Finance

What Is Adjusted Bank Statement Balance

Published: March 2, 2024

Learn about the importance of adjusted bank statement balances in finance and how they impact financial reporting and decision-making. Understand the significance of reconciling discrepancies for accurate financial analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Significance of Adjusted Bank Statement Balance

Welcome to the intricate world of finance, where every dollar counts and accuracy is paramount. In this domain, the term “Adjusted Bank Statement Balance” holds significant weight and plays a pivotal role in ensuring the financial integrity of businesses and individuals alike. Whether you’re a seasoned finance professional or someone delving into the nuances of banking and accounting for the first time, grasping the concept of Adjusted Bank Statement Balance is essential for financial literacy and sound decision-making.

At its core, the Adjusted Bank Statement Balance serves as a crucial indicator of the true financial standing of an individual or entity. It represents the reconciled amount of funds available in a bank account after accounting for all pertinent transactions, including deposits, withdrawals, checks, and electronic transfers. This balance is not merely a numerical figure; it embodies the culmination of diligent record-keeping, meticulous scrutiny, and the assurance of financial accuracy.

Throughout this article, we will delve into the definition, importance, factors influencing, and calculation of the Adjusted Bank Statement Balance. By unraveling the intricacies surrounding this fundamental financial concept, we aim to empower readers with the knowledge and insight necessary to navigate the complex terrain of banking and finance with confidence and clarity.

Definition of Adjusted Bank Statement Balance

At its essence, the Adjusted Bank Statement Balance refers to the reconciled amount of funds in a bank account after considering all relevant transactions and adjustments. This balance reflects the true financial position of the account and is crucial for identifying any disparities between the bank’s records and the account holder’s records. The process of arriving at the Adjusted Bank Statement Balance involves meticulous scrutiny of all financial activities, including deposits, withdrawals, fees, and other charges, to ensure that the recorded balance aligns with the actual funds available.

Furthermore, the Adjusted Bank Statement Balance serves as a vital tool for detecting discrepancies, errors, or fraudulent activities within the account. By comparing the adjusted balance with the bank statement, individuals and businesses can identify any irregularities that may require further investigation or resolution.

It’s important to note that the Adjusted Bank Statement Balance is not a static figure; rather, it is subject to change as new transactions are recorded and reconciled. As such, maintaining accurate and up-to-date financial records is imperative for ensuring the precision of the adjusted balance.

Ultimately, the Adjusted Bank Statement Balance embodies the culmination of meticulous record-keeping, diligent reconciliation, and unwavering attention to detail. It stands as a beacon of financial accuracy and integrity, guiding individuals and businesses toward a clear understanding of their true financial standing within the banking landscape.

Importance of Adjusted Bank Statement Balance

The Adjusted Bank Statement Balance holds immense significance in the realm of finance and accounting, serving as a critical metric for ensuring the accuracy and integrity of financial records. Its importance is multifaceted, impacting both individuals and businesses in several key areas.

First and foremost, the Adjusted Bank Statement Balance acts as a safeguard against discrepancies and errors in financial records. By reconciling all transactions and adjustments, individuals and businesses can identify any inconsistencies between their own records and the bank’s statement. This process not only helps in detecting potential errors but also serves as a deterrent against fraudulent activities that may compromise the financial security of the account.

Moreover, the Adjusted Bank Statement Balance plays a pivotal role in facilitating informed financial decision-making. With an accurate understanding of the reconciled balance, individuals and businesses can make sound judgments regarding their financial activities, such as budgeting, investment, and expenditure planning. This clarity and precision in financial assessment are instrumental in maintaining fiscal discipline and strategic financial management.

From a regulatory and compliance perspective, the Adjusted Bank Statement Balance holds substantial importance. It provides a verifiable record of the account’s financial position, which is essential for tax reporting, auditing, and regulatory compliance. Accurate and meticulously maintained adjusted balances contribute to transparency and accountability, aligning with the standards of financial governance and regulatory requirements.

Furthermore, the Adjusted Bank Statement Balance serves as a cornerstone for building trust and credibility in financial relationships. Whether engaging with financial institutions, business partners, or stakeholders, the ability to present accurate and reconciled bank balances instills confidence and reliability, fostering positive rapport and credibility within the financial ecosystem.

In essence, the Adjusted Bank Statement Balance is not merely a numerical figure; it is a linchpin of financial accuracy, security, and informed decision-making. Its importance reverberates across the financial landscape, shaping the foundation of sound financial practices and ensuring the reliability of financial records.

Factors Affecting Adjusted Bank Statement Balance

The Adjusted Bank Statement Balance is susceptible to various factors that can influence its value and accuracy. Understanding these factors is essential for comprehending the dynamic nature of bank balances and the intricacies involved in reconciling financial records.

1. Outstanding Checks and Deposits: Unprocessed checks and deposits can significantly impact the adjusted balance. Outstanding checks reduce the available funds until they are cleared, while pending deposits may not reflect in the current balance, affecting the reconciled amount.

2. Bank Fees and Charges: Service fees, overdraft charges, and other bank-imposed fees directly affect the adjusted balance. These deductions reduce the available funds and must be accounted for in the reconciliation process to ensure accuracy.

3. Interest Accruals: For interest-bearing accounts, accrued interest adds to the adjusted balance. However, the timing of interest calculations and crediting can influence the reconciled amount, especially if interest is compounded at irregular intervals.

4. Electronic Transactions: Electronic transfers, such as wire transfers, ACH transactions, and online bill payments, can impact the adjusted balance based on their processing timelines and settlement periods. Pending electronic transactions may not immediately reflect in the reconciled balance, affecting the overall financial position.

5. Bank Errors and Adjustments: Mistakes or inaccuracies in the bank’s records, including posting errors, misapplied payments, or erroneous adjustments, can lead to discrepancies in the adjusted balance. Identifying and rectifying such errors is crucial for maintaining the accuracy of financial records.

6. Fraudulent Activities: Unauthorized transactions, identity theft, and fraudulent activities can detrimentally impact the adjusted balance. Detecting and addressing fraudulent transactions is essential for safeguarding the integrity of the bank statement balance and the overall financial security.

7. Reconciliation Timing: The frequency and timing of reconciling bank statements can affect the adjusted balance. Delayed or infrequent reconciliations may lead to discrepancies, as new transactions may not be promptly reflected in the reconciled balance.

Understanding and accounting for these factors is paramount in ensuring the accuracy and reliability of the Adjusted Bank Statement Balance. By acknowledging the dynamic interplay of these influences, individuals and businesses can maintain a clear and precise understanding of their true financial standing within the banking domain.

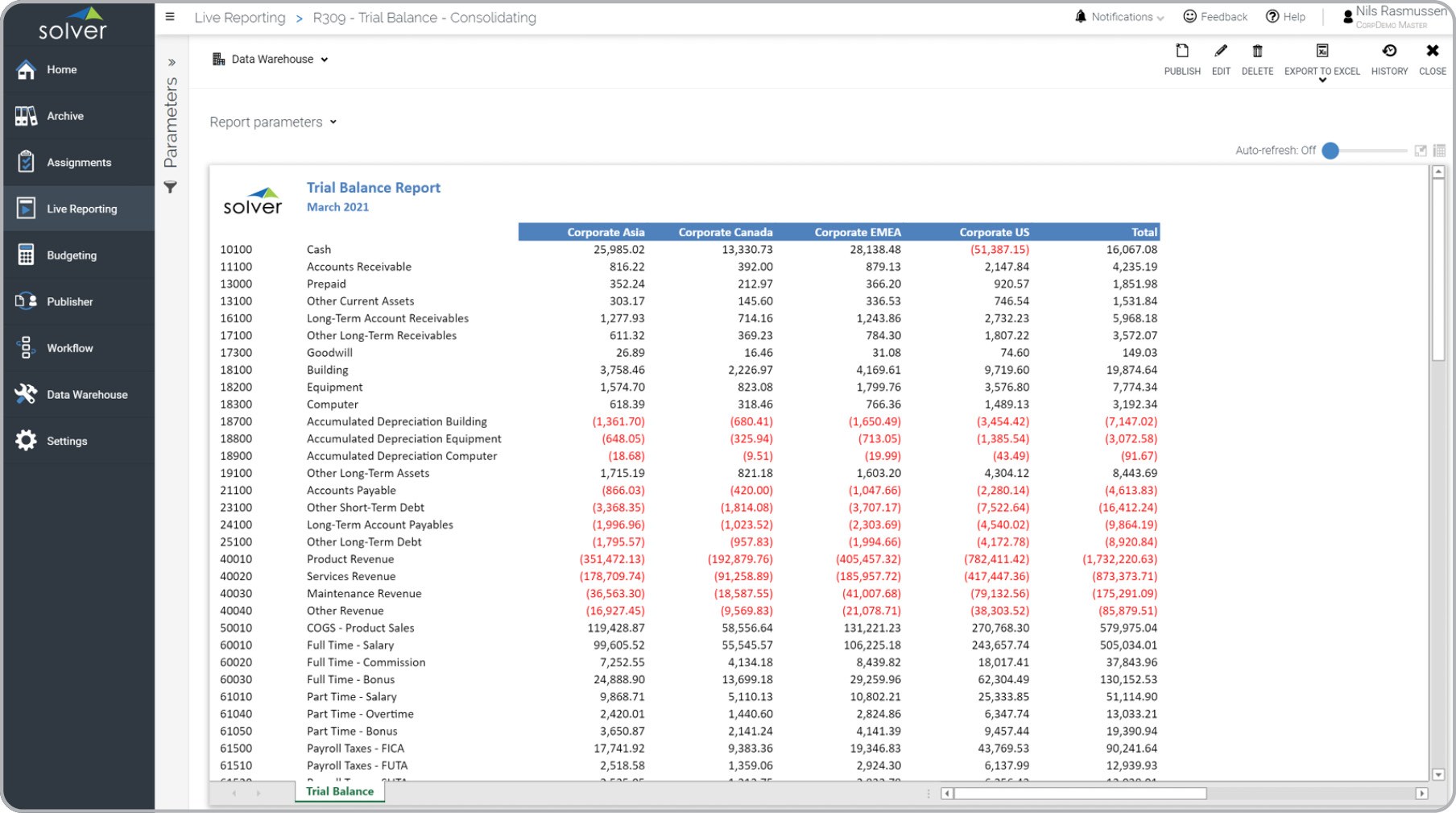

How to Calculate Adjusted Bank Statement Balance

Calculating the Adjusted Bank Statement Balance involves a systematic process of reconciling the account's transactions and adjustments to derive the accurate and up-to-date financial position. Here's a comprehensive guide to the steps involved in calculating the Adjusted Bank Statement Balance:

-

Gather Bank Statements and Transaction Records: Begin by collecting the latest bank statements, including the beginning and ending balances, as well as all transaction records, such as checks, deposits, withdrawals, and electronic transfers, for the relevant period.

-

Identify Outstanding Transactions: Review the transaction records to identify any outstanding checks, deposits, or electronic transactions that have not yet been processed by the bank. These outstanding items need to be factored into the calculation to arrive at the adjusted balance.

-

Account for Bank Fees and Charges: Take into account any bank fees, service charges, or other deductions imposed by the bank. These amounts should be subtracted from the reconciled balance to reflect the actual available funds.

-

Add or Deduct Interest Accruals: If the account accrues interest, calculate the interest earned or charged during the period and adjust the reconciled balance accordingly. Interest accrued adds to the balance, while interest charges reduce the available funds.

-

Consider Electronic Transactions: Review any pending electronic transactions, such as wire transfers or electronic bill payments, to ensure that they are reflected in the reconciled balance based on their processing timelines and settlement periods.

-

Rectify Errors and Discrepancies: Scrutinize the transaction records for any discrepancies, errors, or fraudulent activities that may impact the reconciled balance. Rectify any inaccuracies and address any unauthorized transactions to maintain the integrity of the adjusted balance.

-

Reconcile the Transactions: Reconcile the transaction records with the bank statement, ensuring that all deposits, withdrawals, and adjustments align with the bank's records. Make any necessary adjustments to the reconciled balance based on the reconciliation process.

-

Verify the Adjusted Bank Statement Balance: Once all transactions and adjustments have been reconciled, verify the accuracy of the adjusted bank statement balance by comparing it with the ending balance on the bank statement. The two figures should align, signifying a precise and reconciled financial position.

By meticulously following these steps and conducting a thorough reconciliation of all transactions and adjustments, individuals and businesses can calculate the Adjusted Bank Statement Balance with confidence and precision, providing a clear understanding of their true financial standing within the banking landscape.

Conclusion

Understanding the intricacies of the Adjusted Bank Statement Balance is paramount for individuals and businesses seeking financial clarity and accuracy. As we’ve explored, the adjusted balance serves as a beacon of financial integrity, representing the reconciled amount of funds available in a bank account after considering all relevant transactions and adjustments.

Throughout this journey, we’ve unveiled the significance of the adjusted balance in safeguarding against discrepancies, facilitating informed decision-making, ensuring regulatory compliance, and fostering trust within the financial landscape. Its dynamic nature, influenced by factors such as outstanding transactions, bank fees, interest accruals, electronic transactions, errors, and reconciliation timing, underscores the need for meticulous attention to detail and proactive reconciliation practices.

The process of calculating the Adjusted Bank Statement Balance entails a systematic approach, involving the gathering of bank statements and transaction records, identification of outstanding transactions, consideration of bank fees and charges, reconciliation of electronic transactions, rectification of errors, and the verification of the reconciled balance. By adhering to these steps, individuals and businesses can derive an accurate and up-to-date understanding of their financial position, empowering them to make informed financial decisions and maintain the integrity of their financial records.

In essence, the Adjusted Bank Statement Balance transcends its numerical value, embodying the diligence, precision, and commitment to financial accuracy. It stands as a testament to the unwavering pursuit of financial integrity and the foundation for sound financial management.

As we navigate the complex terrain of banking and finance, the Adjusted Bank Statement Balance serves as a guiding light, illuminating the path toward financial transparency, reliability, and informed decision-making. By embracing its significance and mastering the art of reconciliation, individuals and businesses can navigate the financial landscape with confidence, armed with a clear and precise understanding of their true financial standing.