Finance

What Is Backtesting Stocks

Published: January 18, 2024

Discover the importance of backtesting stocks in the world of finance. Learn how this powerful tool can optimize your investment strategies and improve your overall success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of backtesting stocks! In the realm of finance, backtesting is a powerful tool that allows investors and traders to assess the viability and profitability of their investment strategies by simulating them against historical market data. It provides valuable insights into how a particular strategy would have performed in the past, helping market participants make informed decisions for the future.

Backtesting stocks involves analyzing historical price data, along with other relevant indicators and variables, to simulate how a specific trading strategy would have fared. It allows investors to assess the potential risks and returns of different investment approaches, providing a reliable measure of strategy effectiveness without the need for real-time trading.

By using backtesting, investors can gain a deeper understanding of the strengths and weaknesses of their trading strategies, allowing them to refine and optimize their approaches. It helps them identify patterns, trends, and correlations that may otherwise go unnoticed, enabling them to make more informed investment decisions.

Whether you’re a seasoned trader looking to fine-tune your strategies or a novice investor seeking to learn more about the market, backtesting is an essential tool for assessing the feasibility of your trading ideas. It provides an objective and empirical measurement of strategy performance, fostering discipline and rational decision-making in the face of market uncertainty.

In this article, we will delve deeper into the concept of backtesting stocks. We will explore its definition, purpose, advantages, and limitations. We will also provide step-by-step guidance on how to conduct backtesting and highlight some of the common mistakes to avoid. So, let’s dive in and uncover the fascinating world of backtesting stocks!

Definition of Backtesting Stocks

Backtesting stocks refers to the process of evaluating the performance of a trading or investment strategy by applying it to historical market data. It involves analyzing past price movements, trading signals, and other relevant factors to determine how the strategy would have fared in real-life trading scenarios.

Backtesting allows traders and investors to test the viability and profitability of their strategies without the risk and costs associated with actual trading. It provides a valuable opportunity to assess the potential returns, risk exposure, and overall effectiveness of a trading approach.

The process of backtesting involves applying a set of predefined rules or algorithms to historical price data to generate hypothetical trading signals and calculate performance metrics. These rules can be based on various factors, such as technical indicators, fundamental analysis, market trends, or a combination of these.

Backtesting can be performed using specialized software platforms or by manually analyzing historical data. The software automates the process, making it more efficient and enabling traders to test their strategies across different time periods and asset classes.

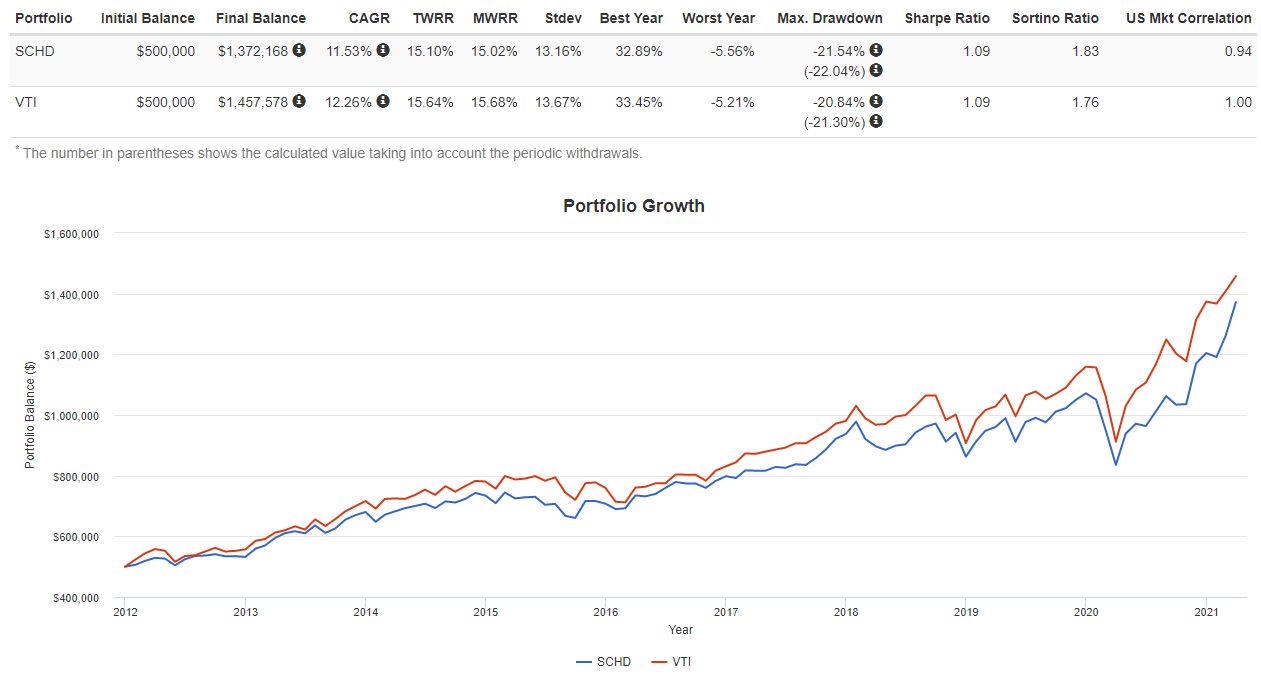

By conducting backtesting, traders can assess the profitability of their strategies over a specific time frame. They can measure metrics such as profit and loss, win rate, drawdowns, and risk-adjusted returns to evaluate the strategy’s performance and determine its potential for success in real-world trading conditions.

Backtesting stocks can be applied to various trading strategies, including trend following, mean reversion, breakout trading, and momentum investing. It allows traders to compare different approaches and identify the most profitable and reliable strategies for their specific investment goals.

It’s important to note that backtesting is not a foolproof method to guarantee future success. It provides insights based on historical data, which may not accurately represent future market conditions. However, it can be a valuable tool in the decision-making process, helping traders and investors gain confidence in their strategies and adapt them according to changing market dynamics.

Purpose of Backtesting Stocks

The primary purpose of backtesting stocks is to evaluate the effectiveness and profitability of trading strategies by simulating them against historical market data. By analyzing past price movements and applying predefined rules, backtesting allows traders and investors to assess the potential risks and rewards of their strategies without the need for real-time trading.

One of the key purposes of backtesting is to provide a quantitative and objective assessment of a strategy’s performance. It enables traders to measure and compare key metrics, such as returns, volatility, drawdowns, and risk-adjusted performance. This helps in identifying strategies that have consistently delivered positive results and determining their suitability for real-world trading.

Backtesting also serves as a valuable learning tool for traders. By backtesting different strategies, traders can understand how various indicators, variables, and market conditions affect the performance of their trading approaches. It helps in gaining insights into the strengths and weaknesses of different strategies and refining them for optimal results.

Another purpose of backtesting is to provide confidence and discipline to traders. By simulating their strategies over historical data, traders can gain a sense of the strategy’s efficacy and develop confidence in their ability to stick to the predefined rules. This discipline is crucial in maintaining consistency and avoiding impulsive decisions during live trading.

Backtesting also allows traders to test the robustness of their strategies under different market conditions. By applying the strategy across various time periods and different markets, traders can assess whether the strategy performs well in both trending and range-bound markets. This helps in adapting the strategy to different market environments and avoiding over-optimization.

Additionally, backtesting facilitates the identification of potential improvements and adjustments to existing strategies. By analyzing the historical performance, traders can pinpoint areas where the strategy underperforms and make necessary modifications to enhance its profitability. It enables continuous refinement and optimization of trading strategies over time.

Overall, the purpose of backtesting stocks is to provide traders and investors with a quantitative assessment of strategy performance, foster discipline and confidence in trading approaches, and serve as a learning tool for refining and optimizing trading strategies. It plays a crucial role in the decision-making process, enabling market participants to make informed and evidence-based choices for their trading activities.

Advantages of Backtesting Stocks

Backtesting stocks offers several advantages to traders and investors, providing valuable insights and enhancing the decision-making process. Here are some of the key advantages of utilizing backtesting:

- Evaluation of Strategy Performance: Backtesting allows traders to assess the performance of their trading strategies by analyzing historical market data. It provides a quantitative and objective measure of strategy effectiveness, helping traders identify the strategies that have yielded consistent profits and those that have underperformed.

- Risk Assessment: Backtesting helps in evaluating the risk associated with a trading strategy. By examining metrics such as drawdowns and risk-adjusted returns, traders can assess the level of risk exposure and make informed decisions about risk management and position sizing.

- Strategy Refinement: Backtesting provides a platform for traders to refine and optimize their trading strategies. By analyzing the historical performance, traders can identify weaknesses and areas for improvement, allowing them to make necessary adjustments and enhancements to enhance profitability.

- Testing Different Market Conditions: Backtesting enables traders to test their strategies across different market conditions. By applying the strategy to historical data from various market environments, traders can evaluate its performance and determine its adaptability to different market trends, ranging from bullish to bearish or volatile to stable.

- Time-Saving: Backtesting eliminates the need for real-time testing and trial and error in live trading. Traders can save significant time and resources by simulating their strategies against historical data, allowing them to make adjustments and optimize their approaches before risking actual capital in the market.

- Emotional Control: Backtesting helps traders develop emotional control and discipline by removing the psychological pressures associated with real-time trading. It allows traders to execute trades based on predetermined rules, fostering consistency and mitigating the impact of impulsive decision-making caused by emotions.

- Enhanced Confidence: Backtesting provides traders with evidence-based results, allowing them to gain confidence in their trading strategies. Seeing positive results from backtesting builds trust in the strategy’s effectiveness, making it easier for traders to stick to their trading plan during live trading.

- Knowledge Building: Backtesting facilitates learning and knowledge building in the field of trading. Traders can gain insights into the impact of different indicators, variables, and market conditions on strategy performance, enabling them to make more informed decisions and adapt their approaches to changing market dynamics.

Overall, the advantages of backtesting stocks make it an essential tool for traders and investors. It assists in evaluating strategy performance, managing risk, refining trading approaches, adapting to different market conditions, saving time, fostering emotional control, building confidence, and enhancing knowledge in the field of trading.

Limitations of Backtesting Stocks

While backtesting stocks is a valuable tool for evaluating trading strategies, it is important to acknowledge its limitations. Understanding these limitations can help traders and investors make more informed decisions and avoid potential pitfalls. Here are some key limitations to consider:

- Historical Data Limitations: Backtesting relies heavily on historical market data, which may not accurately reflect future market conditions. It is crucial to understand that past performance does not guarantee future results, and market dynamics can change over time.

- Assumptions and Simplifications: Backtesting often involves assumptions and simplifications to simulate real-world trading. These assumptions may not always hold true in practice, leading to discrepancies between backtested results and actual performance.

- Selection Bias: Backtesting can be susceptible to selection bias, where traders unknowingly cherry-pick the best-performing strategies or time periods. This can lead to over-optimization and inflated performance metrics that may not hold up in future market conditions.

- Transaction Costs and Slippage: Backtesting typically does not account for transaction costs, such as trading commissions and bid-ask spreads, which can significantly impact strategy profitability in live trading. Additionally, slippage, the difference between the expected and executed price, is often not considered in backtesting.

- Data Snooping bias: Backtesting can be prone to data snooping bias if traders excessively search for patterns and indicators in historical data. It is important to validate any observed patterns using out-of-sample data to ensure their statistical significance.

- Market Impact: Backtesting assumes that trading decisions do not impact market prices significantly. However, in reality, large trades or illiquid markets can result in price impact, affecting strategy performance differently in live trading.

- Psychological Factors: Backtesting does not account for psychological factors, such as emotions and behavioral biases, which can significantly impact decision-making during live trading. Traders need to be aware of their own biases and manage their emotions when executing real trades.

- Changing Market Conditions: Backtested strategies might not perform as expected in changing market conditions. Markets evolve, and what works in one environment may not be effective in another. Traders should regularly reassess and adapt their strategies to current market dynamics.

Overall, while backtesting stocks offers valuable insights into strategy performance, it is essential to recognize its limitations. Traders should use backtesting as a tool to inform their decision-making process, but they must also consider real-world factors, such as transaction costs, market impact, and changing market conditions, to effectively navigate the dynamic nature of financial markets.

Steps to Conduct Backtesting

Conducting backtesting involves a systematic approach to ensure accurate and reliable results. Here are the key steps to follow when performing backtesting on stocks:

- Define the Strategy: Clearly define the trading strategy and the rules that govern it. This includes identifying entry and exit signals, position sizing, stop-loss levels, and any other relevant parameters.

- Obtain Historical Data: Collect high-quality historical price data for the stocks or securities you intend to backtest. Ensure that the data is reliable and accurately represents the timeframe you wish to analyze.

- Set Timeframe and Parameters: Determine the time period for backtesting, whether it’s a few months, years, or a specific market cycle. Specify any additional parameters relevant to your strategy, such as the trading frequency or indicators used.

- Calculate Indicators: Calculate any technical indicators or metrics required for your strategy, such as moving averages, relative strength index (RSI), or any custom indicators specific to your trading approach.

- Implement the Strategy: Apply the defined trading strategy to the historical price data. This involves executing trades based on the specified rules and parameters for each trading signal.

- Track Performance: Monitor and track the performance of the backtested strategy. Record important metrics such as profit and loss, win rate, drawdowns, and risk-adjusted returns.

- Analyze Results: Analyze the results of the backtesting process. Assess the performance metrics and look for patterns or areas of improvement. Identify the strengths and weaknesses of the strategy and potential modifications that may enhance performance.

- Validate with Out-of-Sample Data: Validate the strategy using out-of-sample data to ensure its robustness and reliability. This involves testing the strategy on a separate subset of data that was not used in the initial backtesting process.

- Optimize and Refine: Based on the backtesting results, optimize and refine the strategy as necessary. This may involve adjusting parameters, fine-tuning entry and exit rules, or exploring alternative indicators to maximize profitability.

- Repeat and Iterate: Backtesting is an iterative process. Continuously repeat the backtesting process, making necessary adjustments and improvements based on the insights gained from previous tests. Regularly reassess and adapt your strategy to changing market conditions.

By following these steps, traders can accurately backtest their strategies and gain valuable insights into their performance. A disciplined and systematic approach to backtesting increases the likelihood of developing robust and profitable trading strategies.

Factors to Consider in Backtesting Stocks

When conducting backtesting on stocks, it is crucial to consider several factors to ensure accurate and meaningful results. These factors contribute to the reliability and effectiveness of the backtesting process. Here are some key factors to consider:

- Quality of Data: Use high-quality and reliable historical price data for accurate backtesting. Ensure that the data is clean, accurate, and free from any errors or inconsistencies.

- Trading Costs: Take into account transaction costs, such as trading commissions and bid-ask spreads, during the backtesting process. These costs can significantly impact the profitability of a strategy in real-world trading.

- Slippage and Market Impact: Consider slippage, the difference between the expected and executed price, during backtesting. This factor accounts for the impact of large trades or illiquid markets on strategy performance.

- Sample Size: Ensure that the sample size of the historical data used for backtesting is sufficient. A larger sample size can provide more reliable results and reduce the likelihood of overfitting to a specific set of market conditions.

- Out-of-Sample Validation: Validate the strategy using out-of-sample data that was not used during the initial backtesting process. This step helps assess the performance robustness of the strategy and confirms its effectiveness across different market conditions.

- Realistic Assumptions: Make realistic assumptions during backtesting. Consider factors such as market liquidity, order execution time, and the availability of certain market data to ensure the simulation aligns as closely as possible to real-world trading conditions.

- Adjust for Survivorship Bias: Adjust for survivorship bias, which occurs when the historical data only includes stocks that have survived until the present day. This bias can lead to overestimating the performance of a strategy due to the omission of failed stocks.

- Consider Market Impact: Recognize that executing trades based on backtested signals in real time can have an impact on market prices. Consider the potential market impact of placing trades based on your strategy and adjust the backtested results accordingly.

- Dynamic Strategy Adaptation: Consider the adaptability of the strategy to changing market conditions. A strategy that performs well in one market environment may not be effective in another. Regularly reassess and adapt your strategy to align with current market dynamics.

- Account for Trading Constraints: Incorporate any specific trading constraints or limitations that affect real-world trading into the backtesting process. This can include factors such as order size restrictions, margin requirements, or position limits.

Considering these factors when conducting backtesting on stocks helps ensure that the results are accurate, reliable, and relevant to real-world trading. It allows traders and investors to make more informed decisions and better understand the performance and potential of their trading strategies.

Common Mistakes in Backtesting Stocks

Backtesting stocks is a valuable tool for evaluating trading strategies, but it’s important to be aware of common mistakes that can compromise the accuracy and effectiveness of the results. By avoiding these pitfalls, traders can improve the reliability of their backtesting process. Here are some common mistakes to watch out for:

- Data Snooping Bias: Data snooping bias occurs when traders excessively search for patterns and indicators in historical data. This can lead to overfitting the strategy to past data, resulting in poor performance in future market conditions.

- Ignoring Transaction Costs: Failing to account for transaction costs, such as trading commissions and bid-ask spreads, can significantly impact the profitability of a strategy in real-world trading. It’s important to factor in these costs during the backtesting process.

- Over-Optimization: Over-optimization happens when traders tweak their strategies excessively to fit historical data too closely. This can result in a strategy that performs well in the backtesting phase but fails to deliver consistent results in live trading due to overfitting.

- Not Considering Slippage: Slippage, the difference between the expected and executed price, often occurs in real-world trading. Ignoring slippage during backtesting can lead to unrealistic performance results and misrepresentation of strategy profitability.

- Failure to Validate with Out-of-Sample Data: Only relying on in-sample data for backtesting can lead to a lack of robustness in strategy performance. It’s crucial to validate the strategy using out-of-sample or forward-looking data to confirm its effectiveness under different market conditions.

- Survivorship Bias: Survivorship bias occurs when backtesting only considers stocks that have survived until the present day, neglecting those that may have failed or been delisted. Failing to account for survivorship bias can lead to an overestimation of strategy performance.

- Ignoring Psychological Factors: Backtesting typically does not incorporate psychological factors, such as emotions and behavioral biases, that impact decision-making during live trading. It’s important to be aware of these psychological factors and practice disciplined trading in real-world scenarios.

- Cherry-Picking Results: Selectively choosing and highlighting only the best-performing results from backtesting can lead to biased and misleading information. Traders should consider the overall performance and statistical significance of a strategy rather than focusing solely on exceptional results.

- Not Accounting for Changing Market Conditions: Markets are dynamic and constantly evolving. Failing to adapt strategies to changing market conditions can render them ineffective. Regularly reassess and refine strategies to align with the current market environment.

- Lack of Realistic Assumptions: Backtesting should include realistic assumptions that mimic real-world trading conditions. Consider factors such as market liquidity, order execution time, and restrictions to ensure the backtested strategy aligns as closely as possible with live trading.

Avoiding these common mistakes in backtesting stocks can help traders generate more reliable and meaningful results. By conducting rigorous and disciplined backtesting, traders can increase their chances of developing successful trading strategies that perform consistently in real-world trading scenarios.

Examples of Successful Backtesting Strategies

Successful backtesting strategies have been employed by traders and investors to generate consistent profits in various market conditions. While no strategy is foolproof or guaranteed to work in all situations, here are a few examples of successful backtesting strategies that have shown promising results:

- Trend Following: This strategy aims to capture long-term trends in the market. It involves identifying the direction of the dominant market trend and taking positions in line with that trend. Moving averages, trendlines, and momentum indicators are commonly used to identify and confirm trends.

- Mean Reversion: The mean reversion strategy operates on the belief that prices will eventually revert back to their long-term average. Traders using this strategy identify overbought or oversold conditions in a stock and take positions with the expectation that the price will revert back to its mean.

- Breakout Trading: Breakout trading involves identifying price levels at which the stock is poised to make a significant move. Traders using this strategy enter positions when the stock breaks out of a well-defined range, often accompanied by high trading volume. They aim to capture the momentum and volatility generated by the breakout.

- Pairs Trading: Pairs trading involves identifying two correlated stocks and taking a long position in one stock while simultaneously taking a short position in the other. The strategy capitalizes on the expected convergence or divergence of the price relationship between the two stocks, regardless of overall market direction.

- Momentum Investing: Momentum investing follows the principle that stocks that have performed well in the past will continue to perform well in the future. Traders using this strategy focus on stocks with positive price momentum, high relative strength, or strong fundamental indicators such as earnings growth or revenue increases.

These examples are just a snapshot of the many successful backtesting strategies that traders use. Each strategy has its own unique set of rules and indicators, and success depends on how well the strategy aligns with market conditions and the trader’s risk tolerance.

It’s worth noting that successful backtesting strategies require continuous evaluation and adaptation to evolving market conditions. What works today may not work tomorrow, and traders need to remain nimble and open to modifying their strategies as market dynamics change.

Remember, backtesting is a tool to generate insights and test the viability of a strategy, but it should always be combined with other analysis and consideration of current market factors. Successful trading requires a holistic approach that incorporates risk management, discipline, and continuous learning.

Conclusion

Backtesting stocks is a valuable tool that allows traders and investors to evaluate the performance and viability of their strategies by simulating them against historical market data. It provides insights into strategy effectiveness, risk exposure, and potential profitability. By conducting rigorous backtesting, market participants can make more informed decisions, refine their strategies, and navigate the dynamic nature of financial markets more effectively.

Throughout this article, we have explored the definition, purpose, advantages, and limitations of backtesting stocks. We have discussed the steps involved in conducting backtesting and highlighted key factors to consider during the process. Additionally, we have addressed common mistakes that traders should be mindful of when backtesting, as well as provided examples of successful backtesting strategies.

Keep in mind that while backtesting can be a powerful tool, it is not a guarantee of future success. Markets evolve, and conditions may change, rendering a backtested strategy less effective in the future. It is crucial to constantly evaluate, adapt, and refine strategies based on current market dynamics.

Ultimately, backtesting stocks empowers traders and investors to make evidence-based and informed decisions. By leveraging historical market data, conducting robust backtesting, and combining it with other forms of analysis, traders can increase their chances of developing successful trading strategies and achieving long-term profitability.

Remember, backtesting is just one component of an overall trading strategy. Consistent success in the markets requires disciplined risk management, emotional control, continual learning, and adaptation to changing conditions. By incorporating backtesting into a comprehensive approach, traders can set themselves up for greater success in their trading endeavors.