bodily injury, or liability), dates of occurrence of the loss, details of the claimants, amounts paid in settlement, and any reserves set aside for ongoing claims.

Insurance carriers maintain detailed records of their insured entities’ claims history in order to accurately assess their risks and set appropriate premiums. By examining loss runs, insurers can identify patterns, trends, and potential risks associated with the insured entity’s past claims. This information helps underwriters determine the level of risk the entity poses and make informed decisions regarding policy terms and pricing.

Loss runs are not only beneficial for insurance underwriters but also for insured individuals or businesses. By examining their own loss runs, policyholders can gain valuable insights into their claims history, identify areas of risk or recurring issues, and take proactive measures to mitigate future losses.

Overall, loss runs provide a comprehensive narrative of an insured entity’s claims history and are a crucial component in the underwriting process. They enable insurance companies to make informed decisions regarding coverage, pricing, and risk assessment, while also empowering policyholders to understand and manage their own insurance claims effectively.

Purpose of Loss Runs

The purpose of loss runs in insurance is multi-fold and benefits both insurance companies and policyholders. These detailed reports serve several key purposes in the insurance industry:

- Assessing Risk: Loss runs provide essential information that allows insurance companies to assess the level of risk associated with insuring a particular entity. By analyzing an insured entity’s claims history, underwriters can identify patterns, trends, and potential risks. This information is crucial in determining policy terms, coverage limits, and pricing.

- Setting Premiums: Loss runs play a significant role in determining the premiums an insured entity will pay for their insurance coverage. Insurance companies use loss run data to evaluate an entity’s claims frequency and severity, which directly impacts the pricing of their policy. Entities with a history of frequent or high-cost claims may be subject to higher premiums.

- Underwriting Decisions: Loss runs provide insurers with valuable insights into the insured entity’s claims history. This information helps underwriters make informed decisions regarding accepting or denying coverage, setting policy limits, and establishing policy conditions.

- Identifying Fraudulent Activities: Loss runs can help insurance companies detect potential fraud. By examining claims patterns and inconsistencies, insurers can identify suspicious activities. This allows them to investigate further and take appropriate actions to prevent insurance fraud.

- Loss Prevention and Risk Management: Policyholders can leverage loss runs to better understand their claims history and identify areas of risk or recurring issues. This information empowers them to implement loss prevention strategies and risk management practices that can mitigate future losses.

In summary, the purpose of loss runs in insurance is to provide a comprehensive view of an insured entity’s claims history. They enable insurance companies to assess risk, set appropriate premiums, make underwriting decisions, and detect potential fraud. Additionally, loss runs empower policyholders to understand their own claims history and take proactive measures to minimize future losses.

Contents of Loss Runs

Loss runs are comprehensive documents that provide detailed information about an insured entity’s claims history. While the specific contents may vary between insurance companies, loss runs generally include the following key information:

- Claim Information: Loss runs contain details about each insurance claim made by the insured entity. This includes the claim number, date of loss, and a description of the incident or event that led to the claim.

- Type of Loss: Loss runs specify the type of loss involved in each claim. Common types of losses include property damage, bodily injury, liability, theft, or other events covered by the insurance policy.

- Claimant Details: Loss runs provide information about the individuals or entities involved in the claim. This may include the name, contact information, and relationship to the insured entity.

- Amount Paid: Loss runs indicate the amounts paid by the insurance company to settle each claim. This includes both the total amount paid and any partial payments made over time.

- Reserves: Loss runs may include information about reserves set aside for ongoing claims. Reserves represent the estimated amount of money that the insurance company expects to pay to settle the claim fully.

- Status of Claims: Loss runs often indicate the current status of open claims, such as whether a claim is still under investigation, in negotiation, or awaiting settlement.

- Policy Type and Coverage Limits: Loss runs may provide details about the insurance policy held by the insured entity, including the type of policy, coverage limits, and any endorsements or additional coverage options.

- Policy Period: Loss runs specify the period of time covered by the report, typically ranging from one to five years.

Insurance companies compile loss runs on a regular basis, usually annually, and may provide them to the insured entity upon request. The contents of loss runs are invaluable for both insurance companies and policyholders, as they provide a comprehensive snapshot of the insured entity’s claims history and help inform important underwriting, risk assessment, and decision-making processes.

Importance of Loss Runs in Insurance

Loss runs play a crucial role in the insurance industry, providing valuable insights into an insured entity’s claims history. Here are some key reasons why loss runs are important:

- Risk Assessment: Loss runs allow insurance companies to assess the level of risk associated with insuring a particular entity. By analyzing an entity’s claims history, insurers can identify patterns, frequency, and severity of claims. This information helps underwriters determine the potential risk the entity poses, enabling them to make informed decisions regarding policy terms and pricing.

- Accuracy in Underwriting: Loss runs provide accurate and reliable data that underwriters rely on to make appropriate underwriting decisions. By examining an insured’s claims history, insurers can assess the likelihood of future claims and customize policy terms and coverage limits accordingly.

- Policy Pricing: The information derived from loss runs directly influences the pricing of insurance policies. Entities with a history of frequent or high-cost claims are more likely to pay higher premiums to compensate for their perceived level of risk. Insurers use loss runs to evaluate claims frequency, severity, and patterns to accurately determine premiums.

- Fraud Detection: Loss runs help insurers detect potential fraudulent activities. By examining claims history, insurers can identify unusual patterns, inconsistencies, or suspicious activities that may indicate fraudulent behavior. Early detection of fraud enables insurers to mitigate financial losses and take necessary actions to prevent insurance fraud.

- Loss Prevention and Risk Management: Loss runs provide valuable insights for policyholders to better understand their own claims history. Entities can analyze loss runs to identify areas of risk, recurring issues, or patterns that require attention. This information empowers them to implement loss prevention strategies and risk management practices, reducing the likelihood of future losses.

- Underwriting Efficiency: Loss runs streamline the underwriting process by providing a comprehensive overview of an insured entity’s claims history. By having access to this information, underwriters can expedite their assessment, make informed decisions, and offer accurate and appropriate coverage options.

In summary, loss runs are of significant importance in the insurance industry. They assist insurers in assessing risk, making accurate underwriting decisions, pricing policies accordingly, detecting fraud, and enabling policyholders to better understand and manage their claims history. By utilizing loss runs effectively, insurance companies can optimize their risk assessment processes and provide tailored coverage options to their clients.

Process of Obtaining Loss Runs

If you are an insured entity or an insurance professional seeking to obtain loss runs, here is an overview of the typical process:

- Contact the Insurance Company: Start by contacting the insurance company that provides coverage for the entity in question. This could be the insurer directly or the insurance agent or broker who handles the policy.

- Requesting the Loss Runs: Once in touch with the insurance company, clearly state your request for the loss runs. Provide the necessary information, such as the insured entity’s name, policy number, and any other required details for identification. It is also helpful to specify the desired timeframe for the loss runs, which is typically over a specified number of years.

- Documentation and Verification: The insurance company will require documentation and verification to ensure the legitimacy of the request. This may include a formal written request, proof of identity or authorization, and relevant policy documents.

- Processing Time: The processing time for obtaining loss runs can vary depending on the insurance company and their administrative processes. It is advisable to inquire about the expected timeline for receiving the requested loss runs.

- Delivery of Loss Runs: Once the request is processed, the insurance company will provide the loss runs. This can be in the form of electronic documents sent via email, a secure online portal, or physical copies mailed to the requested address.

- Reviewing the Loss Runs: Upon receiving the loss runs, carefully review the document to ensure accuracy and completeness. Verify that all relevant claims and associated details are included in the report.

It is essential to note that the process of obtaining loss runs may vary between insurance companies. Some insurers may have specific procedures or online portals designated for loss run requests, while others may require direct communication through email or phone.

Insurance professionals, such as brokers or agents, may be able to assist with the process of obtaining loss runs on behalf of their clients. They can help navigate the required documentation, make the formal request, and ensure a smooth communication process with the insurance company.

If you encounter any difficulties or have specific questions regarding the process, it is recommended to directly communicate with the insurance company’s customer service or designated representatives for assistance.

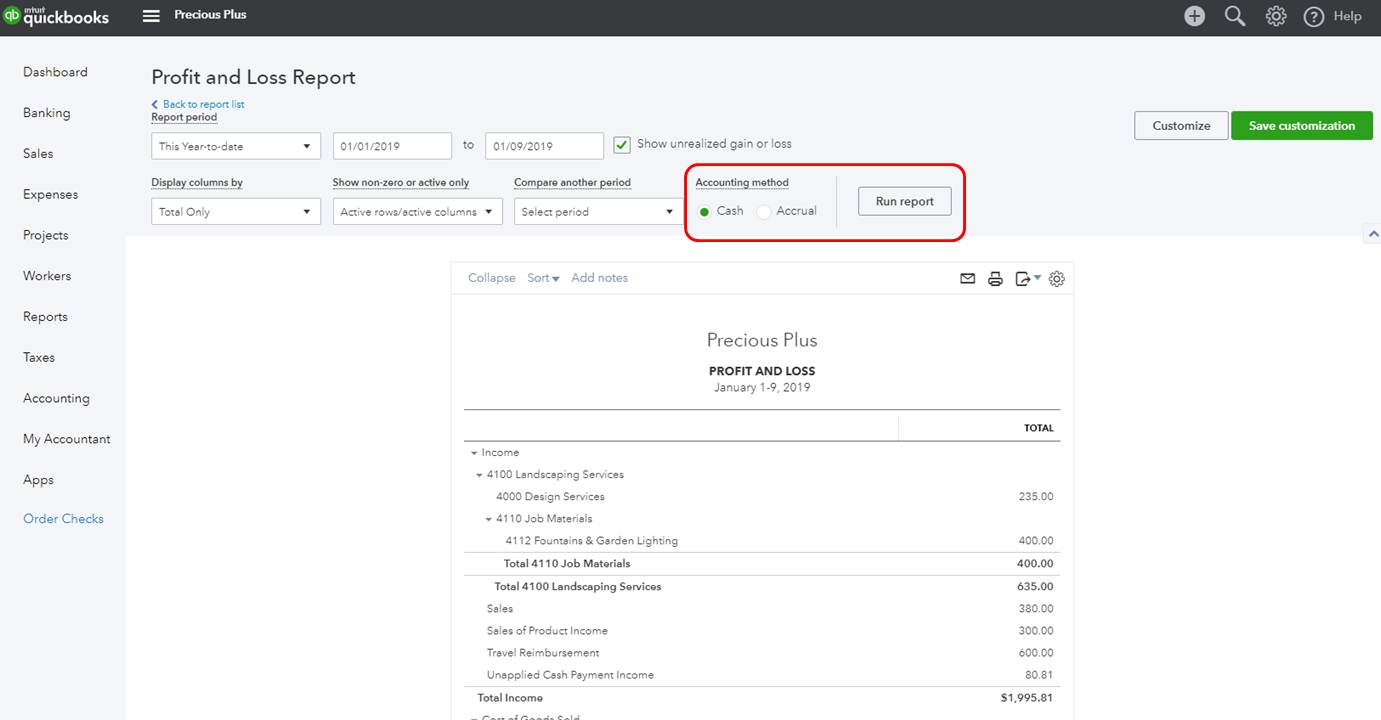

Analyzing Loss Runs Data

Once you have obtained the loss runs, the next step is to analyze the data contained within. Analyzing loss runs data is a critical process for insurance companies and policyholders alike. Here are some key considerations when analyzing loss runs:

- Identify Patterns and Trends: Review the loss runs to identify any patterns or trends in the claims history. Look for common types of losses, frequency of claims, and severity of damages. This analysis can provide insights into the potential risks an insured entity may face.

- Determine Loss Frequency and Severity: Calculate the frequency of claims to understand how often insured entities experience losses. Additionally, evaluate the severity of losses by examining the amounts paid and reserves set aside. This analysis helps assess the financial impact of potential future claims.

- Compare Losses to Industry Benchmarks: Consider how the loss data compares to industry benchmarks or historical averages. This can provide a broader context for understanding the insured entity’s claims history and allows for benchmarking against similar entities in the industry.

- Identify Key Risk Factors: Identify any key risk factors that contribute to the losses. This could include geographical factors, industry-specific risks, or internal factors within the insured entity’s operations. Understanding these risk factors can help in developing strategies to mitigate or manage those risks effectively.

- Review Claim Resolution: Evaluate the efficiency of claim resolution processes. Analyze the time taken to settle claims, the ratio of settled claims to total claims, and any patterns related to denied or disputed claims. This analysis can provide insights into the effectiveness of the claims management process.

- Monitor Loss Control Measures: Identify any loss control measures implemented by the insured entity to mitigate losses. Evaluate the effectiveness of these measures and determine if additional or revised risk management strategies are necessary.

- Communicate Findings: Share the findings of the loss runs analysis with relevant stakeholders, such as underwriters, risk managers, or insured entities themselves. This communication helps inform decision-making processes regarding policy terms, risk mitigation strategies, and loss prevention efforts.

It is crucial to approach loss runs analysis with a strategic mindset and attention to detail. By effectively analyzing the loss runs data, insurance companies can make informed underwriting decisions, set appropriate premiums, and implement risk management strategies. For insured entities, this analysis provides insights into their claims history, helping them identify areas of risk and take necessary measures to mitigate losses in the future.

Utilizing Loss Runs for Risk Assessment

Loss runs are invaluable tools for assessing and managing risk in the insurance industry. Insurance companies rely on loss runs to evaluate the potential risks associated with insuring an entity and make informed underwriting decisions. Here is how loss runs are utilized for risk assessment:

- Identifying Risk Patterns: Loss runs provide a detailed history of an entity’s claims, allowing insurers to identify patterns and trends in their risk profile. By analyzing the frequency, severity, and types of losses, insurers can gain insights into the specific risks an entity faces.

- Evaluating Loss Frequency and Severity: Loss runs enable insurers to assess the frequency and severity of past losses experienced by an entity. This analysis helps insurers estimate the potential likelihood of future claims and estimate the potential financial impact for setting appropriate premiums.

- Assessing Claim Management: Loss runs provide information on how efficiently an entity manages their claims. Insurers can evaluate the time taken to settle claims, the ratio of settled to total claims, and any patterns related to denied or disputed claims. This assessment helps insurers gauge the insured entity’s claims management effectiveness, which can impact their risk assessment and underwriting decisions.

- Comparing Against Peers: Loss runs allow insurers to benchmark an entity’s loss experience against industry peers. This comparison helps insurers gauge how an entity’s loss history aligns with similar entities in terms of types of losses, frequency, severity, and risk profiles. Such comparisons provide insurers with a broader perspective on the risks associated with the entity.

- Identifying Risk Mitigation Opportunities: Loss runs help insurers identify specific areas of risk for an entity. By understanding the key factors contributing to losses, insurers can suggest risk mitigation strategies to the insured entity. This collaboration promotes proactive risk management practices, reducing the likelihood and impact of future losses.

- Customizing Coverage and Policy Terms: Based on the risk assessment derived from loss runs, insurers can tailor coverage options and policy terms to meet an entity’s specific needs. Understanding an entity’s risk profile allows insurers to develop customized solutions that adequately protect against identified risks.

Risk assessment based on loss runs is a dynamic process that evolves over time. Insurers continuously update and analyze loss runs to refine risk assessments, ensure accurate underwriting, and adapt coverage options to changing risk profiles.

For insured entities, understanding how insurers utilize loss runs for risk assessment can be advantageous. By proactively managing their claims history, implementing risk mitigation measures, and maintaining accurate loss records, entities can positively influence their risk profiles and potentially reduce premiums.

Overall, the use of loss runs for risk assessment enables insurance companies to make informed decisions, customize policies, and effectively manage risks. It empowers both insurers and insured entities to collaboratively navigate the complexities of risk in the insurance industry.

Benefits of Using Loss Runs in Insurance Underwriting

The utilization of loss runs in insurance underwriting brings numerous benefits for insurance companies, underwriters, and policyholders. Here are the key advantages of using loss runs in the underwriting process:

- Accurate Risk Assessment: Loss runs provide a comprehensive view of an insured entity’s claims history, enabling insurance companies to accurately assess the level of risk they pose. This enables underwriters to tailor coverage options and policy terms to meet the specific needs and risks of the insured entity.

- Informed Underwriting Decisions: Loss runs serve as essential tools in making informed underwriting decisions. By analyzing an entity’s claims history, underwriters can evaluate the potential frequency, severity, and patterns of future claims. This analysis assists in determining appropriate premiums and coverage limits, ensuring fair and accurate underwriting.

- Customized Coverage Options: Loss runs allow underwriters to offer customized coverage options to insured entities. By understanding their unique risk profile, underwriters can propose policy terms and endorsements that mitigate specific risks faced by the insured entity. This customization ensures the entity receives coverage that aligns with their specific needs.

- Enhanced Pricing Accuracy: By analyzing loss runs, insurance companies can accurately price insurance policies. Loss frequency and severity data obtained from loss runs assist in determining appropriate premiums that reflect the cost of potential future claims. This pricing accuracy promotes fairness for both the insured entity and the insurer.

- Effective Risk Management: Loss runs serve as valuable tools for risk management. By identifying loss patterns and trends, insurance companies can develop strategies for effective risk management and loss prevention. This collaboration with policyholders allows for proactive measures to mitigate potential losses and improve risk profiles.

- Improved Claims Management: Loss runs enable insurers to gain insights into an entity’s claims management processes. By identifying any inefficiencies or areas for improvement, insurance companies can work with insured entities to enhance their claims management practices. This collaboration leads to better claims handling, faster settlements, and improved customer satisfaction.

- Validating Underwriting Decisions: Loss runs serve as tangible evidence for underwriting decisions. When presented with loss runs, underwriters can justify their decisions regarding policy terms, pricing, and coverage limits. This validation helps insured entities understand the reasoning behind underwriting decisions and establishes transparency in the process.

From accurate risk assessment to customized coverage options and enhanced risk management, the use of loss runs in insurance underwriting offers substantial benefits for all stakeholders involved. By leveraging loss runs effectively, insurance companies can improve their underwriting processes, provide tailored coverage options, and maintain fair and sustainable pricing structures. For insured entities, the use of loss runs ensures their unique risks are identified and mitigated while receiving coverage that aligns with their specific needs.

Challenges in Interpreting Loss Runs

While loss runs provide valuable insights into an insured entity’s claims history, there are certain challenges associated with interpreting and analyzing this data. Here are some common challenges in interpreting loss runs:

- Data Inconsistencies: Loss runs may contain incomplete or inconsistent data, making it difficult to accurately assess an entity’s claims history. Inaccurate or missing information can lead to misunderstandings and may impact underwriting decisions.

- Time Lag: There may be a time lag between the occurrence of a loss and its reflection in the loss runs. This could result in the loss runs not capturing the most recent claims, potentially affecting the accuracy of risk assessment and underwriting decisions.

- Frequency vs. Severity: Evaluating the significance of losses can be challenging when loss runs display a mix of high-frequency but low-severity claims alongside low-frequency but high-severity claims. Balancing the impact of these different types of losses requires careful consideration.

- External Factors: Loss runs may not account for external factors that could influence the claims history, such as changes in market conditions, regulatory landscape, or natural disasters. Failing to consider these external factors can lead to misinterpretations of an entity’s true risk exposure.

- Underlying Causes: Loss runs provide information on the occurrence of losses but may not always reveal the underlying causes. It is essential to dig deeper and investigate the root causes of losses to develop effective risk mitigation strategies.

- Claims Reporting Practices: The accuracy and consistency of claims reporting practices can vary across insured entities. Differences in reporting methods or delays in reporting may impact the accuracy and reliability of loss runs data, making interpretation more challenging.

- Comparability: When comparing loss runs across different insured entities, it is important to consider the variations in their size, industry, risk profile, and policy coverage. Direct comparisons without accounting for these factors may lead to inaccurate assessments of risk.

To address these challenges, it is crucial to approach loss runs analysis with a critical mindset and appreciation for the limitations of the data. Insurance companies and underwriters should strive for open communication with insured entities to clarify any discrepancies and gather additional information when needed.

Furthermore, leveraging advanced data analytics and modeling techniques can help overcome some of these challenges and provide a more comprehensive and accurate understanding of an insured entity’s risk profile.

Overall, while interpreting loss runs can present challenges, it is essential to approach the analysis with caution, considering the limitations of the data and seeking additional insights when necessary. With careful interpretation and analysis, loss runs can still provide valuable information for risk assessment and underwriting decisions.

Conclusion

Loss runs play a vital role in the insurance industry by providing a comprehensive history of an insured entity’s claims. They serve as a valuable tool for assessing risk, making informed underwriting decisions, and customizing coverage options. Loss runs enable insurance companies to accurately evaluate an entity’s claims history and determine appropriate premiums and policy terms.

By analyzing loss runs, insurers can identify patterns, trends, and potential risks associated with an insured entity. This analysis helps in risk assessment, loss prevention, and effective claims management. For insured entities, loss runs provide insights into their claims history, allowing them to identify areas of risk, implement loss prevention strategies, and manage their insurance coverage more effectively.

However, interpreting loss runs comes with challenges, such as data inconsistencies, time lags, and variations in reporting practices. It is crucial for insurance professionals and underwriters to approach loss run analysis with caution and consider the limitations of the data.

In conclusion, loss runs serve as a powerful tool in the insurance industry, facilitating risk assessment, underwriting decisions, and risk management practices. By leveraging loss runs effectively, insurance companies can provide tailored coverage options, accurate pricing, and proactive risk mitigation strategies. Policyholders can benefit from a better understanding of their claims history and collaborate with insurers to develop customized, comprehensive coverage solutions.

As the insurance landscape continues to evolve, loss runs will remain a valuable resource for insurance professionals and policyholders. With continued advancements in data analytics and enhanced communication, insurers can further optimize the use of loss runs to navigate the complexities of risk, ensuring a fair and efficient insurance underwriting process.