Finance

What Is A Pivot Point In Stocks

Published: January 18, 2024

Learn what a pivot point is in stocks and how it can be a valuable tool for analyzing financial markets. Explore its significance in finance and trading strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of stock trading, where investors strive to navigate the ever-changing financial landscape to maximize their returns. In this exciting and dynamic field, it is crucial to have a deep understanding of various tools and techniques that can help identify potential trading opportunities. One such tool that has gained popularity among traders is the pivot point.

Pivot points are a technical analysis indicator used to determine potential support and resistance levels in stock prices. They can be applied to various timeframes, from intraday trading to longer-term analysis. By understanding how pivot points are calculated and how they can be used to make trading decisions, traders can gain an edge in the market.

In this article, we will delve into the world of pivot points and explore their significance in stock trading. We will take a look at how pivot points are calculated, their applications in identifying support and resistance levels, and how they can be used as entry and exit signals. We will also discuss the limitations of pivot points and how they should be used in conjunction with other technical indicators to make informed trading decisions.

So, whether you are a novice investor looking to expand your knowledge or an experienced trader seeking to add a new tool to your arsenal, join us as we explore the fascinating realm of pivot points and discover their potential impact on your stock trading journey.

Definition of a Pivot Point

A pivot point is a technical indicator used in financial markets, particularly in stock trading, to determine potential levels of support and resistance. It is essentially a price level at which the direction of price movement is expected to change. Pivot points are calculated based on the high, low, and closing prices from the previous trading session.

The pivot point itself is considered the central point, and it is surrounded by several support and resistance levels. These levels are calculated using a formula that involves the pivot point itself and two other price levels known as the first support level (S1) and the first resistance level (R1).

The key to understanding pivot points lies in recognizing that they are derived from the price action of the previous trading session. They are not influenced by subjective factors or external events, making them a popular tool among technical analysts who rely on historical price data to predict future price movements.

Pivot points can be calculated for different timeframes, such as daily, weekly, or even intraday. The most commonly used timeframe is the daily pivot point, which provides a reference for the trading day ahead.

Traders often use pivot points as a reference to identify potential levels of support and resistance. Support levels are price points below the pivot point where buying pressure may halt the decline in stock prices. Resistance levels, on the other hand, are price points above the pivot point where selling pressure may hinder further upward movement in stock prices.

By identifying these support and resistance levels, traders can gain insights into possible price reversals, breakouts, and ongoing trends. Pivot points serve as valuable reference points to assess the overall sentiment of the market, helping traders make more informed decisions.

How Pivot Points are Calculated

To calculate pivot points, traders typically use the high, low, and closing prices from the previous trading session. There are several different formulas for calculating pivot points, but the most widely accepted method is known as the Standard Pivot Point Formula.

The Standard Pivot Point Formula calculates the pivot point (PP) by adding the high, low, and closing prices from the previous session, and then dividing the sum by three. The formula is as follows:

PP = (High + Low + Close) / 3

Once the pivot point is calculated, several support and resistance levels are derived from it. The first support level (S1) and first resistance level (R1) are calculated using the following formulas:

S1 = (2 * PP) – High

R1 = (2 * PP) – Low

Additionally, second support (S2), second resistance (R2), third support (S3), and third resistance (R3) levels can also be calculated using specific formulas, but they are not as commonly employed as the first support and resistance levels.

It is important to note that pivot point calculations can vary depending on the method used or the preferences of individual traders. Some variations may involve using the midpoint between the high and low prices instead of the closing price, using only the high and low prices without the closing price, or incorporating additional levels of support and resistance.

Traders can manually calculate pivot points using these formulas, but most trading platforms and charting software provide built-in tools that automatically calculate and plot pivot points on price charts.

Once the pivot points and corresponding support and resistance levels are calculated, traders can use them to make trading decisions. These levels act as potential areas of interest where price movements may reverse or encounter barriers.

By studying how stock prices react around these levels, traders can identify potential entry and exit points, as well as gauge the strength of a trend. Pivot points provide a valuable framework for analyzing price action and can be an indispensable tool in a trader’s arsenal.

Applications of Pivot Points in Stock Trading

Pivot points have various applications in stock trading and can be used in different ways to improve trading decisions. Here are some common applications of pivot points:

1. Identifying Support and Resistance Levels: Pivot points are primarily used to identify potential levels of support and resistance in stock prices. Traders can observe how price reacts around these levels to determine if they should buy or sell stocks. If the price bounces off a support level, it may indicate a buying opportunity, while a rejection at a resistance level could signal a potential selling opportunity.

2. Setting Profit Targets and Stop Losses: Pivot points can help traders set profit targets and determine stop loss levels. When initiating a trade, traders can use the nearest pivot point or support/resistance level as a target for profit-taking. Conversely, they can place stop loss orders just below or above these levels to limit potential losses if the trade moves against them.

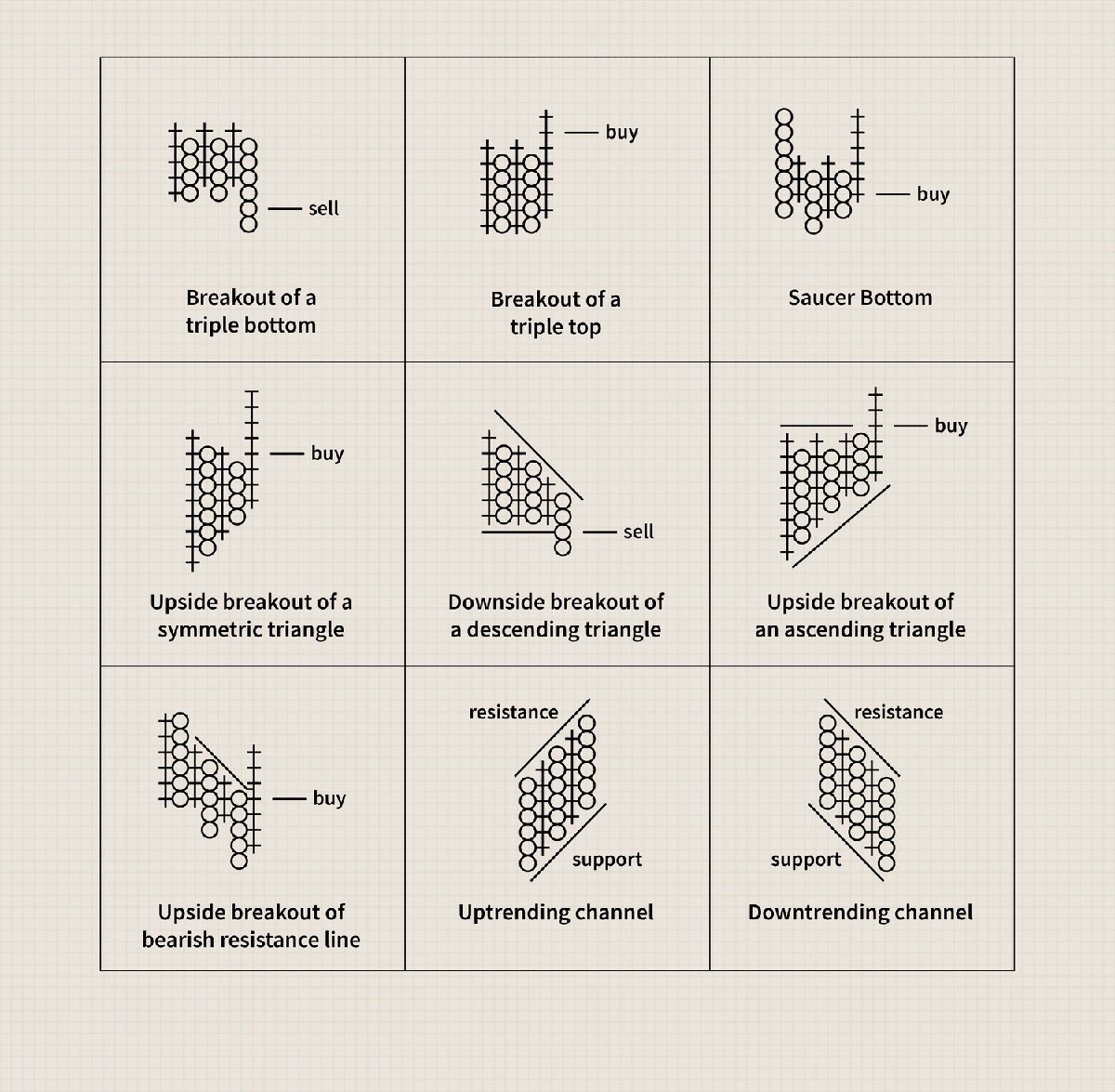

3. Identifying Breakouts: Pivot points can serve as indicators of potential breakout opportunities. If the price breaks above a resistance level, it may indicate a bullish breakout, while a break below a support level may suggest a bearish breakout. Traders can use pivot points to confirm breakouts and take advantage of momentum in stock prices.

4. Assessing Market Sentiment: Pivot points provide a snapshot of the market sentiment and can help traders gauge the overall bias. If prices are consistently trading above the pivot point and support levels, it may indicate a bullish sentiment. Conversely, if prices remain below the pivot point and encounter resistance levels, it may imply a bearish sentiment. This information can be useful when determining whether to take long or short positions.

5. Scalping and Day Trading: Pivot points are popular among short-term traders, such as scalpers and day traders. They can utilize pivot points to identify short-term price targets and make quick trading decisions based on price action around these levels. Intraday traders often focus on the daily pivot point to frame their trading strategies for the trading session.

6. Confirmation with Other Indicators: Pivot points can be used in conjunction with other technical indicators to confirm trading signals. For example, if a pivot point coincides with a trendline or a moving average, it can reinforce the significance of that level. Traders may wait for additional confirmation from other indicators before taking action based on pivot points alone.

It is important to note that pivot points are not magical indicators and should not be relied upon solely for trading decisions. Traders should use them as part of a comprehensive trading strategy, considering other technical indicators, fundamental analysis, and market conditions. Pivot points are most effective when combined with other tools and used as a complementary tool in the trader’s decision-making process.

Using Pivot Points for Support and Resistance Levels

One of the primary applications of pivot points in stock trading is to identify potential levels of support and resistance. Support levels are price levels at which buying pressure may halt the decline in stock prices, while resistance levels are price levels where selling pressure may hinder further upward movement in stock prices.

Traders use pivot points as reference points to identify these support and resistance levels. The pivot point itself is often considered the primary support or resistance level, while additional levels are derived from it. The first support level (S1) and first resistance level (R1) are calculated and widely used in technical analysis.

If the price of a stock is approaching a support level, it indicates a potential buying opportunity as traders anticipate a price bounce or reversal. Conversely, when the price approaches a resistance level, traders may consider selling or shorting the stock, expecting the price to reverse its upward momentum.

Traders can also interpret the strength of support and resistance levels based on how decisively the price reacts at those levels. A strong support level is characterized by multiple bounces off the level, indicating that buyers are actively entering the market at that price. Similarly, a strong resistance level is characterized by multiple rejections, suggesting that sellers are aggressively defending that level.

Pivot points can be particularly effective in range-bound markets where stock prices oscillate between support and resistance levels. In these scenarios, traders can identify potential buying opportunities near support and selling opportunities near resistance, aiming to profit from price reversals.

It’s important to mention that support and resistance levels derived from pivot points are not foolproof and should be used in conjunction with other technical analysis tools and indicators. Traders should consider additional factors such as volume, trendlines, moving averages, and candlestick patterns to confirm the validity of support and resistance levels identified by pivot points.

Overall, pivot points serve as valuable reference points for traders to assess potential support and resistance levels in stock prices. By understanding these levels, traders can make more informed decisions about entry and exit points, setting profit targets and stop losses, and gauging the overall sentiment of the market.

Pivot Points as Entry and Exit Signals

In addition to identifying support and resistance levels, pivot points can also be used as entry and exit signals in stock trading. Traders often look for specific price action around pivot points to determine the optimal timing for entering or exiting a trade.

When using pivot points as entry signals, traders look for price movement that confirms a potential reversal or continuation pattern. For example, if the price of a stock bounces off a support level derived from a pivot point and starts moving higher, it may signal a buying opportunity as traders anticipate a price reversal. Conversely, if the price breaks below a support level, it may suggest a bearish signal and traders might consider selling or shorting the stock.

Traders can also combine pivot points with other technical indicators to increase the accuracy and reliability of their entry signals. For instance, they may wait for a bullish candlestick pattern or a favorable reading on an oscillating indicator, such as the Relative Strength Index (RSI), to confirm a buying opportunity near a support level derived from a pivot point.

When it comes to exit signals, pivot points can help traders determine potential price targets for taking profits or closing their positions. Traders often look at resistance levels derived from pivot points as potential areas where prices may stall or reverse. If the price reaches a resistance level and shows signs of slowing down or encountering selling pressure, it may present an opportunity for traders to exit their positions and lock in profits.

Similar to entry signals, traders can employ other technical indicators and price patterns to confirm their exit signals when using pivot points. For example, they may look for a bearish reversal candlestick pattern or an overbought reading on an indicator like the Stochastic Oscillator to validate their decision to exit a long position near a resistance level derived from a pivot point.

It’s essential for traders to monitor price action and adjust their entry and exit strategies accordingly. Pivot points should not be used as standalone signals but should be considered in conjunction with other technical indicators, market conditions, and individual trading preferences.

By utilizing pivot points as entry and exit signals, traders can enhance their decision-making process and potentially improve trading performance. However, it is important to practice sound risk management and constantly evaluate the effectiveness of pivot points in the context of one’s overall trading strategy.

Limitations of Pivot Points

While pivot points can be a valuable tool in stock trading, it is important to recognize their limitations. Understanding these limitations can help traders avoid potential pitfalls and make more informed trading decisions. Here are some key limitations of pivot points:

1. Reliance on Historical Data: Pivot points are derived from historical price data, making them susceptible to changes in market conditions. They do not take into account real-time news events, market sentiment shifts, or other factors that can influence stock prices. Traders should supplement pivot points with real-time analysis and stay updated on current market developments.

2. Not Foolproof: While pivot points can identify potential support and resistance levels, they are not guaranteed to hold. Stock prices can break through these levels, resulting in false signals and potential losses. It is important for traders to use pivot points in conjunction with other technical indicators and risk management strategies to confirm signals and manage uncertainties.

3. Lack of Precision: Pivot points provide a range of support and resistance levels, but they do not pinpoint exact price levels. Traders need to exercise caution and not rely solely on pivot points for precise entry and exit points. Additional technical analysis tools and price patterns can help refine trades and improve accuracy.

4. Sensitivity to Timeframe: Pivot points can vary depending on the timeframe used in calculations. Different timeframes may generate different support and resistance levels, introducing potential confusion for traders. Traders should choose a timeframe that aligns with their trading strategy and be consistent in their approach.

5. Limited in Trending Markets: Pivot points work best in range-bound markets, where prices oscillate between support and resistance levels. In trending markets, where prices move in one direction, pivot points may not provide as much value. Traders should consider the broader market context and use additional tools to identify trends and potential breakouts.

6. Subjectivity: While pivot point calculations are based on mathematical formulas, there are variations in how traders choose to calculate them. This subjectivity can lead to slightly different levels among traders, adding to the complexity and potential confusion. Traders should be consistent in their approach and validate pivot point levels using multiple sources or platforms.

Despite these limitations, pivot points remain a popular tool among traders due to their simplicity and potential effectiveness. They can provide a useful framework for assessing market sentiment, identifying support and resistance levels, and making trading decisions. However, it is crucial for traders to understand these limitations and use pivot points as part of a comprehensive trading strategy that incorporates other technical indicators, fundamental analysis, and risk management techniques.

Conclusion

Pivot points are a valuable tool in the arsenal of stock traders, providing insights into support and resistance levels, potential entry and exit points, and market sentiment. They are derived from previous price data and can be calculated for different timeframes, making them adaptable to various trading strategies.

By understanding how pivot points are calculated and how they can be applied, traders can gain a better understanding of the market dynamics and make more informed trading decisions. Pivot points can serve as reference points for identifying potential buying and selling opportunities, setting profit targets and stop losses, and confirming price reversals.

While pivot points can be a powerful tool, it is important to recognize their limitations. They should not be used in isolation but as part of a comprehensive trading strategy that integrates other technical indicators, market analysis, and risk management techniques.

Moreover, it is crucial for traders to continually adapt and refine their trading strategies based on market conditions and individual preferences. Regular evaluation of the effectiveness of pivot points and their alignment with the overall trading strategy is key to long-term success.

In conclusion, pivot points are a valuable tool for stock traders, providing insights into potential support and resistance levels and helping to make informed trading decisions. By incorporating pivot points into a comprehensive trading strategy, traders can gain a competitive edge and navigate the dynamic world of stock trading with increased confidence.